Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Whether you’re looking into how to buy XRP to diversify your portfolio, or are new to buying and selling altogether – read on.

Our Crypto Signals

1-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

12-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime Subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioIn this guide, we detail how you can buy and sell XRP tokens yourself, from the comforts of home.

This includes a rundown of the best trading platforms to facilitate your crypto needs. Moreover, we offer a simple how-to-buy walkthrough and some strategies along the way.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

How to Buy XRP in 10 Minutes – Quickfire Guide

Put simply, without a broker providing access to XRP, you won’t be able to buy it. The platform you choose will also execute your orders, so it’s crucial you pick carefully.

If you are short on time, see a quickfire guide of how to buy XRP in 10 minutes.

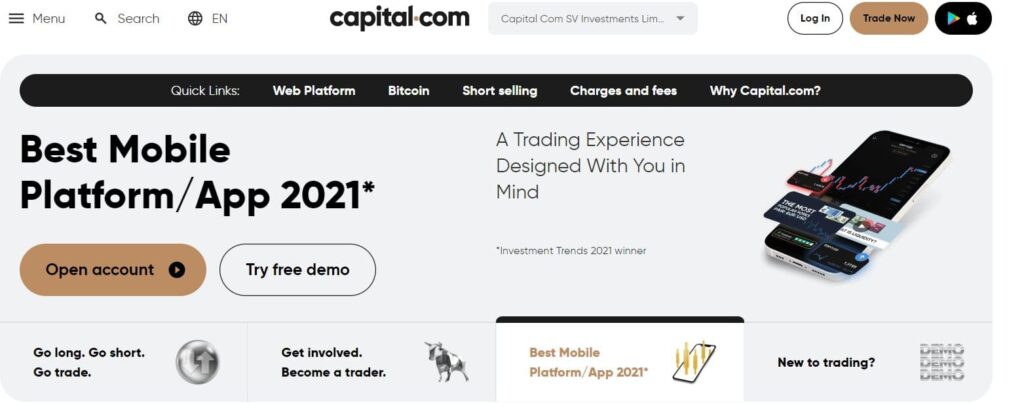

- Step 1: First – sign up with a licensed broker. Capital.com

is commission-free and regulated by ASIC, FCA, CySEC, and NBRB - Step 2: Fill in details including your name and email, when prompted on-screen

- Step 3: Send clear copies of your passport or driving license, in addition to a recent utility bill or bank statement

- Step 4: Select a payment method from what’s available to you and enter an amount to deposit

- Step 5: Find XRP, enter the amount you wish to buy ($25), and complete the investment

You’ve just bought XRP from Capital.com without paying a single cent in commission!

Select a Trusted XRP Broker

As we said, to be able to buy XRP you will have to first register with a trusted broker. There are hundreds online so we have put together a review of our top 4 to start you off.

Notably, eToro allows you to buy XRP in the traditional sense, while the other trading platforms mentioned below will allow you to open both a long and a short position via CFDs. This usually means you are able to apply leverage if it is permitted in your country.

Also bear in mind that with different rules and regulations around the world – it is important you check the leverage limits for XRP in your location before counting on it to boost your gains. For those in the dark, we talk about XRP CFDs later.

1. AvaTrade – XRP CFDs and a Wide Range of Techincal Analysis Tools

AvaTrade is a well-known broker in the industry and has been providing a service to traders and investors for many years now. This broker offers access to over 1,000 financial instruments including forex, commodities, indices, ETFs, stocks, bonds, and of course - cryptocurrencies including XRP.

Although you will not be able to buy XRP in the traditional sense at this platform, you can still speculate on its future value via CFDs. Furthermore, this is another platform on our list that doesn't charge a cent in commission fees. Whilst you can trade XRP against crypto - you will also be able to trade it against fiat currencies such as US dollars, euros, Japanese yen, and more. If it's competitive spreads you are looking for - AvaTrade averages 1.5% over-market on XRP.

CFDs go hand in hand with leverage, so you won't be surprised to learn you can trade XRP on margin here. This broker usually offers leverage of 1:25 for non-EU traders, and 1:2 for Europeans. The latter amount offered is based on a margin of 50% for crypto. This means that if you wanted to open an XRP position valued at $1,000, you would be required to put in $500 from your own pocket (or trading account). However, as we said, always check for your region to know where you stand regarding leveraged CFDs.

As is always the case, if you qualify as a Pro Trader you will be offered significantly more leverage than retail traders. In terms of trading tools, AvaTrade will provide you with a risk management feature to protect any XRP positions from exceeding your account balance. With regards to licensing, AvaTrade is kept in check by six financial regulators. As such, you can rest assured that this trading platform will segregate your account from its own whilst respecting rules and customer care.

You can learn the ins and outs of the crypto markets by utilizing the free demo account facility which comes packed with $100,000 in virtual money - which you can use to trade XRP. When you feel confident to go live with real money, you can get started by meeting the minimum deposit of $100. There are various payment methods accepted by AvaTrade - such as major credit cards, debit cards, wire transfers, and e-wallets like Neteller, Skrill, and Boleto.

- Minimum deposit for XRP just $100

- Regulated in 6 jurisdictions

- 0% commission on XRP CFDs

- Admin fee expensive after 12 months no account action

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Consider Your XRP Strategy

When you are contemplating how to buy XRP online, you will likely think about what strategies you might find useful.

If you have never purchased cryptocurrencies before, see below for some inspiration.

Buy and Hold XRP

When researching how to buy XRP you will likely notice the term ‘buy and hold’ on guides like this. To throw some light on the situation – this means to buy XRP and then sell it months or even years later.

For instance, you may spot a money-making opportunity and cash out your XRP position after 3 months. Alternatively, you might not want to let go of your coins for a decade or more. Essentially, this strategy saves you from worrying about the sentiment of the crypto market throughout the trading day.

See a simple example of how you might incorporate a buy and hold strategy:

- You are quoted $0.55 for XRP and think the coin will see a rise in value

- As such, you decide to buy $500 worth of the crypto-asset

- 8 months later XRP has risen to $0.64

- Clearly, you hypothesized correctly – as the tokens have experienced a price increase of 18%

- Consequently, you sell your XRP and cash out the position with a $90 profit – on top of your initial $500 purchase

When utilizing the buy and hold strategy it’s vital that you also consider how you will store your digital tokens. You have likely heard of crypto-wallets. The problem is that when storing XRP this way, you will also have to deal with the security of your wallet and its contents. This can be somewhat of a daunting task for newbies.

At a licensed online brokerage such as eToro, you can store your digital currencies at no extra cost – in a secure space. This also cuts out the need to worry about being hacked or having your XRP stolen – as you are not personally responsible for its safety.

Trade XRP

An alternative option is to trade XRP via Contracts for Differences (CFDs). This means to partake in trading on the price shifts XRP – rather than personally buying them. Although we touched on CFDs in our earlier broker reviews – we are now going to further clear the mist on this popular short-term crypto strategy.

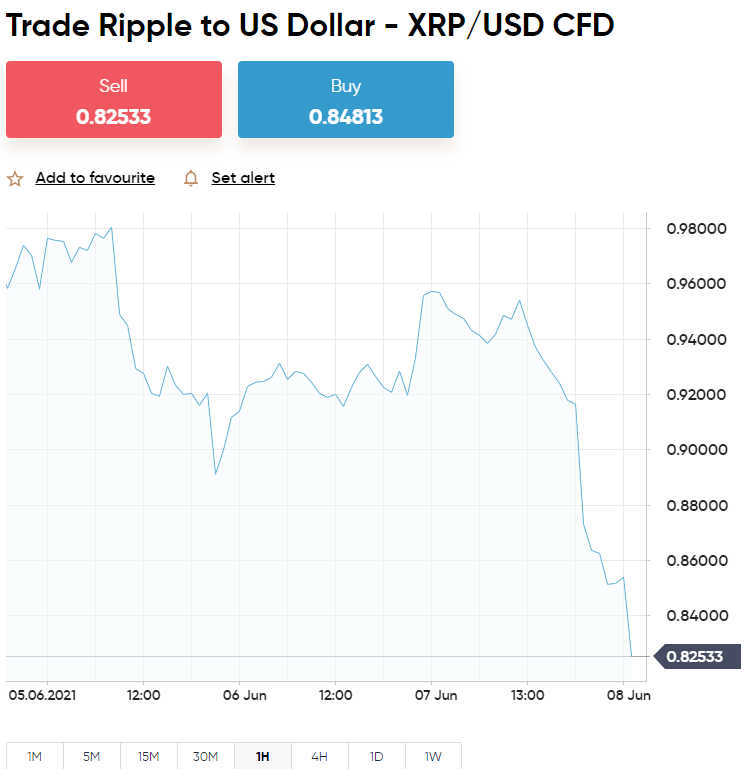

Like in the case of forex, cryptocurrencies are traded in pairs. This will mean you are tasked with predicting the exchange rate movement between XRP and a fiat currency or a cryptocurrency.

For instance, if you see XRP/USD displayed at the trading platform – this is XRP against the US dollar, which is a fiat currency. Most brokers will be able to offer you access to a variety of fiat currencies to trade XRP against. Other popular pairs include XRP/EUR (euros), XRP/GBP (British pounds), and XRP/AUD (Australian dollars).

We mentioned you can also trade XRP against another digital coin. If you were to trade against Ethereum for instance this would be paired as XRP/ETH. Other cryptocurrencies that XRP can be paired with include Litecoin, Bitcoin, and Bitcoin Cash. Crucially, the pair you trade via a CFD will always truly reflect the real market price.

Take a look at an example of an XRP CFD trade:

- XRP/AUD is priced at $0.70 –

- Your chosen CFD platform also offers XRP/AUD at a price of $0.70

- You think the pair is overvalued and will fall – so you place a $200 sell order with your broker (thus ‘going short’)

- 3 days pass and XRP/AUD is now valued at $0.64

- As such, you were right – this indicates the pair has fallen in price by 8%

- Next, you place a buy order with the trading platform to exit your position and cash out your 8% gains

- On a stake of $200 – that’s a profit of $16

As you can see – CFDs enable you to go both long or short on XRP. This means that unlike with traditional stocks, you can also profit from the asset dropping in value.

Furthermore, as we mentioned, you can also apply leverage to XRP CFD trades. As such, if you apply leverage of 1:2 – for every $1 you stake, your trade value is amplified to $2.

See below:

- You add 1:2 leverage to your $200 sell order on XRP/AUD

- Your position is now worth $400

- You made a profit of 8% by correctly hypothesizing on its decrease in value

- Without leverage, you made gains of $16

- However, with leverage, you doubled your profit to $32

Importantly, leverage doesn’t just amplify your XRP profits, as it will do the same with your losses if you incorrectly predict the direction of its value. Furthermore, if leverage is something you are interested in trading with, you will need to check what (if any) restrictions are in place in your jurisdiction.

Where to Buy XRP

As well as considering where you might store your tokens and what strategy suits you – it’s also important to think about where you can buy XRP.

Buy XRP Debit Card

If you are hoping to buy XRP via debit card, you will be pleased to know that many online brokers will allow this. With that said, it’s important to make sure you will not be liable for any extra fees for doing so.

For instance, if you buy XRP via debit card at trading platform Coinbase you will need to pay 3.99% on each transaction. At the other end of the scale, cryptocurrency broker eToro only charges 0.5% – which is only payable if you are not using USD to fund your account.

Buy XRP Credit Card

Alternatively, some brokers allow you to use your credit card to buy XRP tokens. At eToro, you can buy XRP via credit card at no extra cost (provided you are making a deposit in US dollars).

Before you go ahead and set up your credit card, it’s important to make sure your provider doesn’t charge any additional fees for using it at a brokerage. Furthermore, some won’t even allow you to buy digital currencies using a card credit – so be sure to check with your provider.

Buy XRP Paypal

Our guide found that online brokers who accept PayPal are seldom seen. It’s believed this is because fees are higher for the trading platform than with alternative e-wallets on the scene.

With that said, regulated trading platform eToro allows you to buy XRP using PayPal with ease. Moreover, you can still indulge in crypto trading without paying any commission!

XRP ATMs

Found everywhere from street corners and garages to convenience shops and grocery deli’s – more and more XRP ATMs are popping up around the world.

For those unaware, unlike the machines we make withdrawals from to obtain fiat money – crypto ATMs enable us to buy digital coins by inserting cash. Enter the amount of XRP you wish to buy and the machine will tell you how much you can expect to receive.

It’s important to mention that the commission fees charged by XRP ATMs often go above and beyond that of online brokers. This is especially the case when you consider that platforms like eToro do not any commission at all. As such, this is often the cheapest and most convenient option.

XRP Strategies

There are heaps of strategies used on a daily basis by traders and investors.-What suits you will depend on your own personal crypto trading goals.

Read on to see some of the most commonly used.

Dollar-Cost Averaging

Dollar-cost averaging is a simple system used by millions of crypto buyers. This will see you restricting your XRP purchases to a specific amount every week or month.

Buy the Dip

Now that we have covered dollar-cost averaging and how it can help you to be risk-aversive when building your portfolio – let’s briefly explain how to ‘buy the dip’.

See a practical example:

- XRP has fallen from $0.50 to $0.42 – this illustrates an 18% drop

- As such, you spot an opportunity to ‘buy the dip’

- This sees you accumulating XRP tokens whilst they are at a cheap price

As you can see, this strategy can be used in conjunction with the aforementioned dollar-cost averaging system very easily.

Diversify

Traders and investors very rarely put all of their eggs in one basket. As such, it might be a good idea to think about diversifying your own portfolio, albeit now or later on.

For instance, you could add some stock investments to your basket, which can be spread across different sectors such as healthcare, utilities, and technology.

Additionally, consider adding alternative digital coins, gold, and other commodities to create a really well-diversified portfolio. This puts you in a much better position if one of the assets you elected to purchase isn’t performing very well.

XRP Trading Signals

If you are completely new to cryptocurrencies, the chances are you have yet to learn the technical analysis needed to make crucial decisions. One way to get around this is by signing up to a crypto signals service.

In case you haven’t heard of this phenomenon, signals are suggestions backed up by advanced research of the market in question. This way, you don’t have to conduct your own analysis. Instead, you can leave that to those with experience.

Here at Learn 2 Trade, we offer free XRP trading signals – created by our team of researchers, each of which have years of experience in financial and crypto analysis. The insights we discover are shared via our popular Telegram group.

Each signal sent will include every element of the suggested order, such as the XRP pair, the limit price, and the all-important stop-loss and take-profit price suggestions. If you like the free service and wish to upgrade – we also offer a 30-day money-back guarantee on all Premium accounts.

How to Buy XRP Online – Full Walkthrough

If you have experience with online brokers you can probably skip this section as it is standard practice.

If, on the other hand, you have never signed up with a trading platform before – follow the simple walkthrough below for guidance. We are going to use Capital.com as you can buy XRP from $25, no commissions are charged, and signing up is stress-free.

Step 1: Sign Up With an XRP Broker

Using your mobile or desktop computer – open the Capital.com platform and look for the ‘Join Now’ button.

Step 2: Upload Some Identification

When your new account has been opened you can upload some ID to complete the process. As per KYC rules, all regulated trading platforms must acquire official documentation to prove your identity.

This can be a copy of your passport or driver’s license. You will also need to send a copy of a bank statement or utility bill issued within the last 3 months.

You may upload your identification documents later on, but be mindful that until this has been completed, you will not be able to withdraw any money, or fund your account with an amount over $2,250.

Step 3: Deposit Funds Into Your Account

At the risk of stating the obvious, you can’t buy XRP without first depositing some money into your new trading account.

At Capital.com, this is as simple as entering an amount and selecting the most suitable payment method from the list. Please note that bank/wire transfer is the slowest payment type to process for the majority of platforms.

This is why it’s best to deposit funds with a debit/credit card or e-wallet, as Capital.com processing this instantly.

Step 4: Buy XRP

Search for XRP, or browse available XRP pairs under ‘Crypto’ and click ‘Trade’ to reveal an order box.

Enter the amount of XRP you want to buy and click ‘Set Order’ to action – Capital.com will do the rest.

Conclusion

Whether you want to buy XRP in the traditional sense – or trade CFDs without owning any coins – a reputable broker is key! Furthermore, to provide yourself with the best possible start you should think about entering the crypto market with a clear plan.

For instance, you could diversify by adding different assets to your portfolio, in case XRP isn’t doing so well. You might also incorporate the simple but effective dollar-cost averaging system to build up your XRP tokens in a controlled way.

Whatever you decide – online broker Capital.com is regulated, commission-free, offers a free demo, and will enable you to buy XRP from a minimum of just $25!

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

FAQs

What is the minimum amount of XRP you can buy?

How much is XRP likely to be worth in 5 years?

Where is the best place to buy XRP?

How can I sell XRP?

Can XRP make you rich?