Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

2023 has started out remarkably well for the crypto industry. With renewed interest from prominent figures, the value of digital currencies is expected to rise further in the near future.

Our Crypto Signals

1-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

12-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime Subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioThat said, crypto continues to be one of the most volatile trading markets. Consequently, if you are looking to get in on the action – it is paramount that you are armed with the required knowledge of how crypto trading works before taking the plunge.

In this Learn How to Trade Crypto Guide, we walk you through the fundamentals of this digital asset class, discuss the many different strategies, and offer you clarity on how to develop a systematic trading approach.

Further down, we also cover some tips on how you can find the right broker to start trading cryptocurrencies from the comfort of your home.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

Part 1: Understand the Basics of How to Trade Crypto

If you are new to cryptocurrency trading, the first step is to understand the basics of how this asset functions. As such, let us start with the bare-bone basics.

What are Cryptocurrencies?

You might already be familiar with the concept of cryptocurrencies to some extent. In simple terms, cryptocurrencies are digital currencies. They are not issued by any centralized bank or government, nor is their value backed by any fiat currency.

Every cryptocurrency is a token that is stored in a digital wallet. If you Bitcoin, for example, you can use the coins as a medium of exchange for several products and services.

Each of these transactions will be stored in a publicly accessible ledger known as a blockchain. This creates a permanent record that cannot be altered or tampered with – making cryptocurrencies a truly unique asset class.

Now that we have got the fundamentals down, let us talk about how you can trade crypto.

What are the Basics of Crypto Trading?

Cryptocurrency trading revolves around speculating the future price movements of the digital coin in question. For instance, when you are trading Bitcoin – you are trying to predict whether the price of the coin will rise or fall in the open marketplace.

You place a buy or sell order based on your speculation – hoping to make a profit in the process.

Here is a practical example of a cryptocurrency trade:

- Let’s suppose you want to trade Litecoin against USD.

- This will be denoted as LTC/USD on your chosen cryptocurrency trading platform.

- The current price of LTC/USD is quoted at $177.

- You create a buy order worth $500 on the pair.

- A few hours later, the exchange rate of LTC/USD rises to $190

- This translates to a price increase of 7.3%.

- On your stake of $500, you made a profit of $36.50.

This is a typical example of a cryptocurrency trade when you speculate the price of the asset will increase in the short-term.

On the flip side, you can also go ‘short’ if you expect the price to go down. This is possible by trading crypto CFDs. We will get into the ins and outs of short-selling later in this Learn How to Trade Crypto Guide.

To sum up, crypto trading allows you to take advantage of both the upward and downward price trends of the asset – given that you predict the market correctly.

In many ways, cryptocurrency trading draws many similarities to forex trading. In both markets, you are trying to speculate the exchange rate of currency pairs. In addition, both assets are equally famous for their volatility – at least in the case of exotics.

In fact, much like forex, the price of cryptocurrencies also fluctuate every other second or so. If you are thinking of trading cryptocurrency, you will need to understand what causes this price movement and where it is likely to be headed in the near future.

As such, before making any market moves, you need to do your homework on the relevant digital currency and its respective market.

Crypto Trading Pairs

In the world of cryptocurrency, trading pairs are assets that can be exchanged for each other. This can widely be classified into two categories – crypto-cross trading pairs and crypto-fiat trading pairs.

Let us take a closer look at each type of trading pair below.

Cryptocurrency Cross-Pairs

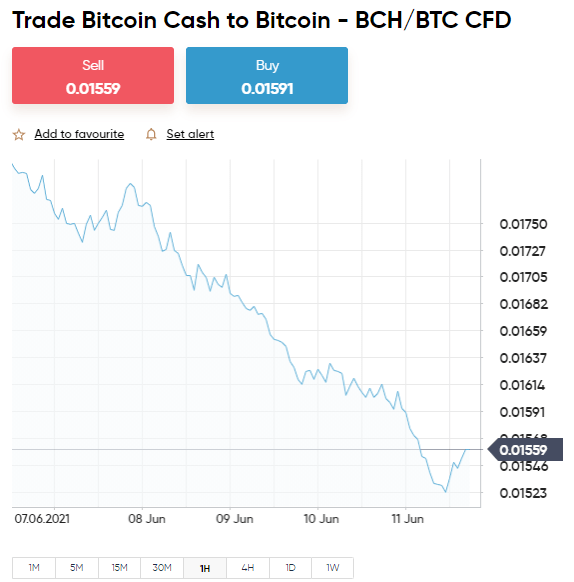

Crypto-cross pairs include two different digital currencies traded against each other.

For instance, if you see the trading pair BTC/XLM – this means that BTC (Bitcoin) is the base currency, and XLM (Stellar) is the quote currency.

If you are trading BTC/XLM, this is how the trade will work:

- Let’s say that the crypto-cross pair BTC/XLM is priced at 110,023.

- This means that for every Bitcoin you trade, you will get 110,023 worth of Stellar in return.

Your job as a trader is to speculate whether this exchange rate of the crypto-cross pair will rise or fall.

As you can see, this process might become a little complex for traders – especially beginners. It requires you to have a firm knowledge of both cryptocurrencies in the trading pair and their markets.

This brings us to the second type of cryptocurrency trading pair.

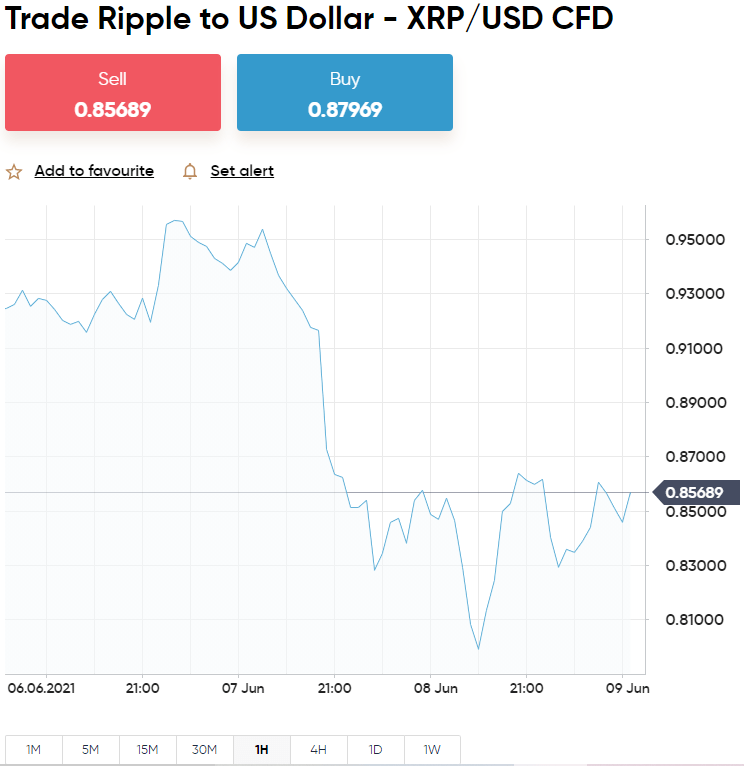

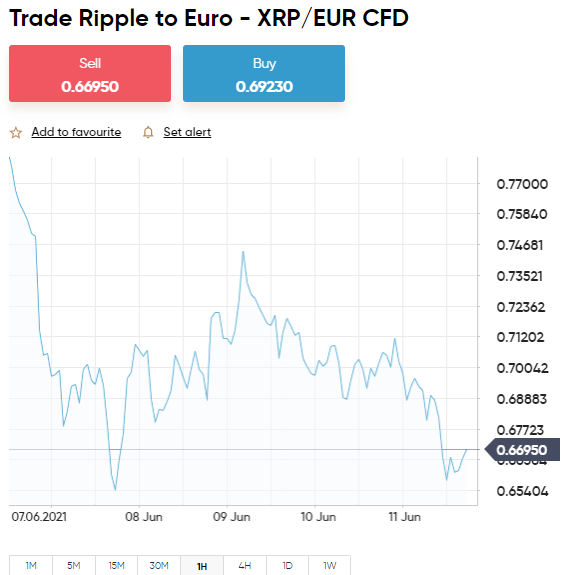

Fiat-to-Cryptocurrency Pairs

As we mentioned above, a fiat-to-crypto currency is made up of a fiat currency and a digital currency.

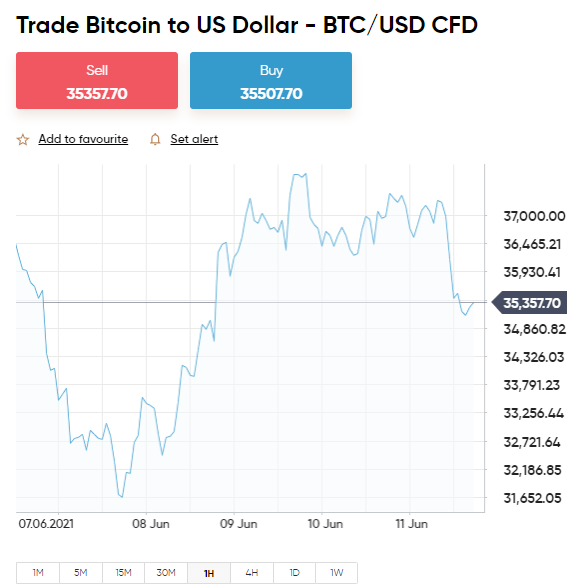

When you see the trading pair BTC/USD or BTC/EUR, it denotes the price of the cryptocurrency in the corresponding fiat currency. For instance, if BTC/USD is priced at $40,000 – it means that one Bitcoin is valued $40,000 in US dollars.

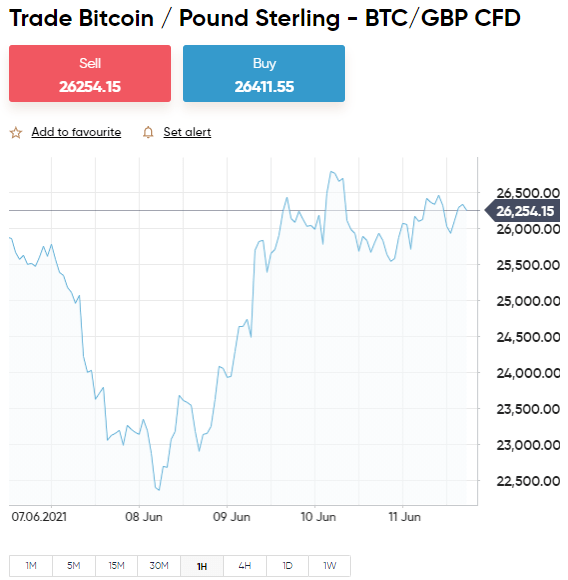

Most commonly, cryptocurrencies are traded against US dollars, as it is the benchmark currency of the world. However, depending on the online trading platform, you might also be able to trade digital currencies against other fiat currencies such as British pounds, euros, Japanese yen, Australian dollars, and others.

Here is an example of a fiat-to-cryptocurrency trade.

- Let’s suppose you want to trade Litecoin against the USD.

- You will find the pair denoted as LTC/USD on your trading platform.

- The price of LTC/USD is quoted at $180.

- Believing that the pair is undervalued – you place a buy order worth $2,000.

- A few days later, LTC/USD is valued at $210.

- This means that the price of the pair has gone up by 16.66%.

- As such, you place a sell order to cash in your profits.

In this trade, you returned $2,332 – with $332 as your profit.

Almost all cryptocurrencies available in the market today can be traded against other fiat currencies.

An additional point to note is that fiat-to-cryptocurrency pairs are often traded via CFDs (Contract for Differences). In simple terms, when using CFDs, you will not own the asset directly. Instead, you will be trading a financial instrument that tracks the real-world price of the crypto-asset.

The main advantage of trading CFDs is gaining access to zero commissions and tight spreads. Furthermore, you will also have the option to apply leverage to your trades, as well as short-sell with ease.

How to Trade Crypto: Short-Term or Long-Term?

When you learn how to trade crypto for the first time, you must consider what your financial goals are. For example, do you want to invest in crypto for several years, or trade via a day trading/swing trading strategy?

Let us consider what each option entails and what financial instuments are available to facilitate this.

Crypto CFDs

The most popular way to engage in short-term cryptocurrency trading is through CFDs. As we noted before, CFDs allow you to trade cryptocurrencies without taking ownership of the underlying asset.

In other words, you do not have to concern yourself with storing your cryptocurrency in a digital wallet or the safety of your digital funds. A CFD will merely mirror the price of the cryptocurrency and gives you the opportunity to profit from both falling and the rising markets.

For instance, when you believe that the price of a cryptocurrency is about to go up, you can take a long position and place a buy order. Once the price goes up, you will create a sell order to cash out – making a profit in turn.

On the contrary, if you think that the value of a cryptocurrency will drop – you can go short by initially placing a sell order. If your speculation is correct, you will place buy order to cash out and thus, turn a profit.

Let us demonstrate how a crypto CFD works in practice with an example:

- The price of DASH/USD is valued at $120.

- This means that a DASH CFD will also be priced at $120.

- If you speculate that the price of DASH is going to fall – you will create a sell order.

- If you speculate that the price of DASH is about to rise – you will create a buy order.

- If the price of the DASH moves in the direction you predicted, you will make a profit.

Rarely do short-term CFD traders keep their positions open for more than a few days or weeks. This is because leveraged CFD products also come attached with overnight financing fees.

Meaning – for every night you keep your crypto CFD position open, you will have to pay a fee to your broker. How much you are liable to pay is dependant on your chosen platform and how much you staked on the trade.

Buy and Hold Crypto

When it comes to long-term strategies, you will be investing in cryptocurrencies rather than trading them. This is often called a ‘buy and hold’ strategy, popularly known as HODLing among crypto investors.

In simple terms, this means you will be buying cryptocurrencies and holding them for months or years – until the time is right to sell the coins for a profit.

If you would rather go for a long-term strategy, it is best that you buy your cryptocurrency from a trusted online broker. To save you some time, we suggest that you consider eToro – a social trading platform regulated by the FCA, CySEC, and ASIC.

With over 17 million clients, eToro has built a long-running reputation in the online trading scene. The brokerage also comes integrated with a trading platform and a crypto wallet – so that you can manage all of your investments right from the online dashboard. Most importantly, eToro allows you to invest and trade cryptocurrencies 100% commission-free.

For this reason, novice traders often choose to trade cryptocurrency using a long-term strategy. In case you want to take this route, eToro gives you access to 16 cryptocurrencies and more than 90+ trading pairs to build a diversified portfolio.

Part 2: Learn Crypto Orders

Cryptocurrency traders often deal with extreme volatility and leverage. As such, it is crucial to have control over your trades. This is only possible by placing the right set of trading orders.

For those unaware, trading orders allow you to communicate with your broker. In simple terms, a trading order conveys to your broker how you want to enter the market, how much you want to stake, and how you want to exit the trade.

In this section of our Learn How to Trade Crypto Guide, we walk you through the most useful orders you will need to have a firm grasp of.

Buy Orders and Sell Orders

We will begin with the most fundamental of order types – buy and sell orders. These orders are necessary for all types of trading – regardless of the asset.

In its most basic form, if you expect the price of a cryptocurrency is about to rise, you will enter the market with a buy order and exit it with a sell order.

As you can see, you will need to use both buy and sell orders for every trade. You will open a position with one order, and you will close the trade with the opposite order.

Market Orders and Limits Orders

In the fast-moving cryptocurrency market, the price of a digital coin fluctuates every second. For this reason, it is critical that you have an entry strategy for all your trading orders.

The two most common entry order used in crypto trading are market orders and limit orders. These orders are used to specify to the broker what entry price you want to take on the trade.

Let us elaborate further.

Market Order

A market order will instruct the broker to complete the order immediately. It means that the broker will have to execute the order at the next best price. This type of order is widely used to take swift action when you see a profitable trading opportunity open up.

That said, it is important to note that a market order might not be executed at the last traded price. As the cryptocurrency market is extremely volatile, the price at which the order is executed might be different from the price at which the order is placed.

For instance,

- Let us consider that Cardano is currently priced at $0.9003.

- You like this price, so you wish to place a trade right away.

- Therefore, you place a ‘market order’, indicating that the broker should execute your order immediately.

- Once it is executed, you take a look at the order.

- You might notice that instead of $0.9003, you entered the market at $0.9005.

As you can see, the variation will be minor and will not significantly affect your ability to make profits. This difference is common with market orders as crypto prices are always fluctuating.

If you want to enter the trade at a specific price, that is where a limit order comes in.

Limit Order

A limit order allows you to buy and sell cryptocurrencies at a certain price. Let us see how a limit order would work with our previous example of Cardano.

- Suppose Cardano is currently priced at $0.9003.

- You want to place a buy order, but only when the price of Cardano has increased to $0.9015.

- As such – you place a limit order at $0.9015.

In this case, your broker will execute your order if and when the price of Cardano rises to $0.9015. If not, the order will remain pending until you cancel it yourself.

Stop-Loss Orders and Take-Profit Orders

Along with an entry strategy, you also need a strong strategy to close your crypto trades. The basic way to do this is via a ‘stop-loss’ and ‘take profit’ order.

Stop-Loss Orders

A stop-loss order is one of the most useful orders while trading cryptocurrency. It allows you to mitigate the potential losses by limiting the risk. In other words, you can decide at what price you want to exit a trade – in case the crypto market goes against your long-term crypto prediction.

Let us clear the mist with an example.

- You want to place a buy order on LTC at $185.

- However, you want to avoid the risk of losing more than 2% on your trade.

- Therefore, you set a stop-loss order at 2% below the entry price – at $181.30.

On the contrary, in case you wanted to place a sell order, you would set the stop-loss order at 2% above the entry price – at $188.70.

If the trade does not go according to your speculation, your broker will automatically close the trade at the stop-loss order you specified – preventing any losses beyond the 2% price mark you set.

Using stop-loss orders is one way to automate your trades, so you do not have to manually keep tabs on the market throughout the duration of your open position.

Take-Profit Orders

Now that you know how to enter the market and how to limit your losses, the only thing left to define is how you control your profits. Crucially, it is important that you enter a cryptocurrency trade with an idea of how much you want to make.

A take profit order is used to illustrate to your broker what your profit target is. This will allow the broker to automatically close the trade in profit once it has reached the specified level.

To explain better:

- Suppose you placed a buy order on LTC expecting the price of the digital currency to go up.

- The current price of LTC is $185.

- You want to make a profit of 5% – so you set the take-profit at $194.25.

If the price of LTC rises to $194.25, your broker will immediately execute your take-profit order and sell the position – locking in your 5% profit.

As you can see, you can place stop-loss and take-profit orders on either side of your entry price. It doesn’t matter which direction the price moves, your broker will close your trades automatically – at the price you specified.

Part 3: Learn Crypto Risk-Management

Risk management is a crucial component when you learn how to trade crypto. As with any other market, it is impossible to stay away from risk in its entirety. After all, in order to make money, you need to risk money.

That said, it is indeed possible to make calculated moves and limit the extent of your losses. Alongside, you should also consider what stake you can afford to invest into each crypto trade.

Here we discuss several risk management strategies to bear in mind when you learn how to trade crypto for the first time.

Percentage-Based Crypto Bankroll Management

A bankroll management system is an underlying concept of trading any asset. In simple terms, it defines the amount of stake you are willing to risk on one trade. Traders usually define their bankroll management in terms of percentages.

For instance, you could set a limit on all your positions at 2%. This means that you will not risk more than 2% of your available trading funds on single cryptocurrency trade. Regardless of how promising the market might appear, you will always stick to this 2%.

Alongside the market, your trading capital will also fluctuate. Consequently, you will have to recalculate your bankroll management relative to your trading successes or failures.

Consider this example:

- Let’s say you have $5,000 in your trading account.

- You decide to stake no more than 2% of your total balance.

- As such, the maximum amount you can stake on a cryptocurrency trade is $100.

- Suppose, after a good week, you now have $7,500 available in your account.

- In turn, you can now stake up to $150 – which is 2% of $7,500.

If your trading funds went down lower to $3,000, according to your current bankroll management strategy, you can stake only up to $60 – and so on.

Trading Crypto via a Risk and Reward Ratio

Another way to control your cryptocurrency trades is to adopt a strategy based on the risk-reward ratio.

Put simply, you are considering the amount of profit you want to target and how much you can risk you are willing to take to achieve this target.

For instance,

- Say that you have a risk-reward ratio of 1:1.5

- Meaning – for every $1 you are willing to risk, you are hoping to make a profit of $1.5.

- In other words, if you are staking $100, you want to make a profit of $150.

In addition to the previous metric, you can also use the scheme described in the crypto trading bot blog — if the resulting ratio is greater than 1.0, the risk is greater than the profit potential. If the ratio is less than 1.0, the profit potential is greater than the risk.

As you can see, the concept is simple, making this a strategy suited for both beginners and seasoned professionals. You can employ these risk-reward strategies using the take-profit and stop-loss orders that we mentioned above.

Crypto Leverage

For those new to the trading industry – leveraging enables you to trade with more capital than you have. You will stake what you can afford and essentially take the rest out as a loan from your broker.

As you can guess, leveraging allows you to magnify your profits exponentially. That said, note that it can also amplify your losses.

Take a look at this example:

- You have $2,000 in your trading account, and you want to stake it on BTC/USD

- Your broker gives you leverage of 1:20 – meaning you can boost your stake 20 fold.

- You apply leverage of 1:20, and now your position is valued at $40,000.

- If you applied leverage of 1:10, your position will be valued at $20,000.

How much leverage you can access will depend on several factors. One thing to note is that trading with leverage is considered risky in many parts of the world – and is thus highly regulated.

For instance, US residents are not permitted to trade CFDs or take advantage of leverage. On the other hand, in the UK, you can apply leverages on all CFD assets, except crypto.

In contrast, some countries in the world have no cap over leverage limits. You will not be surprised to see leverage offered as high as 1:1000 on some platforms. However, as we mentioned earlier, when you apply such huge leverage limits – you are also inviting unwarranted risk.

Let us show you with an example of how leverage can affect a trade:

- You want to place a $100 buy order on NEO, which is priced at $35 per coin.

- You decide to apply leverage of 1:5 – meaning, your total stake is valued now at $1,000.

- After a few hours, the price of NEO rises by 2%

- Without leverage – your profit on this trade will be $2.

- Since you applied leverage of 1:5 – your profit is increased to $10.

As is evident, leverage is an easy way to boost your profits. At the same time, remember that if the price of NEO had dropped, your losses would have also been amplified.

Part 4: Learn How to Analyze Crypto Prices

As you have come this far, you should now have a basic grasp of what cryptocurrency trading entails, the types of orders to use, and how to manage the risks.

In order to get the best possible start in crypto trading, you also need to rely on cold-hard data. Traders use a number of methods to understand the factors that influence the price of crypto.

In this section, we discuss how you can analyze crypto prices to make rational trading decisions.

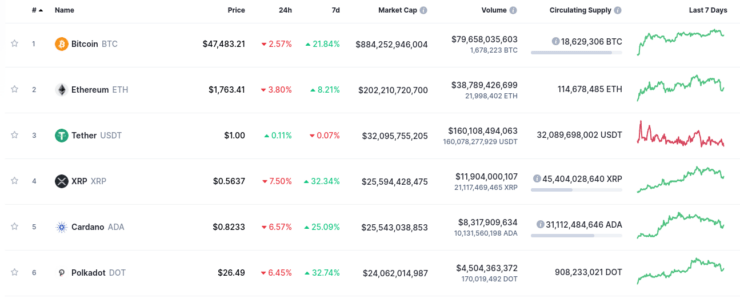

Fundamental Analysis in Crypto

Fundamental analysis examines the economic and financial aspects that contribute to the volatility of cryptocurrency. This type of analysis is essential in order to keep yourself updated with new developments in the world of digital assets.

As a relatively new asset, cryptocurrency networks work a little differently than traditional assets. For instance, when you analyze the crypto markets, you have to consider blockchain advancement and security risks. Such factors are not applicable to conventional securities such as stocks and commodities.

- Market capitalization of each coin

- Total number of coins available

- The philosophy behind the coin

- Liquidity and trading volume

- Economics and usage of cryptocurrencies

- Global and country-wise regulations

As you explore further, you will come across more factors that you think are relevant to cryptocurrency prices.

For instance, in January 2021, the price of Bitcoin went up 14% after Elon Musk tagged the digital currency in his profile. As such, it is no longer far-fetched to assume that ‘social media mentions’ are not a significant factor that contributes to the price movements of cryptocurrencies.

Of course, it might sound like a daunting list to monitor. Thanks to the internet, now you can subscribe to services that deliver real-time news and updates relevant to cryptocurrencies. This way, you are not required to invest all your time researching the market.

Technical Analysis in Crypto

Technical analysis, on the other hand, requires you to analyze the trends of the cryptocurrency market by looking at the historical price of a digital asset. You will be utilizing charts and technical indicators to understand the market sentiment of a particular crypto pair.

Crypto Signals

For a novice trader, keeping track of both fundamental and technical analysis can be quite overwhelming. That is where crypto signals can come to your aide.

Crypto trading signals are triggers based on predetermined criteria such as a set of technical indicators. They cut out the need for you to do the research on the market and asset yourself.

Instead, trading signals include tips such as:

- Whether you should place a buy or sell order

- Entry price

- Take-profit price

- Stop-loss price

If you do not have sufficient time to spend on research, these crypto signals at Learn 2 Trade can be a lifesaver.

Part 5: Learn How to Choose a Crypto Broker

Cryptocurrency trading is mostly carried out online. In order to trade crypto from the comfort of your home, you first need to find a trustworthy broker. As you know by now, your broker executes all of your trading orders on your behalf. Therefore, it is crucial that you find the right one to handle your trades.

We have combined a list of important factors that you need to consider when choosing an online crypto broker.

Regulation

The best way to ensure that a broker is reliable is to check whether they hold a license from a financial authority. The trading space is regulated by bodies that ensure that brokerage platforms abide by strict guidelines – in order to protect the interest of traders.

The first item on your checklist is to verify that your chosen broker holds a license from at least one of these authorities.

Trading Fees and Commissions

In order to facilitate your trades, brokers charge fees. Here is an overview of the different types of fees you will come across.

Commissions

Commissions are direct fees calculated as a percentage of the size of your trade. Say, for instance, your broker stipulates a 1.2% commission on cryptocurrency trades. This means that you have to pay 1.2% when you enter the market and once again when you exit it.

But not to worry, there are numerous online brokers that allow you to trade without paying any commission. One such prominent brokerage platform is eToro, where you can trade 16 cryptocurrencies on a zero commission basis.

Spreads

Spreads are an indirect fee that is the difference between the ask and bid price of a crypto pair. Unlike commission, it is not a fixed rate but will vary depending on the price of the asset.

Let’s say the buy price of EOS/USD is $4.3000, and the sell price is $4.3002. This translates to a spread of 2 PIPS.

If you place a trade on EOS, it means that you are starting your trade at a loss of 2 pips. You need to gain over 2 pips for this crypto trade to earn any profits. Consequently, you are looking for a tight spread from your broker.

Payment Methods

Trading requires you to entrust large sums of capital to your broker. As such, you need to consider what deposit and withdrawal options are available at the platform.

The best brokers on the internet will have a few choices for you. These will include bank transfers, credit/debit cards, as well as third-party e-wallets like Paypal.

Best Broker to Trade Crypto Online

Even with a checklist, we know that finding the right online broker can be a daunting task. That is why we took it upon ourselves to find the best crypto trading sites of 2023.

Here is the broker that ticks off all our criteria.

AVATrade – Trade Crypto CFDs With Tight Spreads

AvaTrade is a well-established brokerage platform that has continued its success in online trading for over a decade. The most notable aspect of AvaTrade is the number of regulatory licenses it holds, allowing the brokerage to facilitate trading in different jurisdictions. This includes the UK, Australia, the EU, Japan, South Africa, and more.

Not only in terms of regulatory standing, but AvaTrade also shines when it comes to the trading resources available on the site. Be it technical indicators, charts, or risk management tools - AvaTrade has got you covered.

The brokerage is also integrated with multiple trading platforms - 'Zulutrade', and 'Duplitrade', along with a mobile app that you can use to trade on the go.

- Min deposit $100

- Leverage offered on all markets

- AvaTradeGO mobile app

- Free commodity trading demo only valid for 21-days

Part 6: Learn How to Trade Crypto Today – Walkthrough

In this exhaustive guide, we have covered all the rudimentary aspects of cryptocurrency trading. Now, all that is left for you is to open your brokerage account and commence your trading journey.

As with everything else, we will give you an example here to guide you through the process. We are going to use Capital.com as our guide to show how you can place your first commission-free cryptocurrency trade.

Step 1: Open an Account

Get started by heading over to the Capital.com website and clicking on the ‘Join Now’ button. You can fill in your personal information such as full name, address, email, date of birth, and so on to create your account.

Step 2: Upload ID

As Capital.com complies with KYC regulations, you will have to upload a government-issued ID such as your passport or driving license to verify your identity.

On Capital.com, you can save this part for later. You only need to attend to it if you want to make a withdrawal or deposit more than $2,250.

Step 3: Deposit Some Trading Funds

With your account set up, you can proceed to deposit funds. As we covered earlier, you can choose to transfer money through a bank transfer, credit/debit card, or via e-wallets such as PayPal, Neteller, or Skrill.

Step 4: Start Trading Crypto

Now you are fully equipped to start trading crypto. If you need a quick brush up on orders – you can read through our session on Crypto Trading Orders again.

That’s it – you have placed your first crypto trade on Capital.com!

Learn How to Trade Crypto – The Verdict

In our Learn How to Trade Crypto guide, we have covered everything you need to know about this digital asset class. By now, you should have a clear understanding of what cryptocurrencies are and what you need to know before entering the market.

It is always a good idea to continue educating yourself on trading, even as you gain experience. Make sure that you get a firm grasp on the market sentiments of your chosen cryptocurrency and practice with a demo account before you take the plunge.

To conclude – you need to find a regulated and well-reputed online broker who can make cryptocurrency trading fast and convenient for you. If you are in doubt, you can always go with Capital.com – where you can trade crypto at zero commission.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

FAQs

Is trading crypto online considered safe?

What determines the price of a cryptocurrency?

How can I make a profit by trading crypto?

Is it possible to make a profit trading crypto?

Can you trade crypto in the US?