By choosing a fully regulated broker, like a CySEC Broker, you’re creating a safety net for yourself and your capital. Traders can lose money when investing, that’s to be expected in this game. But when it comes to choosing a broker, it’s important to select one with a full licence.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Globally there are thousands of online brokers, with each offering their services to an even vaster number of investors. The problem is that there is a worrying amount of scammers out there waiting to rip off unsuspecting traders.

CySEC sticks to all rules set out by MiFID (Markets in Financial Instrument Directive). Without MiFID rules, traders wouldn’t be sheltered from things like terrorist financing, identity fraud, money laundering and theft.

On this page, we are going to go through all of the key metrics you need to be mindful of when looking for a CySEC broker to trade with. We’ve covered everything from what the regulatory body actually does to what you can trade through this type of broker. To conclude, we’ll discuss the very best CySEC brokers of 2023.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What is CySEC?

CySEC stands for ‘Cyprus Securities and Exchange Commission’ and was the first-ever regulatory authority for the online financial sector. This regulatory organisation is based in Cyprus and interestingly – is the biggest government regulatory body for binary options and forex brokers. There are actually a lot of brokers in the online space who are licenced by this body.

In 2004, the Republic of Cyprus joined the EU. As such, things began to change for the financial markets. In 2008, MiFID was introduced by the European Parliament in a bid to synchronise the regulations ruling the financial services space on the continent. This harmonised all providers in the financial services and set out standards to be adhered to.

Each and every transaction carried out by a CySEC broker is fully supervised, including each and every withdrawal and deposit between investors and the brokerage firm. CySEC brokers also have to submit an annual audit, but more on that later.

The main aim of CySEC is to create a regulated and fair financial market for everyone. The body is primarily focused on decentralised markets such as forex, CFDs, and OTC (over the counter) trading.

What Conditions do Brokers Meet for CySEC Approval?

For CySEC brokers, obtaining a licence isn’t particularly easy. After all, there is a wide range of guidelines to adhere to. This is great news if you’re an investor, because you will know that a licenced broker has had to prove their worth and fairness before taking on clients.

This regulatory body requires at least two directors to run a broker firm. As well as that, CySEC brokers are required to contact the regulator if it intends on offering additional services.

In other words, every aspect of the broker platform must be checked and regulated before being offered as a product to the public. We should also note that one singular person is not legally allowed to be an administrator for a brokerage firm. This adds yet another safeguard on the fairness of trading endeavours.

Licenced brokers must layout their exact plans to the licencing body including a detailed account of all financial services the company plans to sell.

AML-CFT

AML is an acronym for ‘Anti-Money Laundering’, whilst CFT is short for ‘Combating the Financing of Terrorism’. Both of these make up one department and this division is responsible for watching over the adherence of CySEC.

This means that CySEC brokers must go through the KYC (Know Your Customer) procedure with every single client that signs up. For this unaware, this consists of obtaining photographic identification, full name and residential address, and even a customer’s financial situation and trading history. The same rules apply across the board – so it doesn’t matter who you are, you must prove your identity before any CySEC broker platform can sign you up for an account.

Should a CySEC broker come across any suspicious activity like financial instrument falsification, money laundering, terrorist financing, identity fraud; or even just a client depositing an unusual amount of cash – they must report their findings to the regulator.

These brokers are also required to show a clear understanding of the importance of creating a ‘customer risk profile’ for each trader. This is in addition to performing regular spot checks on customers.

Risk Disclosure

All CySEC brokers are required to communicate all fees to be paid by customers, with absolute transparency. The company must also produce a competent ‘information notice’, which lists in detail when and by what means the fees will be taken by the CySEC broker firm. This is especially the case with CFDs

Annual Report

Another condition for CySEC brokers to meet when applying for a licence is a yearly audit and submission of reports. Audited statements generally need to be filed by June 30th at the latest every year by this commission.

Each broker details key information like total turnover, proof of annual fees paid to CySEC, trading volumes, and annual fees calculation forms. This is a thorough investigation, and so many financial service providers bring in third-party auditors to help. Published audits must include all capital and assets owned by the firm.

More recently under new rules brought into play in 2018, the commission states that all financial firms also need to provide individual and detailed breakdowns. This includes; asset sub-classes volumes, all trades carried out that year, as well as which clients were professional investors and retail traders etc.

The report must include margin trading reports and what leverage was used. The brokerage has to clearly distinguish between market trades carried out by the client, and the ones executed by the broker on behalf of the client.

If any information is left out of these annual audits, the CySEC broker will be slapped with a fine, or worse – have its licensed revoked.

Bank Account Segregation

Bank account segregation, sometimes called fund segregation, is no new thing – especially in the financial services area. For CySEC, this rule only came into force in 2017. The law now states that any investment firm which holds capital owned by its customers must safeguard client money, away from its own.

Besides this, they must also make sure your account funds are not mixed with its own (for debt etc). The ruling also protects your personal information from getting into the wrong hands.

According to the CySEC, broker firms must ‘segregate funds’ at a minimum of 3 units for every 1,000 units that a customer deposits. This needs to be in a completely separate account to that of the broker firm. By doing this, you can be sure that if the broker was unfortunate enough to go out of business, your money is safe.

It has to be said that while the FCA offers client fund compensation of up to £85,000, CySEC will only compensate €20,000. This is still better than nothing, but we’ll go into a bit more detail on that shortly.

Due Diligence

Having substantial due diligence is crucial for CySEC brokers. This includes detailed background checks on all new clients, including third-party companies. This solid due diligence process should be incorporated into the broker firm’s foundations. CySEC brokers are always under examination. After all, regulatory bodies are essentially like watchdogs – so they need to run a tight ship. Hence – all financial records need to be examined thoroughly.

We mentioned earlier that if a client is investing large amounts of money all of a sudden, the broker must report it. In addition to this, they also need to carry out a detailed due diligence report. The report has to include any investigative findings such as where the money was sourced from.

Again, this is all part of the prevention of financial crime and money laundering within the financial space, which was a much bigger problem before heavy regulation became the norm.

Leverage Restrictions

There was a time when a broker platform could offer investors as much as 1:1000 leverage on trades. A small percentage of traders with a huge bank balance could afford that kind of risk. But, for many people, it’s just too tempting and can easily end in disaster.

Not only can high leverage clear your account very quickly but your portfolio can be badly damaged, too. Those days are gone, not least because CySEC has since imposed leverage restrictions on financial services providers, as per ESMA rules.

As a retail client, this means that you will be capped by the following asset-based leverage limits:

- Major currency pairs – 30:1.

- Major indices, non-major currency pairs, gold – 20:1.

- Commodities (excluding non-major equities and gold) – 10:1.

- Other reference values and individual equities – 5:1.

- Cryptocurrency – 2:1.

Of course, with leverage, you have a lot to lose. But, on the other hand, if it goes your way, you could stand to gain a lot. The important thing is to only invest in the parameters of your budget.

What Protections Does CySEC Offer?

The ‘Investor Compensation Fund’, or ICF for short, was founded in 2004 and is governed by CySEC. All CySEC brokers are legally obliged to participate in ICF and as a result, your account is protected up to either €20,000 or 90% of amassed covered claims. Whichever is less.

So for example – let’s say that you hold €60,000 with a CySEC Broker and unfortunately that broker goes out of business. You will claw back €20,000 from ICF. If however, you claimed €5,000, you will only get €4,500 (90%).

Both CySEC and the FCA are also ruled by ESMA (European Securities and Markets Authority), which is essentially a ‘watchdog’ for the financial space. This group decides what leverage limits are acceptable. If you would like to know what leverage limits are in place on your preferred assets, then you will see a bullet list further up this page.

What Assets do CySEC Brokers Allow you to Trade?

No two CySEC Brokers are the same, so whilst some may concentrate on only stocks, others offer every asset class imaginable. With this in mind, we’ve put together a list of the most commonly seen assets offered by CySEC brokers.

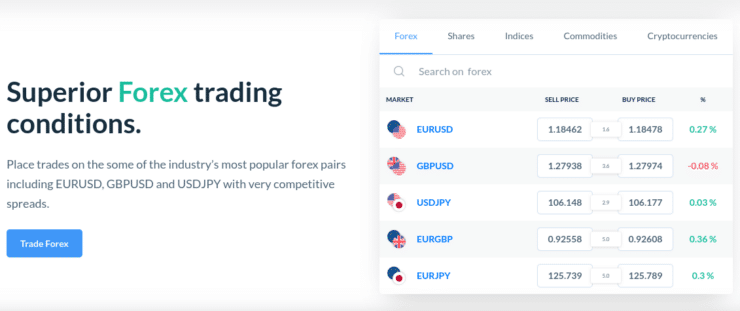

Forex

Foreign exchange is the most liquid market on the planet. For that reason, you will find that a lot of CySEC brokers offer forex trading. In order to access this global market, you need to sign up to a brokerage to start placing orders.

Below is a brief explanation of each (just in case you are new to forex).

- Minor Pairs: Some within the trading community call minor pairs ‘cross-currency’ pairs. A characteristic of these pairs is that they are never inclusive of the US Dollar. Some examples include EUR/GBP, GBP/JPY and CHF/JPY (to name a few)

- Major Pairs: Major pairs are by far the highest in demand and therefore the most liquid. Examples include AUD/USD, EUR/USD, and GBP/USD (there are plenty more). These pairs can be traded any time in the forex market and more often than not come with low spreads.

- Exotic Pairs: These forex pairs are not traded nearly as often as the other two aforementioned – so will come with a much higher spread. Exotic pairs examples include; GBP/ZAR, EUR/TRY and USD/HKD (there are lots more to choose from)

Some CySEC forex brokers are better than others, so it’s always advisable to try and find a broker with lots of educational resources, as well as heaps of technical indicators. Both are essential to being successful in the FX markets.

Contracts for Differences (CFDs)

CFDs are essentially a way for you to try and predetermine the movement of various instruments. For example, currencies, stocks, indices or commodities. Let’s imagine you believe that the market price is on the rise. In this scenario, you would ‘go long’ or ‘buy’.

If, however, you think the market price is going to go down in value, you can ‘go short’ or ‘sell’. Either way, CFD traders do not own the underlying asset. However, CFDs do allow you to tailgate the asset price of a firm (for instance Apple stocks) in real-time. This means that as a trader you are able to make a profit from the price movements.

Generally speaking, there is no commission charged on CFDs and traders can often gain access to leverage – within the previously discussed limits of ESMA.

Commodities

The commodities market is open 24 hours a day, 7 days a week. Commodity trading is considered really attractive to traders who seek volatility. In fact, some full-time investors choose to only trade this particular asset class.

This asset can be split into various groups, but to make things easier we are going to list them in two categories – ‘hard commodities’ and ‘soft commodities’:

Hard commodities are as follows:

- Aluminium, copper, silver, gold, palladium.

- Lead, tin, zinc, nickel, platinum.

- Crude oil, gas oil, heating oil.

- Unleaded gasoline, natural gas.

Soft commodities are as follows:

- Barley, oats, rice, corn.

- Soybean oil, canola.

- Wool, cotton, rubber.

- Pork bellies, live cattle.

Leverage limits are in place on commodities, as set by ESMA regulations and followed by all CySEC brokers. For example, leverage currently stands at 1:20 for gold and 1:10 on other commodities.

Investing and trading in commodities can really liven up your portfolio. Having said that, it’s really important to have a good understanding of how the market works before committing yourself, and your trading budget.

Share Dealing

Put simply, share dealing enables traders to buy and sell shares in businesses and corporations (think Nike or Facebook). All companies which are available for you to invest in are publicly listed, meaning you can sell your shares on the respective exchange.

You are not limited to just buying 1 stock, neither do you have to buy a whole one. Regarding the latter, this is because some CySec brokers now allow you to engage in ‘fractional ownership’. As the name suggests, this means that you can buy a ‘fraction’ of a share.

There are three main types of brokers in this particular space and they are as follows:

- Execution Broker – The clue is in the name with this one. This broker types job is to execute orders as instructed by you, with no interference or advice.

- Advisory Broker – This type of CySEC broker will advise you on any shares you could potentially profit from, or might be good for your portfolio. Whether or not you buy or sell is completely your call.

- Discretionary Broker – If you like to trade stocks and shares passively, then a discretionary broker might be what you are looking for. This type of brokerage firm will make all trading decisions for you, and end-to-end service if you will.

But remember, when it comes to discretionary brokers, with all of that extra work will come extra fees. So always check the terms and conditions as well as fees expected.

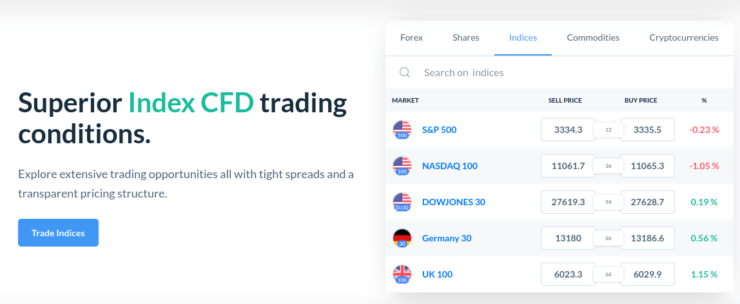

Indices

The fundamental idea of trading this asset class is to forecast the price movements of a wider stock exchange. The difference between this and other assets, such as stocks, is that investors cannot purchase the asset itself. Indices are essentially tasked with tracking the movement of multiple shares operating on a particular exchange.

Indices are measured by using points instead of pounds or dollars. Furthermore, they must be traded through CFDs, futures or ETFs. CySEC brokers typically offer support on major indices such as the FTSE 100, NASDAQ 100, and Dow Jones 30.

Cryptocurrencies

Cryptocurrencies have gained a lot of attention in recent years, with Bitcoin being the most well-known currency of this type. In order to trade with cryptocurrencies, you need to correctly predetermine the rise or fall of a specific pair. In this sense, this operates much like forex.

Nevertheless, cryptocurrencies are another tradeable asset which doesn’t require ownership. If however, you do want to own the coins, you can buy them through a broker like eToro.

Here are some of the most popular cryptocurrencies that CySEC brokers allow you to trade:

Before you start trading cryptocurrencies on a CySEC broker account, it is recommended that you try out a demo or trial to see how the arena works and what currencies you are best suited for.

How to Find the Best CySEC brokers?

At the risk of stating the obvious, it is really of the utmost importance that you start with a broker who is fully licenced by a regulatory body – such as CySEC.

This ensures that you can fully trust the company with not only your money – but also your personal information. Not to mention, with CySEC brokers your funds are protected by fund segregation, in addition to compensation up to 20,000 (or 90% of your account, whichever is less).

There are lots of brokers online – so it can be hard to know where to start. With this in mind, we’ve put together a list of some important metrics to consider in your search for a CySEC broker

Commission Fees

Fees charged by brokers can vary wildly, so you really need to do some research to compare and contrast. Some platforms don’t have any commission fees at all (such as eToro), while others charge a predetermined percentage on every order executed.

Don’t be disheartened if you do have to pay a fee, as most of the bigger broker companies do charge commissions to cover the cost of providing a better all-round service. As an example, let’s say you are trading EUR/USD and your broker charges a 0.4% commission. Next, you invest £1k in that currency pair. In this scenario, you would pay your broker £4 in commission fees.

Spreads

Spreads are really important when trading online. Put simply, it’s the contrast between the buying price and the selling price of an asset (measured in pips).

For example, let’s imagine the ‘spread’ of EUR/USD is 3 pips. As such, you would need to increase that investment by 3 pips just to break even.

Educational and Trading Tools

Seasoned traders will make use of a variety of tools and services to better help them predict which way a financial asset is likely to move. This also ensures that they are able to execute the strategy that they have in mind.

With this in mind, some of the most important metrics that you need to look out for when choosing a CySEC broker are:

- Order execution speed – The best CySEC brokers can execute an order in virtually no time at all. In some cases, this can be done in milliseconds. The process is dependant on what kind of account and trading strategy is being used, not to mention price sensitivity.

- Automated trading – Some CySEC brokers fully support automated software like third party expert advisors.

- Historical and live data – They say price trends come back around. Some traders swear by studying historical price data in order to predict the direction of the markets. This tool is essential when performing backtesting and technical analysis as part of a bigger strategy.

- Charts and indicators – Technical indicators show traders what the market sentiment is by using price charts of various types. See below.

Technical Indicators

As we’ve said, deploying technical indicators and price charts is a great way of actively following what’s happening in the markets.

Some of the most popular indicators used by traders are:

- Ichimoku Kinko Hyo (AKA Ichimoku Cloud).

- Parabolic Stop and Reverse (SAR).

- Stochastic.

- Moving Average Convergence Divergence (MACD).

- Relative Strength Index (RSI).

- Bollinger Bands.

- Average Directional Index (ADX).

The internet is jam-packed with educational resources that explain how each technical indicator works, and you can use them to your advantage.

Asset Diversity

Before you fully commit to a CySEC broker, it’s crucial you know what types of assets are available to you. You may only be interested in trading cryptocurrencies right now, but later down the line, you might want to diversify your trading portfolio and add a few more asset classes to your list.

If you are particularly focused on trading forex, then it’s really important to check what currency pairs are available on the broker site you are looking at. The reason being, some platforms only feature a few different currency pairs while others offer over a hundred.

Finding yourself a CySEC brokerage which has a lot of asset classes avoids the need to open accounts with multiple platforms. After all, in the instance you do change your strategic direction, you have everything under one roof.

Payments

The deposit and withdrawal process varies between CySEC broker platforms. Most offer similar deposit options, but if you need to deposit using a specific method you should check that it accepts it.

The best CySEC brokers process withdrawal requests virtually immediately, or at least within a couple of hours. Having said that, this can differ depending on which platform you use. All reputable brokerage companies will state the deposit and withdrawal process in the terms and conditions of the respective website.

Please be aware that the time it takes for payments to reach your account can also depend on what payment method you decide to use. A perfect example of this is a wire bank transfer, which can take around a week. This is obviously no good if you want to start trading straight away.

Customer Service

The level of customer service offered by any company is really important, and this is especially the case in trading. Lousy customer service can lead to investors being left high and dry at their time of need.

Ideally, you should be looking for 24/7 customer service, and a variety of options such as live chat, email, telephone, and a contact form. Remember though, if you are trading forex, cryptocurrencies, or commodities – these markets operate on a 24/7 basis.

So, if you sign up to a CySEC broker with customer service on offer just 5 days a week – you’re not going to have the assistance there over the weekend.

Accounts on Offer

Whether you are a complete newbie or are a trading pro, it’s always good to have options and to know what’s available.

For example, some CySEC brokers offer Islamic Accounts for followers of the Islamic faith. These accounts have been adapted to ensure they remain respectful of Sharia Law which is strictly against interest (both paid and owed). As a result, these accounts do not pay or receive any interest.

If you are a follower of the Islamic faith and are struggling to find a broker – it’s worth contacting the platform anyway. In doing so, you might find that the broker is able to accommodate this for you.

Similarly, if you are interested in trading in tiny amounts – then you might want to look into mini (0.10pips), micro (0.01pips) and nano (0.001pips) accounts. Even if these accounts aren’t advertised on the platform, the best CySEC brokers will support low trade minimums.

Compatibility

If you happen to be interested in automated trading (for example – forex EAs) then you will need to check that your CySEC broker supports third-party platforms like MT4. If you would like to enhance your portfolio by using a few different platforms, just make sure your broker can accommodate this.

Get Started With a CySEC Broker Today

By this point, you should have a good grasp of everything you need to know about CySEC brokers. If you’re still undecided on which broker best suits your trading needs, then please find our list of top-rated CySEC brokers further down.

Nevertheless, if you are ready to get started, then we have put together a simple step by step guide which should have you trading in no time.

Step 1: Sign up for an Account

Head over to your chosen broker and elect to open an account. You’ll need to provide a range of personal information and contact details. You will also need to outline what prior trading experience you have.

Step 2: Know your Customer (KYC)

Before you are able to start trading, you need to go through the CySEC broker’s KYC process. As per CySEC regulations, all brokers are legally required to ‘know’ their clients. This means the broker needs to verify the identity of each and every trader.

The broker firm will need your photo ID (such as a passport or driving licence). Next, the company will need a recently issued document that displays your name and address. Examples include a utility bill or bank statement (from the last 3 months).

The platform will then process this information and verify your identity before sending you a confirmation email. The best CySEC brokers can do this within minutes.

Step 3: Make a Deposit

As soon as your identity has been verified, you can proceed to make a deposit.

Payment methods available at CySEC brokers often include the following:

Like we have said, if you must use a particular payment method then always make sure this is available before starting the registration process.

Step 4: Start Trading

If you want to trade in real market conditions but aren’t quite ready to use your own money – try a demo account! Demo accounts come with a wad of ‘paper’ cash for you to trade with. This can be as much as $100,000, but usually around $10,000.

Demo accounts aren’t just reserved for inexperienced traders, as they are great for pros too. After all, demo facilities are actually a superb way of testing out new investment strategies. Demos and trials will help you get used to how the market works and aid you in practising how to read charts and technical indicators.

The Best CySEC Brokers of 2023

We’ve covered all of the important things to consider when choosing a CySEC broker, as well as the variety of asset classes on offer.

If you still need inspiration, then check out our list of the best CySEC brokers around right now.

1. Capital.com – Zero Commissions and Ultra-Low Spreads

Capital.com is an FCA, CySEC, ASIC, FSA, and NBRB-regulated online broker that offers heaps of financial instruments. This covers stocks, forex, indices, and commodities for CFDs. Also, real stocks are offered for the UK and some EU countries. You will not pay a single penny in commission, and spreads are super-tight. Leverage facilities are also on offer - fully in-line with ESMA limits.

Once again, this stands at 1:30 on major FX pairs, 1:20 on minor FX pairs and gold, 1:10 on indices and non-gold commodities, 1:5 on stocks, and 1:2 on crypto-assets. Leverage enhances earnings while also magnifying losses.

Getting money into Capital.com is also a breeze - as the platform supports debit/credit cards, e-wallets, and bank account transfers. Best of all, you can get started with just 20 £/$ by card.

- Zero commissions on all assets

- Super-tight spreads

2. AVATrade – 2 x $200 Forex Welcome Bonuses

The team at AVATrade are now offering a huge 20% forex bonus of up to $10,000. This means that you will need to deposit $50,000 to get the maximum bonus allocation. Take note, you'll need to deposit a minimum of $100 to get the bonus, and your account needs to be verified before the funds are credited. In terms of withdrawing the bonus out, you'll get $1 for every 0.1 lot that you trade.

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

3. EuropeFX – Great Fees and Several FX Trading Platforms

As the name suggests, EuropeFX is a specialist forex broker. With that said, the platform also supports CFDs in the form of shares, indices, cryptocurrencies, and commodities. You will be able to trade via MT4, so you can choose from desktop software, or a mobile/tablet application.

If you want to trade via your standard web browser, the broker also offers its own native platform - EuroTrader 2.0. In terms of fees, EuropeFX offers super-tight spreads on major pairs. Your money is safe at all times, not least because the broker is authorized and licensed by CySEC.

- MT4 and native trading platforms

- Super-low spreads

- Great reputation and licensed by CySEC

- Premium account has a minimum deposit of 1,000 EUR

Conclusion

There are thousands of brokers in the online space, all keen to attract investors to their platforms. The problem is there will always be some wolves in sheep’s clothing in the financial industry.

This is why it is so important to only entrust your finances with a fully regulated brokerage. By this, we mean one that holds a licence from a trusted body like CySEC. This is the only way you can guarantee that safety net against disingenuous brokerage firms.

The brokers we have listed above are all fully licenced by CySEC and are reputable. Crucially, you need to conduct your own research when choosing a broker to take care of your trades.

You should be looking at important metrics such as spreads, leverage, commission, and transaction fees. All of these elements together are going to help you make a decision on which is the best broker firm for you. Also, don’t forget the value of utilising demo accounts and free trials to get to know the platform before spending your hard-earned cash.

FAQs

What does CySEC stand for?

Can I use a bank wire transfer to deposit my CySEC broker account?

Do I need a passport to open a CySEC broker account?

If my CySEC broker goes bust, will I lose all of my money?

What is the best CySEC broker for beginners