If you’re familiar with the forex scene, you will know that there are three main types of brokers utilised by traders to access the market. These are STP brokers, ECN brokers and market maker brokers.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

We live in a world where we want things to be done quickly and efficiently with instant gratification. With this in mind, we have STP brokers. Crucially, this is because forex traders need their market orders executed immediately.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

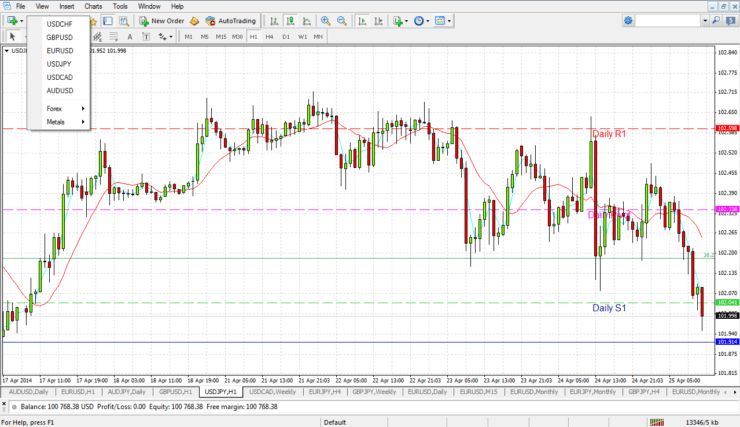

Put into simple terms – STP brokers act as a middleman between you as a trader and the forex markets. This takes away the presence of a dealing desk, which would be traditionally associated with forex dealers and markets. You then have orders which can be processed immediately, as well as giving you a direct route to liquidity providers.

However, with so many brokers working as STP providers these days, it can be difficult to know where to begin.

As such, to help you find the best STP brokers of 2023 – our team of experts have put together a guide. This covers the basics of STP platforms, some helpful tips on what to look out for, and of course – 5 of the best STP brokers worth your consideration.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What are STP Brokers?

STP is an acronym for ‘Straight Through Processing’. It was first created in London about 30 years ago, where it was actually used for equities trading. Without any manual interference – as STP is completely electronic, such brokers use technology that implements an automated payment process. This is referred to as STP and creates much quicker payment transactions for traders.

Widely considered to be more efficient than the conventional payment system, numerous financial services such as ‘payment processing’ now use this system considerably more often. As we said with, the dealing desk side of things is completely redundant with this STP brokers.

How do STP Brokers Work?

Liquidity providers have full access to the interbank market. The best STP brokers tend to have countless liquidity providers in their pool, and each one will quote a bid-ask price.

For example:

- Let’s say your STP broker has six individual liquidity providers.

- They are going to see six individual pairs of bid-ask quotes, one for each provider.

- When it comes to arranging these liquidity provider quotations, the STP brokerage system will automatically arrange the bid-ask quotations in order of the best to worst and adds a small fee to each quote.

This ‘pip’ added to each liquidity provider quotation is essentially the broker’s commission for obtaining the quotes and liquidity for you. Once you have placed your order to buy a specific amount of a currency pair, your broker is going to send the order to the liquidity provider.

When the order is accepted, the liquidity provider is going to see their original unit quotes. Meanwhile, the broker keeps the leftover pip as profit.

What are the Benefits of Using STP Brokers?

One of the main benefits that springs to mind is that STP brokers will not subject you to re-quotes. This is great, because they can often be damaging to your trading endeavours. You’re also going to find that unlike other brokers types, there aren’t as many unnecessary delays. STP is attainable thanks to the advancement of the FIX (Financial Information Exchange) protocol.

The main fundamentals of STP is to make order execution times shorter. This leads to a reduction in slippage and re-quotes, and enables you to have access to the best possible prices. STP brokers can be considered to be a bit more straightforward, because of the lack of conflict of interest as aforementioned.

Cutting out the need for intervention by the broker means that the provider is able to make a profit from the spread fee on every trade. This means that both parties experience honest and fair trading. Because the technology utilises such speed when sorting quotes, the STP broker is able to offer and fill your orders at the best possible price.

When looking at STP spreads, they are generally considered to be variable. This is due to constantly changing bid-ask prices taken from the variety of quotes (offered by liquidity providers). With that said, the spread is generally very competitive, especially in comparison to market makers.

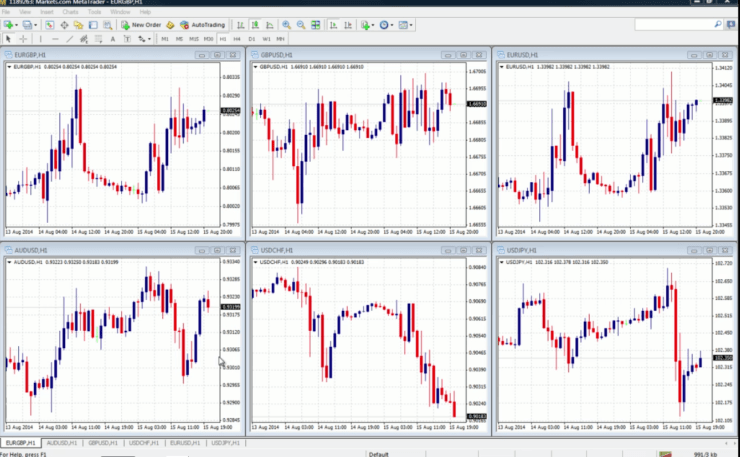

STP Brokers vs Market Makers

We think it is important for you to have a basic understanding of the many different types of markets and quotations before you dive in and choose a broker. STP and market makers are considered to be the two most widely used business models forex brokers. Getting to grips with the system market makers use to quote prices can really help you to understand the essence of STP brokers.

The market maker is often also called a dealing desk. Unlike STP brokers, market makers offer the bid-ask prices rather than going through a liquidity provider. This means that the quotation mimics the market price.

Market maker brokers don’t put client positions with any other liquidity providers. They set bid-ask prices via their own system. Investors can open and close positions after checking the prices on the market maker’s platform.

The vast majority of brokers offer market maker and STP services so you can adapt depending on your requirements. This information will be available on the broker’s website.

Why Should I Trade With an STP Broker?

Put simply – if you are new to trading, you are likely to benefit from an STP platform. This is because you avoid the market maker putting the rates up – usually off the back of a big financial news announcement (this is when orders can be rejected as well).

However, there are many other benefits of using an STP broker – which we discuss in more detail below.

Liquidity Provider Diversity

In a nutshell, the best STP brokers provide you as a trader with a variety of liquidity providers. Crucially, their quotes are all pooled together for comparison.

STP brokers are able to make this much wider diversity of markets available to you mainly because the system accumulates prices from several liquid providers at once. This, of course, means that you are going to have access to much more competitive prices.

DMA (Direct Market Access)

A lot of STP brokers offer Direct Market Access – or simply DMA. This is something that ECN brokers and STP brokers both have in common. However, while ECN platforms always offer DMA, some STP brokers don’t. As a result, always check this before signing up.

Nevertheless, the DMA protocol connects you as a trader to the market so that you are able to place orders with liquidity providers. This is all done via ‘electronic trade executions’.

Some common DMA features include:

- Five-digit pricing.

- Access to market books.

- Only market execution.

- Variable spreads.

- Better execution transparency.

It could be said that STP brokers lacking DMA might not be as transparent. This is because orders will be filled in by your broker and then protected by the liquidity providers, by way of hedging.

Various Assets Available

There are a diverse number asset classes available to you via your STP broker. Supported assets available are usually as follows:

Anonymity

As the STP broker allows both the liquidity provider and you as a trader to connect, a higher level of invisibility is needed for both. Put simply, by trading with an STP broker – no one is going to know your identity. You will be completely anonymous, and trades are formed on true market conditions, as well as impartial prices.

This can be really good for scalpers, for example. This is because they don’t have to worry about slippage or re-quotes – not to mention better interbank rates and access to more liquidity.

Trading With STP Means More Transparency

STP brokers remain popular amongst traders due to the fact they remain neutral at all times. This is the case regardless of whether or not you make a profit. By now, you know that executing trades through an STP broker doesn’t involve a dealing desk (market maker). So, this means that you will be entering trades in a true market rather than the one a market maker has ‘created’ using their own system.

Many traders believe that this makes STP brokers more transparent and trustworthy. You are able to gain access to better and quicker fills using this type of broker.

- For those unaware, a fill is essentially an order carried out.

- For instance, you place a buy order for a stock at £100 and the seller agrees to it.

- The seller completes the sale and the order ‘fills’.

- The £100 is known as the fill, otherwise called the order execution price.

All orders are carried out automatically through the network, and all anonymously.

No Re-Quotes

Due to the pool of liquidity providers, your STP broker is going to give you the best price and spread of all options available via your broker. The great thing about having access to these quotes is that you won’t be faced with any re-quotes.

In normal circumstances, when one of your trading orders is rejected because of a change in the price of an asset, you will be hit with a re-quote. When not trading via an STP broker, the respective platform will have to re-quote the asset (which initially experienced the price shift).

Ultimately, re-quotes can be detrimental to your trading accomplishments in the long run, because it rarely works out in your favour!

STP Brokers Never Trade Against Their Own Clients

Unlike with market maker brokers; there is no conflict of interest with STP brokers. Instead of making money from the losses of their customers, STP brokers will never take the opposite position. If they did, they would be able to benefit from your failures and make a profit that way.

STP brokers simply create a profit by charging a low commission fee on each trade (also referred to as a mark up), instead of going against you to cover their own back.

Considerations When Choosing an STP Broker

We at Learn 2 Trade think that one of the most important things to think about when finding a good broker is to make sure they are regulated. Well, it’s a good place to start at least. In doing so, you can be sure that your trading funds are secure.

When you re making a decision on the best STP broker for you, it’s also a good idea to choose one with the most variable spreads. This is because they are far more likely to choose the best bid price from one, and the best ask spread from another (all within their own liquidity provider pool).

There are a few other things we think you should consider In your search for the best STP brokers – which we discuss below.

Tier-One Licensing

As we have said, we highly recommend that you choose an STP broker which is fully licenced and regulated. However, we also think that you should go one step further by ensuring that the respective license has been issued by a tier-one body.

This would include the likes of the:

The best STP brokers are regulated by several tier-one bodies. You will also find that reliable brokers tend to be thoughtful when it comes to bringing out new and improved features for your support and happiness as a trader.

Ultimately, regulated brokers have a great track record and durability in the forex market. Not only that, but you can also be sure your funds have been segregated and covered by insurance.

Are Client Funds Segregated?

As we’ve touched on above, fund segregation is used by many different companies and the principle is always the same. Put simply, a company keeps your funds separately to its own for the protection of your money.

As a customer, it’s important to know that if the company goes into bankruptcy, your trading money won’t be taken as part of their debt. The reason for this is that depending on the level of fund protection offered by your STP broker, your funds will be segregated from that of the company, as well as fully insured.

For example, if you have high fund protection, then your funds are usually kept safe by a third party. Then, in the unfortunate event of the broker firm sinking, there is a legal obligation for the third-party institution to have your funds returned back to you.

Fees and Commissions

When it comes to fees and commissions, transparency is extremely important. The best STP brokers will offer you competitive commissions and fees when trading with them. The best thing is that most STP brokers won’t charge you a penny for depositing and withdrawing funds. Of course, you will need to check with your broker whether this is the case with them.

There will, however, usually be a small markup on each trade, and this will vary from broker to broker. This is how an STP broker is going to make its money. You need to have a larger amount of trading capital with an STP broker.

Customer Support

The best STP brokers will have an amazing customer service team ready to support you whenever you might need it. We find that the most popular STP brokers tend to have live chat options on their platform and 24/7 support to boot.

After all, when it comes to dealing with financial assets, you want a spectacular support network to help you whenever you might need it. Having a good source of contact and support available to you is invaluable when it comes to finding a good broker.

The more forms of contact available to you the better. However, no two STP brokers are the same, so always do your homework so that you know what kind of platform you are going to be dealing with.

Deposit and Withdrawal Options

There are various ways in which you are able to put funds into your STP broker trading account. Each STP broker platform will be slightly different in this respect.

For the most part, STP brokers offer a vast amount of accepted payment method options, with a few of the usual suspects. Here are the most commonly seen payment methods supported:

- Credit and Debit cards.

- Bank transfer.

- Prepaid card.

- E-wallets.

Once again, you will need to check this out before taking the plunge with a new broker.

Trader Resources and Tools

The best STP brokers will make a variety of different tools and trading resources available to you on their platform.

They will generally be as follows:

- Trading analysis.

- Risk management tools.

- Economic calendar.

- Financial market news.

- Technical indicators.

We think the more resources an STP broker can offer you, the better your trading experience will be.

Technical indicators are a very good way of studying price movements and trends.

- SAR (Parabolic Stop and Reverse).

- Moving Average Convergence Divergence (MACD).

- ADX (Average Directional Index).

- Relative Strength Index (RSI).

- Ichimoku Kinko Hyo (also called Ichimoku Cloud).

- Stochastic.

- Bollinger Bands.

What are the Pitfalls of Using an STP Broker?

Realistically, where there are pros, there are usually a few cons, too. As such, it is only fair that we make you aware of some of the possible negatives of choosing to open an account with an STP broker.

No Micro-Lots

As you might already be aware, a micro-lot is one thousand units of the base currency (the currency on the left of the pair). Crucially, STP brokers don’t deal in micro-lots.

On occasion, market participants hold a position of a 0.1 lot (10,000 currency units). This means that if you wanted to open a position for a 0.01 lot (1,000 currency units) – you cannot, as it is too small.

Liquidity providers can have really steep service costs and requirements. As a result, without access to micro-lots, you will definitely need to do your research to find out which type of broker suits your trading style and indeed budget.

On the flip side – even if you have a small budget and don’t want to open large positions, an STP broker could still be the right type of broker for you.

Less Consistent Spreads

During volatile stages in the financial market, the spread could potentially widen by quite a lot. Therefore, you might notice that the spreads at STP brokers might be less consistent.

Trade Costs

As we touched on earlier, even the best STP brokers can sometimes be considered costly. This is due to the commissions being charged on each individual trade order. For those unaware, these are shown as pips (point in percentage).

Some brokers charge a mark up of pips for each individual lot. This will generally be added to the spread for retail clients to see, but will sometimes be an invisible mark up to you.

At the risk of repeating ourselves, it’s important to always check those terms and conditions. After all, you should never create a new STP broker account before you know what it is going to cost you to trade.

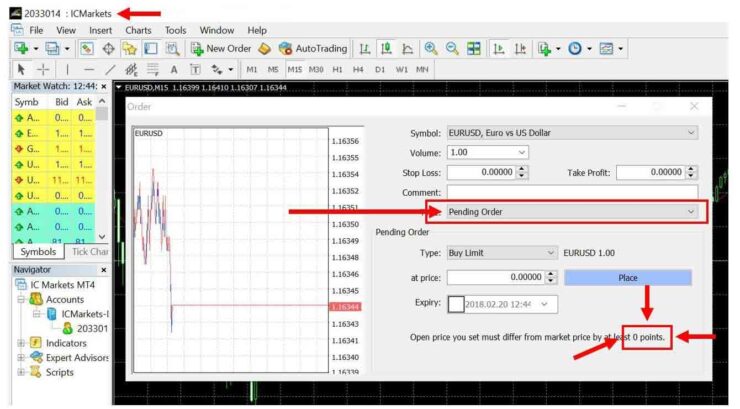

Signing up With an STP Broker – How-to Guide

At this point in our guide, you should have a much greater understanding of the role of an STP broker in forex trading, as well as how to find a good platform.

However, before you can get the ball rolling, you must first decide on which STP broker is going to suit your needs. It’s always advisable to do your research before you commit yourself entirely.

Nevertheless, below you will find some simple steps to get you started when it comes to signing up.

Step One – Find an STP Broker

Still unsure about which STP broker is right for you? Fear not, our dedicated team have compiled a list of the best STP brokers of 2023.

We think that the brokers we have listed are all at the top of their game, and are certainly worth your time and consideration. You will find our pre-vetted platforms at the end of this page.

Step Two – Open Broker Account

So, assuming you have found an STP broker you like, it’s now time to register. As is standard procedure with any broker, you must fill in a fairly simple form.

Information generally required is as follows:

- Full name.

- Home address.

- Date of birth.

- Contact details; usually telephone number and email address.

- Any financial information required; such as monthly income and trading experience (information requested will vary from broker to broker).

Step Three – Identify Yourself

KYC (Know Your Customer) is a legal obligation which must be carried out by regulated brokers before you are allowed to open an account.

The STP broker is going to need to ensure that your source of finance is legitimate and that you are who you say you are. Broadly speaking, you will just need to send the broker a scanned copy of your passport or another accepted form of ID.

From time to time a broker may require a little more proof of your identity, such as a phone bill, utility bill, or any other official letter containing your full name and home address.

Step Four – Account Confirmation

More often than not you will receive confirmation of your new account almost straight away.

If you feel like you’ve been waiting a while or something doesn’t quite seem right, we advise contacting the STP brokers customer support team. Each broker differs when it comes to how procedures are carried out, and some might take longer or be more thorough than others.

A quick call or email to the customer support team will usually result in your confirmation being chased up for you so that you can put your mind at ease.

Step Five – Get Started

At this point, you should be all set to get started as a trader.

You now need to login to your new STP broker account using your username and password. Then, all that is left to do is to select your payment option and deposit funds.

It’s worth having a look into whether or not there is an STP demo account available for you to have a practice run on if you are still a little bit nervous to go full steam ahead.

5 Best STP Brokers of 2023

Can’t find a suitable STP trading platform that meets your needs? Below you will find a selection of the 5 best STP brokers of 2023!

1. Forex.com– Best All-Round STP Broker

Forex.com is a house-hold name in the forex scene. It offers both ECN and SPN accounts, and minimum deposits start at just $50. You will have access to over 90 forex pairs, and heaps of supported payment methods. As a reputable broker, Forex.com is regulated by several tier-one bodies.

- High-grade ECN trading platform.

- $50 minimum deposit

- More than 90 forex pairs supported

- Other ECN platforms in market are more competitive with fees

2. FXTM– Best STP Broker for Zero Commissions

Heavily regulated broker FXTM offers fully-fledged STP accounts. On top of forex, you can also access stocks, metals, energies, and more. You will need to meet a rather hefty minimum deposit of $500, so this STP broker is best suitable for those with a larger starting bankroll. Both MT4 and MT5 are supported, and you will not pay any trading commissions.

- Zero commissions.

- Tight spreads

- Heaps of financial instruments supported

- $500 minimum deposit

3. Pepperstone Markets – Best STP Broker Advanced Trading Platform

Whether you are looking to trade via ZuluTrade, cTrader, or the MT4/5 series - Pepperstone has you covered. Best of all, you will have access to an STP trading account at the click of a button. You can load your account instantly with a debit/credit card. Trading fees, commissions, and spreads are very competitive with Pepperstone, and regulation is taking very seriously.

- Low fees and spreads.

- Multiple payment methods supported

- Choose from four different trading platforms

- Real-time news is a bit basic

4. Think Markets– Best STP Broker For High Leverage

If you are looking for an STP broker that offers high leverage limits, Think Markets could be up your street. With leverage available of up to 1:500, a $100 stake would yield a maximum order size of $50,000. The platform holds several tier-one licenses, including that of the FCA. Minimum deposits start at $500, which you can fund with a debit/credit card or e-wallet instantly.

- Zero commissions.

- Tight spreads

- Heaps of financial instruments supported

- $500 minimum deposit

5. Robo Forex - STP Accounts With 0 Spreads

In a somewhat uncanny move, Robo Forex is an online broker that offers 0 spreads. It does this through its STP accounts, so you can trade via an industry-leading pricing structure. Best of all, you can get started with an account with a minimum deposit of just $10.

- 0 spreads.

- Minimum deposits just $10

- Fast execution speeds

- Relatively unknown in the brokerage scene

To Conclude

It’s important to bear in mind that there are strict rules and regulations in place to protect you as a trader or investor, and the best STP brokers will be fully licenced for that reason.

When it comes to the protection of your trading funds and having trust in your broker, then a fully licenced platform is crucial. For that reason, we will never recommend an STP broker (or any kind) which isn’t fully regulated for your safety.

Nevertheless, one of the major benefits of trading with an STP broker over a market maker is that you are able to enter trades in a true market. Thanks to so many liquidity providers offering quotes via your STP broker, you have access to much more competitive market bids. On top of this, your market orders and fills are going to be executed with speed and precision.

Always do your research before fully committing, as brokers do differ and their products and services will vary as well. It’s also advisable to perhaps start with a small scale investment whilst you find your feet.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card