If you’re on the lookout for a new online trading platform – you might be considering Blueberry Markets. This popular online broker allows you to trade leveraged CFD positions on shares, indices, forex, commodities, and more without paying any commission.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Plus, the trading platform is heavily regulated by tier-one body ASIC – so safety will be of no concern. But, is Blueberry Markets the right online broker for you?

In this guide, we review everything there is to know about Blueberry Markets. This covers core metrics surrounding fees and commissions, tradable markets, leverage limits, regulation, payments, and customer support.

Blueberry Markets - Buy and Invest in Assets

- Lightning-fast trade execution

- Zero commission on a standard account

- Hassle-free withdrawals within 24 hours

- One-to-one customer service

Blueberry Markets in a Nutshell

Don’t have time to read our comprehensive Blueberry Markets review right now? If so, below we outline the most important points that we discovered about the online trading platform.

- 100% commission-free trading on all markets

- Spreads from as low as 0 pips

- Markets include stocks, indices, forex, and commodities

- Leverage and short-selling facilities

- Easy and fast account set up process and lots of supported payment methods

- Regulated by tier-one body ASIC

The above factors alone illustrate that across the board – Blueberry Markets is a top-rated platform. With that said, no two online brokers are the same – so we would suggest reading the rest of our review to ensure Blueberry Markets is right for you.

What is Blueberry Markets?

Blueberry Markets is an online trading platform that allows you to speculate on CFD instruments. This includes a full suite of popular assets – such as stocks, indices, forex, and cryptocurrencies. As you will be trading CFDs, you can go long or short on your chosen market.

This top-rated broker does not charge any trading commissions – meaning that all fees are built into the spread. This starts at 0 pips if you are on a ‘Direct’ account – and slightly more if you are on a ‘Standard’ account. Blueberry Markets was first launched in 2016 and has since grown its client base at a rapid pace.

The broker is regulated by ASIC – so you can be sure you are trading in a safe space. In terms of trading platforms, Blueberry Markets can be accessed via MT4 or MT5. This includes a web-trading facility, desktop software, and a mobile app.

What can you Trade at Blueberry Markets?

As noted above, Blueberry Markets specializes in leveraged CFDs. This means that you will not be buying or selling traditional assets – such as shares or ETFs. Instead, you will be ‘trading’ the CFD asset class by speculating on whether its price will rise or fall. As the underlying financial instrument does not exist – this gives Blueberry Markets the freedom to offer a huge library of assets.

This includes:

- Stocks: More than 50+ large-cap stocks listed on the NYSE and NASDAQ

- Indices: 11+ indices including the FTSE 100, S&P 500, Dow Jones, and JPY 225.

- Forex: Dozens of supported forex pairs from the major, minor, and exotic currency categories

- Commodities: Gold, silver, platinum, and oil (WTI and Brent Crude)

As you can see from the above, Blueberry Markets covers the most liquid and traded asset classes in the investment scene – so you can easily diversify.

Blueberry Market Fees and Commissions

So now that our Blueberry Markets review has established that the broker offers heaps of assets – we now need to discuss those all-important fees.

Let’s break down the fee department bit-by-bit you so you have a firm grasp of what you will be expected to pay.

Commissions

Put simply, Blueberry Markets is a 100% commission-free trading platform. This means that whenever you enter or exit a market – there will be no direct trading fees to pay. Instead, everything is built into the spread – which is the difference between the buy and sell price of the respective instrument.

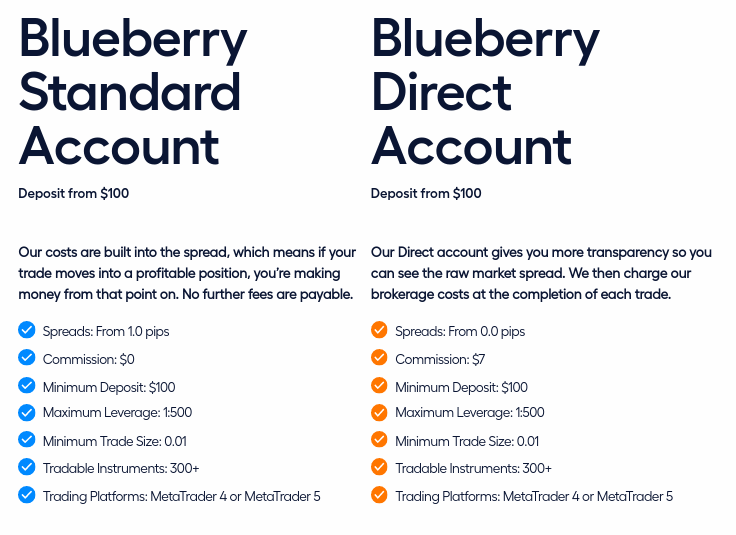

Spreads

As always, spreads will vary depending on the market you wish to trade. At Blueberry Markets, the spread will also depend on the account type you are on.

Due to the sheer size of the asset library at Blueberry Markets – we can’t list each and every spread. Instead, below we outline a few examples so that you can get a feel for the competitiveness of this broker.

- EUR/JPY: 0.2 pips

- EUR/USD: 0.3 pips

- S&P 500: 5.3 pips

- Gold: 1.5 pips

- Brent Crude Oil: 4.4 pips

As you can from the above, spreads at Blueberry Markets are super-tight. In fact, if you open a ‘Direct’ account, you can often get your spreads down to 0 pips on major currency pairs.

Blueberry Direct Account

Although we noted in the sections above that Blueberry Markets allows you to trade without paying any commission – this is based on the Standard Account. You do, however, also have the option of opening a Blueberry Direct Account. This account type is most definitely the best option to go with if you are an experienced trader that places a large number of positions.

This is because you will benefit from spreads that start at 0.0 pips. In turn, you will pay a small commission of $7 per slide. But, if you’re trading with large volumes, this commission offers great value. Much like the Standard Account, the minimum deposit on Direct Account is just $100.

This is because you will benefit from spreads that start at 0.0 pips. In turn, you will pay a small commission of $7 per slide. But, if you’re trading with large volumes, this commission offers great value. Much like the Standard Account, the minimum deposit on Direct Account is just $100.

Deposits and Withdrawals

Depending on your preferred payment method, you might need to pay a deposit fee.

Check the list below to what you will be charged by Blueberry Markets

Debit/Credit Cards: FREE

Bank/Wire Transfer – FREE (but check your own bank’s fees)

Skrill: 3%-4%

Poli Payment: 0%

China UnionPay: 0%

Fasapay: 0.5%

When it comes to withdrawals, you won’t be charged any fees. In even better news, Blueberry Markets will typically process your withdrawal request within 24 hours.

In terms of supported currencies – Blueberry Markets supports the following:

- AUD

- USD

- CAD

- GBP

- NZD

- EUR

- SGD

If, however, you want to deposit in a currency that isn’t listed above – this is still possible. This just means that you will pay a small FX fee at the point of the transaction.

Leverage at Blueberry Markets

Perhaps one of the biggest plus-points of using Blueberry Markets is that the platform states that all clients will be offered leverage of up to 1:500. This means that you can amplify your stake by a huge ratio of 500x. As such, a $300 account balance would effectively get you access to $150,000 in trading capital.

However, do treat with caution when applying high levels of leverage – especially if you are a beginner. After all, if your position goes against you by a certain percentage, your trade will be liquidated and you will lose your stake.

Blueberry Markets Trading Platforms

Blueberry Markets does not offer its own native trading platform. Instead, the broker has partnered with two leading third-party providers – MetaTrader 4 (MT4) and MetaTrader 5 (MT5). This is ideal for those of you that want access to advanced trading tools. After all, both MT4 and MT5 are packed with technical indicators and chart drawing tools.

Is Blueberry Markets Safe?

In a nutshell, you should have no concerns regarding safety when you sign up with Blueberry Markets. This is because the broker is authorized and regulated by the Australian Securities and Investments Commission (ASIC).

For those unaware – alongside the FCA (UK) and SEC (US) – ASIC is one of the most reputable financial regulators globally. The license issuer will ensure that Blueberry Markets follow a range of guidelines and regulations – such as keeping your money in segregated bank accounts.

If for some reason you did run into an issue with Blueberry Markets – you always have the option of taking your complaint up directly with ASIC.

Customer Support

Our Blueberry Markets review found that the platform offers top-notch customer support. In fact, you can speak with a support agent in real-time by using the live chat facility. This ensures that you do not need to wait hours or even days to receive a response to your query.

How to Get Started With Blueberry Markets Today

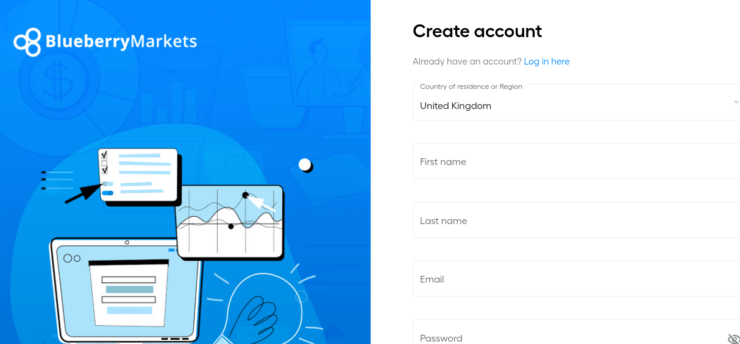

If you have read our Blueberry Markets review up to this point and like what you see – we are now going to walk you through the process of getting started. By following the simple steps outlined below you will have an account opened in just a few minutes!

Step 1: Open an Account

Like all online brokers that are regulated by ASIC – you will first need to open an account with Blueberry Markets. Simply head over to the provider’s homepage and click on the ‘Start Trading’ button.

You will need to select from a Standard or Direct Account – and then follow the on-screen instructions by entering your personal information and contact details.

Step 2: Upload ID

Another requirement that ASIC has on the brokers it regulates is that all traders must be verified. This is a simple process at Blueberry Markets – as you only need to upload a copy of your:

- passport or driver’s license

- proof of address – such as a bank account statement or utility bill

Your documents will usually be verified by the Blueberry Markets platform in less than 10 minutes.

Step 3: Deposit Funds

You can now deposit some funds into your Blueberry markets account. Choose your preferred payment type from the list of supported deposit methods. This includes debit/credit cards, a bank wire, and e-wallets. The minimum deposit is $100.

Step 4: Choose Platform

You now need to choose your preferred trading platform. Blueberry Markets supports MT4 and MT5.

You can use your preferred platform directly on the Blueberry Markets website. Alternatively, you can also access your account via the MT4/5 desktop software and mobile app.

Step 5: Start Trading

You are now set up with a fully-fledged Blueberry Markets trading account. All you need to do now is start trading. You can find your preferred market or asset by using the search box.

Then, you will need to set up an order. This will require you to choose from a buy/sell order and market/limit order – and to enter your stake. You can also set up a stop-loss and take-profit order.

Confirm your position to place your first commission-free trade with Blueberry Markets!

Blueberry Markets Review – The Verdict?

In summary, our Blueberry Markets review found that this ASIC-regulated broker is one of the best trading platforms in the market right now.

Not only can you trade heaps of financial instruments without paying any commission, but spreads are super tight. In fact, if you elect to open a Direct Account – some markets come with a spread of 0.0 pips.

Blueberry Markets - Buy and Invest in Assets

- Lightning-fast trade execution

- Zero commission on a standard account

- Hassle-free withdrawals within 24 hours

- One-to-one customer service

FAQs

Is Blueberry Markets a good broker?

Is blueberry markets regulated?

Can you use Blueberry Markets in the US?

What payment methods does Blueberry Markets accept?

How much leverage does Blueberry Markets offer?