Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Trading digital currencies from the comfort of home has never been easier for your Average Joe investor. The first decentralized cryptocurrency in the world – Bitcoin remains to be the most traded digital asset globally. In this guide, we walk you through the most important requirements to learn how to trade Bitcoin. We talk about online broker fees, trading strategies, orders, risk management, and more!

Our Crypto Signals

1-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

12-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime Subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratio8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

Part 1: Understand the Basics of How to Trade Bitcoin

Largely thanks to liquidity and volatility, Bitcoin is often referred to as digital gold. As such, it is paramount that you understand the bare basics of how to trade this cryptocurrency before taking the plunge.

In doing so, you’ll give yourself the best chance possible of trading in a risk-averse and calculated manner.

What are the Basics of Bitcoin Trading?

Put simply, Bitcoin trading involves trying to correctly forecast the price movement of the digital coin later down the line. The price of which is dictated by the supply and demand of the markets.

See below a practical example of a Bitcoin trade to clear the fog:

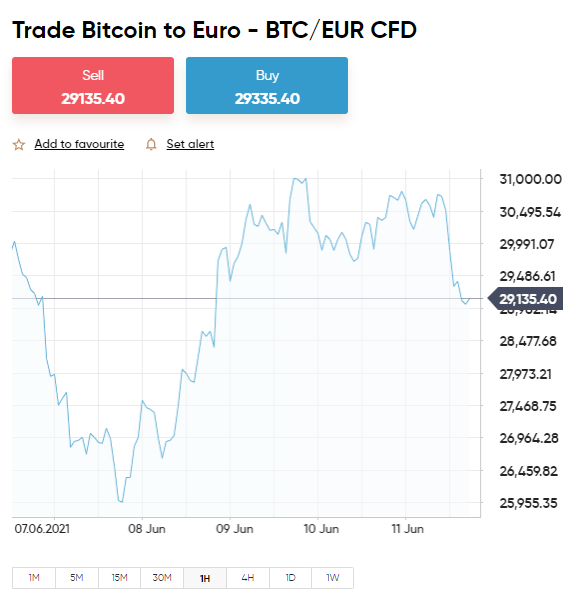

- Imagine you are trading Bitcoin against the euro.

- This will be displayed as BTC/EUR at your chosen online brokerage.

- At the time of your trade, BTC/EUR is valued at $45,162.

- Feeling as though the pair will see a price increase – you decide to action a buy order worth $1,000.

- Hours pass by and BTC/EUR rises in value by 5% – which equates to a new price of $47,420.

- From the initial $1,000 you staked – you made gains of $50 ($1,000+5%).

As you can see, if you buy a Bitcoin pair and are correct with your hypothesis, you stand to make a profit. For those unaware, you can also go short on Bitcoin – which we cover later in this guide.

Bitcoin Trading Pairs

When looking to learn how to trade Bitcoin, you will see there are different trading pairs on the table. If you have ever traded forex before you will know a little about how this works.

For those who have no experience with currencies in any capacity – cryptocurrency trades are facilitated in pairs. Trading pairs enable you to collate prices between different coins and establish its value.

Crypto-to-Bitcoin Pairs

The most common way to trade Bitcoin, especially for newbies, is via ‘crypto-to-fiat’ pairs. This involves trading Bitcoin against a fiat currency. Put simply, a fiat currency is one approved and usually produced by a government. Some trading platforms call these pairs ‘currency crosses’.

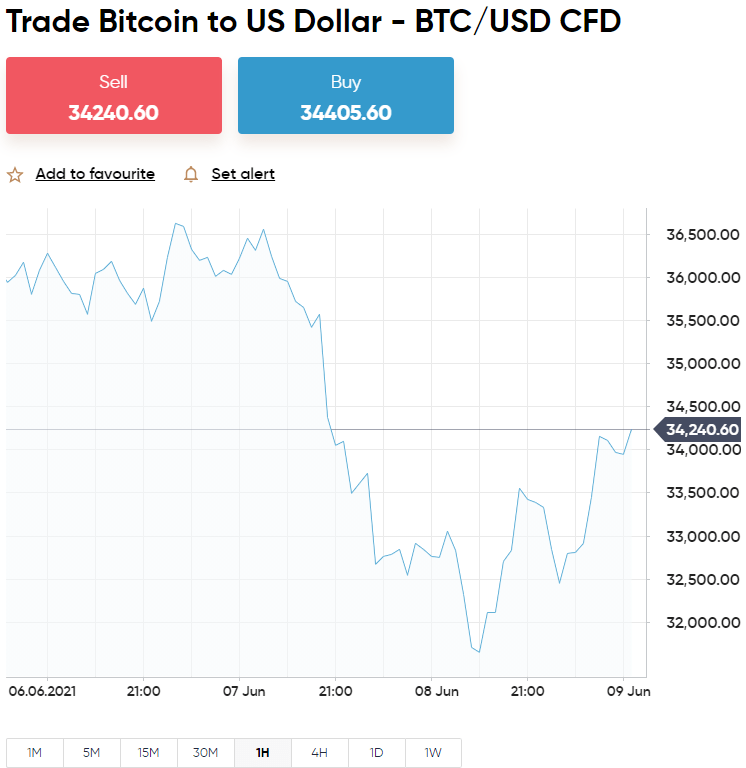

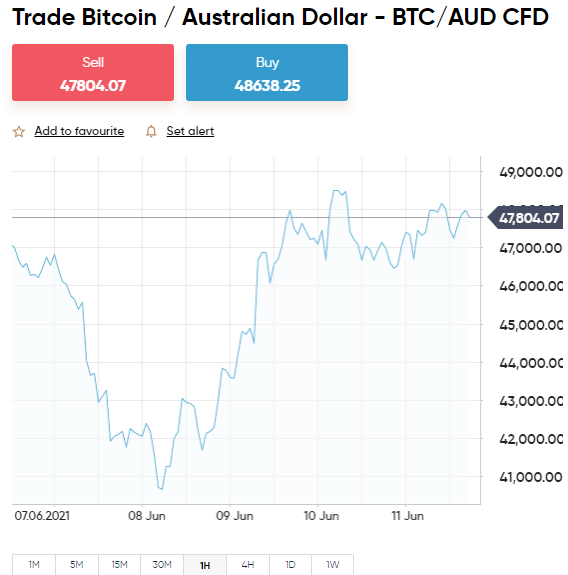

One of the most traded pairs in this category is Bitcoin against the US dollar – shown as BTC/USD. Other popular pairs include Bitcoin against (GBP) British pounds, euros (EUR), Swiss francs (CHF), and Australian dollars (AUS).

- To further explain, if you are trading BTC/AUS and are quoted $68,545 – every 1 Bitcoin is worth 68,545 Australian dollars.

- As such, if you are trading BTC/EUR and see a price of €44,547 – every 1 Bitcoin is worth 44,547 euros.

See an example below of a fiat-Bitcoin trade:

- You are interested in trading Bitcoin against Australian dollars.

- This pair will be displayed as BTC/AUD, and you are quoted AU$67,749.

- You have a strong feeling the price of this pair will skyrocket – so place a $500 buy order.

- A matter of days passes and BTC/AUD is priced at AU$77,234.

- Bitcoin against AUD has increased in value by 14% – so your prediction was correct.

- As such, you place a sell order so that you can cash in your gains.

As you can see, because BTC/AUD increased in price (as you suspected it would) – you made a profit of $70 ($500 + 14%).

We mentioned a moment ago that most beginners opt to trade Bitcoin via crypto-fiat pairs. The reason for this is that it is much easier to hypothesize on a pair including a government-issued fiat currency than it is on another digital one.

As we said, if you think Bitcoin is about to plummet, you can elect to go short on the digital currency as well. This is because Bitcoin pairs are often traded via CFDs – which we talk about shortly.

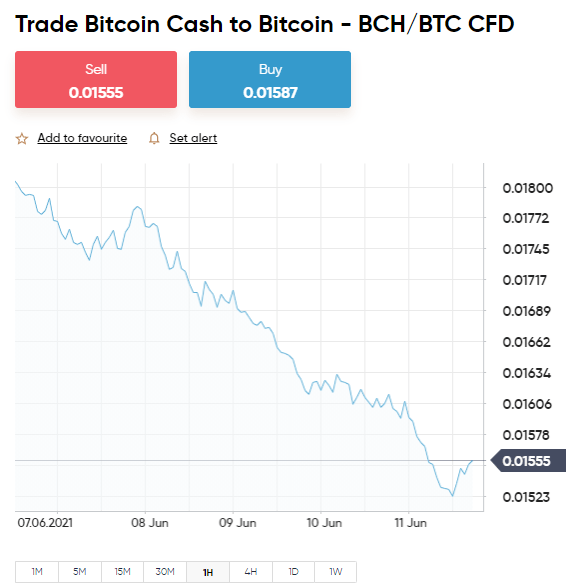

Crypto Cross-Pairs

Another way to trade this volatile asset is by trading it against another cryptocurrency. This is called a crypto-cross pair (sometimes referred to as a ‘crypto-cross’). For instance, if you were to trade Bitcoin against Ripple – this would be shown as BTC/XRP.

See below an example, using BTC/XRP:

- Cross pair BTC/XRP is priced at 93,587.

- As such, for each 1 Bitcoin, the market will give you 93,587 worth of Ripple.

It is as simple as that. The question is – will the exchange rate of the pair in question rise or fall? There are various ways to help yourself when it comes to making the right decisions. As such, the most important thing is to carry out plenty of research into your chosen Bitcoin market.

How to Trade Bitcoin: Short-Term or Long-Term?

Now that we have talked about the basics, we should cover how to trade Bitcoin in the short and long term.

Bitcoin CFDs

CFDs are undoubtedly the most common way to trade any asset on a short-term basis these days. Bitcoin CFDs track the real-world price of the digital currency – saving you the need to own it.

Bitcoin CFDs enable you as a trader to speculate and ‘go short’ if you think Bitcoin is overvalued and is about to see a price fall. This is done by creating a sell order via your online broker.

- You are trading Bitcoin against Stellar.

- BTC/XLM is priced at 114,322.

- Sure enough, your Bitcoin CFD is also valued at 114,322.

- If you think the pair will rise in value – create a buy order at the trading platform you have chosen.

- On the other hand, if you think the pair will fall in value – create a sell order on the trading platform.

- If the pair rises or falls, in line with your hypothesis – you will make gains on this trade.

Bitcoin CFDs are often kept open for minutes, days, or in some cases weeks. The less amount of time CFDs is left open the better. This is because each and every day a CFD trade is left open an overnight financing fee will be payable Some providers will refer to this as a ‘swap fee’, and, the charge is usually slightly higher on a weekend.

At brokers such as eToro, you will see the payable overnight fees as you enter your stake and leverage. This allows you to see exactly what you are paying in overnight financing fees on your leveraged CFD trade.

With that said, if you think you might want to adopt a long-term strategy and avoid these fees – see below.

Buy and Hold Bitcoin

Long-term traders tend to buy Bitcoin and hold onto it – hence the name of the strategy being called ‘buy and hold’. In the case of cryptocurrencies, in particular, this is often referred to as ‘HODLing’. Ergo, if you have purchased Bitcoin and are holding onto it – you are a ‘Hodler’!

Hodlers typically hold on to Bitcoin for years at a time before cashing out their investment. At top-rated Bitcoin provider eToro, you will be able to buy Bitcoin directly – whilst paying absolutely nothing in commission fees. This will be done via the integrated trading suite and you will be given a Bitcoin wallet upon signing up.

eToro offers access to 16 digital currencies and over 90 tradable pairs. This includes plenty of crypto-cross pairs, as well as fiat-to-crypto pairs such as BTC/USD – and many more, should you want to diversify later on.

Part 2: Learn Bitcoin Orders

To trade Bitcoin you need to be able to weather the storm against extreme volatility. As well as being essential – some orders can also aid you in mitigating your losses on each trade.

Buy Orders and Sell Orders

Starting with the most basic of orders to trade Bitcoin – buy and sell. Put simply, if you think that Bitcoin is undervalued and about to see an upwards price shift – you need to enter the market with a buy order. If this is the case, when it’s time to exit your position – you will need to utilize a sell order.

If you think that Bitcoin is overvalued and will experience a decrease in price – create a sell order with your broker. When you wish to cash out, you will exit the market with a buy order.

Market Orders and Limits Orders

The price of Bitcoin changes with every passing second, so it’s super important to have entry and exit strategies set up for every eventuality.

Starting with market and limit orders, you will see an explanation of both below.

Market Order

A ‘market order’ is often set as default when entering a position at an online brokerage. This elementary order tells your broker that you like the current market price of Bitcoin and want your order to be executed immediately.

Notably, due to the constant shifts in the price of Bitcoin – the price you see when you set up the order and the one you get will differ.

See below:

- You are quoted $53,427 on BTC/USD.

- Happy with that price, you place a market order.

- The trading platform executes your order immediately.

- You check the order and the price is $53,428.

This disparity is minute, but unavoidable nonetheless, due to almost-constant price shifts.

Limit Order

Another way to enter the Bitcoin market is by using a ‘limit-order’. This enables you to choose your own entry price.

See below:

- Bitcoin is priced at $53,427 and you are keen to place a buy order.

- However, you are not interested in entering the market until it rises to $57,200.

- As such, you need to set your limit-order to $57,200 when placing your order.

If or when Bitcoin rises to $57,200, your limit order will be executed by your broker. Importantly, the order will remain as it is until this price is reached, or you cancel it.

Stop-Loss Orders and Take-Profit Orders

We’ve covered how to enter the market when electing to trade Bitcoin, so now we can talk about your exit strategy. Having an exit plan is a great way to avoid losing too much money on a trade that doesn’t go to plan. After all, there is always the potential for the Bitcoin trade to go in the opposite direction than you had hoped for.

Stop-Loss Orders

‘Stop-loss’ orders are utilized by traders of all shapes and sizes. Put simply, by adding this order to every trade, you are able to stop your losses at a specific point. The purpose is to prevent you from losing more than you want or can afford to.

See an example below of how a stop-loss order can protect your Bitcoin trade from large losses:

- You are trading Bitcoin against British pounds.

- BTC/GBP is priced at £38,095 and you decide to place a buy order.

- You do not want to lose any more than 3% on this trade.

- As such, you set a stop-loss order at 3% below the entry price.

- If you were instead going short and placed a sell order – set the stop-loss order at 3% above the entry price.

Stop-loss orders are automated. So, once you have placed your order you can sit back and wait for the price of Bitcoin to rise or fall. The trading platform will execute your order to stop your losses as soon as the asset falls/rises to that price.

Take-Profit Orders

Another useful order when you are looking to learn how to trade Bitcoin is a ‘take-profit’ order. This one needs little explanation as it is comparable to the aforementioned stop-loss order. The obvious difference is that stop-loss orders prevent your losses from getting out of hand – whilst take-profit orders lock in your gains.

As such, the take-profit order tells your broker at which price point you would like to close your Bitcoin trade and cash out your profits.

See an example below:

- You want to make 6% on your Bitcoin trade.

- As such, if you enter with a buy order – you should place a take-profit order at 6% above the entry price.

- If you enter the market with a sell order – you should place a take-profit at 6% below the entry price.

As is clear to see from the above example, no matter which way the price of Bitcoin goes, you have an order in place to stop losses/lock in profits. Either way, the position will be closed automatically by the broker, at the price instructed by you.

Part 3: Learn Bitcoin Risk-Management

One of the most crucial parts of effectively learning how to trade Bitcoin for beginners is understanding risk management.

As we touched on, Bitcoin is a particularly volatile asset. Ergo, the better prepared you are, the better it will be for your trading profits. You are spending and risking your hard-earned cash after all.

Bitcoin Bankroll Management

Bitcoin bankroll management is a frequently used strategy by traders of all levels of expertise. To make this system easier – work in percentages.

For instance:

- You may decide to cap each stake to 3%.

- This means that irrelevant to whether you have $100 or $100,000 in your trading account – you will only ever risk 3% on a position.

- As such, if you have $3,000 – don’t risk more than $90.

- If you have $1,000 left, don’t stake more than $30.

This system is very easy to add to your strategy, no matter how experienced you are in trading Bitcoin. Simply perform a quick calculation before each order creation – based on your trading account balance at that time.

Trading Bitcoin via a Risk and Reward Ratio

The risk and reward ratio strategy is easily achieved. Simply think about how much you want to gain when looking to trade Bitcoin – and how much you are willing to risk to get it.

For example:

- Let’s say that for every $1 you stake, you wish to see $2 in return.

- This would be a 1:2 risk/reward strategy.

- As such, if you stake $200 – you expect to make $400 in profit.

- If you were risking $1,000 on a Bitcoin position – you would expect $2,000 in gains.

The aforementioned stop-loss and take-profit orders are invaluable for utilizing this strategy to its fullest.

Bitcoin Leverage

For those unaware, leverage means you can trade Bitcoin with more than your account balance allows. Leverage is usually illustrated as a ratio or multiple and is offered by most reputable brokers alongside Bitcoin CFDs.

See below an example of leverage used on a Bitcoin trade:

- You currently have $1,000 in your trading account.

- You decide to place a buy order on BTC/EUR.

- The trading platform offers you 1:2 leverage.

- This transforms your $1,000 stake into $2,000.

As you can see, even just increasing your stake two-fold can have a great impact on your profits. The problem is, this can be a double-edged sword. By that, we mean that whilst leverage offers you an opportunity to magnify your gains, unfortunately, if things go the other way they boost your losses too.

Crucially, CFDs are now banned in the US by law. If you are from the US, this means you are unable to access leveraged Bitcoin CFDs. UK traders are able to access leveraged CFDs, but not on Bitcoin, or any other cryptocurrency.

Some jurisdictions allow access to leverage without any restrictions in place. As such, make sure to research what will be available to you where you live. It’s also advisable you make sure you are dealing with a regulated Bitcoin provider. Some unregulated spaces can offer as much as 1:500 leverage, which might not be legal in your country.

Part 4: Learn How to Analyze Bitcoin Prices

Having completed parts 1-3, you should be feeling much more clued up about how to trade Bitcoin. Whilst a big part of learning is having a grip on order types and such – it’s also important to understand how to analyze prices.

After all, the majority of your decisions, and hopefully profits, will be based on your hypothesis on the direction of Bitcoin’s value.

Fundamental Analysis of Bitcoin

Studying fundamental analysis entails keeping abreast with economic and financial news that might affect the price of Bitcoin.

See below for some indication of what to look out for:

- Demand and supply.

- Statements from governments regarding crypto-assets.

- Competing digital coins and market capitalization.

- Geopolitical events.

- Fear-mongering media headlines.

- Bitcoin mining rewards.

- Cryptocurrency exchanges.

- Cost of mining Bitcoin.

- Legal matters and regulation (or lack of).

If this sounds like too much to keep an eye on, you might want to consider signing up for a Bitcoin subscription service. This way, you will receive real-time updates and news related to the asset you are trading.

It goes without saying that news services make it much easier to time the markets. As such, you are more likely to make a profit from your Bitcoin trading endeavors.

Technical Analysis of Bitcoin

Technical analysis entails using pricing data to assess market sentiment, from the past and the present. This helps shed some light on where the next Bitcoin trend might begin or end.

Bitcoin Signals

For those who are yet to fully understand the complexities of technical analysis – you may want to learn how to trade Bitcoin via signals.

Bitcoin signals are created by seasoned pros and can be likened to trading tips. This means that you subscribe to a service and no longer need to perform any analysis. Instead, you just need to place the recommended order if it suits you.

Bitcoin trading signals will tend to include the following:

- Bitcoin pair.

- Buy or Sell.

- The recommended entry price.

- A take-profit price.

- Finally, a stop-loss price.

Here at Learn 2 Trade, we offer heaps of crypto signals – saving you hours of research!

Part 5: Learn How to Choose a Bitcoin Broker

Choosing the right provider to trade Bitcoin is essential. We research and scrutinize hundreds of online brokers in the trading space. This follows a ruthless checklist of metrics to find the very best platforms for our readers.

When the time comes to conduct your own research, in a bid to find a Bitcoin trading platform worth your time – you can check out our checklist below for inspiration.

Regulation

Lack of regulation, particularly when trading cryptocurrencies, should be avoided. These spaces are renowned for being hacked. Furthermore, you won’t know whether the broker is legit until it’s too late.

To avoid malpractice, theft, and fraud – it’s crucial you only sign up with a regulated Bitcoin provider. For those unaware, you will know a trading platform is regulated as it will show a license number on its website.

The most commonly seen regulatory bodies in the trading space are the FCA (UK), ASIC (Australia), MAS (Singapore), CySEC (Cyprus), and FINRA (US). There are a handful more, but if you see these organizations at your chosen brokerage, you know you are in safe hands.

All regulated brokers must adhere to a list of uncompromising rules created by financial authorities. This includes fee transparency, client fund segregation, frequent and detailed audits, and more. This keeps the online brokerage space clean and fair for everyone.

Trading Fees and Commissions

To keep the wheels in motion and offer millions of clients a daily brokerage service – all Bitcoin providers will charge trading fees and/or commissions.

See below some of the most frequently seen Bitcoin trading fees.

Commissions

The commission is generally charged as a percentage, which will be based on the size of your Bitcoin position.

For instance:

- Let’s say your broker stipulates a 1% commission fee. This will be payable both upon entering the Bitcoin market and exiting.

- As such, if you open a Bitcoin position worth $1,000, you will pay $10 in commission to enter the market.

- If your position is worth $1,600 upon closing the trade – you will pay $16 – and so forth.

- Some online brokers stipulate as much as 2% for each trade. As you can imagine, these fees can soon eat away at your profits.

Popular online broker eToro allows you to trade Bitcoin on a completely commission-free basis. As such, on the above trade, you would have saved $26 towards your next Bitcoin trade!

Spreads

The spread on all trades is the difference between the current buy price and sell price of Bitcoin. This spread ensures the platform turns a profit irrelevant to the market sentiment.

For example:

- Let’s imagine the buy price of Bitcoin is $47,765.

- The sell price is $48,142.

- A quick calculation shows us that this equates to a spread of 0.79%.

- As such, you are beginning your trade 0.79% in the red.

As per the above, if the digital coin rises in value by over 0.79%, this counts as profit on your trade.

Payment Methods

Our Learn How to Trade Bitcoin Guide found that most new-age brokers enable you to deposit funds into your account with a choice of payment methods.

The quickest and most convenient payment types are credit and debit cards, as well as e-wallets. Think along the lines of PayPal, Neteller, and Skrill for the latter.

The slowest payment method for your Bitcoin provider to process will invariably be a bank wire transfer – which can take anywhere between two days to a week.

Best Broker to Trade Bitcoin Online

We mentioned earlier that we don’t take our search for brokers lightly and include many key metrics to scrutinize.

With that in mind, we’ve saved you heaps of online legwork. See below our best broker to trade Bitcoin online today!

AVATrade – Trade Bitcoin CFDs and Access Heaps of Techincal Analysis

AvaTrade is very well known in the Bitcoin trading space. In fact, the online broker has been facilitating a sea of varied traders for over a decade now. This trading platform operates under stringent compliance requirements as dictated by multiple bodies. This includes the FCA, ASIC, MiFID, JFSA, PFSA, B.V.I, FRSA, FSCA, IIROC, and ADG.

This top broker offers access to lots of tradable assets. This includes crypto-fiat pairs such as BTC/USD, BTC/JPY, and BTC/EUR. Such pairs will be traded as CFDs though, so do be mindful of overnight financing fees. If you like to buy and sell on the move, the broker has its own app called AvaTrade GO. The app has an impressive amount of educational material and trading tools.

This includes account simulators, demos, adaptable charts, trading guides, and more. Furthermore, AvaTrade is fully compatible with MT4 and MT5. If you like to gain insight from other Bitcoin traders in a social setting - you might want to link your trading account to DupliTrade or Zulutrade where you can 'like', 'follow', and 'comment' on other traders, strategies, and updates.

This is a great way to strategize as well as learn the ins and outs of the market from seasoned traders with heaps of practical experience. Most clients are able to deposit funds using credit and debit cards as well as bank transfers. Some will be able to use e-wallets such as Neteller - although this does not include the EU and Australia. You can get started with a minimum deposit of $100

- Deposit as little as $100

- Trade Bitcoin without paying commission

- Comprehensive AvaTradeGO app with educational content and tools

- Initial demo account expires after 30 days

Part 6: Learn How to Trade Bitcoin Today – Walkthrough

Having made it all the way to Part 6, you are no doubt feeling ready to learn how to trade Bitcoin in a practical sense. First, you need to open an account with a regulated and highly regarded brokerage.

To keep things super simple, we are using top Bitcoin broker Capital.com for our walkthrough.

Step 1: Open an Account

The first thing to do is to visit the capital.com website and hit ‘Create account’. You will need to enter some information about who you are.

As you can see, the information required at this point is fairly basic – your name, email, and such.

Step 2: Upload ID

Importantly, as per KYC to prevent financial crime – you will also be required to upload a government-issued photo ID. Next, you will need to upload proof of your address. Most people use a utility bill or recent bank statement.

The uploading of ID can wait for now if you don’t have it to hand. However, you must complete this part of the sign-up process before you make a withdrawal request (or deposit more than $2,250).

Step 3: Deposit Some Trading Funds

Having received your account confirmation email, you can now fund your account to enable you to trade Bitcoin from home!

Select from the available payment methods where you live and enter the amount you would like to deposit into your new trading account. As you can see, at Capital.com there are various options to choose from, depending on your personal preference, and also your location.

Step 4: Start Trading Bitcoin

The sign-up process is nearly complete. To trade Bitcoin you now need to place your order at Capital.com as discussed earlier. Feel free to scroll up to Part 2 for a recap of orders.

However, you should be choosing between buy or sell, and market or limit orders to start with.

Choose your stake amount, check over all of the information entered, and hit ‘Open Trade’. At this point, Capital.com will execute your orders as and when you have instructed.

Learn How to Trade Bitcoin – The Verdict

In this Learn How to Trade Bitcoin Guide, we have talked about the nuts and bolts of trading to the importance of regulation and risk management. It’s also super important to go into any new venture with your eyes open to potential fees.

Crucially, unless you plan on trading passively via signals or a Copy Trading tool – you must thoroughly educate yourself on the market. This should include learning fundamental and technical analysis, trying out Bitcoin-specific courses, and incorporating a clear trading strategy into each position.

Capital.com shines in all respects. Here you can trade Bitcoin commission-free – and in a safe and regulated environment (thanks to FCA, CySEC, ASIC, and NBRB). The top-rated broker offers a free demo account and accepts heaps of fast and convenient payment types. Furthermore, you can usually start trading Bitcoin in less than 10 minutes!

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated