For those unaware, CFDs (Contracts for Difference) enable you to speculate on the future value of an underlying asset, without taking ownership of it. As such, this is a more flexible way to enter your desired market – than say traditional stocks.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Whether you want the ability to go long or short on oil, gold, stocks, forex, cryptocurrencies, or sugar – you will need to sign up with a great brokerage.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Today we review 5 of the best CFD trading platforms, offer a detailed guideline to choosing one for your future trading adventures, and a simple 5 step sign-up at the end.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

CFD Trading Platform: Sign up Now in 4 Steps

Below you will see a quick 4 step sign-up, for those who lack the time to read this page in full.

- Step 1: Decide on a suitable CFD trading platform and sign up – Capital.com takes less than 10 minutes and has heaps of CFD markets

- Step 2: Upload proof of your identification with a passport, etc

- Step 3: Use your preferred payment type to add funds to your account

- Step 4: Find a market you would like to trade, and place a buy or sell order

As you can see, all you have to do is tell the broker who you are, deposit your account, and then you can get started right away. First, you need to make sure you are signing up with the right platform!

CFD Trading Platform: 5 In-depth Reviews

When you are researching brokers, you will probably notice that there is some disparity between companies. For instance, when reviewing the best CFD platforms, just some of the things we look for are regulation, the lowest fees, a high volume of quality markets, and more.

We cover these key considerations next, to give you a clearer indication of what to expect from a provider. First, for those who still have the daunting task of deciding on a CFD trading platform – we have reviewed the best in the space.

1. AvaTrade – Best CFD Trading Platform With Third-Party Compatibility

AvaTrade is a top-class CFD platform with approval and licenses from several regulatory bodies. Consequently, it must comply with the rules set out by each jurisdiction. As such, you can trade leveraged CFDs in safe conditions here. There are heaps of options when it comes to markets. We found this to include minor, major, and exotic forex pairs. Exotics include various strong currencies against the South African rand, Chilean peso, Russian ruble, Mexican peso, Swedish krona, and more.

If you want to take your position on a stock index, you can trade indices such as FTSE MIB, INDIA50, DAX30, Nikkei225, FTSE100, ChinaA50, CAC 40, and Spain 35. By hooking your account up to MT5 you can also trade Green Energy, TSX60, and FAANG. Top-traded stocks include Vodaphone, Proctor and Gamble, Snapchat, Intel, Groupon, Tesla, Mastercard, Microsoft, Apple, Adidas, Alibaba, Twitter, and more.

The aforementioned MT5 provides access to additional stocks such as Walmart, Starbucks, Cisco Systems, Medtronic, Wells Fargo & Co, Colgate, Kinder, Wells Fargo & Co, Microsoft, Colgate, Netflix, and more. This is also a useful channel for ETFs such as Market Vectors TR Gold Miners, and S&P500 VIX. Cryptocurrencies include Dash, IOS, Ripple, IOTA, Uniswap, Stellar, Chainlink, and others. If you would like to trade the underlying value of commodities without owning or storing them, you will see live cattle and orange juice on MT5.

At the AvaTrade platform itself, you will find oil products such as cooking and crude, as well as palladium, gasoline, wheat, sugar, coffee, and more. You may have heard of social trading sites such as ZuluTrade and DupliTrade? These allow you to 'like' and 'follow' people - just like at social media outlets. This CFD trading platform will not charge you a cent to trade and the spread is competitive across most assets.

You may also opt for AvaSocial, which is like the aforementioned third-party platforms. Here you can copy an already experienced trader with similar interests to your own. Another compatible platform option is AvaTradeGO. This is a free application you can use to access your account and place orders on live CFD markets around the world. You can get started from $100. Accepted methods are credit/debit card, bank transfer and e-wallets including WebMoney, Skrill and Neteller.

- Minumum deposit only $100

- Licensed in 6 jurisdictions including Australia, the EU, Japan, and South Africa

- Trade CFDs with 0% commission on any asset

- Admin and inactivity fee after 12 months

2. Capital.com – Best CFD Trading Platform for Newbies - Deposit Just $20

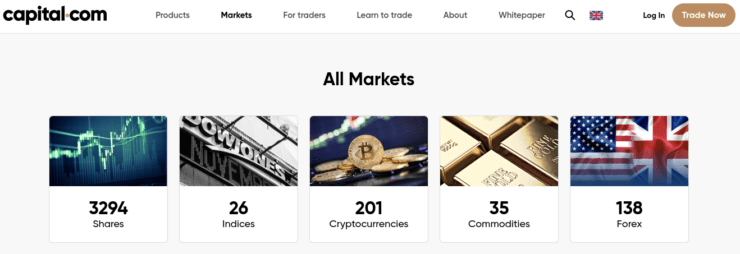

Capital.com is a top-rated CFD trading platform that was designed with traders of all experience in mind. CySEC, FCA, ASIC, and NBRB regulate and license this broker so it's a secure place to deposit and trade. When it comes to markets, we found thousands. Starting with share CFDs, this includes Johnson & Johnson, Nintendo, eBay, Toyota, Uber, Fujitsu, Spotify, Lenovo, Easy Jet, and others.

Indices consist of IT40, US500, HK50, UK100, FR40, EU50 and others. This guide found there to be an abundance of forex pairs here covering all 3 categories. Exotic markets include Romanian leu, Mexican peso, Russian ruble, South African rand, Turkish lira and more. The 70 Cryptocurrency CFDs include NEO, Bitcoin Cash, Ethereum, Ripple, Tron, Bitcoin, Cardano, and XEM (amongst others)

You will also find some newly added DeFi tokens. We often use commodities as a way to diversify, beyond the realms of traditional financial instruments. Capital.com provides access to a selection, including copper, gold, silver, aluminium, sugar, wheat, and oil - to name a few. This CFD trading platform is partnered with MT4 so you can link your account and make use of the various trading tools.

This is another commission-free CFD trading platform on our list with tight spreads on the majority of markets and leverage on offer. You can also hook your account up to the previously mentioned MT4 for the technical analysis side of things. You can also use a free demo or automated trading. Accepted deposit types include credit and debit card, bank wire transfer and e-wallets like Apple Pay, iDeal, Trustly, and more. The minimum is $20.

- Connect your account to MT4 technical analysis and automated trading

- Heaps of CFD markets with minimum deposit of just $20

- Regulated licensed and by the CySEC, FCA, ASIC, and NBRB

- Not much in terms of fundamental analysis

3. LonghornFX – Top-Rated CFD Trading Broker With High Leverage

LonghornFX is a CFD trading platform with tons of markets to trade. You can access all this broker has to offer by linking your account to MT4 software. This is where you can trade the future value of minor, major and exotic forex pairs. For the latter we found Czech koruna, Israeli new shekel, Swedish krona, Norwegian krone, Polish złoty, Danish krone, Turkish lira, Mexican peso, Russian ruble and more.

If you would prefer to trade crypto CFDs, you will find the usual coins such as Bitcoin, Ethereum, and Litecoin. Others include IOTA, dodgecoin, Dash, Eidoo, OMG, Qtum, EOS, and Zcash - to name a few. If stocks are more your cup of tea, you won't be short of options. We found a mixed bag including FRA40, US30, SPX500, ESP35, JPN225, AUSTX50 and more.

LonghornFX allows you to trade the US dollar and euros against metals such as platinum, gold, and silver. If you would rather trade a commodity on its own you can access UK and US oil markets. There are far too many stock CFDs to mention. To give you an idea, we found Goldman Sachs Group, eBay, Apple, Google, Coca Cola, Air France, Amazon, Boeing, Twitter, Netflix, Volkswagen and more.

This CFD trading platform does charge commission fees. However, it works out that for every $100k you allocate; you pay $7 in commission. You may be offered up to 1:500 leverage here, depending on your level of experience. LonghornFX is fully compatible with MT4 and you can fund your account with Bitcoin, credit cards, or bank transfer.

- CFD trading platform with competitive spreads

- Low commission and high leverage up to1:500

- Same-day withdrawals and plenty of CFD markets

- Platform favors Bitcoin deposits

4. EightCap – Trade Over 500+ Assets Commission-Free

Eightcap is a popular MT4 and MT5 broker that is authorized and regulated by ASIC and the SCB. You will find over 500+ highly liquid markets on this platform - all of which are offered via CFDs. This means that you will have access to leverage alongside short-selling capabilities.

Supported markets include forex, commodities, indices, shares, and cryptocurrencies. Not only does Eightcap offer low spreads, but 0% commissions on standard accounts. If you open a raw account, then you can trade from 0.0 pips. The minimum deposit here is just $100 and you can choose to fund your account with a debit or credit card, e-wallet, or bank wire.

- ASIC regulated broker

- Trade over 500+ assets commission-free

- Very tight spreads

- Leverage limits depend on your location

Guideline for Choosing the Best CFD Trading Platform

So far we have divulged the top 5 CFD trading platforms of 2023. We have covered what markets are available, regulatory standing, accepted payment types and everything in between.

Still deliberating on the best place to carry out your CFD trading endeavours? See below a list outlining the key characteristics of a good platform.

A CFD Trading Platform With a Licence

Regulation and licensing carries weight when you want to feel secure CFD trading. These organizations make sure that online brokers stick to a multitude of strict rules and standards. The obvious benefit of choosing a regulated broker over an unregulated one is the giant safety net they provide.

Some of the most well known regulatory bodies are ASIC, CySEC, and FCA. There are others, including but not limited to – FSCA, Mifid, and FSA. A rule that carries across most jurisdictions is KYC (Know Your Customer). This is to prevent money laundering and such, so the broker must obtain your ID and learn a bit about you.

Whilst this differs, depending on the jurisdiction, you could be entitled to financial compensation. For instance, if the CFD trading platform becomes bankrupt. Many regulators also insist that online brokers keep your trading capital safe in a separate tier 1 or 2 bank account.

Low CFD Trading Platform Fees

The fewer fees you have to pay a CFD trading platform, the better it will be for your take home profit. No two are the same, so always check what is expected of you.

- Spread: The spread is a fee charged by most CFD trading platforms. This is based on the differentiation between the buy and sell price of the asset you are looking to trade. For instance, if you are trading British pounds against US dollars with sell price of 1.4126 and a buy price of 1.4128. This is a spread of 2 pips. If you make 2 pips – you break even.

- Overnight Financing Fees: This is charged for each and every CFD position you keep open overnight. It is sometimes referred to as a ‘swap’ or ‘rollover’ fee. The amount you pay depends on the value of your position, the amount of leverage added and the market you are trading. If you were trading the aforementioned GBP/USD FX pair at eToro, with a $200 sell order and 1:30 leverage, you would be charged around $0.14 daily and $0.42 at the weekend.

- Commission: Commission fees vary. One CFD trading platform might require $3 off you for every trade. Another may stipulate 0.9% for the opening of your position and the same again when cashing out. The best CFD trading platforms charge low or no commission, this frees up your capital for the next potential win.

Let’s say that you plan on scalping forex throughout the day, on a regular basis. You will be better off financially avoiding CFD trading platforms that charge commissions to enter and exit the market.

If you must pay say 3% on every position, you will soon see your gains drain away. AvaTrade and Capital.com are both ZERO commission CFD trading platforms we reviewed positively earlier on.

Wide Range of CFD Markets

Having a wide ranger of markets should be a key consideration when looking for the best CFD trading platforms. You may be focussing all of your attention on one asset class right now but want try new markets later on.

Note that UK traders cannot access leveraged CFDs for any market other than cryptocurrencies. If you live in the US – CFTC and SEC prohibit you from this type of financial instrument. With that said, you can add leverage to forex positions up to 1:50.

CFD Platform Features and Tools

Some CFD trading platforms come with all the bells and whistles needed to predict markets, copy seasoned traders, and even trade 100% passively via autotrading robots. Others are basic but might be just what you need.

At the end of the day, the tools and features you want from your chosen CFD trading platform will depend on your own goals.

CFD Copy Trading

We briefly touched on the Copy Trader in our eToro review. You can choose up to 100 skilled investors, from over a million – based on preferred market, risk score, number of copiers, and much more.

See how this works below with an example:

- You invest $1,000 in a Copy Trader called MrCFD13

- MrCFD13 creates a short position using 3% of his equity on Tesla stocks

- Consequently, you now have a sell order on Tesla of $30 (1,000 * 3%)

- MrCFD13 places a buy order to close the earlier trade and makes a profit of 21%

- You made $6.30 without having to lift a finger

This can also be a great way to learn based on the failures and successes of others. You can check the Copy Traders stats and view a plethora of trading information whenever you like.

Automated CFD Trading

Automated CFD trading comes in many forms – most notably ‘robots’ (or EAs) and ‘signals’. Robots are based on algorithms and scour the markets – automatically placing orders for you at your brokerage. If the provider in question is partnered with MT4/5, the chances are you will be able to let an EA do your bidding.

Another option when considering how to trade CFDs is ‘trading signals’. This will suit you better if you prefer to have a say in where your trading capital is spent. For those unaware, this service is offered across a few different markets. Here at Learn 2 Trade we offer forex signals, stock signals and cryptocurrency signals.

Trading signal subscriptions range from free to premium annual plans. We offer a money back guarantee within 30 days on the 1 month offering. This service is compatible with each of the 5 CFD trading platforms we have reviewed today.

All you have to do is head over to your account and place an order -using each element of the signal we send. For those new to this phenomenon, this includes the market to trade, long or short, entry price, and stop loss and take profit values.

Free CFD Trading Facility

If this is your first time at a CFD trading platform, you may wish to try it for free until you find your way around. With that said, even the most experienced CFD traders see value in strategizing using virtual equity – it’s 100% risk-free!

Many CFD trading platforms offer clients a free demo trading facility when signing up. This usually includes atleast $10,000 paper funds, if not more. For instance, AvaTrade and eToro will give you a virtual trading balance of $100k to get you started!

Join a CFD Trading Platform: 5 Step How-To Guide

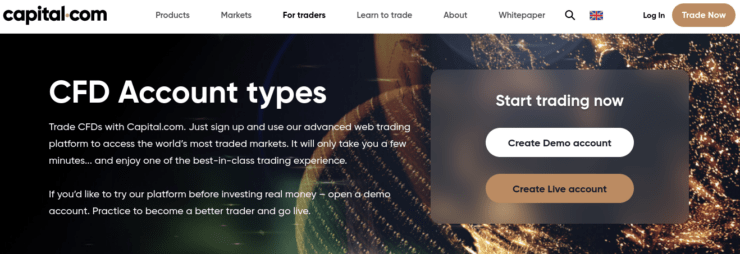

For those who have no experience in this field – see a simple 5 step how-to guide below. We are using Capital.com as the CFD trading platform is extremely easy to use.

Step 1: Sign Up With a CFD Trading Platform

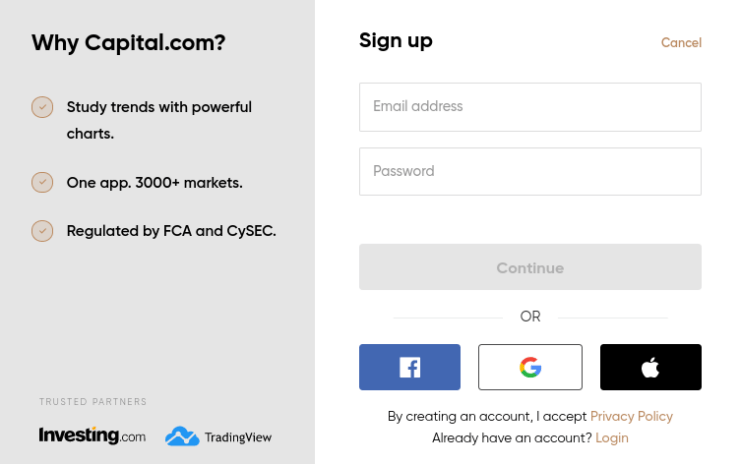

When arriving at Capital.com, click ‘Join Now’ and enter your name, username, password and other information – as and when you are prompted.

Step 2: Validate Your Personal Details

This CFD trading platform is regulated by FCA, CySEC, ASIC, and NBRB – so must follow KYC to the letter and that means making sure you are legitimately who you say you are. In order to finish setting up your account the broker will require you to upload some ID, like your passport.

If you want to do this later, you will still be able to trade at Capital.com However, this and your proof of address will need to be validated before the CFD provider will let you withdraw funds or deposit over $2,250.

Step 3: Make a Deposit

Next, choose from the various options available and enter an amount to fund your account with.

When you have checked all is correct, you can click ‘Deposit’.

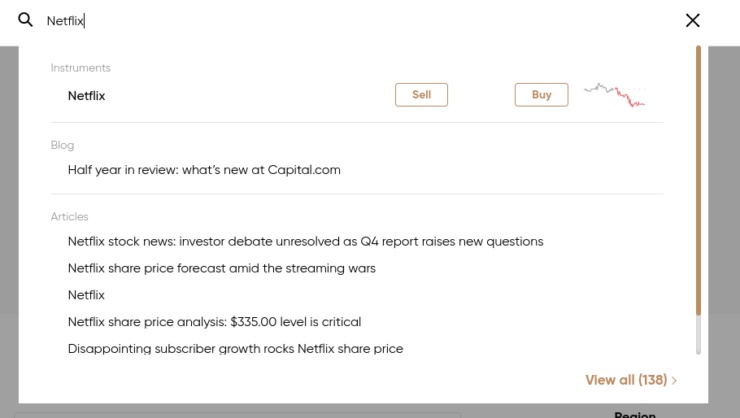

Step 4: Find a CFD Market

Now you can find the CFD market you are interested in, or look under ‘Trade Markets’ if you need inspiration.

Step 5: Place a CFD Trading Order

Once you see the order box appear you can choose between buy and sell, depending on your prediction.

Best CFD Trading Platform: To Summarize

Today we thoroughly reviewed the best CFD trading platforms of 2023. Hopefully, this helped you along with your decision. It makes sense to sign up with a provider who can give you access to multiple markets for when you want to try something different.

Regulation should also be a priority – otherwise you don’t know if you are trusting a shady broker until it’s too late. The best CFD trading platforms in the space include AvaTrade, Capital.com and LonghornFX.

All of which offer a plethora of different CFD markets with leverage, low or zero commission fees, tight spreads and standout trading features such as Copy Trading or MT4 compatibility.

FAQs

What is the best CFD trading platform?

Is CFD trading profitable?

Is CFD trading banned in the US?

Do day traders use CFD trading platforms?

Can I lose more than I invest in CFDs?