The online investment space has grown to exponential heights in recent years. First, we made the transition from a traditional phone-based broker to that of an online trading platform that allows you to buy and sell assets from the comfort of your home. And now? Mobile trading apps.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

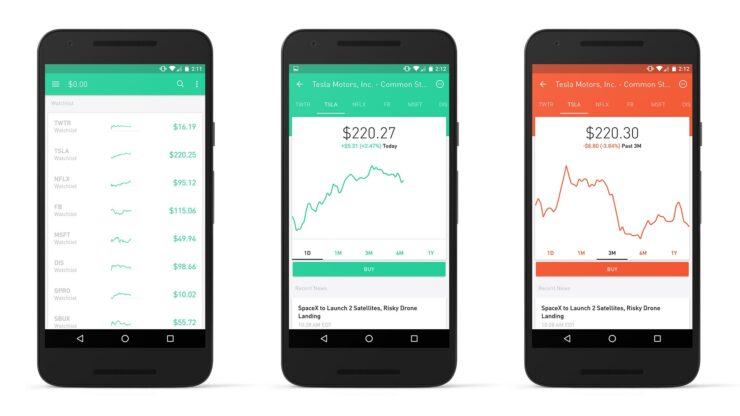

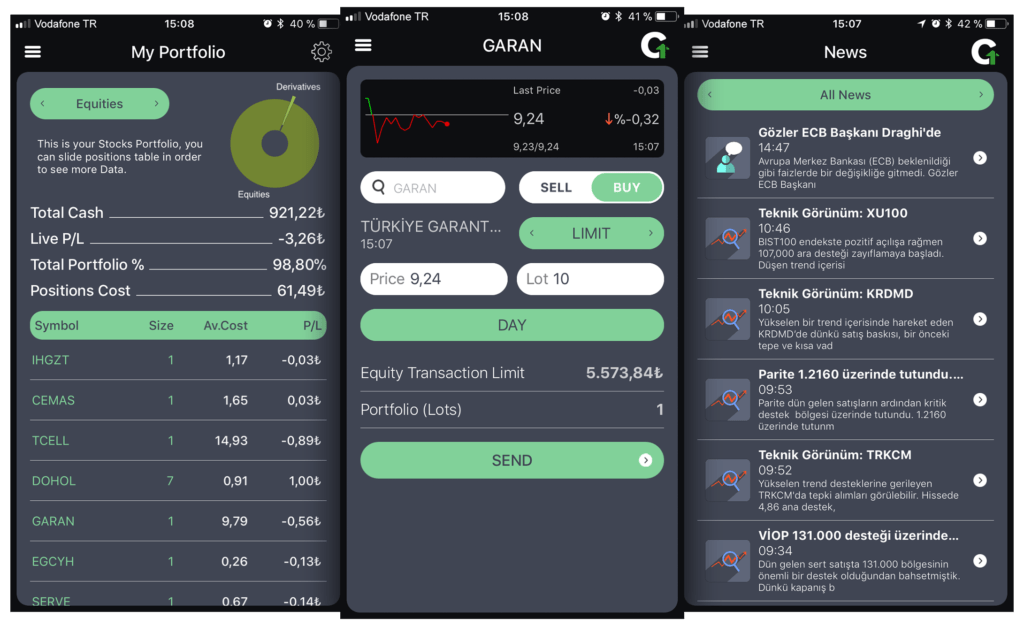

By using an online broker that offers a fully-fledged mobile trading app, you can access thousands of financial instruments at the click of a button. Whether that’s stocks and shares, forex, commodities, indices, or cryptocurrencies – trading on the move has never been easier.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

With that said, there are hundreds of trading apps active in the market, so knowing which broker to go with is no easy feat. As such, we would suggest reading our in-depth guide on the Best Trading Apps of 2023.

Note: If you’re looking to engage in high-level technical analysis, you might be best to do this on a desktop trading platform as opposed to a small mobile screen.

What are Trading Apps?

In a nutshell, trading apps allow you to trade on a mobile device. As such, most of the features available on a standard desktop trading site will also be accessible via your trading app. It is important to note that trading apps are not stand-alone investment platforms. By this, we mean that the app will form part of a much wider brokerage service.

What are the Pros and Cons of Using a MT4 Broker?

The Pros The Cons

How do Trading Apps Work?

If you’ve never used a trading app before, you should know that the process is largely the same as a standard online trading platform. With that said, below we’ve listed the main steps that you will need to follow to get your mobile trading career off on the right foot.

Step 1: Choose a Mobile Trading App

First and foremost, you will need to choose an online broker that meets your individual needs. At a minimum, you need to ensure that the broker offers a trading app that is compatible with your mobile device. In most cases, this will cover both Android and iOS operating models.

However, you also need to look at factors other than just the mobile app. This should include metrics such as regulation, trading fees, spreads, payments, and customer service.

Note: We’ve provided an in-depth section on how to choose a mobile trading app further down in our guide. We’ve also listed our top 5 picks towards the end of this page if you don’t have time to perform your own research!

Step 2: Download and Install the App

Once you have chosen a broker that meets your trading needs, you will then need to download the app to your phone. You can find the app via the main desktop website of the broker in question, or by searching for it via the Google Play or iTunes Store.

Step 3: Open an Account

You will now need to open an account with your chosen online trading platform. This will initially require you to enter some personal information so that the broker knows who you are.

This will include:

- First and Last Name

- Home Address

- Date of Birth

- National Insurance Number or Tax Identification Number

- Telephone Number

- Email Address

You will also need to provide some information about your employment status. This will include your annual salary band, and the type of industry that you work in. You’ll also need to let the broker know what your prior trading experience covers – such as the type of assets you’ve previously traded, and the average size of your trades.

Step 4: Verify Your Identity

Known as KYC (Know Your Customer), all UK brokers are required to verify your identity before they can allow you to use their services. This is a seamless process – especially if you are doing it via the mobile trading app. All you need to do is take a photo of your government-issued ID (passport or driver’s license) and upload it to the app.

Some trading apps will also ask you to verify your address. If they do, you just need to take a picture of an official document that contains your name and address – such as a bank statement or utility bill.

Step 5: Deposit Funds

At this stage of the step-by-step process, you should now have an active trading account that has been fully verified. As such, you can now proceed to deposit some funds. Depending on the broker in question, you might be able to do this via a debit/credit card. If so, it’s likely that Google Pay or Apple Pay will be able to streamline the process for you.

Alternatively, you might be required to deposit funds via a bank transfer. If so, you might need to wait a few days for the funds to clear. In some cases, you might be able to deposit funds via an e-wallet like PayPal or Skrill, which is usually instant.

Step 6: Start Trading

Once your deposit has been processed, you are then ready to place your first order. Most trading apps allow you to search for the asset or financial instrument that you wish to trade. For example, if you want to trade GBP/USD, simply search for the currency pair and you should be taken straight to the trading page.

As a side note, it might be best to start off with smaller trade sizes until you get more comfortable with your chosen trading app. This is because you will be trading on a much smaller screen than you are likely used to.

What Assets do Mobile Trading Apps Offer?

Mobile trading apps allow you to trade the very same assets as found on the broker’s main desktop platform. For example, if you’re using a specialist forex broker that lists 100+ currency pairs, all of these pairs will be available to trade via the mobile app.

Nevertheless, below we’ve listed the main asset types that you will be able to buy and sell on a mobile trading app.

✔️ Stocks and Shares

Most trading apps will list thousands of stocks and shares from multiple markets. At a minimum, this should include major stock exchanges such as the NASDAQ, New York Stock Exchange, London Stock Exchange, and Tokyo Stock Exchange.

Some of the best mobile trading apps will also host stock exchanges from less liquid marketplaces. This could include exchanges in Australia, Canada, Singapore, or Hong Kong.

✔️ Forex

The vast majority of trading apps will also offer a comprehensive forex department. This will allow you to buy and sell heaps of currency pairs from the majors, minors, and exotics.

Just be sure to keep an eye on the spreads when trading forex via your mobile app – especially outside of standard market hours.

✔️ Commodities

If you’re keen to speculate on the multi-trillion pound commodities space, most trading apps will host dozens of markets. In the energies department, this should include various oil markets, as well as natural gas.

You’ll likely find heaps of markets in the precious metals sector too – such as gold, silver, and platinum.

✔️ ETFs

Exchange-traded funds (ETFs) allow you to speculate on an asset, or group of assets, without actually owning it. The ETF simply tracks the real-world price of the asset in question, which subsequently allows you to go both long and short.

Popular ETF markets found on mobile trading apps include the S&P 500, gold, and the Russell 2000 Index.

✔️ Indices

If you’re keen to trade stocks and shares, but you don’t have the required experience to buy and sell individual companies, why not consider stock market indices? This is where you speculate on the wider stock markets by investing in hundreds of companies.

You can do this via a single trade, so there’s no need to spend hours-on-end placing hundreds of orders. Popular stock market indices include the FTSE 100, NASDAQ 100, and Dow Jones.

✔️ Cryptocurrencies

Trading apps now allow you to speculate on the future price of popular cryptocurrencies like Bitcoin. You will often have the option of trading crypto-to-fiat pairs like BTC/USD, or crypto-cross pairs like BTC/ETH.

Just remember, if you’re using a traditional broker to invest in cryptocurrencies, it’s all-but-certain that you’ll be doing so via a CFD. This means that you won’t own the underlying asset, rather, you are simply speculating on the digital currency’s future price.

How do I Choose a Mobile Trading App?

If you’re yet to find a mobile trading app that meets your investment needs, the good news is that you have hundreds of brokers to choose from. However, this also makes it difficult to know which platform to go with – not least because no-two trading apps are the same.

Note: If you don’t have the required time to read through the following metrics and perform your own research, you can skip this section and go straight to our list of recommended mobile trading apps.

🥇 Compatibility

First and foremost, you need to ensure that the mobile trading app is compatible with your respective device. In most cases, online brokers will develop a trading app for both Android and iOS devices, although this isn’t always the case.

Ultimately, if you’re using a device that falls outside of the Android/iOS spectrum, you might not be able to trade via a mobile application.

🥇 Regulation

Once you’ve assessed whether or not the app is compatible with your device. you then need to explore the broker’s credentials. At the forefront of this should be the broker’s regulatory standing. If the platform is based in the UK, then it will need to be licensed by the Financial Conduct Authority (FCA).

If you’re unsure whether the broker holds an FCA license, you can search the regulator’s online register. If it appears that the broker is trading without the required regulatory approval, avoid the platform in its entirety.

🥇 Deposits and Withdrawals

You also need to consider how the funding process will work when making a deposit via your mobile phone. The easiest way to do this is will be via Google Pay or Apple Pay. This is because your debit/credit card details will automatically populate, while at the same time protecting your sensitive financial information from getting into the wrong hands.

Alternatively, the broker might support an e-wallet like PayPal, or a traditional bank transfer. Make sure to assess whether or not the trading app charges any fees to deposit funds, and whether any minimum balances are required.

🥇 Types of Assets

Mobile trading apps come in a range of shapes and sizes. While some focus exclusively on forex, some specialize in cryptocurrencies like Bitcoin and Ethereum. Either way, you need to explore the type of asset classes that the broker offers.

Moreover, you also need to assess how extensive its list of financial instruments is. For example, it’s all good and well if the mobile app supports forex, but you might be left disappointed if only supports major pairs.

🥇 Trading Fees and Spreads

All mobile trading apps are in the business of making a profit, so you need to explore how the broker charges you to use its services. Regardless of what asset class you intend on trading, there will always be a spread of some sort. This is the difference between the ‘buy’ price and ‘sell’ price.

The larger the spread, the more expensive the asset is to trade. As such, the best mobile trading apps will offer super-tight spreads. Similarly, be sure to understand the broker’s commissions structure. While some brokers offer commission-free trading, others will charge you a variable fee based on the size of your trade.

🥇 User-Friendliness

While a mobile app might stand out by offering thousands of assets at rock-bottom spreads, you also need to explore how user-friendly the application is. After all, you will be trading on a screen size that is much smaller than a standard desktop device, so it’s crucial that the app offers a seamless trading experience.

Not only should this include the main trading area itself, but also the ability to move from asset-to-asset, as well as initiating deposits and withdrawals.

🥇 Customer Support

There might come a time where you require assistance in real-time. If you’re looking to use your chosen broker primarily through your mobile phone, then make sure that you are able to contact support via the trading app. This should come in the form of live chat or email.

Best Trading Apps in 2023

While we would suggest using the above section to research your chosen broker independently, below we have listed out top 5 trading app picks of 2023. Each recommendation targets a specific area of the online trading space – such as the best app for beginners, stocks, forex, and Bitcoin.

Conclusion

If you’ve read our guide on the best trading apps of 2023 from start to finish, you should now have the required tools to find a broker that meets your needs. As we have discussed throughout our guide, you need to ensure that the platform excels in multiple areas – such as regulation, fees, spreads, tradable instruments, and customer support.

With that being said, we have also listed our top 5 trading app recommendations for those of you that don’t have the time to find a platform independently. This includes a trading app for newbie investors, as well as the best app for trading forex, stocks, and Bitcoin.

1. AVATrade – 2 x $200 Forex Welcome Bonuses

The team at AVATrade are now offering a huge 20% forex bonus of up to $10,000. This means that you will need to deposit $50,000 to get the maximum bonus allocation.

Take note, you'll need to deposit a minimum of $100 to get the bonus, and your account needs to be verified before the funds are credited. In terms of withdrawing the bonus out, you'll get $1 for every 0.1 lot that you trade.

- 20% welcome bonus of up to $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

FAQs