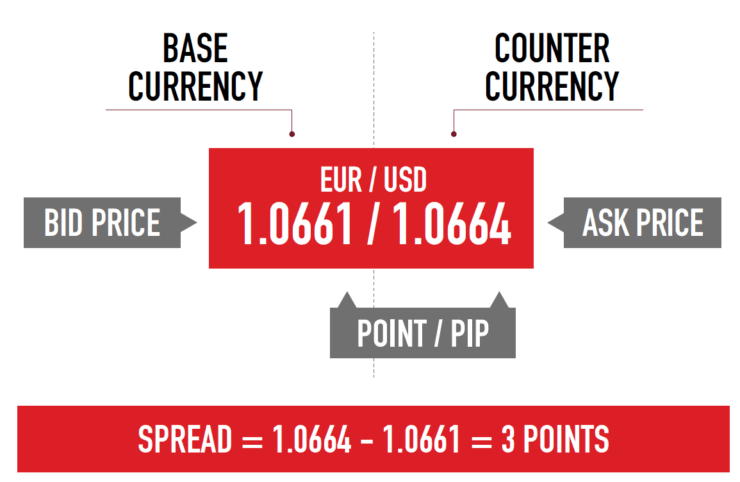

Forex spreads, even if you’ve yet to trade a single forex pair, it’s likely that you’ve still heard of the ‘spread’. In its most basic form, the spread is the difference between the ‘buy’ and ‘sell’ price of a forex pair.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

The spread relates to a fee that you are indirectly paying to trade, and it’s how online forex brokers make money. Quantified by the number of ‘pips‘, the tighter the spread, the more beneficial it is for you as a trader.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Fancy finding out more about what the spread is and how it works? Be sure to read our comprehensive guide on What is Spread in Forex?

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Note: Although some forex brokers offer super-tight spreads on their major pairs, you still need to assess what the commission amounts to. It’s all good and well using a low spread broker, but it’s counter-intuitive if you’re paying a high commission.

What is the Spread?

In a nutshell, the spread is the difference between the ‘buy’ price of a forex pair, with that of the ‘sell’ price. This ensures that the forex broker in question always makes a profit – regardless of which way the markets go.

The spread is an important talking point in the world of forex, not least because it will dictate how much you are paying to trade. In other words, the higher the spread, the more you are indirectly paying in fees.

- You are trading USD/CAD.

- Your broker is quoting a ‘buy’ price of 1.31.

- The ‘sell’ price is 1.30.

- This means that the difference between the buy and sell price is 0.76%.

As per the above, if you were to place a buy order on USD/CAD – meaning that you are confident on the pair increasing in price, you would pay 1.31. As soon as the order is placed, you would be in the red by 0.76%.

Why? Well, because if you wanted to sell your position, you would need to do so at 1.30. As this is less than what you paid, the spread puts you at an immediate disadvantage as soon as you place an order. This is why it’s crucial to choose low forex spreads forex broker.

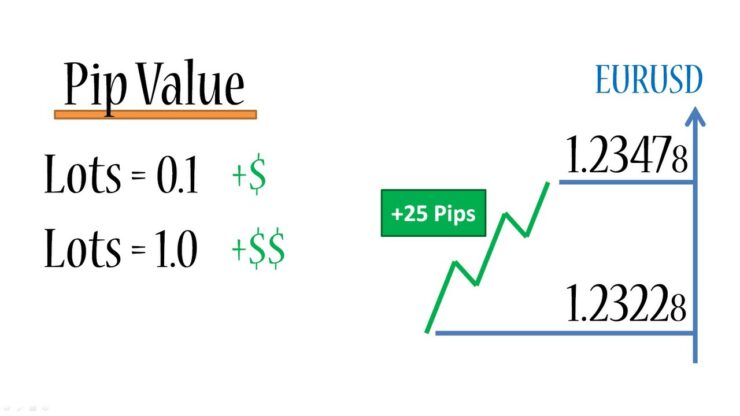

What are Pips in Forex?

Before we can get a full grasp of what the spread is and how it is calculated, we first need to learn about ‘pips‘. The reason for this is that in order to ascertain the width of the spread, we need to be able to quantify pricing movements in pips.

Nevertheless, if GBP/USD went from 1.3103 to 1.3104, this would indicate a movement of 0.0001 USD. In the world of forex terminology, this would be referred to as ‘1 pip’. Similarly, if the price of GBP/USD went from 1.3103 to 1.3098, this would be a movement of ‘5 pips’.

Calculating the Spead in Pips

So now that you know what the spread is, as well as how pips are calculated, we can now show you a real-world example of the spread.

Example of Pips: Spread of EUR/USD

Let’s say that you want to trade EUR/USD, and you’re looking to go long. As such, you believe that EUR will outperform USD, meaning that the exchange rate will go up.

- The ‘buy’ price is 1.1389.

- The ‘sell’ price is 1.1382.

- With a difference of 7 digits, the spread is 7 pips.

- You place a buy order at 1.1389, meaning that you need the price of EUR/USD to increase by at least 7 pips just to break even.

As you can see from the above example, even though the buy price is 1.1389, you would need the selling price to increase to 1.1389 before you can break even. Before it reaches this price, you would need to exit your trade at a lower price than what you paid.

What About Pipettes in Forex?

Without intending to confuse you even further, you also need to understand what ‘pipettes’ are. In a similar nature to pips, pipettes relate to the ultra-small pricing movements of a forex pair. However, while pips are based on 4 digits after the decimal point (2 in the case of USD/JPY), pipettes utilize 5 digits.

For example, instead of pricing GBP/USD as 1.4592 (4 digits), it might look something like 1.45927 (5 digits). As such, the movement of 1 pipette would amount to 0.00001 USD. Confused? Don’t be, as the calculation works in exactly the same way as pips, albeit, you’re adding an extra digit in.

Example of Pipettes: Spread of GBP/USD

In this example, we’ll look at how we would calculate the forex spreads on GBP/USD when a broker uses pipettes.

- The ‘buy’ price is 1.31016.

- The ‘sell’ price is 1.31008.

- With a difference of 8 digits, the spread is 8 pipettes.

- You place a buy order at 1.31016, meaning that you need the price of GBP/USD to increase by at least 8 pipettes just to break even.

In the above example, the forex spreads of GBP/USD is 8 pipettes. However, although the broker in question utilizes a pipette system (5 digits after the decimal), the spread is always calculated in ‘pips’. As such, the spread would, therefore, amount to 0.8 pips.

Note: If you’re able to find a broker that offers 0.8 pips on major forex pairs, this is super-competitive. However, be sure to check what trading commissions you’ll be required to pay!

What Spread Should I aim for When Trading Forex?

If you’ve read our guide up to this point, you should now be able to calculate the forex spreads in both pips and pipettes. Don’t forget, even if the broker offers 5 digits after the decimal point, we still quantify the forex spreads in pips.

Nevertheless, we are now going to explore what sort of spreads you should be aiming for when using a forex broker. Firstly, the width of the spread will be determined by the underlying trading pair.

The reason for this is liquidity. While the global markets will demand trillions of pounds worth of GBP/USD on a daily basis, the likes USD/TRY will often suffer from liquidity. And what happens when markets suffer from low liquidity levels? Volatility is high. As such, the forex spreads of exotic pairs will always be significantly higher than that of the majors.

In some cases, a number of brokers will offer a spread of zero on its major pairs. However, this is typically reserved for those with a professional trading account. Moreover, the zero forex spreads forex broker will likely offer this during standing trading hours only.

Should I Consider Factors Other Than the Spread?

As important as the spread is in the world of forex trading, this shouldn’t be your primary reason for joining a new broker. On the contrary, you need to look at a range of other variables. This includes regulation, the number of instruments that you can trade, and the type of payment methods it supports.

Here’s what you need to look out for.

✔️ Trading Commission

Most forex brokers will charge a trading commission of some sort. This is usually a small percentage of the amount that you trade. For example, if the broker charges a commission of 0.3%, and the value of your trade is £2,000, then you would pay £6 in fees. You usually need to pay a commission at both ends of the order.

✔️ Deposit and Withdrawals

It’s always great when you are able to save some money on the spread. However, there’s nothing worse than choosing a low spread broker, only to find out that you will be charged to make a deposit and withdrawal. As such, check whether or not your preferred payment method comes with a transaction fee.

✔️ Overnight Financing

If you’re looking to trade on leverage, you will need to be aware of overnight financing fees. This is the cost of borrowing the money from the broker, and it’s charged for every 24 hours that you keep the position open. As such, although you might be paying a super-tight spread at the broker, you might be paying for this when you apply leverage.

Best Low Spread Forex Brokers 2023

So now that you have a firm grasp of what the spread is, and how it will have a direct impact on your ability to make gains in the long run, we are now going to list our top 3 forex broker picks.

These brokers offer some of the lowest spreads in the UK trading space. With that being said, just make sure that you perform additional research on the broker before signing up.

1. AVATrade – 2 x $200 Forex Welcome Bonuses

The team at AVATrade are now offering a huge 20% forex bonus of up to $10,000. This means that you will need to deposit $50,000 to get the maximum bonus allocation. Take note, you'll need to deposit a minimum of $100 to get the bonus, and your account needs to be verified before the funds are credited. In terms of withdrawing the bonus out, you'll get $1 for every 0.1 lot that you trade.

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Conclusion

In summary, if you've read our guide all of the way through, you should have a good understanding of what the spread is, how you calculate it, and why it's crucial to stick with brokers that offer 'tight' spreads. With that being said, you should never choose a new forex broker primarily on the size of the spread.

On the contrary, the broker might be charging you in other areas of the platform. For example, this could include commissions, overnight financing, and even deposit/withdrawal fees. As such, always perform enhanced research on a broker before signing up.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card