The content does not apply to US users.

The Copy Trading feature available at eToro is nothing short of revolutionary. All you need to do is select a trader that you like the look of, decide how much you wish to invest – and that’s it – you can sit back and enjoy passive income.

If only it was that simple.

By this, we mean that eToro is home to over 12 million traders – subsequently making it difficult to separate the wheat from the chaff. The good news for you is that our team of in-house traders recently joined the eToro Copy Trading phenomenon.

Read on to find out how you can mirror our seasoned traders like-for-like and profit when we profit!

Learn 2 Trade Copy Trading Portfolio at eToro

- Copy our buy and sell positions like-for-like at eToro

- Actively trade the financial markets in a passive manner

- Mirror our team of in-house traders

- Join our Copy Trading portfolio service for FREE!

What is eToro Copy Trading?

The Copy Trading feature is a hugely popular tool offered by online broker eToro. In a nutshell, it allows you to ‘copy’ an experienced trader that is using the eToro platform. Initially, you will copy their portfolio like-for-like.

For example, if the trader has 40% of their portfolio in Apple stocks, as will you. If the trader has 20% in gold and 15% in natural gas, as will you. Furthermore – and perhaps most importantly, you can also elect to copy the trader on an ongoing basis.

That is to say, if the trader exits a position, as will you. If the same trader then adds a new asset to their portfolio – again, as will you. In theory, this means that you can actively trade online.

Instead, your chosen copy trader will determine which assets to buy, and when. They will also determine how much of their portfolio to allocate to each asset, and of course – when to sell. Best of all, eToro allows you to utilize this feature with a minimum investment of just $200 – and no additional fees apply.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

How eToro Copy Trading Works

The Copy Trading process itself is relatively straight forward. The most difficult part is knowing how to select a trader that is going to make you consistent profits. After all, past performance is never a sure-fire indicator of future results.

Nevertheless, the end-to-end investment process typically works as below:

Step 1: Choose a Copy Trader

Your first port of call will be to choose a trader to copy. Although the eToro platform is home to over 12 million investors, not all users are signed up to the Copy Trader program. With that said, there are still thousands of traders to choose from, meaning that you will need to do some homework.

Past performance is not an indication of future results.

Some of the metrics that eToro allows you to view about the trader are:

- Historial Performance: When you click on the profile of an eToro Copy Trader, you can essentially view each and every position that the investor has placed. As such, you have a clear overview of how the trader has performed since they joined the platform. This can be viewed on a month-by-month basis – which is really useful.

- Preferred Assets: You can also view the preferred asset class that the trader likes to speculate on. For example, while some traders stick with stocks, others are more focused on forex. Some traders are more of a Jack of All Trades – covering several asset classes.

- Risk Rating: The underlying technology powering eToro is able to build a risk rating on each and every copy trader. This runs from 1 being the lowest risk, up to 10. This allows you to stick with traders that mirror the level of risk that you feel comfortable taking.

- Trade Duration: eToro also lets you know the average number of days (or hours) that the trader keeps a position open. While this might not sound like an important metric – it actually is. After all, while some traders take a day trading or swing trading approach, others are more interested in a long-term strategy.

- Assets Under Management: You can also view the number of eToro users that are currently copying the trader in question. Additionally, this also lets you know how much money the trader has under management. Ultimately, the best copy traders at eToro typically have heaps of followers.

As you can see from the above, there are many metrics that you need to take into account when choosing a copy trader at eToro.

Step 2: Allocate Funds

Once you have selected an eToro copy trader that you like the look of, you will then be asked to allocate some of your account balance. As noted earlier, this needs to be at least $200.

Additionally, you also need to decide whether you want to copy the trader on an ongoing basis, or only copy the portfolio that they currently have.

In our view, there isn’t much point opting for the latter. After all, you will not benefit from ongoing buy and sell orders that the trader makes – meaning that you are potentially missing out on profit-making opportunities.

Once you confirm the investment, eToro will deduct the respective figure from your cash balance. If you’re still confused about how the ‘copying’ part of the process works, let’s look at a quick example.

- Let’s suppose that your chosen copy trader has £100,000 worth of assets in their portfolio

- £25,000 is in IBM stocks (25%) and £75,000 in a bond ETF (75%)

- You decide to invest £1,000

- This means that £250 (25%) of your portfolio will consist of IBM stocks and £750 (75%) in a bond ETF.

As you can see, it doesn’t matter how much capital you have at your disposal – your Copy Trading portfolio will be weighted like-for-like with that of the trader.

Step 3: Making Money

When it comes to making money, the eToro Copy Trading feature works no different from a standard do-it-yourself investment strategy. In other words, your portfolio is simply a carbon copy of your chosen trader. As such, any profits that the trader makes – in percentage terms, will be reflected in your portfolio.

For example:

- Let’s suppose that you invest $2,000 into a copy trader that focuses exclusively on forex

- The trader allocates 1% of their portfolio on a GBP/USD buy order – with leverage of 30x

- In turn, this means that you are risking $20 on the trade, albeit, with 30x leverage applied

- The trader closes their GBP/USD position – making gains of 0.5%

- Your portfolio mirrors the trade – meaning that you made 0.5% of $20 – which just $0.10 ($20 stake x 0.5%)

- However, you also had leverage of 1:30 applied – meaning that you actually made $3

Although the above figures represent a small return, it is important to remember that forex day traders will often place dozens of positions throughout the day. As such, small returns can very quickly add up.

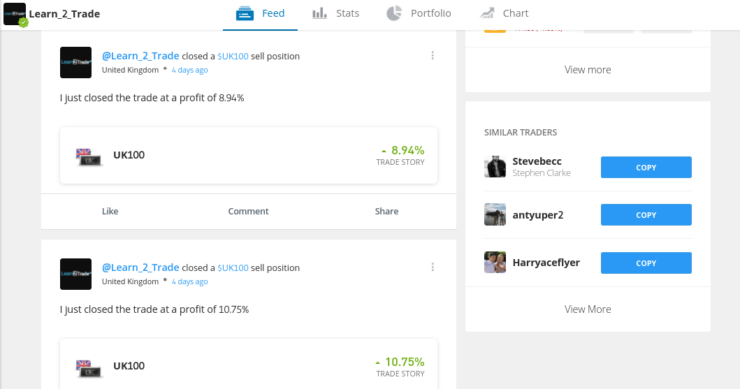

Copy Learn 2 Trade at eToro

So now that you know how Copy Trading works, we now need to discuss what Learn 2 Trade can offer. First and foremost, our team of in-house traders have been active in the currency and commodity trading arena for over 15 years.

We are well known in the signal service space – with other 1,000+ members taking advantage of our daily trading suggestions. In fact, our team target a win rate of over 76% – which is why we are experiencing a surge in account sign-ups.

Furthermore – and perhaps most importantly, signals often need to be actioned the very moment they are received. After all, the financial markets can move at an incredibly fast pace. In turn, this means that some of our members miss out on profit-making opportunities.

Que – the Learn 2 Trade Copy Trading portfolio!

In a nutshell, you now have the opportunity to mirror the buy and sell positions of our in-house traders. If our traders buy EUR/USD – as will you. If our traders sell AUD/NZD – again, as will you.

In terms of our trading strategy, this works much the same as our signal suggestions. For those unaware, this means that we tend to take a risk/reward ratio of 1:3.

In simple terms, this means that by risking 1% of our capital, we stand to make gains of 3%. Of course, this is achieved by entering stop-loss and take-profit orders on all of our trades. Once again, by copying us at eToro – you don’t need to worry about individual orders – as everything is automated.

How to Copy Learn 2 Trade for FREE

Like the sound of copying our team of in-house traders via the eToro platform? If so, follow the steps below to get started right now!

1. Open an Account With Our Unique Link

To get the ball rolling, you’ll need to open an account with eToro through our unique link.

You can go straight to the respective page by clicking the link here.

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Once you arrive on the eToro website, begin the registration process. This will require some personal and contact information – such as:

- Full Name

- Home Address

- Country of Residence

- Date of Birth

- National Tax Number

- Email Address

- Mobile Phone Number

You will also need to create a username and a strong password.

Note: If you already have an account with eToro and wish to make use of our free Copy Trading service, send us a quick message and we’ll get you set up!

2. Deposit Funds

You’ll now be asked to deposit some money into your newly created eToro account. The minimum amount with this broker is $200 – which is the same minimum for investing in our Copy Trading portfolio.

Supported payment options at eToro include:

Top tip: Avoid opting for a bank wire as you will need to wait a few days for the funds to arrive. All other payment options are instantly credited!

3. Send us a Screenshot to Receive our eToro Username

Once you are signed up with a funded account, you will then need to take a screenshot that shows your:

- eToro username

- That you have met the $200 minimum deposit

Take note, you will not be exposing any sensitive information by sending us the above. On the contrary, all usernames at eToro are public. We will, however, ensure that your username is not shared with anyone and thus – your privacy is 100% protected.

Once we receive the required screenshot, we will then send you a message outlining our unique eToro username.

4. Begin Copying Learn 2 Trade

Once you receive our eToro username, you’ll need to search for it. Then, click on the ‘Copy’ button.

You will then see a pop-up box appear. Here, you need to:

- Enter the amount that you wish to invest in our Copy Trading portfolio (minimum $200)

- Tick the box to copy all of our ongoing trades

Once you confirm the above, you will instantly copy our portfolio! Then, any buy or sell positions that we make will be reflected in your personal portfolio.

Note: You can cash in your funds at any given time when copying us via eToro. In fact, as soon as you close the position, the funds will be placed into your eToro cash account and available for withdrawal.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Learn 2 Trade Copy Trading Portfolio at eToro

- Copy our buy and sell positions like-for-like at eToro

- Actively trade the financial markets in a passive manner

- Mirror our team of in-house traders

- Join our Copy Trading portfolio service for FREE!