Everyone is looking for the optimal time to trade currencies. However, with a market that barely sleeps, daylight saving hours, and exchanges located in different time-zones to consider – knowing when to trade forex can be a bit confusing.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

As such, it’s super important to have a firm understanding of the various forex sessions – and importantly when they are open for business.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

If this is something you’re looking to explore further – read on!

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What is Meant by Forex Market Hours?

The foreign exchange market runs 24 hours a day and 7 days a week. The people trading it include financial institutions such as hedge fund managers, big central banks, corporations, and investment managers. Then you have your average Joe Traders – known as retail clients.

In order for the foreign exchange markets to be open on an almost constant basis, exchanges will cross over, opening and closing throughout the week at different times of the day. As such, it can be confusing trying to figure out when is best to trade currencies, and what markets will be open, or most volatile in your specific time zone.

Global Forex Market Sessions

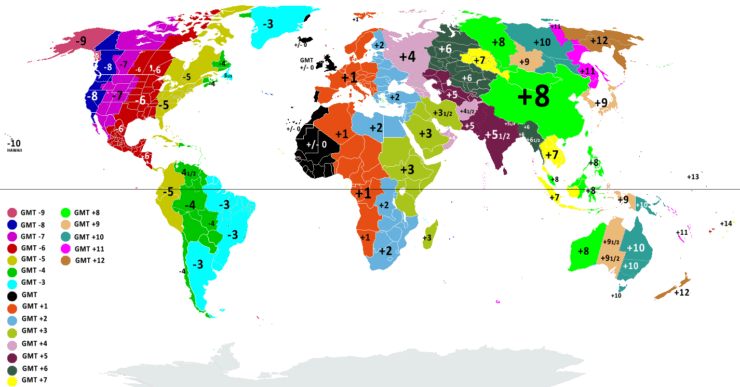

We are going to keep things simple by using GMT as a standardized time-zone throughout this guide, so you can add or subtract hours depending on where you live.

As we mentioned, marketplaces invariably open and close at different times. With this in mind, below you will find the four biggest market sessions globally. Crucially, you will notice that every market overlaps by at least 1 hour – keeping the wheels in motion.

Tokyo/Asian Forex Market Hours

The start of the trading week is kicked off by the Asian markets, often called the ‘Tokyo sessions’. The Tokyo capital markets go live between 00:00 and 06:00. Notably, the beginning and end of the Asian markets are usually extended beyond that of the Tokyo sessions.

This tends to instead open from 23:00 until 08:00. This is to accommodate the activities of scattered markets across Russia, New Zealand, China, and Australia – who are also are active at this time.

Some of the major pairs typically traded during the Asian sessions include AUD/USD, USD/JPY, and NZD/USD. Therefore, if you are trading a currency pair that includes JPY and such, you will notice much greater volumes during these hours.

London/European Forex Market Hours

Just before the close of the aforementioned Asian markets, Europeans come alive. Whilst the official hours for London are 07:30 until 15:30 – the sessions extend beyond that and run from 07:00 until 16:00. This is to allow for the presence of other exchanges such as Germany, France, and many more.

New York/North American Forex Market Hours

Several hours after the Asian markets close, and around halfway through the European sessions, the North American forex markets leap into action. Taking financial futures, economic releases, and commodities into consideration – off the record these markets kick off at 12:00.

As such, there is a considerable gap between the time the American markets shut down, and the time the Asian markets re-open again. At 20:00, the New York Stock Exchange officially closes.

Sydney Forex Market Hours

At 21:00, just after the NYSE shuts down, the Sydney markets open – closing again at 05:00. At which point, the Tokyo markets are up and running.

The Sydney market hours are often considered to be the least volatile, and therefore not ideal for short-term traders who wish to indulge in scalping and such.

Market Hours: Daylight Savings Time

It’s important to be aware that DST (Daylight Saving Time) will affect forex market hours. As such, being mindful of when the clocks go back or forward will aid you in trying to predict the markets. Whilst the majority of East Asia does not observe daylight saving time, heaps of countries do.

For instance, there is no use studying a candlestick chart illustrating a specific time such as the 1-hour, 4-hour, or daily – only to realize you’re measuring the wrong timeframe because that particular country has fallen back or moved forward an hour!

Most Volatile Forex Market Hours

When the Asian forex markets open at about 00:00, it would be advisable for newbies to refrain from trading. In fact, many currency traders with decades of experience hold back on placing orders within these first few hours.

This is because low liquidity often gives rise to volatility, which in turn makes for risky trading and wide spreads.

Most Liquid Forex Market Hours

When it comes to liquidity, retracement, trends, and momentum – this is strongest during the first 2 or 3 hours of a major market opening. Think along the lines of London/Europe or New York/North America.

Of course, volatility isn’t always a bad thing in this game. As such, you might want to catch some profitable opportunities by trading during TOTH (Top Of The Hour).

This is well known amongst the trading community and refers to the first and last 5 minutes of every hour during a trading day. At this time you will find high volatility and strong price fluctuations.

Forex Market Hours – The Bottom Line

When trading forex the obvious end goal is to make a profit by timing the markets well. As such, knowing when one session closes and another begins is going to help you no end – as you will be able to gauge volatility and such depending on your chosen FX pair.

As well as working out the forex market hours in a way that’s relevant to your specific time zone, it’s also important to bear in mind how any changes in Daylight Saving Time can affect a session’s opening and closing hours. Therefore, you will also have to adjust any price chart timeframes that you are looking at accordingly.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

FAQs

Can I trade forex after hours?

What are the main forex market sessions?

Why is the spread wider at night time?