Would you like to trade or invest from the comfort of your own home? First, you need to find a good South African broker to connect you to the markets.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Whether you are keen on exploring stocks, forex, cryptocurrencies, or commodities – you will find everything you need to know in this Best Brokers South Africa 2023 guide.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

In addition to a detailed review of our top 5 picks of the best brokers in South Africa, we also talk about the key metrics of picking a noteworthy platform yourself. Additionally, we cover broker regulation, fees to expect, and supported markets.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Best Brokers South Africa 2023 – Our Top 5 Picks

When you are looking to find the best brokers in South Africa, there are heaps of factors to consider. Later in this guide, we cover these key points in further detail.

Nevertheless, a great place to begin in your search is regulation, trading tools, and educational material. Other key metrics to consider include fees, and asset class variety.

To make things easier, you will see below a selection of the best brokers in South Africa in 2023 – alongside a review of each provider.

1. AVATrade – Best South African Broker for MT4/5

- Achievable deposit of $100

- Regulated by various bodies

- Plethora of assets avilable to trade

- Inactivity fees considered quite pricey

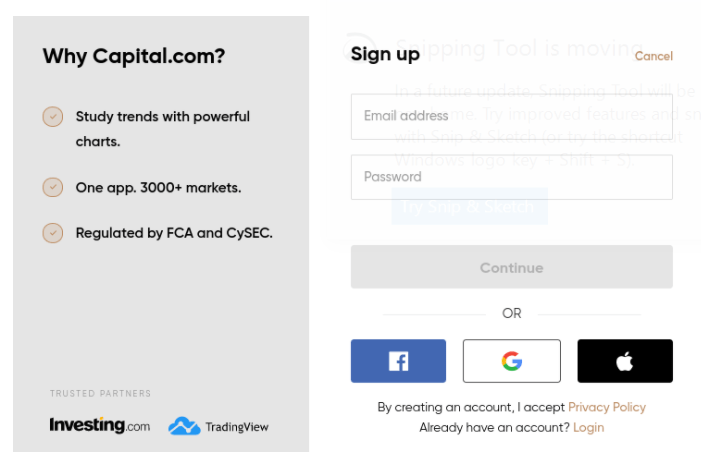

2. Capital.com – Commission-Free Broker for Newbies (Minimum Deposit Just US$20)

Making the number 3 spot in our best brokers in South Africa 2023 list is Capital.com. This platform is newbie-friendly and jargon-free. Moreover, the minimum deposit is just $20 - which is about R300.

In terms of payment, Capital.com is compatible with credit and debit cards, wire transfers, and e-wallets. The latter is fast becoming the go-to way to pay and here you can choose from Skrill, Neteller, and more.

If you are looking to diversify your portfolio, then Capital.com offers access to thousands of markets. Furthermore, there are heaps of different assets supported.

Similar to EightCap, Capital.com is a CFD broker. Markets at this platform include stocks, cryptocurrencies, forex, and indices. Irrelevant to what asset you are electing to trade, this broker charges 0% commission. Not only that, but you can expect competitive spreads, and the platform is super transparent.

Furthermore, if you want to deposit funds into your account when you are away from your desktop, you can download the broker's app on iOS or Android. If you are concerned about security, as you should be with any financial endeavor - this broker is very safety conscious. The platform is regulated by giants in the industry - CySEC, FCA, ASIC, and NBRB.

For beginners, there is also a good range of educational material available. This includes articles and mini guides about specific trading subjects.

- Zero commission on thousands of assets

- Very competitive spreads

- FCA, CySEC, ASIC, and NBRB regulated

- Too basic for well seasoned traders

Best Brokers South Africa – Types of Platforms

Now that we’ve lifted the lid on our top South African broker picks of 2023, we are going to dive right into the various platform types you might want to use.

Best Brokers South Africa for Stocks

When on the lookout for the best brokers in South Africa for stocks, you will notice there are hundreds in the space. This type of broker enables South Africans to access shares from a huge variety of different marketplaces.

For instance, in South Africa, this may include shares that are listed on the Johannesburg Stock Exchange (JSE). In this scenario, once you have chosen some stocks that take your fancy and completed your investment – you own the shares outright.

Social trading platform eToro offers access to 2,400 stocks from 17 different exchanges. Furthermore, as we mentioned earlier, this broker charges 0% when it comes to share-dealing commissions. You can get started with a minimum investment of $50 per stock

Best Brokers South Africa for Forex

With daily trading volumes of well over US$6 trillion, Forex is undoubtedly one of the most traded financial markets, the world over. If you are trading forex, you are speculating on the future value of an exchange rate.

- Let’s imagine you think that the South African rand will increase in value against the US dollar.

- This currency pair would be shown to you as ZAR/USD.

- Next, because you believe the price will rise, you need to place a buy order.

- Alternatively, if you thought ZAR was going to fall in price against the USD – you would need to place a sell order instead.

The clear objective is to speculate on the price rising or falling later down the line. Depending on your strategy, this can be on a timeframe of minutes to weeks.

The best brokers in South Africa offer a variety of different forex pairs. For instance, if you are interested in ‘major forex’ pairs, then you will find that most brokers offer at least a handful.

Whereas if you fancy trading exotic pairs (which includes the South African rand), you will need to make sure the broker offers access to such markets.

Additionally, you will likely be able to apply leverage to forex trades via some brokers. Our guide found that some platforms offer South African trades as much as 1:1000. However, whilst leverage can boost your gains, it can also do the same for your losses if your speculation is incorrect.

With that said, a commonly applied leverage limit on forex is 1:30 for major pairs. This turns an account balance of $100 (approx R3,050.030) into a $3,000 trading position (approx R45,780.55) .

Be mindful that leverage on a trade gone wrong can easily lead to your account being liquidated, so tread with caution.

Best Brokers South Africa for Commodities

In South Africa, commodities like metals have seen exponential growth since the early 2000s, and are showing no sign of slowing down. If you have your eye on commodities, then your journey to find the best broker in South Africa should be a breeze. Furthermore, commodities are often available as CFDs.

In a nutshell, CFDs enable you to try to predict the future value of a commodity – and make a profit if your prediction is correct. It’s important to be aware that unlike with traditional stocks and such, you will not own the underlying asset in question.

This means that you don’t need to concern yourself with storing and looking after heavy bars of gold, or bushels of wheat. All brokers in South Africa will vary when it comes to available commodities, but the most commonly offered markets are metals like gold and silver. You will often see energies like Brent crude oil and natural gas on the table too.

If you want a bit more variety, eToro provides access to a plethora of agricultural commodities like cocoa, cotton, sweet crude oil, sugar, wheat, corn, and more. When it comes to metals, the platform offers copper, silver, platinum, gold, and nickel.

If you are a seasoned investor, you may be better trading these commodities via a ‘futures’ or ‘options’ contract. These contracts are a little more sophisticated. If you like the sound of investing in the long term, it might be worth considering investing in your chosen commodity via an ETF. You can do this at eToro whilst paying zero commission.

Best Brokers South Africa for CFDs

We find that the best brokers in South Africa can offer CFDs on heaps of financial mediums. As we said, when trading in CFDs you will not own the asset.

The CFD simply tracks the real-world price of the asset using a specific benchmark. CFDs are offered in the form of most asset classes, from commodities, forex, stocks, bonds, cryptocurrencies, indices, and more.

This Best Brokers South Africa Guide discovered that the vast majority of CFD platforms will allow you to trade on a commission-free basis, with competitive spreads.

Furthermore, there are heaps of platforms that will still afford you the benefit of dividend payments on stock CFDs. You can do this by choosing to ‘go long’ on the relevant market. The traders electing to ‘go short’ will essentially cover the dividend.

Best Brokers South Africa for Cryptocurrencies

Cryptocurrency trading and investing has skyrocketed in the last 12 months. The best part is that any Joe Public with an internet connection can get involved.

At eToro, there are 16 popular digital currencies to choose from, and all can be purchased on a commission-free basis. Moreover, you can start investing in crypto-assets from just $25 (approx R380.00).

Such a modest minimum investment means that you don’t need to risk a huge chunk of your trading budget on such a speculative financial asset. After all, the cryptocurrencies scene is notoriously volatile

Whilst many seek to trade via unregulated spaces, albeit for anonymity or high leverage – these environments can be a breeding ground for cybercriminals and shady brokers. The best thing to do is only trust your hard-earned money with regulated and respected brokers like eToro, EightCap, Capital.com, AVATrade, and EuropeFX.

How to Find the Best Brokers South Africa of 2023?

If you have carried out your own research, the chances are you are still making your mind up. There are hundreds, if not thousands of online brokers today – making it very difficult to know who to trust your money with.

As such, it’s important to consider many different factors when considering which are the best brokers in South Africa for your needs. See below a list of considerations when looking for your perfect match.

Regulation and Safety

Regulation should be considered a priority when you are looking for a platform. After all, it’s your own rands and cents you are handing over. Crucially, it makes sense to first check the platform for a regulatory license.

If you are unsure, you can perform an internet search of the company name alongside the word ‘regulation’ and you should find what you are looking for. If a broker or exchange seems to be unregulated – it should be avoided at all costs.

Some of the biggest and most well respected regulatory bodies to look out for include the FCA (UK), ASIC (Australia), and CySEC (Cyprus).

You will also find that some brokers, such as AVATrade, are regulated by The Financial Sector Conduct Authority (FSCA) of South Africa. Additionally, if the platform is registered with the JSE and the broker becomes bankrupt, you will be entitled to a reimbursement of up to R500,000.

eToro shines in this department as well, not least because the broker is regulated by three authorities reputable bodies. The platform is also registered with FINRA in the US.

Whilst this might seem irrelevant to you as a South African citizen, this does illustrate just how seriously eToro takes regulation. The broker has heaps of rules to stick to and audits to submit in order to keep its license. That bodes well for you as a client.

Supported Assets

As soon as you have made sure the broker is regulated, you can take a look at what assets you will be able to access.

To give you an indication of the most commonly seen markets on offer at the best South Africa brokers, check out the list below below:

- Stock CFDs

- Commodities

- ETFs and Mutual Funds

- Indices

- Cryptocurrencies

- Shares

- Options and Futures

- Forex

As is clear, the platform you decide on will depend on your personal investment goals. Some online brokers concentrate purely on forex so won’t have anything to offer in terms of commodities.

All in all, the best brokers in South Africa will give you access to a plethora of different markets.

Ownership or CFDs

When you are researching the best brokers in South Africa, you will probably notice that you have the option of buying and owning an asset – or trading a CFD.

Importantly, these are two very different things, as we touched on earlier. To further explain, if you wish to purchase stocks or ETFs and would like to take ownership – CFDs won’t be for you.

A traditional broker will allow you to utilize a ‘buy and hold’ strategy until you feel ready to cash out – as don’t need to worry about ongoing CFD fees.

If you feel like you might be better suited to more sophisticated short-selling – you might consider CFDs. Such platforms will usually offer you leverage. However, as we mentioned earlier, leverage should be used with caution.

Ultimately, CFDs carry an ‘overnight financing fee’, or a ‘swap fee’ – which is charged for each day your trade is left open. This is why CFD trading is best suited for day traders or swing traders.

Trading Platform

When doing your homework about the best South Africa broker for your needs, consider whether you have the option to trade and invest on the provider’s webpage.

Many traders prefer this option as it cuts out the necessity to install any software. This enables you to just head over to the website and sign in as and when you please.

Finally, the best brokers in South Africa tend to offer a mobile-friendly version of their platform for iOS and Android users. This means that you are able to make a deposit and trade wherever you are.

South Africa Brokerage Fees

Even the best brokers in South Africa will charge you fees. This is standard practice. After all, the broker is a business and is providing you with access to the financial markets.

Therefore, you are going to be liable for fees of some description. Fees and commissions vary from platform to platform, so it’s a good idea to check the pricing structure of the broker before signing up.

To help clear the mist, below you will find a list of the most commonly charged fees so that you know what to keep an eye out for.

Dealing Fees

You may have heard of dealing fees when researching the best broker. This particular fee is generally connected to mutual funds, shares, and ETFs.

We find this is usually a fixed rate fee on each slide.

- For example, let’s hypothesize you are looking to invest in shares

- Your South African broker charges R150 for each and every trade

- No matter how much you invest, the fee is R150

- When you cash out your shares, you again need to pay R150

If this investment had been done via eToro, you would have saved R300- as the broker is 100% commission-free to invest in stocks and ETFs!

Trading Commissions

If trading alternative assets like oil, gold, or forex is more your style – then the chances are you will be required to pay variable commissions. This is usually illustrated as a percentage against your stake.

- For example, imagine the South African Broker you choose charges a trading commission of 0.7%

- You stake R7,636.00 on oil rising in price

- You must pay a R53.45 commission

- You decide to cash out your position at a value of R10,690

- Again you must pay 0.7%, which is R74.83 (0.7% of R10,690)

Once again, you would have saved nearly 130 rands at eToro – as the broker charges zero trading commissions.

Spreads

When you are doing some homework on the best brokers in South Africa, you will notice that all platforms charge a spread. For those unaware, it’s essentially the difference between the buy price and the sell price of the asset in question.

The vast majority of brokers display the spread as a percentage, whereas in the case of forex this is often shown as ‘pips’. However the spread is shown to you, it’s the amount that matters. This is because you will need for your investment to grow by this amount to break even.

For instance:

- Let’s say the spread is 0.4%. As such, you need to make a profit of 0.4% to reach a break-even point

- If your broker is charging a spread of 4 pips, you need to make a profit of 4 pips to reach a break-even point.

The best brokers in South Africa will clearly display the spread on their platform.

Deposits and Withdrawals

Before you can begin to trade or invest in the asset of your choosing – you will need to deposit some funds into your account.

At some brokers, this process can be rather long-winded, leaving you no choice but to manually transfer funds from your South African bank account. This is the most sluggish way to get started in your trading endeavors as it can take days on end for the money to arrive.

Another potential charge to be aware of is transaction fees. For example, some brokers charge a fee for making a deposit or a withdrawal request. Always do your research when it comes to deposits and withdrawals. After all, a platform might not charge you anything to fund your account – but the process might take a week.

Tools for Beginners

As we touched on, some platforms only offer a basic service or might specialize in one single asset class. If you are a pro trader this might be sufficient. But, if you are a beginner, chances are you want a bit more choice.

The best brokers in South Africa offer some of the tools and features listed below.

Educational Tools

At the risk of pointing out the obvious, if you are a newbie – choose a platform with heaps of educational content. This usually comes in the shape of mini online courses, video classes, and trading simulators.

There is also a plethora of other educational material out there, such as courses on understanding the spread and technical analysis, and guides for specific assets. A useful extra to look out for is regular webinars.

Automated Trading

Some people regularly talk themselves out of investing due to self-doubt and ‘what ifs’. There is help out there for people who want to trade or invest in a completely passive manner.

The best brokers in South Africa have automated trading options. This is ideal for investors who don’t have the time to keep one eye on the markets. Or perhaps novice traders, who don’t know a candlestick chart from a line chart.

eToro offers clients a feature called ‘Copy Trading’. Put simply, you choose a pro-investor with similar investment interests and copy them like for like.

This is a completely passive way to invest. If the pro-investor buys shares in Microsoft, this will be shown in your portfolio, and so on and so forth. Although you don’t have to lift a finger, you are able to add or remove assets as you please.

Another feature on offer at eToro is ‘CopyPortfolios’. You are able to select from a variety of strategies and assets – and eToro will professionally manage your portfolio for you. Again, this is entirely passive.

Tools for Experienced Traders

We’ve covered plenty of options above for those of you who are brand new to the game. However, for the more seasoned traders and investors out there, you might need a little bit more depth.

For instance, some people want to take part in day trading or swing trading. In this instance, a trading discipline often utilized by more experienced traders is technical analysis.

The best brokers in South Africa will tend to provide the following features:

- Chart drawing tools offering in-depth analysis

- Trading indicators such as price trends and market sentiment

- Multiple technical indicators like exponential moving averages, MACD, and RSI

- Works with automated trading robots

- Customizable trading screens like multiple charts and custom watchlist

Being aware of price trends and patterns is crucial to learning the market sentiment and spotting trading opportunities. Our Best Brokers South Africa Guide found that online platform EightCap ticks all of the above. Moreover, the platform is compatible with MT4.

Customer Service

Now onto customer service, which is often overlooked when looking for a broker. Especially for beginners, this is likely to be your lifeline when you are in need of help or advice.

The best brokers in South Africa offer clients more than one method of contact. Most people prefer the instantaneous nature of the ‘live chat’ facility, whereas some prefer to speak to someone on the phone in person.

Email, although great for having a record of your conversation, is often the slowest response time. The lion’s share of platforms offer customer support in line with traditional financial markets’ opening hours – 24/5.

Whatever your preferred method of customer support is, make sure the provider in question offers it.

How to Get Started With the Best Brokers South Africa Today

If you have read up to this point in our Best Brokers South Africa Fuide, you are probably ready to get started. We’ve divulged our top South African broker picks of 2023 and Capital.com made the top spot as the best overall provider.

To reach this conclusion, we tested the platform for seamless site navigation and user-friendliness in general. We also looked at the broker’s regulatory standing, fee table, and markets on offer.

With that in mind, and nearing the end of our journey, we are going to walk you through the simple sign up process at Capital.com

Step 1: Open an Account

First, visit the official Capital.com website and hit ‘join now’. Next, fill in the online form by entering some basic information to reveal your identity.m As you can see below, it is simply a case of entering your name, address, and such.

Next, you will be required to upload a copy of your passport or driver’s license. You will also need to send proof of the address you provided, which can be a utility bill or bank account statement.

The sign up with this top-rated South African broker will take less than 10 minutes from start to finish, thanks to the automated ID validation process used.

Step 2: Make a Deposit

Now that you have opened your new account with one of the best brokers in South Africa, you can make a deposit.

To get started on your journey in the fastest time possible we recommend using one of the following payment methods:

- PayPal

- Skrill

- Neteller

- Credit Card

- Debit Card

You can also use your South African bank account to fund your Capital.com account. However, this could delay your investments by up to a week.

Step 3: Search for Asset

Now that you’ve loaded your Capital.com account, you can look for the asset you wish to trade or buy. As we said, Capital.com is easy to navigate so this part is as easy as can be.

Step 4: Place Order

Once you have found the asset you are interested in – go ahead and create a trading order. Simply create a buy order next to the asset. Remember, if you think the price will fall – place a sell order instead.

When you have checked the details you entered, you can click ‘open trade’ to verify your commission-free and secure investment at Capital.com.

Best Brokers South Africa – The Verdict

Irrespective of whether you decide to trade cryptocurrencies, stocks, forex, or ETFs – there will be a South Africa broker out there for you. As there are so many platforms online offering a similar service, it can be hard to sort the wheat from the chaff.

Regulation here is key to finding a trustworthy broker to execute your orders. These providers have to jump through hoops to keep their license year on year – so you can bet that they take the client experience seriously and stick to the rules imposed on them.

We’ve listed our best brokers in South Africa, researching key metrics like regulation, fees, customer service, available asset classes, and features.

All in all, we found Capital.com is very newbie-friendly which makes finding your preferred asset class and placing orders a walk in the park. Moreover, the platform is 100% commission-free and offers tight spreads and heaps of choice.

Finally, Capital.com is regulated by multiple regulatory bodies, including the FCA, ASIC, CySEC, and NBRB.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts