Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

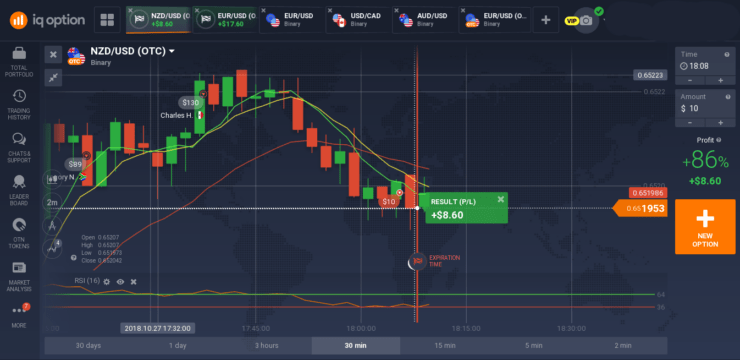

In a similar nature to options trading, binary options allow you to speculate on assets like stocks, indices, gold and oil without you owning the underlying instrument. However – unlike traditional options contracts, binary options offer just two outcomes.

Our Crypto Signals

1-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

12-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime Subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioYou either end up in the money when the binary options expire with a fixed payout, or you lose your entire stake. In this sense, binary options are as close to gambling as you will get in the online investment space.

With that said, there is much to learn about binary options before you part with your money, so be sure to read our in-depth guide. On top of explaining the ins and outs of how this particular financial instrument works, we also explore the best binary options brokers of 2023.

Note: You need to have a firm grasp of the underlying risks associated with binary options trading. In truth, you might be better suited for traditional options or even spread betting if you want access to sophisticated financial instruments in a more risk-averse manner.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card

What are Binary Options?

In its most basic form, binary options are a highly speculative asset class that allows you to wager money on the future direction of a financial instrument. As the name suggests, the potential outcomes are binary, insofar that you will either win a fixed amount of profit, or lose your entire stake. The overarching objective is to assess whether you think the asset in question will finish above or below the ‘strike price’ offered by the options broker.

For example, let’s say that your chosen options broker offers a strike price of $200 on Apple stocks, with an expiry date of 10 am tomorrow. If you felt bullish on Apple, you would need to go long, meaning you think it’s share price will be higher than $200 when it expires tomorrow. If it does, you would win a fixed amount of profit – say 80% of your stake. If Apple stocks are priced lower than $200 at 10 am tomorrow, you would lose your entire stake.

Both the stake and your potential profit will vary depending on a number of variables. At the forefront of this is the strike price in relation to the current market value of the asset. For example, if Apple stocks were priced at $199 today, then there is a very good chance that it will surpass $200 tomorrow. However, if the strike price was then increased to $210, the odds of this happening are lower and thus – you should expect a higher rate of return.

The stake vs profit ratio will also be determined by the length of the binary options contract. This can be as short as 60 seconds, right up to 365 days. Naturally, the longer the contract, the more chance you have of ending up in the money. As such, this would have a direct impact on your potential returns.

In terms of where to trade binary options, there are heaps of brokers active in the online space. With that said, you need to ensure that your chosen broker is regulated. In doing so, your funds will remain safe at all times.

Pros and Cons of Binary Options

- Suited to those with a higher appetite for risk.

- Trades thousands of financial instruments without owning the asset.

- Choose whether you think the asset will increase or decrease in price.

- Binary options brokers offer various risk levels to choose from.

- A few platforms allow you to exit your binary options trade before expiry.

- Deposit and withdraw funds with everyday payment methods.

- Most of the industry is regulated.

- Profits are tax-free in the UK.

- Highly speculative asset class.

- An unsuccessful trade will result you losing your entire stake.

Understanding Binary Options – Key Terms

Binary options are complex financial instruments that can appear confusing to newbie traders. Crucially, there are a number of key terms that you need to be made aware of before we unravel some real-world binary options examples.

As such, be sure to read through the following:

✔️ Long vs Short

Binary options brokers will always give you the option of going long or short. In Layman’s terms, this refers to the direction that you think the asset will go. For example, let’s say that you are looking to trade binary options on the FTSE 100.

If you are feeling confident on the index, you would be going long. This is no different to placing a call option in the traditional options space, or a buy order in the world of CFD and forex trading

At the other end of the spectrum, you would be required to go short if you were bearish on the FTSE 100. In other words, you would be speculating that the price will end lower when the binary options contract expires. This is no different from placing a put option or sell order in the traditional investment arena.

✔️ Strike Price

The strike price in binary options is a crucial term that you need to have a firm grasp of. If you’ve previously traded traditional options contracts, then you’ll be pleased to know that the strike price works in exactly the same way when speculating on binary options. For those unaware, the strike price refers to the ‘mid-point’ of a binary options trade. You then need to decide whether you want to go long or short on the asset, in relation to the strike price.

For example, let’s say that Nike stocks are currently priced at $75, and the broker is offering a strike price of $80. If you feel that the price of Nike stocks will be priced at more than $80 when the contract binary option expires, you would need to go long. If you thought the opposite, you would need to go short.

In most cases, binary options brokers will offer various strike prices on a single asset. This then allows you to choose your preferred risk level. For example, alternative strike prices on Nike stocks might stand at $85 and $90. The higher the strike price, the more you would receive on a successful long order (and visa-versa when going short). This is because you should expect a higher reward as the odds of the trade becomes less likely.

✔️ Expiry Date and Time

In a similar nature to traditional options contracts, binary options will always have an expiry date and time. This is the point in time when the binary options settle, and you either win or lose your trade. As we briefly noted earlier, binary options brokers typically offer various expiry dates to choose from. This can be as short as 60 seconds, right up to a full year.

Nevertheless, the expiry date of your binary options can impact your returns on the trade. For example, if you speculate on the price of a binary options contract that expires every 60 seconds, you will get a much higher return in comparison to an option that expires in three months.

✔️ Stakes

When it comes to stakes, the amount that you decide to speculate has no relation to the underlying value of the asset. Crucially, whether the price of the asset is $20, $500, or $10,000 per barrel, ounce, or stock – you can speculate as much or as little as you like – within the limits imposed by the binary options broker.

For example, let’s say that you wish to speculate on the value of the S&P 500 finishing above a strike price of 3,000 points when the binary options expire tomorrow afternoon. As the binary options pay a fixed percentage return, you can effectively set your own stakes. This means that binary options brokers are suited to both low and high stakes traders.

✔️ Win Percentage

In terms of working out your potential profit, binary options brokers stipulate this is as a win percentage. If the trade is successful, you would then need to multiply the rate of return against your stake.

For example, let’s say that your chosen binary options trade pays a return of 90%, and you stake $100. If you speculate correctly, you ill win $90 in profit ($100 stake x 90%). You will, of course, also get your original stake of $100 back too, taking your total return to $190.

The size of the profit percentage will ultimately depend on the odds of the outcome coming to fruition. For example, let’s say that you are looking to trade binary options on crude oil. At the time of the trade, oil is priced at $25 per barrel. The binary options broker offers four strike prices in total – two for those wishing to go short, and two for those going long.

In terms of going long, you can choose from a strike price of $30 or $50. In the case of the $30 strike price, you might only get a return percentage of 60%. As the strike price of $50 is far less likely to come in, you might get a return of 95% if successful. At the other end of the spectrum, the options broker might offer a strike price of $20 and $10 for those wishing to go short. The win percentage will reflect accordingly.

🥇 Example of a Long Binary Options Trade

So now that you know the key terms surrounding binary options, we can now look at a real-world example of a how a trade might work in practice. Let’s say that you decide to trade IBM stocks.

- You opt for an IBM stock binary option with an expiry of 24 hours.

- The current price of IBM stock is $120.

- The options broker sets a long strike price of $124.

- The win percentage is 80%.

- You are feeling bullish on IBM, so you decide to place a long order at a stake of $100.

- In 24 hours time, the binary options contract expires at a price of $127.

- As you went long, and the binary option finished at a higher price than the strike price of $124, you won your trade.

- Your total return is $180. This consists of $80 in profit ($100 stake x 80%) and your original $100 stake.

Considering an alternative outcome, let’s say that IBM stocks were priced at $123 when the binary options expired. As this is less than the strike price of $124 that you took, you would have lost the trade. As such, the broker would keep your $100 stake.

🥇 Example of a Short Binary Options Trade

To ensure that you understand how a short binary options trade works, let’s look at a quick example. We’ll say that you are feeling bearish on the price of Bitcoin, so you opt to go short.

- You opt for a Bitcoin binary option with an expiry of 1 week.

- The current price of Bitcoin is $6,500.

- The options broker sets a short strike price of $5,900.

- The win percentage is 95%.

- You are feeling bearish on Bitcoin, so you decide to place a short order at $500.

- In 48 hours time, the binary options contract expires at a price of $5,850.

- As you went short, and the binary option finished at a lower price than the strike price of $5,900, you won your trade.

- Your total return is $975. This consists of $475 in profit ($500 stake x 95%) and your original $500 stake.

Considering an alternative outcome, let’s say that Bitcoin was priced at $5,901 when the binary options expired. Although you only fell short by $1, you would have lost your trade. This is because the price of Bitcoin was higher than the strike price of $5,900 when the binary options contract expired. As such, you would have lost your $500 stake.

What Assets can you Trade at Binary Options Brokers?

In a similar nature to traditional options platforms, binary options brokers typically give you access to hundreds, if not thousands of financial instruments. To give you an idea of the many asset classes you can speculate on when trading binary options, check out the list below.

- Stocks and Shares.

- Stock Market Indexes.

- Oil.

- Natural Gas.

- Gold.

- Silver.

- Copper.

- Platinum.

- Wheat.

- Corn.

- Sugar.

- Interest Rates.

- Forex Currency Pairs.

- Cryptocurrencies.

Can I Cash Out a Binary Options Trade Early?

One of the main benefits of investing in traditional options contracts is that you will often have the ability to lock-in your profits early. Crucially, if you are trading American options, you can exit your trade at any point between the time you pay your premium, and the date in which the options expire.

Unfortunately, the vast majority of binary options brokers do not allow you to do this, so you will need to wait until the contract expires before you know the outcome of your bet.

With that being said, a small number of binary options brokers do offer the capacity to exit a trade early. If they do, you will be offered a ‘cash out’ price, which will either be more or less than your original stake. Ultimately, your cash out price will be based on the real-time odds of your binary options bet ending up in the money.

Downsides to Binary Options

Even if you’ve got your heart set on trading binary options, it’s well worth considering some of the downsides.

As such, be sure to make the following considerations prior to starting your binary options career:

🥇 Limited Upside Potential

In the case of binary options brokers, there are only two potential outcomes. You either win your fixed win percentage, or you lose your stake. For example, if you stake $100 at a win rate of 80%, you’ll either make $80 profit or lose your $100 stake. While this might suffice for many of you, it’s important to remember that you might be missing out on greater returns.

- For example, let’s say that you are super-confident on the value of GBP/USD increasing over the next 7 days.

- To keep things simple, let’s say the strike price is 1.35, you stake $300, and the win percentage is 70%.

- In 7 days time, GBP/USD is now priced at 1.40. This means that you won your bet, so you made $210 in profit ($300 x 70%).

As great as this is, think how much you might have made by opting for a spread betting broker? For example, if you staked $1 per point, and the difference between the strike price of 1.35 and closing price of 1.40 is 500 points, then you would have made $500. Increase the stake per point to $2, and you’re looking at $1,000.

In other words, binary options limit your returns to the fixed win percentage, while the likes of spread betting, CFD, and traditional options brokers offer the chance to make uncapped profits.

🥇 Inability to Exit a Trade Early

In the vast majority of cases, binary options operate much like European options contracts. In Layman’s terms, this means that you are unable to exit a trade before the time and date that the binary options expire. This can be problematic for two key reasons – both of which centre on risk management.

Firstly, you will not have the ability to cash out your binary options when you are in the money until the contracts expire. For example, let’s say that you are shorting a strike price of $200, and the asset is currently priced at $195. With just 2 days to go until the contracts expire, you might be tempted to lock in your gains at a slightly lower win percentage. However, binary options brokers rarely allow you to do this.

Secondly -and perhaps most importantly, binary options brokers do not offer much in the form of risk mitigation. For example, let’s say that you decide to go long on oil at $29 per barrel. In order to mitigate your losses in the event the markets go against you, a stop-loss order would allow you to exit your trade automatically when a certain price is triggered (say $27 per barrel). However, this isn’t something that you can do when trading binary options.

🥇 Ability to Lose Entire Stake

It is also important to remember that an unsuccessful binary options trade will result in you losing your entire stake. For example, if you go short on oil at a stake of $200, and you don’t end up in the money, you will lose your entire $200.

While this is also the case when trading traditional American options – insofar that you will lose your premium if you don’t breach the strike price, you do at the very least have the choice of cashing out your trade at a slight loss – as opposed to losing everything.

With that said, opting for a CFD platform offers even greater protections over binary options brokers, as the only way that you will lose your entire stake is if you apply leverage – or the asset goes to zero. For example, if you buy $1,000 worth of IBM stocks via CFDs, and the price falls by 10%, you will only lose 10% of your stake. This would be the case when trading binary options, as it’s effectively an ‘all-or-nothing’ outcome.

Binary Options Brokers and Tax

Depending on where you live, you might be able to benefit from tax-free profits when trading binary options. For example – and much like the spread betting space, investors in the UK are exempt from binary options tax, not least because HMRC views the sector as gambling.

This allows you to keep 100% of your profits, which is in stark contrast to trading at a CFD or forex platform. However, this won’t be the case in every jurisdiction, so you are advised to speak with a qualified tax accountant first.

Fees at Binary Options Brokers

When it comes to fees, most binary options brokers allow you to trade on a commission-free basis. The reason for this is that you are effectively betting with the broker directly, as opposed to being matched with other traders.

As such, if you lose a binary options trade, the broker will keep the stake that you forfeited. Moreover, you do not own the underlying asset when trading binary options, so there is no requirement for the broker to actually buy or sell the financial instrument on your behalf.

The only fees that you need to look out for when choosing a binary options broker is with regards to deposits and withdrawals. While it is hoped that the platform allows you to fund your account without being charged, this isn’t always the case. Similarly, you should also assess what minimum deposit and withdrawal amounts are in place.

How to Find the Best Binary Options Brokers?

So now that you know the ins and outs of how the binary options sector works, you now need to start thinking about which broker you wish to use. This is because no-two binary options brokers are the same.

For example, while a broker might give you access to thousands of financial instruments, it won’t be suitable if it doesn’t support your preferred payment method.

As such, we would suggest making the following considerations prior to opening an account with a new platform.

✔️ Regulation and Licensing

The most important factor that you need to assess is whether or not the binary options broker is regulated. Certain sections of the space resemble that of the Wild West, so you really need to be careful with what platform you sign up with.

This is because in some cases, binary options brokers are not regulated at all, so this should act as a major red flag. Even if the broker is regulated, you need to judge the credibility of the licence issuer.

For example, a broker opting for a license in the Marshall Islands over the UK’s FCA or CySEC in Cyprus should ring alarm bells. Ultimately, where the binary options broker is regulated can have a major say in the safety of your investment.

✔️ Supported Payment Methods

You then need to explore what payment methods the platform supports. As binary options broker typically cater their services to retail traders, you will often get to choose from a wide range of everyday payment options.

This should include a traditional debit or credit card, a bank transfer, or an e-wallet like PayPal, Skrill, or Neteller. Don’t forget to check what fees apply on your chosen payment method – as well as what account minimums you need to meet.

✔️ Tradable Binary Options

It’s all good and well using a regulated binary options broker that supports your preferred payment method, but you’ll be left disappointed if it’s lacking in tradable markets.

The good news is that you can normally view what binary options the broker offers before signing up. It’s best to choose platforms that offer a full range of asset classes – including but not limited to stocks, indices, commodities, and cryptocurrencies.

✔️ Minimum Stakes

As we have discussed throughout our guide, binary options are a highly speculative asset class. As such, your best bet is to start off with really low stakes until you begin to feel more comfortable.

Most binary options brokers allow you to stake just $1 per contract, which is ideal. However, we have also come across platforms that install a minimum trade size of $100. While this might appeal to the high-rollers of the binary space, it won’t for newbie traders.

✔️ Win Percentage Rates

You also need to have a firm understanding of what win percentage rates are on offer. For example, the industry standard in the binary options space is a maximum win of 95%. So, a $1,000 bet would yield a maximum payout of $950. However, some binary options brokers will offer lower win rates – potentially in the 70%-80% range.

At the other end of the spectrum, we have also come across binary options brokers that offer a win percentage rate that exceeds 100%. Don’t forget, as the win percentage rate increases, the chances of your bet landing in the money decreases.

✔️ Competitiveness of Strike Rates

Leading on from the section above, you also need to assess the competitiveness of the strike rates being offered by the broker. For example, let’s say you are trading binary options on Facebook stocks, which are currently priced at $129.

- Two individual brokers offer a win percentage rate of 80%.

- Broker A has a long strike price of $134, and a short strike price of $124.

- Broker B has a long strike price of $138, and a short strike price of $120.

Which of the two binary options brokers do you think is more competitive? Well, this would be Broker A. The reason for this is that although you are getting a win percentage rate of 80% at both platforms, Broker B requires Facebook stocks to surpass to $138 when going long, and $120 when going short. However, Broker A only requires a strike price of $134/$124 to be in the money, which is going to be much easier.

✔️ Educational and Research Tools

Although research tools will have limited use when trading binary options with super-short expiry dates, they can be highly effective with longer trades. For example, if you’re trading binary options with a 6-month expiry date, you’ll want access to a range of technical indicators and chart analysis tools.

It would also be useful if the binary options broker offers fundamental news in real-time, as well as ongoing market analysis. In terms of education, we prefer binary options brokers that cater to newbie traders. This should include a number of handy videos and blogs, step-by-step guides, and even regular webinars.

✔️ Customer Support

It is also important to choose a broker that offers top-grade customer support. As binary options typically trade on a 24/7 basis, you’ll want to use a broker that providers support around the clock. This should come in the form of live chat, email, and telephone support.

Binary Options Brokers: How to Get Started Today

If you’ve got your finger on the pulse and wish you to start trading binary options right now, below we have listed a simple step-by-step guide for you to follow. This includes the end-to-end process of opening an account, depositing funds, and setting up a binary options trade.

Step 1: Find the Best Binary Options Broker for Your Needs

Your first port of call will be to find a binary options broker that meets your trading requirements. The best way of doing this is to follow the tips we outlined in the section above. Key focus points should be regulation, tradable markets, and payment methods.

If you don’t have time to find a binary options broker yourself, scroll down to the bottom of this page to review our top three picks of 2023. All of our recommended binary options brokers come pre-vetted, so rest assured your money is safe at all times.

Step 2: Open an Account and Verify Identity

If you’re using a regulated binary options broker (which you should be), you will now need to open an account. This requires some basic information form you, such as your:

- Full Name.

- Date of Birth.

- Home Address.

- National Tax Number.

- Residency Status.

- Mobile Number.

- Email Address.

To ensure the broker complies with anti-money laundering regulations, it will also ask you to verify your identity. Most binary options brokers allow you to do this by uploading a copy of your government-issued ID. This can be a passport or driver’s license.

Step 3: Deposit Funds

Once you’ve uploaded your ID, you will then need to deposit some funds. Options should include a debit/credit card e-wallet, or bank transfer. Be sure to meet the broker’s minimum deposit amount.

Step 4: Search for Binary Options Markets

You will now need to find a binary options market that you wish to trade. If you’re using an online broker that specializes in a range of asset classes, head over to the binary options section of the site.

Once there, browse through the many different binary options markets that the broker supports. This should include the likes of stocks and shares, oil and gas, indices, hard metals, and cryptocurrencies.

Once you have found the asset that you wish to trade, take extra care to assess the following metrics:

- Strike Price.

- Expiry Date and Time.

- Minimum Stake.

- Win Percentage Rate.

Step 5: Place Your Binary Options Trade

You now need to place your binary options trade. You’ve already assessed the fundamentals, so you simply need to:

- Enter your stake. Don’t forget, if you lose the bet, you lose your stake in its entirety.

- Decide whether you want to go long or short.

Once your order has been placed, you are then at the mercy of the financial markets. In most cases, you will need to wait for the binary options to expire to assess whether or not your bet was successful.

Best Binary Options Brokers of 2023 – Our Top Pick

Looking to start trading binary options right now, but don’t have time to research a broker yourself? Below you will find our top binary options broker of 2023.

Crypto Trader– Join Us and Start Getting Rich with Crypto Trader!

The Crypto Trader is a group reserved exclusively to people who jumped on the insane returns that Bitcoin offers and have quietly amassed a fortune in doing so. Our members enjoy retreats around the world every month while they make money on their laptop with just a few minutes of “work” every day.

- Minimum deposit of $250

- No trading fees other than the spread

- Fast registration and KYC process

- No guarantee you will make money

Conclusion

In summary, binary options allow you to speculate on assets at the click of a button. You simply need to decide whether the asset will close at a higher or lower price than the stated strike price. Contracts can last for just 60 seconds, right up to 365 days.

However, binary options won’t be for everyone – especially if you are the type of trader that likes to employ a risk-averse strategy. Nevertheless, if you do like the sound of trading binary options, we have explained the ins and outs of how this particular investment space works.

To help you choose a platform to trade with, we’ve also discussed our top three binary options brokers of 2023. Ultimately, just make sure that you have a firm grasp of the risks of trading binary options, as you will lose your entire stake if a bet is unsuccessful.