Become A Professional Forex Trader with Learn 2 Trade Forex Course:

- Unlock all 11 chapters for just £99!

- Know when to trade and when not to!

- Learn from your phone or desktop!

- Professional education from real traders!

Forex Course & Signals

1 – month

Subscription

Up To 20 Signals Daily

Copy Trading

Up to 81% Success Rate

24/5 Forex Trading

10 Minute Setup

per

month

3 – month

Subscription

Up To 20 Signals Daily

Copy Trading

Up to 81% Success Rate

24/5 Forex Trading

10 Minute Setup

per

month

Most popular

6 – month

Subscription

Up To 20 Signals Daily

Copy Trading

Up to 81% Success Rate

24/5 Forex Trading

10 Minute Setup

per

month

Lifetime Subscription

Up To 20 Signals Daily

Copy Trading

Up to 81% Success Rate

24/5 Forex Trading

10 Minute Setup

billed one time

- 📖 Get tons of tips, case studies, examples and bonuses, all in a friendly, easy to understand, intuitive way

- 💻 Test your knowledge with unique quizzes, train yourself after each chapter

- 📝 Practice all you learn straight from your account, with live market rates

Our Course has everything you need to learn to become a Forex trader. Take advantage of the financial market in 11 lessons and learn how to trade Forex like a professional.

By Taking Our Forex Trading Course, You Will Learn To

- Recognize business opportunities

- Utilize movements of currency rates

- Forecast future events and their influence on currencies

- Use all the tools and aids offered by the trading platforms

- Implement technical and fundamental analysis

- Start making profits and begin your journey to success!

- different trading styles

A detailed list of the chapters, lessons, and topics you will find on Learn 2 Trade Trading Course:

📖 Chapter 1. Preparation for Learn 2 Trade Trading Course.

The Forex market is a worldwide market of currencies (called instruments). The market measures the value of a currency in terms of another currency’s value (e.g.. $1 = £0.66).

📖 Chapter 2. First Steps in Learn 2 Trade – Basic Terminology

It is very important to get to know Learn 2 Trade Terminology in order to trade knowledgeably. The terminology is important to be able to read currency price quotes.

📖 Chapter 3. Synchronize Time and Place for Forex Trading

It’s time to learn more about the market. Our step by step journey through Forex continues. So before jumping into the deep water, let’s wet our feet first, and get used to the temperature… and focus on the following forex trading terms:

📖 Chapter 4. Get Equipped for Learn 2 Trade

Now that you wet your toes, we are ready to start swimming lessons… Let’s jump right in. We will now start giving you the basic tools necessary to be a successful Learn 2 Trade trader.

📖 Chapter 5. Fundamental Learn 2 Trade Strategies

Sometimes a fundamental approach is even more important than a technical one. From George Soros to Warren Buffet, some of the world’s most famous traders have admitted that they owe their fortunes to the fundamental analysis they have made over the years.

📖 Chapter 6. Technical Forex Trading Strategies

It’s time to get right into the thick of things and start learning about technical analysis, one of the most common forex trading strategies. In Chapter 6 we will discuss some of the most popular forex trading strategies.

📖 Chapter 7. The Fibonacci Technical Indicator

In the next two chapters, you will receive a detailed introduction to your technical toolbox. Every professional has his own working tools and so do Forex traders. Our toolbox contains a variety of analytical tools. These tools are helpful for efficient, professional technical analysis (which at the same time, in many cases, support fundamental decisions).

📖 Chapter 8. More Technical Trading Indicators

Having met Mr. Fibonacci, it’s time to get to know some other popular technical indicators. The indicators you are about to learn about are formulas and mathematical tools. As prices shift all the time, the indicators help us put prices into patterns and systems.

📖 Chapter 9. 6 Killer Combinations for Trading Strategies

In Chapter 9 we will show you which trading strategies you can combine to get the best results (two is usually better than one).

📖 Chapter 10. Risk and Money Management

In Chapter 10 – Risk and Money Management we will discuss how to maximize your profits while minimizing your risk, using one of the most important tools of forex trading – proper money and risk management. This will help you mitigate your risk and still allow you to make a nice profit.

📖 Chapter 11. Learn 2 Trade in Relation to Stocks and Commodities and Trading with MetaTrader

In Chapter 11 – Learn 2 Trade in Relation to Stocks and Commodities and Trading with MetaTrader you will learn about the relationship between stocks, indices, and commodities to the learn 2 trade market. In addition, you will learn how to master the MetaTrader platform.

Our Forex Signals

1 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

3 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

Most popular

6 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

Lifetime

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

Separate Swing Trading Group

Up to 3 signals weekly

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

1 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

one

time

Forex Course

Forex Course & Forex – otherwise referred to as ‘FX’, is the largest and most liquid asset marketplace globally. It involves trading currencies day and night, 24/7. With stakeholders including traders, banks, investors, and even tourists – forex consists of swapping one currency to another.

Like a marriage of currency and exchange – traders around the world are buying and selling these currencies with the view of profiteering or hedging. The demand and supply determined in these markets is what sets the currency exchange rate.

Whether you are new to forex trading or are a seasoned trader, knowledge is power. As such, our team of experts here at Learn 2 Trade has put together a guide full of useful information.

In this forex course, we are going to run you through everything you need to know about trading currencies. This includes basic terminology, technical analysis, chart reading, trading strategies, risk management, and more!

Our Forex Signals

1 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

3 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

Most popular

6 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

Lifetime

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

Separate Swing Trading Group

Up to 3 signals weekly

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

1 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

one

time

What Is Forex?

Forex is essentially the foreign exchange market, comparable to the London Stock Exchange or NASDAQ, but for currencies from around the globe. Sometimes referred to as FX, forex is responsible for the exchange rate for two currencies (referred to as a currency pair). Anyone can join in and try to make a profit in this trading market.

This trading scene covers a variety of purposes, such as exchanging foreign currencies for tourism, a corporation looking to hedge risk, or perhaps just to make a trade which might prove profitable. Whatever the reason, one of the major draws is the fact that once you have opened a position you can put an automatic stop loss in place, which closes the trade for you in a risk-averse manner.

Ultimately, from your perspective, the main premise of the forex market is to sell or buy currencies against each other, with the aim of making money. You will achieve this goal when you correctly speculate which way a particular exchange moves in the short term.

Next in this forex course, we are going to run through some of the most predominantly used phrases and terms utilized in the space.

Forex Course: Commonly Used Terms

We at Learn 2 Trade believe that cutting through the jargon is crucial when it comes to learning and honing in on your forex skills.

Below you will find a list of the most important terms that you need to master.

Currency Pairs

In effect, the currency pairs considered the most liquid are the currencies which are the most popular (supply and demand). These are known as ‘major pairs’. The investments of traders, banks, exporters, and importers actually create this all-important supply and demand.

A great example of a liquid currency pair would be EUR/USD. In fact, it is widely believed that this is the most liquid currency pair in the forex market. Again this is down to supply and demand, and thus – it is the most traded currency pair.

EUR/USD offers traders a variety of short term trading prospects. This is because of a large number of pips moved on a daily basis. With an impressive average of between 90 and 120 pips, it is clear to see why this is considered a very liquid pair.

Some other popular currency pairs are as follows:

- GBP/USD: Great British Pound/United States Dollar.

- AUD/USD: Australian Dollar/United States Dollar.

- USD/JPY: United States Dollar/Japanese Yen.

- USD/CAD: United States Dollar/Canadian Dollar.

- USD/CHF: United States Dollar/Swiss Franc.

- AUD/USD: Australian Dollar/United States Dollar.

Here are a few examples when it comes to lesser used and more ‘exotic’ currency pairs

- EUR/GBP: Euro/Sterling.

- NZD/JPY: New Zealand Dollar/Japanese Yen.

- GBP/JPY: Great British Pound/Japanese Yen.

- EUR/AUD: Euro/Australian Dollar.

- GBP/CAD: Great British Pound/Canadian Dollar.

- AUD/HKD: Australian Dollar/Hong Kong Dollar.

Whilst they are less popular than the majors, it is not impossible to do well from these pairs with a little knowledge.

Pip (Point In Percentage)

The pip is representative of the lowest amount that a currency pair quotation can change, within the forex trading market. A pip, meaning ‘point in percentage’, shows any small shifts marked in a forex currency pair.

The base unit in the cost of a currency pair is essentially the pip, so 0.0001 of the quoted price.

For instance, if a bid price for EUR/GBP currency pair shifts from 1.15701 to 1.15702, this shows you as a trader that the difference is of one pip.

Spread

Even if you only have a basic grasp of forex trading, you will have no doubt heard of the spread. Having a basic understanding of the spread and how it works in the forex market can certainly help you make a profit in the long run.

Generally speaking, the most extensively used currency pairs will have a tighter spread, and the least popular will have a higher spread. Sometimes the most commonly used currency pairs can have a spread of less than a pip.

The spread is essentially the difference between the purchase cost and the sale price of the currency pair, at your chosen broker. These costs will shift and swing throughout the trading day, and whatever happens, is depicted by the spread.

The profits you make from trade must exceed the spread in order for you to make a profit.

Margin

We could not create a forex trading course page without talking about margin. after all, margins are an essential part of forex trading.

The amount of money put forward by a trader in order to either place a trade or maintain a position is called a margin. This can be a great way for traders to build up their market prospects.

Your margin will be guarded by the best forex brokers whilst the forex trade is open. Essentially, a margin is a bit like a down payment, instead of a transaction cost.

Forex brokers will quite often give their clients access to leverage (see below). Normally, the forex trader needs a high margin so that they can trade in high volumes. As such, in order to make a decent enough profit leverage will be offered.

Leverage

For many forex traders, the leverage tools provided by their forex broker can be an excellent way of boosting market positions. Capital is typically presented in the shape of leverage, and this is so forex brokers can expand the number of trades it can provide to their customers.

Before you can begin trading whilst also taking advantage of leverage, you are going to need to open a margin account with a forex broker. Depending on the size of your position and also the broker in question, leverage is often as high as 200:1. But, the UK and European retail clients are often capped to 1:30 – as per ESMA regulations.

Example

Our team at Learn 2 Trade has put together 3 examples of leverage.

- Example 1: If you stake $100 at a leverage of 1:10, then your trade is worth $1,000. If you initially made a profit of $40, this would be amplified to $400.

- Example 2: If your leverage is 1:20 and you have $1,000 in your trading account – you can trade a position of $10,000 on your currency pair. In other words, all profits and losses are boosted by 20x.

- Example 3: If you have a long position of GBP/USD with a stake of $500 at a leverage of 1:30, your profits and losses will be amplified by 30x. So, if you make gains of 10%, your profits would go from $50 to $500.

Like light and dark, what brings a reward can also bring a loss. Always be aware that whilst leverage can be excellent for boosting those profits, it can also boost losses if you are not careful.

If your account does happen to drop below zero, then you might be able to contact your forex broker to request a negative balance policy. In doing so, this will make sure that you do not lose more money than you have deposited in the first place.

It is essentially a protective measure for traders and will give you peace of mind that you are not falling into debt with your forex broker. The good news is that most online forex brokers offer negative balance protection automatically, albeit, you should check this before signing up. This is especially the case with brokers that fall within the remit of ESMA.

Our Forex Signals

1 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

3 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

Most popular

6 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

Lifetime

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

Separate Swing Trading Group

Up to 3 signals weekly

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

1 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

one

time

Forex Trading: Commonly Used Orders

In this section of our forex course, we explain some of the most broadly used market orders, with an explanation of each. This is crucial, as these orders will be passed on to your forex broker of choice, to enable them to carry out positions on your behalf.

Forex Course: Buy And Sell Orders

If as a trader you expect for the price of an asset to drop, you will ‘go short’. The reason for this is that in order to benefit from purchasing the asset at a lower rate, you essentially need to place a ‘sell order’. Similarly, if you think the price of the pair will increase, you place a ‘buy order’, which is known as ‘going long’.

A simple way to view a currency pair price is that it will be based on what the value of the 2nd currency is, and how much you are able to swap the 1st currency for. In other words, the currency pair price will be based on the current exchange rate for the currency (as a pair). For example, if EUR/USD is priced at 1.14, then you are getting 1.14 USD for every 1 EUR.

he forex broker will offer you a purchase (buy order) and sale price (sell order) based on either side of that number. The difference between the two prices is the spread.

Now let’s say you have purchased a primary financial instrument like GBP/JPY and choose to remain in a long position. This means that you are predicting that GBP will go up in value against the JPY. If you purchased the pair GBP/JPY twice, it means that you have 2 long positions of the same currency pair (USD/JPY). The base currency in this pair is GBP, and the size of the position is 2 lots (contracts), and the direction is ‘long’.

Also called a limit-buy order, this is essentially an order to say that you want to enter the market at a specific price. For example, if GBP/USD is priced at 1.30 but you want to enter the market when it hits 1.29, you would need to enter a limit order. Only when your pre-defined price is triggered, does the order go live. Until then, it remains in a status of ‘pending’.

Stop-Loss Order

This order tells your broker that you want to sell a ‘security’ as soon as a specific price is reached. The aim here is to help decrease your loss on a security position.

Take-Profit Order

A take-profit order tells your forex broker that you wish to close your trade or position as soon as a price hits a particular price profit level. In other words, the fundamentals work exactly the same as a stop-loss order, but in reverse.

Our Forex Signals

1 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

3 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

Most popular

6 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

Lifetime

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

Separate Swing Trading Group

Up to 3 signals weekly

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

1 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

one

time

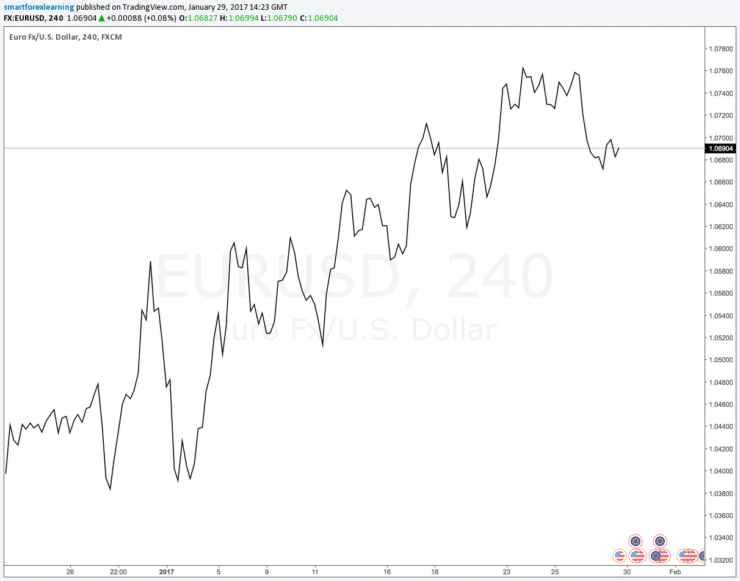

Forex Course: Common Forex Charts

In this part of our forex course, we are going to delve into the most commonly used charts. Thanks to the vast amount of technical analysis tools available to you as a trader, there are many ways in which you can increase your chances of making a profit.

Generally, traders use forex charts on a daily basis in order to examine and analyse a huge variety of currency pairs, as well as alternative financial markets. Below we have put together a list of the most used charts in forex trading, with an explanation of how each one works.

Forex Course: Line Chart

The line chart is one of the simplest charts, so it is a great starting point if you are a newbie trader. Crucially, it is still very helpful for traders to study when it comes to examining the bigger picture. The elementary style of the price chart is actually one of the things which makes it so popular. Because of the style used, traders are able to cut out some of the ‘busy noise’ of the market and just focus on simple facts.

For example, when looking at a daily line chart which is displaying the price action on GBP/AUS, the line shown will represent the price action on that pair. This is displayed by the line connecting results and daily losing prices. As any great forex course will tell you, line price charts act as a useful filter for people wanting to analyse information in a busy market.

The line chart mirrors the nature of the market by showing only the closing price. By not concentrating on the price action within closing and opening market prices, a line chart makes trends easier to spot, and patterns more easily recognisable.

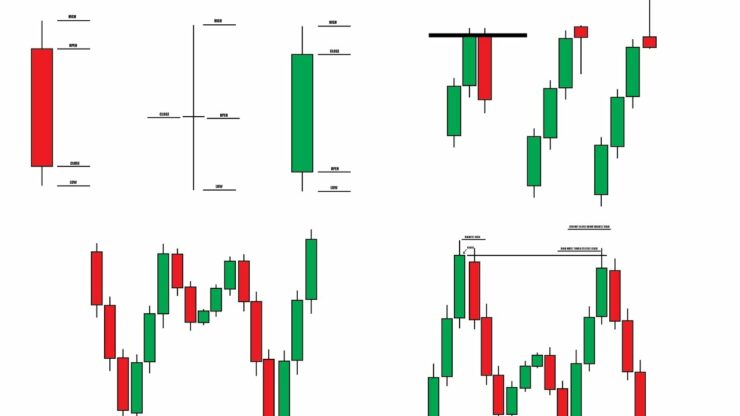

OHLC (Open, High, Low, Close)

Although another helpful chart for traders, OHLC does differ from the line chart. This is mainly because it is a bar chart, and displays a lot more information such as the opening and close price of the pair, as well as highs and lows. An OHLC bar chart is a great way for you to really study any negative or positive stock price movements. This will always be done within a specified time frame, whether that is 1 hour or an entire trading day.

We have put together a few points which should help you to make sense of the OHLC:

- The low of the chart bar is to illustrate the lowest market price – within the specific time frame.

- The high of the chart bar is to illustrate the highest market price – within the specific time frame.

- The dash on the right of the bar illustrates the closing price.

- The dash on the left of the bar illustrates the opening price.

- The buyer (or green bar) illustrates that the opening price is more than the closing price.

- The seller bar (or red bar) illustrates that the opening price is less than the closing price.

When traders are studying which direction assets and price movements might be going, the OHLC is a very helpful way to gain a clearer picture.

Forex Course: Candlestick Chart

First used by Japanese rice traders during the early 1700s, the candlestick chart is now hugely popular with heaps of traders worldwide. The candlestick chart is very similar to the OHLC chart we talked about a moment ago. This is because traders have access to open, close, low, and high values within a specific time frame.

You will see 3 distinct points on a ‘price candle’:

- Open: This is the body of a candle and illustrates the starting price of an asset within a select period of time.

- Close: This is the body of a candle and illustrates the finishing price of an asset within a select period of time.

- The Wick: Also referred to as the shadow, the wick illustrates the price extremities for the specific timeframe. The wick is helpful for identifying market momentum.

Each candle will represent the price movement for the timeframe you have chosen. For example, when studying a daily chart, each candle will illustrate the close, open, and upper and lower wick for each individual day.

Do not forget, a good way for traders to get to grips with these charts and really get the most out of them is to start with a demo account facility. You can typically find a forex demo account through your broker. It will allow you to practice before you take the plunge and begin trading with your hard-earned money.

Our Forex Signals

1 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

3 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

Most popular

6 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

Lifetime

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

Separate Swing Trading Group

Up to 3 signals weekly

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

1 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

one

time

Forex Trading Strategies And Systems

If you are just starting out in the world of forex, it is imperative that you learn the ins and outs of trading strategies. No trading strategy is better than the next, so you need to figure out what works for you and your long-term financial goals.

Below we list some of the most commonly used forex trading strategies.

Swing Trading

This is known as a medium-term strategy (or approach). Swing trading very much concentrates on the bigger picture when it comes to price movements. Some Traders use swing trading as a way to amplify their current daily trades. Swing trading also means that you are able to leave your trade open for days or weeks at a time.

Forex Scalping

In a nutshell, forex scalping is used by traders who want to make multiple trades on a single pair, reaping the benefits of smaller price movements during the trading day.

Generally speaking, scalping will involve the buying and selling of trades within a matter of seconds, or a few minutes. This type of trading strategy makes it entirely feasible for traders to make a variety of small profits, all added together to potentially make up a big gain.

Intraday Trading

Intraday trading is more of a prudent approach to trading, and it focuses its attention on the 1-4 hour price trends. We think that this is a great trade for beginners due to the short amount of time the trade stays open. Intraday trading also provides traders with entry and stop-loss strategies and is considered low-risk.

Our Forex Signals

1 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

3 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

Most popular

6 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

Lifetime

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

Separate Swing Trading Group

Up to 3 signals weekly

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

1 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

one

time

Forex Course: Forex Trading Platforms

If you want to trade forex from the comfort of your home, you will need to find a forex trading platform that meets your needs. There are hundreds to choose from, so spending some time researching a suitable broker is crucial.

Some of the things that you need to look out for as listed below:

Trust In Your Broker

We think it is just as important for your peace of mind as it is for your trading wallet to fully trust your forex broker. When you find a broker you would like to work with, we recommend checking that you are happy with a few key points:

- Speedy execution of data transfer.

- Accuracy of quoted prices.

- Fast order processing.

- Reliable customer support.

- Opening hours which match the forex market (24/7).

If your forex broker provides all of the above services (in a manner you trust), this will only enhance your trading experience. It is going to aid you in making the most of new trading opportunities in a timely and efficient manner.

Account Manager

The majority of forex brokers will allow you to trade your account independently. This means you do not need to request for your broker to take action on your behalf. You can act on any market movements quickly and efficiently and should have better control over open positions as and when they come up.

Forex Course: Technical Analysis

The most reputable forex trading platforms will have a variety of technical analysis and trading tools available to you at your disposal. You may find that some platforms offer embedded indicators, whilst others offer a plethora of fundamental analysis and technical analysis for you to study. We think the more features a broker has, the better. But, it depends on your trading style.

Having access to current financial news, a range of price charts, and technical indicators will only enhance your trading journey and help you to become a much better trader later on. An example of a fast and simple trading platform is Meta Trader 4/5. A lot of forex brokers offer these platforms, which is great. Whether it is highly developed charts or live market data news, these trading platforms are popular for a reason.

Broker Safety

Always choose a forex broker who is fully licenced and regulated. This will give you the peace of mind that your trading account and your personal information is sufficiently protected.

Further down this forex course, our team of experts has put together a list of reputable forex brokers for your consideration. With that said, you need to check what regulatory bodies the broker in question is licensed by. We prefer reputable bodies like the UK’s FCA, Australia’s ASIC, or CySEC in Cyprus.

Our Forex Signals

1 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

3 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

Most popular

6 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

Lifetime

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

Separate Swing Trading Group

Up to 3 signals weekly

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

1 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

one

time

Forex Course: Technical Indicators

In this section of our forex course, we are going to discuss some of the most popular technical indicators utilized by seasoned traders. These allow you to perform advanced chart analysis and ultimately – evaluate which way a particular currency pair is likely to move in the short term.

SMA (Simple Moving Average)

The simple moving average (SMA) is famous amongst forex traders. This strategy is often referred to as a lagging indicator because it operates at a slower rate than the current market price. The SMA trading indicator focuses more on the history of price movement data than other strategies, making it very functional when spotting an overall trend.

If the short term moving average is above the long-term moving average – that is a sign the most recent price is higher than the original price. You could take this as a buy signal because of the sign of an uphill trend in the market. Of course, if the opposite happens, then this would indicate that a sell position is potentially in the making!

Forex Course: Donchian Channel

The donchian channel is a technical indicator that offers the trader an element of flexibility. You can choose your own timeframe, such as a 20-day breakdown. In doing so, the trend-following indicator will be illustrated by using the lowest low and the highest high within 20 periods.

A break in the channel will prompt one of these two orders:

- Buy: Within the last 20 periods the market price exceeds the highest high.

- Sell: Within the last 20 periods the market price exceeds the lowest low.

The moving averages of a donchian channel can be viewed between anywhere from 20 days to 300 days. The direction of the short-term moving average determines which direction will be permitted.

When considering your opening position there are two options:

- Short: The moving average of the previous period is higher than the moving average of 20 days.

- Long: The moving average of the previous period is lower than the moving average of 25 days.

If you have opened a long position but the market falls under the aforementioned limit, you will need to sell to exit your position.

Forex Course: Breakout Signal

A ‘breakout’ is a best forex signals, often referred to as a consolidation breakout. A breakout is thought to be a medium-term strategy, as markets switch between support bands and resistance bands. Whether the consolidation limits are lower or higher – the point at which a breakout signal occurs is when the market goes beyond those limits. Whenever there is a new trend, a breakout has to occur.

Analysing these breaks is a great way for you as a trader to try and predict whether a new trend is about to begin. Of course, there is no guarantee of the accuracy of the breakout signalling a new trend. As such, you might decide to utilise a stop-loss in order to give yourself a better chance of keeping your money safe.

Our Forex Signals

1 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

3 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

Most popular

6 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

Lifetime

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

Separate Swing Trading Group

Up to 3 signals weekly

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

per

month

1 – month

Subscription

Up to 15 signals daily

76% success rate

Entry, take profit & stop loss

Amount to risk per trade

Risk reward ratio

one

time

Forex Course: Risk Management

Shielding your market orders from any sudden negative movement is really important. Following technical analysis and the financial market, the news is going to help you in doing this. You can give yourself a better understanding of risk management strategies by trying out a forex trading demo and taking some of your trading strategy ideas for a test drive.

Forex Course: Risks

When it comes to trading, there is always some risk. After all, you will be trading with your own money.

Some of the risks to keep an eye out for when trading forex are listed below:

Risk 1: Leverage

As we touched upon earlier in this forex course, leverage can play a big part in your trading – both in a good way and a bad way. In other words, the greater your leverage is, the greater your benefits (or losses) will be. The risk is always that as well as boosting your profits, it can work against you and boost your losses. As such, you would better limit the amount of leverage you apply when starting out.

Risk 2: Interest Rates

When the interest rate of a country drops, the currency of the country in question will become weaker. A weak currency results in investors withdrawing from investments. Due to the lack of supply and demand, this means you might suffer greater volatility levels and wider spreads.

Vice versa, when a currency is rising, it will be more liquid. The more liquid a currency is, the more people invest, and the lower the spread/volatility.

Risk 3: Transactions

At some point during the course of the contract, the exchange rate could be unsteady in the market. This is known as transaction risk. The main reason for currency rate fluctuation is usually differences in time zones and exchange rates. The longer that passes between the entering and closing of a contract, the higher the risk of these changes taking place.

Which Forex Broker To Use?

As we have noted throughout our guide, you need to use a reliable and trustworthy broker to trade forex online. Although we have discussed some of the research metrics you need to consider when selecting a platform, this can be time-consuming.

As such, below you will find a selection of popular brokers that forex traders utilize.

1. AVATrade – 2 x $200 Forex Welcome Bonuses

AVATrade is popular with traders that are looking for an extensive offering of tools and features. Whether you opt for MT4 or the AVATrade platform, you’ll have access to market insights, technical indicators, and highly advanced chart reading tools. The platform charges no commissions, and deposits are free. Major pairs typically come with spreads of below 1 pip.

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs – this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Forex Course: Conclusion

Our forex course has put together a simple, yet highly informative introduction to online forex trading. We think that understanding technical analysis and macroeconomic principles of currency values are extremely important. Once you have the basics down, you are in a great position to be able to put your own trading strategy into action. This will help you to become a more successful trader later down the line.

If you are a trader who only wants to spend a small amount, you could find day trading and swing trading are good options for you. Due to the short-term nature of these trading strategies, this usually means making smaller profits, but on a more frequent basis.

Ultimately, we hope that this forex course has been a helping hand in making you feel like a more confident forex trader. All you need to do now is get trading and hopefully make consistent profits. If you are still nervous about taking the plunge, then there is nothing wrong with starting off on a forex demo account whilst you find your feet.

AvaTrade – Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card

Forex Course — Frequently Asked Questions

Everything you need to know about learning forex trading in 2026 — answered by our expert team.

What is the best forex trading course for beginners in 2026?

The best forex trading course for beginners combines theory with live-market practice. Look for courses that cover the fundamentals of forex markets, currency pairs, pip calculations, chart reading, risk management, and trading psychology. Learn 2 Trade’s forex course is highly rated because it pairs structured lessons with real-time signals and a supportive Telegram community, making it ideal for complete beginners.

How long does it take to complete a forex trading course?

Most structured forex trading courses take between 4 and 12 weeks to complete, depending on depth and the time you commit. A comprehensive beginner-to-advanced course covering technical analysis, fundamental analysis, risk management, and live trading practice typically requires 60–100 hours of study. Many traders continue learning through live trading experience for months or years after completing a formal course.

Can I learn forex trading for free?

Yes, there are free resources such as YouTube tutorials, forex broker education centres, and community forums. However, free content is often fragmented and lacks structure. A paid course like the one at Learn 2 Trade provides a proven curriculum, mentorship, live signals, and accountability — significantly accelerating your learning curve and reducing costly beginner mistakes.

What is a pip in forex trading?

A pip (percentage in point) is the smallest standard price movement in a currency pair. For most pairs, one pip equals a 0.0001 movement in price. For example, if EUR/USD moves from 1.0850 to 1.0851, that is a one-pip move. Understanding pips is essential for calculating profits, losses, and position sizes in forex trading.

What leverage is available in forex trading?

Leverage in forex trading varies by broker and jurisdiction. Retail traders in the EU and UK are typically limited to 30:1 on major currency pairs under ESMA/FCA regulations. In other regions, leverage can reach 100:1 or higher. While high leverage amplifies potential gains, it equally amplifies losses, making robust risk management essential. Regulated brokers like Eightcap and Focus Markets offer competitive leverage within regulatory guidelines.

What is the difference between scalping, swing trading, and position trading?

Scalping involves taking many small trades throughout the day, holding positions for seconds to minutes. Swing trading holds trades for days to weeks, capturing medium-term price moves. Position trading is a long-term approach holding trades for weeks, months, or even years. Each style suits different personality types and time availability. A good forex course teaches all three so you can choose the approach that fits your lifestyle.

How much money do I need to start forex trading?

You can technically start forex trading with as little as $10–$50 with some brokers. However, a more realistic starting capital for serious beginners is $500–$1,000. This allows proper position sizing and risk management without blowing an account on a few bad trades. With $1,000, risking 1–2% per trade means your stop-loss allows for $10–$20 risk per position — enough room to trade meaningfully.

What is risk management in forex trading?

Risk management in forex refers to the strategies traders use to limit losses and protect capital. Core principles include never risking more than 1–2% of your account per trade, always using stop-loss orders, maintaining a favourable risk-to-reward ratio (typically 1:2 or better), avoiding overleverage, and diversifying across currency pairs. A comprehensive forex course will dedicate significant time to risk management as it is the number one factor separating profitable traders from losing ones.

Which forex broker should I use as a beginner?

Beginners should choose a regulated forex broker with tight spreads, a user-friendly platform, and strong educational resources. Eightcap is an ASIC and SCB-regulated broker known for low spreads on major pairs and a clean MetaTrader 4/5 interface. Focus Markets is another well-regarded broker offering competitive conditions. Both are trusted by the Learn 2 Trade community.

What is technical analysis in forex?

Technical analysis (TA) in forex involves analysing historical price charts and using indicators to forecast future price movements. Common tools include candlestick patterns (doji, hammer, engulfing), trend lines, support and resistance levels, moving averages (MA, EMA), RSI, MACD, Bollinger Bands, and Fibonacci retracements. A solid forex course will teach you to read charts fluently and combine multiple TA signals for higher-probability trade setups.

What is fundamental analysis in forex?

Fundamental analysis in forex examines macroeconomic indicators, central bank policies, and geopolitical events that drive currency valuations. Key fundamentals include interest rate decisions, inflation data (CPI), GDP reports, employment figures (NFP), and trade balances. For example, when a central bank raises interest rates, its currency typically strengthens as higher rates attract foreign capital seeking better returns.

How do I join the Learn 2 Trade community?

You can join the Learn 2 Trade free Telegram channel at https://t.me/learn2tradenews for daily market insights, educational content, and forex signals. For premium signals, full course access, and dedicated mentorship, visit our premium membership page at learn2.trade/go-premium. Premium members receive higher-accuracy signals, advanced strategy content, and priority support.

Ready to Start Your Forex Trading Journey?

Join thousands of traders who have transformed their trading with Learn 2 Trade’s proven course and expert signals.

Recommended Brokers for Forex Course Students:

Eightcap — Low spreads, MetaTrader 4/5, ASIC regulated | Focus Markets — Competitive conditions, trusted by our community

⚠️ CFDs are complex instruments and carry a high risk of losing money rapidly due to leverage. Please ensure you understand how CFDs work and whether you can afford to take the high risk of losing your money.