Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Best traders on eToro, the scene of hundreds of boisterous traders all yelling and jeering at a big screen on a trading pit are seldom seen these days, with more and more people trading online.

Our Crypto Signals

1-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

12-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime Subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratio

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

If you’re a new investor just finding your feet, you are now able to mimic the trades of more successful, well-seasoned traders quite easily. This trading knowledge is attainable by using a fairly new phenomenon called copy trading.

Copying a trader means that you don’t have to do any homework yourself. Of course, that’s not to say it doesn’t come with any risks – that’s the nature of trading. Nevertheless, the copy trading scene is largely dominated by eToro – a platform that is now home to over 12 million traders.

To help you point you in the right direction, we’ve put together a guide on the 5 best traders on eToro. This also covers what you need to know about copy trading to get you started and crucially – what you need to do in choosing a seasoned trader that meets your long-term investing goals.

Learn 2 Trade Free Signals Service

- Get 3 Free Signals per Week

- No Payment or Card Details Needed

- Test the Effectiveness of our High-Level Signals

- Major, Minor, and Exotic Pairs Covered

Top 5 Best Traders on eToro 2023

With such a wide variety of copy traders to choose from, it can be hard to decide which eToro investors you want to copy and gain more insight from. It might seem like the obvious thing to do is choose a trader that already has a considerable amount of copiers under their belt. But, when taking into account what you are interested in as a trader, some of the best investors on eToro might shine in other ways.

With this in mind, we have put together 5 of the best traders on eToro 2023 together, with a little information on each.

1. Jay Edward Smith

There are thousands of successful copy traders on eToro, but Jay Edward Smith is currently one of the most copied on the platform. With 12,381 copiers and a return of 24.61% in the last 12 months – the investor is highly sought-after by eToro users.

A little background information on this full-time eToro investor – Jay Edward Smith is 31 years old and based in Basingstoke, England. He is a former professional gamer, esports manager, and logistics coordinator with interests in the financial markets, crypto, logistics, economics and technology – to name a few.

This trader has a minimum copy suggestion of $500, but $2,000+ is recommended. It is also recommended to copy trade him for 2 years or more to get the best out of his portfolio.

With over $5 million of copy assets under management, Jay is 35.20% in the green in 2020 (up to July) and in 2019 – he made unprecedented returns of 52.32%.

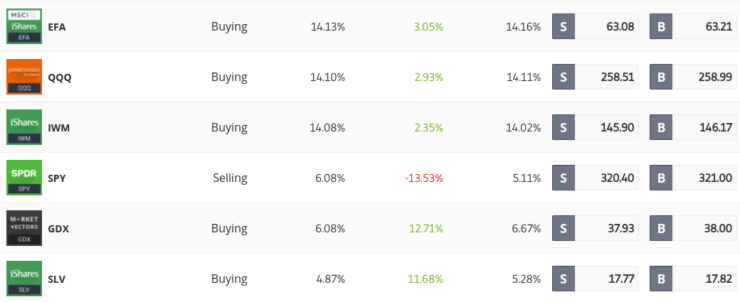

Let’s have a quick look at what currently makes up Jay Edward Smith’s trading portfolio:

With a risk rating of 5 – this trader’s investment strategy includes:

- Using minimum leverage (x2 at the most).

- Using fundamental, technical and sentimental analysis.

- Main trades are stocks and cryptocurrency.

Risk Score: 5

Gain 27.75%

*If you had invested $1,000 a year ago, you would have a profit of $281.00

2. Olivier Jean Andre Danvel

This trader has an impressive 9,807 copiers and has a return of 6.38% in the last 12 months. With over $5 million assets under management on eToro, Olivier has a low-risk trading strategy with strict money management rules and a target of 1% per month.

Olivier has been a professional fund manager for over two decades and is certainly one of the most popular investors when it comes to forex trading, in particular. He studies technical analysis as well as financial articles, and investment news.

In 2019, this trader made returns of 8.40%. In the first six months of 2020, he is in the green 2.27%. Olivier Jean Andre Danvel’s portfolio is made up of:

- 84.48% currencies.

- 10.84% commodities.

- 4.15% Indices.

- 0.54% crypto.

With a minimum copy recommendation of $500 and risk level 2, Olivier is a great option if you are particularly interested in forex trading.

Risk Score: 1

Gain: 6.37%

*If you had invested $1,000 a year ago you would have a profit of $65.00

3. Jeppe Kirk Bonde

Jeppe is another one of the most copied traders on eToro with 8,360 copiers on the platform. In the last 12 months, he has seen returns of 23.19%. In 2019, Jeppe had an impressive return percentage of 45.55% and was mostly in the green month-on-month.

As of mid-2020, he is in the green by 8.33%. His background consists of a management consultant role, advising some of the worlds largest and best-known banks. He holds a master’s degree in finance & strategic management.

Jeppe is a risk level 5 and his strategy includes:

- Executing fundamental valuations.

- Studying trends in markets from around the world.

- Uses hedging and diversification to manage portfolio risk.

- Usually avoids leverage where possible.

This copy trader generally avoids instruments with high fees, short positions and tries to keep trade frequency to a minimum.

Here is a quick look at how Jeppe’s trading portfolio is made up:

- 88.97% stocks.

- 6.76% ETFs.

- 2.60% crypto.

- 1.56% commodities.

It is advisable to copy open trades at a stake of at least $300 minimum to ensure you are able to mirror his orders like-for-like.

Risk Score: 5

Gain: 22.86%

*If you had invested $1,000 a year ago you would have a profit of $232.00

4. Heloise Greeff

This copy trader has 1,498 copiers and has returned 26.39% in the last 12 months. By the end of 2019, Heloise Greeff returned profits of 20.19%. In the first six months of 2021, this investor made gains of 17.74%.

Heloise holds an MBA degree from Oxford University and specialises in trading stocks. But, he also dabbles in ‘exchange-traded funds’ (ETFs) and indices.

The trading portfolio of Heloise Greeff is currently as follows:

- 98.29% Stocks.

- 0.55% ETFs.

- 0.55% Indices.

- 0.36% Commodities.

- 0.18% Crypto.

Some of Heloise’s trading niches are as follows:

- Pharma and tech.

- US Indices.

- Machine learning and technical analysis.

- Spreading risk, achieving good returns.

The minimum suggested copy amount is $1,000. Some of her biggest investments are Aalesforce.com (5.40%), Mastercard (5.36%), Microsoft (4.50%) and Visa (3.80%)..

Risk score: 5

Gain: 28.63%

*If you had invested $1,000 a year ago you would have a profit of $290.00

5. Teoh Khai Liang

Another popular copy trader on our list is Teoh Khai Liang – with 7,740 copiers. In the last 12 months, Teoh has seen a return of 55.92%. The trader has over $5 million worth of assets under his belt In 2019 alone, he made returns of 46.65%. So far this year, his returns are sitting at 37.66% – which is huge.

Teoh trades mostly in stocks, so if you do want to copy him you must be prepared to deal mainly blue-chip share. Crucially, he is focused on holding positions long term.

Portfolio:

- 97.30% Stocks.

- 2.70% ETFs.

This copy trader’s strategy includes:

- Long term investments..

- Holding stocks, unless fundamental changes occur.

- Holding stocks when the market goes up.

- Buying stock if the market goes down.

Risk score: 5

Gain: 59.11%

*If you had invested $1,000 a year ago you would have a profit of $599.00

What is Copy Trading?

These days, every tom, dick, and harry has access to the financial markets – with trading from home now available on a global scale. The fact that everyone – including retail investors, now have access to the so-called ‘playground of the rich’ is great.

But, if you are still a nervous trader, or have never even stepped foot in the world of investments – then copy trading could be the best thing you ever did! Furthermore, and perhaps most importantly – it can be a great way of learning to trade.

Social media accounts ran by experienced traders have been around for a while in the form of investor profiles. The idea being, you can follow a trader with similar trading ideas to yourself, and get tips along the way because some investors share stats and charts.

The big difference with copy trading is that it is essentially about making money, rather than just being sociable.

The copy trader you decide on is going to use their skills to trade on your behalf (and anyone else copying them). All you have to do is decide how much to ‘copy’. This means how much money are you willing to put forward for the investor to trade with.

As we briefly covered earlier, copy trading enables you to copy other investor’s trading decisions, for better or for worse. As such, when you choose to copy a trader – and they decide to buy, it means you buy too. When the copy trader decides to sell, you sell too. You don’t have to do a thing and ultimately – you get to trade in a passive manner.

Copy Trading Mechanics

Put simply, the mechanics of copy trading boils down to allocating a portion of your trading portfolio with the portfolio of the experienced trader – of your choice.

Once you have decided which traders you would like to copy and how much you would like to invest, any open trades they have will be copied over to your trading account, like for like. The copy trader will make all of the decisions for you. As they will also be using their own capital, you can be sure that the trader avoids making reckless decisions.

With that being said, there are thousands of copy traders to choose from at eToro, so you really need to do some homework before taking the plunge.

As such, in this section of our guide on the 5 best Traders on eToro, we have compiled a list of steps needed to get started today.

Step 1: Finding a Good Copy Trader

First of all, you need to decide which experienced investor you want to copy and learn from. Remember that any losses or gains coming your way will be entirely determined by the results of their trading endeavours.

eToro has over 12 million investors on its platform, so it’s a very popular choice for people looking to copy trade. Let’s be clear though, not all of these investors will have the skills or experience to warrant you copying their trades.

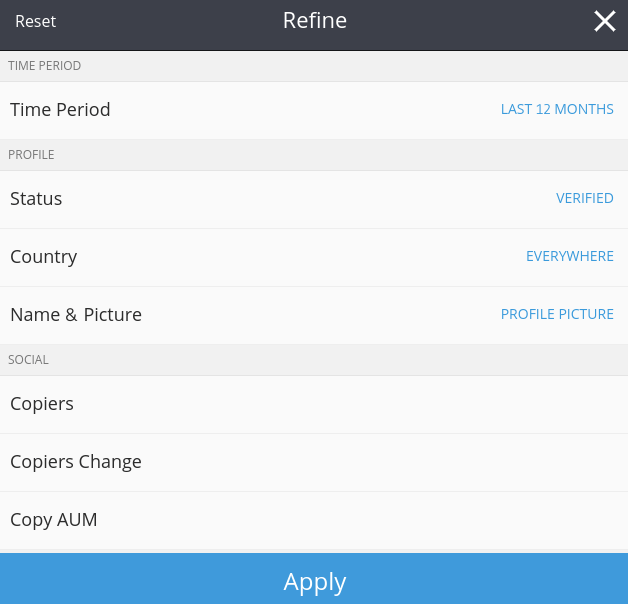

During your selection process, proceed with caution and properly utilise the filter facilities. This will save you a lot of time, as there are literally millions of traders in this space. You will see a good amount of options when you’re searching for the best traders on eToro and they are as follows:

- Time period – This can be anything from the current month to the last 2 years.

- Status – The choice between verified and popular investors.

- Country – Where the investor is located (we don’t think this really matters so we advise just leaving it as ‘everywhere’).

- Name and Picture – This is just whether you see a profile picture or the investors name. Again, somewhat irrelevant.

- Copiers – Find investors based on social trading activity status.

- Performance – Find investors based on return and profitable months.

- Risk – Focus on risk score, daily drawdown, weekly drawdown.

- Portfolio – Discover investors based on assets in their portfolio and average trade size.

- Activity – This filter allows you to find people based on volume levels and trading activity.

If you decide to use one or many filters, you need to hit the ‘apply’ button after making your selections. Now you can hit ‘go’ and you will be shown an expansive list of possible copy traders. You are then able to delve into the copy trader’s profile for more detailed information.

As you can see from the list of filters – which are available when searching for the best traders on eToro, there are lots of different options to explore.

This includes:

Performance Record

In your search for the best traders on eToro, a lot of investors consider this metric to be the most important indicator to study. Largely, this is because it illustrates the entire breakdown of the trader’s performance since joining the platform.

When it comes to the performance record we recommend that you pay full attention to the timeframe illustrated.

For instance, a trader might be 46% in the green, which looks good. But, upon closer inspection, you might realise it’s only based on a few months of trading. All of a sudden this could be a lot less attractive. In other words, it is a strong sign that they like to take big risks in trading.

We would advise favouring copy traders who have at least 12 months experience on the platform. In doing so, you’re going to have a better idea of how they operate.

AUM (Assets Under Management)

In a nutshell, AUM (Assets Under Management) is the total cash value traders like you have invested to be able to copy an expert trader. The total value what the copy trader in question holds in their portfolio.

Copiers

Assuming you are considering copy trading yourself, you would be classed as a ‘copier’. When you are searching for the best traders on eToro you will see copiers and a figure next to or underneath it.

This could be loosely compared to how many followers people have on the Twitter platform reflecting how popular they are. It literally displays to you how many people are actively copying that specific trader.

Whilst a trader could seem more attractive because of a large number of copiers, it isn’t the be-all and end-all.

Trading Statistics

This set of statistics is great for getting inside the investors head. By studying these statistics you are able to gain an understanding of what the investor likes to buy and sell, in the form of a thorough breakdown.

You will also have access to statistics such as average losses and gains from each and every trade. It has to be said that it’s also a good way of seeing how the trader operates when entering and exiting positions. This is a great way to show how much of a risk the trader likes to take.

If there are particular markets you are looking to trade in – such as cryptocurrency trading or stock trading, for example – this information is going to be invaluable when it comes to deciding whether the trader is one you want to copy.

Trading Averages

The trader’s averages are always worth a look. To find these, simply scroll to the bottom of the investor’s profile. Trading averages can show you various things, such as the average amount of trades placed per day, week or month (for example).

For instance, if the investor doesn’t trade much per week, chances are their preference is a long-term strategy (buy and hold). In other cases, a particularly active trader probably prefers short-term positions.

Risk Meter

This is the selected investor’s risk rating which has been assigned by eToro. These ratings are updated regularly. The risk rating (risk meter) is measured between 1 and 10 – 1 being the lowest amount of risk, and 10 being the highest.

Ultimately, it is entirely up to you what level of risk you are willing to take when choosing a trader to copy.

Step Two: Minimum Investment Budget

Once the selection process is over, you can start thinking about what your investment budget is going to be. As we touched on earlier on, there will be a ‘recommended; minimum amount of investment required before you can copy a trader. However, eToro actually allows you to copy a portfolio from just $200 – so as long as meet this threshold you can invest as little or much as you like.

Once you have approved the investment in question, the money will be transferred from your brokerage account and into the trader’s portfolio (adding to the AUM).

Step Three: Mirroring the Portfolio

Here is a simple example of what happens to your own portfolio; post-investment.

For the purpose of this example we are going to say that this is the trader’s portfolio:

- £20,000 worth of shares in RBS (20%).

- £40,000 worth of shares in Halifax (40%).

- £40,000 worth of shares in DHL (40%).

Here the trader’s portfolio is worth £100,000, but that won’t make any difference to you. The only thing that is relevant to you is the ‘weighting’, meaning what value each and every stock is going to add to the portfolio.

- 20% of the copy trading portfolio is in RBS shares, totalling £800.

- 40% of the copy trading portfolio is in Halifax Shares, totalling £1600.

- 40% of the copy trading portfolio is in DHL Shares, totalling £1600.

It’s clear to see now that your portfolio is a mirror image of your choice of copy trader. But, at a weighting proportionate to the amount you invested.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

Step Four: Mirroring Ongoing Trades

Whilst you don’t need to do anything after choosing your copy trader, you do have the option of copying their trades on an ongoing basis. After all, it’s worth bearing in mind that investors are buying and selling stocks and shares on your behalf for as long as you decide to.

For example, if the trader should suddenly decide to sell all shares in HSBC, then, of course, your HSBC shares are sold as well. And the other way around, if the trader decides to buy shares in Microsoft, you have Microsoft shares too.

We should also note that copy traders on eToro tend to deposit extra funds along the way. The reason for this is so that they can boost their portfolio with more assets. In this scenario, you will be left with 2 options.

Option 1 – Deposit More Funds

An investor will usually make an announcement when they are planning on adding additional funds in order to give you enough time to make arrangements.

Whether you decide to or not, it has to be said that the idea is to copy the trade. So, if you truly want to mirror what the investor is doing, then you will need to deposit funds accordingly (and in proportion).

Here’s a quick example of how this might look:

- Let us imagine that the investor has a portfolio to the value of £25,000 and they add £5,000 to that. This means the investor is increasing the position by 20%.

- Now let’s say your portfolio has a value of £1,000, you are going to need to add £200 (20% of £1,000).

Option 2 – Auto Adjustment

Should you decide that you can’t, or don’t want to invest more funds into your portfolio then your position is going to be readjusted for you automatically.

This readjustment means that eToro will have no choice but to sell some of your shares in order to make some space for the new purchase. You will still be copying the investor, but the weighting will be off.

Step Five: Making Money via Copy Trading

If you have any experience with mutual funds or ETFs then will already be aware of how to make a profit from copy trading. That is to say, you will make money in the same way as doing it yourself by making a profit from dividends and capital gains.

Dividend Stocks

If the copy trading investor you have chosen has dividends in their portfolio then you will get your share of that. Your dividends will be paid to you as soon as the company shares out the payment.

This is great for making the most of compound interest. Like with anything else in copy trading, all payments you receive will be relative to the amount you have invested.

Capital Gains

Imagine you have invested £10,000 into a copy trading portfolio, and within that portfolio has 50 different shares.

By the end of the first year, the total value has gone up by 10%. This means that your copy trading portfolio is valued at £11,000. So, when it comes to exiting your position, your profit will stand at £1,000.

To Conclude

Due to the fact you can adapt your portfolio as and when you want, copy trading is a great way to invest – regardless of what life throws your way.

There might be a time when the investor you are copying decides to purchase stocks in a sector you have absolutely no interest in. In this instance, you can just exit the position manually to avoid exposure in that particular sector.

Some people like to use more than one copy trader at a time. This allows you to diversify across several traders – further reducing your long-term risk alongside the way.

As we’ve said, the best traders at eToro aren’t necessarily the ones with the highest number of copiers, so always study as much information as you can. As well as a good understanding of how copy trading works and the risks involved, this knowledge is only going to help you in the long run.

Learn 2 Trade Free Signals Service

- Get 3 Free Signals per Week

- No Payment or Card Details Needed

- Test the Effectiveness of our High-Level Signals

- Major, Minor, and Exotic Pairs Covered