Penny stocks are companies with a value of less than $5 per share. In theory, this could include a number of large-scale firms that are listed on major stock exchanges like the NYSE and NASDAQ. However, a more broad definition is that of small-cap companies that trade on over-the-counter (OTC) markets like the Pink Sheets.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Penny stock trading is often regarded as a ‘high-risk, high reward’ phenomenon, as the underlying share price of the company can go up or down in a parabolic manner. This is because penny shares suffer from high volatility and low liquidity levels.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

In our Learn 2 Trade 2023 Guide On Penny Stock Trading, we explain everything there is to know. This includes a full break down of what penny stocks are, how the marketplace works, and what you need to do to start trading today!

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What are Penny Stocks?

In a nutshell, penny stocks are defined by the Securities and Exchange Commission (SEC) as a listed company with a share price of $5 or less. In this sense, penny stocks operate much like any other company in the share trading arena. That is to say, the overarching concept is to purchase a penny stock with the hope it will increase in value in the future.

Nevertheless, penny stocks have a set of characteristics that separate them from traditional blue-chip firms. Crucially, penny stocks are typically very small companies that have a micro-market capitalization. As a result, the price of penny stocks can go up and down in lighting fashion – even more so than speculative asset classes like cryptocurrencies.

Pros and Cons of Penny Stocks Trading

- Huge upside potential – invest in a company before it becomes large-scale

- Opportunity to purchase a large number of equities without breaking the bank

- Ability to create a diversified portfolio of penny stocks to mitigate the risks

- Penny stocks are one of the most volatile asset classes in the investment space

- Spreads are significantly wide

- You might find it difficult to sell your penny stocks as liquidity levels are minute

- Penny stocks are usually listed on OTC markets – which makes it difficult to gain access

- Prices can go up and down by three-digit percentages in a single day of trading

How do Penny Stocks Work?

In theory, penny stocks are public companies, insofar that they have the capacity to raise money from investors of all shapes and sizes. However, this is where the similarities stop. For example, think about the recent multi-billion dollar listing of Uber.

The ride-sharing company went through an in-depth application process with the SEC, which involved large-scale financial institutions to assist with the capital raise. Then, the stocks were listed on the largest stock exchange in the world – the NYSE.

Crucially, penny stocks will all-but-certainly trade on an OTC marketplace, as opposed to a major exchange like the NYSE or NASDAQ.

Penny Stock Trading on OTC Markets

Once a penny stock company has completed its initial IPO, it will then hit the secondary market. In Layman’s terms, this means that stockholders can sell their shares on an exchange, which can then be purchased by other investors. As noted above, this will ordinarily be on an OTC market.

What is an OTC Market?

The over-the-counter, or simply OTC market, allows investors to trade financial instruments outside of traditional exchanges. The two main players in this field are the Pink Sheets – which is privately owned, and the OTC Bulletin Board.

Both arenas have one thing in common – there is no trading floor. Instead, deals are done on a broker-to-broker basis – subsequently resulting in an investment space that is somewhat opaque.

In other words, you won’t be able to sit at your computer screen and watch the value of penny stocks go up and down on a second-by-second basis. Instead, everything is typically done via the telephone.

A prime example of this is listed below:

- You read about an up-and-coming apparel company that was recently listed on the Pink Sheets

- You find a stock broker that has direct access to the Pink Sheets, and let them know that you wish to buy $1,000 worth of shares

- The last time the shares were traded, they were priced at $0.10 per stock

- The broker makes some calls and finds a fellow broker that is holding enough penny stocks to cover the trade

- The broker calls you back to give you a price of $0.15 per stock – a ‘mere’ 50% higher than the last trade

As you can see from the example above, penny stocks can move at a parabolic rate – not least because those holding the shares are often able to dictate what price they sell them for!

Characteristics of Penny Stocks

Penny stocks are completely different from blue-chip firms like Apple, IBM and Facebook for a number of reasons – which we outline in more detail below.

Type of Companies

First and foremost, penny stock companies are often brand new firms that need to raise capital. They are often unable to use traditional channels like high street banks or venture capital firms, which is why they turn to the OTC markets.

Straight away, this should present alarm bells, as a lack of financing options might be because of the financial health of the company – or one of its directors.

In terms of industries, penny stock companies can come from virtually any sector.

Liquidity

Liquidity refers to the amount of trading volume a financial instrument is accustomed to. At one end of the spectrum, large-scale companies like Facebook, Amazon, and British American Tobacco are responsible for billions of dollars worth of trading activity each and every day. This is even the case with cryptocurrency pairs like BTC/USD.

However, penny stock companies are often home to just tens of thousands worth of dollars in daily trading activity, which subsequently results in super-low levels of liquidity. This is crucial, as it means you might struggle to offload your shares once you have bought them.

A common occurrence in this respect is that newbie traders will get super excited to see that their penny stock investment has increased by double or triple figures, only to be left disappointed when they are unable to find a buyer. As a result, they are often forced to sell the penny stocks at a significantly lower price than the market dictates.

Volatility

Make no mistake about it, penny stocks are extremely volatile. In the traditional investment space, major companies listed on the NYSE or NASDAQ will often move up or down by a few percentage points per day.

On the contrary, penny stock trading platforms will often see double or triple-digit movements. This makes penny stock trading a highly risky investment vehicle.

Spreads

Irrespective of what asset class you are trading, there will always be a direct correlation between liquidity and spreads. For example, highly liquid assets like gold and the S&P 500 will benefit from water-tight spreads.

In the cryptocurrency space, while Bitcoin benefits from the most competitive spreads, ERC-20 coins are the complete opposite. As a result, with penny stock platforms suffering from such low levels of liquidity, this means that spreads are often astronomical.

So why does this matter?

Well, let’s suppose that you have your eye on a newly listed penny stock that has a buy price of $0.22. Once you make the purchase, you then find out that the same stock has a sell price of $0.16.

In percentage terms, this means that you have just placed an order at a spread of 27.27%! This means that you need to make at least 27.27% in gains on your penny stock investment just to break even!

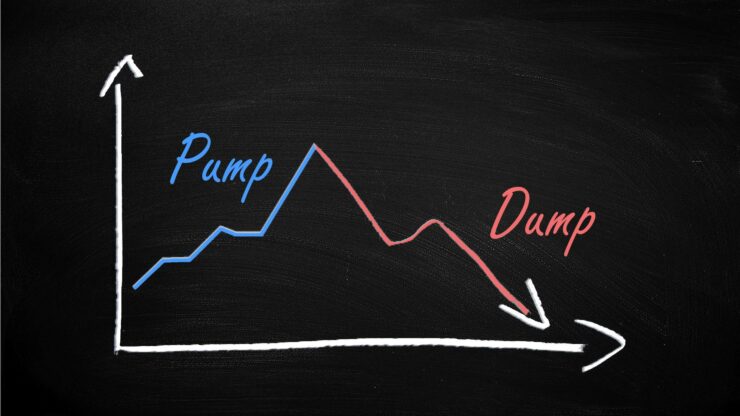

Pump and Dump

When you have an asset that is home to low trading volumes and liquidity, high volatility, and super-wide spreads – this is highly conducive for a ‘pump and dump’ scheme.

For example:

- Let’s say that a penny stock has a market capitalization of $550,000.

- A group of investors plan to artificially pump the penny stock

- They do this by investing lots of money into the stock at pre-defined intervals.

- In turn, the price of the penny stock will quickly shoot up – resulting in what is known as FOMO (Fear of Missing Out).

- Just as more and more unsuspecting investors decide to purchase shares in the penny stock, the original group of bad actors will offload their shares at huge profits.

- As they do, the price of the penny stock very quickly begins to decline – with victims losing the vast bulk of their investments.

Crucially, you need to be extremely careful when trading penny stocks. If it looks too good to be true, it probably is!

Limited Public Information

When a company like Ford Motors, Disney, Nike, and thousands of others are listed on a major stock exchange, there is a significant amount of information that is made available to the general public. In fact, it is illegal for companies to discuss key events with third-parties without first making the information public.

In doing so, each and every investor is on an equal playing field – as they are all privy to the same data. Anything short of this and the company is entering into ‘insider trading’ territory.

However – in the case of penny stocks, there is virtually no information available about companies listed on OTC exchanges. This is because there is no legal requirement for firms to regularly update investors. As a result, those with inside knowledge of the OTC markets are at a distinct advantage.

Success Stories

It’s not all doom and gloom in the penny stock trading arena. On the contrary, a number of companies have made the transition from a small-cap penny share to that of a large-scale corporation.

For example, hydrogen manufacturer Power Plug was priced at around $0.15 back in 2013. Fast forward to the following March and the company hit a peak price of $10.31.

Monster Beverage Company is an even bigger success story. Back in 1995, its shares were priced at just $0.63. Those that backed the firm in its early days have since been rewarded, as the Monster Beverage Company is now priced at over $72 on the NYSE. This represents an increase of over 11,600%.

Then you have the likes of BJ’s Restaurants, which has a number of chains throughout the US. While it was trading at just $0.88 in 1997, it has since hit highs of over $50 per share. The firm has since retraced back down to the $20-$25 region, but this is a success story nonetheless!

Penny Stock Trading Tips

Penny stock trading is not something that you should attempt unless you have a firm understanding of the risks. With that in mind, below you will find some handy tips to help you along the way.

1. Start With Small Stakes

If you are going to back small-scale companies, it is crucial that you start off with super-low stakes. Don’t get carried away just because the value of the stock is low. Instead, it is better to invest in small increments than inject a large one-off lump sum.

2. Research as Much as you can

As we covered earlier in our guide, penny stock companies are not legally required to release public statements. This means that there is going to be a severe lack of information available to you.

With this in mind, you are going to need to spend countless hours utilizing information that is available in the public domain. If you feel that you are unable to make an informed decision because of a lack of data, you should probably avoid investing in the firm.

3. Diversification is key

On top of investing in small stakes, you also need to diversify as much as you can. For example, let’s say that you are willing to invest $5,000 into penny stocks. Instead of investing in a single firm, you would be far better off backing 50 companies at $100 each.

In doing so, you won’t feel the impact of a penny stock dump anywhere near as much. To take things to the next level, you should also consider diversifying into multiple industries. For example, think about backing companies involved in oil and gas, apparel, food and beverage, finance, retail, and more!

4. Avoid Penny Stock Trading Experts

Although most investment sectors suffer from so-called ‘experts’, nothing quite matches that of the penny stock space. More specifically, the internet is jam-packed with expert traders that believe they have that ‘secret sauce’ to pick the next big penny stock.

This in itself operates like a pump and dump scheme, as the overarching objective is to create FOMO. That is to say, if the so-called expert can convince enough people that their penny stock tip is going to explode in the near future, this paves to way to manipulate the markets.

5. Perform due Diligence on Your Broker

It is also important to perform due diligence on your chosen penny stock broker. After all, brokers that have direct access to the OTC markets will be privy to information that the public isn’t. This puts them at a distinct advantage over you as an investor. As such, only go with a reputable broker that has a long-standing track record in the space.

Penny Stock Alternatives

If you are a newbie trader, it might be worth re-thinking your plan to engage with penny stock trading. Whether it’s high volatility levels, wide spreads, or a lack of liquidity – the penny stock scene is not conducive for inexperienced investors. Even if you do want to take the plunge, you are going to find it extremely difficult to gain access to the Pink Sheets and OTC Bulletin Board as a retail trader.

Furthermore, if you decide to trade stocks listed on the London Stock Exchange, you will find that many of these firms have share prices of less than $5. This is because the UK stock markets price its shares up in pence, as opposed to pounds!

Below we list some of the advantages of opting for stock CFDs instead of attempting to buy penny shares on the OTC markets.

Regulation

Stock CFD brokers must be in possession of a trading license. We at Learn 2 Trade go one step further by only recommending brokers that are licensed by tier-one bodies.

This includes the likes of the FCA (UK), ASIC (Australia), CySEC (Cyprus), and MAS (Singapore). Among heaps of other regulatory protections, tier-one licensing bodies demand that stock CFD brokers keep client funds in segregated bank accounts.

Major and Minor Exchanges

When you use a stock CFD broker, you will have access to major (US, UK, Japan) and minor (Australia, Canada, Germany, etc.) exchanges at the click of a button. That is to say, you will be able to buy or sell your chosen company on your desktop or mobile device.

This is in stark contrast to penny stock trading brokers, which require you to place orders over the phone. Moreover, nothing is instant in the penny stock space, as the broker will need to act on your requirements by negotiating with other brokers!

Tight Spreads and Low Fees

You might remember us talking about the size of the spread when buying and selling penny stocks on the OTC markets. Ultimately, this is a direct trading fee that is going to make it extremely difficult to make gains in the long run.

In the case of conventional stock CFDs, you can often trade blue-chip companies at spreads of less than 1 pip. Moreover, most of the stock trading sites that we recommend on this page allow you to trade on a commission-free basis – so it’s only the spread that you pay!

Easy Payments

When you trade penny stocks at a CFD broker, you will benefit from a seamless deposit and withdrawal process. Most platforms allow you to fund your account with an everyday debit/credit card or bank account, and some even support e-wallets. This makes it super-easy to get money into and out of your trading account.

Best Penny Stock Trading Platforms 2023

So now that you know the ins and outs of how penny stock trading works, we are now going to discuss some of our top brokers picks of 2023. Take note, the brokers listed below meet the SEC’s definition of penny stocks – meaning that they list companies with a share price of less than $5.

Crucially, all of our recommendations are regulated, supports lots of payment methods, and offer top-notch customer service.

1. AVATrade - Established Broker With Tight Spreads

AVATrade is an established broker that offers super-tight spreads. You will have access to thousands of CFDs - including that of stocks of shares. The platform supports MT4, subsequently allowing you to deploy your automated trading robots.

AVATrade has a low minimum deposit amount of just $100, which you can facilitate with a debit/credit card or bank wire. AVATrade is also heavily regulated, with licenses held in several jurisdictions.

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Conclusion

In summary, penny stock trading is an industry fraught with scams. You need to ask yourself whether it is worth trying to invest in a financial sector that is home to minute levels of liquidity, extortionate spreads, and an all-round Wild West mentality. In fact, even if you do decide to take the plunge, you will find it virtually impossible to gain access to the OTC marketplace. Instead, you will need to go through a third-party broker.

As such, we think that it is well worth considering traditional CFD stock trading. This will give you access to thousands of companies at the click of a button in a heavily regulated ecosystem. Crucially, you won’t be trading assets that can lose 90% in value over a single day – so you stand a much better chance of making a success of your online investment endeavours!

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card