When it comes to trading currencies in the foreign exchange market, it’s important to understand the difference between each one and how they behave in the markets. Globally, the United Nations recognizes 180 currencies, although only the top 18 are traded on a larger scale.

As such, in part 6 of this beginners forex course, we talk about major and minor pairs, and what to look out for.

We also touch on alternative categories you can trade such as exotic forex markets, commodity currencies, negative and positive correlations between pairs – and safe haven economies.

Learn 2 Trade Forex Course - Master Your Forex Trading Skills Today!

- 11 core chapters will teach you everything you need to know about forex trading

- Learn about forex trading strategies, technical and fundamental analysis, and more

- Designed by seasoned forex traders with decades of experience in the space

- Exclusive all-in price of just £99

What is a Forex Pair?

Throughout this beginners forex course, we cover each and every element of forex trading. We’ve already talked about forex basics such as margin and leverage, as well as technical and fundamental analysis. Now we can discuss forex pairs and what to look out for!

Currencies are traded in pairs, one against the other. For instance, if you select to trade EUR/USD – this will see you trading euros against US dollars. Here, euros is the base (or transaction) currency, and US dollars is the quote (or counter) currency.

- If you are quoted $1.21 – for every euro, the marketplace will give you 1.21 US dollars.

As we discussed in part 3 of this course pips, lots, and orders, each quote will have a buy and sell price – otherwise called ‘bid’ and ‘ask’. This is the price the market is willing to pay for the asset – and the amount they would sell it for. Again, the difference between the two is the spread of the FX pair – the small fee charged by your brokerage.

As a trader, your role is to take a short or long position – based on your prediction of whether the exchange rate of the pair will rise or fall. There are three main types of currency pairs – major, minor and exotic. All of which we talk about next.

Major Forex Pairs

A standout characteristic with major forex pairs is that they always incorporate the US dollar. Not only is this the world’s reserve currency but it’s also the most traded. When trading majors, this will be paired with another strong economy – such as the Japanese yen, euros, British pounds, and Swiss francs.

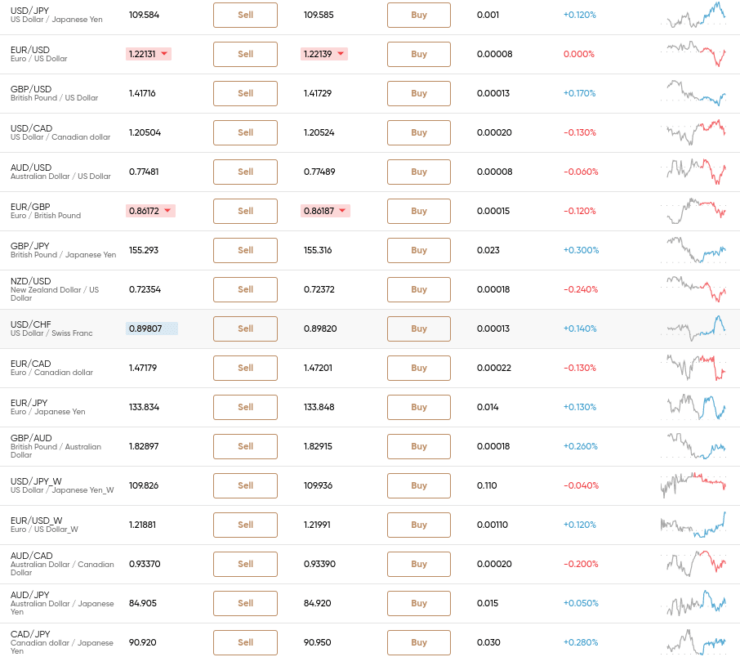

As such, you will see a list of the major pairs traded in the highest volumes below:

- EUR/USD – ‘fiber’: the euro against the US dollar is nicknamed the ‘fiber’. This is said to be because euro notes used to be made from cotton fibers, and also a nod to GBP/USD being the ‘cable’

- USD/JPY – ‘yen’: the US dollar against the Japanese yen. This is due to the namesake of the native currency of Japan.

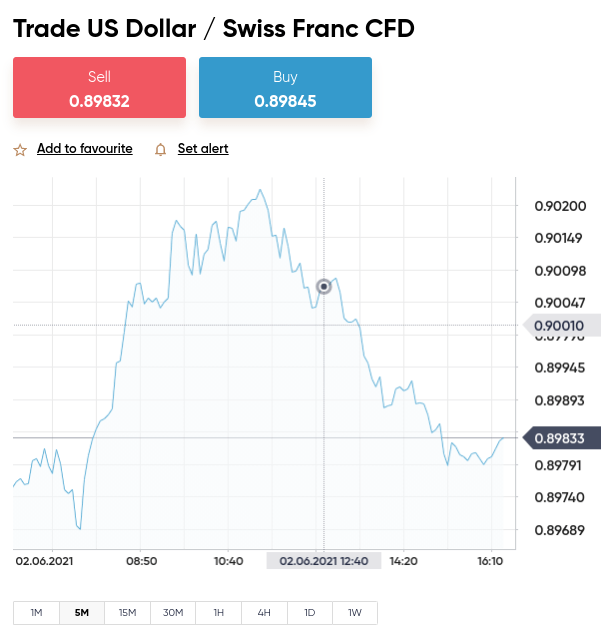

- USD/CHF – ‘swissy’: the US dollar against the Swiss franc. As the name suggests., this is because it includes the Swiss franc. Often referred to as a safe haven – as we discuss later.

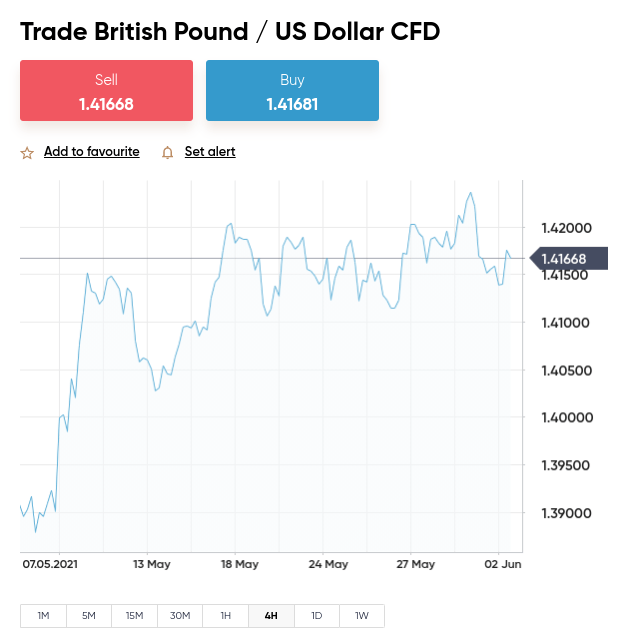

- GBP/USD – ‘cable’: the British pound against the US dollar. This pair has the nickname ‘cable’ – from the mid-1800s when the US and UK were first connected by the Atlantic cable service

The two biggest currency markets in the world are the US dollar and the euro – representative of the USA and the European Union. You can usually expect tight spreads and low trading fees when trading highly liquid pairs, as there will never be an issue finding a buyer or seller.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

All of the aforementioned currency pairs are considered to be highly liquid so the chances are the spread will be super tight, for instance, EUR/USD can be 1 pip or less. This is great for your potential profits as the fewer fees you have to pay the better.

It is for this reason that many newbies gravitate towards major forex pairs, especially to begin with. This market is not nearly as volatile as the other pairs we’ll be discussing today, and so you can trade them with fairly low risk. The US dollar is included in more than 80% of all foreign currency trades.

Minor Forex Pairs

You will spot a minor forex pair easily when learning to trade forex – now you know that all majors contain the US dollar. As such, if you see a pair with two strong currencies that is missing USD – this is a minor, otherwise called a cross pair.

Some of the most commonly traded minor forex pairs are as follows:

- EUR/CHF – ‘euro-swissy’: The euro against Swiss francs.

- EUR/ GBP – ‘the chunnel’: The euro against the British pound. The nickname for this pair comes from the literal connection between the UK and Europe – which is the Channel Tunnel.

- EUR/JPY – ‘yuppy’: The euro against the Japanese yen. The simple explanation for the nickname of this pair is that it is pronounced as yuppy when looking at the asset’s ticker symbol.

- GBP/JPY – ‘guppy’: The British pound against the Japanese yen. The name guppy comes from the connection between the two currency tickers.

As you can see, the most traded currency pairs have their own nicknames, often given fondly by forex traders. Whilst knowing what these are is unlikely to make you more gains on its own – you might be surprised.

For instance, when performing fundamental analysis, you may see a report that “chunnel has broken its resistance level”, or “cable is on the rise”. This increased volatility could give you the heads up you need to close a position. For instance, this could be an open trade that is reliant on the price trend moving in the opposite direction.

More volatile minor forex pairs include:

- AUD/JPY: The Australian dollar against the Japanese yen

- AUD/GBP: The Australian dollar against the British pound

- CAD/JPY: The Canadian dollar against the Japanese yen

- NZD/JPY: The New Zealand dollar against the Japanese yen

- AUD/USD: The Australian Dollar against the US Dollar

- GBP/CAD: The British pound against the Canadian dollar

As with all minors – you will be offered a lower ratio of leverage than major forex markets. These less liquid pairs will also come with wider spreads from your online brokerage.

Exotic Forex Pairs

A key characteristic of exotic forex pairs is that they invariably include one strong currency. For instance, one from the aforementioned major economies – think euros and US dollars.

An exotic pair will also be inclusive of an emerging currency like the Turkish lira or Mexican peso.

See below a list of commonly traded exotic currency pairs:

- USD/SGD: The US dollar against Singapore dollar

- USD/SEK: The US dollar against the Swedish krona

- EUR/TRY: The US dollar against the Turkish lira

- USD/ILS: The US dollar against Israeli shekel

- USD/PLN: The US dollar against the Polish zloty

- USD/ZAR: The US dollar against South African rand

Exotic currency pairs are not nearly as liquid as the other pair types we have mentioned. For this reason, you can expect wider spreads and less leverage offered to boost your trading positions.

The volatility sometimes experienced by emerging markets, due to their sensitivity and low liquidity, can be great for making above-average gains. That is if you time the market correctly. For this, you can utilize technical and fundamental analysis to help speculate on the direction of the pair.

What are Commodity Currencies?

There is another type of forex market, sometimes referred to as ‘commodity currencies’. So-called because the countries issuing them are huge exporters of major commodities.

With this in mind, you will see below a list of currency pairs that can affect the commodity markets in various ways:

- AUD/USD – The Aussie: The Australian dollar against the US dollar. The nickname for this pair needs no explanation.

- NZD/USD – The Kiwi: The New Zealand dollar against US dollars. As many people know, New Zealanders have the nickname Kiwi due to the country’s native bird.

- USD/CAD – The Loonie: The US dollar against the Canadian dollar. So-called because the Canadian dollar featured a common Loon (a local species of bird) on its backside.

As you can see, commodity currencies mainly include the Canadian dollar, New Zealand dollar, and the Australian dollar. Other markets that are sensitive to commodity price shifts include the Russian ruble, Norwegian krone, Saudi riyal, and Brazilian real.

- New Zealand is well known for being a major producer of dairy products. As such, you will notice that this market has a positive correlation with prices in this sector of the commodity markets.

- Some of the biggest oil exporters in the world include Canada, Norway, Saudi, and Russia. As such, any price shifts in this commodity will probably affect the value of the Canadian dollar, Russian ruble, and Norwegian krone.

- Year in year out, Australia produces hundreds of tonnes of gold and silver via its mining companies. If the price of these precious metals decreases, the companies extracting the commodity earn less revenues and the Australian government suffers from decreased tax revenues, and vice versa. For this reason, gold is often tied to AUD.

- Due to its iron and coal exports – the price of Australian dollars is also dictated by any increase or decrease in these commodity prices.

- If there is a major development in the value or production of sugar or coffee – this is highly likely to affect the value of the Brazilian real. This is because the country is a major producer and exporter of such goods.

Although things like interest rates and such can warp the usual patterns of a pair, it is entirely possible to use commodity markets to reduce your exposure to risk.

We talk more about hedging currencies in part 7 of this beginners forex course – ‘Trading Commodities: Oil and Gold’

What Affects the Exchange Rate of Major and Minor Currency Pairs?

At the root of it, natural supply and demand affect forex prices in the marketplace. However, a wide range of different things can throw this off balance. For instance, the relationship between the currency it is being paired with. We talk about the correlation between FX pairs shortly.

See below some of the biggest factors influencing the exchange rate in the forex markets.

Supply and Demand

As we just touched on, supply and demand is the biggest driver in the price of currencies. Having a clear understanding of how this works is going to aid you in making well-informed choices when entering and exiting the forex markets.

Put simply:

- Supply refers to how much is available to sell to the market

- Demand refers to how much the market is buying

When there is an increase in supply, this is also a reference to a rising pressure to sell. This selling pressure usually results in a currency pair falling in value. When, however, the rate of the market is on the up, people sell – which again causes falling prices.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Of course, these price shifts are what we hope to take advantage of in the world of forex trading. You can translate this into profits by focusing on the areas of support and resistance that this represents. We talked about this in part 4 of this course.

Economic Data Releases

Economic data releases in the currency markets can have a major impact on the FX pair you are trading, largely because it causes temporary price spikes. This can be as a result of the monthly US economic figures released, news or rumours of increased or decreased interest rates, the price or supply of oil – and much more.

We covered fundamental analysis in part 5 of this forex course – where we talked about the knock-on effect of economic data releases. We also mentioned that you can easily access this information yourself by finding a trustworthy economic calendar and keeping abreast of the financial news.

Interest Rate Changes Political Instability

As discussed in part 5 – when studying fundamental analysis on major and minor currency pairs, look for any news relating to the major world economies, plus any relevant commodity data.

You will also need to look at data releases on interest rates and inflation relating to either the pair you are trading or any currency markets related to them. Keep an eye out for any surprise announcements outside of your economic calendar surrounding this subject.

If a central bank increases interest rates, you can safely assume that this will affect the value of its domestic currency. For instance, day traders look to buy higher interest rate markets – due to the potentially bigger profits this volatility brings.

Major and Minor Pairs: What to Look out for – Safe Haven Currencies

For those unaware, a safe haven currency is one that is able to withstand extremely unstable market conditions – by either rising in value or at least maintaining its previous rate.

These assets are more often than not uncorrelated with traditional bonds or stocks. This makes them a lifeline during a market crash or a financial crisis, such as the one in 2008.

Japanese Yen (JPY)

Key characteristics of a safe haven currency are super high liquidity and economic, political, and financial stability. With that said, there are exceptions.

For instance, Japan’s financial stability is not exactly great right now, yet the currency maintains its safe haven label. When the world marketplace shares a risk-off attitude – the Japanese yen usually soars.

This economy leans heavily on exports. As such, if this becomes less competitive it leads to profits and equities declining. At this point, the government can take on negative interest rates, or sell yen in exchange for dollars.

Swiss Francs (CHF)

Swiss francs have been known to take a similar route during times of uncertainty. For instance, on multiple occasions, the Swiss central bank flooded the country with francs in an attempt to prevent the currency from becoming too strong.

This particular economy is attractive to traders because of the country’s low growth and debt ideals. In fact, despite the global pandemic, this forex market continues to grow stronger. As such, this is still very much a safe haven to turn to in times of crisis.

US dollars (USD)

It may not surprise you to learn that during times of geopolitical stress – the US dollar is also a go-to safe haven market. As we said, this is also the world’s reserve currency, which often means the currency of choice for global business deals.

With lower rates, the backing of a stable political system, and high liquidity – the USD continues to be considered a safe haven on a global scale. The US dollar did suffer at the beginning of the pandemic, but soon bounced back in March 2020 – much like some other markets.

As such, this shows that in an uncertain market environment, many traders will rush to a safe haven currency or asset – and liquidate other instruments. Many countries lean on the US to manage its economy.

Major and Minor Pairs: Safe Haven Examples

See below some prime examples of times when many traders flocked to safe haven currencies over others.

- Post 9/11 in 2001 – the Swiss franc appreciated against the US dollar within 2 hours of the first plane crash, by 3%.

- When the train bombings of Madrid happened in 2004 – safe haven currencies such as the Japanese yen and Swiss franc both appreciated against the US dollar within hours. This was a different story for francs against euros, which ended negatively.

- During the great recession (2007-2009) and the collapse of Lehman in 2008 – the Japanese yen was the only Asian forex market to appreciate by a noteworthy amount. Swiss francs also appreciated.

- At the time of the bombings in Brussels, in 2016 – the euro got weaker, whilst traders flocked to the safety of the Swiss franc and Japanese yen

As you can see, whilst tragic world events reflect negatively on a country’s currency, largely due to fear and uncertainty in the marketplace – safe haven currencies can flourish.

With this in mind, having a basic grasp of which major and minor pairs to trade at what time is crucial. This will help you during times when breaking news is likely to have a huge effect on the wider sentiment of the market in question.

Major and Minor Pairs: What to Look out for – Positive and Negative Currency Correlation

Understanding negative and positive currency correlation enables you to recognize any suspected volatility. Crucially this will help you spot your portfolio’s potential sensitivity to it. This is helpful for managing your overall risk exposure.

You will see below an explanation of positive and negative correlation in a nutshell:

- Positive Pair Correlation: This refers to two currency pairs that are on the rise at the same time.

- Negative Pair Correlation: This means two FX pairs are moving in opposite directions.

To further clarify:

- USD/CHF and EUR/USD – we normally consider these pairs as being negatively correlated because if EUR/USD finishes a session 100 pips lower, the chances are USD/CHF will end the day on a high.

- GBP/USD and EUR/USD are generally positively correlated. This means that if one finished a trading day say 80 pips in the green, the likelihood is that the other did well too.

This kind of knowledge could prevent you from accidentally doubling your risk with a say a sell or buy order on each. There are some great currency correlation sources out there, most will offer a free option laid out in the form of a table.

Major and Minor Pairs: What to Look out for – Trading Tips

You will see below some useful trading tips for major and minor pairs – utilized by traders of all shapes and sizes in this space.

- Establish the Right Leverage for Your Needs: As we said earlier in this course – when trading major forex pairs, you may be offered higher leverage to boost your stake. As we also stated, you shouldn’t necessarily maximize the amount of leverage you have access to. If your trade goes in the other direction, you will magnify your losses. As such, it’s important to use what’s right for your level of experience in the FX field.

- Study Technical and Fundamental Analysis: In parts 4 and 5 of this beginners’ course, we talked about technical and fundamental analysis. Unless you are looking to trade passively, such as with forex signals, you will need to learn this skill.

- Stick to a Forex Trading Strategy: Create a forex trading strategy and try to stick to it. We talk about strategies in part 9 of this course if you need inspiration. But to give you an idea, this could start with drafting a money management plan, or sticking with highly liquid pairs using a stop-loss order to create a risk ratio of say 1:3.

- Decide on the Best Timeframe: It’s a good idea to think about what timeframe you might want to trade on. Some people like to scalp – opening and closing heaps of positions within a single day. Others prefer the short-medium strategy of holding on to a pair for a day or two before catching a trend and cashing out.

- Practice Trading Positive and Negatively Correlated Pairs: Many people play around with hedging and correlated pairs using fractional trades or free demo account facilities. Again, we talk more about this throughout this course.

As you can see, there are plenty of tips to help you learn what to look out for when trading minor and major forex pairs!

Major and Minor Pairs: What to Look out for – Full Conclusion

We categorize major and minor pairs based on their demand and liquidity in the global marketplace. As such, this will give you a better indication of when and what to try and make a profit on. As a beginner, the best thing to do is choose a forex pair to suit your specific strategy.

This will be easier once you understand how they are expected to behave in certain situations. For instance, not all correlated markets will be worth trading, but it might aid you in avoiding a conflict of interest. It’s also important to have an understanding of commodity major and minor currencies.

For example – New Zealand, Australian, and Canadian dollars, the Norwegian krone, or Brazilian real. When oil, gold, sugar, or silver hit the news – the likelihood is that some of these markets will experience a rise or fall in value as a result.

On the other hand, you have safe haven major and minor pairs like the Japanese yen, Swiss franc, and US dollar – which you can use to manage your risk exposure to a contrasting market during times of uncertainty.

Learn 2 Trade Forex Course - Master Your Forex Trading Skills Today!

- 11 core chapters will teach you everything you need to know about forex trading

- Learn about forex trading strategies, technical and fundamental analysis, and more

- Designed by seasoned forex traders with decades of experience in the space

- Exclusive all-in price of just £99