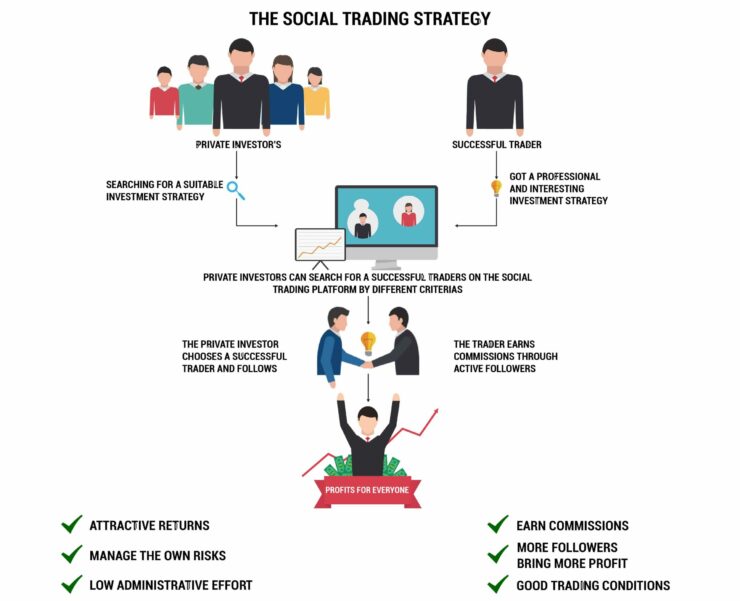

Social trading is a relatively new phenomenon in the online investment space. In a nutshell, online brokers that support social trading features allow you to engage with other traders of the site. This then allows you to discuss potential trading opportunities with your fellow peers, as well as learn and improve your investment knowledge.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Some social trading investment platforms go one step further, by allowing you to copy the trades of other users. In doing so, you stand the chance of earning passive income without you needing to lift a finger.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Fancy finding out more about the social trading buzz? If so, we welcome you to read our Learn 2 Trade 2023 Guide On Social Trading. Not only do we cover the ins and outs of how social trading actually works, but we discuss the best platforms currently active in the market.

Note: Just remember, although members of a social trading platform might claim to know what they are talking about, you should always take third-party advice with a pinch of salt. Instead, you should focus on members that have a verifiable track record in making long-term gains!

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What is Social Trading?

As the name suggests, social trading is a form of online trading that allows you to ‘socialize’ with other members of the site. By this, we mean that you get to discuss potential trading ideas with other users of the same brokerage platform, with each and every comment made public.

For example, let’s say that you have an interest in trading oil. By heading over the oil section of the broker, you’ll get to view the thoughts and viewpoints of how other members think the markets will go. Alternatively, you might decide to give your own opinion on the oil markets, which in turn, will see other members comment back.

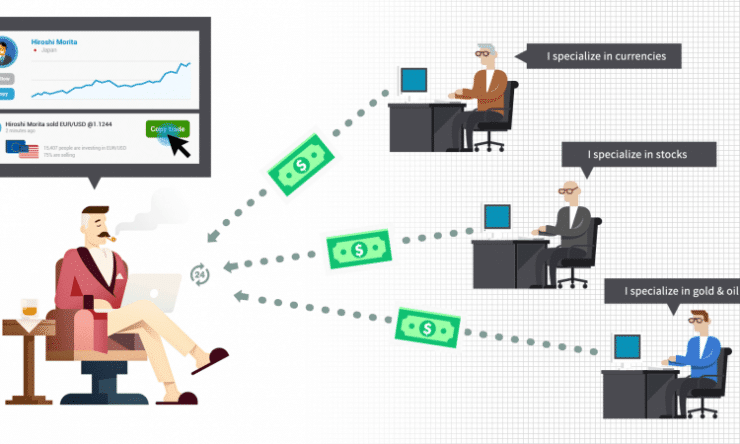

An additional point to note in the discussion of social trading is that some platforms also support copy trading. This is where you get to mirror the trades of other users at the site like-for-like. You get to choose which investors you seek to back, as well as what stakes you want to assign to the portfolio.

Pros and Cons of Social Trading

- Discuss investment ideas with other traders of the platform

- Learn and improve your trading knowledge

- Speak with expert traders that have a consistent track record of making profits

- Mirror the trades of other investors via Copy Trading

- On top of the social aspect, you have direct access to thousands of financial instruments

- Social trading sites typically support debit/credit card and e-wallet payments

- Easy to be influenced by so-called expert traders

- No guarantee that the social trading platform will improve your investment skills

- Lots of bad advice floating around

How Does Social Trading Work?

First and foremost – and as we briefly mentioned earlier, the overarching purpose of a social trading site is much the same as any other investment platform – you are there to make money. In other words, you’ll need to open an account with the online broker, upload some ID, deposit funds, and then choose your investments on a DIY basis.

With that said, you will then have the social aspect of the platform to draw from. Hopefully, this will mould you into a better all-round trader and help take your investments to the next level.

Social Trading Profiles

The easiest way to get your head around social trading is to think about how a traditional social media platform like Facebook works. As you probably know, everything is public unless you are talking to somebody via the platform’s private messenger feature. This includes the ability to click on somebody’s profile and find out more information about them.

In the case of a social trading platform, unless you decide to keep your profile private, other members of the site get to see your investment activity. This is great for you as a newbie investor, as you get to explore what assets seasoned traders are buying and selling.

The type of information that you will be privy to includes:

- Username of trader (no personal information)

- Photo of trader

- Historical trading results

- Risk level

- Current portfolio

By spending some time looking through the individual’s profile, you’ll get to assess how successful the trader is.

Finding Expert Traders

The online investment space is jam-packed with so-called ‘expert traders’. The reality is that most of these ‘experts’ are not really experts at all. Ordinarily, it would be difficult to assess the credibility of an online trading guru. For example, time and time again we sell investors on Instagram and YouTube with mass followings, only to learn that they are not as successful as they appear to be.

The good news is that social trading platforms are 100% transparent. For example, you get to explore each and every trade that the user has made since they joined the platform. This information cannot be amended or manipulated by the trader, as the data is based on real trading activity. As such, you can break the information down into easy-to-read reports, which allows you to gauge just how successful the trader is.

Once you have found a trader that you like the look of, you can add them to your friend list – just as you would with Facebook or Twitter. After that, you can keep tabs on everything they do at the platform!. This includes ongoing trades, as well as any comment they post in the public forum.

Overall Sentiment

Social trading sites are also great for gauging the overall sentiment on specific asset classes. Take eToro as a prime example. The online platform gives you a percentage breakdown of where the money is going on its site. This is fundamentally useful, especially when you consider that eToro is home to over 12 million traders.

For example, let’s say that you are attempting to assess the short-term direction of gold. If the social trading site states that 97% of the money is being placed on sell orders, then you know that the overall sentiment on gold is extremely bearish. With that said, the contrarians at the platform would likely go against the market sentiment by placing a buy order!

Public Discussions

We really like the public discussions that you find at social trading sites. This allows you to speak with other traders at the platform, with the view of finding out which way people think the markets go. For example, let’s say that you are interested in trading Apple stocks.

By heading over to the respective trading page, you’ll get to see a thread of discussions. This looks no different from a thread on Facebook, insofar that somebody will start the discussion by posting a comment, and then other people can join the conversion by leaving replies.

What you will often find is that seasoned investors will leave a highly in-depth analysis of an asset, which way they think it will go, and crucially – the underlying reasons for their prediction. Similarly, you will often find people discussing their fundamental and technical analysis findings.

Copy Trading

As great as the above features are, we would argue that the overarching benefit of joining a social trading platform is the ability to ‘copy trade’. Otherwise referred to as ‘automated trading’ or ‘mirror trading’, the process allows you to copy the trade of other users.

For example, let’s say that an investor at the site has a remarkable track record in buying and selling US stocks. You want to place exactly the same trades as them, proportionate to an amount you can afford. You can achieve this at the click of a button at social trading sites, and in most cases – you won’t be charged anything extra.

Let’s look at an example of how copy trading works.

1. Find a Trader That You Wish to Copy

Your first port of call is to find a trader that you like the look of. With leading social trading platform eToro now hosting over 12 million traders, you are going to need to do some serious research. Fortunately, you can easily narrow your search down by using filters.

Some of the metrics that you should focus on are:

Assets: Look to see what assets the user specializes in. For example, do they only buy stocks, or do they like to take a more diversified approach to investing?

Time at Platform: You’ll want to focus on traders that have a long-standing track record of making consistent gains. As such, just because the trader made double-digit gains in their first month of trying, this doesn’t mean you should copy them. Instead, opt for traders that have been active at the site for a number of years.

Gains: You will, of course, also need to assess how successful the trader has been. The best way to gauge this is to look at the monthly charts. This allows you to see what profits and losses the trader made within each calendar month since they joined the site. The more ‘green’ months the better.

Risk: Social trading platforms like eToro assign a risk rating on each user. This is an auto rating that is based on the types of trades the individual makes, alongside the amount they stake in relation to their account balance. Leverage will also play a part. It’s best not to rely solely on the pre-defined risk rating. Instead, assess the overall risk of the trader by exploring the metrics outlined earlier.

Number of Copy Traders: Often overlooked, it’s also useful to see how many users at the site copy the trader in question. Although not an exact science, traders that have an extensive following typically do so because they consistently make gains. This also puts additional pressure on to the trader, as the more people that follow them, the more money they are responsible for.

2. Choose Your Stake

Once you have found a trader that you wish to copy, you will then need to assess how much you wish to stake. Social trading platforms use a proportionate-based system, meaning that your total stake will be weighted the same as the portfolio you are copying.

For example:

- Let’s say that you want to copy a trader that has 5 stocks in their portfolio

- To keep things simple, we’ll say that the trade has allocated $100 on 4 x different stocks, and $600 on 1 x stock.

- This takes the total portfolio to $1,000

- However, you only want to stake $100 – which amounts to 10% of the actual portfolio value

- As such, your portfolio will have 4 x stocks at a stake of $10, and 1 x stock at $60.

As you can see from the above, you were given the option of copying the entire portfolio via a single click. Moreover, you also got to choose how much you wanted to invest in total – with the trades being placed at the same ratio as the person you coped.

With that said, you don’t have to copy the current portfolio if you don’t want to. Instead, you can elect to copy all future trades. Alternatively, you can opt for both.

3. Realizing Your Gains

Any gains that you make by following another social trading user will mirror the individual you are copying. For example, let’s say that over the course of July 2020, the trader makes a 4% profit.

Irrespective of how much the trader has staked, the 4% profit is calculated against the size of your portfolio. Sticking with the same example as above, this means that your $100 copy trading portfolio would have made $4 profit in July 2020.

However, excluding fixed income in the form of dividends or coupon payments, you will only realize your profits if you proceed to close the trade. If the copy trader doesn’t do this themselves, then you will need to do it manually.

4. Diversification Strategy

One of the best things about social trading sites like eToro is the sheer number of active users. What this means for you is that you will have thousands of profitable traders to copy.

With that in mind, this allows you to create a highly diversified portfolio of copy traders. In doing so, you’ll stand the best chance possible of shielding yourself from a trader that has a disastrous month.

Passive Income

A super-important characteristic of engaging in an automated social trading strategy is that the entire investment stream is passive. This means that you stand the chance of earning income at the end of each month, without you needing to do any of the hard work. Instead, all you need to do is choose which traders you wish to copy, and the social trading platform takes care of the rest.

The Benefits of Becoming a Social Trading Guru

While we have focused on the benefits of social trading platforms from the perspective of a newbie investor, what’s in it for those that have advanced trading skills? After all, if you were able to consistently outperform the wider markets, would you really want everyone to know what your Secret Sauce is?

For example, let’s say that the trader has 100 people copying them, with each portfolio worth $1,000. This means that the total AUM amounts to $100,000. If the social trading site pays a commission of 1%, this amounts to an extra $1,000.

Crucially, the trader is getting additional income for doing what they were going to do anyway, so it’s a win-win situation for all parties involved.

Tips to Make Money at a Social Trading Site

If you like the sound of social trading, but you don’t quite know where to start, below you will find some handy tips on how to give yourself the best chance possible of making money.

Set Some Parameters

When it comes to finding profitable traders to copy, it’s important that you set some parameters. By this, we mean that you should spend some time thinking about what minimum requirements you expect the trader to meet. For example, a good starting point is to only consider traders that have a track record of at least one year.

To be really sure that the trader’s results are not a case of sheer luck, you might want to up this to two years. An additional parameter that you might want to look at is the trader’s risk rating. While you might consider low-to-medium risk profiles, you might want to stay away from those that fall under the high-risk threshold.

Types of Assets

You then need to think about the types of assets that you wish to gain exposure to. For example, just because the user has made double-digit gains trading Bitcoin and Ethereum over the past 12 months, if you don’t feel comfortable investing in cryptocurrencies; don’t.

Furthermore, some of you might be more interested in assets that generate income – such as dividend-paying stocks or bonds. If this is the case, focus on social traders that typically hold income-yielding assets.

Diversify Across Multiple Traders and Assets Classes

Although we briefly discussed diversification earlier, we can’t stress enough just how important this is. In fact, you are best advised to diversify across multiple traders and asset classes. Regarding the former, it’s well worth copying the trades of dozens of different users.

Weighted Portfolio

It’s also worth thinking about creating a weighted portfolio of copy traders. For example, some traders will employ a 70/20/10 approach to risk. This is where 70% of your portfolio is based on traders with a low-risk score, 20% medium, and 10% high.

In following such an approach to social trading, you have the vast majority of your money in low-risk investors. However, you’ve also got a bit of money allocated to higher risk investors too – just on the off chance that they come good.

How to Choose a Social Trading Site?

Looking for a new social trading site where you can network and trade at the same time? If so, we would suggest following the tips outlined below.

✔️ Regulation

The most important metric that you need to assess is whether or not the social trading site is licensed. After all, you will be required to deposit real-world money at the platform, so it’s crucial that you protected by a tier-one body. For example, leading social trading site eToro is licensed by regulators in the UK, Australia, and Cyprus – so your money is safe at all times.

✔️ Payments

You should choose a social trading site that supports your favourite payment method. Whether that’s a debit/credit card, e-wallet, or bank account – be sure to check this before signing up.

✔️ Transparency

If you’re joining a social trading site because you wish to give copy trading a go, then make sure the platform is 100% transparent. In other words, when you review the performance of a trader you are considering copying, you should be able to view each and every trade they have ever made.

✔️ Easy Reporting

On top of being 100% transparent, you should also choose a social trading site that allows you to view statistics in an easy-to-read manner. For example, the best platforms will break trading results down on a month-by-month basis. That way, you get to see how consistent the copy trader in question is.

✔️ Financial Instruments

Don’t forget, you are going to be trading real-world assets, so be sure to explore how many financial instruments you will have access to. After all, you want to be creating a highly diversified portfolio of copy traders, so you’ll want to access to as many asset classes as possible.

✔️ Fees and Commissions

Not only do you need to take trading fees into account, but you might be charged to utilize the copy trading feature. In the case of eToro, you won’t pay any fees at all to mirror the trades of other users. However, a number of social trading sites will charge you a commission when you copy trade, so be sure to check this out.

Best Social Trading Site of 2023

Like the sound of social trading, and wish to get started with an account right now? If so, you’ll find our top-rated platform listed below.

Conclusion

In summary, the social trading phenomenon has really taken the retail investment space by storm in recent years. In a time not so long ago, online brokers would target their products to a specific type of investor. Things have changed a lot since then, with a number of platforms now following similar principals to social media sites like Facebook and Twitter.

This is great if you’re a newbie trader, as you get access to a wealth of knowledge in a transparent environment. Similarly, you also get the chance to earn passive income by mirroring the trades of other users. With that being said, you really need to do some homework on a trader before risking your own money.

Ultimately, if you do want to experience what social trading is like, we hope that our in-depth guide has armed you with all of the information you’ll need to succeed. We have also pointed you in the direction of our top-rated social trading platform – eToro. By opening an account with the broker, you could be social trading in a matter of minutes!

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card