Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

It has been over a decade since the first altcoin was introduced to the cryptocurrency world – Litecoin being one of the most well-known.

Our Crypto Signals

1-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

12-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime Subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioIf you want to learn how to buy one of the hottest digital currencies in the cryptocurrency market – stay right there.

In this comprehensive guide, we detail how to buy Litecoin from start to finish. We also divulge some of the most commonly used crypto strategies and review the most trustworthy trading platforms in the industry.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

How to Buy Litecoin in 10 Minutes – Quickfire Guide

In order to buy Litecoin online – you are first going to need to join a brokerage to gain access to this digital coin. Once you have decided which platform to use, you can embark on buying Litecoin with ease.

If you are yet to do your homework in this respect, not to worry, -we review the top 4 platforms shortly.

- Step 1: As we said, you will need to join a brokerage – Capital.com is used by millions and you will not pay commission to buy Litecoin

- Step 2: Complete the sign-up process including a username and a memorable password

- Step 3: As per KYC, you will now be asked for some proof of ID and address – most people use their passport and a recent bank statement for this

- Step 4: Click on ‘Payment Methods’ and select one from what’s available – input the amount you would like to deposit

- Step 5: Search Litecoin, enter the amount you wish to buy (minimum $25), and place your order.

You have just bought Litecoin at commission-free!

Select a Trusted Litecoin Broker

Online brokers provide access to the cryptocurrency markets. As such you need to buy Litecoin via a trusted platform.

There is more than one way to buy Litecoin, so we’ve saved you hours of research and reviewed the top 4 platforms offering this digital currency.

Notably, we have also included CFD brokers – as this enables you to go short on LTC coins, as well as apply leverage.

1. AvaTrade – CFD Broker and a Wide Range of Techincal Analysis Tools

AvaTrade is another commission-free CFD broker on our list that is able to provide you with access to Litecoin. There are also over a dozen other cryptocurrency CFDs, as well as more than 1,000 markets across indices, forex, ETFs, stocks, and bonds. Our guide found the typical spread on Litecoin CFDs to be 0.6% over the market.

Furthermore, this trading platform will offer leverage on Litecoin trades where permitted. The site states that this will be 1:2 for European clients and 1:25 for non-EU traders. The latter means for every $1 you stake, you can trade with $25. There are no concerns about the legitimacy of this platform. Not only has AvaTrade been around for over a decade - but the company is regulated in 6 jurisdictions. This includes Europe, Australia, Japan, and more.

Not all Litecoin traders like to dive right in. As such, AvaTrade offers a full educational center packed with various trading videos, indicators, and strategies. You will also find lessons on crypto order types and tips on advanced trading techniques. Furthermore, you can hook your account up to MetaTrader4 and utilize the wide range of trading tools on offer there.

Before going live with real money, you may want to try out the free demo account. This enables you to trade Litecoin CFDs without risking a cent of your own money. Instead, you will be using a paper trading balance of $100,000. In terms of accepted payment methods, you will see the most commonly used. This includes major credit/debit cards and wire transfers. Some people will be able to deposit funds using e-wallets such as Skrill, Boleto, and Neteller. Finally, the minimum requirement to start trading Litecoin CFDs at AvaTrade is just $100.

- Trade Litecoin from $100

- Regulated by 6 regulatory bodies

- Litecoin CFDs come with 0% commission

- Fee payable after 12 months account inactivity

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Consider Your Litecoin Strategy

Strategies are used by both novice and expert Litecoin buyers. After all, having a plan aids you in maintaining better control over your finances.

If you don’t know where to start, you will see the two best options below.

Buy and Hold Litecoin

If you decide to buy and hold Litecoin – you are purchasing digital coins and keeping a hold of them for months or years – before selling them.

Why you might ask? Some people don’t wish to be concerned with the short-term price fluctuations this particular digital asset experiences. As such, you might be more interested in purchasing Litecoin at a low price and then selling it later on, for much more than you initially paid.

- Based on current prices, you think that Litecoin represent a good investment

- As such, you place a $300 buy order with your online broker

- You leave your LTC coins in storage for a little over 9 months

- Upon checking the price again, you see that Litecoin is now valued 21% higher than when you initially placed your order

- You quickly grab the opportunity and cash-out by placing a sell order on your Litecoin purchase

- From your $300 buy order, you made $63 in gains by holding onto your digital coins ($300 x $21%)

Importantly, you must pay some consideration to where you will store your purchase. You could sieve through the hundreds of crypto wallet apps available, and download one of those. The issue is that you then need to take on the responsibility of encrypting and securing the digital currencies yourself.

Our above example saw you storing your LTC tokens at your chosen brokerage. This is undoubtedly the safest and least complicated way to take care of cryptocurrencies. For example at eToro, you can buy, trade, and store your Litecoin investment in a regulated and safety-conscious space – at no extra fee.

Trade Litecoin

If you choose to trade Litecoin, this will usually be achieved via CFDs (Contracts for Differences) at your carefully selected trading platform.

We talked about trading CFDs throughout our trusted broker reviews. This is because they are so flexible and convenient for traders of all levels of experience. If you have ever engaged in forex trading, you will know that currencies are grouped into minor, major, and exotic pairs.

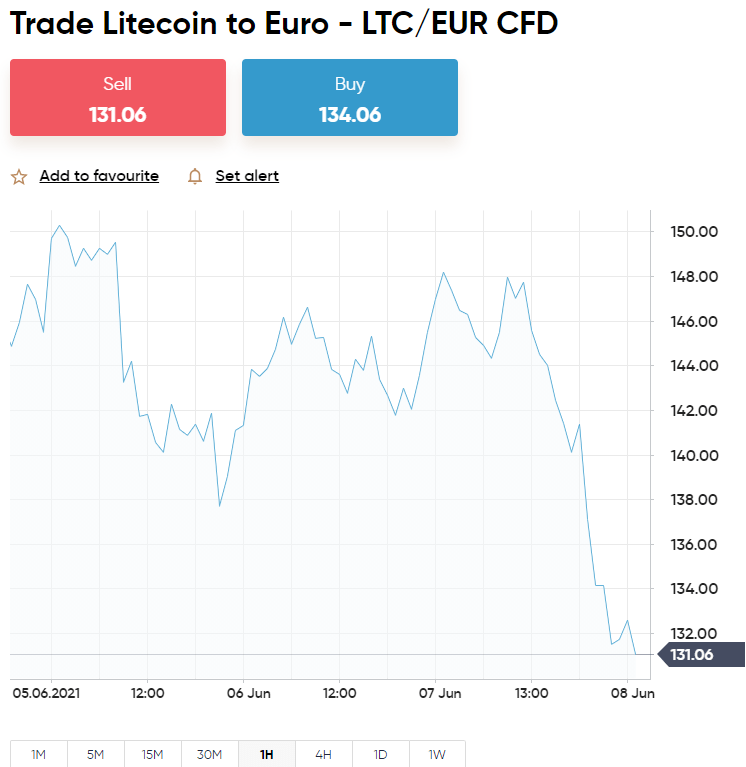

In cryptocurrency trading, pairs are usually categorized as either crypto-crypto or crypto-fiat. The former will see you trading Litecoin against a crypto-asset like Ethereum – traded as LTC/ETH. Alternatively, you might look for a pair like LTC/XRP which is Litecoin against Ripple, or LTC/BTC (Bitcoin).

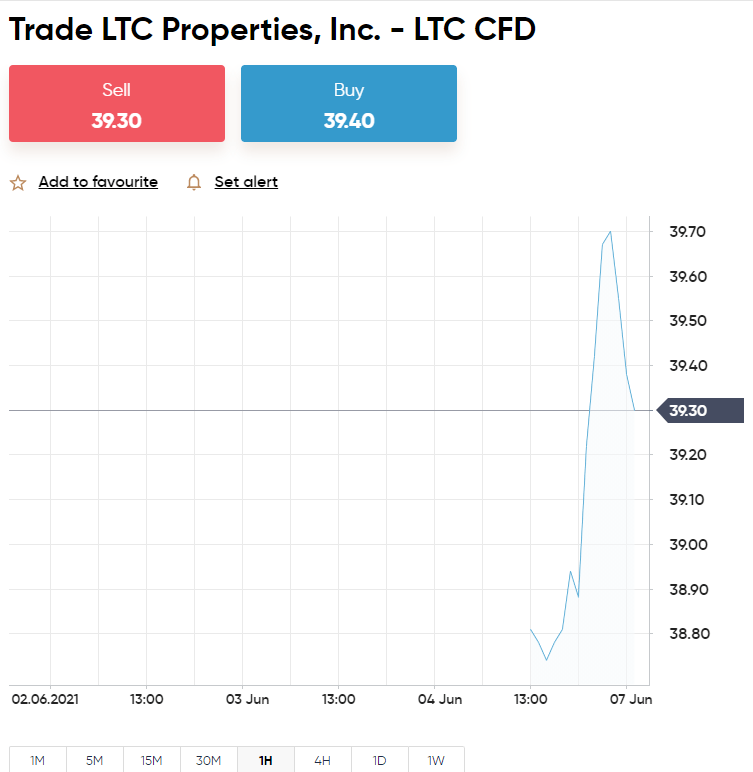

The most common way to trade Litecoin is against a fiat currency such as euros or US dollars. For instance, if you see LTC/EUR, you are trading Litecoin against the value of the euro.

See an example below, to clear any confusion:

- You want to trade Litecoin against the Australian dollar via a CFD – priced at $262

- Having analyzed this market for a while now you think the pair has been hyped-up and will soon fall in value

- With this in mind, you go short on LTC/AUD with an $800 sell order

- Sure enough, 2 days later the trading platform is quoting $220 – this illustrates a 16% price drop

- As such, your speculation was well-founded and you create a buy order to cash out your $128 profit ($800 x 16%)

The thing with crypto CFDs is that you are able to make a prediction in either direction. For instance, if you think Litecoin is undervalued and will soon skyrocket in price – you simply need to go long by placing a buy order with a trusted cryptocurrency broker .

We also mentioned leverage earlier. Importantly though – restrictions and limitations will be dependant on your jurisdiction. With that said, let’s shed some light on what it entails.

See a simple example of a Litecoin CFD with leverage:

- You create a sell order on LTC/AUD and are offered leverage of 1:2

- That original $800 order is now boosted to $1,600 by your chosen trading platform

- As such, instead of making gains of $128, you have leveraged your profit to an impressive $256

As you can clearly see, leverage allowed you to increase the value of your Litecoin trade. On the flip side, had LTC/AUD gone the other way and experienced a price increase, you would have ballooned your losses 2-fold. As such, always use leverage with caution.

Where to Buy Litecoin

Naturally, you will need to contemplate where you might look to buy Litecoin. With this in mind, we have listed some commonly used methods below.

Buy Litecoin Debit Card

Our guide found that the lion’s share of online cryptocurrency platforms will let you buy Litecoin using a debit card. However, the fees can be steep. For example, both Binance and Coinbase charge between 3% and 4% on each transaction – depending on various circumstances.

In stark contrast, eToro will only charge a small deposit fee of 0.5%, for anyone not choosing to deposit using US dollars on the platform. In other words, if you pay in USD, you can buy Litecoin via debit card for free free.

Buy Litecoin Credit Card

Some platforms will allow you to buy Litecoin using a credit card. The main thing to be wary of is that you might have to pay a cash advance fee, which is typically around 3-5% of the transaction amount.

Furthermore, some trading platforms will also charge you from their end for using this particular method to buy crypto. Apart from the previously mentioned charge for not using USD, you will not pay anything to buy Litecoin via credit card at eToro.

Buy Litecoin Paypal

PayPal is one of the most well-known e-wallets of all and is considered by some investors to be the preferred deposit method. Despite the hundreds of brokers offering access to crypto-markets, not many accept this payment type.

Whether you wish to use this payment method for speed or convenience – you can buy Litecoin using PayPal at eToro – commission-free.

Litecoin ATMs

Crypto ATMs require the user to put fiat cash into the machine to buy Litecoin. On the screen, you will be given important details such as how many coins you will get for your offering.

Since the first Bitcoin ATM popped up in a coffee shop over 10 years ago, there are now thought to be over 10,000. They can be found all over the world, and whilst some will only enable you to buy BTC coins, there are hundreds of LTC compatible terminals. These can be found everywhere from the US and the UK to Spain, and South Africa.

Before getting ahead of yourself we should point out that these machines often come with huge commission fees. As such, you will be better off making your purchase via a commission-free broker like eToro.

Litecoin Strategies

We talked about the different strategies available, based on long or short-term Litecoin goals.

However, there are many simple systems you can add to build a solid strategy moving forward. See a few tips below to spark your imagination

Dollar-Cost Averaging

Dollar-cost averaging, also known as ‘the dollar plan’, involves sticking to a regular investment budget.

You may check out your finances and decide you can afford to top up your investment account with $400 each month. Accordingly, you can then think about your strategy and proceed to buy a specific amount of Litecoin per week or on a specific date of the month.

Buy the Dip

If you like the simplicity of adding dollar-cost averaging to your Litecoin strategy – you might want to also try buying the dip. In fact, both can be used in conjunction with one another when the moment takes you.

Let’s offer a simple example:

- Litecoin has had a very eventful time of late, falling in value by 23% in just a week

- Knowing how volatile this market is, you are all but certain the digital coins will soon recover

- As such, you head over to your trading platform and place a buy order on Litecoin

- This is what it means to buy the dip

In a nutshell, purchase your Litecoin whilst it is going cheap – so that you can reap the rewards in the future by selling when prices rise again.

Diversify

You will have no doubt seen the word ‘diversify’ used a lot in guides like this. The reason is – it’s unwise to depend on success based on a single asset – Litecoin.

Sure, the speculative asset might be making you gains now, but everything can change in an instant in this arena. As such, why not think about investing in something completely different like stocks indices?

In most cases, the more of a contrast there is between the asset classes in your portfolio – the better. Consequently, if one isn’t doing so great, you still have various different sectors to lean on.

Litecoin Trading Signals

When looking to buy Litecoin you may have seen crypto signals advertised? Put simply, this is a free or paid-for service offering traders and investors inside knowledge on market sentiment. This is obtained either through automated robots or actual seasoned traders.

For example, at Learn 2 Trade we offer a hugely popular Litecoin Trading signals service, which is offered via our Telegram group. Our signals are sent off the back of intense and advanced technical analysis, performed in-house.

Here, we offer a free service that includes the Litecoin pair we see potential in, what price to enter the market at, and what value to input as your stop-loss and take-profit. If 3 signals a week isn’t enough you can try out the Premium account – which comes with a 30-day money-back guarantee. This will get you 3-5 crypto signals per day!

How to Buy Litecoin Online – Full Walkthrough

If you are looking to buy Litecoin for the very first time and need a bit of guidance – check out the walkthrough below. In doing so, you can buy Litecoin at regulated brokerage site Capital.com

without paying any commission.

Step 1: Sign Up With a Litecoin Broker

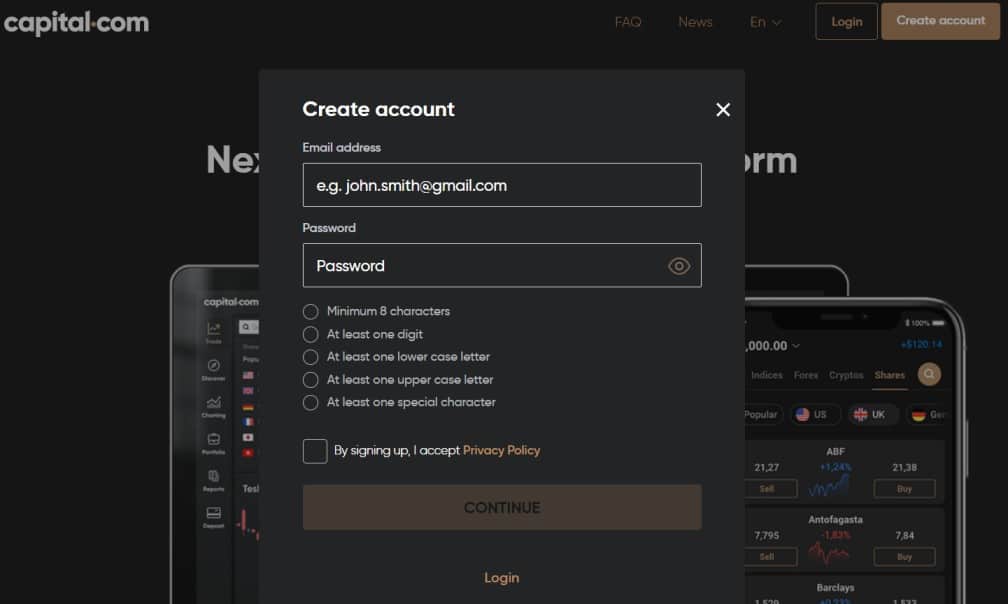

We are using Capital.com for this walkthrough because you can buy and trade Litecoin commission-free, with no fuss – in less than 10 minutes!

Upon landing at Capital.com look for the ‘Create account’ link and fill in the required information. This will include your name, location, home address, date of birth, and contact details.

Step 2: Upload Some Identification

After providing the broker with some basic details about who you are, you will be asked to upload some identification. This is standard amongst all regulated platforms.

The fastest ID for Capital.com to process is a passport. Once that is done, all you need to do is upload a copy of a recent utility bill or bank statement to confirm your address.

You may leave the documentation part right now, but this must be done before you are able to make a withdrawal later on. The document verification takes minutes regardless, thanks to automated ID validation.

Step 3: Deposit Funds Into Your Account

Once you have opened an account you will then need to make a deposit. At Capital.com, you can choose from a debit/credit card, Paypal, Neteller, and Skrill. This will be credited to your account instantly.

Enter the monetary amount you wish to deposit in the relevant box and confirm.

Step 4: Buy Litecoin

Now that you have deposited funds, enter ‘Litecoin’ into the search box at the top of the page.

Then, an order box will appear like the above. All you need to do is enter the amount you wish to invest – ensuring you meet a $25 minimum.

Finally, click on ‘Set Order’ to buy Litecoin commission-free!

Conclusion

When you are weighing up your options and considering how to buy Litecoin – consider focusing your attention on more than one asset, to hedge against crypto volatility.

Never go into the cryptocurrency market blindly or naively, so make sure you have one strategy or more lined up. Also, do your research and only entertain the idea of investing in Litecoin via a regulated brokerage.

At Capital.com, you can buy Litecoin with ease and you won’t be liable for a cent in commission. Plus, you can instantly deposit funds with a debit/credit card or e-wallet and the minimum investment is just $25!

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

FAQs

What is the minimum amount of Litecoin you can buy?

How much is Litecoin likely to be worth in 5 years?

Where is the best place to buy Litecoin?

How can I sell Litecoin?

Can Litecoin make you rich?