Margin trading is the process of applying leverage to your investments. In doing so, you will be able to trade with more money than you have in your account.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

While margin trading can boost your profits, it can also amplify your losses. With this in mind, you need to have a firm understanding of how margin trading works prior to taking the plunge.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

In our Learn 2 Trade 2021 Guide On Margin Trading, we explain everything you need to know. Not only do we cover the ins and outs of how margin trading works, but we also discuss the best leverage brokers to get started with today.

Note: If your leveraged trade goes against you by more than you have in your margin account, the trade will be liquidated by the broker. This means that you will lose your entire margin.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

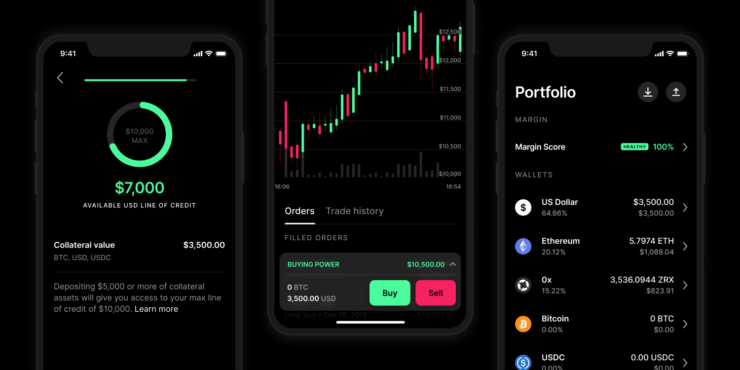

What is Margin Trading?

In its most basic form, margin trading refers to the process of applying leverage to your trades. Whether it’s forex, stocks, indices, cryptocurrencies, or commodities – you can typically apply leverage on any asset class of your choosing. In doing so, you are effectively trading with more money than you have in your account. This is because you are borrowing the funds from your chosen broker, which in turn, will attract a financing fee.

In terms of how it works, you will need to choose the amount of leverage that you wish to apply to your trade. For example, let’s say that you have an account balance of $500, and you apply the leverage of 10x. In theory, this means that you are actually trading with a stake of $5,000. So, if you make 5% on the trade, your profits will be amplified from $25 to $250.

If effect, if the trade goes against you by more than you have in the margin, then the broker will automatically close your trade. This is known as being ‘liquidated’, and it means you will lose your margin in its entirety. This is why you need to have a firm grasp of how margin trading and leverage work, as you can lose a lot of money if you don’t have the required stop-loss safeguards in place.

What are the Pros and Cons of Margin Trading?

The Pros The Cons

How Does Margin Trading Work?

There is a lot to learn about margin trading, so we are going to break down the fundamentals step-by-step.

Leverage

First and foremost, there is often a misconception that leverage and margin both refer to the same thing. Although they correlate to one another, there is a slight difference. In a nutshell, while leverage refers to the multiple that you plan to apply on your trade, margin refers to the upfront deposit the broker will require from you.

So, leverage is typically expressed as either a ‘ratio’ or a ‘multiple’. For example, this might be 5x and 5:1, or 10x and 10:1. For the purpose of simplicity, we’ll discuss leverage as a multiple, but just be aware that some brokers might display it as a ratio. Nevertheless, the amount of leverage that you decide to apply will dictate how much your trade is worth.

For example:

- Let’s say that you are looking to go long on Apple stocks

- You have $1,000 in your account, but you want to invest more

- As such, you apply the leverage of 5x

- This means that your Apple buy order is now worth $5,000

As per the above example, let’s say that later in the week Apple stocks increase by 10%. Ordinarily, you would have made $100 profit, as your balance is $1,000. However, as you applied leverage of 5x, we need to multiple this by 5. As such, you actually made a profit of $500.

With that being said, we also need to factor in what would happen if your Apple stock trade went the other way.

- Sticking with the same example as above, you have a $1,000 buy order on Apple at a leverage of 5x

- Later in the week, Apple stocks go down in value by 5%

- Ordinarily, you would have lost 5% of $1,000 – which is $50.

- However, you applied leverage of 5x, so your losses actually amount to $250

As you can see, leverage not only applies to winning trades, but losing ones too.

Margin

So now that you know how leverage works in practice, we now need to look at your margin requirement. In its most basic form, the margin is upfront security that the broker requires from you to be able to trade on leverage. In Layman’s terms, this simply amounts to the size of your trade without the leverage.

For example, let’s say that you have $500 and apply the leverage of 10x. Sure, the size of your trade equates to $5,000 – but, your margin is only $500. As such, this is the amount that you will need to have in your account to get the trade on. It is then placed in your ‘margin account’ until the trade is closed.

In order to work out how much margin you will need to put up, you simply need to look at the multiple.

- For example, if you want to trade with leverage of 10x, the required margin is 10% (1/10)

- If you want to trade with leverage of 30x, you will need to put up a margin of 3.33% (1/30)

This is really important to understand, as your entire margin is at risk when you trade with leverage.

Liquidation

Leading on the from the section above on margins, we now need to discuss the meaning of ‘liquidation’. As noted earlier, this will occur if your leveraged trade goes against you by more than you have in your margin account.

For example:

- Let’s say that you applied leverage on a buy order on GBP/USD.

- You staked $100 at a leverage multiple of 20x.

- This means that your trade is worth $2,000.

- Your margin of $100 amounts to 5% of the trade size.

- If your GBP/USD trade goes against you by 5%, the broker will liquidate the position.

- This means that the trade is automatically closed and you lose your $100 margin.

As you can see from the above, you will be liquidated if the trade goes against you by 5% – which is the amount of margin that you put up.

In another example, if you placed a $1,000 order at a leverage of 2x, your margin would amount to 50% – or $500. As such, you would have a huge buffer of 50% before having your trade liquidated, which is much more risk-averse than trading at 20x.

Margin Call

It is important to note that you typically have the option of avoiding liquidation. Known as a ‘margin call’, your chosen broker will notify you when you are approaching your liquidation price.

For example, let’s say that you are trading the FTSE 100 at leverage of 25x. This means that your margin is 4%. Let’s then suppose that your trade goes against you by 3.8% – which is just under your margin balance of 4%.

The first option is to do nothing. If the FTSE 100 continues to go against you and hits the 4% mark, your trade will be liquidated and the broker will keep your margin.

The second option is to add more money to your margin account. This will give you extra breathing space and prevent your trade from being liquidated – at least for the time being.

For example:

- Let’s suppose that you originally put up a margin of $500.

- You’re trading at a leverage of 25x, meaning you trade is worth $12,500.

- You are approaching the 4% mark, meaning that you stand the risk of losing your $500 margin

- As such you decide to add a further $500 into your margin account

- In theory, this means that you have just bought yourself an additional 4%

- That is to say, even if the original 4% liquidation is triggered, your trade will remain open as you added an additional 4% in the margin!

Ultimately, although adding more margin will prevent you from being liquidated in the short-term if the trade continues to go against you and your trade is closed by the broker, the amount you will lose will be even greater.

Margin Trading Fees

On top of your usual trading fees, margin trading comes with additional costs. At the forefront of this is overnight financing.

Overnight Financing

Regardless of how much leverage you decide to apply to your trade, you will always need to pay overnight financing fees. This is a fee charged by the broker for lending you the funds to trade on leverage. After all, you will be trading with more money than you have in your account – so it makes sense that this needs to come at a cost.

Crucially, overnight financing works like an interest rate on a loan. In the case of margin trading, you will need to pay a fee for each day that you keep your position open. As such, the longer you keep your leveraged trade in the market, the more you will need to pay. This can have a direct impact on your ability to make gains, so it’s really important that you assess how much you will need to pay.

It is important to note that your overnight financing costs will be deducted from your margin balance. With this in mind, you will inch closer to your liquidation price for each day that you keep the position open.

Other Trading Costs

On top of your overnight financing fee, you will also need to take the spread and trading commission into account.

- Spread: This is the difference between the buy and sell price of your chosen asset. The higher the spread, the more you will need to indirectly pay in fees.

- Commission: While some brokers charge trading commissions, others don’t. If you are charged, then this is typically a percentage against the amount you trade. For example, a 1% commission on a $200 trade would cost you $2.

How to Mitigate the Risks of Margin Trading

So now that you know the underlying risks of margin trading, we now need to look at some of the methods you can take to mitigate your losses. After all, even seasoned traders encounter regular losses, as this is just the nature of the online investment space. With that said, skilled traders know how to reduce these losses by installing sensible stop-loss orders.

Stop-Loss Orders

Installing a stop-loss order will be the difference between you losing a small amount of money on your leveraged trades or your entire margin. For those unaware, stop-loss orders allow you to specify an exact price that you want the trade closed at.

For example, let’s say that you apply the leverage of 10x on a $2,000 trade. This means that you will lose your entire margin if the trade goes against you by 10%. You obviously don’t want to lose 10%, so naturally, you install a stop-loss order.

If you want to mitigate your losses to 1%, then you would need to reflect this in your stop-loss trigger price. For example, if you are trading Disney stocks at $100 per share, your stop-loss price would need to be positioned at $99 on a buy order, and $101 on a sell order.

If and when your stop-loss price is triggered, the broker will close the position automatically. Ultimately, this will prevent you from losing huge amounts of money when trading on margin.

What Assets can I Trade on Margin?

You can engage with margin trading on just about any asset classes imaginable.

This includes everything from:

- Stocks.

- Indices.

- Cryptocurrencies.

- Hard Metals.

- Oil and Gas.

- Interest Rates.

- ETFs.

- Futures.

- Options.

- And more.

With that being said, you will need to be trading CFDs (contracts-for-differences) if you wish to apply leverage to your chosen asset. CFDs allow you to speculate on the future price of the asset without you taking ownership.

As such, although your chosen CFD will mirror the real-world price of your chosen asset, you won’t be entitled to dividends or coupon payments, nor will you have any voting rights.

The good news is that CFD brokers typically host thousands of financial instruments – all of which you can apply leverage to.

Margin Trading Limits

When it comes to margin trading limits, this will depend on a number of variables – such as your whether you are a retail or professional client, the type of asset you are trading, and the broker you are using.

Professional Clients

If you are a professional trader, then you should be able to apply as much leverage as the broker is willing to give you. In fact, this is often as high as 200x at some brokers. This means that by depositing just $2,000, you would be able to trade with $400,000!

With that being said, you will need to pass a verification process at your chosen broker to be determined a professional trader. For example, you will likely need to meet a minimum net worth, which you will need to validate in the form of a document.

Retail Clients

If you cannot prove that you are a professional trader, then you will be deemed a retail client. While you will still be able to trade on margin, your limits will be capped. This is to prevent inexperienced traders from losing vast amounts of money.

The specific limits might depend on where you are located. For example, all UK and European traders are capped by the limits imposed by the European Securities and Markets Authority (ESMA). These limits are based on the specific asset class you are trading, and are as follows:

- 30x: Major forex pairs.

- 20x: forex pairs, gold, and major indices.

- 10x: Commodities other than gold, non-major indices.

- 5x: Stocks.

- 2x: Cryptocurrencies.

Even if you are not a UK/European citizen, a lot of online brokers follow the limits outlined above.

How to Start Margin Trading Today

Like the sound of margin trading and wish to get started today? If so, we are now going to give you a step-by-step guide on what you need to do.

Step 1: Choose a Broker That Offers Margin Trading

Your first port of call will be to choose an online broker that offers margin trading. Essentially, any platform that hosts CFDs will allow you to trade on leverage, so you need to assess a number of other variables before making a decision.

This should include the types of assets you can trade, overnight financing fees, commissions, spreads, payment methods, and customer support. Crucially, you need to ensure that your chosen broker is licensed by a tier-one body like the FCA, CySEC, or ASIC.

If you don’t have time to research a broker yourself, you will find our top five rated platforms towards the end of this page. All of our recommended brokers are heavily regulated, allow you to trade on the margin of up to 30:1 (more for professional clients), and support heaps of payment methods.

Step 2: Open an Account

Once you have found suitable margin trading broker, you will then need to open an account. The process works largely the same regardless of which platform you are using, as you will need to provide some personal information.

This will include your:

- Full Name.

- Home Address.

- Date of Birth.

- Nationality.

- Email Address.

- Telephone Number.

You will also need to answer some questions about your historical trading experience. This is because you will be trading with leverage products, so the broker needs to know that you have a firm understanding of what you are doing.

Step 3: Verify Identity

As you will be using a regulated broker, you will now need to verify your identity. Most platforms will ask you for two documents in particular – a government-issued ID and proof of residency. Regarding the former, this can be either a passport, driver’s license, or national ID card.

And the latter – you’ll need to provide a recent copy of a bank statement or utility bill. The amount of time it takes for the broker to validate your documents can vary wildly. With that said, most of the platforms that we recommend can do this instantly.

Step 4: Deposit Funds

Now that your account has been verified, you will need to deposit some funds. Once again, the specific payment options available to you will vary from broker-to-broker, so be sure to check this out before opening an account!

In most cases, you will get to choose from the following:

You will need to ensure that you need a minimum deposit amount. Also, pay particular attention to any potential deposit fees on your chosen payment method.

Step 5: Trade on Margin

You are now ready to place your first margin trade. Take note, if you’re using a CFD broker then you won’t need to open a separate account to apply leverage. This is only the case if you are using a traditional brokerage firm. As such, start the process by searching for the financial instrument that you wish to trade.

Once you know what asset you want to buy or sell, you will need to enter:

- Stake: This is the amount that you wish to risk on the trade. Let’s say that you stake $500.

- Leverage: This is the amount of leverage that you want to apply. Let’s say that you select 3x.

As per the above, you staking $500 at a leverage of 3x – taking your total trade size to $1,500. Therefore, the required margin is 33.3%. In other words, if your trade goes against you by more than 33.3%, you will lose your entire margin.

Finally, confirm your order to execute the trade.

Best Margin Trading Sites and Platforms of 2023

With hundreds of margin trading providers now active in the investment space, knowing which platform to sign up with can be a challenge. As such, we are now going to discuss our top five margin trading sites of 2021. As always, make sure you to conduct your own research before signing up!

1. AVATrade – 2 x $200 Forex Welcome Bonuses

The team at AVATrade are now offering a huge 20% forex bonus of up to $10,000. This means that you will need to deposit $50,000 to get the maximum bonus allocation. Take note, you'll need to deposit a minimum of $100 to get the bonus, and your account needs to be verified before the funds are credited. In terms of withdrawing the bonus out, you'll get $1 for every 0.1 lot that you trade.

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Conclusion

In summary, margin trading is a highly sophisticated investment strategy that allows you to amplify your gains. As long as you are using a specialist CFD broker, you will likely be able to apply leverage on thousands of financial instruments. This includes stocks, indices, gas, oil, gold, cryptocurrencies, and even interest rates. On the flip side, margin trading and leverage can also amplify your losses.

This is why you need to have a firm understanding of the risks prior to taking the plunge. Nevertheless, if you do think that you have the required skill-set and knowledge to get your leverage trading career started, we would suggest exploring one of the five top-rated platforms we have discussed on this page.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card