The chances are you have landed on this page because you want to trade cryptocurrencies from the comfort of your abode. eToro is hugely popular for trading digital coins, and so a natural choice for many.

There are many benefits of trading via this social trading platform. For a start, the broker offers access to 16 cryptocurrencies – and you can trade on a completely commission-free basis. That’s right, zero trading fees.

Whether it’s a case of you having no experience of this particular online broker, or being a newbie to trading – this guide will teach you the ropes.

Not only do we explain the ins and outs of how to trade crypto on eToro, but we also explore which crypto-assets are available, potential fees to consider, leverage, and some invaluable strategies to utilize.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

Step 1: Open an Account at eToro

Before diving into the core principles of how to trade crypto on eToro, you need to begin the process of setting up an account. If you have already reached this point and have verified your account, you can skip ahead to Step 3 and proceed from there.

Nonetheless, one of the many benefits of trading digital currencies via eToro is that it usually takes a matter of minutes to have your ID verified.

To set the wheels in motion, head over to the eToro website to open a new account. You will need to provide the broker with some information about who you are, which is as follows:

- Full Name

- Home Address

- Nationality

- Date of Birth

- Email Address

- Mobile Number

- National Tax Number

Additionally, you will need to think of a username and safe password for your account. Within a few minutes, you will receive an SMS code from eToro – enter this when prompted. This will enable you to move forward to the next step.

As per KYC rules, you will now be asked to send a clear copy of your passport or driver’s license. Secondly, you need to send proof of the address you provided. This can be in the form of a utility bill or bank account statement.

As we said, eToro is usually able to verify your ID and set up your account within minutes. This is in stark contrast to some traditional brokers in the online space that can take days to manually check each document.

Step 2: Add Funds to Your Crypto Trading Account

Before you can learn the ins and outs of how to trade crypto on eToro, you will be required to go through the deposit procedure. The idea is that you want to make regular cryptocurrency trading profits, so having money in your account is imperative.

We should mention that eToro accounts, deposits, and withdrawals are facilitated in US dollars. Regardless, the good news is that the broker accepts clients from over 140 countries.

If you aren’t a trader from the US this won’t be a problem for you. The platform will charge you a small FX fee of 0.5%. Whilst this may be mildly irritating – consider that eToro charges no account management fees and is 100% commission-free.

When it comes to accepted deposit methods, eToro doesn’t disappoint. You will be able to select from the following payment types when funding your account:

- Maestro

- Visa

- MasterCard

- Neteller

- Paypal

- Skrill

- Bank Wire

If you are eager to get started with your cryptocurrency trading endeavors, then you are advised to opt for an e-wallet or credit/debit card. Wire transfers are one of the slowest ways to deposit, and can more often than not take days to process.

Step 3: Search for a Cryptocurrency to Trade

By this point, you have a verified and funded account. As such, you can start trading cryptocurrencies on eToro.

As you likely know, as well as buying cryptocurrencies such as Bitcoin, Ethereum, or Litecoin, these digital tokens can also be traded in pairs.

Such pairs fall into two categories. These are crypto-cross pairs and crypto-fiat pairs.

See below for a brief explanation of each, for those unaware.

Crypto-Cross Pairs

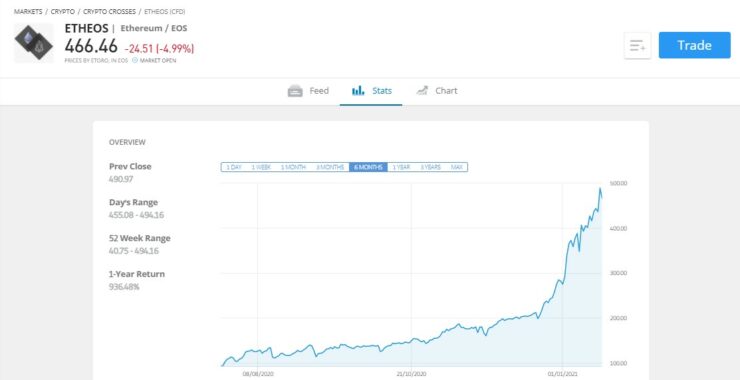

When seeking to trade crypto-cross pairs on eToro, you are trading two digital coins against each other. For instance, if you wanted to trade Ethereum against EOS – this would be shown as ETH/EOS.

- Let’s imagine you are trading Ethereum against EOS

- As we said, this crypto-cross pair is displayed as ETH/EOS

- eToro quotes the pair at $465.50 – meaning for every Ethereum coin you will get 465.50 EOS

- Your job as a cryptocurrency trader is to speculate on the rise or fall of this price

As you can see, the premise is simple – try to predict the rise or fall in the price of the crypto pair and place an order accordingly. If you predict correctly, you will make a profit. We discuss orders in detail later.

eToro has 16 crypto-cross pairs to choose from, these include:

- ETH/BTC

- BTC/XLM

- XRP/DASH

- EOS/XLM

- ETH/EOS

- ZEC/ZRP

- and more

Crypto-Fiat Pairs

A more popular way to trade digital currencies is to trade crypto-fiat pairs. For beginners who might not know, this involves trading a crypto-asset such as Bitcoin, against a fiat currency such as British pounds or Australian dollars. To be clear, ‘fiat’ money is a currency printed and approved by a government.

This type of pair is suitable for newbies, as it’s much easier to try and predict which way the markets will go.

With that said, the idea is much the same as with crypto-cross pairs, as you need to predict the increase or decrease in the value of the pair and place an order with eToro.

Crypto-fiat pairs tend to invite much tighter spreads – and best of all, eToro has dozens of pairs to choose from. See below a list of available crypto-fiat pairs to give you an idea of what to expect.

- BTC/USD

- ETH/GBP

- XRP/GBP

- BTC/JPY

- EOS/ GBP

- ETH/CAD

- XRP/AUD

- and more

If you know what pair you want to trade already, simply type it into the search box on eToro and click ‘Trade’.

Here we are searching for Bitcoin aginst the Euro (BTC/EUR). If you are still not sure which crypto-asset you want to trade, click ‘Trade Markets’ followed by ‘Crypto’ and you can have a look at what is available for yourself.

It’s advisable to spend a little time familiarizing yourself with the eToro platform. Have a look around for a clear idea of what is on offer in terms of cryptocurrencies. This will make it easier to find what you are looking for when the feeling of a trade opportunity grabs you in the future.

Step 4: Buy Cryptocurrencies or Trade CFDs

Assuming you’ve made a final decision about which crypto-asset or pair you want to trade, you can now think about whether you want to buy the digital coins or trade them.

Let’s walk through the difference between buying and trading digital currencies on eToro.

Buy Cryptocurrencies on eToro

If you see yourself as a medium-to-long term investor, you will likely want to buy your digital assets outright. This means that you will look to adopt a ‘buy and hold’ strategy, holding onto your digital coins for weeks or months – until you see a profitable opportunity.

By buying digital currencies on eToro in this way, you are cutting out the need to worry about the highly volatile nature of the market. Not to mention short term price spikes, and hours dedicated to studying technical analysis. You can buy cryptocurrencies on eToro on a completely commission-free basis.

Cryptocurrency Trading via CFDs

In terms of trading cryptocurrencies, eToro supports Contracts for Differences.

Cryptocurrency CFDs allow you to trade digital coins without having to own the underlying asset. Instead, CFDs are tasked with monitoring the real-world price movements of the crypto-asset in question. As well as cutting out the need to store your own coins, you can also benefit from going short.

As we touched on earlier, this means that if you feel like the value of your chosen crypto coins is going to fall – you can still make gains by creating a sell order, instead of a buy order.

You can also boost your purchasing power by applying leverage to your eToro crypto trade. Leverage allows you to trade on margin and is usually offered in the form of a ratio.

In some countries, there are limits to the amount of leverage offered when looking to trade cryptocurrency CFDs. This usually stands at a ratio of 1:2, which means that with an eToro account balance of $400, you could trade with $800.

For those unaware, let’s take a look at how a leveraged CFD might affect your cryptocurrency trade on eToro:

- For instance, let’s say that you have $1,000 in your account and are interested in ETH/CAD

- eToro offers you 1:2 leverage

- This means that you can now trade ETH/CAD with $2,000

- If your gains would have ordinarily been $100 from this trade, with leverage you would increase your gains two-fold to $200

It is important to be mindful when applying leverage. Whilst it can boost your profit potential, it can also magnify your losses.

Crucially, we should mention that CFDs aren’t available to everyone. As of January 2021, the FCA banned cryptocurrency CFDs for all UK citizens. Furthermore, US citizens are banned from accessing these contracts, as per CFTC and SEC ruling.

Whilst it might be tempting to join an unregulated exchange or broker to get your hands on leverage – we advise against this. These spaces are often unsafe. Furthermore, the lack of regulation can be a breeding ground for cybercriminals.

Step 5: Try out a Cryptocurrency Copy Trader

When you have decided which crypto-asset you wish to trade or buy – you might want to expand your portfolio by utilizing eToro ‘Copy Trader’ feature.

This tool isn’t reserved just for beginners. For instance, it could be that you simply lack the time to trade effectively, or perhaps you haven’t yet got to grips with technical analysis.

Copy trading is a passive way of trading cryptocurrency on eToro. Simply click ‘Copy People’ on the left-hand side of your main account page. Next, you can filter the results to your liking. As you can see, in our screengrab above we searched for people who invest in the crypto market.

Before making your final decision, you will need to check out the stats of the pro investor. This includes the risk rating, preferred asset class, success rate, and various other factors to help you make your decision.

In a nutshell, whatever the trader invests in will be mirrored in your eToro portfolio. Ergo, if the Copy Trader places a buy order on Etherum, this will appear in your portfolio – in proportion to your investment. If the investor cashes out on Etherum a few weeks later to make a profit, again this will be reflected in your account.

The minimum investment in a ‘Copy Trader’ on eToro is $200, and you can copy up to 100 ‘Copy Traders’. This means if you have $1,000 in your account you could invest in 5 different pros. This is a great way of avoiding overexposure to just one investor. Finally, eToro allows clients to elect to copy all trades or just new ones. Plus, you can add or remove assets as you see fit.

Step 6: Set up a Cryptocurrency Trading Order

In step 6 of our how to trade crypto on eToro guide, we are looking at the procedure of placing an order. Start by clicking on ‘Trade’, which will bring up an order box on your chosen crypto-asset.

Take a look at the list of important orders below, all of which will enhance your experience of trading digital currencies on eToro.

Buy or Sell Order

Starting with the most simplistic of orders, you will need to set up a buy or sell order. Put simply, if you think the digital coin in question will rise in value, you need to use a buy order. If you believe the price will fall, create a sell order.

When the order box appears on your digital currency it will be set to ‘buy’ by default. If you wish to go short, simply change this to ‘sell’ by clicking it at the top.

Set Rate – Market Order or Limit Order

You will now need to decide between two orders – a ‘market’ and ‘limit’. These orders let eToro know how you want to enter the cryptocurrency market.

Market Order

If, for example, you are quoted a price on BTC/USD and would like for eToro to execute your order immediately – select a market order. It’s important to note that there will be a difference in price between the one you see in the order box, and the price you get.

To give you an example, you might be quoted $30,795.50 but the order is executed at $30,795.91. This is down to the supply and demand of the market. As such, the price of digital coins changes on a second by second basis in this volatile cryptocurrency arena.

A market order is the default order when you elect to trade cryptocurrencies on eToro, so remember to change it if you need to. Unlike in the case of stocks and such, there is no need to worry about the opening hours of the markets when trading digital currencies – they are open 24/7.

Limit Order

If you wish to use a buy and hold strategy then it will be best to stick with a simple market order. If, however, you are hoping to make the most of small, but frequent, gains whilst adopting a short-term trading strategy – a limit order is your go-to order.

The reason for this is that limit orders allow you to be specific about the price at which you would like to enter the cryptocurrency trade.

See below an example of a limit order used on a cryptocurrency trade on eToro:

- Let’s say eToro quotes $140.70 on Litecoin

- However, you are not interested until it reaches $146.50

- As such, you can now set up a limit order at $146.50

- This means that eToro won’t action your trade until Litecoin hits $146.50

- For the time being, this order will remain pending. You are entitled to cancel this order whenever you see fit.

As is evident from our above example, limit orders are very well suited to short-term cryptocurrency traders. This is largely because you have complete control over the price of your position.

To choose this order you must select it manually, as the default order is a market order. To do this simply click ‘Rate’ next to ‘At Market’ and enter the price you wish to set your limit order at.

Amount

You will now be required to enter the amount of money you want to stake in the ‘Amount’ box. To clarify, this means how much you want to spend on your digital coins.

As we mentioned, eToro is denominated in US dollars – which is the case no matter what financial asset you are electing to trade.

The reason you are able to invest such a small amount in digital currencies is that eToro enables fractional ownership. This means that if you want to purchase Bitcoin, but can’t afford over $35,000 for this crypto-asset, you can still buy $25 worth. This works out to be about 0.07% of a Bitcoin.

Stop-Loss

The stop-loss order is one of the most important orders you can grasp when learning how to trade crypto at eToro. As its namesake suggests, this order will enable you to stop your losses at a specific price.

For instance, you might want to trade crypto-fiat pair LTC/EUR but aren’t willing to lose more than 3% of your initial stake. This is an instance where you can create a stop-loss order so that eToro automatically closes your LTC/EUR trade. Thus ensuring you lose no more than 3% on your stake.

- Remember the market order is the default, so you will need to manually select ‘stop loss’

- Next, enter the price you wish for the stop-loss order to be actioned at

- You won’t be able to enter a percentage, but as you change the stop loss value you will see this change on-screen

- This means you can alter the price until you reach the percentage you have in mind

Alternatively, you can save yourself some time and calculate the stop-loss price.

For example:

- Imagine you are trading LTC/EUR which is quoted at $119.06

- You don’t want to lose more than 2% on your trade

- If you go long on this pair – believing it will rise in value, create a stop loss order 2% lower than $119.06. This equates to $116.67 (119.06 – 2%)

- If you go short on LTC/EUR – believing it will fall in value, create a stop loss order 2% above $119.06. This equates to $121.44 (119.06 + 2%)

As is clear from the above example, if LTC/EUR reaches your stop-loss order price – your trade will be closed automatically. This is a great way to mitigate your losses, as you will only ever lose a maximum of 2% from your cryptocurrency trade on eToro.

Take-Profit

This section on take-profit orders will be short and sweet. The reason being they are virtually the same as a stop-loss order – with the opposite goal. Put simply, stop-loss orders control your losses and take-profit orders lock in your gains.

For instance, let’s say you want to make gains of 8% on a Litecoin position, and the digital coins are worth $120.50. Take a look below for a better idea of what your take profit order might look like:

- If you go long on Litecoin, believing the price will rise – your take profit order will be set to 8% over $120.50. This equates to take profit price of $130.14 (120.50 + 8%)

- If you go short on Litecoin, believing the price will fall – your take profit order will be set to 8% below $120.50. This equates to a take profit price of $110.86 (120.50 – 8%)

This order is easy to set up. Click on ‘Take Profit’ on the order screen, and enter the price depending on your profit goals. It is recommended to utilize both stop-loss and take-profit orders, every time you create an order.

The reason for this is that you are cutting out the stress of having to keep an eye on your computer, waiting to time the market. Instead, eToro will automatically close your position when your stop-loss or take-profit order has been activated.

Furthermore, you have a clear picture of what your potential losses or gains will be – meaning your entry and exit strategy is firmly in place.

Confirm Cryptocurrency Trading Order

At this point, you are nearly at the finish line in terms of placing an order. All that’s left to do is review it. If everything looks good, hit ‘Open Trade’.

When trading other assets, you may find at this point the market is closed when you elect to confirm your order. In this is thr case ‘Open Trade’ would be displayed as ‘Set Order’. This won’t be a cause for concern when learning the ropes of how to trade crypto on eToro.

After all, the cryptocurrency markets are open 24 hours a day, 7 days a week. With that said, you should note that some times of the day are more liquid than others.

Step 6: Withdrawing Your Profits From eToro

At some point later down the line, you will want to withdraw your profits from eToro and have the money sent to your bank account. As long as you have already uploaded your proof of identity and had this verified – you can request a withdrawal any time.

The withdrawal fee on eToro is $5, with a minimum withdrawal of $30, If you are a US resident you do not have to pay a fee for withdrawals. In terms of where the money will be sent, this will invariably be the same account used to initially make a deposit.

This is a legal requirement for any regulated broker. If this is a problem for you, you will need to contact the eToro customer support team.

The Verdict: How to Trade Crypto on eToro

In this guide on how to trade crypto on eToro, we have talked about the nuts and bolts of trading this speculative asset class. We walked you through how to open an account, cryptocurrency pairs, and CFDs.

We also talked about how to set up an order and the important role of take-profit and stop-loss orders. These orders will enable you to gain control over your trades in a systematic and risk-averse manner.

When you are educating yourself on how to trade crypto on eToro, you shouldn’t settle for the basics. It is key to your success as a trader to have a firm grasp of fundamental and technical analysis. There are heaps of short online courses, books, and educational videos to take advantage of in this respect.

If you are still a beginner but keen to get started, it’s worth considering the ‘Copy Trader’ feature on eToro. This is an entirely passive way to trade, and you can copy a pro cryptocurrency trader like-for-like for as little as $200.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated