Copper is often considered a tertiary commodity by investors compared to the other lustrous metals – such as gold and silver.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

However, it is the third most traded metal globally and plays a crucial role in the advancement of the developed world. The several properties of copper, both in its singularity or in combination, make it a highly versatile metal.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Its superior thermal and electrical conductivity, malleability, and resistance to corrosion makes it a core component for industrial applications, only third after iron and aluminium. Considering its role in electric vehicle evolution, experts anticipate copper consumption to rise 250% by 2030.

In short, this rising demand makes copper trading a potentially lucrative asset arena to consider. As such, this might be the right time for you to take a closer look at the metal.

In this guide, we will walk you through the ins and outs of how copper trading works, what risks and strategies to take into account, and which online brokers offer this popular asset class.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Copper Trading Fundamentals

Copper follows the same trading fundamentals of any basic commodity, which is the economic concept of buying and selling with the intention of making a profit.

To explain with an example:

- You speculate that the price of copper is about to rise

- As such, you decide to buy copper

- Copper increases in value as you predicted

- You sell the copper at a higher rate, subsequently making a profit.

The strategy mentioned above is called a long position, where you buy first and sell later.

If, on the other hand, you thought that the price of copper was due to fall, you would be taking a short position. This method is possible when you trade a commodity through derivatives that represent the value of copper.

As you might have guessed, it is not always possible for you to trade copper in its physical form. That is where the derivatives come into play. The most common ways of accessing the copper trading market include options, futures and CFDs. We will get into the specifics of each shortly.

What Drives the Cost of Copper?

The price of copper is swayed by the underlying imbalance in the supply and demand of the market. A strong global economic health typically leads to rising copper prices. At the same time, a struggling economy has less demand for copper and thus – drives a lower cost.

Therefore, it is essential to keep an eye on the many factors that influence the global economy.

The Emerging Markets

There is a reason why this metal has the moniker of Doctor Copper in the market. It is deserving of a PhD, thanks to its capability to be the indicator of economic health.

If a country’s economy is growing, then the price of the copper will also mirror the industrial demand. As such, the development of infrastructure is one of the key drivers of copper pricing.

The largest copper deposits on earth are distributed among Chile, Australia, Peru, Mexico, and the US. Its top consumers are China, and other emerging markets such as India and Brazil. Copper is commonly used in manufacturing, energy, telecommunications and the transport sectors.

Therefore, any developments in the socio-economic conditions that affect China’s GDP growth will also influence the price of copper. On the flip side, copper prices will take a hit if there is an economic downturn.

Disruptions in Supply

The COVID-19 pandemic lockdown is one example of how the global socio-economic landscape can affect the copper trading industry. The year-on-year comparison of Peru’s output fell by 23% between January and May 2020. Then you had Chile’s Chuquicamata mine strike saga of 2019.

Additionally, natural disasters such as floods, earthquakes, or landslides can also impact mining output. The disputes and shutdowns of mines will also limit supply, which translates to higher demand and ascending copper prices.

The US Housing Market

Copper is used extensively in building construction in the US for the purpose of electrical wiring, plumbing, roofing, and other works.

This also makes up for almost 50% of the total copper used in the country. As such, those engaging in copper trading will also have to monitor the factors influencing the housing market, including the US GDP.

Copper Alternatives

Substituting one commodity with another is quite common in all markets in order to find cheaper alternatives.

Aluminium is often chosen as a replacement for copper in electrical equipment, so are nickel, lead and iron depending on the purpose. Naturally, this brings about a decrease in the price of copper.

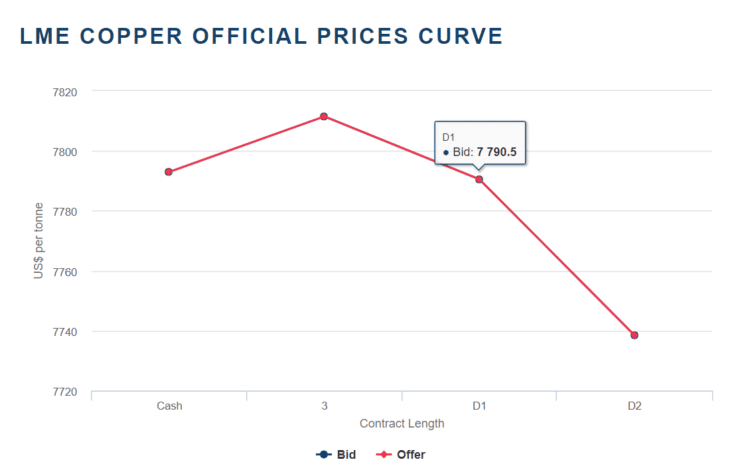

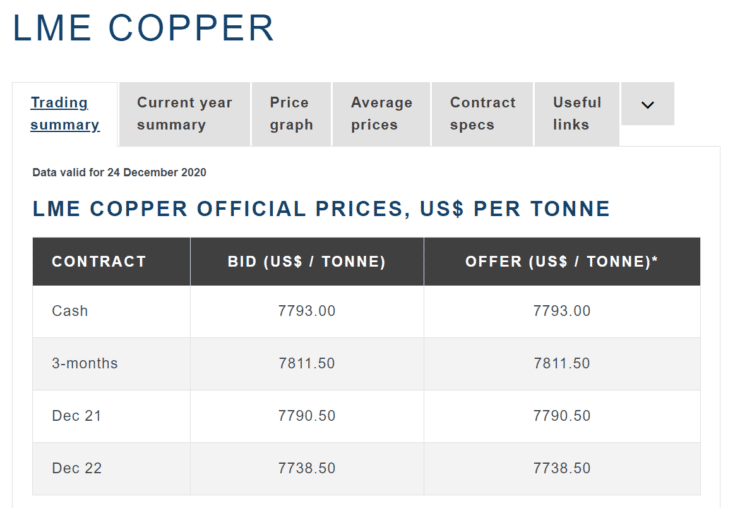

How is the Price of Copper Calculated?

If you want to trade copper in its tangible state, you can acquire the metal in the form of bullions, bars or coins. These are weighed in ounces, tonnes, kilos, or grams. But as you can imagine, owning and trading copper billions is not the easiest task.

For online trading, copper is often dealt with in derivatives such as options, futures, ETFs, and CFDs. The price of copper is generally indicated in US dollars; as the Greenback is the benchmark currency for trading across most commodities.

However, depending on your chosen online broker, you will be able to deposit funds into your account in your own currency.

When is the International Copper Market Open?

You can engage with electronic copper trading 24 hours a day throughout the week by entering different exchanges around the world.

The main commodity markets are:

- London Metal Exchange (LME),

- New York Mercantile Exchange(NYMEX),

- Chicago Mercantile Exchange (CME), and

- Shanghai Futures Exchange(SHFE).

The copper markets are typically open from 10 pm to 9 pm GMT. Traders can enter these markets through online brokers who can provide access to different exchanges.

How can I trade Copper?

Online copper trading can be done in several ways. Bullions and copper stocks are one way to invest in copper. But most commonly, traders capitalise on this metal through derivatives, which are financial contracts that mirror the value of copper.

Copper Trading Stocks

Copper stocks are considered a direct route to the copper markets, but a risky one too. You will be investing in companies that mine copper by buying their shares.

Your returns will depend on not only the smooth running of the mine itself but also the company management and other issues that will influence its production. Besides, input costs such as the price of equipment, as well as oil, could also impact the price of the shares.

Some of the most notable names in the copper mining industry are Turquoise Hill Resources LTD (TRQ), Southern Copper Corp. (SCCO), and Lundin Mining Corp. (LUN).

Copper Trading ETFs

Exchange-Traded Funds (ETFs) are also listed on public exchanges – much like stocks. The difference is that instead of focusing on companies, ETFs track a basket of assets such as stocks that follow the value of copper in the market.

For reference, two of the best-performing copper ETFs are the United States Copper Index Fund (CPER), and the iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC).

The basic premise of copper ETF trading is that if you buy CPER ETFs and its value of copper goes up, so will the value of your ETF. Crucially, you will have access to copper shares without having to own the metal in its physical form.

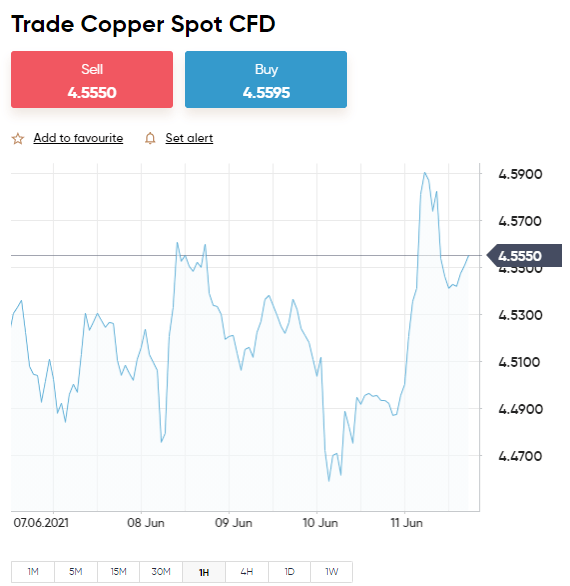

Copper Trading CFDs

One of the most commonly used copper derivatives is the Contracts for Difference or CFD. Instead of buying or selling the actual metal, you will be trading contracts with the broker that effectively reflects the price of the copper in the market.

Similar to stocks or ETFs, you will be speculating on the price of copper, and how it is likely to perform in the future.

To illustrate, here is how a copper CFD trade would pan out.

- The current price of copper is $3.50

- Your broker offers a CFD at the market value of $3.50

- The value of copper shoots up to $5.00

- Now the CFDs will also be valued at $5.00

Simply put, CFDs will always carry the same value of copper. But instead of buying real copper, your investment is represented through contracts.

CFDs also come with several advantages to copper traders. For one, they are cost-effective as you can avoid expenses of transporting and storing the real commodity.

Let us provide an example for you.

- Copper at the moment is valued at $3.50 per pound

- As per your analysis, you think that the price of copper will decrease within a day or two

- So you ask your broker to place a sell order worth $1000

- You were right, as the price of copper falls by 2.5% the next day

- You make a profit of $25 on your sell order ($1000 stake x 2.5%)

Now, another perk of using CFDs is that you can apply leverage on your trades. This means that you can open a trade for much more than you have in your brokerage account. You will essentially be loaning the money from the broker which then allows you to trade on credit.

In the above example, if you applied leverage of 10x, your profit of $25 would be magnified to $250. While leverage is a great way to boost profits, it can also amplify your losses – and quickly.

For the same reasons, leverage via CFDs is prohibited in many countries, including the USA. In the UK and Europe, leverage of copper is restricted to 1:10. If you trade with regulated copper brokers – which you should be, you will not be able to get more leverage than this.

Copper Trading Futures

Copper futures are another type of contract wherein the trader agrees to buy or sell the metal at a specific price at a predetermined date. This mutually-agreed price is called a strike price.

Typically, copper futures have an expiry date set for three months. After that, the parties involved are obligated to carry out the asset’s purchase or sale, as mentioned in the contract. The trade must be executed if you are still holding the copper trading futures on expiry, even if the market goes against you.

Similar to CFDs, copper futures also come with leverage and can be used for short-selling. Ultimately, the market volatility of copper makes futures one of the more sophisticated trading methods and is, therefore, best suited for experienced investors.

Copper Trading Options

Copper options are also derivatives like futures that come with an expiration date and a specific strike price. However, the main distinction is that there is no obligation for you to complete the trade on expiry. Instead, you have the right to buy or sell copper.

Here is an example that will offer you a bit more clarification.

- You purchased copper call options that expire after three months.

- The strike price is at $5.00

- In order to access the market, you need to pay a premium of $0.50 per contact

- The minimum order is 1,000 contracts, so that’s a total premium of $500

- When the options expiry, copper is worth $7.00 – which is $2.00 above the strike price of $5.00

- This results in a profit of $2,000 ($2 x 1,000 contracts)

- You need to subtract the $500 premium you paid, so that’s an all-in profit of $1,500

Crucially, if options expired and copper was worth less than the strike price of $5.00 – you would simply refuse to execute your right to make the purchase. In turn, you would simply lose your premium of $0.50 per contract.

In case you expected the price of copper to fall, you would have purchased put options instead. As such, copper options are a way to profit from both rising and falling prices of copper.

Three Popular Copper Trading Strategies

Now that we have established the different copper trading methods available, we will now shift our focus to strategies. After all, trading strategies play a crucial role in enabling you to make consistent, risk-averse returns.

Remember that the best traders are adaptable and choose the right strategy that suits the current market conditions. With this in mind, below we discuss three common copper trading strategies that can inspire you to devise your own system.

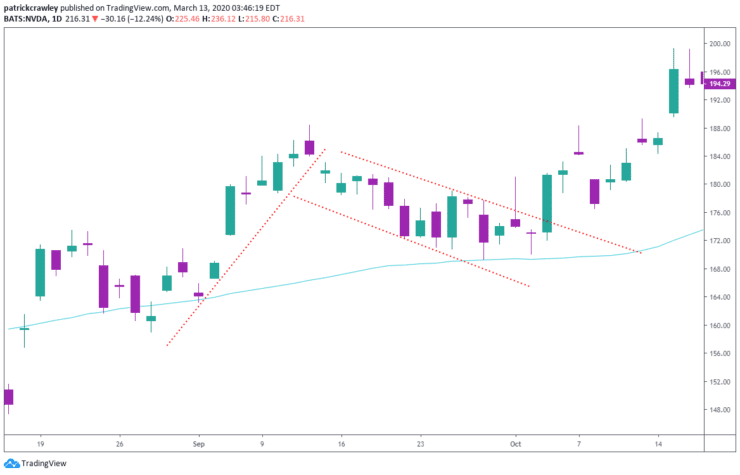

Copper Swing Trading

Swing traders try to capture the rise and fall of copper over a short period. This might be from a few days to a few weeks. They take advantage of the market’s variations, as the price of copper swings up and down around the dominant trend line.

The success of this type of trading depends on analysing the length and duration of each of these swings, and in defining the supporting and resistance levels correctly. If you suspect the market to rise, then you buy the asset.

Support and Resistance Levels

Support and resistance levels are key concepts that help traders determine whether a buy or sell position is the right course of action to take. In technical analysis, support lines show the price level upon which the asset is likely to stop falling.

In this case, copper’s support level is the cut-off line beyond which the price of copper will not decrease any further – as per historical trends. If it breaches this level, the chances are that the price will drop further to meet another support level.

The resistance level, in contrast, is where the price meets resistance as it rises. So if you are going long on copper, you want to set the take-profit just before the price approached this resistance level. There will be many historical support and resistance levels on copper, some stronger than others.

Copper Scalping

The scalping strategy specialises in taking advantage of the smallest market changes. This copper trading strategy works really well during times of uncertainty. This is because the price of copper is likely to trade within a certain price range.

In turn, scalpers can enter and exit dozens of positions throughout the trading day – ensuring that they capitalize on the respective consolidation period.

Although profit targets are super-small when scalping copper, these gains can quickly add up. Additionally, scalpers will usually apply leverage to ensure that small margins translate into healthy gains.

Copper Trading Tips

For any commodity trading arena, including copper, risk management plays a significant role. In order to do this, you first need a thorough understanding of all the underlying factors that influence the price of copper.

To help you along the way, check out the copper trading tips we discuss below.

Read Copper Trading Books

The best trading books can teach you how the copper market has evolved throughout the years. These books often carry insights into trading strategies of experienced traders, and the lessons they have learnt. There is no reason why you won’t find a few useful tips and learning points from these books.

If you do not find a title specific to copper, you can also search for more general commodity trading books.

Examples include.

- A Trader’s First Book on Commodities by Carley Garner

- Viewpoints of a Commodity Trader by Roy W. Longstreet

- Commodity Derivatives: A Guide for Future Practitioners by Paul E. Peterson

- Higher Probability Commodity Trading by Carley Garner

If reading is not your forte, today you can get the same or better understanding of copper trading through online courses. Alternatively, there are several websites – such as ours, dedicated to educating traders wherein you will find articles that will feed you relevant information on trading in snippets.

Keep Track of The Copper Market

When we mentioned earlier the many factors that can influence the copper market, your first thought might be how do you even keep up with all this? Well, you can approach this by combining two methods, fundamental analysis and technical analysis.

Fundamental analysis is all about getting a clear indication of factors such as the emerging markets, global economy and political landscape. You can gain access to this information by tailoring your news resources from financial websites.

As one news story alone can have a major impact on your trading strategy, we recommend that you turn on alerts and notifications so as not to miss any key pieces of information.

Technical analysis involves using software with algorithms specifically designed to read the markets. These help traders understand what might happen in future based on historical trends.

Understanding technical analysis might require some time and effort from your side, as it is complex even for experienced traders. That said, there are also traders who base their research entirely on fundamental analysis.

Use Copper Trading Signals

It might seem like copper trading requires full-time dedication. After all, you need to be constantly on top of the markets, perform analysis and be ready to take action at the click of a button.

Fortunately, thanks to copper trading signals, you can get the relevant insights from the market and actionable inputs from a third-party in real-time.

For those who don’t know, trading signals are triggers that will recommend for you to place a buy or sell order based on pre-defined criteria. Different trading signal platforms use a variety of algorithms to send you each signal.

We tell you which entry and exit orders to place via Telegram in real-time, including the take-profits and stop-losses. In effect, you will be able to place trades based on these signals alone, saving time and effort.

Use a Copy Trader Feature

One of the best ways for new traders to learn copper trading is to follow experts in the field. A few online brokers offer a Copy Trader feature that allows you to mimic the buy and sell orders placed by experienced copper traders. You will be investing a certain amount of money per trader, and in return, copy their portfolio like-for-like.

You can choose a trader you want to copy based on their performance, primary asset classes, and risk patterns. To give you an example, eToro’s Copy Trader feature allows you to mirror your chosen investor from just $200.

Trade Copper Using Demo Accounts

Demo accounts are a coveted feature among online brokers today. These come preloaded with paper money that you use to practice your trades and strategies. Even the most experienced copper traders use demo software that replicates real-market conditions to test their trading systems.

This will help you familiarise with the interface of the broker’s site, the several tools available for research, as well as place trades without risking real money.

Key Metrics: Finding the Best Copper Trading Broker

Choosing the right copper trading broker for you is a crucial step that requires some thought. With a plethora of options out there, it can be confusing for a newbie trader to choose a broker most suited for their interests.

Much like anything , the process of selecting your copper broker can also follow a criterion. As such, further down in this guide we discuss some of the best online brokers that offer copper trading facilities.

Before that, let us explore the most important factors you need to consider when searching for a top-rated copper trading broker.

Regulation

Trading can be a precarious venture, even for the most seasoned trader. Whether you are trading in small amounts or large volumes, it is best that you stick with licensed brokers that offer security and transparency.

Regulatory bodies are in place to ensure a level playing field for all. They have a set of rules to protect both traders and brokers. These bodies can supervise brokers in their specific jurisdictions.

The FCA in the UK, ASIC in Australia, CySEC in Cyprus, FINMA in Switzerland, and the SEC in the US are a few among the most well-known regulatory bodies around the world. When a trader is licensed from one of these regulators, it means that they can operate within the jurisdiction given that they follow the required rules and regulations.

Copper Trading Fees

Trading fees are how platforms charge you for their services and vary from one broker to another. As such, checking out the broker’s fee structure is one of the first things that you need to be doing.

While some brokers offer reasonable fees, others are expensive. The main copper trading fees you need to consider are listed below.

Commission

Trading commissions are a standard fee that brokers of almost all sectors charge. However, since trading moved online, many traders have also decided to cut back on commission. As such, it shouldn’t be a surprise if you come across a broker offering zero-commission on copper trading.

Where commissions are involved, it might be a one-time fee per trade, or for each order. This means you might have to pay the commission when you open the position and again when you close it.

Instead of a fixed amount, broker commissions are usually charged as percentages.

For example, let’s say your broker charges 2% commission on your copper trades. This means if you stake $1,000 on copper buy order, you will have to pay them $20 as commission.

Overnight Financing Fees

Some trading strategies, such as swing trading, require you to keep a position open overnight. Such trades will also require you to pay an overnight fee, otherwise known as swap fees.

It is similar to the interest fee you pay to the broker to keep the position open for you. Some brokers might also charge you a higher swap fee during the weekends. In case you keep a long term position open, these overnight fees can easily add up to considerable sums.

Inactivity Fees

Some copper trading brokers also charge you a fee after a period of inactivity on your account. Say, if you haven’t traded for six months or a year, a certain amount will be debited from your trading funds.

If you know you will not be using your trading account for a specific period, it is, therefore, best to withdraw your funds out.

Currency Conversion Fee

As we covered earlier, most trades take place through US dollars. While most online brokers allow you to deposit funds in other currencies, they might impose a conversion fee to exchange the currency for you.

Platform Navigation

Whether you are a beginner or a professional trader, the design of the copper trading platform could make the princess easier or difficult for you.

Smooth navigation translates to a better user experience on the platform, where resources are easily accessible, and you do not have to search extensively to find your desired marketplace.

Deposit and Withdrawal Options

When trading copper through an online broker, you will first need to deposit some funds into your account. The best brokers will have a few payment options at your disposal, including bank cards and wire transfers. They might also have third-party integrations that allow you to add funds through e-wallets such as PayPal, Skrill or Neteller.

As such, ensure that the broker supports your preferred payment before signing up. While deposits are usually free, some brokers charge a small withdrawal fee to cash out your funds from your trading account.

Spreads

While you might be able to avoid commissions when trading copper, you will not be able to circumvent spreads. In trading lingo, this is the gap between the bid price and the ask price of copper.

You want to limit the size of the spread to ensure you maximize your potential profits. For instance, some of our recommended brokers charge a spread of only 2 pips on copper CFDs at the time of writing. However, remember that the spread is not fixed; it varies along with market volatility.

Best Copper Trading Brokers

As you might have guessed, you need to perform a lot of research to find a copper trading broker that meets your needs. Don’t have time to do this and simply want to start trading copper right now?

If so, below you will find a selection of top-rated metal trading platforms that have all been pre-vetted by our team here at Learn 2 Trade.

1. AVATrade – Trade Copper CFDs With Tight Spreads

AVATrade is one of the prominent names in the online trading sector. The platform has been around for over a decade now and has built a solid reputation with licenses from ASIC, FFAJ, FSCA, ADGM, and FSA. The brokerage also offers very competitive spreads for copper CFDs.

If you rely on technical analysis, you will be happy to know that AVATrade integrates perfectly with MetaTrader4 and 5. To make trading on the go easier, you can download either AVAOptions or AVATradeGO.

There is also tons of informative content out there, and a demo account to engage in paper trading. You can sign up for a copper trading account with a minimum of just $100.

- Min deposit $100

- Leverage of 1:10 on commodity trades

- AvaTradeGO mobile app

- Free commodity trading demo only valid for 21-days

2. Capital.com - Commission-Free and Competitive Spreads on Copper

Capital.com allows you to trade copper through commodity CFDs. Or, you can trade stock CFDs of copper mining companies such as the Southern Copper Corp. Approved by the FCA, CySEC, ASIC, and NBRB, the brokerage currently has over 700,000 clients.

The time-honoured reputation and expertise of Capital.com are visible from its vast suite of resources for new traders. This includes CFD demo accounts, trading courses, and educational videos.

Capital.com is one of the few brokers that will charge you zero commission for copper trades. They also cover the cost of your deposits and withdrawals.

You will only have to pay the spread, which is also highly competitive at this platform. The minimum deposit required is 20 dollars, 20 pounds, or 20 euros, or whichever currency you prefer to pay in.

- Trade commodities commission-free

- Competative spreads

- Regulated by the FCA, CySEC, ASIC, and NBRB

- No traditional assets

Open an Account With a Copper Trading Broker Right Now

Yes, it will take you time to get prepared to trade copper like a pro. But you can sign up for an account with an online broker in minutes nonetheless.

Simply follow the 3-step walkthrough outlined below.

Step 1: Register with a Copper Trading Broker

If you have already chosen a copper trading broker to sign up with, head over to the platform and open an account.

As per the Know your Customer (KYC) process implemented by the regulatory bodies, you will have to provide some personal information to verify your identity.

This includes:

- Your full name

- Your address

- Your phone number

- A valid government-issued ID

- National tax number

Sometimes brokers also ask you to send a photo of you holding your ID card next to your face. This is only to avoid identity fraud and prevent financial crime.

Step 2: Add Funds to Your Copper Trading Account

In order to start trading copper, you will first have to deposit some funds. You can choose a payment option from the available methods, ensuring that you meet the minimum deposit amount stipulated by the platform.

Step 3: Place an Order

Once your account is verified, you can enter the copper trading market right away. You can speculate on the price of copper in any of its forms, and place an order accordingly.

Don’t forget to enter both take-profit and stop-loss orders to minimise your risk. Additionally, if possible, we suggest you get a taste of the market by trying a few trades through the demo account facility offered by the copper trading broker.

To Summarize

Other hard metals – such as gold and silver, might hold a much higher value than copper. But it is unlikely that their prices will change dramatically in the short term. Copper, on the other hand, could very well go up or down by double-digit percentages in a matter of weeks – as per its volatile nature.

This makes it highly conducive for both short-term and long-term commodity traders. In other words, a seasoned trader who can assess the ebbs and flows of the copper market has plenty of opportunities to capitalize.

With that said, whether you plan to trade copper via CFDs, ETFs, futures, or options – just make sure that you have a firm grasp of the risks. A great way to counter the threat of losing more money than you had hoped is to deploy stop-loss orders on all copper trading positions.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card