There are thousands of brokers offering financial services globally. The problem is that not all of them are legitimate. Unfortunately, there is an immeasurable amount of rogue broker sites out there, so doing your homework is key.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Thankfully over the past couple of decades or so government mandates made it possible for regulatory bodies to be set up. The purpose of these jurisdictions is to regulate and govern the financial services space to create a fairer and more transparent investment scene for all.

On your investment travels, you’ve probably come across many brokers holding an ASIC licence (Australian, Securities & Investments Commission). This licence is particularly common in forex broker space.

On this page, we are going to cover everything you need to know about ASIC brokers. This includes what ASIC does and the most important metrics to be mindful of before joining a broker that is licensed by this body. To conclude, we’ll discuss the best ASIC brokers currently offering their service to retail traders in 2023.

What is ASIC?

This regulatory body has been around since 1991, although it was originally called ASC (Australian Securities Commission ). The Wallis Inquiry began in 1996 with the aim of investigating and improving financial conditions, as well as a complete overhaul of financial conduct and stability in general.

Fast forward to 2009 and another progressive overhaul was implemented. This time it affected how ASIC brokers could function in the Australian stock markets. New and stricter rules came into play as well as rigorous tests and regular revising of broker firm’s accounts and customer care.

Some other notable changes were introduced to the Australian financial sector, including MoneySmart (which replaced FIDO and Understanding Money). MoneySmart is a free service offering people unbiased advice, information and educational tools and resources.

Furthermore, this was put in place to form part of a bigger picture – safeguarding investors, but also helping them to make better financial choices in the future, thus maximising gains.

How do Brokers Obtain a Licence From ASIC?

The answer is – not with ease. ASIC operates using strict rules, much like the FCA and CySEC. To begin with, all brokers need to apply for a valid licence from the AFS (Australian Financial Securities), and then ASIC will evaluate the respective application.

All ASIC brokers need to wait for approval before they can legally offer a financial service. Thereafter, the broker must comply with each and every condition of the AFS licence as per the ‘Corporations Act 2001’.

We’ve put together a list of some of the conditions required for a prospective ASIC broker to obtain a licence.

Submit an Annual Audit

This might sound obvious, but in order to keep an eye on ASIC brokers, it is required by law for firms to submit various and detailed audits to the body. As well as annual turnover, these audits must include a highly detailed trading volume of financial assets, margin investing account figures, and the turnover of sub-class assets.

Moreover, they must include proof of fee calculations and detailed breakdowns of leverage used on accounts. In addition, an audit inclusive of all trades carried out and who they were carried out by. In other words, the broker must differentiate between which orders were executed by clients themself, and which were carried out by the broker firm.

ASIC is more than entitled by law to fine any brokerage company not following its rules to the letter or missing information of the audits required. So, as a trader, you don’t need to worry about ASIC brokers being unprofessional. Crucially, ASIC has very high standards.

Client Fund Segregation

In any country which has a commission in charge of regulating the financial sector – fund segregation is a legal requirement. This financial customer protection is not exclusive to brokers.

Fundamentally, all ASIC brokers are legally obliged to keep your account funds in a different account to that of the firm’s money. This means that in the event of the company going bankrupt or being the victim of illegal activity, your money is safe and sound.

When it comes to keeping your money safe, ASIC brokers are advised to only associate with tier-1 banks (meaning banks with huge levels of capital). Furthermore, the tier-1 bank holding your account funds must be in no way connected to the brokerage, under any circumstances.

Full Client Disclosure

Brokers are legally required to help clients make informed decisions based on transparency, fairness, and complete professionalism. All financial markets must be orderly and honourable when selling a product to the public.

Sometimes called ‘risk disclosure’, your ASIC broker is required by law to fully divulge any fees payable to the firm. An example of this would be a detailed commission structure and inactivity fees which might be applicable if you don’t use your account for a month.

On top of this, you should be made aware of any transaction fees, including overnight financing on CFDs. Not all ASIC brokers charge every fee under the sun, but regardless, the provider must be fully transparent regarding its pricing structure.

You will often find that you need to read a page relating to your confirmation of understanding, sometimes referred to as a ‘customer confirmation form’. The long and short of it is – by law, an ASIC broker has to disclose all fees which might be applicable to you.

Dispute Resolution

A satisfactory internal dispute resolution is another legal requirement for ASIC brokers. As such this is yet another enforceable standard from the body.

Sufficient Amount of Capital

As per ASIC standards, licensed brokers must have a minimum of 1 million Australian Dollars in the firm’s bank account. This needs to be the case before it can offer financial services to the public.

Australia AML/CTF Act

AML is short for ‘Anti Money Laundering’, whilst CFT stands for ‘Combatting the Financing of Terrorism’. This is another regulatory requirement for any ASIC broker. Essentially, the AML/CTF division is tasked with putting a stop to terrorism financing, money laundering, financial fraud, identity theft and a range of other inquisitive crimes.

With this in mind, ASIC brokers have to perform a KYC procedure – which is an acronym for ‘Know Your Customer’. In a nutshell, this is the reason you need to provide information and proof of who you are.

The same goes for FCA and CySEC brokers. In fact, this is the standard pretty much across the board. In other words, no licenced ASIC broker will ever sign you up without going through this procedure. If you are allowed to sign up to a brokerage with no photo ID, then that should be a red flag when it comes to the legitimacy of the company.

Now, let’s say the ASIC broker becomes suspicious of a client. To give you an example; imagine the customer usually deposits an average of $1k per month. All of a sudden, the same investor starts depositing $20k a month. Although there could be a legitimate reason for the higher investment, the broker must report this activity to the Australian AML/CTF regime.

Full Due Diligence Report

A strong due diligence report is to be included in the broker company’s framework. ASIC brokers are under frequent scrutiny from the regulatory body, which makes sense – they are after all like guardians for investors.

We just mentioned that if a customer has drastically changed the way they invest, ASIC brokers are legally required to report it. However, it doesn’t stop there. In addition to this, the broker must go through an investigative procedure. This involves finding out where the money was sourced from. This also includes producing a clear due diligence report inclusive of all enquiry findings. This is just another way ASIC is regulating and preventing money laundering and financial crime.

With all of the above in mind, the best ASIC brokers should demonstrate a clear comprehension of producing a ‘customer risk profile’ to the satisfaction of the regulatory commission.

Conflicts of Interest Management

First of all, as per regulatory guide ‘181’, ASIC brokers must avoid dealing with any client where there could be a conflict of interest. If there is a conflict of interest, then the brokerage must provide evidence of conflict management.

By providing a conflict management structure within the company, the licensee won’t compromise their financial standing or integrity. The idea with financial conflicts of interest is to ‘control’, ‘avoid’, and ‘disclose’ any potential conflicts of interest.

ASIC Broker Protections

The commission actually protects investors in a number of ways. First and foremost – they make sure that any ASIC broker you are trusting your money with is transparent and operating their service within the law. This creates investor trust as well as confidence in the financial space.

In the event of a broker firm going into liquidation, ASIC has a compensation scheme in place. This essentially helps you access any ‘lost’ money’. In fact, this body commits itself when it comes to enforcing financial codes of practice.

In the unfortunate event that you need to make a complaint about an ASIC broker, then you are able to contact ASIC directly. The commission also follows up any reports of delinquency and criminality. This is essential in maintaining its integrity.

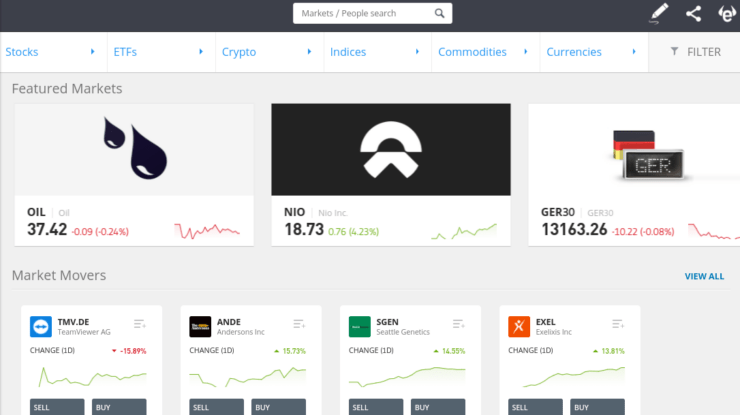

ASIC Brokers: Tradable Assets

There are some platforms which only offer a few asset classes. You then have ASIC brokers who provide services for every asset under the sun. As such, you should always check what assets your chosen platform supports before signing up.

Nevertheless, if you’re still not sure what kind of asset you would like to trade, we’ve put together a list of frequently seen instruments offered by the best ASIC brokers.

CFD (Contract For Difference)

As it stands, CFDs can be traded, but there have been talks about drastically changing access to retail clients under ASIC regulation. Probable restrictions include leverage caps and new marketing rules. After some investigation, officials found that a high number of retail customers had their CFD positions closed unjustly by brokers, and at a rock bottom margin value.

As these changes haven’t come to fruition yet, and these things can take years to implement, we’re going to briefly explain how CFDs work with an ASIC broker.

As you may be aware, CFDs work by you predicting the future price of a variety of trading instruments. For example, you might choose to guess the price movement of stocks and forex pairs. If you think the market price is on a downward swing, you would ‘sell’ or ‘go short’. If you have a feeling the market price will increase, you would ‘buy’ or ‘go long’.

When trading in CFDs, you will not be the owner of the asset itself. Instead, the CFD is tasked with tracking the real-time price of the instrument. For instance, if the price of Nike stocks increases by 1.25%, as will the CFD. Crucially, trading CFDs means that you have the potential to make gains from ‘going short’ and ‘going long’.

With most ASIC brokers, you won’t need to pay any commission fees on CFDs. Depending on the platform, CFDs could give you access to the ultra liquid forex market. Not to mention shares, gold, oil, indexes, cryptocurrencies and much more!

Forex (Foreign Exchange)

Many forex brokers look to ASIC or the FCA when it comes to obtaining a licence. And of course, before you yourself can trade forex you must have a broker behind you. Without a broker to place the order on your behalf, you won’t have access to the global currency markets.

There are three categories of currency pairs and they are ‘exotics’, ‘minors’ and ‘majors’. For those who are unaware, please find below some examples of each:

- Exotic Currency Pairs – GBP/ZAR, EUR/TRY, USD/THB, JPY/NOK, AUD/MXN.

- Minor Currency Pairs – EUR/AUD, EUR/GBP, CHF/JPY, NYZ/JPY, GBP/CAD.

- Major Currency Pairs – GBP/USD, EUR/USD, USD/JPY, USD/CHF.

Using an ASIC broker to trade forex means you can buy and sell currency pairs at the click of a button. This global market is open 24 hours a day and 7 days a week, in different corners of the world.

When it comes to FX, if you want to be a hands-on trader, we recommend looking for a platform that offers real-time financial news, price charts, technical analysis and educational tools.

Commodities

The commodities market is open for trading 24 hours a day, 7 days a week. This asset falls into three categories – ‘energy’, ‘metals’, and ‘agriculture’. Please find below some examples of each commodity type.

Energy: crude oil, heating oil, unleaded gas, natural gas, gasoline, and heating oil, etc.

Metals: aluminium, silver, palladium, gold, platinum, and copper, etc.

Agriculture: oats, corn, cotton, wheat, wool, beans, rice, etc.

Some traders believe that always having some commodities in your trading portfolio adds diversity and reduces overall risk.

Stocks and Shares

Even people who have never traded a day in their lives have heard of stocks and shares. Of course, now it’s mostly done online. Share dealing allows investors to buy and sell shares in corporations (for example; British American Tobacco, HSBC, Amazon).

Furthermore, if you don’t want to buy a whole share in say Adidas for example, some companies enable investors to only purchase a fraction of a share. There are 3 commonly seen ASIC share brokers and they are as follows.

- Discretionary: This type of broker will trade on your behalf so that you don’t have to lift a finger. The firm takes on the role of executing all buy/sell endeavours, albeit, be aware of extra fees payable for the extra work carried out.

- Execution: An execution broker simply places orders when you instruct them to do so.

- Advisory: If you need a little guidance, but don’t want a totally passive trading career, then an advisory broker could be the best option for you. The broker will advise you on which shares could be profitable for you to buy/sell. Moreover, the ASIC broker will only execute a buy or sell with your permission.

Cryptocurrencies

There are over two thousand types of cryptocurrencies in the market, so it wouldn’t be practical to list them all. With that said, below you will find a list of cryptocurrencies that are typically hosted by ASIC trading platforms.

- Bitcoin (BTC).

- Ethereum (ETH).

- Litecoin (LTC).

- Ripple (XRP).

- Bitcoin Cash (BCH).

- Tether (USDT).

- Monero – Guide, Tips & Insights | Learn 2 Trade (XMR).

- Bitcoin SV (BSV).

- EOS (EOS).

- Binance Coin (BNB).

When it comes to cryptocurrencies, we think it’s a sensible idea to take full advantage of a demo account on an ASIC broker platform. Whilst you won’t be able to use a demo account on the actual exchange, it is a superb way of having a practice run before you start investing using real money.

Indices

People who invest in indices make a profit by correctly forecasting indices price movements. You can just focus on one index, or you can trade multiple. Indices essentially ‘indicate’ the price shift of multiple stocks listed on a particular exchange. For example, the FTSE 100 represents the 100 largest companies on the London Stock Exchange.

The shift in price on an index is measured with points and moves in points. Contrary to other assets on our list, you can’t directly invest an index. Instead, it must be done through ASIC brokers offering CFDs, Futures or ETFs.

Choosing an ASIC Broker

The first step to finding a great broker is finding one which holds a licence from a respected regulatory commission like ASIC. Broker platforms proudly display licencing so you shouldn’t need to do much digging to find out who regulates the company.

By only trusting your hard-earned cash with regulated brokers you know that your money is kept safe and apart from the firm with fund segregation. Additionally, you have the peace of mind that the company has to follow strict rules to offer its service.

Low Spreads

When it comes to making a decent trading profit, spreads make a big difference. In a nutshell, this is the gap between the purchase and selling price of an asset, as it’s typically illustrated using ‘pips’.

Let’s say the currency pair GPB/USD has a spread of 6 pips. In order to make a profit, you must grow your investment by more than 6 pips.

Commissions Payable

This is another consideration when choosing a good ASIC broker, but again each firm will differ. Some broker platforms don’t charge any commisson fees but will make money purely from the spread. Others might charge you a fee on every buy or sell order. This fee should always be made clear to you as a client.

As an example, imagine the following scenario:

- Let’s say you are trading GBP/USD

- Your broker charges a commission fee of 0.6%

- You decide to invest £2,000

- The ASIC broker would take £12 in fees for the trade

Technical Tools

Technical tools definitely vary from site to site, but just to give you an idea of what you should be looking out for we’ve listed the most useful indicators offered by ASIC brokers.

- Relative strength index (RSI)

- Average directional index (ADX)

- Parabolic Stop and Reverse (SAR)

- Bollinger bands

- Moving average (MA)

- Stochastic oscillator

- Ichimoku cloud

- Moving average convergence divergence (MACD)

- Fibonacci retracement

- Standard deviation

- Exponential moving average (EMA)

Part of becoming a profitable trader is pairing these tools with money management and a great strategy. Again demo accounts are invaluable when finding your feet with technical indicators such as the aforementioned.

Trading Tools and Educational Material

The best brokerage platforms provide both live market information and historical data to clients. For investors, studying the historical price movement can be really helpful when it comes to predicting the future.

The reason being, trends often repeat, so backtesting and examining the previously mentioned technical trading signal tools are extremely useful for predicting the direction of the market.

Additionally, if you want to try an automated trading system just make sure your broker supports third-party software like MT4. Another important consideration when selecting an ASIC broker is how quickly orders are executed. Depending on what kind of account you have opened, your orders could be executed as fast as milliseconds. This can have a major impact on your investing strategy.

Selection of Assets

Before you go ahead and sign up for an ASIC broker, it’s advisable to investigate the platform further by finding out what assets are available. What you enjoy trading now might change further down the line. So if you want to diversify your investment portfolio later on it’s good to know you have more than a few asset classes to choose from.

If it is forex that you are focused on, then make sure you make yourself aware of which currency pairs will be available for you to trade. For instance, whilst some broker platforms offer minors, majors and exotics – some only focus on a small handful of pairs.

Most forex traders will tell you that the best ASIC brokers are the ones with a wide range of asset classes available, in the event you want to later expand your portfolio.

Customer Support Options

Customer support is definitely an important factor when choosing a good broker firm. The ideal situation is that the brokerage is available 24/7 with support if and when you need it.

For instance, with markets like commodities and forex open 24/7, it would be a bit of a nightmare if you needed help on a Saturday evening and there was no one around to assist or advise you.

The very best ASIC brokers offer a variety of contact options such as 24/7 live chat, email, telephone support and a contact form.

Accepted Payment Methods

Every ASIC broker differs in the deposit/withdrawal department. Whilst some might accept the majority of payment methods, some may only accept a traditional bank transfer.

If you have a payment method in mind you want to use, you should check that the company accepts it. The most commonly seen payment options are a credit/debit card, bank transfer, and e-wallets such as Neteller, PayPal and Skrill.

Deposit/Withdrawal Protocol

Assuming you have found a brokerage which accepts your chosen payment method, you now need to look into some other metrics. For example, check to see whether the broker charges any deposit fees.

Furthermore, you’ll also need to look at the withdrawal policy of the platform. Ideally, the ASIC broker will process withdrawal requests within 2 working days, if not faster. This also hangs on which payment method you use.

Alternative Accounts

When it comes to accounts, it’s different strokes for different folks. There are a variety of brokerage accounts available, and each and every platform will differ in what they have to offer.

If you’re a trader who is a follower of Islamic faith, then you would need to find an ASIC broker who offers Islamic Accounts. This account will have been adapted to enable traders to remain faithful to their religion and Sharia Law (which prohibits giving and receiving interest).

If the brokerage doesn’t advertise Islamic accounts specifically, it may still be worth contacting the platform. The reason being that some ASIC brokers will be willing to adapt standard accounts to meet your needs.

A standard account is well known amongst investors, but for beginners or traders who don’t like to risk too much capital, there’s ‘Nano’, ‘Micro’, and ‘Mini’ accounts. If you would like to try this way of trading, then contact the ASIC broker you are interested in – they might adapt a standard account to accommodate you.

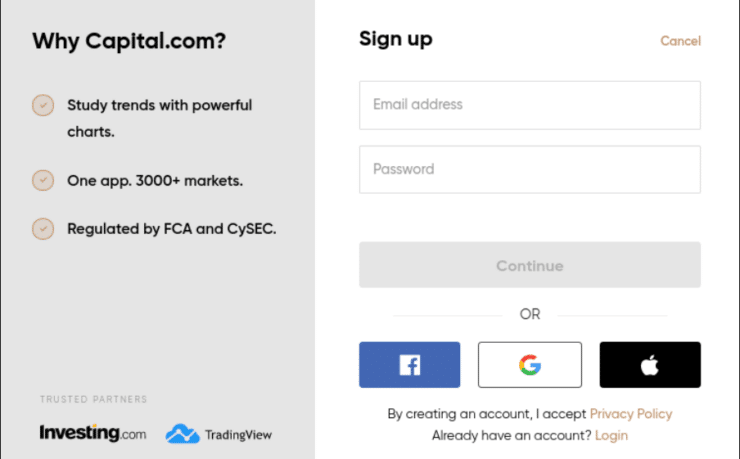

How to Sign-Up With an ASIC Broker Today

By this point, you will have a much deeper understanding of not only how ASIC protects you as a trader, but also what to look out for when choosing a platform. If you still haven’t found a suitable provider, then you’ll find our list of the best ASIC brokers of 2023 further down on this page.

To get you started, we’ve put together a step by step guide to signing up to an ASIC brokerage site today!

Step 1: Get Signed Up

Firstly, you need to head over to the website of your chosen ASIC broker. Look for the ‘sign up’ button/link.

Next, you will need to enter your email address and create a password which is unique to you.

Step 2: Identify/Know Your Customer (KYC)

As we explained earlier as per ASIC rules and regulations – brokers are required by law to obtain proof of identity from each and every client.

The brokerage will also need copies of your passport or driving licence, followed by an official bill with your name and address on (most commonly – a utility bill from within the last 3 months will suffice). Another big part of KYC is the need to grasp your monthly incomings, salary and brief investing history/experience.

Step 3: Deposit Some Funds

You will now be asked to deposit some funds.

Payment options available on ASIC broker platforms are usually as follows:

- E-wallets like Skrill and Neteller.

- Credit/Debit card.

- Bank wire transfer.

As we covered earlier, it’s important to check the availability of your chosen payment method before signing up.

Step 4: Begin to Trade

Once your deposit is processed, you are good to go. If you don’t yet feel confident enough to trade with your own cash, it’s a good idea to make use of a demo account. ASIC brokers usually provide anywhere between $10,000 and $100,000 in demo money.

The Best ASIC Brokers of 2023

By this point, we have covered all of the important things to look out for when choosing the best ASIC broker for your needs.

Please find a few of the best ASIC brokers listed below for your careful consideration, all of which are fully licenced ad regulated.

Avatrade - Lots of Tradable Assets

AvaTrade is another established ASIC broker on our list and has been in operation since 2006. The company aims to attract investors of all levels of experience. This platform has over 200,000 clients on its books and those investors execute around 2 million trades through the site every month.

This ASIC broker supports various third-party platforms, such as MetaTrader4/5, Mirror trader, and ZuluTrade. To begin trading with AvaTrade you simply need to deposit $100. Tradable assets include cryptocurrencies, bonds, shares, ETFs, indices, and commodities - all in the form of CFDs

When it comes to forex, AvaTrade has capped leverage at 1:20 for minors and 1:30 for majors. Large-cap indices and gold are limited at 1:20. Equities are at 1:5 and cryptocurrencies at 1:2.

There are over 50 currency pairs on offer at Avatrade - as well as Bitcoin, Bitcoin Cash, Litecoin, Bitcoin Gold, Ripple, EOS, Dash, and Ethereum. This broker firm has 11 offices globally and holds licences from ASIC, FSP (South Africa), IIROC (Canada), and the FSA (Japan), so you can be sure it is reputable and under strict supervision from various bodies.

- Demo account available

- Holds a licence from multiple juresdictions

- $100 minimum deposit

- Slow withdrawal process compared to others

To Conclude

From a simple internet search, you will see there are tonnes of broker platforms promising to offer a great service to investors. The problem with so much choice is sorting the wheat from the chaff. The first place to start is to make sure the broker is fully licenced and regulated by a respectable licencing commission such as ASIC, the FCA or CySEC.

This really is the only way to know that your money is protected and you are not dealing with a rogue company. Another tip when choosing a broker is to do your homework in terms of the commission structure, withdrawal and deposit fees applicable, and spreads.

As we’ve said, demo accounts are a superb way of finding your feet in live market conditions without spending your real money. They are also a great way of trying out new strategies.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

FAQs

What is an ASIC broker?

Can I use leverage with an ASIC broker?

What assets can I trade with an ASIC broker?

Why do I need to send copies of my ID to the ASIC brokerage?