The foreign exchange marketplace is the most popular trading scene in the world. As such – the internet is overwhelmed with forex brokers. This means that when you want to trade currencies, you need to ensure that you do so via a reliable source.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Fancy trading currencies but struggling to find the best forex broker for the job? Read on.

Today we review 5 of the best forex brokers in the space right now. We also divulge a list of key considerations when comparing potential forex brokers yourself.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

In a Hurry? Open an Account With a Forex Broker in 4 Steps

You will see below a simple run-through of how you can sign up with the best forex broker – right now.

- Step 1: Research the best forex brokers and sign up with one that meets your needs. Joining Capital.com takes less than 10 minutes and the platform is commission-free.

- Step 2: Fill in the sign-up form including your name, password, and such. Next, upload some proof of ID.

- Step 3: Add some funds to your trading account and find a forex market you want to trade.

- Step 4: Place a trading order based on your prediction of the market sentiment on the pair

That’s it! For those who still need to choose a provider, you will see reviews of the 5 best forex brokers in the sections below.

Best Forex Brokers 2023: Reviewed

When we are searching for the best forex brokers of 2023 – we think about a multitude of different aspects. For instance, as well as dozens of supported forex pairs, ideally you need to find the platform easy to get around and one won’t charge you the earth in fees.

For anyone who has zero experience in trading, we divulge key considerations after the following reviews. This will prove valuable when you are on your own journey to find the best forex broker.

1. AvaTrade – Best Forex Broker for CFDs 2023

AvaTrade offers people of all levels of expertise admission to the currency markets. You will trade CFDs (Contracts for Difference) via this forex broker. For anyone unaware, this is a super flexible contract between you and your trading platform of choice. This enables you to speculate on the exchange rate of an FX pair in a low-cost manner.

We checked out the forex markets at AvaTrade and found an abundance! The 50+ markets available here cover all the most popular minor and major pairs you'd expect to see - as well as a good selection of exotic pairs. This includes EUR/RUB, USD/MXN, EUR/TRY, GBP/SEK, USD/CLP, EUR/ZAR, GBP/ILS, USD/TRY, and many more. Most assets come with super tight spreads, which is much better for your returns.

This top-rated forex broker does not charge commission fees to trade and is compatible with heaps of third-party platforms. This includes the MT4 - which is mainly used for technical analysis and automated trading. You can 'copy', 'like', and 'follow' seasoned traders by downloading AvaSocial, ZuluTrade, or DupliTrade. To access currency CFDs from the palm of your hand, you can try AvaTradeGO.

Multiple regulatory bodies regulate this forex broker, including ASIC, FSCA, and MiFID. You can get started at AvaTrade with a minimum deposit of just $100. Compatible payment types include bank transfer, Visa, Mastercard, Neteller, Skrill, WebMoney, and more. If you would like a virtual account for the purposes of strategizing or learning the ropes, open a demo and you will be given $100,000 in paper funds.

- Commisson-free forex broker

- Regulated by 6 bodies, including MiFID, ASIC, and FSCA

- Dozens of forex markets and compatible with MT4 and MT5

- Admin fee charged after 12 months of inactivity

2. Capital.com – Best Newbie-Friendly Forex Broker - Minimum Deposit $20

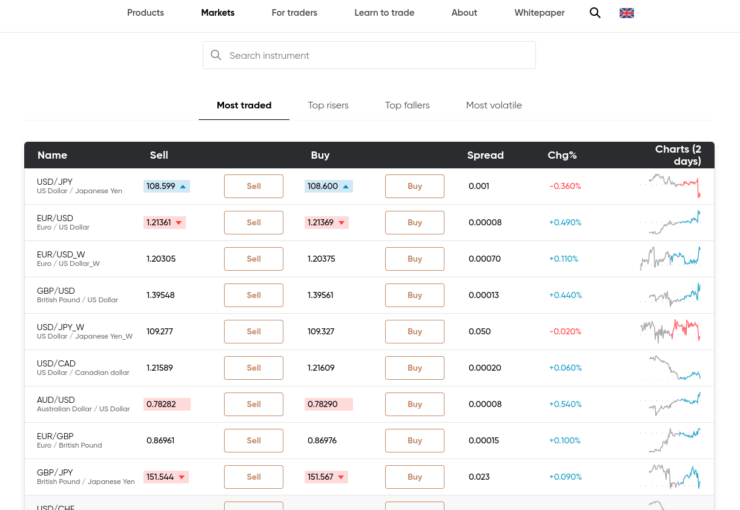

Capital.com is easy to use for traders from all walks of life and you will find placing CFD orders uncomplicated and free from jargon. As with the other platforms on this list, how much you can leverage your trade depends on your jurisdiction - and whether you classify as a retail or professional client. This forex broker has access to tons of currency markets, covering all 3 pair categories - minor, major, and exotic.

We found a whopping 70 FX pairs here. Exotic markets include EUR/ILS, SEC/RUB, USD/TRY, EUR/RON, PLN/TRY, GBP/RUB, AUD/TRY, USD/MXN, CAD/MXN, TRY/JPY, GBP/HUF, PLN/RUB and plenty more. You won't be charged any commission fees to trade via the forex broker. Furthermore, we found the spread to be pretty competitive on all currency pairs.

If you are still finding your feet in the currency markets, you can access a good amount of forex-based educational content. This includes lessons on trading psychology and strategies. You can also find webinars, and trading calendars, as well as being able to link your account to MT4 for dozens of indicators, price charts, and EAs.

CySEC, FCA, ASIC, and NBRB regulate this forex broker so you can rely on it to keep your funds safe. To get started with Capital.com, sign up for the standard account and deposit from just $20. This can be completed using bank wire transfer, credit or debit card, Astropay, Trustly, iDeal, Apple Pay, Sofort, and more. You can test-drive the platform with a free demo facility with $10,000 in paper equity.

- Access forex technical analysis via MT4

- Commission-free forex broker with $20 minimum deposit

- Licensed and Regulated by CySEC, FCA, ASIC, and NBRB

- Lacking fundamental analysis

3. LonghornFX – Best Forex Broker With High Leverage and Super Fast Withdrawals

ECN broker LonghornFX offers a plethora of leveraged CFD instruments and prides itself on being efficient, transparent with fees, and offering great customer support. You will be linking your account and trading via the aforementioned trading platform MT4. This forex broker has over 55 currency pairs - covering minor, major and exotic markets.

This guide found the 27 exotic pairs here to consist of USD/CZK, USD/ZAR, EUR/CZK, EUR/PLN, EUR/TRY, NOK/SEC, USD/PLN, GBP/SEK, USD/SEK, GBP/DKK, USD/ILS, and more. The spread is super competitive across all markets and this is another forex broker charging 0% commission. You can get your hands on as much as 1:500 leverage via the provider.

In case you don't know, this means you can multiply your stake by up to 500x. For the best chance at predicting the currency markets, you will need to partake in technical analysis at some point. For this, you will find dozens of technical indicators, chart drawing tools, and other advanced features via MT4.

You can fund your new account to start trading forex with as little as $10. Please note that you have several options to deposit at LonghornFX. This includes debit/credit card, bank transfer, or Bitcoin.

- ECN broker with lots of FX pairs and competitive spreads

- Leveraged CFDs via MT4

- Super fast withdrawals

- Platform favors Bitcoin deposits

4. EightCap – Trade Over 500+ Assets Commission-Free

Eightcap is a popular MT4 and MT5 broker that is authorized and regulated by ASIC and the SCB. You will find over 500+ highly liquid markets on this platform - all of which are offered via CFDs. This means that you will have access to leverage alongside short-selling capabilities.

Supported markets include forex, commodities, indices, shares, and cryptocurrencies. Not only does Eightcap offer low spreads, but 0% commissions on standard accounts. If you open a raw account, then you can trade from 0.0 pips. The minimum deposit here is just $100 and you can choose to fund your account with a debit or credit card, e-wallet, or bank wire.

- ASIC regulated broker

- Trade over 500+ assets commission-free

- Very tight spreads

- Leverage limits depend on your location

Key Considerations When Comparing the Best Forex Brokers

In this section of our guide, we are going to discuss the key considerations to make when choosing the best forex broker for you. This will ensure that you select the very best provider for you and your financial goals.

Regulatory Status

We touched on KYC in the above forex broker reviews. This stands for Know Your Customer and is a rule that all regulated platforms must follow. This is precisely the reason you will be asked to send a photo ID and prove your address when signing up – it’s a form of fraud prevention.

The most commonly seen regulatory bodies governing the best forex brokers are ASIC, FCA, MiFID, and FSCA. As well as KYC, all regulated brokers must submit audits and segregate your capital from its own.

Each jurisdiction will have different rules and stipulations. However, such organizations only provide legitimate and compliant brokers with a license. As such, look for the stamp of approval whenever you are doing your research for the best forex broker – before signing up.

Supported Forex Markets

There are hundreds if not thousands of forex brokers in operation. However, you may be surprised to learn that some trading platforms only offer a limited selection of currency markets – usually the most popular to trade.

The reality of currency trading is that major, minor and exotic pairs offer a different trading experience. This is largely due to the varying volatility, liquidity, and short-term price spikes.

As such, it’s wise to make sure the forex broker you sign up with has access to a plethora of markets. Each of the platforms we reviewed today can offer you a wide choice of currency pairs – with either zero, or low commission fees.

Forex Trading Fees

This brings us to forex trading fees. Although obvious, the best forex brokers offer low trading costs!

See below some common forex broker fees, so that you know what to look out for:

- Tight Spreads? Paying the spread is all part of forex trading. With that said, the ‘fee’ payable can vary by some distance. The best forex broker will be able to offer you tight spreads across most currency pairs. For those unaware – the spread is the gap between the buy andsell price and is shown in ‘pips’.

- Variable or Fixed Commission? Be mindful, some platforms charge a commission on every trade. Whilst some stipulate a fixed fee (e.g. $3), others charge a variable percentage. For instance, if the broker charges 4%, a $1,000 market order is going to cost you $40 – a fee you will pay again depending on the value of your trade when closing it. AvaTrade is regulated and a 100% commission-free forex broker.

- Are deposit Fees Liable? It’s good to have a clear understanding of any fees expected of you – which includes fees for funding your account. This isn’t a charge every forex broker asks for. We found that some charge on deposits over or under a specific amount, and others for a particular payment type (such as credit card). eToro will simply charge non-US clients 0.5% for exchanging their native currency.

As you can see, the fee and commission structure is definitely something you will need to investigate in your search for the best forex broker.

Broker Platform Ease of Use

Forex traders are dipping in and out of the currency markets all the time. For instance, if you’re a scalper you will be opening and closing a high volume of positions throughout the day to make gains from price fluctuations.

Trading Attributes and Features

Another key consideration for finding the best forex broker is trading attributes and features. This might include anything from educational material and webinars – to forex EAs and copy trading.

Copy Trading

Starting with one of the most popular trading features – Copy Trading. As we touched on in our eToro review, this enables you to mirror the trades of someone with years of experience in currency trading.

You are able to choose a trader to invest in based on their risk score and past performance, as well as favored asset class – like forex. In fact, you can filter the results down by many different aspects and timeframes. At eToro, you have hundreds of thousands of traders to choose from – so you’re sure to find one that meets your financial goals.

You can choose to copy all open trades or only ongoing positions. There is even the option to ‘Pause Copy’, which you can utilize to stop copying them temporarily without losing all of the existing positions.

Here’s an example of how the Copy Trading feature works at eToro:

- After scrutinizing a plethora of Copy Traders, you invest $1,000 in BobFX123

- BobFX123 believes the euro will depreciate against the Japanese yen so allocates 2% of their equity on a EUR/JPY sell order

- As such, your profile shows that you are short on EUR/JPY with $20 (2% of $1,000)

- Next, the Copy Trader cashes out with a 16% profit

- As such, you have made 16% too – in proportion to your investment.

- On your $20 trade, this works out at a profit of $3.20

It’s important to remember that although this doesn’t sound like much – this is a completely passive way to trade currencies and any gains are good for your trading balance. eToro will let you trade up to 100 Copy Traders at once!

Demo Account

Otherwise called a forex simulator, demo accounts enable us to practice strategy ideas and try new currency markets. For beginners – this is a valuable way to learn how to trade, by getting out there and placing orders in real market conditions.

Demo accounts come pre-loaded with thousands of dollars worth of paper trading funds. We sometimes refer to this as ‘virtual equity’ and it means you can access the markets in a completely risk-free manner – on a separate account from your real capital. The best forex brokers will provide you with a free demo upon signing up.

If you’ve ever thought about trying forex signals before, this is a superb way to take these so-called trading tips for a test drive. Here at Learn 2 Trade, we offer both a free and VIP service. Each trading signal includes the forex pair to trade, whether to go long or short, the suggested stop-loss and take-profit values, and a risk-reward ratio.

Our team of professional currency traders performs advanced technical analysis and sends this information to our Telegram group. You can then head over to your forex broker of choice and enter the aforementioned information. You can use your virtual equity to test us out and can easily switch to your real account if you see fit.

Third-Party Compatibility

If you are keen to try forex EAs (Expert Advisors), you will need to first make sure the forex broker in question supports the respective software file. Some don’t allow ‘robots’ at all. Others do, but it must be done via a third-party trading platform like MT4 or MT5.

This guide found that the best forex brokers for automated trading via MT4 are AvaTrade, Capital.com, and LonghornFX. All of which offer tight spreads on most currency markets.

Sign up With the Best Forex Broker Today

Not only have we reviewed the 5 best forex brokers of 2023, but we have also divulged key considerations you can look out for whilst you make your mind up.

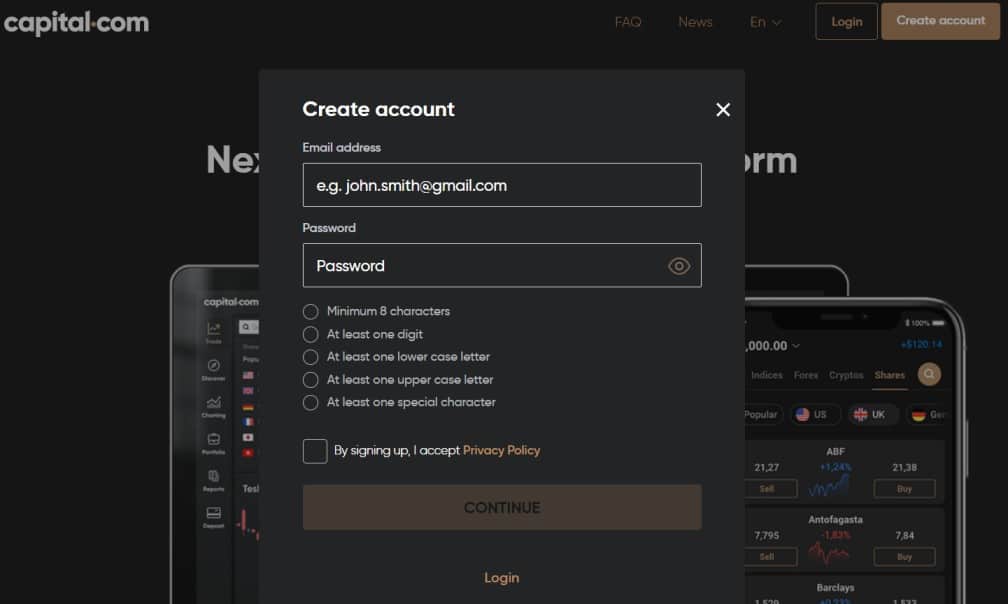

For this step-by-step walkthrough, we have chosen to use Capital.com The forex broker has a wide variety of minor, major and exotic markets to choose from – plus, it takes less than 10 minutes to sign up.

Step 1: Join the Best Forex Broker Now

On the Capital.com platform, you will see a ‘Create account’ button – click that to reveal the order box you see below.

This is a case of entering basic information about your identity. As you can see, this includes your name and email address. After that, you’ll need to provide your home address and date of birth.

Step 2: Send a Copy of Your ID

Next, you will receive a welcome email with a link to your Capital.com trading account. Another requirement, as per regulations, is to complete the next step of your profile by uploading a government-issued photo ID.

This can be a driving license or passport. Then, you can prove your address by sending a recently dated utility bill or bank statement. You may leave this step until later if you wish, only you cannot withdraw funds in the meantime.

Step 3: Make a Deposit

If you want to trade the live currency markets right away, you will need to make a deposit.

Capital.com accepts lots of different payment types covering bank transfers, e-wallets, and credit/debit cards. When you have entered the amount and chosen a method, you can click ‘Deposit’.

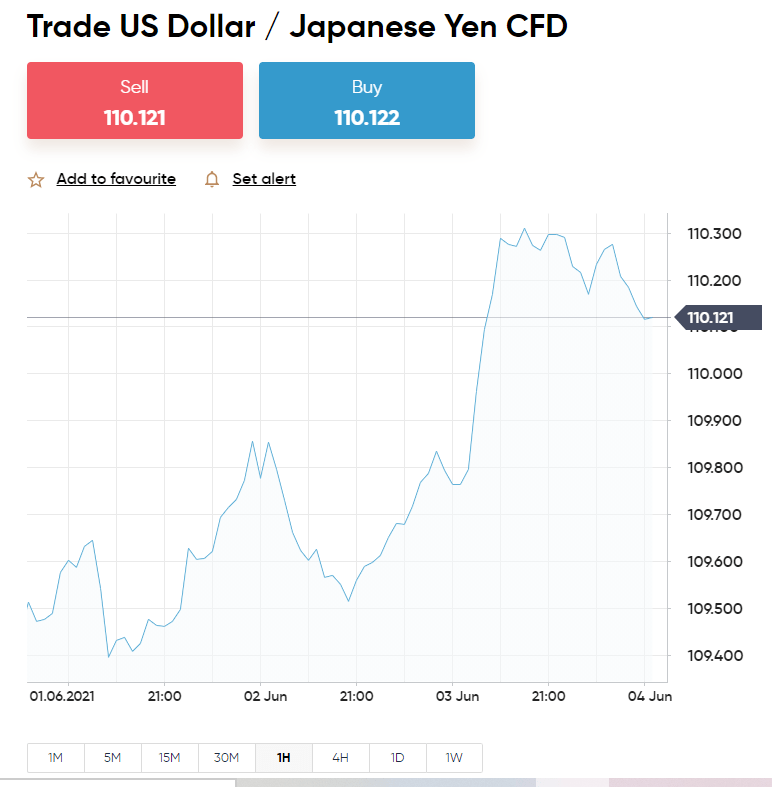

Step 4: Find a Forex Market

Now that your forex broker account is set up, you can find a forex market to trade. Here we are looking for the Australian dollar against the Japanese yen.

As you can see, we have used the search box. You can also click ‘Trade Markets’ followed by ‘Currencies’. This will bring up all available pairs. When you have made your decision, you can click ‘Trade’.

Step 5: Place an Order With Your Forex Broker

Next, you can place the order on your chosen currency market. Here we are looking to go short with a $500 sell order on AUD/JPY.

Best Forex Broker 2023: The Results

The foreign currency markets run 24 hours a day, 5 days a week – offering low margins and massive trading volumes. With this in mind, it’s important to choose the best forex broker suitable for your goals – offering a range of markets, and low trading fees.

We whittled our findings down to 5 of the best forex brokers and reviewed each of them. We also covered some of the most important metrics to look out for when researching a broker yourself. This should include regulation, supported markets, payments, fees, and more.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts