Gold has near enough held its own, in terms of value, for the last two and a half thousand years. In fact, 1 ounce of gold would get you near enough the same amount of bread tomorrow as it would have back then!

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Most of us have fantasised about finding a life-changing fortune of gold. Cult ‘gold fever’ movies like Treasure of the Sierra Madre are a million miles away from trading gold on the internet. However, films like this taught us a moral lesson about not getting too greedy – keeping a check on our trading emotions.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

If you fancy becoming a ‘gold bug’, focusing on gold as part of your trading strategy – then you’ve come to the right place. To gain access to the markets, you are going to need to find a good broker.

However, with hundreds to choose from -finding the right trading platform isn’t easy. With that in mind – we’ve correlated a guide for selecting the best gold trading brokers in the online space right now.

Within it, we will cover everything from how the value of gold is calculated to how this attractive asset is traded. Once we’ve familiarised you with the basics of trading gold, we’ll run through some helpful strategies and then conclude by discussing our top 5 gold trading brokers to consider.

Gold Trading Fundamentals

Trading, in its simplest form, is buying and selling with the hope of making a profit. In a nutshell, the foundation of gold trading is as follows:

- Correctly hypothesise whether the value of gold will rise or fall

- Hopefully, predict correctly

- Sell the gold for more than you bought it for

- Make a profit

These days, if you want to get involved in gold, you would be much more likely to trade it online.

When trading gold from the comfort of your home, you still have to watch out for those powerful emotions – greed, fear and conviction. After all, you will be making important decisions that affect your end goal, so it’s important to keep your emotions under control.

When trading gold online, you will be more likely to trade it in the short-term – like day trading for example. Day trading gold usually involves keeping a position open for a matter of minutes or hours.

Should you want to trade gold for a little longer than one day, you could try swing trading, which will see your gold trade being held open for weeks instead. We will go through the basics of ways in which you can trade gold later.

Undoubtedly the most popular way to trade gold is to use CFDs – enabling you to trade it, without having to actually own the physical asset. If however, you want to trade gold on a more long-term basis – you will need to swerve gold CFDs and their fees.

What Drives the Cost of Gold?

The price of most things is based on ‘supply and demand’. Meaning the price you are quoted will depend on the relationship between the number of gold customers want to purchase – and the amount of the asset that manufacturers (for example) are selling, for different prices.

As we mentioned, gold has been traded for over 2,000 years. It is considered strong, so is often used as part of a trading strategy to hedge against major inflation and economic uncertainty.

The value of gold changes multiple times per day and will fluctuate by the second. Interestingly, due to the fact a lot of traders flock to gold in times of economic uncertainty – at times when the market is considered healthy – the price of gold usually falls.

How is the Price of Gold Calculated?

The price of gold is usually measured using US dollars, or another major currency. When it comes to the weight per unit, it depends on the trading market. Generally speaking, gold will be shown in grams, ounces or kilos.

With that said, it doesn’t matter if you are depositing in another currency, as your chosen gold trading broker will simply convert it at the point of the trade. This means once you have deposited into your account, you can trade gold from the get-go.

When is the International Gold Market Open?

The global gold trading market is continuously open for business – that’s 24/7. If you think about it like this, 90% of the world’s gold is traded via the US futures markets, Shanghai Gold Exchange (SGE), or London OTC market, with the rest being traded in smaller markets. Where one market will be closed, another will be open.

You will find that different gold trading brokers can provide access to different markets, so you might only be able to trade gold 5 days a week via your particular platform. For instance, in the case of eToro, you can trade the asset between 12am Monday and Friday at 10.30 pm – with a customary break in the trading day between 11 pm and 12 am every day.

How Can I Trade Gold?

Now that we’ve clarified what gold trading is, how it works and how its value is calculated – let’s delve into the different ways in which you can trade it online.

Gold Trading: CFDs

Gold trading using ‘contracts for difference’ (CFDs) is considered to be the main market when it comes to trading it online. If you like the sound of being able to buy and sell gold, without actually having to take ownership of the tangible asset – then gold trading via CFDs could be right for you.

Let’s give you an example of the basics when it comes to gold trading CFDs:

- The price of gold has risen from 1,902.22 to 1,909.21

- This higher price represents an increase of 0.36%

- The gold CFD will reflect this increase

- Should the value of gold drop in value by 0.18% – your gold CFD will mirror this

In terms of gold CFDs, you will find that most brokers will not charge much in the way of commission fees – if anything at all. Not only that, but we find that trading platforms usually offer clients tight spreads on this type of asset, not to mention leverage.

In case you are unaware, leverage enables you to trade gold with larger stakes than you might have otherwise been able to. It’s comparable to a loan from your broker allowing you to trade on credit. With that said, due to ESMA leverage restrictions in the UK and Europe, you will be capped at 1:20 (sometimes displayed as 20x).

Put simply this means you can trade with 20 times your stake. For example, your £100 stake could become £2,000 when using your maximum leverage allowance on gold trades. When gold trading via CFDs you can also potentially make gains when the price falls. This can be achieved by ‘going short’.

We’ve put together another simple example of a gold CFD trade:

- Let’s say your broker values gold at $1,909.21 per oz

- However, you think that the value will drop in a few hours time

- You decide to place a sell order of $1,500

- Your prediction was correct – the price of gold drops by 2%

- From your $1,500 sell order, you made a profit of $30

Had you opted to utilise 1:20 leverage offered by the gold trading broker in question, your profit of $30 could have been elevated to $600. However, we can’t stress enough that you should apply leverage with caution. Whilst is can improve your profit levels, it can also intensify your gains.

Gold Trading: Options

The vast majority of people trade gold via CFDs, however, there are a few other ways you are able to access this precious metal. One such example is in the form of options. In a nutshell, an options ‘contract’ will always have an expiry date.

Should you believe the value of gold is going to rise, you can buy ‘call’ options – this allows you to buy the asset at a specific price (within a set amount of time).

Here is a gold options example:

- You buy call options with a 3-month expiry date

- The strike price $1,800 per oz

- This means that you think the price of gold surpass $1,800 on or before the options contracts expire

- In order to access the market, you need to pay a ‘premium’ upfront. In this scenario, that’s 5% of the contract price.

- This amounts to $90 per contract (5% of $1,800)

At this point, only one of two things can happen. If gold surpasses the strike price, you can exercise your right to buy the asset at that specific price.

For example, if the contract expires when gold is worth $2,000 per oz, you make $200 for each contact that you hold ($2,000 less $1,800 strike price). If gold does not surpass $1,800, then you simply lose your premium. Once again, this amounts to $90 for each contract that you hold.

On the other hand, if you think that the value of gold will go down before the contract expires, you can purchase ‘put’ options. This works in the same way as the example above, albeit, in reverse.

Gold Trading: Futures

Gold futures bare many similarities to CFDs – given that you are able to go long and short, as well as apply leverage. However, in contrast, gold futures come with an expiry date. Unlike options, you have an obligation to purchase the underlying asset if the futures expire and you are still in possession of the contracts. In most cases, the futures will be settled in cash – so you don’t need to worry about receiving a truck-load of gold bullion bars at your home!

To be clear, these contracts only usually last around 3 months at a time. Once the contract expiry date comes around you have to either buy it or sell it – depending on which way you speculated. Much like options, futures always come with a strike price. On the flip side, there are no premiums when you trade futures, so unless you apply leverage you need to fork out a much larger amount to access the market.

Gold Trading: Forex

A great way to hedge against inflation and economic uncertainty is to trade gold against a currency such as the US dollar.

Here is how that pair would be displayed: XAU/USD.

At times of geopolitical tension or as we said inflation – gold tends to go up in price. In turn, you are somewhat protected against the weakening dollar, because you have overcompensated by hedging.

Gold Trading: ETFs

When investing in gold ETFs you can purchase gold, but in an indirect manner. To give you a quick example of how you can buy gold via an ETF, please see the below.

- You want to buy gold.

- You purchase a VanEck Vectors Gold Miners ETF via your broker.

- This ETF monitors the Arca Gold Miners Index.

- You now have access to some of the biggest gold mining firms in the industry, globally.

This can be achieved without you needing to ever store or transport the gold itself. Instead, this role is reserved for the ETF provider. When using a newbie-friendly platform like eToro, you can buy the above ETF with a minimum investment of just $50 – in a 100% commission-free basis.

Three Popular Gold Trading Strategies

Interested in trading gold online but not to sure where to start? Below you will find three popular gold trading strategies that are popular with investors of all shapes and sizes.

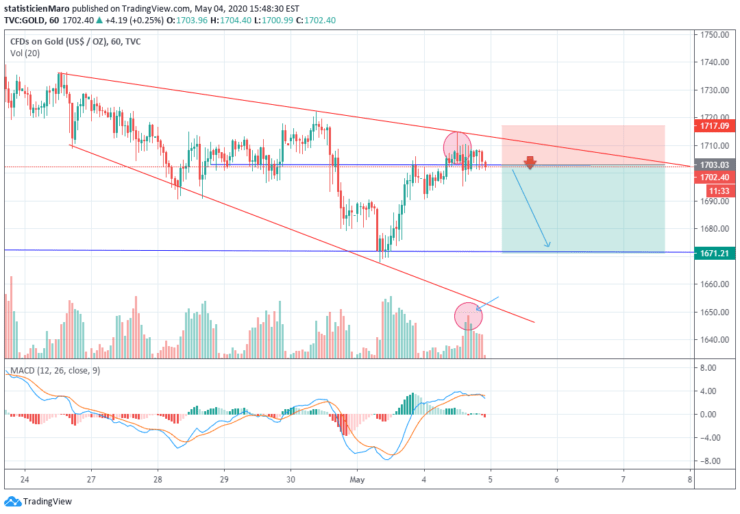

Gold Swing Trading

Gold swing trading consists of following the wider trend. Usually, this is done by using technical analysis to predict the market sentiment. When gold momentum is strong, you will be aiming to successfully capture profits from a ‘buy’ position.

You might keep your position open for anywhere from a number of days – to weeks at a time. When it appears the trend is about to move the other way, you would place a reverse trade. In this example, that would mean cashing out your long position and entering a sell order.

Use Support Levels

In a nutshell, support levels are ‘price levels’, illustrating support and resistance in the market. These levels are useful for revealing trading opportunities. For instance, a ‘stop level’ may be actioned if gold experiences a downward trend. This is to stop the asset value falling further.

Scalping

Scalping is a popular strategy amongst gold traders who strive for modest gains – on a regular basis. Traders tend to open several buy and sell positions in a single day and thrive on volatile market conditions.

In particular, when gold is trading between two price ranges for a prolonged period, this allows traders to ‘scalp’ profits for as long as the range remains in place.

Key Metrics: Finding the Best Gold Trading Broker

When you are searching for the best gold trading broker there are a few things you should be mindful of. We’ve listed what we consider to be the most important metrics below.

Commission and Other Fees

Whilst this one seems obvious, fees can easily eat away at any potential profits. Some brokers charge as much as $15 per trading transaction – so, in this case, you would be charged a total of $30 for simply opening and closing a position.

The most common way for brokers to charge commission fees is as a percentage of the trade. For example, you might be charged 2%, so if your stake was $100, you would pay $2 for that trade. The good news is that -many brokers offer clients zero commission when trading gold CFDs. In fact, this is the case with all of the top-rated gold trading sites listed on this page!

Another fee to look out for is overnight financing fees. If you use leverage and keep a position open overnight, you will be charged interest for every day the trade is open. Whether it’s overnight financing fees, commission or charges for not actively trading – you should always check the fee table on the trading platform before signing up.

Platform Navigation

It’s really important that you find your chosen trading platform easy to navigate – especially if you are a newbie gold trader. Having an overly complex website is only going to confuse the whole process for you, and no doubt slow the rate at which you can learn the ropes. Trading platforms such as Skilling make trading super easy, it’s simple to find an asset to trade, and very easy to place an order.

Deposit and Withdrawal Options

As you might have gathered, all brokers are different. They all differ with regards to fees, spreads, assets, markets – and the same goes for accepted payment methods.

Should you only be able to fund your trading account via say, Mastercard – you need to make sure the trading platform you are interested in accepts that payment method. You will generally find that the best gold trading brokers allow deposits via debit/credit card, e-wallets and bank transfer.

Regulation

When choosing the best gold trading broker online, we highly recommend only signing up to one holding a licence from the FCA or another respectable regulatory body.

This ensures that you are able to buy and sell gold instruments in a safe and secure environment. If your chosen broker isn’t regulated – or it holds a license with a suspect body, you should avoid it.

Spreads

The spread is the difference between the buy price and the sell price of gold (or whatever asset you are trading). Some brokers offer super-tight spreads, whilst others are not so competitive.

For example, Skilling offers a very competitive spread of 600 pips when trading gold CFDs. The tighter the spread, the better it is for your profits.

Gold Trading Tips

Trading gold online can be very challenging if you don’t quite know what you are doing. If you are a complete newbie in this respect, check out the tips listed below!

Read Gold Trading Books

There are heaps of books centred around gold trading, and by performing a simple internet search you’ll find the top-rated books of this kind.

Each to their own, but if you like to read you may find getting stuck into a gold trading book a helpful way to educate yourself on the market.

If you prefer the convenience of a digital book, there are plenty of audiobooks available on gold trading. Some brokers have a great selection of educational videos and reading material as well.

Keep Abreast With the Latest Gold News

Largely due to the relationship that inflation, politics and economic news have with gold, it makes sense to keep up with the latest news. As mentioned above, you can use the internet to your advantage here. There are lots of providers offering the latest financial news, in real-time.

Use Gold Trading Signals

These signals offer traders who don’t have the time to keep abreast with the financial news – or are new to trading – ‘buy’ and ‘sell’ signals for the relevant asset. Put simply – when using trading signals you receive suggestions advising you of a potentially profitable position.

It is entirely up to you whether or not you buy or sell, etc. Although Learn 2 Trade signals specialize in the forex and cryptocurrency markets, form time to time we dabble in the gold scene when a profit-making opportunity arises.

Utilise a Copy Trading Feature

Some brokers, such as eToro, offer clients the chance to copy the trades of a successful and fully vetted investor. By investing as little as $200 you can mirror the portfolio of an investor with a proven record.

This means that if the investor you are copying places a ‘buy’ order which equates to 0.8% of their portfolio, then 0.8% of your portfolio will reflect this. There are heaps of copy traders to consider and you can access information related to their personal track record.

Trade Gold With Paper Money

Utilising demo accounts is a super-effective way of a) learning the gold trading ropes, and b) practising trading strategies without risking your capital.

Using Skilling as an example – the platform offers clients a free demo account that not only covers gold CFDs, but prices reflect that of real market conditions.

Best Gold Trading Brokers

Now you know all there is to know about gold trading, you will need to find a good broker to execute your market orders for you. As we have noted throughout this guide, when you are looking for a trading platform you need to make sure they can provide access to the gold markets you are interested in.

After all, not all brokers offer the same assets and markets. We have put together a list of the best gold trading brokers in the UK at this time, for your consideration.

1. AVATrade – Trade Gold CFDs With Competitive Spreads

AvaTrade is a well-respected trading platform offering clients gold CFDs and tight spreads - as well as a variety of other CFDs in the form of forex and cryptocurrencies.

Not only that, but for those who like to buy and sell gold on the move there is the AvaTrade application 'AvaTradeGO'. This means you can place trade orders and fund your account wherever you have access to the internet.

As well as being MT4 compatible - this broker also offers clients a free gold trading demo account that comes loaded paper funds. Demo accounts are invaluable for helping newbies learn the ropes, and seasoned traders try out new strategies. You can get started with a gold CFD from as little as $100.

- Reasonable min deposit of $100

- Leverage of 1:20 on gold trades

- AvaTradeGO mobile app

Open an Account With a Gold Trading Broker Right Now

Ready to start trading gold online right now? If so, by following the steps outlined below you could be trading gold in a matter of minutes!

Step One – Sign up With a Gold Trading Brokerage

Let’s assume that you have selected a broker to sign up with. First, you need to head over to the trading site and click ‘sign up’.

Next, you are going to need to enter your full name, residential address, email and phone number. Later you will be asked for a clear photograph of your ID, as per KYC rules enforced by regulators like the FCA and CySEC.

Step Two – Deposit Funds Into Your Account

Next, you need to add some funds to your new gold trading account. This is really simple – you just need to enter the amount you would like to deposit and select the payment method from a drop-down list of accepted options.

Step Three – Place an Order

Depending on which way you think the price of gold will go – you can now create the appropriate order for your position.

We always recommend either trading with small amounts to begin with or trying out a demo for a few weeks. In doing so, you will avoid burning your account balance out before you’ve even had a chance to learn how the gold markets really work.

To Summerise

The first step to kick-starting your gold trading adventure is to have an understanding of the market. The next step is to find the best gold trading broker to execute your orders, and give you access to the global markets.

By reading our guide from start to finish, you should be feeling confident about how this liquid asset is traded – therefor you are ready to choose a gold trading platform. All of the brokerage firms we have listed are licenced, thus fully regulated for your safety.

Finally, never underestimate the value in taking advantage of demo accounts. New traders can really learn a lot by being free to make mistakes – without losing real money along the way.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

FAQs

Am I able to invest in physical bars of gold?

Can I gold trade with leverage?

How can I practice gold trading?

How much money do I need to start trading gold?

Am I able to trade gold online?