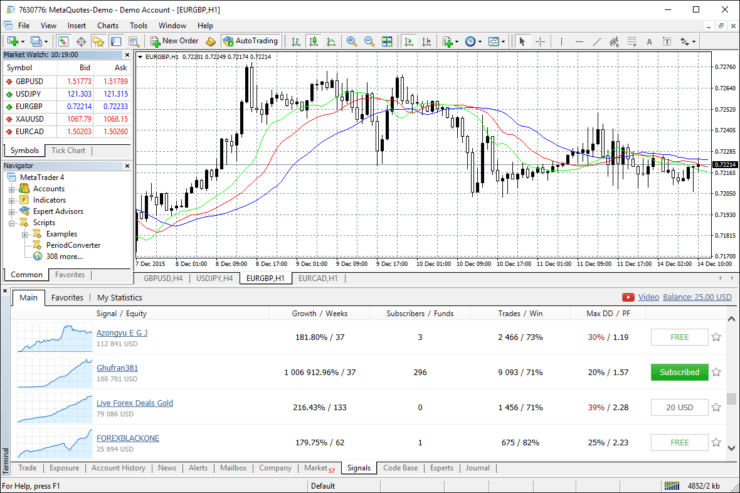

If you’re looking to buy, sell, and trade assets from the comfort of your own home – you will need to use a trading platform. At the forefront of this is MetaTrader 4 – or simply ‘MT4’. In a nutshell, MT4 is an electronic trading platform that is used by hundreds of online brokers.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card

The underlying technology is what allows you to trade online, not least because it has the capacity to execute orders in microseconds. One of the best things about MT4 Is that it allows you to trade both forex and CFDs – subsequently giving you access to thousands of financial instruments.

As such, if you’re looking to find the best platforms that support the MetaTrader 4 system – be sure to read our guide on the Best MT4 Brokers of 2023.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Note: Although your main priority might be to find a broker that supports MT4, you need to look at factors other than just the platform itself. This should include trading fees, regulations, customer support, and payments.

What is MetaTrader 4 (MT4)?

In its most basic form, MetaTrader 4 is an electronic trading system that is used by brokers of all shapes and sizes. The trading platform is what allows you to trade at the click of a button, as it has the capacity to match your orders with other traders in microseconds.

MT4 is often preferred by brokers because it allows them to facilitate trading services without needing to build their own proprietary platform. Instead, brokers merely need to license it from the developer of MT4 – MetaQuotes Software. MT4 is also a notable option for brokers because it has the capacity to support both forex and CFDs.

It is also important to note that MT4 is ideal for newbie traders. Not only is the overall layout is clean and crisp, but it gives you the option of customizing it to mirror your personal preferences. As such, this allows you to set up your day trading screen as you see fit.

Pros and Cons of Using an MT4 Broker?

The Pros The Cons

Features and Benefits of MT4

If you’ve heard the buzz surrounding MT4, but you’re not quite sure what features and benefits make it so popular with traders, be sure to check out the following:

✔️ Multi-Asset Platform

First and foremost, MT4 brokers allow you to trade forex and CFDs via a single platform. As such, there is no requirement to trade at separate brokers. Instead, you’ll have the ability to access thousands of CFD trading instruments, as well as heaps of forex trading pairs – with a single MT4 broker.

✔️ Analytical Functions

If you’re looking for up-to-date pricing feeds, MT4 is ideal. The platform allows you to receive online quotes in real-time, subsequently allowing you to react to pricing movements as and when they happen.

✔️ Technical Indicators

If you’re the type of trader that likes to perform highly advanced technical analysis, then MT4 has you covered. The trading platform covers more than 30+ technical indicators.

As such, you’ll be armed with the required tools to analyze historical pricing trends and thus – speculate how these trends could impact the future direction of the asset in question.

✔️ Centralized Accounts

If you have a tendency to use multiple MT4 brokers – possibly for risk mitigation purposes, the platform allows you to access all of your MT4-supported brokerage accounts through one hub. This is ideal if you want to import your customized trading settings over to your new MT4 broker.

✔️Online Marketplace

MT4 also hosts a consumer-driven marketplace. This allows vendors to sell anything from automated trading robots to new and improved technical indicators.

✔️Notifications and Alerts

An additional benefit of using an MT4 broker is that the platform allows you to set up real-time pricing alerts. For example, let’s say that you want to trade EUR/USD. You’re really keen to enter the market when EUR/USD breaks through its resistant point of 1.14.

When it does, you want to be notified straight away so that you can manually trade the pair. As such, you simply need to set your trigger point and the MT4 broker will notify you when it is hit.

✔️ Copy Trading

If you’re still a newbie trader and you’re somewhat intimidated about choosing your own trades, why not utilize the MT4 copy trading feature? This allows you to choose a provider, and the MT4 terminal will proceed to mirror their trades.

On top of benefiting from the success of seasoned traders, this will also allow you to get a birds-eye view of the many strategies that your respective provider uses.

MT4 Demo Account

One of the best features of using an MT4 broker is that you will have access to a fully-fledged demo account. For those unaware, this allows you to trade with ‘paper’ money, meaning that you can test our trading strategies before risking your own funds.

However, we would argue that utilizing an MT4 demo account to prepare you for the real-world financial markets is somewhat ineffective. The reason for this is that you will not get to experience the emotional effects of losing money. This is a major attribute to learn when trading online – and it’s something that only the most skillful traders can accomplish.

What Devices do MT4 Brokers Support?

MT4 supports most operating systems across desktop and mobile devices, as well as its native web trader platform.

This includes:

✔️ Windows

✔️ Mac

✔️ Linux

✔️ iOS

✔️ Android

✔️ Web Browser

How do you Use an MT4 Broker?

If you’re just starting out in the world of online trading, MT4 might appear somewhat daunting at first glance. As such, we would suggest reading through the step-by-step guidelines that we have listed below.

🥇 Step 1: Choose an MT4 Broker

First and foremost, you will need to open an account with an online broker that supports MT4. With that said, you also need to look at metrics other than just the underlying platform.

This should include the broker’s reputation and regulatory standing, trading fees and spreads, customer support, and more. To help you along the way, we’ve listed our top five MT4 broker picks towards the bottom of this guide.

🥇 Step 2: Open an Account

Once you have chosen your preferred MT4 broker, you will then need to open an account. You are best advised to this via your web browser for ease. You’ll initially need to enter some personal information – such as your full name, address, nationality, national tax number, date of birth, and contact details.

The broker will also ask you some questions about your financial standing. This will include the type of industry that you work in, as well as your annual salary. Moreover, the MT4 broker will need to know about your prior trading experience. This will include the types of assets you’ve previously purchased and the average size of your trades.

🥇 Step 3: Verify Your Identity

In order to remain compliant with domestic and regional anti-money laundering laws, your MT4 broker will need to verify your identity. This is known as the KYC (Know Your Customer) process, and simply requires you to upload some documentation.

🥇 Step 4: Deposit Some Funds

You will now need to fund your MT4 brokerage account. Although the specific payment methods will vary from broker-to-broker, it will likely include one or more of the following options:

- Debit Card

- Credit Card

- Bank Wire

- Local Bank Transfer

- E-wallet

Once you have had your deposit credited, you can then proceed to download MT4 to your preferred platform.

🥇 Step 5: Download and Install MT4

In order to get the most out of the MT4 platform, you are best advised to download it to your desktop device. Whether you’re running Windows, Mac, or Linux – MT4 has you covered.

Simply head over to your chosen broker’s download section and choose the respective operating device. Once you’ve installed the program, you can log in with your MT4 broker’s account credentials.

🥇 Step 6: Open a Position

You are now ready to open your first position. You will first need to search for your chosen asset class (such as forex) or financial instrument (such as GBP/USD). Once you are on the trading screen for the asset you wish to trade, click on the ‘TOOLS’ button at the top of the screen, followed by ‘NEW ORDER’.

You will then need to set up your order parameters. This will include:

- Whether you want to place a ‘buy’ or ‘sell’ order

- The volume you would like to trade (for example the number of CFD contracts)

- What market orders you would like to place (stop-loss orders and take-profit orders)

- Whether you want the order executed at the next available price, or at a predefined price

🥇 Step 7: Close Your Position

If you didn’t install a stop-loss, or you did, and you’re looking to exit the trade manually, you will need to click on the ‘TERMINAL’ button, followed by ‘TRADE’.

You will then have a birds-eye view of all of the positions you currently have open. Click on the order that you wish to close, and then click on the ‘X’ button to exit the trade at the current market price.

Top Forex MT4 Brokers List: Best 5 Platforms 2023

If you’re looking for brokers that use MT4, we would suggest performing your own independent research. This is because you need to ensure that the MT4 broker meets your individual trading needs. For example, while some brokers excel by offering super-tight spreads, others offer same-day withdrawals.

With that being said, if you don’t have the time to perform your own research, be sure to read through the top 5 MT4 broker picks that we’ve listed below.

1. AVATrade – 2 x $200 Forex Welcome Bonuses

The team at AVATrade are now offering a huge 20% forex bonus of up to $10,000. This means that you will need to deposit $50,000 to get the maximum bonus allocation. Take note, you'll need to deposit a minimum of $1,000 to get the bonus, and your account needs to be verified before the funds are credited. In terms of withdrawing the bonus out, you'll get $1 for every 0.1 lot that you trade.

- 20% welcome bonus of upto $10,000

- Minimum deposit $1,000

- Verify your account before the bonus is credited

2. EuropeFX – Great Fees and Several FX Trading Platforms

As the name suggests, EuropeFX is a specialist forex broker. With that said, the platform also supports CFDs in the form of shares, indices, cryptocurrencies, and commodities. You will be able to trade via MT4, so you can choose from desktop software, or a mobile/tablet application. If you want to trade via your standard web browser, the broker also offers its own native platform - EuroTrader 2.0. In terms of fees, EuropeFX offers super-tight spreads on major pairs. Your money is safe at all times, not least because the broker is authorized and licensed by CySEC.

- MT4 and native trading platforms

- Super-low spreads

- Great reputation and licensed by CySEC

- Premium account has a minimum deposit of 1,000 EUR

3. EightCap – Trade Over 200+ Assets Commission-Free

EightCap is an online forex broker that is fully compatible with MT4. You can trade over 200 financial instruments at this popular platform and there are two account types to choose from.

One account permits commission-free trading with spreads starting at just 1 pip. Or, you can trade from 0 pips at a flat commission of $3.50 per slide. In terms of markets, EightCap covers everything from forex and shares to indices and commodities.

Not only can you get started with this broker for just $100, but you can trade for free via the demo account facility. Most importantly, this broker is regulated by tier-one body ASIC.

- ASIC regulated broker

- Trade over 200+ assets commission-free

- Very tight spreads

- No cryptocurrency trading