Commodities are traded by millions of people every day, sometimes during periods when the markets are highly volatile. This asset class also lends itself well to portfolio diversification, as prices tend to move in the opposite direction to stocks.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

If you want to learn how to trade commodities online, but are unsure where to start – stay right there!

In this guide, we walk you through the fundamentals and how to place commodity trading orders, divulge the best way to incorporate risk management and analysis into your strategy – and how to sign up to a great broker today!

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Part 1: Understand the Basics of Trading Commodities

Before we get into the nitty-gritty of what it takes to trade commodities, it’s hugely important that you understand the bare basics. After all, you will be risking your won money – so knowledge is crucial.

What Does Trading Commodities Entail?

When it comes to the trading of any asset, the clear goal is to make money. This is made possible by correctly predicting the market you are trading, and selling the product or instrument for more than you initially paid.

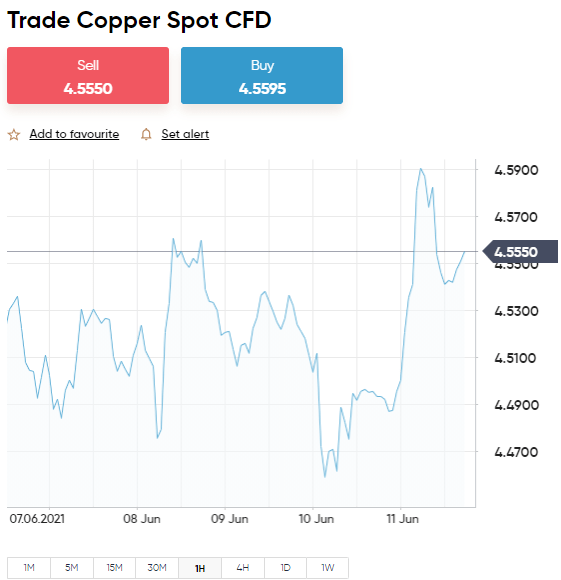

So how is this achieved? Let’s say you are trading copper and think it is undervalued. As you believe a price increase is highly likely – you need to place a buy order with your broker. If your prediction is correct – you make a profit.

Notably, regardless of your location, you will usually find commodities like oil and gold are priced in US dollars – occasionally in an alternative strong fiat currency.

With the right broker, you will be able to trade commodities from home on a long-term or short-term basis. Irrelevant of which strategy is suitable for your trading plans, the end goal is to make gains from the commodity in question’s rise and fall in value.

How are Commodity Prices Determined?

Such price fluctuations are caused by multiple factors that affect the supply and demand in that particular market – much like any asset. As such, understanding what causes price shifts will be very helpful.

Not just when it comes to making educated and informed choices, but also when performing fundamental analysis on your chosen commodity.

US Dollars

As we touched on earlier, some commodities will always be quoted in USD. As such, it’s important to be mindful that anything happening with the value of US dollars is likely to have a strong influence on the price of commodities.

Supply, Demand and Geopolitical Uncertainty

Other major influencers when it comes to the price of commodities are:

- Geopolitical events

- Currency shifts

- Economic growth or decline

- Natural disasters/extreme weather

- Civil and social unrest

- Rising storage and transportation costs

- Rising or falling interest rates

- Increase or decrease in supply and production of the product

Benchmark Indices and ETF Demand

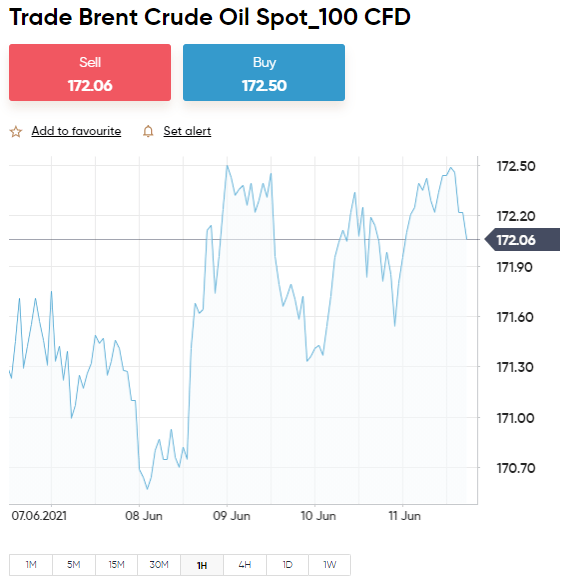

Commodity benchmarks such as WTI Crude and Brent can also have an impact on the price of your chosen asset. For those unaware world oil prices are often determined by the Brent Crude benchmark, whereas in the US WTI is used.

Therefore, if news breaks regarding a huge benchmark such as this, it could be important to keep a closer eye on things.

Similar to third-party exchanges, these indexes show us shifts in the buy and sell prices of a commodity. Whilst prices will differ slightly, benchmarks will invariably illustrate any market volatility present. As such, if a particular commodity goes into overbought territory, the value of the index will also rise.

Exchange-Traded Funds can also impact the price of commodities. If an underlying asset of the ETF increases, but the shares remain unchanged – the price per share will rise. However, if demand increases for ETF shares, then more of the asset will need to be supplied to meet the market demand.

As such, the natural course of supply and demand ensues, and additional shares will make sure the price remains in line with the net asset value of the commodity-based ETF.

How to Trade Commodities: Short-Term or Long-Term

We mentioned that you are able to trade commodities in the long-term or short-term. As there are a few different ways to do this, see a list of the most common methods below.

Commodities Futures

As the name suggests, commodity futures are a financial instrument that enables you to trade based on the future valuation of an asset. This will be an agreement on a particular price, on a specific date later down the line. A commodity future is a legal contract between you and the online broker of your choosing.

Futures contracts tend to last around 3 months at a time before reaching the agreed expiry date – sometimes longer, but rarely. At which point you must decide whether to buy or sell the commodity in question.

You don’t have to wait for the contract to expire, so in most cases, you can cash out on your commodity whenever you feel like it. If you correctly predict the direction of the asset’s price before the end of your contract – you stand to make a profit.

Commodities CFDs

Another highly effective way to learn how to trade commodities is via CFDs (Contracts for Difference). In case you are new to trading, CFDs are contracts created by online trading platforms. Such contracts monitor the real-time price fluctuations of the asset in question.

This allows you to trade gold, wheat, or oil for example – without having to take ownership of the underlying asset. Instead, you can predict the rise or fall in the value of the commodity – and profit if you are correct.

Commodity CFDs cut out the obvious problem of transportation and storage. Which would otherwise be a problem when trading metals, energies, and agricultural products.

Let’s look at a simple example of a commodity CFD, using platinum:

- Platinum is quoted at $1,285.90

- As such, your platinum CFD is also priced at $1,285.90

- If the price of platinum increases or decreases by even a fraction – this will be mirrored in the CFD’s value

As you can see, all you have to do is try to correctly hypothesize on whether the value of the commodity you are trading will increase or decrease.

You can benefit from both the rise and the fall of an asset via CFDs – and ven trade with leverage. Even retail traders in heavily regulated regions like Europe can obtain leverage of put o 1:20 on gold CFDs and 1:10 on all other commodity markets. If you are yet to learn how to trade commodities in full – we cover CFD orders in more detail later on.

Commodities ETFs

We touched on ETFs earlier when talking about how the price of commodities can be affected. ETFs are suitable to medium-long-term traders looking to adopt a buy and hold strategy. Commodity ETFs enable you to invest in numerous assets via one single trade, and like CFDs, cut out the need to directly own or store the asset.

Instead, the ETF will reflect the wider sentiment of the market. For example, if you are interested in gold, you will find hugely popular funds such as the GLD (SPDR) ETF at commission-free platform eToro.

GLD trades on the stock exchange and is the largest physically-backed gold fund in the world. Unlike in the case of CFDs, you will not be charged overnight financing fees when trading commodity ETFs and crucially – the fund is actually backed by the respective commodity.

Part 2: Learn Commodity Orders

It goes without saying that as you learn how to trade commodities you are going to need to have a firm understanding of the different orders available to you.

As such, below we have listed some useful orders and an explanation of each.

Buy Orders and Sell Orders

The most rudimentary of orders when it comes to trading commodities (or any asset) is the buy and sell order.

As we have said, you can go long or short when trading commodities via CFDs.

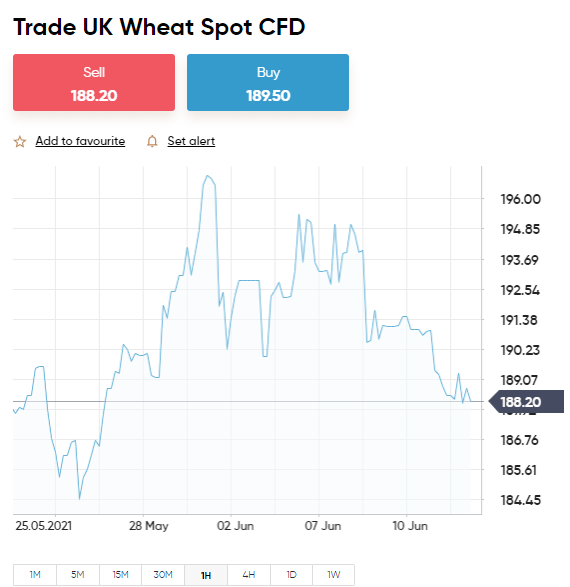

- You think that wheat is going to increase in price – place a buy order

- You think that wheat is going to decrease in price – place a sell order

To further clarify:

- If you enter the market using a buy order – you must exit the position with a sell order

- If you enter the market with a sell order – you must exit the position using a buy order

As is evident, buy and sell orders are compulsory.

Market Orders and Limit Orders

Now that you know the simplest way to enter the commodities market – we can offer some more detailed order insight. We are going to start with ‘market’ and ‘limit’ orders – as you will need to choose between the two.

Market Order

A market order is usually set as the default at trading platforms. This particular order illustrates to your broker that you like the current price. And therefore, would like your order executed immediately. It really is as simple as that.

Notably, there will be a slight difference between the price on your original order, and the price you get. Which is down to the ever-changing supply and demand of the markets. For instance, you may place a platinum order at $1,285.90, but actually, get $1,285.92.

Limit Order

Another entry order, a ‘limit’ order allows you to accurately control what price you enter the market you are interested in.

See an example below:

- You are trading platinum which is currently $1,285.90

- You are not interested in entering the platinum trade until the metal rises to $1,350.19

- As such, you select a buy ‘limit’ order and enter a value of $1,350.19

- This order will only be opened when either platinum rises from $1,285.90 to $1,350.19 – or you manually close it

Stop-Loss Orders and Take-Profit Orders

If you are smart you can plan your entry and exit to and from the commodity market – thus shaking off some of the risk usually involved with trading. This brings us nicely onto ‘stop-loss’ and ‘take-profit’ orders.

Stop-Loss Orders

A stop-loss order allows you to stop your losses at a specific point on a commodity trade. As such it is advised that traders of all skillsets utilize a stop-loss order on each and every position.

To take advantage of a stop-loss order, simply decide on the maximum amount you are willing to lose on a trade and place your order accordingly.

See an example of a practical stop-loss order below:

- Let’s say, you want to go short on oil, but do not want to lose more than 3%

- As such, you need to place your stop-loss order 3% above the entry price

- In contrast, let’s say you want to go long on oil.

- In this case, place your stop-loss 3% below the entry price

Using an imaginary oil trade again, see a further example of a stop-loss order:

- You are trading oil which is priced at $35.50 per barrel and do not want to lose more than 3%

- If you think oil will see a price fall, so decide to go short – Your stop-loss order will need to be placed at $36.56 ($35.50 + 3%)

- If you think oil will see a price rise, so decide to go long – Your stop-loss order will need to be $34.43 ($35.50 – 3%)

Due to the automatic nature of stop-loss orders, you will not need to worry about perfectly timing the market and closing your commodity trade. Instead, the broker will close your commodity position when the aforementioned price point has been hit. This is going to save you from losing more than you can afford on any trade moving forward.

Take Profit-Orders

There is no need to go into too much detail on take-profit orders. The premise is much the same as stop-loss orders. Only instead of stopping your losses, you set the price at which your profits are locked in.

By this point you should have the following in place:

- A buy or sell order – depending on your prediction

- A market or limit order – depending on whether you want to set your own entry price

- A stop-loss order – set to the maximum amount you are willing to lose on the trade

This is where a take-profit order comes into play – as the order instructs the online broker of your profit target.

See a quick example:

- You are looking to make gains of 5% on your trade

- As such, you must place your take-profit order 5% above or below the entry price – depending on whether you are long or short

Ultimately, by having both stop-loss and take-profit orders in place, you are trading commodities in the most risk-averse way possible.

Part 3: Learn Commodities Risk-Management

It’s also important that when you are looking to learn how to trade commodities for the first time, you take risk management into account.

A crucial part of managing your risks is to try and be prepared for every eventuality. Although this isn’t easy, there are strategies you can use.

Percentage Based Commodities Bankroll Management

As a newbie, it can be easy to get carried away and throw everything you have into a ‘good feeling’. This can often lead to disaster. The fact is, even seasoned pros utilize systems such as percentage-based commodities bankroll management.

For instance, you may adopt the commonly used 2% approach. Meaning no matter whether you have $100, or $1 million in your trading account – you never stake more than 2% on any position. As such, if you have $2,000 – don’t stake more than $40 – and so forth.

This is a very simple yet effective approach that can be easily recalculated before any trading endeavor.

Trading Commodities via a Risk and Reward Ratio

The risk and reward strategy is handy for all levels of expertise. Put simply, think about how much risk you are willing to take in return for the profits you wish to make.

A popular strategy is 1:3, meaning for every $1 you risk, you hope to make at least $3. Both stop-loss and take-profit orders lend themselves well to this trading strategy.

Commodities Leverage

Leverage is usually displayed as a ratio or a multiple. For instance 1:2, 1:5, 1:10 might instead be shown as x2, x5, x10. The amount of leverage you can access via your online broker depends on which commodity you are trading, and where you live. Clients from some countries are not restricted and can access huge amounts of leverage.

Whereas commodities leverage is capped at 1:10 in the UK, Australia (from April 2021), and most of the EU – apart from gold which is capped at 1:20. This means that with an account balance of $100, you could potentially open a gold position worth $2,000.

Leverage can be a blessing or a curse – comparable to a loan it allows you to trade with more than you actually have. As such, it is great for boosting your stake, and therefore profits. Importantly, it will also magnify any losses incurred.

Part 4: Learn How to Analyze Commodity Prices

Having a firm grasp of commodities prices and how to analyze them is going to aid you in making informed decisions. In the next sections of our Learn How to Trade Commodities Guide, we explore two key areas of research that can help you achieve this goal.

Fundamental Analysis in Commodities

Fundamental analysis is a hugely important part of learning to trade commodities. This entails keeping up to date with global news events which might affect the price of the commodity you are invested in.

We talked about this earlier on, whereby various events can shift the supply and demand – which in turn causes the price of a commodity to fluctuate. You can carry out fundamental analysis in various ways, albeit, many people choose to subscribe to relevant trading news services for regular updates.

Technical Analysis in Commodities

Whilst fundamental analysis is important, technical analysis is vital for staying ahead of the commodities trading game. Performing technical analysis will see you studying a multitude of historic and current price charts as well as indicators, following different timeframes.

See some of the most commonly used indicators below:

- Relative Strength Index

- Moving Average

- MACD Indicator

- Aroon Indicator

- Stochastics Oscillator

- Average Directional Index

Commodities Signals

For those unaware, commodities signals offer a less time-consuming way to trade. In a nutshell, signals are like trading tips.

Let’s say you are looking to trade copper, but are new to the scene. To cut out the need to learn the ins and outs of in-depth analysis, you might want to try copper trading signals.

The signals sent to you will include:

- Whether to place a buy or sell order on copper

- What your limit order should be set at

- A take-profit order suggestion

- A stop-loss price

Whether you decide to action the trade is entirely up to you. If you like the sound of commodity signals, this is something that we offer here at Learn 2 Trade. You can find out more about our free signals service here.

Part5: Learn How to Choose a Good Commodities Broker

By now, you are no doubt feeling eager to get started on your trading endeavors. First, you need to find a good commodities broker to execute the aforementioned orders for you – as well as provide access to your desired market.

See below the most important metrics to consider before signing up.

Regulation

Regulation is extremely important when it comes to sorting the wheat from the chaff. At the end of the day, the regulatory bodies of the world were created to keep the online trading space clean, and free from shady companies.

The most well respected regulatory authorities in the commodity trading scene include :

- FCA (United Kingdom)

- ASIC (Australia)

- CySEC (Cyprus)

- FINRA (US)

There are other notable regulatory bodies. However, most online brokers seek regulation from one of the above. All regulated brokers must adhere to strict rules on regular audits, client fund segregation, KYC, fee transparency, customer care, and more.

Fees and Commissions

Whilst this might seem like a no-brainer – never sign up with a trading platform without first checking out the fee table. For example, some brokers charge a fixed fee for every trade, whilst others charge a variable fee.

Let’s show you a quick example of how a variable commission fee might affect your trade:

- In this scenario, your broker charges 0.3% for each trade

- If your leverage commodity trade is valued at $5,000 – you have to pay $15 in commission (5,000 * 0.3%)

- If the same trade was worth $12,000 at the time of closing – you would be liable for another payment, this time $36 (12,000 * 0.3%)

Had you instead elected to trade commodities via one of our recommended commission-free brokers, you would have saved $51.

Yet to make your mind up about which broker will be right for your commodity trading goals? I fos, we review the best 5 brokers to trade commodities with further down in this guide.

Spreads

Almost all trades will come with a spread, which is an indirect broker fee to ensure the company turns a profit to keep the wheels turning. The spread is the gap between the buy price and the sell price of the commodity in the question.

Put simply:

- The ‘buy’ price illustrates how much the market is prepared to buy the commodity for

- The ‘sell’ price illustrates how much the market is willing to sell the commodity in question for

- If the buy price is $15,225 and the sell price is $15,222 – the spread is 3 pips

- If you see a bid price of $53.20 and an ask price of $53.21 – the spread is 1 cent

If your spread is 3 pips, like in our first example, you will need to make 3 pips to break even – anything over that is profit.

Payments

Each online broker will differ when it comes to compatible payment types. Our guide found that some trading platforms will only allow clients to deposit using bank transfer – which can delay your commodity trading endeavors by days.

The best commodity brokers accept a plethora of payment methods, including credit/debit cards and e-wallets. eToro accepts the fastest and most convenient deposit types, from Mastercard and Visa to PayPal and Skrill, and heaps in between.

Best Brokers to Trade Commodities Online

We have covered everything from the bare basics to strategies, to help you learn how to trade commodities. We also discussed important factors to bear in mind when searching for the best broker yourself.

With that in mind, we have saved you hours of online research by reviewing our best 5 brokers to trade commodities in 2023!

1. AvaTrade – Commodity CFDs and Lots of Techincal Analysis Tools

AvaTrade has been operating for over a decade and is very well respected by regulatory bodies and traders alike. Commodity CFDs include oil, gold, copper, silver, platinum, and natural gas. You can also choose agricultural commodities such as soybean, corn, cocoa, orange juice (via MT5), sugar, and more.

When it comes to regulation, AvaTrade excels. The online broker is bound by stringent requirements from heaps of jurisdictions. This includes Australia, UAE, British Virgin Islands, South Africa, and Japan. If you are interested in trading away from home, you can download the free app - 'AvaTrade GO'.

Here you can deposit funds into your account, and buy and sell while on the move. You can also access the plethora of helpful trading tools, available such as social trends, live feeds, and more advanced analysis features. Clients can also manage various MT4/5 accounts and easily switch between fixed spread, demo, and real accounts with ease.

For sociable traders or investors out there, AvaTrade works well in conjunction with Zulutrade. Such third-party social trading platforms enable clients to share and copy commodity trading strategies and connect to your trading account.

It's simple to open an account at AvaTrade. The minimum deposit is just $100. In terms of payment methods, the platform accepts credit and debit cards, Skrill, Western Union, Wire Transfer, and more (location dependant). Notably, if you are from Australia or the UK, you will not be able to fund your trading account using an e-wallet.

- Minimum deposit only $100 to trade commodities

- Regulated in heaps of countries such as the UK, Australia and South Africa

- Hundreds of tradable assets with 0% commission

- Admin fee pricey after 12 months inactivity

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Part 6: Learn How to Trade Commodities Today – Walkthrough

Hopefully, by now you have a crystal clear understanding of what it takes to learn how to trade commodities.

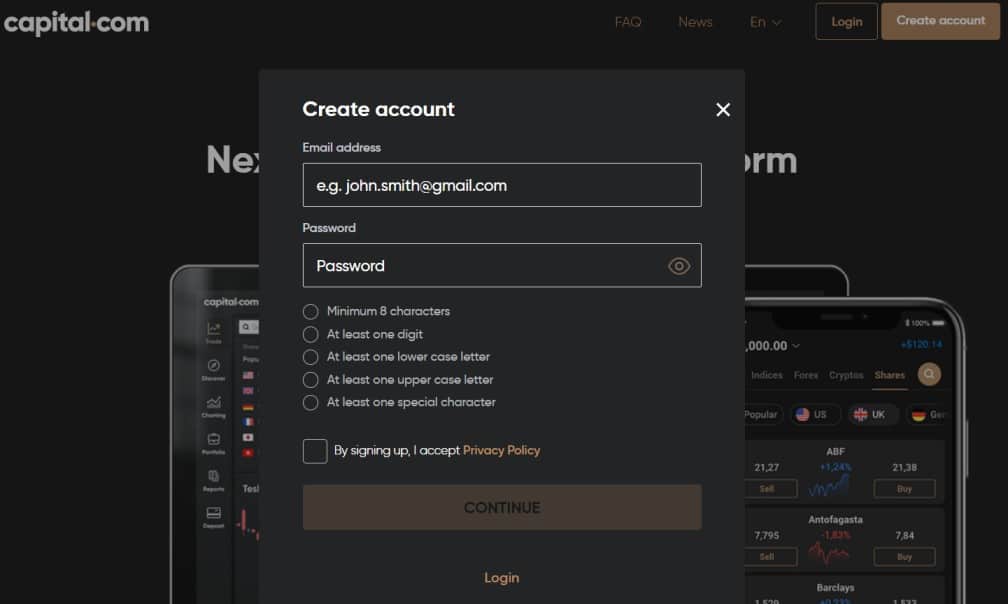

Particularly for those who have never traded before, we have included a simple walkthrough of how to sign up. For this step-by-step, we are using newbie-friendly Capital.com – where you can sign up in less than 10 minutes, and in 4 easy steps.

Step 1: Open an Account & Upload ID

To get things started, you will need to head straight over to the official Capital.com website and hit ‘Create account’.

Next, a simple sign-up form will appear. Simply enter your name, address, and email address, etc as instructed. As per KYC, you will also need to upload a clear copy of your government-issued photo identification.

When it comes to proof of address, the platform accepts a recent utility bill or bank statement. Thanks to the automated ID validation used at this popular brokerage, the process usually takes minutes from start to finish.

If you are in a hurry, you can upload your photo ID later. Take note, this must be done before you either elect to withdraw funds or deposit a sum of $2,225 or more.

Step 2: Deposit Some Trading Funds

Now that you have successfully opened your new trading account, you can proceed with the next step. It goes without saying that before you can fully learn how to trade commodities, you must first deposit some funds.

Funding your account is quick and simple at Capital.com, and the trading platform accepts heaps of payment methods. The minimum deposit is just $200.

Step 3: Search for a Commodity to Trade

If you are already sure of which commodity you wish to trade, you can utilize the search facility and find it with ease at Capital.com.

For those of you who are yet to decide, we recommend clicking ‘Trade Markets’ on the left-hand side of your account screen. This will reveal all available asset classes at Capital.com.

As such, you can click ‘commodities’, which will reveal a list of everything that’s available. As you can see from the above, this includes both hard and soft commodities.

Step 4: Start Trading Commodities

Once you have decided on which commodity you want to trade, you can select ‘Trade’ next to the respective asset.

At this point, an order box will appear. In our example, we are looking to trade copper.

You will need to enter:

- buy or sell order

- market or limit order

- stop-loss and a take-profit order

When you are happy with your choices click ‘Open Trade’. The broker will now execute your order – as and when instructed.

If you need a quick refresher, feel free to scroll up to ‘Part 2’ of our guide, where we discuss commodity trading orders in great detail.

Learn How to Trade Commodities – The Verdict

By this point in our Learn How to Trade Commodities Guide, you are hopefully clued up on everything you need to know. It’s important to be mindful of risk management tactics such as utilizing stop-loss orders on every trade.

You can also incorporate A percentage-based bankroll management system. Additionally, one of the most important metrics when finding a good commodity broker is regulation.

Such brokers are trustworthy and follow very strict rules – for your protection. If you are a complete novice, why not utilize free demo accounts or trading signals to learn the ropes or strategize?

Either way, Capital.com is regulated, offers heaps of commission-free commodities to trade from the comfort of your home, and you can even benefit from an automated trading tool!

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

FAQs

Is commodities trading good for beginners?

What's the best way to learn the commodities market?

What is the best broker to trade commodities?

How much money can I make from commodity trading?

What is the minimum trade size for commodities?