In the context of Sharia Law (God’s will for humankind, according to the Quran) – there has been some debate over the years about whether or not trading forex is haram or halal.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Of course, most people know that gambling (Al-Maisir), alcohol (Khamr) and pork (swine) are all haram (therefore forbidden) according to the Quran – but did you know that trading forex doesn’t have to be?

These days many scholars are differing in opinion slightly, having to take into account modern life and what that means for people of the Islamic faith. This involves still fully respecting Islamic Law, but perhaps interpreting parts of it slightly differently.

If you are a follower of the Islamic faith and would still like to trade forex, you will be pleased to know that it is possible to open a halal trading account.

In this guide, we are going to explain what Islamic forex brokers are, key metrics to look out for when choosing a platform that meets your needs, and which providers we think you should consider in 2023.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What Is An Islamic Forex Broker Account?

In a nutshell, an Islamic forex broker account exists to allow followers of the Islamic faith to be able to trade currencies – whilst remaining true to their religious beliefs.

How do broker platforms make this possible? According to Sharia Law, the accumulation of financial interest is strictly forbidden, so Islamic accounts neither receive nor pay any interest at all.

The Fundamentals Of Forex Trading Halal

The very foundation of Islamic forex accounts is actually very comparable to standard forex accounts. This is, of course, excluding the fact that Islamic forex brokers have to meet the fundamentals of Islamic finance laws.

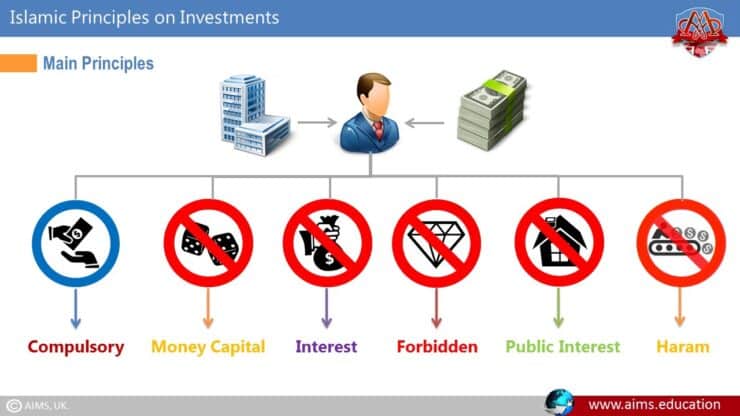

The key fundamentals of Islamic finance are:

- Speculating/Gambling – ‘maisir’

- Charging or paying interest – ‘riba’

- Risk and uncertainty – ‘gharar’

- Hand in hand – ‘halal trading’

As we’ve mentioned, the whole point of Islamic brokers is to provide forex accounts for people who want to remain faithful to their religion. The way that Western countries trade simply doesn’t consider these four principles.

Although the bare bones of forex trading doesn’t actually go against Sharia Law, there are other factors such as overnight financing fees etc to consider.

Forex Trading – Haram Or Halal?

Bearing in mind that around 25% of the planet are followers of the Islamic faith, it’s no surprise that the age-old debate of whether or not forex trading is haram or halal is an ongoing one.

As we unravel in this guide, aspects of forex trading are perfectly acceptable in Sharia Law – but things could get complicated for a person of Islamic faith trying to use a traditional forex account.

There are elements which would make it nigh-on impossible to remain respectful to your faith at all times, such as overnight and swap fees. So you are 100% better off only trading with Islamic forex brokers. This way, there are no dangers of getting involved with any haram stocks or bonds.

We’ve put together a bit more information on the key principles of Islamic finance law to help clear the mist.

Maisir (Speculation/Gambling)

This area of Islamic financial law is strictly regulated by the following key principles:

- Bai bithaman ajil (sale with deferred payment)

- Bai al inah (sale and repurchase)

- Bai muajjjal (credit sale)

- Murabaha (cost-plus financing)

- Mudarabah (profit sharing)

- Musawamah (price paid by the seller is unknown to the trader)

- Bai salam (full payment in advance)

It’s well known that gambling is prohibited for followers of the Islamic faith, but is trading forex also a game of chance?

There has been much debate on this subject, After all, the fact is you are buying and selling currencies, and the main goal is to make a profit from fluctuating prices in the forex market.

Now consider that in order to trade forex, traders need to study technical analysis, price charts and historical data – not to mention have a strategy in place.

One could argue that this means forex trading is anything but a game of chance, and therefore not gambling. Being successful in forex trading requires a certain amount of skill and research – so cannot be considered haram.

Riba (Interest)

Riba is essentially Arabic for interest. Riba is haram as no follower of the Islamic faith is permitted to receive or lend money. When it comes to Islamic banking, there is no interest whatsoever on any account, whether savings or current account – and the same goes with mortgages.

In an attempt to overcome the riba law, people use ‘Bai’ al-Inah’ which means ‘sale and repurchase’. This is an Islamic finance practice which allows people of the Islamic faith to lend.

For example:

- Let’s say someone sells you an asset

- Instead of paying for the asset straight with cash, the ‘lender’ gives you it on credit (at a fixed cost)

- The ‘lender’ adds a profit element

- That person then buys the asset back from you straight away, in cash, and at the prearranged price

- This means that the person who gave you credit owns the asset and you got the money you needed

- Now you must pay the price of the asset in instalments, as well as the profit element previously agreed

There are frequent disagreements on this particular technique, usually between the two main areas of Islamic Finance – MENA (the Middle East and North Africa), and Indonesia/Malaysia.

Normally, when you open an account with a forex broker, in the event you hold a position after the trading session has closed, the brokerage will take a swap commission (overnight financing fee).

As the broker is essentially giving you a loan indirectly in the shape of leverage. – this means it makes a profit. In this case, it’s considered haram, as interest plays a part.

The key difference is – Islamic forex brokers abolish swap interest payments. Interestingly, according to Islamic finance law, followers of the faith can take out an interest-free loan in order to make an investment for gains.

Islamic forex brokers still need to make money for the service they provide, albeit, they will often do this by building their costs into the spread.

Gharar (Legitimacy of Risk/Uncertainty in Investments)

Speaking of gharar – the Quran states “And do not eat up your property among yourselves for vanities”. Gharar is also mentioned in the book ‘hadith’ where it states “Sell not what is not with you”. The message is clear.

Under this Islamic finance code, any trading with excessive uncertainty or risk is strictly prohibited under Sharia Law. For example, short selling, derivative contracts, and futures are all haram because they won’t be settled within the same transaction.

Whereas trading via Islamic forex brokers is a different kettle of fish. Crucially, you don’t need to worry about breaking these rules as your account has been adapted to remain respectful to them.

Hand in Hand Islamic Trading

In Islam, ‘trading’ itself is permitted, but only if it’s done ‘hand in hand’. In years gone by, this meant on a face to face basis. Of course these days most trading interactions are carried out in the online space.

Some scholars point out that trading should be halal due to the fact it is still between two parties (you and the broker). Still, trading endeavours must be completed in the same trading session.

When it comes to forex, orders are usually executed immediately anyway, which works out well for Islamic forex brokers and remains faithful to Islamic Laws.

The long and short of it is that Islamic forex brokers have to respect all fundamentals of Islamic finance and Sharia Law – whilst still giving you access to the global forex markets. By forex trading halal, you can stay true to your religious ethics but also take part in investment opportunities.

Islamic Forex Brokers: Commissions

On the contrary to traditional trading broker accounts, Islamic forex accounts come with zero swap interest. This is necessary for it to be considered halal. As we explained earlier, swap interest is created when someone leaves their position open overnight – as they get charged a fee.

To reiterate, when it comes to an Islamic forex broker account, there is no interest – therefore no swap fees to be seen. In order for the forex brokerage to make some profit, you will need to pay other fees such as:

- Margin fees

- Commission fees

- Admin fees

All of the above are considered to be halal in forex trading. With that being said, the above fees are likely to be included in the spread. As such, the only ‘fee’ that you pay when using a trusted Islamic forex broker is the difference between the buy and sell price of your chosen forex pair.

Islamic Forex Trading: How to Get Started

By now you are aware that you can remain true to your Islamic faith whilst also trading forex. As such, we are going to quickly run through the three main types of trading you will come across buying and selling currencies.

Day Trading

If you are day trading, you have to close your trading position before the market closes. In other words, before the trading day is over. Hence the name, day trading is carried out in one singular day.

This means that in terms of remaining true and faithful to Sharia Law, there is no overnight fee (swap commission). The good thing about using an Islamic broker account, over a standard one, is that you don’t need to worry about closing the trade and going into overnight fees.

Scalping

Put simply, scalping requires opening multiple small scale positions which will all close in a timeframe of just seconds, or minutes. Because the trade closes at such a rapid rate – you don’t need to worry about interest, which makes it perfect for followers of the Islamic faith!

In fact, if you wanted to, you could theoretically trade using a standard forex account when using a scalping strategy. However, if you would prefer to keep your positions open for longer, then to avoid interest, the only option for you is to stick with an Islamic forex broker.

Swing Trading

The only way to utilise a swing trading strategy is through your Islamic forex broker. This uses a strategy of leaving positions open for days or often weeks at a time. Most importantly, it’s crucial that you use a swap-free account to avoid those interest rates.

If you had used a standard account, for example, you would have to abandon any financial profit. By using an Islamic/swap-free account you are eliminating the risk of leaving a position open overnight by mistake.

How to Find an Islamic Forex Broker

Whilst there are thousands of forex brokers on the scene, not all of them will be suitable for followers of the Islamic faith. It can be hard enough at the best of times to find a good brokerage firm, so when you need a specific and somewhat niche account, locating one can be even harder.

We’ve put together a list of things you should consider when you’re searching for the best Islamic broker for you. If you could do with further inspiration, we have also listed the best Islamic forex brokers of 2023 further down this page.

Is the Broker Regulated?

Although this might sound somewhat obvious, you would be surprised at how many brokers fly under the radar. Such platforms offer brokerage services to traders without actually being monitored by any regulatory bodies.

Firstly, we will never recommend an Islamic forex broker to you which doesn’t hold a licence from an official regulatory body. Secondly, it’s also really important that you also conduct your own research when looking for a broker.

The initial thing on your list should be to make sure the platform displays a valid licence. If you are in the UK, for example, this will be from the FCA (Financial Conduct Authority).

If you are unsure, let’s say the website shows an FCA licence number. You can always head over to the official FCA platform and conduct a simple company search to back it up.

The FCA has rules and regulations in place which ensure your money is kept in a separate account to the broker firm, in case of financial crime or bankruptcy. This is also the case with other trusted regulatory bodies – such as ASIC (Australia), CYSEC (Cyprus), and MAS (Singapore).

Deposits and Withdrawals

Another deciding factor for you when looking for an Islamic forex broker is what deposit and withdrawal options are available to you. The vast majority of Islamic forex brokers will let you deposit using a bank transfer via your usual bank (also called wire transfer).

Bank transfers are a safe payment method most people are familiar with, however, it’s worth noting that this can delay your trading start date by a few days in some cases.

For that reason, its advisable for you to choose a platform which accepts a variety of payment methods such as Credit/Debit cards and e-wallets like as PayPal and Neteller – as these deposits are instant.

Withdrawals can take up to 2 days to process, partly due to KYC (Know Your Customer) checks and partly due to your payment method of choice.

Spreads

An important fee to consider on your broker platform is the spread. If you aren’t sure what that is, it is essentially the contrast between the buy price and the sell price of the forex pair you are trading. This spread is always measured in ‘pips’ and can greatly affect your overall gains.

For instance, let’s say the spread for GBP/USD is 3 pips. In order to break even you would need to make at least 3 pips in profit.

Here’s an example of how the spread in that trade would look:

- As we said, you are trading GBP/USD via your Islamic forex broker.

- The ‘buy’ price is 1.1200.

- The ‘sell’ price is 1.1203.

- As you can see the last digit shows the smallest unit that the forex pair price will move.

- In this case, the GBP/USD spread is 3 pips.

Variety of Forex Pairs

If you like to just focus on one or two currencies then you might not think you need a high number of forex pairs to choose from. This is a tried and tested tactic in the forex space, as you are able to devote your research time to fewer pairs.

Ideally, you should be looking for Islamic forex brokers offering a variety of ‘minors, ‘majors’, and ‘exotics’. You will be able to find all of this information on broker’s website and you should check all of the metrics on this list before signing up.

Technical Indicators and Trading Tools

Another thing to look out for when you’re looking to open an Islamic forex account is what trading tools and educational material is available.

To give you an idea of what to look out for we’ve listed some of the most useful technical indicators used by forex traders.

- Bollinger Bands.

- Relative Strength Index (RSI).

- Oscillator.

- Commodity Channel Index (CCI).

- Support And Resistance.

- Moving Average Convergence Divergence (MACD).

- Stochastics.

- Parabolic SAR.

Trading forex is no easy feat. Unless you are using a fully automated system it requires research, chart reading and keeping up with global news. This brings us nicely onto trading tools.

All Islamic forex brokers are different so will have a different amount and variety of indicators and tools built into the site. You can also access indicators, charts and tools via MetaTrader4, which is a trading platform often supported by some Islamic forex brokers.

Some of the most popular trading tools utilised by forex traders today are as follows:

- MetaTrader4 trading platform.

- Fundamental analysis tools such as economic news calendars.

- Financial newswires like Bloomberg and Reuters.

- Pip calculator tool.

- Currency correlation tools.

- Forex time zone converter.

- Broker spread comparison tool.

- Forex volatility calculator.

- Trading diary/journal.

Customer Support Service

Good customer service is crucial. A good way to gain some insight into the performance of a customer support team is to read some client reviews. If the service is bad, people will talk about it.

Look out for 24/7 customer support. After all, forex is a 24/7 market. Live chat is usually the most popular option for traders as it’s instant. Alternatively, you can expect to see an email address and in some cases a telephone number.

If your chosen Islamic forex broker has a healthy presence on social media it can be very useful for keeping up to date and chatting to other traders.

How Do I Sign-Up With An Islamic Forex Broker?

By now, we have covered everything there is to know about Islamic forex brokers and what metrics are important when it comes to choosing one. If you have yet to find a suitable broker yourself, we have listed some of the best further down this page for you to consider.

If you are ready to get started, then we have put together a step by step guide on how to sign up.

Step 1 – Open an Islamic Account

The first thing you need to do is go to the brokerage platform you have chosen to sign up to. The procedure is just about the same wherever you go, as the site will ask for your full name, address, email and a unique password.

Next, you will need to answer a few questions about your financial situation such as monthly salary and employment status. The reason brokers ask about your financial standing is so that they offer suitable products.

Step 2 – Enter Trading History

The chances are you will be asked a variety of questions with regards to your trading history. Forex isn’t for the faint-hearted, so this information is going to help the brokerage to understand your level of experience, trades you’ve been involved with in the past, and what investments you focus on.

Step 3 – Know Your Customer

Due to KYC which we talked about earlier, you might only be able to deposit funds into your account when you have verified your identity. This is usually clarified by the broker when sending a copy of your passport or driving licence.

As an extra precaution, most brokers will also require a copy of a recent utility bill or bank statement with your name and address on it.

Step 4 – Deposit Your Islamic Forex Broker Account

Once you have submitted your KYC documentation, you can go ahead and make a deposit. As we’ve touched upon, payment methods do vary, so always check the site to see what will be available to you.

Bear in mind that bank transfers can take days to clear, whereas other methods are instantaneous.

Step 5 – Begin to Trade Forex

Now you’ve gone through steps 1 to 4, confirmed that you are who you say you are, and funded your account – you can begin trading forex.

If you are somewhat of a beginner in trading forex, then you could either start with a demo account or trade with tiny increments using an Islamic micro account. Even just whilst you find your feet in the forex space.

Best Islamic Forex Broker of 2023

AvaTrade - Sharia-compliant MT4/5 Trading

AvaTrade is another reputable broker on our list and fully tailors its Islamic forex accounts to suit the individual client. Being an Islamic account holder, you can expect zero rollover charges (overnight fees) or daily swaps. Instead, you will be charged admin fees when trading forex. This means that you are still able to remain true to Islamic finance laws.

This brokerage platform supports MetaTrader4 and Metatrader5 so you can trade commodities (as long as they are halal), CFDs and currency pairs with full transparency.

The platform proudly notes that there will be no hidden commission fees or confusing spread charges you didn’t know about. People of the Islamic faith can also access Islamic halal silver and gold trading. Crypto trading is not permitted on this Islamic account, so if you wanted to trade cryptocurrencies you would have to use a standard account.

When it comes to forex, TRY, RUB, ZAR, and MXN pairs are all excluded from Islamic Accounts. The rest are all tradable interest/commission-free but you should expect a spread increase - After all, Islamic forex brokers still need to make money.

This brokerage firm fully respects all Islamic finance rules and executes trades immediately as such. Islamic forex traders are entitled to unlimited access to all platforms free of charge (such as android, iOS and WebTrader),

- Heaps of currency pairs to trade

- Easy to open Islamic account

- Copy trader function

- No e-wallets

Conclusion

In this guide, we’ve covered just about all there is to know about Islamic forex brokers, as well as key metrics to look out for when finding a suitable one for your trading endeavours.

As we noted, it’s important to remember that not all broker platforms will advertise Islamic accounts as such, as they are sometimes used as ‘swap-free’ or ‘halal’ accounts. In a nutshell, this means that all fees are waivered in respect of Islamic finance laws.

As we covered, by only using Islamic forex brokers which are fully regulated, you know that your trading funds are automatically segregated from that of the brokerage, amongst other regulatory safety nets. All brokers recommended by us are fully regulated for your safety.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card