Thinking about trading online but are somewhat lacking in the funds department? If so, you might want to consider a high leverage broker.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

In a nutshell, high leverage brokers enable you to trade with a higher stake than your account balance allows. The maximum leverage you can get your hands on is dependant on where you live, and what asset you are looking to trade.

New to trading with leverage? Fear not, in this Best High Leverage Brokers 2023 Guide, we review the cream of the crop.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

On top of saving you from having to research hundreds of providers in the space, we also talk about how leverage works, how to sign up, key metrics to consider, and how to place an order.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Best High Leverage Brokers 2023 – Our Top 2 Picks

When searching for the best high leverage brokers, it’s also crucial that you think about other important factors.

For instance:

- Is the platform regulated?

- Which assets will you be able to access?

- What commissions and fees are you expected to pay?

- Is the broker’s website easy to navigate for your level of experience?

When reviewing the best high leverage brokers for your consideration – all of the above metrics were taken into account.

See our top 5 high leverage brokers of 2011 below.

1. AvaTrade – Best High Leverage Broker With Heaps of Techincal Analysis Tools

AvaTrade is a popular online CFD platform that is suitable for traders of all skill sets.Leverage offered to clients from outside of the European Union is capped at 1:20 on cryptocurrencies, 1:20 on individual shares, and ETFs. When it comes to commodities, you can get as much as 1:200, and on indices and forex, you can multiply your position by a whopping 1:400.

The key phrase here though is 'clients from outside the EU'. The reason is that as we mentioned, there are leverage limits in place depending on your location. When it comes to the all-important regulatory standing, AvaTrade excels. The online broker is regulated by several authorities around the world. From the UK, Australia, and Europe - all the way to Abu Dhabi, Japan, and South Africa.

Furthermore, whether you are a beginner or a seasoned trader, there is lots on offer in terms of trading tools. You have access to various charts, economic indicators, risk management tools, and even portfolio simulations. This will all be done on AvaTrade's own proprietary trading platform.

- If you like a bit more when it comes to technical analysis, you will be pleased to know that AvaTrade is compatible with third-party trading platforms MT4 and MT5.

- As we said in our EightCap review - this enables you to access a plethora of trading tools and helpful features like indictors and such.

- For those who like to both trade and socialize, the broker is also compatible with 'Zulutrade' and 'DupliTrade'.

AvaTrade has a whole host of CFD instruments on offer, which is inclusive of cryptocurrencies, forex, indices, commodities, and ETFs. All of these markets can be accessed without paying a cent on commission fees. Moreover, for those who like to buy and sell on the move - the 'AvaTradeGo' app is available for download on Android and iOS.

You can get started on this platform for as little as $100. This can be done via credit/debit card or traditional wire bank transfer. The latter will always take longer to process - which is the same with all online brokers.

- Minumum deposit of just $100

- Regulated in multiple juresdictions

- A plethora of zero commission assets to trade

- Inactivity fees a little steep

2. Capital.com – Great High Leverage Broker with Only $20 Minimum Deposit

Capital.com has only been around for about 5 years, but has already managed to accumulate nearly 100,000 traders, from over 200 countries. In terms of regulation, the popular online broker is authorized by the FCA, CySEC, ASIC, and NBRB all of which are well known in the industry. Just one of the benefits is that the platform keeps all client funds in a separate account. This means your money will never be affected by corporate or sovereign debts.

Furthermore, this online broker may be worth considering if you have zero to little experience in the trading scene. The minimum deposit is a very newbie-friendly $20. However, it's important to note that if, instead of an e-wallet or credit card, you intend on funding your account via bank transfer - the minimum deposit at this platform is 250 of whatever your base currency is.

Capital.com is packed with educational content. This includes guides on specific asset classes such as forex, cryptocurrencies, ETFs, shares, and more. The CFD brokers also offer a free demo account for all clients. This allows you to trade in an environment that mirrors the real-world market conditions.

Maximum leverage for most retail clients is 1:30. If you fall into the professional trader category, you can access up to 1:500. Naturally, this also depends on the asset you are trading. Another major pull for this provider is that you can trade all markets without paying a cent in commission.

Furthermore, the majority of markets on this platform come with tight spreads. Capital.com has its own app, which is compatible with both iOS and Android. This means you can buy, sell and check on your trades on the go.

- Heaps of different markets to trade with 0% commission

- Minumum deposit a mere $20

- Regulation comes from FCA, CySEC, ASIC, and NBRB

- No option to build own custom trading strategies

High Leverage Brokers Unwrapped – Important Factors

The online trading scene is rife with scammers and shady companies. As such, the best high leverage brokers will be fully regulated for your protection.

In this section of our guide, we talk about the ins and outs of high leverage, and how that is affected by the rules and regulations set out by such authorities.

What is Leverage?

The likelihood is that you will know what leverage is and how it works. However, in the name of thoroughness, or for any beginners – let’s explain. In a nutshell, leverage is like a loan from your broker. This ‘loan’ allows you to trade with more than you actually have in your trading account.

In most cases, leverage is shown as a ratio such as 1:2, 1:10, or even 1:500. At some platforms, such as eToro, leverage is displayed as a multiple such as x2, x5, and so forth. To clear the mist, let’s imagine that you open a $1,000 position on copper using leverage of x10. Put simply, you are able to multiply your stake 10 fold. This means your $1,000 actually becomes $10,000 in trading capital.

See below a practical example of how using the best high leverage brokers might affect your trade:

- You think the price of EUR/USD is going to increase – so place a $1,000 buy order

- You decide to utilize leverage of x10

- Later in the day, the same pair is worth 3% more

- Pleased with your gains you decide to place a sell order

- Had you not applied leverage to this trade, you would have made $30 (3% of $1,000)

- Because you decided to apply leverage to your trade, this $30 profit instead becomes $300

As you can see, by using the best high leverage brokers, you are able to magnify your gains. This means even if your brokerage balance doesn’t allow a large stake, you can simply apply leverage and go for it anyway. Importantly, be mindful that whilst leverage amplifies your profit – if you speculate incorrectly, it will amplify your losses.

Potential Leverage Limits

We have mentioned leverage limits throughout our reviews of the best high leverage brokers. To clarify, in some countries, there are no limits in place at all.

Whereas, on the contrary, in the US you can access up to 1:50 leverage on forex trades. However, no CFDs are permitted (on any asset).

Over in the UK, most of Europe, and Australia (as of April 2021) – the maximum leverage allowed for retail clients is as follows:

- 1:30 on major FX pairs

- 1:20 on exotic and minor FX pairs, gold, and major indices

- 1:10 on commodities

- 1:5 on ETFs or shares

- 1:2 on cryptocurrencies (excluding the UK)

We mentioned retail clients there. For those unaware, a retail client is someone who trades on their own personal account. If you fall into the category of a retail client yourself but are interested in higher leverage – we talk about your options next.

Option 1: Open an Account as a Professional Client

Option 1 is to open an account as a ‘Professional Client’. For those unaware, people who qualify as institutional or ‘pro’ trader often trade much larger volumes – sometimes on behalf of other groups or institutions.

There are, of course, requirements to be able to open such an account. In fact, you must comply with at least two of the following conditions.

- You must have placed a minimum of 10 trading transactions in each quarter, covering the last 4 years. This includes any other platform, meaning it doesn’t necessarily need to have been done via the best high leverage broker you are looking to sign up with.

- A high leverage broker will require you to have no less than 1 year of proven experience in the financial sector. The chances are that you will also need to be able to show that you have worked as a professional investor or trader as well.

- Savings/investments or assets totaling no less than $/€/£ 500,000 – real estate does not count towards this

As is crystal clear, it’s hardly a walk in the park becoming a professional client. It’s also highly likely that the provider will need you to submit some form of documentation to confirm your claims.

Option 2: Opt for an Offshore Broker

When looking for high leverage brokers, the second option is to use an offshore platform to escape the leverage restrictions enforced by regulatory entities. This might sound good, but when you consider the protection and standards these authorities impose on online brokers – you’re in a vulnerable position trading via an unregulated space.

With this in mind, you should proceed with caution when thinking about how to find the best high leverage brokers.

Leverage and Overnight Financing

Another important consideration when searching for the best high leverage broker is overnight financing fees. For those unaware, this is a fee charged for each day a leveraged trade is active, so it’s comparable to an interest rate.

Sometimes called a ‘swap fee’, this is charged because you have essentially loaned money from the platform in order to amplify your stake. This is a service – after all, and just like any business, the brokerage needs to be sure that it will see a return. When it comes to how much the overnight financing fee will be, it will vary between platforms.

Furthermore, the time of day at which the overnight financing fee is initiated will depend on the online broker in question.

- For instance, at eToro, the fee on your leveraged trade kicks in if your position is still open by 17:00 New York, USA time. To give you a clearer indication of what this might be in your location – this is 22:00 United Kingdom time, and 09:00 Canberra, Australia time.

- Furthermore, if you were to open a new leveraged position at 23:00 on Tuesday, you wouldn’t be charged until 22:00 on Wednesday

If you consider yourself a short-term trader, this is one of the most important fees to be mindful of. The fee will be charged daily without fail. Ergo, if the online broker is charging an extortionate amount for you to keep positions open – it won’t be conducive to you being a profitable trader.

For clarification, take a look at leverage on an eToro trade below:

- You decided to trade $100 worth of Amazon shares with x2 leverage – the overnight fee would be $0.04 daily and an extra $0.07 on a weekend

- Should you change that stake from $100 to $2,000, still with x2 leverage – the daily fee changes to $0.72 daily, and an extra $1.43 on a weekend

At eToro, you will always be able to see what overnight financing fee you are expected to pay before you go ahead and confirm your order. The high leverage broker is super customer-friendly, and transparent when it comes to fees.

Margin and Leverage – What’s the Difference?

When researching the best high leverage brokers online you have no doubt noticed that some platforms use the term ‘leverage’, and some ‘margin’. Notably, there are contrasts between the two.

To clear the mist:

- As we touched on, leverage increases your stake. If you want to increase your stake 2-fold, you apply leverage of x2 – turning a $100 stake into $200. If you apply leverage of x5, your $100 becomes $500.

- In layman’s terms, ‘margin’ is the amount of money you need to put into the trade from your own account. As such, you will need to meet the margin requirements in order to be given the amount of leverage you are hoping for

In our example above, your margin is $100 in both scenarios and might be shown as 1:2, and 1:5 at another brokerage. When looking for the best high leverage brokers, it is important that you have a firm grasp of how margin and leverage work. This can help you to avoid the dreaded ‘account liquidation’.

If your trade goes in the opposite direction to how you predicted by a certain amount – your account will be liquidated. As a result, you will lose your stake in its entirety.

Key Metrics to Finding a High Leverage Broker

It’s important to not have the blinkers on when it comes to finding the best high leverage brokers. In other words, high leverage is good – but be mindful of other components.

This includes:

- Does the high leverage broker hold a license from one or more respected regulatory bodies?

- Is the high leverage broker easy enough to navigate for your skillset?

- What commissions and fees will I be expected to pay the high leverage broker?

- What assets will be available to me via the high leverage broker?

- What deposit methods are compatible with the high leverage broker?

When reviewing our top 5 high leverage brokers, we found that eToro covers every component listed above. The popular online broker is fully regulated, user-friendly, commission-free and offers heaps of assets and payment types.

Start Trading Today With a High Leverage Broker

Now that you understand the nuts and bolts of trading via a high leverage broker – you can start trading! Of course, first, you will need to sign up with the respective platform.

Opening an account is super easy. However, in case you have never traded before, you will find below a simple walkthrough of how to sign up with our top-rated high leverage broker Capital.com.

Step 1: Sign up and Upload Some ID

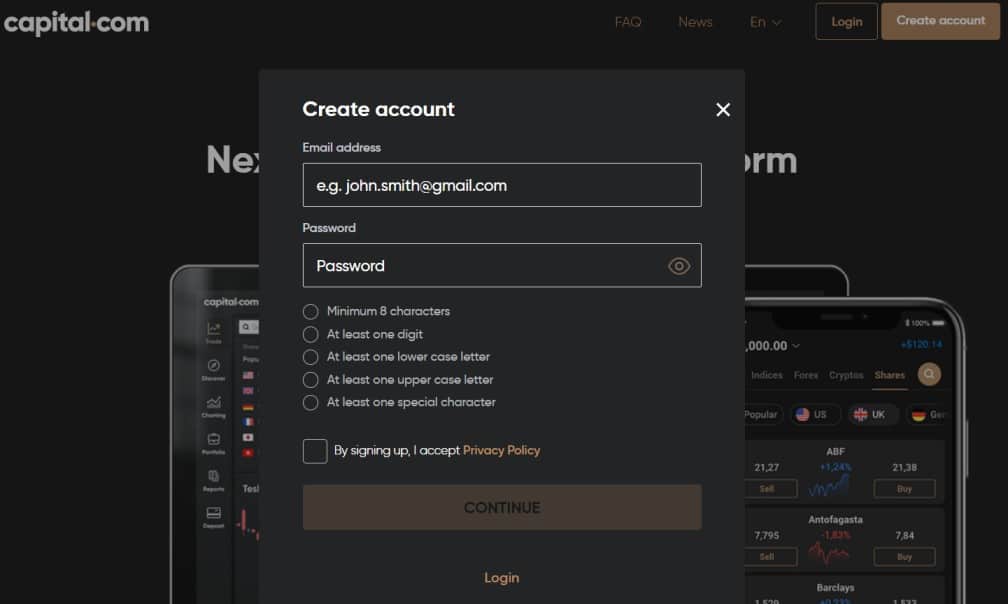

To get the ball rolling, head over to the official Capital.com website and hit ‘Create account’.

Next, you will be required to enter some information about yourself – which includes:

- Full name

- Username

- Email address

- Unique password

- Residential address

- Date of birth

- Mobile phone number

- Tax number

Step 2: Validate Your ID

As we have touched on various times, regulated online brokers have to follow strict rules imposed by financial authorities. One such rule is KYC, which insists that financial providers verify your identity. This is in a bid to prevent financial crime.

As such, you will be required to provide:

- Proof of identity – in the form of a driver’s license, passport, or accepted government-issued ID

- Proof of address – in the form of a bank account statement or utility bill, issued within the last 3 months

If you don’t have the time now, you can actually go ahead and start trading on Capital.com. However, you must make sure you upload these documents before you make a withdrawal request, or try to deposit over $2,250.

Step 3: Deposit Some Funds Into Your Trading Account

Now, you can deposit some funds into your new Capital.com account. There are heaps of options available, so you should have no problem finding your preferred method.

You can deposit funds on Capital.com using the following payment types:

- Credit and debit cards such as Maestro, Mastercard, and Visa

- e-wallets such as Neteller, PayPal, and Skrill

- Bank transfer

- and more, depending on your location

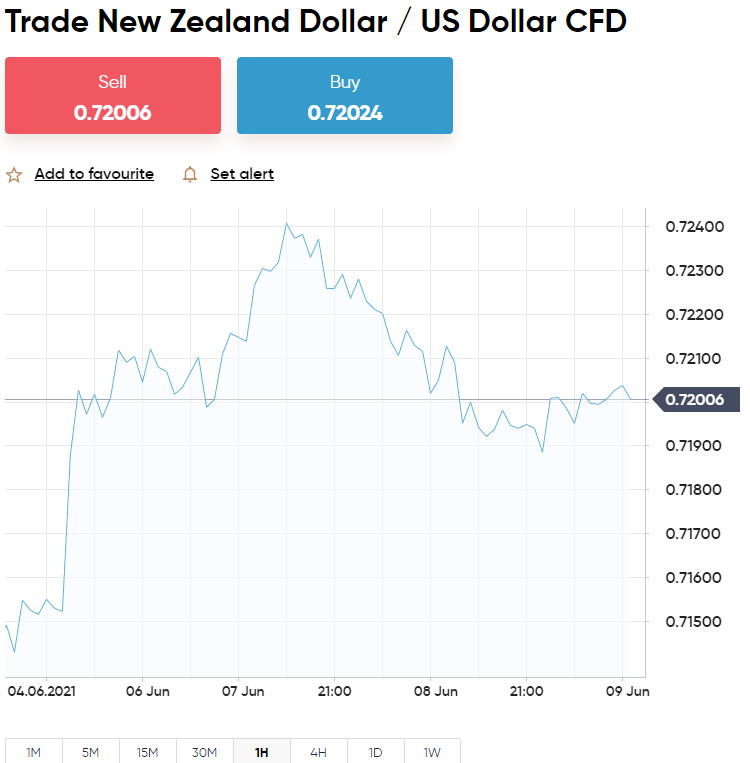

Step 4: Select an Asset to Trade

If you have an idea of what asset you might like to trade, you can utilize the search bar. To give you a clear example, here we are looking for New Zealand dollar against the US dollar.

As soon as you start to enter the name of the asset – you will see it come up as a suggestion – it really is that simple.

If you are yet to decide what you want to trade, click on ‘Trade Markets’ to the left-hand side of your account page for inspiration. This will bring up a range of different asset classes, and a useful filter to help you narrow down your search.

Step 5: Create an Order

When you see the market you are interested in, you can click ‘Trade’. This will reveal an order box. Depending on which way you believe the price of the asset will go you can now choose between a buy and sell order.

Look over your order to make sure you are happy and click ‘Open Trade’ – Capital.com will execute your commission-free order as instructed by you!

Best High Leverage Brokers: Conclusion

Throughout this guide, we have covered the ins and outs of trading via the best high leverage brokers. This includes key metrics like leverage limits, regulation, available assets, and more. In terms of safety, you should be looking for licenses from bodies such as the FCA, ASIC, CySEC, and NBRB.

It’s important to remember – although it might seem tempting to get high leverage from an unregulated space – this should be avoided at all costs. At Capital.com, you can trade a huge variety of assets, with the highest leverage permitted for where you live. On top of that, you can do so on a completely commission-free basis.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

FAQs

What kind of trader should use high leverage?

What is the best high leverage broker 2023?

Is it safe to use a high leverage broker?

Can I trade cryptocurrencies via leveraged CFDs?

What is the biggest benefit from applying leverage?