If oil trading sounds like something you might be interested in, then stay right where you are. We are going to explore how oil is traded, cover popular strategies and of course – discuss the best oil trading brokers of 2023.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Oil Trading Fundamentals

Energies like coal and oil have kept the world turning for many years. However, the modern-day oil industry we know now can be traced back to the late 1830s when the industrial revolution kicked off.

Fast forward to 2022 and oil is one of the most highly volatile commodity assets there is. Globally, we use a staggering 95 million barrels every single day! Supply and demand is one of the key factors when it comes to asset value, so oil regularly sees huge price fluctuations.

Do you fancy your chances at trading this alluring commodity? The good news is that this asset is no longer reserved for market bigwigs or institutional traders and hedge funds alike. By following guides like ours and conducting some of your own research you’ll be trading oil like a pro before you know it!

Moreover, due to the huge price shifts in the market, it is advantageous for short-term traders. When trading this commodity online, traders are able to make gains from rising markets, as well as when the asset goes down in value.

Let’s start by diving right into oil trading fundamentals. When trading oil you are aiming to speculate correctly on whether the price of oil is going to rise or fall. The value of any asset is mainly dictated by the supply and demand of the market.

When there is a higher volume of people buying oil than there are selling it – the price is going to rise. On the opposite, when more people are selling oil – the price will fall. More experienced traders in the space tend to take full advantage of these price fluctuations.

For those unaware, let’s give you a practical example of how oil trading works:

- Brent crude oil is quoted at $37 per barrel.

- You have a feeling this price is going to rise.

- With this in mind, you place a buy order worth $500.

- You speculated correctly – Brent crude oil is now priced at $56 per barrel.

- This price increase shows us that the value of Brent crude oil has risen by 61.35%.

- As a result, you decide to place a sell order to lock in your profit

- Your order is now worth $806.75.

- From your $500 stake, you made gains of $306.75 on this trade.

As you can see from our example, you made the right decision – so you made a healthy profit of $306.75.

To access the markets and start trading oil you need a good broker. We have listed our top 5 oil trading brokers further down this page. You will likely trade oil via CFDs – which monitor the price shifts of the asset. Consequently, you do not need to take ownership of huge barrels of oil, which would be a logistical nightmare.

What Drives the Cost of oil?

Understanding what makes the value of oil fluctuate can really help you when it comes to the decision making process of trading – and of course, making gains.

We’ve already mentioned that the price of any asset tends to shift due to supply and demand. Your goal as an oil trader is to try and foresee whether that price will go up or down.

Please find below a list of key factors when it comes to the trading price of oil.

Oil Barrels in USD

Oil is used and consumed by millions all over the world on a daily basis and is easily one of the most popular commodities to trade. The US dollar also happens to be used and traded by millions all over the world.

Oil is almost always traded in US dollars by the barrel. At the time of writing in late 2020, this stands at $36.17 for one barrel. In this scenario, you are trying to speculate on whether the price of oil will fall below $36.17, or rise above that value.

As you will know from our example in the section above – whether or not you make a profit is riding on whether you have predicted the shift correctly – and placed the right order accordingly.

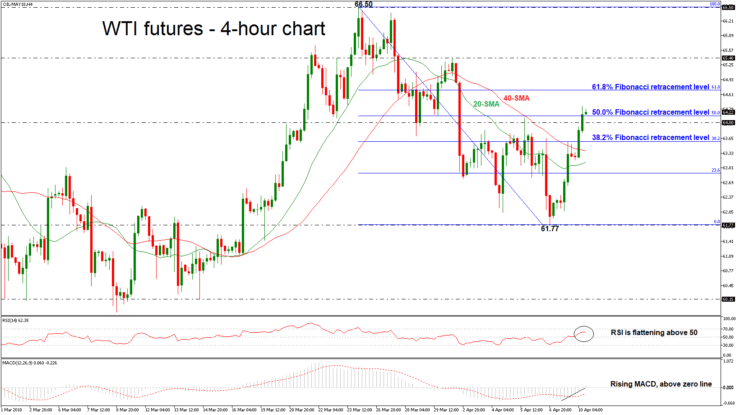

Brent and WTI Crude Benchmark Indices

The benchmarks we are referring to are comparable to third-party stock exchanges – illustrating fluctuating ask and bid prices. There are multiple benchmarks in place, and these prices are based on supply and demand, as we touched on.

Two of the most important benchmark indexes are WTI crude and Brent crude. The latter is the number 1 point of reference beyond the US. West Texas Intermediate (WTI) is the number 1 point of reference within the US.

Both have comparable market movements, but the value of each will be different. If oil has gone into the oversold territory – this will affect both benchmarks negatively. In the same way, if there isn’t enough oil being supplied – the value of both oil indexes will rise.

Geopolitical Turmoil & Supply and Demand

We have mentioned supply and demand a few times already, which is because it is a huge part of how assets are valued. When it comes to oil specifically, the price can also be heavily influenced by geopolitical turmoil, such as tensions in the Middle East. Not to mention the ‘Organization of the Petroleum Exporting Countries’ (OPEC).

OPEC is led by Saudi Arabia and also contains 14 other oil-rich countries. In case you aren’t aware of what OPEC is, the organisation stabilizes the oil markets. One of the main ways they achieve this is by controlling the supply and demand of the asset.

Used as a way to defend itself against US oil giants, OPEC controls the market by upping oil production, knowing it will cause the price to fall from a height. On the contrary, this organisation can easily slow down oil production to increase market price.

How can I Trade oil?

Now that you have a gist of what oil trading is all about and how the market price is driven in either direction – chances are you want to know how to trade it yourself.

Oil Trading: CFDs

The most popular and simplest way to trade oil is via a regulated CFD broker, such as the ones listed further down in our guide.

We mentioned that trading oil via CFDs means that you do not own the underlying asset (in this case oil). Instead, the CFD monitors the real-world price shifts of the asset – on a second by second basis.

When it comes to the value of oil, your CFD brokers will get the market value from a reputable oil benchmark index like the aforementioned WTI or Brent.

Let’s give you a quick example of an oil CFD trade:

- The WTI benchmark prices oil at $34.50.

- Your CFD trading platform quotes $34.50.

- You believe the price of oil will fall so place a sell order worth $200.

- 3 days later the WTI benchmark prices oil at $30.50.

- Accordingly, your CFD trade is also valuing oil at $30.50.

- You place a buy order to exit the trade.

- You made a profit of 11.59% on this oil CFD position.

The best oil trading brokers will not charge clients any commission at all on trading oil CFDs. Not only that, but you will be able to apply leverage of up to 1:10.

This means that for every $1 you have in your account – you could trade with $10. Importantly, leverage can amplify your gains – but also your losses.

Oil Trading: Options

Oil can be traded using ‘options’ as well. Trading in this way means that you still need to speculate on the rise or fall of your asset – but it must be done before the contract runs out.

If it is crude oil you are interested in trading then you should know that you have the right to buy or sell the asset, but are not obligated to do so.

- Your options contract with your broker is for 3 months.

- The ‘strike price’ on this contract is $60.

- You need to pay a ‘premium’ of $3 to open the contract.

- There are 500 barrels of crude oil in each options contract.

- You have a feeling that the value of oil is going to rise above $60 – within 3 months.

- With this in mind, you purchase call options.

- You have had to layout $1,500 for this contract (500 * $3 premium).

Now, let’s say 3 months pass and when the contract expires oil is priced at $80. This is $20 above your ‘strike price’ of $40 – congratulations, you made gains.

- Your gross profit is $20 per oil barrel.

- Your ‘premium’ was $3 so your net profit is $17 for each barrel.

- Your call options contact contained 500 barrels – so that’s a total profit of $8,500 (500x$17).

It’s important to note that your options contract is going to fluctuate much like the value of oil. However, you will be able to get rid of your contracts whenever you like – at any point between your initial order and your options contract expiry date.

Oil Trading: Futures

CFDs are great for short-term trading strategies, but if you wish to leave your trade open for a little longer you can opt for futures. Futures usually come with a contract limit of 3 months, and every contract has its price – for instance, $45 per oil barrel.

Oil Trading – Three Popular Strategies

Being able to trade oil online and make consistent profits will require you have a few strategies up your sleeve. To help point you in the right direction, below you will find some popular oil trading strategies utilized by seasoned investors.

Oil Strategy 1: Utilise Support Levels

Support levels show traders the ‘key price levels’ of the asset in question. In this case, the goal is to illustrate resistance and support levels in the oil market.

Support levels are a very useful tool when it comes to oil trading as you are going to gain valuable insight into possible oil trading opportunities.

For example, if oil is in the midst of a downward trend – you can action a stop level. This is going to prevent the price of the asset from plummeting any further.

By entering the market above the support line whilst simultaneously actioning a stop-loss order underneath the support line – you are able to mitigate your risk to a certain degree.

Oil Strategy 2: Oil Scalping

If you are looking for small gains on a regular basis, then oil scalping could be for you. This entails opening multiple buy and sell orders throughout a single trading day – meaning you can make the most of this volatile market.

The way this works is that you will be looking to take advantage of periods where oil trades within a tight pricing range. For example, let’s suppose that oil has been trading between $35 and $38 per barrel for several days.

Such a small consolidation range allows skilled scalping traders to enter frequent buy and sell positions between the two prices. This particular oil trading strategy is relatively low risk.

After all, the trader knows that the price will eventually rise through $38 or below $35. To counter this, they will have a stop-loss order at both ends of the range. Until then, the oil trader can capitalize for as long as the range remains in place!

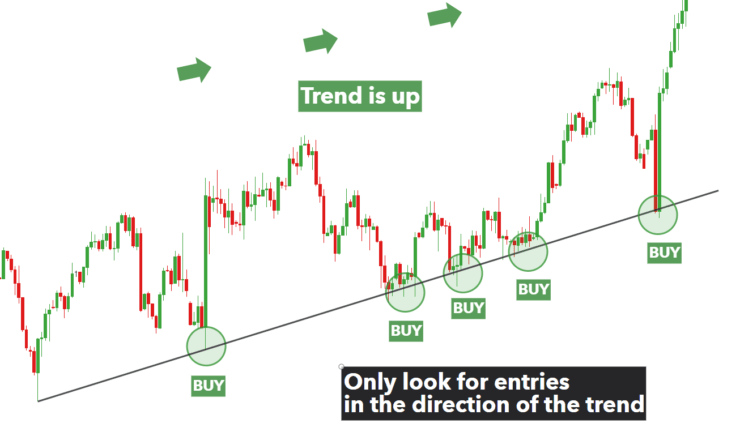

Oil Strategy 3: Oil Swing Trading

The idea of oil swing trading is to go along with the wider market trend using various forms of technical analysis. The goal of oil swing trading is to try and utilise buy orders when the momentum of oil is going strong – which is going to enable you to catch those profits.

With that in mind, swing traders might keep positions open for anywhere from a couple of days to weeks on end. Crucially, when it appears that the trend is about the reverse, a skilled swing trader will do two things. Firstly, they will exit their position to ensure that they are able to lock in profits made on the trend in question.

After that, the trader will likely place another buy or sell order to catch the new trend. Once again, the trade will remain open for days, weeks, and or a couple of months. The key point is that they look to stay with wider market trends as opposed to catching super short-term swings.

Important Metrics When Finding a Good Oil Trading Broker

It is all well and good having an understanding of how to trade the asset you want to focus on. However, as we explained, you do need a broker to enable you to access the oil markets – and execute your orders on your behalf.

We’ve saved you the metaphorical legwork and have compiled a list of important metrics to consider when looking for the perfect fit for your trading goals.

Platform Usability

Whether you are a newbie investor or consider yourself a seasoned trader – we think that using a broker with an easy to navigate website makes all the difference.

Some trading platforms offer clients an all singing all dancing website, which is great. But, it can make it a lot harder to get to grips with how to trade oil.

Ideally, you should be looking for a broker with a super user-friendly platform, and one that makes finding your desired asset and placing your orders easy-peasy.

Commissions

No two online brokerage firms are the same, so when you are looking for the right platform for your trading needs – it’s not just market access you need to consider.

Commissions and fees can make a big dent in your profits if you choose the wrong trading platform. Some oil brokers charge in excess of $10 for each and every trading transaction. While this might be great for those trading huge volumes, it won’t be if you want to access the market with smaller stakes.

With that said, you will generally find that oil trading brokers charge commission in the form of percentages. If your broker charges 1% commission, and you stake $1,500 – in this instance, you need to pay your broker $15.

That said, you can now breathe a sigh of relief – the best oil brokers that we discuss on this page offer clients commission-free trading via CFDs.

Spreads

Just in case you are new to oil trading, you may not know that the ‘spread’ is the gap between the buy price of oil, and the sell price of oil. The smaller that gap, the better it is for you as a trader. No two brokers are the same, so watch out for trading platforms with less than desirable spreads.

Deposit and Withdrawal Protocol

It is fairly obvious that you should check to see what payment methods are available before immersing yourself in the signing up process. We should, however, mention that some brokers might only accept bank wire deposits. So, if you have a payment method in mind – such as a debit/credit card or PayPal – then it is crucial you make sure it is listed on the platform.

It’s also important to check whether there are any fees chargeable for either funding or withdrawing from your account. If you are using top-rated oil trading platform Skilling, you won’t be charged anything to deposit!

Platform Regulation

As you are here to find the best oil trading brokers right now, it’s only right that we mention regulation. By only signing up with trading platforms holding a licence from a regulatory body such as the FCA or ASIC – you can rest assured knowing that you are protected against fraud and dodgy brokers.

These regulatory bodies were created to keep the trading markets clean and fair for all. Regulated brokers (like the ones on our list) must adhere to a variety of strict rules, one of which is ‘account segregation’. For those who don’t know, account segregation means that your trading funds will be kept in a completely separate bank account to that of the broker company.

Oil Trading Online – Five Tips to Succeed

In the world of oil trading, you can never be exposed to enough strategies, tips and tricks. At the end of the day, whatever you decide to actually utilise in your own strategy is up to you.

Nevertheless, we’ve put together five oil trading tips for you to consider. Hopefully, this will help you on your way to becoming a successful oil trader in the future!

Keep Informed of Up-to-Date Oil News

Keeping abreast of all of the latest oil news and forecasts is going to assist you in predicting the direction of the oil market. After all, the oil markets are hugely depending on demand and supply.

This demand and supply can be hindered by geopolitical or financial turmoil. There are heaps of trading tools and websites available to aid you in sourcing this information.

Utilise Oil Trading Signals

Oil trading signals are like a helping hand in your trading endeavours. Some traders just lack the time to keep up to date with the financial and economical news – not to mention keeping track of price data. With that in mind, oil trading signals can be a godsend for inexperienced traders too.

Not only that but the signal also suggests a stop-loss point, and an exact point at which you should take-profit. This is not an entirely passive way of oil trading – as whether or not you decide to act on the signal is your call.

We at Learn 2 Trade offer a fully-fledged signal service that focuses on forex and cryptocurrencies. With that said, we do come across oil trading opportunities from time to time. When we do, we let our members know which way we think the markets will go and why – all in real-time via Telegram.

Study Oil Trading Books

There are hundreds of oil trading specific books – available both in good old fashioned tangible book form, and in the shape of e-books, and audiobooks. You can easily sniff out the cream of the crop by conducting a simple internet search for ‘best oil trading books’.

Try a Demo Account

Trading oil with paper money is definitely something to take advantage of. Not only can you trade in a real-life market environment for free, but you can practice new oil trading strategies without risking your capital.

Plenty of online oil CFD brokers offer clients demo accounts. Some give you a specified amount to trade with – such as a hefty paper balance of $100,000. This ensures that you have enough demo capital to get to grips with the oil trading markets before risking your own money.

Take Advantage of Copy Trading

Copy trading is nothing short of a phenomenon in the online trading space. These days there is an option on some trading platforms which will allow you to ‘copy’ a vetted investor with a proven trading record.

You will have a selection of copied traders to choose from. Most either focus on specific markets or have a totally diverse portfolio. You can easily find a copied trader by searching for one with the same asset interests as you.

Then all you need to do is invest the minimum amount required to ‘copy trade’ (on eToro this is $200) and elect to mirror their portfolio like for like. Put simply – if they invest 1.6% of their own portfolio in crude oil, your own trading portfolio will reflect this.

Best Oil Trading Brokers

Now that you have your eyes wide open when it comes to trading oil, you are going to need to find a broker to make your financial goals a reality. Not only have we discussed strategies, orders and tips – but also important metrics to look out for when choosing a broker.

We have detailed our five best oil trading brokers below for your consideration, all of which are fully regulated and well respected in the trading community.

1. AVATrade – Oil CFDs With Competitive Spreads

AvaTrade has been on the scene for over 10 years and is a fully licenced and regulated broker in various regions such as Ireland, Australia, Canada, and Japan - to name a few.

This trading platform offers a wide variety of CFDs in the shape of forex, crypto assets, and commodities such as metals and oil. You will find highly competitive spreads at Avatrade when trading oil CFDs.

If like us you prefer to have the option of creating a quick order on the go, or check your account etc - Avatrade makes this really easy due to having its own mobile app. The app is called ‘AvaTradeGO’ and enables you to trade and deposit wherever you are connected to the internet.

AvaTrade is another broker on our list which is compatible with MT4, the third party trading giant. If you are a newbie trader or have been thinking about trying out a new oil trading strategy then you can open a free demo account.

This way you can trade with a fully loaded oil trading account without having to risk your own account funds right away. You can start trading oil CFDs with AvaTrade from as little as $100

- Minimum deposit $100

- Leverage of up to 1:20 on oil trades

- AvaTradeGO app

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

How to Open an Account With an Oil Trading Broker

Opening an account with an online broker is usually an extremely easy process. Generally speaking, it can be done in under 10 minutes. We’ve listed below 3 simple steps on how you can get started with the broker of your choice today.

Step 1: Elect to Sign up With an Oil Trading Broker

The first thing you need to do is head over to the website of the broker you have selected. You are going to need to enter some basic details about who you are, such as your full name, email address, date of birth and telephone number.

Assuming the trading platform is licenced by a regulatory body, you are going to need to upload a copy of your passport or driving licence as part of the KYC (Know Your Customer) process. This is standard procedure.

Step 2: Fund Your Oil Trading Account

Once you have opened your account you need to fund it, so that you can begin trading oil. Simply select a payment method from those listed on the platform and enter the amount you wish to deposit. Don’t forget, most online brokers require you to meet a minimum deposit threshold.

Step 3: Place Your First Order

As you know, you need to decide whether the price of oil will rise or fall. To do this, you need to place an order to buy or sell with your broker. It’s a good idea to open a demo account to try out the trading platform yourself before you start dipping into your real account funds.

On the other hand, if you feel ready to get started you could still start with small stakes. This will reduce your initial risk while you become accustomed to the trading platform.

Oil In Conclusion

Oil trading is becoming more and more popular every year. It enables you to benefit from both the rise and the fall of the asset’s value. In addition to that, most brokers will allow you to trade with leverage to magnify your oil trading profits.

This means that a $1,000 stake would allow you a maximum trade of $10,000. Of course, leverage should be used with caution because it can also exaggerate your losses, should you be incorrect on your market prediction.

There are various ways in which you can oil trade. Once you’ve had a think about what your own trading goals are then you can elect to trade oil via your broker with ease.

All of the best oil trading brokers listed on this page are fully regulated – so you can rest easy knowing you are dealing with a reputable company in the online trading space.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts