The chances are you’ve heard of the Financial Conduct Authority (FCA). But, just in case you haven’t, the FCA is an independent body which actively regulates around 60,000 UK brokerage firms.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Without the FCA, we wouldn’t have this blanket of protection from identity theft, money laundering and terrorist financing. By only using FCA regulated brokers, you are safeguarding not only your money but also your personal information.

Today we are going to divulge the very best FCA regulated brokers in the UK trading scene. To rate our top broker firms, we look at how user-friendly the platform is and what kind of financial instruments the site has to offer. In addition to that, we are going to explore important metrics such as company reputation, applicable fees and asset diversity.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What is the FCA?

The FCA first launched on April 1st 2013, so you could be forgiven for thinking it’s a fairly new operation. However, the truth is that FCAs antecedent the Financial Services Authority (FSA) was the UK’s principal regulator in the financial field for many years.

That is until the FSA was split into two separate authorities; the FCA and Prudential Regulation Authority (PRA). The latter is the body in charge of supervising and regulating credit unions, banks, insurers and building societies etc.

The FCA is a public body which is now wholly tasked with monitoring financial conduct within the UK. In the run-up to the FSA being fractionated, the Financial Services and Markets Act 2000 was amended. In turn, the Financial Services Act 2012 actioned some huge changes, especially when it comes to the way the financial sector is now regulated.

It’s believed that the major financial crisis across 2008 and 2009 played a big part in the revisiting of the financial space and how it was regulated and protected. The main goal of the FCA from the start has been to make the financial and trading industry a safer place to be. This means fair and transparent markets for everyone – no ifs or buts.

These days the markets and economy wouldn’t function the same without the FCA. The body not only strengthens the integrity of the financial markets and protects customers, but also promotes competition in the industry.

What Conditions do Brokers Need to Meet for FCA Approval?

The FCA does not make it easy for brokers, as obtaining a licence takes months and months of auditing and jumping through hoops to meet the body’s standards. In order for the broker to obtain an FCA licence, they must show that they can comply with the regulator’s rules and codes of practice. On top of that, they must operate fully within UK law.

Leverage Restrictions

It’s no secret that super high leverage can lead to debt if traders aren’t careful. In fact, if abused it can lead to big losses. In response to some online forex brokers offering insanely high leverage (for example 1:1000), the FCA introduced limits for retail clients. This simply means the ‘Average Joe’ investor that does not come from a professional or institutional trading background.

For example, CDF trading brokers are limited to offering leverage of between 1:2 and 1:30. Let’s say the trader’s position drops to under 50% of the amount needed to keep their position open (in terms of the CFD account). In this case, the brokerage firm has to close the customer’s position straight away.

Anti-Money Laundering (AML)

No matter where the trader is registering for an account, all FCA brokers need to be able to identify every single investor that signs up to the platform. This is the reason that you cannot sign up to a regulated brokerage without providing various forms of identification.

The objective of an AML policy is to recognise and pass on any suspicious financial activity. This includes terrorist financing, money laundering, securities manipulation and market fraud. Brokers are legally required to adhere to risk-based policies and individual customer spot-checking.

With the view of looking after the needs of clients, they must also show an understanding of customer care and the importance of evolving a ‘customer risk profile’. Each and every FCA broker must observe and identify any suspicious proceedings and hand that information over to the body.

Yearly Audit

We’ve said that brokers need to jump through hoops for the approval of the FCA – and so one of the many things required is the annual audit.

The brokerage in question must notify the FCA of all assets and capital it holds. As per the ‘Companies Act’ legislation, the platform must hire a statutory auditor to carry out an annual report of this nature. CASS asset audit reports are also required to be submitted to the FCA.

The regulatory landscape has changed significantly over the last decade, and brokers are now more accountable than ever for their compliance of the law. Once again, this is only good news for you as a trader!

Risk Disclosure

FCA regulated brokers must fully disclose all fees payable clearly and transparently. This includes an ‘information notice’ detailing how and when the fees will be payable to the brokerage – especially when it comes to CFD assets.

Next, we have ‘customer confirmation’. This is a form to be filled out by clients to confirm that they have been told and understand the formerly mentioned ‘information notice’.

Due Diligence

Strong due diligence is vital for FCA regulated brokers. This includes background checks on third-party companies and looking into the company’s compliance framework. FCA regulated brokers are constantly under consideration, and all financial records must be examined by the body.

Let’s say for example that a client seems to be investing unusually hefty amounts of money. In this case, and without exception, the broker is legally required to generate out an enhanced due diligence report. Each and every FCA broker is then obliged to obtain proof of where the funds were sourced.

Bank Account Segregation

Any brokerage firm must legally segregate customer funds from any accounts in the company’s name. This rule in place to safeguard your money in the event of any illegal activity, or the brokerage going out of business.

What Protections do FCA Offer?

As we’ve covered, the FCA offers multi-layer protection to the trading community and regulates online brokers with an iron fist. Each and every FCA trading platform has to meet the financial market standards set in place by this body and can expect to be frequently audited and assessed.

Due to Fund Protection, your money will be protected up to £85,000 by the ‘Financial Services Compensation Scheme’ (FSCS). Additionally, all customer assets will be taken care of by segregated fund protection. This measure keeps your capital safe from any wrongdoing from the broker platform, as well as any company debt associated with that platform.

‘Segregated funds’ is sometimes taken care of by an intermediate broker, who will be responsible for returning your money to you in the event of the broker platform going out of business.

What Assets do FCA Regulated Brokers Allow you to Trade?

Some FCA regulated brokers might just concentrate on a select number of assets, whereas others offer everything. We’ve assembled a list of the most traded assets available.

Share Dealing and Stocks

In a nutshell, share dealing is a way for you to purchase and sell shares in companies, both in the UK and internationally. The bid/ask spread in dealing stocks is the contrast between what the person buying is prepared to pay, and what the person selling is willing to accept to sell.

Via this market, you are able to invest in publically-listed companies, as well as being able to sell shares via the London Stock Exchange (LSE) and Alternative Investment Market (AIM). You don’t have to buy just 1 share in HSBC or AstraZeneca, for example, as you can sometimes buy fractions.

There are a few types of FCA share dealing brokers commonly seen in the space.

- Advisory brokers: This kind of shares dealing broker gives you advice on what shares will likely be good to buy or sell. Whether you decide to buy or sell will be up to you.

- Discretionary brokers: For traders who like to take a backseat, a discretionary broker is useful. This broker takes total control of buying and selling decisions so that you don’t have to. Be aware of share dealing fees associated with this type of broker.

- Execution brokers: This broker simply executes orders based on your instruction, and doesn’t interfere at all.

The London Stock Exchange helps FCA regulated brokers with harmonized bid and ask prices. The latter will always be higher than the bid cost, and the difference creates the ‘spread’. This is an indirect fee than FCA regulated brokers charge in return for giving you access to your desired market.

Contract for Difference (CFDs)

This kind of trading enables you to predict the price shifts of multiple instruments such as stocks, currencies, commodities and indices. If you think that the market price is going to go up you can ‘buy’ or ‘go long’. If on the other hand, you believe that the market will drop, you can ‘sell’ or ‘go short’.

With CFDs, traders do not have to own the underlying asset. On the contrary, a CFD enables you to follow the asset price of a company, and in real-time. Consequently, you are able to make gains from fluctuating prices by going ‘short’ or ‘long’, and often without having to pay any commission. CFDs allow also traders to access leveraged facilities.

As an example of CFDs:

- Let’s that that Amazon is priced at $3,001 on the NASDAQ.

- You stale £500 on a buy order – meaning you think Amazon stocks will increase.

- A days later, the price of Amazon stock is 10% higher on the NASDAQ.

- This means that the value of your £500 CFD has also increased by 10%.

- You close the position, making a £50 profit along the way.

Crucially, you were able to trade and profit from Amazon stocks via CFDs – meaning that you were not required to take ownership.

Indices

As a trader, you need to correctly predict the price shifts of indices, so that you can make a profit. You can either trade several indices or concentrate on a single index. You cannot purchase an index as you can with stocks. Indices are the indicators of the combined movement of several assets.

Commodities

This market runs 24/7, so is considered highly flexible for traders who might not have the time to trade on stock exchanges. There are some highly successful investors who solely trade with commodities. In this market, there are ‘hard commodities’ and ‘soft commodities’.

‘Soft’ commodities include:

- Corn, Cotton, Canola, Barley, Oats, Rice.

- Sugar, Cocoa, Coffee, Orange Juice.

- Soybeans.

- Wool, Rubber.

- Live Cattle, Pork Bellies.

The following commodities are considered ‘hard’ commodities:

- Gold, Copper, Silver, Aluminum.

- Crude Oil, Natural Gas, Heating, Unleaded Gasoline.

- Lead, Nickel, Platinum, Palladium, Tin, Zinc.

Before trading with this particular type of asset it is important to have a grasp of how the real-life market works. Trading with commodities can expand your portfolio and reduce your risks.

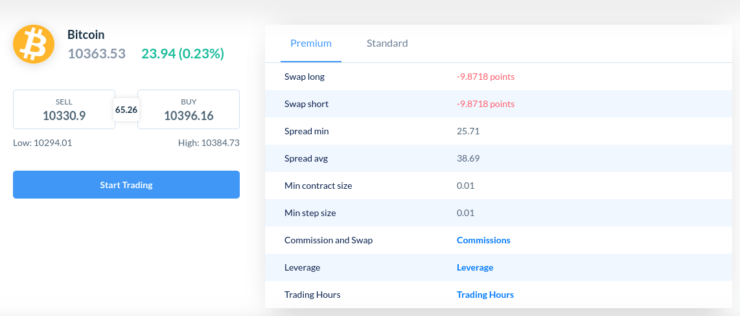

Cryptocurrencies

There are very few people who haven’t heard of cryptocurrencies. To trade a cryptocurrency, traders must predict the rise or fall of the currency price. All without needing to ‘own’ underlying currencies. If the case is that you do want to own the underlying coins, you will need to trade via a an FCA regulated CFD broker.

- Litecoin.

- Bitcoin Cash.

- Ether.

- Ripple.

- Stellar.

- NEO.

- EOS.

It’s a good idea to have a go at buying and selling cryptocurrencies on an FCA broker demo account. In doing so, you can test out trading strategies is a 100% risk-free environment.

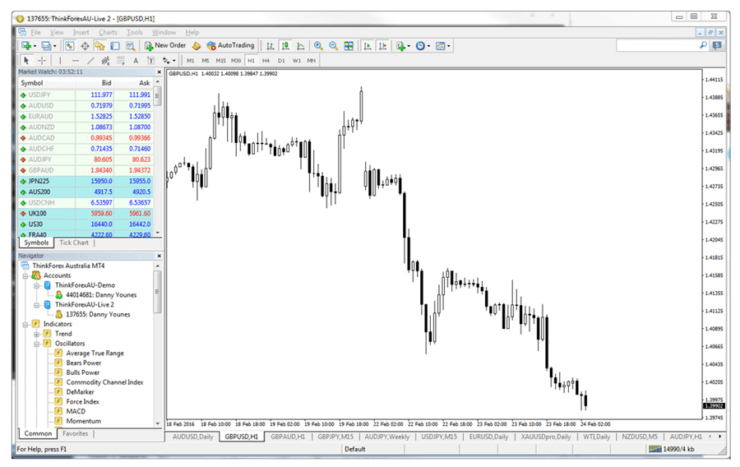

Forex

When a trader wants to trade foreign currencies, they turn to an FCA forex broker to place an order. This enables you to sell or buy currency pairs such as GBP/USD. The traditional forex market space runs 24 hours a day and 5 days per week. However, some FCE regulated brokers allow you to trade over the weekend, too. This is known as ‘out of hours trading’.

Forex pairs fall into 3 categories; majors, minors, and exotics.

- Major pairs are the most liquid and in demand, such as EUR/USD, GBP/USD, AUD/USD – to name a few. These pairs have low spreads and can be traded the majority of the time.

- When it comes to minors, they are often called cross-currency pairs and never include the US Dollar. Examples include GBP/JPY, EUR/GBP, CHF/JPY.

- Exotic pairs often come with a higher spread. This is because they are not traded as often. Exotic pairs include EUR/TRY, USD/HKD, GBP/ZAR.

It’s good to choose a platform with a variety of educational material, as well as informative price charts and market research. If you are a beginner when it comes to the forex market then eToro is a great platform to consider.

How to Find the Best FCA Brokers?

First and foremost you should make sure your broker is fully regulated and legitimate. As we have made very clear, finding an FCA regulated broker is extremely important as the body is there to protect you as an investor.

By only committing to a platform operating within UK law, you’re creating a safety net in a space occupied by many fraudulent companies. In light of this, we have compiled a list of considerations when searching for the best FCA related brokers in 2023.

Asset Diversity

Before taking the plunge, it’s important to know what assets will be on offer to you. After all, you might just want to trade in forex right now, but later down the line, you might decide to diversify across other assets.

If it’s forex you’re interested in trading then it’s crucial you explore the site’s currency offerings. For example, some brokers focus on just a few pairs, whereas others might offer the full month – such as majors, minors and exotics.

For this reason, it’s good to find an FCA regulated broker which offers a range of asset classes. This way, you have all of your brokerage needs under one roof. Should you want to add to your portfolio later, this saves you going through the process of finding another broker platform.

Commission and Fees

Each and every broker is different when it comes to fees. There are platforms who don’t charge traders a commission fee at all. Then there are others who charge a fixed percentage on each and every trade.

The likelihood is that with a reputable FCA broker, you will have to pay a trading commission. This will usually be a variable rate on each trade.

- For instance; let’s just say you are trading a currency pair.

- Your broker charges 0.2% in commissions.

- You stake £1,000 on GBP/USD.

- You would pay the broker firm £2 in fees for that trade.

The good news for you is that most of the FCA regulated brokers listed on this page allow you to trade without paying a single penny in commission. Instead, all fees are built into the spread!

Customer Support

Often overlooked, but still really important – customer support is a big part of selecting the right broker for you. The keyword here being support. Ideally, you want a broker platform which offers support to its clients 24 hours a day, and 7 days a week. At your time of need, you want to know that your broker is going to be there to assist you.

The best FCA regulated brokers offer multiple customer support options such as live chat, email, telephone and a contact form. Having a broker who also occupies social media is a great way to see the latest news, as well as communicate with other traders.

Deposit and Withdrawal Process

First of all, if you have a particular payment method you wish to use, you should investigate what your options are on the platform before going any further.

When it comes to processing times – ideally you want a broker who can process your deposit instantly.. Of course, this does depend on the individual brokerage, and also the payment method you choose. If you want to deposit and begin trading immediately then options like e-wallets and debit/credit cards are often the quickest to process.

Spreads

The ‘spread’ is another important metric to consider when choosing a broker. This is the difference between the selling price and the buying price of an asset (the number of pips).

The spread makes a difference in how much profit you stand to make. For example, if the spread of the EUR/USD was 4 pips, your investment would have to increase by at least 4 pips for you to break even.

Educational and Trading Tools

There are a handful of trading tools which are considered priceless for traders of any calibre. These features can assist you in analysing the markets.

As such, we’ve put together a quick list of the most commonly seen educational and trading tools seen at FCA regulated brokers.

- Live and Historical Data: Generally speaking, this feature tells traders about any price changes in the markets. It’s also an important factor when performing backtesting, technical analysis and investment strategies.

- Charts and Indicators: Market sentiment is often illustrated via technical indicators and charts.

- Automated Trading: This isn’t every trader’s cup of tea, but some brokers support automated trading systems, for instance, an expert advisor.

- Order Execution Protocol: The best broker sites will execute your order within seconds, even milliseconds. This depends on the kind of trading strategy used (i.e. automated) and price sensitivity.

Technical Indicators

The technical indicators featured on most good quality broker platforms include:

- Relative Strength Index (RSI).

- Parabolic Stop and Reverse (SAR).

- Bollinger Bands.

- Moving Average Convergence Divergence (MACD).

- Stochastic.

- Ichimoku Kinko Hyo (AKA Ichimoku Cloud).

- Average Directional Index (ADX).

Independent Trading Platform Compatibility

Third-party trading platforms are used by investors to manage and visualise their portfolios, and to place trades with more than one broker at a time. If you have an interest in using an independent platform, you should always check which platforms your broker supports, if any.

Accounts Offered

Whether you are experienced and have a specific trading plan in mind, or are new and open to options – make a point of learning which accounts are available.

Some online FCA regulated brokers offer a variety of different account options such as nano (0.001), micro (0.01), mini (0.10), and standard (1.00) accounts. Although if you are interested in micro accounts, for instance, a lot of brokers don’t actually advertise these accounts but will support you in trading such small amounts.

For followers of the Islamic faith, some FCA regulated brokers offer Islamic Accounts. These accounts have been adapted to follow Sharia Law, in which paying or receiving interest is strictly forbidden. As a result, investors using an Islamic Account do not pay interest rates at all. If you require this type of account then it is worth asking the FCA broker in question to see whether they can accommodate your account needs.

Get Started With an FCA Regulated Broker Today

Now you know everything there is to know about FCA regulated brokers, you should be ready to get started. If, however, you still haven’t found an FCA broker you feel confident in, then not to worry. You can check out our recommended FCA regulated brokers further down on this page.

For those of you who are ready to start trading, please review our 5 step sign up guide below. This will help you begin trading via an FCA broker today.

Step 1: Sign up for an Account

First, you need to go to the website of your chosen FCA approved broker. Next, you will need to find the ‘sign up’ page and enter your email address and a unique password to sign up for your new account.

Step 2: Verify Your Identity

Before you can move forward any further, your brokerage of choice is going to need to confirm your identity. As per KYC (know your customer/client) regulations – FCA brokers are legally required to request information about you. This includes your financial situation, your trading history/knowledge, your tolerance of risk and of course, your identity.

As such you will need to provide a copy of your passport or driving licence, as well as an official utility bill from the last 3 months (to further prove who you are). You will also need to enter your national insurance number and enter your monthly incomings and a little bit about who you are as a trader.

Step 3: Make a Deposit

As soon as your identity has been confirmed (usually instant) and the broker has emailed you your registration details, you can go back to the platform and make a deposit.

Payment methods can include:

- Bank wire transfer.

- Debit/Credit card.

- E-wallet such as Skrill, PayPal and Neteller.

Each broker platform is different, so you will need to check the payment options available. It’s also a good idea to consider what impact your payment method will have on the time it takes to reach your trading account. For example, bank wire transfers are notoriously one of the slower payment methods. Always check the fee table of any brokerage before committing to an account.

Step 4: Start Trading

It is strongly advised to begin with a demo account, as this enables you to get a good feel of the platform before you start spending your own money.

Instead, you will be given ‘paper funds’ to trade with, in real market conditions. Even for experienced traders, using a demo account facility is a great way to try out different strategies. For newbies, this will allow you to get used to tracking price movements and performing technical analysis.

What is the best FCA Regulated Broker of 2023?

We’ve covered metrics to look out for, and assets to trade – so by now, you should be armed with everything you need to know. In terms of finding the best platform your trading goals – below you will find a selection of our top-rated FCA regulated brokers.

Etoro.com - Zero Commission Payable

If you happen to be a beginner when it comes to trading, Etoro.com could be the broker you're looking for. You can get started with as little as 50 USD and can even trade with tiny stakes (think mini and micro-lots). This platform doesn't charge any commission and offers really low spreads on CFDs.

Etoro.com provides access to various stock markets like the LSE, NASDAQ, NYSE, TSE, and SSE. This FCA broker offers leverage as per ESMA caps and accepts bank wire transfer, debit/credit cards and e-wallets such as Skrill, NETELLER, Klarna and PayPal.

- Minimum Deposit just 50 USD

- Tight spreads and zero commissions

- Good for beginners

- All eToro trading accounts are in USD

To Conclude

There are heaps of online broker companies offering trading services, so knowing who to trust can be a nightmare. With this in mind, choosing an FCA regulated broker is a no brainer. The level of protection that such platforms offer gives traders a safety net against poor broker practice and ensures your money is protected.

As a result, you should check out or best FCA regulated brokers listed above. If you decide to sign up with a broker not listed on this page, it’s always important to do your own homework. This should include the platform’s liquidity, commission rate, spreads and deposit/withdrawal fees.

If you are only planning on trading with small amounts, then choosing a broker with high flat fees won’t be worth it for you in the long run. Another sterling piece of advice is to make the most of demo accounts. They truly are invaluable when it comes to getting used to a platform and ultimately – in learning how to become a better trader.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card

FAQs

Can I deposit my FCA broker account using a cheque?

Will I need to provide ID to an FCA broker

What happens if my FCA broker goes into liquidation?

How much leverage can I use with an FCA broker?

What is an FCA broker?

Read more related Articles:

Forex Trading for Beginners: How to Trade Forex and Find the Best Platform 2024