With so many brokers operating in the online space, it can be hard to know where to begin without getting your fingers burned. This is where regulation comes in.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

The Commodities & Futures Trading Commission (CFTC) is an authority responsible for regulating the financial environment and governing brokerages. This particular regulatory body is a federal agency based in the US.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Irrespective of whether you’ve already begun your trading journey, or are still searching for a decent broker – you’ve probably seen platforms with licences from the likes of the CFTC, FCA and ASIC to name a few. These bodies were created to protect you from fraudulent companies as well as giving you a safety net on your funds.

Throughout this page, we are going to tell you everything you should be aware of when looking for a CFTC broker. We’ll conclude by discussing the best CFTC brokers of 2023.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What is the CFTC?

In a nutshell, the CFTC is an independent organisation which was created in 1974. This was the first time that regulations and rules were put in place to hold brokers accountable for their actions and customer care.

There have been a few changes since the body’s inception. For example, the Commodity Futures Modernization Act of 2000 was installed to connect the CFTC and SEC (Securities and Exchange Commission) with the view of governing the stock futures scene. The Dodd-Frank Act of 2010 led to the CFTC’s power being extended to the swap markets. It also meant a new set of guidelines to follow for CFTC brokers.

What Demands do CFTC Have on Brokers?

The demands imposed by the CFTC on brokers are extensive. Each and every financial company (such as brokers) must apply for a licence from the regulatory commission. The broker firm has to pass rigorous compliance tests, display an understanding of customer care, and jump through hoops before they are able to offer financial products to the public.

There are a handful of other essential conditions to be met before the company can operate legally in the financial space. We’ve put a list together outlining the key demands on brokers from the CFTC.

AML/CTF and CDD

When it comes to keeping the financial space a safe and transparent place for all – the division of AML (Anti Money Laundering) and CTF (Combatting the Financing of Terrorism) play a big role. CDD (Customer Due Diligence) is also a minimum requirement.

- Identify all customers.

- Confirm the client’s identity.

- Have a grasp of each client’s financial earnings.

- Oversee the client’s investment activities.

This is the reason you need to provide a photo ID and proof of address whenever signing up to a regulated platform. The CFTC broker must abide by the rules set out and ask you for your full name, residential address, and photo ID (like your passport or driving license).

Furthermore, you will also be asked for an official letter or utility bill from within the last 3 months, monthly or annual incomings, employment status, and some trading experience history.

The aforementioned practice is a blend of the KYC and CDD processes. KYC ensures that you are who you say you are and are not a financial risk when it comes to money laundering or identity theft. CDD ensures that the broker has all of the data necessary to provide the best customer care for your needs.

Enhanced Due Diligence

Enhanced Due Diligence measures are usually introduced when the client is considered high risk. As an example, the customer is politically exposed or from a high-risk country. In this instance, the CFTC broker has to perform a much more detailed and intense investigation into the client in question.

A full and detailed due diligence report needs to be included in the company’s structure, and CFTC carries out regular checks on brokerage platforms to ensure this is being adhered to. Let’s imagine that you go from investing an average of £2,000 per calendar month, and suddenly begin to deposit £15,000 a month. Your CFTC broker will have to report this and organise a thorough investigation to establish where the money came from.

Annual Audit Submission

Make no mistake about it – the CFTC rule with an iron fist. This commission is one of the most strict globally in some respects. Like FCA and ASIC regulated platforms, all CFTC brokers are legally obligated to provide an annual audit each year.

The annual audit must contain a wide variety of detailed information on things like:

- Financial asset trading volume.

- Margin trading numbers.

- Revenue of sub-class assets.

- Thorough fee breakdowns.

- Detailed clarification on the leverage used.

- A clear distinction between orders carried out by the brokerage, and by the client.

If these audits are missing information, or the broker is found to be disobeying the rules in any way at all, the CFTC has the legal power to fine the brokerage company in question. In severe cases, the CFTC can revoke the broker’s trading license.

Bank Account Segregation

Bank account segregation has been around in the securities space for over 40 years and was incorporated into SEA Rule 15c3-3 (Securities Exchange Act). Segregation is yet another legal requirement for all CFTC brokers.

Fundamentally, all regulated brokers are required to hold your account funds in a separate account to that of the company’s capital. The reasons for this are clear – by segregating your assets from its own, the CFTC broker is protecting your money from the unfortunate event of financial crime or company collapse.

Leverage Caps

There are leverage limits in place when it comes to CFTC brokers dealing in forex, and they are as follows:

- Major currency pairs: Leverage is capped at 1:50.

- Minor currency pairs: (also called cross-currency pairs) Leverage is capped at 1:20.

- Exotic currency pairs: Leverage is capped to 1:20.

The only way around these leverage caps is if you are deemed to be a professional client. If this is the case, you’ll need to submit various documents to your chosen CFTC broker.

How CFTC Protects Traders

The CFTC protects traders by maintaining the integrity of the financial markets. This means zero-tolerance for harmful trading practices, financial crime, or client manipulation.

As we’ve mentioned, the CFTC has created several regulations and criteria for broker platforms to abide by, and the commission ensures that these rules are being followed by performing regular checks.

In addition to this, each and every CFTC broker is obliged to show its CFTC licence details on its website. This not only creates confidence in the financial sector but also gives you peace of mind that the firm is operating within the law.

What Assets can be Traded at a CFTC Broker?

No two CFTC brokers are the same, so if you have a particular asset in mind you would like to trade – then always consider what is available at the platform. Whilst one brokerage might only deal in forex, another might offer just about every single asset known.

Stocks and Shares Dealing

It might be the case that you have never traded before, but chances are you are familiar with stocks and shares. What used to be done on huge busy stock trading floors is now often facilitated on the internet.

If you are wanting to get involved in share dealing then you will be able to buy and sell stocks in a variety of companies. Just as an example, this gives you access to companies like Apple, Ford Motor Co, Amazon, and Procter & Gamble.

When it comes to the ‘spread’ on this asset type – this is illustrated as the ask/bid. In other words, the contrast between what the seller will sell for, and what the buyer will pay for it. This asset class enables you to invest funds into US exchanges like the NYSE and NASDAQ, as well as international markets like the LSE (London Stock Exchange).

When it comes to shares dealing brokers, there are usually three contrasting types. First of all, there is an ‘execution broker’ who will execute any orders you instruct them to.

If you want to trade this asset class but want a more passive experience, then a ‘discretionary CFTC broker’ might be best, as they buy and sell so that you don’t have to. Discretionary brokers do more work, so always check any extra fees which might be payable with this type of provider.

Should you prefer somewhere in the middle in terms of how much involvement you have in the placing of orders, then you can look for an ‘advisory broker’. This type of broker is somewhat halfway between hands-off and hands-on.

A CFTC advisory broker will give you recommendations and guidance on which market moves might be profitable to you. Whether you want to take the broker’s advice or not is entirely your choice, you simply have to instruct the firm on your next move.

Indices

In a nutshell, the purpose of indices is to indicate the price movement of a variety of different stocks – often from the same exchange. For example, the FTSE 100 tracks the 100 largest stocks on the LSE, and the Hang Seng Index tracks 50 large firms listed in Hong Kong.

Then you have the S&P 500, which is made up of 500 sizeable companies from the NASDAQ and NYSE. The Dow Jones is also a popular index with US traders. This tracks 30 large-scale American companies – all of which pay dividends.

Forex

As you may know, you will need to sign up to a broker before you can start trading forex. After all, the broker will facilitate trades for you on your chosen currency pair. Again, when choosing a said broker, make sure the platform holds a licence to ensure you are trading in a safe environment.

- Major currency pairs include USD/CAD, GBP/USD, EUR/USD, USD/JPY, NZD/USD, AUD/USD, USD/CHF, and NZD/USD.

- Minor currency pairs include EUR/GBP, CHF/JPY, GBP/JPY, GBP/CAD, EUR/AUD, and NZD/JPY.

- Exotic currency pairs include USD/HKD, AUD/MXN, NZD/SGD, EUR/TRY, GBP/ZAR and JPY/NOK.

Your CFTC broker is going to enable you to trade on this global market 24/7. Depending on how involved you like to be in the FX trading process, it might be advisable to select a CFTC broker that also offers a variety of technical tools, current financial news updates and price charts.

Commodities

This particular asset can be traded 24 hours a day and 7 days a week. Some traders refer to this asset as ‘soft commodities’ and ‘hard commodities’. However, commodities can also be split into 5 classification types – energy, precious metals, forest products, agriculture’, and ‘other’.

Please find below a list of energy commodities:

- WTI Crude Oil, Heating Oil, Brent Crude.

- Purified Terephthalic Acid (PTA).

- Ethanol, Propane, Natural gas, Gulf Coast Gasoline, RBOB. Gasoline (reformulated gasoline for oxygen blends).

- LME Copper, LME Nickel.

- Lead, Zinc, Tin, Aluminium, Aluminium alloy.

- Cobalt, Molybdenum, Recycled steel.

- Precious Metals: Gold, Platinum, Palladium, Silver.

Forest Products:

- Random Length Lumber and Hardwood Pulp, Softwood Pulp.

Last but not least – agriculture:

- Cotton, Corn, Wheat, Oats, Rapeseed, Rough Rice.

- Soybeans, Soybean Meal, Soy Meal, Soybean Oil.

- Milk, Cocoa, Coffee, Adzuki bean, Robusta coffee.

- Sugar, Frozen Concentrated Orange Juice.

- Lean Hogs, Live Cattle, Feeder Cattle.

- Other – Palm Oil, Rubber, Amber, and Wool.

If you are interested in trading commodities at a CFTC broker, hopefully, our list above has given you some inspiration about what you might want to start with.

Cryptocurrencies

Please find below a list of some of the most traded cryptocurrencies in the digital currency market:

- Litecoin (LTC).

- Binance Coin (BNB).

- Bitcoin (BTC).

- Bitcoin SV (BSV).

- Ripple (XRP).

- Ethereum (ETH).

- Bitcoin Cash (BCH).

- Tether (USDT).

- EOS (EOS).

- Monero – Guide, Tips & Insights | Learn 2 Trade (XMR).

How to Find a Great CFTC Broker

Trading is full of surprises, good and bad – so choosing a broker which is held to high standards by an official agency is crucial. In doing so, you know where you are and what to expect in terms of service.

We’ve put together a list of things you should look out for when you’re on the hunt for the best CFTC brokers.

Multiple Assets

It has to be said that some people like to keep their portfolio down to just a few asset classes. This is especially the case with inexperienced investors, as it makes sense to learn the ins and outs of a few assets – rather than trying to be a Jack of all financial trades.

That being said, there might come a time when you tire of trading those financial instruments and want to try something different. It is for this very reason that we recommend looking for a CFTC broker with a selection of different asset classes. This will enable you to diversify your portfolio, should you ever need to.

Low Spreads

The spread offered by a CFTC broker can make a huge difference to your trading gains as a whole. The spread is depicted using ‘pips’, which is the difference between the buy and sell price of the asset you’re trading.

To give you an example, if you are trading the forex pair EUR/USD with a spread of 4 pips, to break even, you will need to increase your investment by over 4 pips.

Commission Structure

Much like spreads, commission fees can affect your trading profits. All CFTC brokers are different, so you will need to conduct some research of your own. We’ve found that some CFTC brokers don’t take any commission at all. Conversely, others take a percentage for every trade you execute.

To give you an example of how broker firm commission fees work, check out the below:

- You are trading GBP/USD.

- Your CFTC broker has a commission fee of 0.8%.

- You invest £3,000.

- The CFTC broker is going to take £24 commission (£3,000 x0.8%).

The good news for you is that most of the CFTC brokers we discuss on this page allow you to trade without needing to pay any commissions.

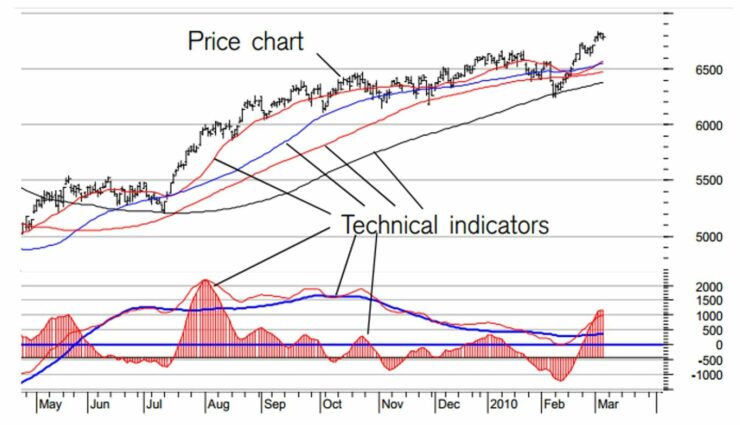

Technical Analysis Tools

The vast majority of reputable brokers provide technical analysis tools. Unless you’re an entirely passive trader using automated trading, technical tools are absolutely crucial when it comes to predicting the general feel of the market.

- The Average Directional Index (ADX).

- Exponential Moving Average (EMA).

- The On Balance Volume Indicator (OBV).

- Fibonacci Retracement.

- The Stochastic Oscillator.

- Aroon.

- The Relative Strength Index (RSI).

- The Accumulation/Distribution Line (A/D line).

- Moving Average Convergence Divergence (MACD).

- Standard Deviation.

Educational Tools

Especially when it comes to newbie traders, educational tools can be vital for learning and understanding things like live market data and historical charts. In the same way, signalling tools and backtesting can assist you in predicting the direction of the market.

After all, you will often find that price trends tend to repeat themselves at some point. As we touched on, another great way to educate yourself is to try out a demo account facility as they enable you to trade in real market conditions, risk-free. Either that or try out a semi-automated trading system so that the success of the trade is not entirely on your inexperienced shoulders.

Customer Support Options

There is never a time when customer support isn’t important. In an ideal world, the CFTC broker’s customer support team will be available to assist you 24 hours a day and 7 days a week.

The reality is that some only offer support 5 days a week. As such, if you are trading on a 24/7 market like forex – this might not be good enough for you. In other words, if you need help over the weekend you would be left high and dry, and Monday morning would likely to be too late.

For this reason, always check the specific brokerage to see what customer service options are available to clients (and when). Some offer live chat as well as email and telephone.

Payment Options

You may have gathered by now that each CFTC broker will differ slightly when it comes to options, fees and protocol. If there is a specific payment method you must use for your broker account – always make sure it is available through the platform before opening an account.

We find that most brokers offer the usual suspects when it comes to payment methods. This usually includes a wire bank transfer and credit/debit cards.

Then there are e-wallets such as PayPal, Skrill and Neteller which are rising in popularity for the sheer convenience. Some broker companies might even allow you to deposit using cryptocurrencies such as Bitcoin.

Deposit and Withdrawal Procedure

So, you’ve found a good CFTC broker who accepts your desired payment method – now you need to check out its funding policy. Some broker firms charge fees to clients to deposit or withdraw. You can usually find this information on the platform’s website.

In terms of funding timeframes, each site will differ slightly, but most will process your debit/credit card or e-wallet deposit immediately. This means you can start trading straight away. That is unless you decide to deposit with a bank transfer, which offers the slowest processing time.

In the matter of withdrawals, this should be carried out by the brokerage within a couple of days.

CFTC Account Options

Account options vary, but some of the most commonly seen are listed below with a brief explanation of each type.

Nano, Micro and Mini Accounts

Most traders have heard of a standard brokerage account – but nano, micro and mini accounts are also picking up steam. These miniature accounts are great for newbie investors who don’t want to risk a lot of capital. Similarly, they are suited to experienced traders who want to try out a new strategy with less money.

If you can’t see this type of account advertised, it is worthwhile asking the CFTC broker’s customer support team. They might be willing to adopt a standard account to suit you.

Islamic Account

This isn’t for everyone, but if you are a follower of the Islamic faith, and still want to trade – then keep an eye out for Islamic accounts. According to Sharia Law – accepting and paying interest is completely forbidden and therefore ‘haram’ (like gambling).

If you are a follower of the Islamic faith and can’t see this type of account advertised, there is no harm in asking whether the CFTC broker is able to accommodate your needs. In some cases, they will offer you a ‘swap-free account’, which alleviates interest on positions held overnight.

Demo Accounts

We talk about demo accounts quite a lot because they are very valuable for traders at all levels of experience. Not all brokers offer demo accounts to clients, but it’s usually easy to find out if there is one available by visiting the platform and having a look around.

Crucially, demo accounts allow you to get a feel for trading without risking any money. Once again, they are also conducive for testing out new stratifies in a risk-free environment.

Get Started With a CFTC Broker Today

Hopefully, by now you have a clear understanding of the important metrics to look out for when choosing a CFTC broker. Furthermore, you know the importance of conducting some research before committing to any brokerage platform.

Before we get to our list of the best CFTC brokers of 2023, below you will find a snap overview of how the sign-up process typically works.

Step One: Open a CFTC Trading Account

In order to begin trading, you are going to need to sign up with the respective CFTC broker. Start by hitting the firm’s website. The sign-up/create account button is usually one of the first things you will see.

You will then need to provide some personal information. This is the first stage of the KYC process, insofar that you need to let the broker know who you are and where you live. You’ll also need to provide your date of birth, social security number, and contact details.

Step Two: Provide Proof of Identity

There is a need for all regulated CFTC brokers to identify each and every client. With that in mind, you will need to take upload a copy of your driving licence or passport.

It will also be necessary for you to provide a copy of a recent utility bill (or something similar with your full name and residential address on it), as well as answering a few questions about your financial situation.

Step Three: Deposit Your Account

We’ve talked about deposit options earlier, so choose the best option for you and go ahead and fund your account.

The process is usually simple, as all you need to do is choose the payment option from a drop-down menu (credit/debit card, etc.), and decide how much you would like to deposit. Keep an eye out for transaction fees and account minimums.

Step Four: Start Trading/Try a Demo Account

If you want to, you can start trading immediately as soon as your account is funded. If you’re not quite ready to take the plunge then you can use a demo account. This is, of course, on the proviso that your chosen CFTC broker offers such a facility.

Best CFTC Brokers of 2023 – Our Top Picks

If you’re ready to start trading with a regulated platform right not, below you find our list of the best CFTC brokers of 2023. Each broker offers competitive fees, heaps of tradable assets, and of course – that all-important CFTC license.

1. IG- Established Trading Platform with MetaTrader4

First launched in the mid-1970s, this CFTC broker offers a huge array of assets including cryptocurrencies, commodities, stocks, indices, and forex currency pairs - covering 17,000 markets. Speaking of forex pairs, there are heaps to choose from on this platform so you won't be short of options.

If you’re the type of trader who is often on the move, you will find the IG app very useful. The CFTC broker has developed the app to work on both Android devices and iOS (for those of you with an iPhone). Using the mobile app enables you to buy and sell at the touch of a screen, not to mention the ability to deposit and withdraw with ease wherever you are. IG is compatible with MetaTrader4. This hugely popular third-party platform allows you to install automated forex trading systems and comes packed with advanced research tools.

The minimum deposit to get started with IG is £250 (about $320) and you can pay via bank account transfer, or for a faster process - a debit/credit card. This brokerage firm is fully regulated and holds licences from CFTC, FCA, ASIC and more.

- Useful educational tools

- Dozens of forex pairs

- Well respected CFTC broker

- Customer Support is said to be a bit slow

2. Forex.com - Trade with MT4

This CFTC broker offers over 90 forex pairs as well as other assets such as cryptocurrencies and metals. Forex.com doesn’t charge anything at all in terms of commission and opening an account is super easy.

We find Forex.com to have some of the best spreads in the space. The minimum amount you need to deposit in order to open an account is $50, and you can start trading with as little as $1 per order.

If you happen to be a retail investor, then you will have access to leverage of up to 1:50 leverage - not to mention a plethora of risk management tools, trading features like trailing stop loss, and technical indicators.

For those of you who might be a little less experienced in the markets, Forex.com offers all clients a demo account to improve their skills. You are able to trade either on MT4 or the Forex.com trading platform itself. This broker, like the others on our list, is fully regulated and licenced by CFTC.

- Demo account available to clients

- Can be used on MetaTrader4

- Minimum deposit $50

- Inactivity fee $15 (after 12 months)

- No negative balance protection offered

3. Oanda - Highly competitive spreads

This CFTC broker stands out because of its excellent trading analysis, highly competitive spreads and educational trading tools. If you are a high volume investor then you are in luck - as this firm offers lower fees for people who trade an above average amount.

Opening an account is fairly simple on this broker's platform - which you can do online or via your mobile phone. Oanda is packed with trading features for investors to make the most of, and we really like that you can adapt an existing chart to suit your trading style.

Oanda offers traders competitive spreads - especially when accessing major pairs like EUR/GBP. When it comes to leverage, forex traders are capped at 1:50 - as per CFTC limits. If you want a premium account with this regulated broker, you’ll have to fork out $20,000 minimum.

- Advanced technical indicators

- Easy to open account

- 70 supported currencies

- Number of FX trading pairs is quite limited

- $20,000 minimum for premium account

4. Interactive Brokers - Great variety of products and markets

This platform is one of the most well-known brokerage firms in the US. It is fully regulated and holds licences from the CFTC and SEBI (Securities and Exchange Board of India) - plus many others.

Opening an account on this platform is quite simple and gives you access to over 90 markets globally. This includes bonds, ETFs, stocks and forex. If you want to sign up to Interactive Brokers the minimum deposit is $500. The site is fully compatible with APIs, NinjaTrader and various automated EAs

- Vast selection of products

- Access to over 90 markets

- Copy trader function

- $500 minimum deposit may be too much for beginners

- Margin requirements are on the high side

5.TD Ameritrade - Good for long term investors

If you are the type of trader who likes to invest in the long term, then TD Ameritrade could be just what you are looking for. This CFTC broker is based in the US and is definitely one of the most well-known platforms domestically. TD Ameritrade has been around for nearly 50 years, so after half a century of brokerage experience, it’s no wonder its reputation precedes it.

When signing up to this broker firm you have access to a variety of different securities, most of which you can instantly buy at the click of a button. Not only that, but customers are provided right of entry into the most well-known stock exchanges in the world. This includes the NASDAQ, NYSE and LSE.

Assets on offer from this CFTC broker include forex (an entire forex division), options, stocks, futures, and mutual funds. In addition to this, you can invest in IPOs via the company. When it comes to broker fees, you can trade without paying any commissions when accessing mutual funds or ETFs.

There is a catch with this offering of commission-free trading - you need to keep your investment for a minimum of 30 days. Failing to do this will mean having to pay an additional fee of $13.90 for each trade. For this reason, it’s more beneficial if you are a long term investor. TD Ameritrade is heavily regulated under CFTC so you know you are dealing with a safe company.

- Most asset classes available

- Easy to open account

- Zero trading fees if you hold mutual fund/ETF for more than a month

- Not as good for short-term trades

Final Thoughts

With so many wolves in sheep’s clothing in the financial services industry, it is absolutely crucial that you select a CFTC broker – or at least one holding a valid licence from another jurisdiction.

This will be your safety net in an already uncertain space. These companies don’t receive their official licence easily, as there are strict rules to adhere to like keeping your funds segregated. All in all, if you want to trade in a safe and secure trading ecosystem, we would suggest using one of the CFTC brokers listed on this page.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card