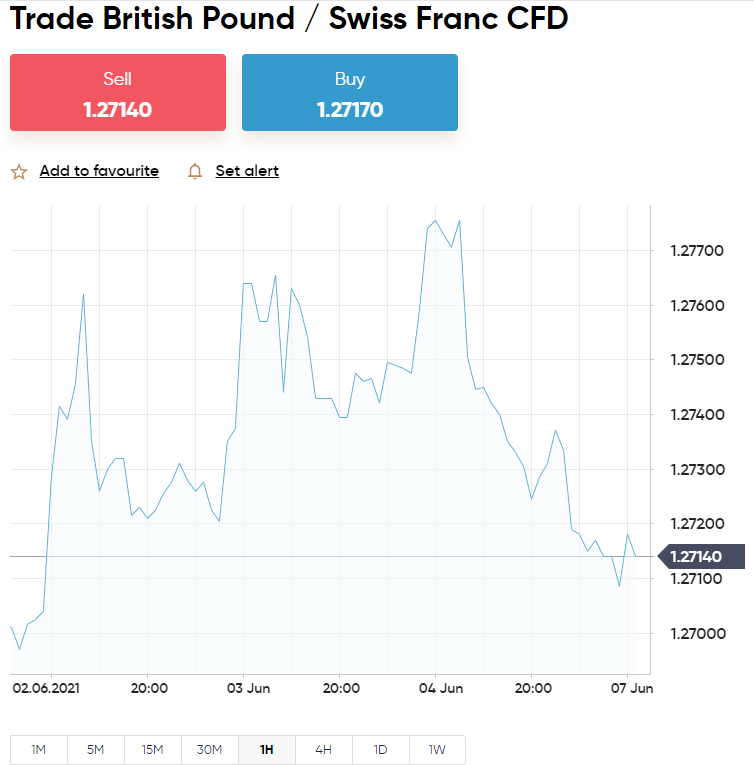

The severe price fluctuations experienced by the forex markets are not for the fainthearted. Even the Swiss franc – often seen as a relatively safe currency during times of inflation – experienced one of the biggest price swings in history back in 2015 when the SNB removed the price peg on EUR/CHF. With this in mind, it’s hardly a surprise that more people are searching for the best forex demo trading platforms!

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

If you want a risk-free way to learn, strategize or get to grips with forex – read on.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

In this guide, we are going to provide you with some insight into the best forex demo trading platforms with some thorough reviews. We also discuss key metrics to look for when looking for a forex trading simulator yourself. In addition to this, we divulge advantages and some tips to get the best out of using a risk-free demo account.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Reviewed: Best Forex Demo Trading Platforms 2023

We spent countless hours thoroughly reviewing the best forex demo trading platforms. We looked for various elements when putting online brokers to the test. For a start, any demo provider worth its salt should be regulated, offer heaps of currency pairs, and charge low fees on live trading accounts.

See below the results of our best forex demo trading platform rundown of 2023.

1.AvaTrade - Overall Best Trading Platform 2023

AvaTrade is another CFD broker on our list that is no stranger to providing a service to traders on a global scale. To start forex trading, you will have more than 60 currency pairs to choose from - which includes major, minor and exotic pairs. Some of the FX pairs available at AvaTrade include CHF/JPY, EUR/USD, GPB/JPY, NZD/USD, GBP/USD, CAD/JPY, GBP/SEC, NZD/CHF, USD/NOK, USD/RUB, EUR/PLN and many more.

The spreads at this forex brokerage are generally competitive. This guide found other assets to include ETFs, commodities, bonds, cryptocurrencies, stocks, and indices. You will not pay any commission to enter or exit the markets at AvaTrade. Furthermore, regulation comes from six jurisdictions so you can trade in safety-conscious conditions with some form of protection in place. If you would like to start forex trading via a free demo facility before going to the live markets - AvaTrade is partnered with MT4.

As we said, you can download the third-party platform to benefit from heaps of tools and automated trading options. We also found the broker's own apps AvaTradeGO and AvaSocial to be useful. The latter allows you to 'follow', 'copy', and 'like' other currency traders. This is a useful way to gain some insight into the forex market - from people with experience.

AvaTradeGO includes charts, management tools, live prices, and the ability to manage your MT4 accounts in both demo and real mode. You can start forex trading by making a minimum deposit of just $100 with one of the many payment options. This includes credit and debit cards, bank transfers, and e-wallets like Neteller, WebMoney, and Skrill.

- Minimum deposit to start forex trading just $100

- Regulated in 6 jurisdictions, including Australia, South Africa, Japan, and the EU

- 0% commission to trade forex

- Admin fee charged after 12 months no account activity

2. Capital.com - Best Beginner-Friendly Forex Demo Trading Platform

Capital.com is a forex trading platform specializing in CFDs. As we said - this offers you the flexibility to place orders based on the currency price shifts in either direction - also enabling you to leverage your stake and profits. This online broker is partnered with MT4. By using your Capital.com account with MT4, you can try out passive trading options such as forex robots and signals. As we said, the third-party platform also offers a plethora of advanced trading features.

This enables you to hone in on your chart reading skills, as well as other invaluable tools to predict the market sentiment on your chosen FX pair. To access the free demo account pre-loaded with $10,000 in paper funds at Capital.com you simply need to open an account. We checked out the asset diversity at Capital.com and found that there are plenty of currency pairs - covering minors, majors, and exotics. This includes USD/JPY, EUR/GBP, USD/CAD, GBP/CAD, AUD/CAD, NOK/TRY, SEK/RUB, USD/ZAR, and heaps more.

We found all assets to come with competitive spreads. Other markets include shares, cryptocurrencies, indices, and commodities. When you are prepared to go in with your real capital, you will not pay any commission to trade at this forex platform. You can select from 3 accounts with varying conditions including minimum deposits, account balances, and more. The FCA, CySEC, ASIC, and NBRB regulate this forex demo trading platform. Thus, you know the company takes things like client fund segregation and due diligence seriously.

When you feel like buying and selling currencies using actual money you can swap to a real forex trading account at the click of a button, To enter the real FX markets at Capital.com, you will need to deposit a minimum of $20. You can do this using bank wire transfer, credit and debit cards and a wide range of e-wallets. This includes Apple Pay, Sofort, iDeal, Trustly and more.

- Partnered with MT4 for forex demo trading

- Minumum deposit in live forex market just $20

- Licensed by regulatory bodies CySEC, FCA, ASIC, and NBRB

- Not much fundamental analysis

3. LonghornFX - Top-Rated ECN Broker With High Leverage

LonghornFX is a user-friendly trading platform that covers dozens of cryptocurrency and forex pairs. You can also trade stock CFDs and multiple indices. You will be able to trade with leverage of up to 1:500 at LonghornFX - irrespective of whether you are a retail or professional client.

In terms of fees, you will benefit from competitive variable spreads throughout the trading day. After all, LonghornFX is an ECN broker - so you will get the tightest buy/sell prices available in the industry. Commissions will vary depending on the asset but typically amount to $7 per $100,000 traded.

We like the fact that LonghornFX processes withdrawal requests on a same-day basis. Plus, the broker offers full support for MT4. The platform can be accessed online, via desktop software, or through a mobile app.

- ECN broker with super tight-spreads

- High leverage of 1:500

- Same-day withdrawals

- Platform prefers BTC deposits

4. Eightcap

Eightcap is a popular MT4 and MT5 broker that is authorized and regulated by ASIC and the SCB. You will find over 500+ highly liquid markets on this platform - all of which are offered via CFDs. This means that you will have access to leverage alongside short-selling capabilities.

Supported markets include forex, commodities, indices, shares, and cryptocurrencies. Not only does Eightcap offer low spreads, but 0% commissions on standard accounts. If you open a raw account, then you can trade from 0.0 pips. The minimum deposit here is just $100 and you can choose to fund your account with a debit or credit card, e-wallet, or bank wire.

- ASIC regulated broker

- Trade over 500+ assets commission-free

- Very tight spreads

- Leverage limits depend on your location

Best Forex Demo Trading Platforms: Checklist

Choosing a new trading platform shouldn’t be taken lightly. The sad fact is there are hundreds of online brokers operating today – and only a handful meet our high standards.

If you haven’t yet decided which of our best forex demo trading platforms you want to sign up with – read on for some important considerations.

Licensing and Regulation

We have touched on licensing and you will have noticed that all the forex demo trading platforms on our list are regulated by at least one financial body. Organizations and independent authorities exist to protect traders, clean the online investment space of financial crime, and to keep the industry safe for all.

When signing up with a forex demo trading platform with a license, you will find that it requires you to provide some proof of identity – by means of sending a copy of your passport. Whilst this seems invasive, this is all part of KYC (Know Your Customer), and is simply the broker following the rules set out by the regulator(s) that it is licensed by.

By using a regulated forex demo trading platform to start with, when you look to trade currencies with real money, you won’t need to worry about the safety of your capital or private information. For instance, when trading at eToro, your funds will be kept in a separate top-tier bank account, and SSL encryption will protect your personal data.

Forex Pair Variety

Forex pair diversity shouldn’t be taken for granted when looking for the most suitable forex demo trading platform. You may only be interested in major pairs like EUR/USD to start with, but the chances are you will want to make the most of this risk-free option by trying new things.

The vast majority of online brokers will provide access to major and minor markets. However, you may find that when you want to try trading some emerging currencies – the forex demo trading platform doesn’t offer them.

At eToro, you can trade 49 currency pairs, as well as thousands of other assets. Furthermore, when you swap over to your real account you will not pay a cent in commission fees.

Low Trading Fees

The more you have to pay your broker, the fewer profits you will see. See below for the most commonly charged fees to trade forex online.

- Transaction/Deposit Fees: Some forex demo platforms charge for specific payment card transactions. For instance – credit cards. This means that when you go to a ‘real’ account you want to make a deposit, you could be charged as much as 3%. eToro simply charges 0.5% for non-USD deposits – regardless of the method used. If you are funding your account in USD, there is no fee at all.

- The Spread: The spread is the difference between the bid and ask price of the currency pair you are trading. So if the bid price of a pair is $1.5001 and the ask price is $1.5002 – this is a spread of 1 pip. The smaller the spread, the better it will be for your gains in the long run.

- Commissions: This guide found some platforms charge a hefty fixed rate on every transaction, where some charge a variable percentage – and others nothing. All the 5 forex demo trading platforms we reviewed will charge you 0% commission to trade in a safe and regulated space.

As you can see, no two forex demo trading platforms are the same. As such, it’s important to have your eyes wide open to any fees you may be liable for when you move to a real capital account.

Forex Demo Trading Tools

Again, forex demo trading platforms differ in what they can offer you. Which one is best for you will depend on various factors. For instance, how hands-on do you want to be? Some online brokers offer access to passive trading options like signals or the Copy Trader feature.

As discussed in our eToro review, this enables you to copy a pro forex trader without needing to lift a finger. This can be a helpful way to get a few tips on risk exposure and see how to manage market volatility.

When thinking about how actively you want to watch the currency markets – think about how much technical analysis you wish to perform yourself. With this in mind, you will probably need to check whether the forex demo trading platform is compatible with MT4 for automated trading, indicators, adaptable charts, and such.

Platform Usability

Being able to find your way around the forex demo trading platform easily is essential to allow you to place an order quickly when the moment takes you. There is no use signing up with a brokerage packed with features you will never use.

A forex demo trading platform presents the perfect opportunity to get to know the broker and also the market before taking the plunge with your hard-earned cash. eToro and Capital.com in particular offer a super user-friendly experience for both new and experienced currency traders.

Forex Demo Trading Platforms: The Benefits

Now that we’ve covered the important subject of finding the right forex demo trading platform in depth – we can talk about the benefits of doing so.

Whether you want to learn from the bottom up, or would rather rely on forex signals so you don’t have to study technical analysis – read on for inspiration.

Study Forex Trading Risk-Free

Let’s say you are just starting out and primarily want to use a forex demo trading facility to learn how to trade currencies from scratch. This couldn’t be easier, as all you need to do is sign up with the broker and you can learn forex risk-free by diving right in and learning as you go.

With that said, especially if you are a newbie, it’s important to try to be vigilant when using a forex demo account. In other words, make sure the platform is regulated. You can also take full advantage of real-world conditions by practicing risk management strategies. We talk about this shortly for anyone unaware of how to do this.

Test Forex Trading Robots

If you aren’t keen on the idea of performing hours and hours of research on the market sentiment – you may want to consider automated forex trading. One of the ways you can do this is to use a forex trading robot.

For those unaware, this is a fully automated way to trade. The robot uses sophisticated software to perform technical analysis and then create forex trading orders on your behalf.

This will be carried out on the forex demo trading platform you sign up with. Furthermore, because you will be using paper funds, you can test the forex trading robot in a risk-aversive way.

Crucially, the price of forex robots varies by some distance. As such, you should always check what the cost of the software is, and make sure your chosen forex demo trading platform is compatible with it.

Experiment With Forex Trading Signals

We mentioned some people opt for daily forex signals to cut out the need to learn technical analysis. For those who have never heard of this phenomenon – it’s like being sent a tip-off on a potentially profitable forex trade.

All you have to do is decide whether to place the order with your forex demo trading platform of choice. To give you an example, here at Learn 2 Trade we offer premium and free forex trading signals. We send signals via our successful Telegram signal group of more than 20k members.

This means you could easily experiment with our currency signals via your free forex demo trading facility. Simply enter each signal into an order form on your virtual account as it comes in and see how it goes for a week or two. eToro will give you $100,000 in demo funds – which is a great platform for acting on our signals!

Practical Tips on Forex Demo Trading Platforms

You will see below some practical tips on forex demo trading platforms. Some of which you may wish to try yourself when you’ve chosen a suitable provider.

Be Pragmatic with Forex Trading Capital

Taking a pragmatic approach to using a forex demo trading platform is a great way to start as you mean to go on.

See below how you might include risk-reward into your next trade:

- For every $1 allocated to a forex trade – you wish to gain $2.

- Thus, your strategy should include a risk-reward ratio of 1:2 on each position.

- Let’s say you place a $1,000 sell order on GBP/USD – you are hoping to make a profit of $2,000.

This simple yet practical tip will help you stay on track when entering the currency markets via a forex demo trading platform. Whilst you could go off the rails with your paper trading funds – you won’t learn much by doing so.

Practice Forex Risk-Management

As we touched on earlier, it’s important to be pragmatic when accessing the currency markets via a forex demo trading account. Even for experienced traders, being realistic is the best way to use such accounts.

This brings us neatly onto the subject of ‘stop-loss’ and ‘take-profit’ orders.

- A stop-loss allows you to have your forex trade closed as soon as it has reached a specific price – this stops your losses from getting out of hand.

- On the other side of this is a take-profit order – automatically locking in your gains from the position before the moment passes you by.

Let’s offer an example of how you can use these orders to your advantage at the forex demo trading platform of your choosing:

- You are trading EUR/AUD priced at AU $1.30.

- You believe this is in undervalued territory.

- Foreseeing a price increase, you place a buy order worth $500.

- You do not want to lose any more than 1% on this position.

- As such, you set your stop-loss order to 1% below the current market value.

- Working on a ratio of 1:2 – you set your take-profit order to 2% above the current price.

- As soon as EUR/AUD falls 1% below or 3% above its current price – your trade will be closed by the forex demo trading platform.

- Had you predicted the opposite and gone short on this pair with a sell order – the take-profit would sit 3% below, and the stop-loss 1% above.

Include risk management into your forex demo trading endeavors and you will have a better chance at properly understanding how to place the appropriate orders when you go live.

Monitor Your Forex Trading Emotions

The most common trading emotions to watch out for are greed and fear. Like in day-to-day life, these feelings need to be kept in check to prevent us from making rash decisions. We find that one of the best ways to monitor your emotions, and indeed trading success, is by keeping a journal as you go.

Let’s offer a few tips on what you might include in your own journal to get the most out of forex demo trading:

- Write down every detail of your order – from the forex pair and order type (buy or sell) to the date, time, entry and stop-loss values, and everything in between.

- Always leave room to make a note of the outcome of the position at the time of closing – irrelevant to whether the forex demo trading platform automatically executed this for you.

- Consider using a mobile phone or desktop device to create a digital journal – enabling you to add any relevant images and charts.

- Jot down what your expectations of the trade are, how you reached your decision, and how the outcome differs from your perceived idea of it.

Journals are used by forex trading veterans and newbies alike. In the currency trading game, not learning by your mistakes can be costly when going live with real funds.

Open an Account With a Forex Demo Trading Platform: Walkthrough

By this stage, you are no doubt ready to get started with a forex demo trading platform. For anyone who is completely new to trading currencies, we have included a 5-step walkthrough below.

We have used Capital.com as it came out top in our best forex demo trading platform rundown. It takes less than 10 minutes on average to sign up and you will not pay a cent in commission when switching to a real account to trade currencies!

Step 1: Sign up With a Forex Demo Trading Platform

When you arrive on the Capital.com website, look for the ‘Join Now button on the main page. Once you have clicked that you will see a sign-up box like the one below.

Step 2: Substantiate Your ID

As soon as you received your email, you can click the link within it and head over to your account. As Capital.com is regulated, the broker will ask you to upload some ID, like your driving license or passport.

You will also be required to substantiate your address with a bank statement or utility bill dated within 6 months.

Please note that if you are using the free forex demo trading account at Capital.com, this is not contingent on your uploading any ID. You may do this at a later date via your real portfolio – crucially before you wish to make a withdrawal or deposit over $2,250.

Step 3: Opt for Virtual Portfolio

On the Capital.com dashboard, you will see that underneath your username it says ‘Real’ – click this and select the ‘Virtual’ option underneath.

When you have switched to the demo account, you will notice that you have a balance of $100,000 in paper equity to trade forex with.

As we said, Capital.com doesn’t put an expiry date on its forex demo trading offering, and will not charge you a commission to trade the real currency markets once you eventually make a deposit.

Step 4: Find a Forex Pair to Trade

If you are already sure which currency pair you would like to trade via the Capital.com forex demo trading platform – you can use the search box on the main dashboard.

You may also search under ‘Currencies’ to see all available pairs for inspiration. Once you have found what you are looking for, you can click ‘Trade’.

Step 5: Start Forex Demo Trading

Next, you will see a forex demo trading order box appear. This is when you can enter your entry price, leverage, and some risk management orders. As we talked about earlier, this can be achieved by using stop-loss and take-profit orders on each position you take.

Nevertheless, when you have double-checked the order – confirm by hitting ‘Open Trade’. Capital.com will execute your risk-free order using your paper equity!

Forex Demo Trading Platform: To Conclude

To truly make the most of your chosen forex demo trading platform, you should include various strategies to better prepare you for volatility and the unexpected. It’s also advisable to only trade via respected and regulated online brokers.

After much in-depth research and many considerations, Capital.com came out as the number one forex demo trading platform. The free demo account doesn’t expire and comes loaded with $100k in paper money. If or when you switch to a ‘real’ account, you can trade any asset without paying commission.

The FCA, CySEC, ASIC, and NBRB regulate this forex demo trading platform – so there are no issues with safety. Furthermore, there are 49 currency pairs to choose from and thousands of other markets with tight spreads and a user-friendly website.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts