Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

In terms of decentralized crypto products, Ethereum is one of the most actively invested in – globally. Unlike the proof-of-work mechanism used by Bitcoin, this network recently proof-of-stake – making it even more desirable. If you want to know how to buy Ethereum from the comfort of your homestay right where you are.

Our Crypto Signals

1-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

12-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime Subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioToday, we delve into everything you need to be aware of when investing in this flexible crypto asset. Taking into account different ways to purchase Ethereum, investment strategies, and how to find a trusted broker.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

How to Buy Ethereum in 10 Minutes – Quickfire Guide

Before you can buy Ethereum, you will need to join a brokerage that can facilitate your purchase. In other words, one that can offer access to the market in question.

- Step 1: Head over to a creditable cryptocurrency broker – capital.com.

- holds licenses from 3 jurisdictions and you can buy Ethereum without paying any commission.

- Step 2: Select ‘Join Now’ to open an account – enter the details needed as per the sign-up box on your screen.

- Step 3: As proof of identity, upload a clear copy of your photo ID – such as a passport or driving license. You will also need to send proof of address such as a utility bill or bank statement.

- Step 4: To fund your new account, enter the amount you wish to deposit and select from the many payment methods available at Capital.com. Once satisfied – ‘Confirm’.

- Step 5: Search for Ethereum and click ‘Trade’. Now you can create a ‘buy’ order and enter the amount you wish to purchase.

You have just made your first commission-free Ethereum investment at Capital.com!

Select a Trusted Ethereum Broker

As noted above, you will need a broker to buy Ethereum. To save you hours of in-depth research, we have narrowed the best Ethereum platforms down to five.

1. AvaTrade – Ethereum Platform With Heaps of Techincal Analysis Tools

AvaTrade offers access to heaps of CFDs, covering Ethereum and other cryptocurrencies, indices, ETFs, commodities, bonds, and stocks. All can be traded on a commission-free basis. When it comes to the technical analysis tools - there is an abundance at AvaTrade. This is made up of multiple strategies, tutorials, indicators, asset-specific lessons, economic calculators, and AvaProtect.

If you are interested in using a free demo facility whilst learning how to trade Ethereum, AvaTrade offers one with a balance of $10,000 in paper funds. If, however, you would like to start trading using real money from the offset, the minimum deposit is $100. Furthermore, if you are an MT4 user you can connect your AvaTrade account quite easily.

Alternatively, if you would rather not download any software, you can stick with the proprietary platform. This includes a good selection of trading tools. If you would like to be sociable when trading Ethereum, you could check out the AvaSocial app. This feature is great for gaining market insight from experts and fellow investors - as well as giving you the option to automate your trades.

AvaTrade serves over 100 countries and is regulated by several jurisdictions such as the UEA, South Africa, and the EU. As such, you can expect a transparent and fair service. Furthermore, there are plenty of payment types accepted. This includes wire transfers, major credit cards, and e-wallets like Qiwi, Neteller, Skrill, and Boleto.

- Minimum deposit only $100

- Regulated in heaps of places including Japan, EU, and South Africa

- Access Ethereum CFDs whilst paying 0% commission

- Admin fee pricy after 12 months of not trading

2. LonghornFX – Top-Rated ECN Broker With High Leverage

LonghornFX is a user-friendly trading platform that covers dozens of cryptocurrency and forex pairs. You can also trade stock CFDs and multiple indices. You will be able to trade with leverage of up to 1:500 at LonghornFX - irrespective of whether you are a retail or professional client.

In terms of fees, you will benefit from competitive variable spreads throughout the trading day. After all, LonghornFX is an ECN broker - so you will get the tightest buy/sell prices available in the industry. Commissions will vary depending on the asset but typically amount to $7 per $100,000 traded.

We like the fact that LonghornFX processes withdrawal requests on a same-day basis. Plus, the broker offers full support for MT4. The platform can be accessed online, via desktop software, or through a mobile app.

- ECN broker with super tight-spreads

- High leverage of 1:500

- Same-day withdrawals

- Platform prefers BTC deposits

2. EightCap – Trade Over 500+ Assets Commission-Free

Eightcap is a popular MT4 and MT5 broker that is authorized and regulated by ASIC and the SCB. You will find over 500+ highly liquid markets on this platform - all of which are offered via CFDs. This means that you will have access to leverage alongside short-selling capabilities.

Supported markets include forex, commodities, indices, shares, and cryptocurrencies. Not only does Eightcap offer low spreads, but 0% commissions on standard accounts. If you open a raw account, then you can trade from 0.0 pips. The minimum deposit here is just $100 and you can choose to fund your account with a debit or credit card, e-wallet, or bank wire.

- ASIC regulated broker

- Trade over 500+ assets commission-free

- Very tight spreads

- Leverage limits depend on your location

Consider Your Ethereum Strategy

Before you can properly learn how to buy Ethereum, you will need to think about what strategy you might adopt.

Take a look at the two most common ways to buy and sell Ethereum below.

Buy and Hold Ethereum

A popular way to access the Ethereum markets is by utilizing a buy-and-hold strategy. Subsequently, this will see you purchasing ETF and holding on to the digital coins for months or years at a time.

In terms of accessing Ethereum to purchase, there are different avenues you can take. For instance, you could buy Ethereum via a cryptocurrency exchange. Although it has to be said that these spaces are often free from regulation. For security reasons, the best option is to buy crypto assets via a licensed brokerage.

See a quick example below:

- Ethereum is priced at $1,770 but you think it is undervalued.

- As such, you place a $1,000 buy order.

- 11 months pass and you predicted correctly – Ethereum has risen by 26% to a value of $2,230.

- Pleased with your gains, you cash out your investment with a sell order.

- From your initial investment of $1,000, you made a profit of $260.

Crucially, when adopting this strategy, it’s also important to consider how you are going to store your coins. First, there is the option of looking after them yourself via a private crypto-wallet.

As you may already know, this means you are entirely responsible for keeping your coins safe from hackers. You must also trust yourself to look after the lengthy private key needed to access your Ethereum.

Alternatively, you can store your Ethereum at a top-rated brokerage like eToro. The platform is regulated and will allow you to safely store your coins at no extra charge. On top of that, there is no need to worry about accessing your Ethereum – as you can cash out your purchase very easily, and at any time.

Trade Ethereum

When considering how to buy Ethereum, there is also the option of short-term trading via CFDs (Contracts for Differences). For those unaware, CFDs enable you to hypothesize on the rise or fall in the value of the underlying asset – without having to own it.

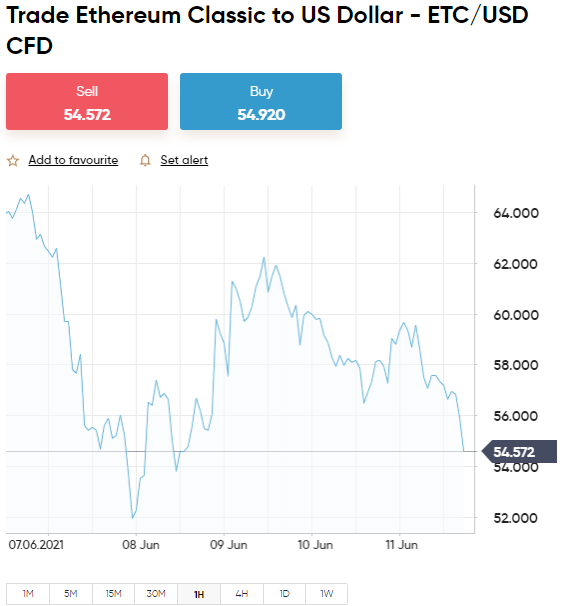

Trading Ethereum CFDs entails predicting the increase or decrease in the exchange rate of a pair. The two distinct categories of crypto-pairs you will see at online brokers are ‘crypto-fiat’ and ‘crypto-crypto’.

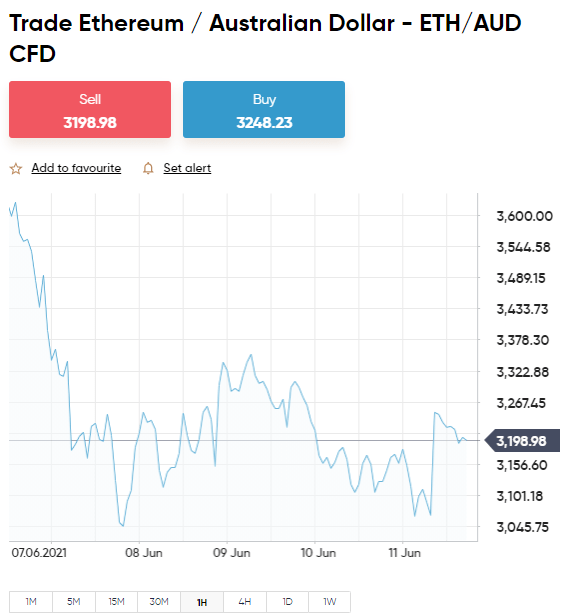

In case you don’t know, a crypto-fiat pair contains a digital currency and a government-printed one. Ethereum against US dollars is shown ETH/USD. It can also be paired with euros, UK pounds, Japanese yen, Australian dollars, and more.

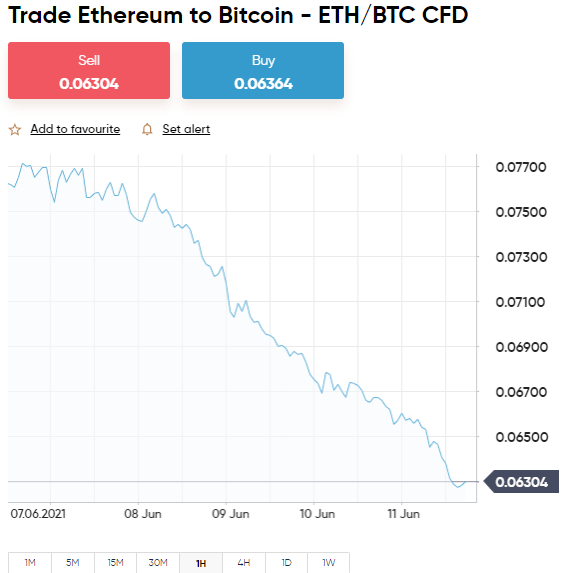

Trading crypto-crypto pairs will see you trading Ethereum with another cryptocurrency – such as Bitcoin. This would be displayed as ETH/BTC. Other popular crypto-crypto pairs are ETH/LTC (Litecoin) and ETH/XRP (Ripple). Crucially, no two brokers are the same, so if you are keen on a particular Ethereum pair, it’s important to make sure it is available at your chosen crypto platform.

One of the most appealing things about CFDs is that they enable you to go both long and short. Ergo, if you think Ethereum is heading for a nosedive in terms of price – you will be able to make gains from the downfall of its value.

See an example below:

- Ethereum against the Chinese yuan is priced at ¥11,685.

- As such, ETH/CNH CFDs are also valued at ¥11,685.

- After performing an analysis on the pair, you believe it is overvalued.

- Consequently, you place a $500 sell order.

- A week later ETH/CNH falls to ¥9,581 – which shows an 18% drop.

- Pleased with your profit of $90 ($500×18%) – you cash out with a buy order.

For clarification:

- You believed Ethereum would lose value, so you went short. This will be done by placing a sell order at your chosen brokerage.

- If, on the other hand, you think the crypto coins will rise in value, you need to go long by creating a buy order.

For those unaware, CFDs also enable you to apply leverage to Ethereum trades. Leverage is shown as a ratio or multiple such as 1:5 or 5x and enables you to boost your stake. In the case of 1:5, this magnifies your position 5-fold.

Some traders can get their hands on as much leverage as they like, others will be restricted. This is mainly dependent on where you live. In Europe, for example, leverage on crypto-assets is capped to 1:2. This means with $100, you could still potentially open a $200 position.

See our earlier ETH/CNH example, this time with leverage:

- Upon creating a $500 sell order on ETH/CNH – you apply 1:2 leverage.

- Your position is now worth $1,000.

- As such, when this pair falls by 18% – you make a $180 profit instead of $90 ($1,000*18%).

Notably, US and UK citizens will not be eligible for crypto CFDs – nor the leverage they invite. Equally as importantly, whilst leverage can clearly do wonders when the market goes your way – it can magnify your losses as well.

Where to Buy Ethereum

When considering how to buy Ethereum, the natural thought process takes us to where. As we’ve already said, you can buy crypto-assets at unregulated exchanges, or preferably via a trusted trading platform.

Buy Ethereum Debit Card

The vast majority of modern-day brokers will enable you to buy Ethereum using a debit card. With that said, it’s important to be aware that this may come at a charge, depending on the platform.

eToro is denominated in USD. As such, you will be charged a small exchange fee of 0.5% if not depositing funds in US dollars. In contrast, Coinbase charges a 3.99% fee on all debit card transactions. Binance on the other hand charges somewhere in the range of 3% to 4%, depending on your location.

Buy Ethereum Credit Card

Another option is to buy Ethereum using a credit card. Be aware that there are sometimes a few hurdles with this payment method. First of all, some credit card companies charge a cash advance fee in the region of 3-5%. Furthermore, you might find that your card issuer doesn’t allow cryptocurrency purchases.

At eToro – as long as you are depositing funds into your account using US dollars – you will not be charged a cent when buying and selling via credit card. If it’s a non-USD, then the fee is just 0.5%.

Buy Ethereum Paypal

Did you know you can also buy Ethereum with PayPal? With that said, our guide found that not many brokers accept this payment type.

However, at eToro, you can deposit and buy Ethereum using this popular e-wallet at the click of a button. Furthermore, the long-standing crypto trading platform AvaTrade will also enable you to deposit funds via PayPal. You can then trade Ethereum CFDs commission-free.

Ethereum ATMs

There are almost 20,000 crypto ATMs worldwide. Whilst some just offer Bitcoin – many allow you to buy Ethereum. To clarify, the regular cash machines we use to withdraw tangible money differ somewhat from Ethereum ATMs.

Specifically, rather than making a fiat withdrawal – you will insert government cash like US dollars or euros into the machine in order to buy cryptocurrencies. Next, you will select the amount you want to buy, put your money in the machine and digital coins will be added to your crypto wallet.

Notably, this should be one of the most expensive ways to buy Ethereum, largely due to the extortionate commission fees. Depending on the location of the ATM – this can be in excess of 10% of your crypto purchase.

Ethereum Strategies

Have you ever thought about what Ethereum techniques and strategies you might want to add to your framework? This might include dollar-cost averaging, or perhaps utilizing crypto signals to reduce the learning curve.

See below.

Dollar-Cost Averaging

One of the most popular and straightforward investment strategies to implement is dollar-cost averaging. To start, think about how much money you can or would like to dedicate to buying Ethereum. This could be worked out on a weekly, or monthly basis.

Buy the Dip

There is a saying amongst the investing/trading community – “don’t catch a falling knife”. This means that you should hold off until the price bottoms out.

However, this is not to be confused with ‘buying the dip’ – which will see you incorporate the dollar-cost averaging system when Ethereum is in the midst of a sharp price decline – and/or buy it when things have settled down.

See an example below:

- It comes to your attention that the value of Ethereum has fallen dramatically from $11,709 to $9,601.

- This represents an 18% decrease in price.

- As such you begin to buy Ethereum little and often as the price continues to fall.

As you can see, by buying the dip you will be in a better position to make gains – when the digital coins inevitably rise in value further down the line. Alternatively, some traders and investors prefer to hold off until the market has settled down.

Diversify

In terms of your investment portfolio, diversification is not only a way to boost your returns, but also hedge against market volatility. To further explain, you may start by looking to buy Ethereum only. However, this means you will be exposed to one single market for better or worse.

Alternatively, you can mitigate your risk by also incorporating other digital currencies such as Ripple, Bitcoin Cash, Polkadot, and such. With that said – one of the best ways to diversify your portfolio is by adding different assets entirely.

Thing along the lines of gold or stocks. These are popular options because they behave in a different way to digital currencies. By spreading your investments across different investment classes, if one asset in your basket isn’t doing too well, its poor performance will usually be counteracted by a well-performing asset.

Ethereum Trading Signals

Another useful strategy to incorporate is trading signals. As we eluded to, this saves you having to learn as much before you can start. It’s no secret that technical analysis plays a very important role in cryptocurrency trading, however, the problem is learning it can take such a long time.

More often than not this is done via the encrypted messaging app Telegram. Here at Learn 2 Trade, we offer free Ethereum trading signals, as well as a Premium service with a 30-day money-back guarantee.

How to Buy Ethereum Online – Full Walkthrough

By this point in our guide, you are likely feeling ready to start. If you have invested or traded before – this part will be instantly familiar.

For those who have no experience in the space – see a full walkthrough below of how to buy Ethereum today! We are using Capital.com in our example, as the regulated broker allows you to buy Ethereum commission-free and the minimum purchase is just $25.

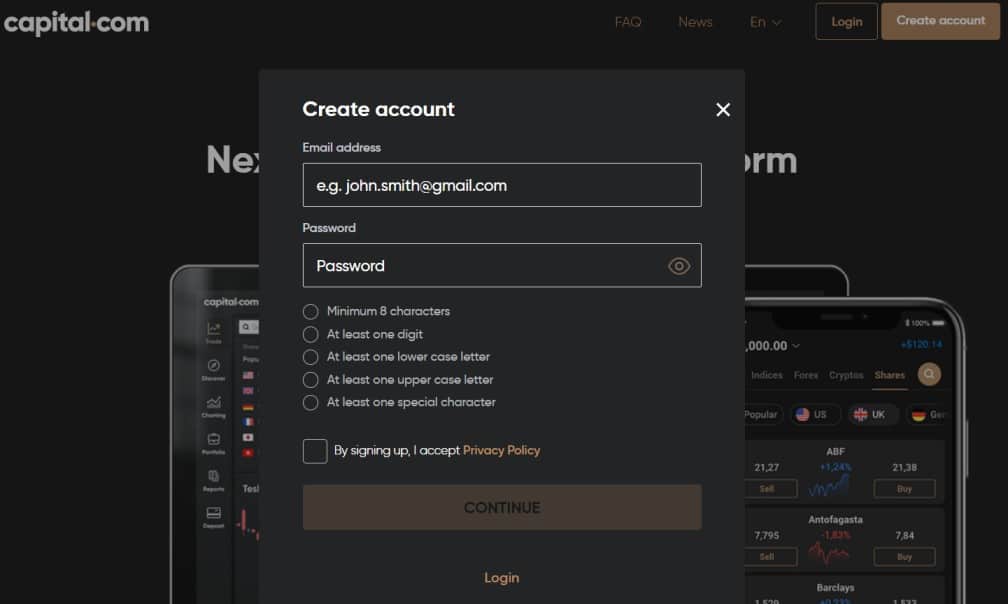

Step 1: Sign Up With an Ethereum Broker

Head over to the official capital.com website and click ‘Create account’.

Now you can fill in the sign-up box accordingly. As you can see this includes your name, email – and the usual KYC requirements.

Step 2: Upload Some Identification

You will also need to provide proof of identity. This can be your driving license, passport, or in some cases national ID card.

To demonstrate your address, the broker will accept a recent bank statement or utility bill. Note, you can complete this step at a later date. However, it must be before you either request a withdrawal or deposit a sum of $2,250 or more.

Step 3: Deposit Funds Into Your Account

Now it’s time to deposit some funds so that you can buy Ethereum.

Enter the amount you wish to purchase and select your preferred payment method. It’s also important to check through the info you have entered – before pressing ‘Deposit’.

Step 4: Buy Ethereum

Use the search bar function to find Ethereum, or click ‘Trade Markets’ and you will see it listed under ‘Crypto’.

Conclusion

It’s never been easier to buy Ethereum from the comfort of your own home. You might fancy investing directly, or trading via CFDs. With a respected broker on your side to execute orders and offer access to a range of assets – you will be off to the best start possible.

Think about what systems to incorporate in your strategy – which could include buying the dip, or dollar-cost averaging. Also, you could consider branching out by investing in other assets such as stocks, oil, or gold.

This is a great way to mitigate the risks involved when focusing on just one asset class. Finally, a word to the wise – always use a regulated broker to buy Ethereum. Capital.com is a great option here – as the platform allows you to invest in ETH commission-free and at a minimum stake of just $25!

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

FAQs

How much does it cost to buy Ethereum?

How much is Ethereum likely to be worth in 5 years?

Where is the best place to buy Ethereum?

How can I sell my Ethereum?

Can Ethereum make you rich?