As the name implies, day trading requires you to enter buy and sell positions throughout the day. As such, a consistent and well thought out day trading strategy is essential. After all, it can be far too easy to get carried away and start making important trading decisions which haven’t been properly thought out.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

With this in mind, we have put together some great day trading strategies to ensure you stand the best chance possible of making money from the get-go. Whether you’re interested in trading forex, crypto, stocks, or something else – we at Learn 2 Trade have you covered.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What is Day Trading?

Fundamentally, day trading is a type of online investing whereby you open and close a position before the end of the trading day. Unlike stocks and bonds – which are traditional investment streams, day trades are not held onto for months or years at a time by investors. Instead, positions are typically held for hours or even minutes.

Due to the short-term disposition of day trading as a whole, day investors can place dozens (or even hundreds) of individual orders each and every day. The main goal for individuals dealing in day trading is to aim for small gains. And for experienced traders, this could potentially lead to lots of winning positions throughout the day – resulting in healthy profits.

No. 1: Understand Which Markets to Day Trade

When it comes to day trading, there are some markets which might suit you to a ‘T’. With this in mind, we recommend only starting with one or two asset classes until you find your day trading feet.

There is a vast assortment of trading instruments for you to choose from these days, in large thanks to the superb advancements in technology available to us. From stocks to forex and cryptocurrency, our team has put together some of the most popular day trading markets sought-after by investors.

This covers both benefits and drawbacks to give you a bigger picture of which ones might be best for you.

Cryptocurrencies

There are quite a lot of markets available to you if you like to trade cryptocurrencies. Much like forex, the crypto market is open 24/7, so it is becoming more and more popular amongst day traders. Secondary products allow you to make the most of both falling and rising prices, and alternative internet coins are known to have higher levels of volatility. This makes them perfect for you if you are an intraday trader.

As a short-term investor, day trading cryptocurrencies enables you to bypass the costs and fees associated with overnight funding. This means that you don’t need to lay awake at night worrying about any overnight shifts in market prices.

On top of Bitcoin, there are some alternative cryptocurrencies that can be traded at the click of a button – such as:

Some of the most common features that come with day trading in the cryptocurrencies market:

- Low capital requirements: Trading with cryptocurrencies enables you to get involved in the market with a low amount of capital.

- Educational resources: There is a great amount of accessibility for you as a crypto day trader these days. With a huge range of software, equipment and educational resources available – you can day trade wherever you like, 24/7.

- Price swings: Fluctuations in volatility within the cryptocurrency market can create huge gains for you. Of course, there is always the risk it can go the other way and create a loss.

If you are the kind of trader who is attracted to technology and don’t mind taking an enhanced risk, the cryptocurrency markets might be your cup of tea. For instance, If you want to share your experiences with others by writing for some blogs that cover the information about crypto, to do that search write for us cryptocurrency on google, then the websites that appear on SERP are your destination.

Stocks and Shares

Day trading stocks is often where new traders head first. There is a huge variety of shares available to trade. In the equity market, traders tend to close positions at the end of the trading day. This ensures that you stay away from the ‘gapping risk’.

For those unaware, t gapping risk refers to a share price opening a lot lower or higher than it was at the close of the previous trading day. The explanation for this gapping is often down to outside influences or overnight fundamental news causing a shift in the perceived value of the company.

Indices

Because of market opening hour restrictions, day trading indices are not too dissimilar to share trading. By trading indices, instead of just one company; you are speculating on how a group of shares are going to perform.

You are going to have access to a huge portion of the stock market thanks to FTSE 100 (the biggest companies on the London Stock Exchange). Trading through cash indices or index futures gives you great trading exposure to FTSE 100. Other leading indices include the New York Stock Exchange, NASDAQ, and the Tokyo Stock Exchange.

Forex

There are no two ways about it – the currency trading market is the biggest and most liquid financial arena in the world. Currencies are always trading in pairs, such as EUR/GBP or AUD/NZD. With so many options, it is important to note that only a select handful are liquid enough to give you decent intraday gains.

Here are some of the most appealing features as far as day trading within the forex market goes:

- No commission: Generally speaking, you will not be required to pay commission with forex trading. The reason for this is that forex brokers make money from the spread you pay for market trading quotes.

- Trading anytime: With regards to the forex market, there is no need to be concerned with opening hours. The forex market is constantly running, 24 hours a day, 7 days a week. For those of you who are a little short of time through the week or don’t want to have to check the market every day, forex can be a great alternative.

- Low investment requirement: Sometimes, the traditional stock market can have a large minimum investment, whereas for as little as £50 you can begin trading in currency.

As well as the minimum investment requirements, technical help and free strategies – the forex market is one of the most accessible markets for traders there is.

If you are interested in learning more about forex trading, day trading or otherwise – you can find lots of helpful information on forex on the Learn 2 Trade website.

Futures

In a nutshell, ‘futures’ are a contract (or agreement) between a buyer and a seller. This is related to an order to carry out a specific trade at a predetermined price and date. In other words, this will be some time in the future, hence the name.

As a day trader, you are essentially aiming to make gains from any price shifts in the market. This can happen at any given time from when the buy-sell contract was executed, to the position closing. Overall there are usually two types of traders who use futures contracts – speculators and hedgers.

More often than not, futures agreements revolve around underlying assets like:

- Precious metals – gold, silver, platinum, aluminium, copper, steel and even uranium (less commonly traded)

- Oil

- Alternative energies

- Foods

The idea of futures is to soften the uncertainty and risk for traders. For instance, if you knew you were going to produce 1 ton of corn next year, you could sell the corn at market price. There’s always the chance though that the price of corn will drop throughout the next year, and so the market price falls.

This is when a pre-determined price is going to help you in your day trading strategy, as you can sell your corn at that price now. That way, you will secure yourself a certain amount of profit. As far as financial markets go, futures trading works in a comparable way. Essentially, it is an agreement to buy or sell a financial product later down the line, using an agreed date and a fixed price.

In Layman’s terms, you are predicting that a specific index is going to reach a certain level at a date further down the line. Financial products or instruments include things like foreign currencies, certificates of deposit and treasury bills – to name a few. Interesting, the market value of financial futures contracts tends to move in a different direction to interest rates. This is why it makes it a perfect day trading strategy to consider!

There are a few other things we think you should think about when day trading in the futures market:

- Futures Capital: Futures requires lower capital when compared to stock market trading. Trading experts do recommend that you start with at least a couple of thousand pounds with futures. Different futures contracts will require a different amount of capital.

- Futures Flexibility: Whilst futures markets do offer a level of flexibility, depending on the futures -contract markets can alter. Always make sure that you are no longer in any positions before you stop trading on that specific futures contract. It is possible to trade premarket and post-market in futures because there are high levels of volatility and volume in the US, European and Asian trading sessions.

- Narrow Futures Contracts: As people trading within the futures market often focus on one specific futures agreement, you won’t find much day trading diversity. If you follow volume and volatility as well as variety, you might be better off trading on a different market.

Put simply, if you would like to begin trading in energy, commodities, or oil markets – then you will probably find futures enticing. Just be mindful that you will probably need to narrow your attention to just a few futures contracts, and there will be a minimum amount of capital required.

Options

A lot of broker platforms offer traders the chance to trade in ‘options markets’. The options contract or agreement allows you to sell or buy an asset within the parameters of the ‘exercise date’ (pre-determined date).

The most popular types of options categories are stock call options and stock put options.

- Stock call option: The holder is able to buy stock from a seller as long as it is within the expiry date, for a specific price. If the price of the underlying stock goes up, so does the value of the call option.

- Stock put option: With this category of the options market, the holder is able to sell a stock for a previously agreed price. Again, this must be before a certain date. If the price of underlying stock drops, so does the value of the put option.

All in all, each of the markets we’ve discussed above are suitable for day trading. So, whatever market, or markets you decide to include in your day trading strategies – it is important for you to learn the specific industry inside-out!.

No. 2: Stick to a Trading Plan

No matter what market you are interested in, one of the best day trading strategies is to make a plan and try your utmost to stick to it. Many seasoned traders also keep a diary, as it is a great way of reassessing current trading strategies. This also allows the individual to forge new strategies by learning from past mistakes.

With that in mind, we’re going to run through some of the tried and tested techniques used by traders.

Strategy

Some of the most commonly used intraday trading strategies are as follows:

- Range Trading

- Scalping

- News Based Trading

- HFT (High-Frequency Trading)

Sufficient Capital Levels

It’s a good idea to evaluate how much of your capital you are comfortable risking on each and every trade. Some traders never risk more than 2% of their trading account on each position. Sometimes this is as low as 1%.

For example, let’s say you have £20,000 in your trading account, and you’ve decided you want to risk no more than 0.5% of that capital (for each trade). The very most you are going to risk losing is £100 per trade (0.5% x £20,000).

It’s always a good idea to put a spare amount of trading funds to one side. This should be an amount you aren’t too afraid to lose.

Time Dedication

It can be easy to start off well and then get distracted by life. And of course, you might lose out on some great gains by taking your eye off the ball. With this in mind, when you’ve decided how many hours per day you can dedicate to trading, you should try to stick to that.

They say wisdom is power, so it makes sense to arm yourself to the teeth with trading knowledge. To keep yourself informed, we would recommend staying abreast with the following sources of information:

- Stock market news

- Financial media outlets

- World economy news

- General markets

- Fed interest rates

- Technical Analysis

Setting yourself a few targets when it comes to time management and research can only be a good thing. As a trader, it is a good idea to follow and track the markets so that if an opportunity arises you are able to move as quickly as possible.

No. 3: Demo Accounts are Your Friend

A lot of broker platforms will provide the option of setting up a day trading demo account. Sometimes called practice simulators, there are demo accounts widely available for most types of trading.

Demo accounts are not to be knocked, as they are a superb way of gaining valuable experience without spending a single penny. Therefore, you have no risk attached to your hard-earned cash.

No. 4: Research Technical Analysis and News

To have a good chance of being a successful trader, it is vital that you have a good understanding of interpreting financial news in relation to your assets.

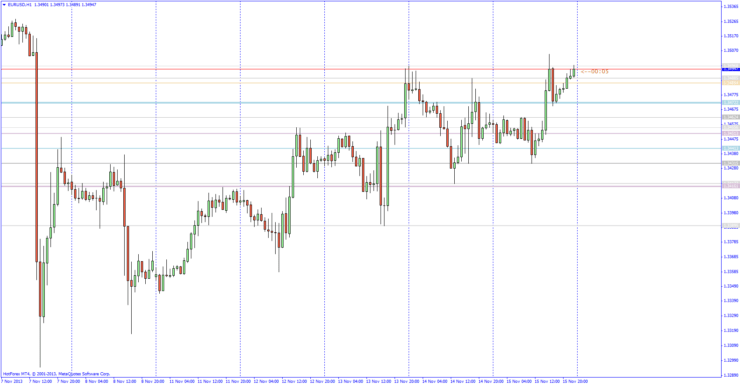

Having a good grasp of how to read charts is also going to be a powerful skill for you to possess as a day trader. This is going to give you an advantage when it comes to speculating on whether your asset will go up or down in price.

In other words, to plan your next move – then the wide variety of information available to you at your fingertips is only going to help.

Trading Software

Up to date analysis tools and trading software are essential for anyone wanting to make a career from day trading. As we covered briefly earlier, a good day trading strategy would be to make the most of all of the information available you. This is going to help you decide which direction you might take on your position.

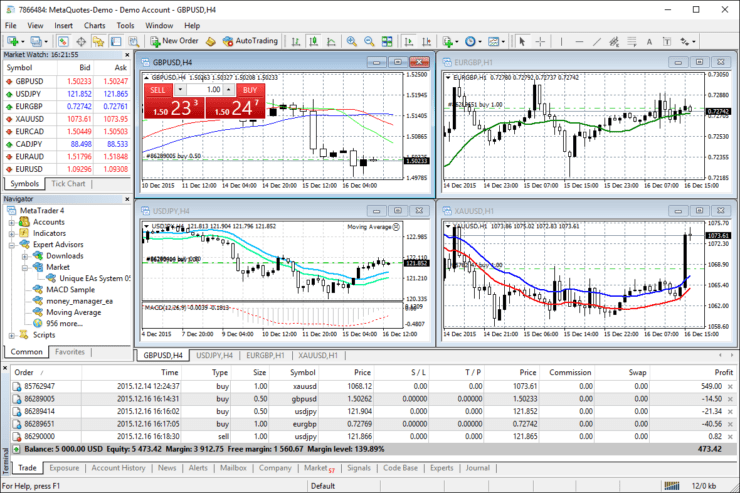

One of the most widely used software packages utilized by day traders is that of MetaTrader 4 (MT4). The software sits between you and your day trading brokerage account, and gives you access to a range of tools and features. This includes everything from chart reading and drawing tools, pricing charts, custom orders, and even the ability to install trading robots.

Technical Analysis

Technical analysis is essentially the mathematical chaos theory to a ‘T’. Day traders find technical analysis invaluable when it comes to trading without blinkers. Price charts, technical data and analysis tools are all going to make you a better and more thoughtful trader.

Looking at the price action from the past often helps traders to predict what might happen later down the line. This is where the mathematical chaos theory comes in, because of trading and market psychology, trends and price movements usually end up following a pattern.

There are three main types of technical analysis charts used in trading and they are -candlestick charts, bar charts and line charts. All of these tools can be used in your day trading strategy.

Below are the main types of day trading chart analysis tools available to you:

- Volatility tools

- COT data and position summaries

- Correlation tool

- Session highlighter

Each and every broker platform will differ slightly, and not all of them will have the tools you are specifically interested in. This is why it’s always important to do some research first.

Financial News

Good day trading strategies will always keep an eye on financial news, from various sources. If something happens which could potentially impact your invested assets, then you will want to know as and when it happens.

We have listed below the 3 best free sources of news and data available for you as a day trader:

- Twitter Lists and Feeds: Beleive it or not, some forex traders make their own news feeds on twitter. So, if forex interests you, you will find a lot of well-respected traders as well as financial news providers in this arena.

- Financial Juice: This one requires you to open an account, but it is 100% free to use and offers a live squawk (someone reading out the news as it hits). It is very important to be mindful of the fact there is a 10-second delay, and in day trading that 10 seconds can be the difference between a gain and a loss.

- Online News Providers and Blogs: Some of the most popular financial news providers are market watch, Bloomberg, Reuters and the Wall Street Journal. A popular free option for forex traders, in particular, is ForexFactory. But, be aware that it’s not great for live news and is better for historical data and charts.

Of course, there are many more free news sources. As such, yet another good day trading strategy is to do some homework and see what platform you prefer.

Please find below a quick run-through of the two most popular paid sources of information used in day trading:

Benzinga Pro

A few of the things on offer for traders here are real-time alerts and squawks, as well as fantastic technical analysis. It is considered to be pretty expensive to subscribe to this one.

So a good day trading strategy would be to make the most of the 14-day free trial option so that you can take it for a test run. It is very important to remember to set a reminder to cancel your subscription just before the free trial ends.

Newsquawk (Previously Called Ransquawk)

With breaking news in real-time, up to date global developments, macroeconomics, block trades, and forex trends – it’s no wonder that this is such a well-respected source of information for traders.

This is superb for day trading, because you are able to look at market summaries morning, noon and night with a full list of impending dev developments for that trading session to boot.

We think when weighing up the benefits with the costs, it could well be worth it. Crucially, this kind of up to date news can significantly impact your trades for the better.

No. 5: Knowing When to Stop

Learn from the best. Those who have made a good living from day trading know that it’s really important to have a grasp of when to stop. As such, set yourself limits and follow your trading plan.

As well as practising discipline, another day trading strategy is to learn how to deal with the emotional effects of any possible losses you might experience. After all, this is all part of the process.

Emotions can land traders in hot water, perhaps leading them to go much further than they initially planned on doing. Some new traders might go too far to try and make up for a big loss, which can lead to even greater financial issues if you’re not careful.

Using a Trailing Stop

Traders often say cut your losses short, and let your profits run. Trailing stops are actually great for enabling traders to do just that and shielding any gains on a position.

One of the best things about using a trailing stop as part of your day trading strategy is that you can set the stop to move according to the market. This, of course, means that you can follow those trends without keeping one eye on the markets at all times.

Using Stop and Limit Orders

One of the classic day trading strategies used amongst traders is to utilise stop and limit orders.

- A limit order means that you will set a minimum or maximum price that you want to sell your asset at. This means the price won’t go beyond the above-mentioned price, no matter whether you are buying or selling.

- A stop order, on the other hand, means that you set a specific price. Again, whether buying or selling you can’t go beyond that price.

For instance, if you have a long position, you might set your price just over the current market price – as so this enables you to make a profit. You will then go ahead and set a stop order under the current price – which will cap the loss on the position.

When your position goes live, everything is automated so you don’t need to worry about manually closing the position. Both orders are a good way for you as a trader to take a financial gain, as well as limiting those dreaded margin calls from your broker.

No. 6: Be Aware of Trading Costs

Most day trading brokers charge a variety of fees such as margin rates and commission. Traders who are highly active on a daily basis are often entitled to special discounts on commission fees.

We think it’s an essential part of any traders day trading strategy to educate yourself on costs you are likely to incur.

Spreads

Put simply, the contrast between the ‘ask’ price and the ‘bid’ price of an asset is the spread. In the short term, it doesn’t matter how much the asset shifts, your broker will still make a financial gain. The spread is shown as a ‘pip’ which is usually the last decimal point in the price.

Here is an example of a spread in trading:

- The buying price of the stock is £200.00, the selling price of the same stock is £201.00 – The spread (percentage difference) is 0.5%

- If the trader now bids on the same stock and pays £201, you are only able to ask for £200.00.

- In this scenario, you must make a profit of 0.5% at the very least so that you can break even. Anything above that is classed as profit.

With day trading particularly, the spread can be your worst enemy – so always look for trading platforms that can offer tight spreads. If you don’t, you might find that the spread can swallow up your potential gains.

Trading Commission Fees

As well as the spread, another important part of your day trading strategy should be to make yourself aware of the broker’s commission fees.

A lot of trading platforms actually offer 0% commission trades. Just be wary that some platforms might have a higher spread to make up for the lack of commission you’re going to pay. As such, always weigh up the commission fees against the spread.

Where commission fees are charged, they will be payable when buying and selling as well.

Withdrawal/Deposit Fees

You may find that some brokers offer free withdrawals, while some may charge a small fee. Ultimately, it is going to depend on which broker you decide to trade with.

It is also worth noting that the payment method you decide to use to deposit can sometimes be the difference between hours and days before your funds reach your trading account. This is why you are best advised to use an instant payment method – such as a debit/credit card or e-wallet.

No. 7: Timing Your Trades

They say timing is everything. One thing which definitely contributes to price volatility is the number of orders executed as soon as the trading day starts (first thing in the morning).

More experienced traders are usually good at recognising patterns, whereas if you are fairly new to trading, you might find that taking the first 20 minutes or so to read the market without making any moves will be beneficial to you.

To start with, it is recommended that you avoid these so-called rush hour opportunities, and to avoid the temptation of making any hasty decisions detrimental to your trading budget.

No. 8: Choose a Niche and Stick to it

There is such a vast amount of assets out there for you as a day trader. A good day trading strategy might be for you to make a bucket list of assets you are interested in trading. As we covered earlier, this could be forex, stocks, cryptocurrencies, or metals – to name a few (see further up this page).

If you are fairly new to day trading, we do advise that you only start with a small number of assets during each session. This will help you to avoid getting in over your head with too much to keep track of. By starting small, you can hone in on your day trading skills by concentrating on just a few things and doing them well.

You can then focus your attention on particular financial instruments and markets. Sticking to an asset you have identified as your niche is going to allow you to put all of your trading energy into learning one. This is much more effective than attempting to specialize in everything at once, creating confusion.

As a side, it is becoming increasingly popular for newbie investors to trade in fractional shares, enabling you to be able to specify a particular amount of capital to invest. Essentially, a brpoker will allow you to purchase much smaller shares, such as one-fifth.

No. 9: Don’t be Afraid to Change Your Strategy

It might be the case that certain day trading strategies work for a while, and then start to feel like it’s just not working for you anymore.

Even the most experienced day traders out there like to mix it up a bit and try a new strategy. As such, whether you’re a seasoned trader or a newbie, sometimes changing things up is good. After all, the global investment markets can change at the drop of a hat, so you must ensure that you stay ahead of the curve.

Like we touched on earlier, a great way to keep track of your tried and tested strategies is to keep a trading diary to look back on when you need it.

Tip 10: Choosing a Day Trading Broker

By this point, you should be familiar with the most important day trading strategies and have an idea of which direction you would like to take your investment career. Looking at costs like commission, margin rates, spreads, and other expenses will all aid you in being as informed as possible.

You are now going to need to decide which day trading broker is right for your trading style. There are a few more things to consider first when choosing a broker platform, which we outline below.

Tradable Assets

As we have covered earlier, no-two day trading brokers are the same Whilst there are many assets available (most of which we have listed), you also need to check that the specific niche you are interested in is supported by the broker.

Trading Tools

Is there a variety of trading tools at the platform?

We have listed various day trading tools further up this page. And when it comes to your day trading strategy, it’s recommended to check which trading tools are available on that particular broker platform and whether they fit into your plan.

Regulation

Is the broker fully licenced and regulated?

When you are deciding which day trading broker is best for you, it’s important to make sure the platform is fully licenced and regulated within the UK and EU. At the forefront of this is holding a brokerage licence from the FCA, ASIC, CySEC, or an alternative tier-one body.

Ensuring the broker has a reputable licence means that your funds and personal information is protected by law. You will also benefit from client fund segregation, which is crucial.

Fees

What fees will you be subjected to?

It probably goes without saying, but it’s always important to go in with your eyes open before committing to a new broker. Making yourself aware of any fees expected of you is going to help you to look after your trading budget in the long run. Stick with day trading brokers that offer low commissions and tight spreads.

Payment Methods

You should always check what deposit options are available when researching a broker, especially if you have a specific payment method in mind.

Generally speaking, payment methods you will commonly see when choosing a broker will be as follows:

- Credit and debit card

- Prepaid card

- Bank transfer

- E-wallets (such as Paypal)

Best Brokers to Test Your Day Trading Strategies

So now that you have 10 handy day trading strategies to consider, we are now going to discuss to best brokers to utilize them on. Each of the following pre-vetted platforms offer heaps of tradable assets, alongside competitive fees and commissions.

1. AVATrade – 2 x $200 Forex Welcome Bonuses

AVATrade offers several trading platforms - including MT4. It hosts thousands of tradable assets - all in the form of CFDs. Spreads are tight and there are no trading commissions to take into account. New customers are offered a sign up bonus.

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

To Conclude

Day trading will never come risk-free, but having a plan in place will definitely help you to reduce these risks. We think the key to being a successful day trader is to arm yourself with as much information as you possibly can.

Put simply, learn the ins and outs of day trading before you dive right in and take any massive risks. Hopefully, you now have a much clearer idea of what kind of day trader you would like to be and have picked up a few tips along the way!

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card