If you’re looking for an online broker to trade forex, stocks, commodities, cryptocurrencies, and more – it might be worth considering FBS. This popular CFD broker offers some of the best trading fees in this marketplace – alongside plenty of account types and platforms to choose from.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

In this FBS review, we cover everything there is to know about the online trading platform so that you can assess whether the broker is right for you.

FBS - Top-Rated Broker With 0% Commission and ZERO Spread Accounts

- Trade forex, stocks, indices, crypto, and more

- Various 0% commission and ZERO spread accounts to choose from

- Heavily regulated and solid reputation

- Minimum deposit of just $1

What is FBS Broker?

Founded in 2009, FBS is an established online trading platform that specializes in contracts-for-differences (CFDs). This means that you will be able to trade a wide variety of assets with leverage and have the ability to go long or short on your chosen marketplace.

In fact, with leverage of up to 1:3000 on offer, FBS will appeal to those that wish to trade with significantly more than they have available in their account. In terms of supported markets, you will find a huge number of CFD assets across stocks, indices, energies, metals, crypto, and forex.

FBS appeals to a broad number of traders, not least because it offers multiple account types to choose from. This includes a commission-free account with spreads that start from 1 pip, which is ideal for casual traders. Alternatively, for those looking to trade larger volumes, the ECN account at FBS offers -1 pip spreads alongside a competitive commission of $6.

When it comes to safety, FBS has a great reputation in this field. Not only has the broker been offering trading services for over 12 years, but it is licensed by the IFSC, FSCA, CySEC, and ASIC. Furthermore, FBS has since attracted over 17 million traders to its platform across more than 150 counties. All in all, our FBS review found that the broker offers a solid and low-fee trading experience that will suit investors of all shapes and sizes.

FBS Pros and Cons

Below we outline the main findings of our FBS review.

Pros

- A huge number of markets offered

- Leverage of up to 1:3000

- Multiple account types to choose from

- Commission-free and zero-spread plans

- Operational since 2009

- Copy trading tools

- MT4 and MT5 supported

- Licensed by CySEC, IFSC, FSCA and ASIC

Cons

- Not available in all countries – including the US and Canada

FBS - Top-Rated Broker With 0% Commission and ZERO Spread Accounts

- Trade forex, stocks, indices, crypto, and more

- Various 0% commission and ZERO spread accounts to choose from

- Heavily regulated and solid reputation

- Minimum deposit of just $1

FBS Supported Markets

To begin our FBS review, we will explore the number and types of markets offered by the broker.

Let’s break each asset class down.

FBS Forex

Starting with the forex department, FBS offers dozens of currency pairs. This covers all major and minor pairs – such as GBP/USD, GBP/EUR, and USD/JPY.

You will also find a good selection of exotic currencies that be traded with ease. This includes pairs that contain the Polish zloty, Chinese yuan, Brazilian real, and Czech koruna.

FBS Commodities

If you’re also looking to trade commodities from the comfort of your home, FBS has you covered. This includes precious metals such as gold and silver – both of which can be traded against the US dollar. Additionally, our FBS review found that the broker offers several energy markets.

FBS Stocks

FBS offers dozens of stock CFDs – so you can trade your favorite companies with leverage and short-selling facilities. The vast majority of supported stocks are listed on the NYSE, NASDAQ, and London Stock Exchange.

FBS Indices

If you’re looking for broader exposure to the global stock markets, you might consider trading indices at FBS. Liquid markets cover the Dow Jones 30, NASDAQ 100, S&P 500, and FTSE 100. You can also trade indices that track markets from Japan, France, Hong Kong, and more.

FBS Crypto

Finally, our FBS review also found a comprehensive cryptocurrency trading division. This covers some of the most popular crypto assets in this marketplace – such as Bitcoin, Ripple, NEO, Litecoin, Ethereum, Bitcoin Cash, EOS, and more.

Once again, as FBS specializes in CFD instruments, you can trade all supported cryptocurrency markets with leverage. Plus, if you believe that a digital token is likely to go down in value, you can short it by entering the market with a sell order.

FBS Trading Fees and Accounts

The fees that you pay to trade at FBS will be dictated by the account type that you choose to open. With this in mind, the sections below provide an overview of what each account offers alongside its applicable fees and commissions.

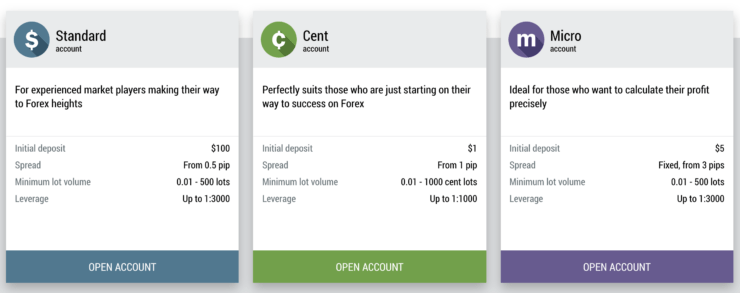

Cent Account

If you are an absolute beginner in the world of trading, you might consider the Cent account. This allows you to get started with a minimum deposit of just $1 and gets you access to commission-free markets.

In turn, you will pay an entry-level spread of 1 pip. This account type also permits leverage of up to 1:1000. However, as we cover in more detail later, this is dependent on your country of residence, client status (retail or professional), and the specific asset that is being traded.

Micro Account

The Micro account at FBS also offers commission-free trading, albeit, spreads start from 3 pips. However, while the spread on the Cent account is floating, the Micro plan is fixed.

Standard Account

Next up is the Standard account, which requires an initial minimum deposit of $100. Once again, this account type allows you to enter buy and sell positions on a 0% commission basis.

Much like the Micro account, the spreads are offered on a floating basis. But, the spreads on the Standard account are more competitive, as they start at 0.5 pips.

Zero Account

If you are happy to meet an initial minimum deposit of $500, you might consider opening a Zero Spread account at FBS. As the name suggests, this will allow you to trade financial instruments from a minimum of 0 pips – and spreads are floating.

In turn, you will be required to pay a commission of $20 per lot – which is charged when you enter and exit a position. The maximum leverage amount offered on this account type is 1:3000.

ECN Account

ECN accounts are highly sought-after by professional traders, as they give you access to some of the best rates in the market. This is especially the case when speculating on forex, as you will be trading directly with other market participants.

At FBS, ECN accounts require a minimum deposit of $1,000. This is actually notable, as ECN brokers often require a five-figure minimum. Not only does FBS offer floating spreads that start from -1 pips, but this account type comes with competitive commissions of $6 per slide.

Crypto Account

If you want to trade digital token pairs like BTC/USD and ETH/USD, you will need to open a Crypto account at FBS. The good news here is that the minimum initial deposit requirement is set at just $1. This allows entry-level traders to experiment with cryptocurrency CFDs without needing to risk large sums of capital.

This account type at FBS comes with floating spreads that start from 1 pip alongside a competitive commission of 0.05% per slide. Due to the highly speculative and volatile nature of cryptocurrencies, the maximum leverage offered on this FBS account is 1:5.

FBS Demo Accounts

What we also like about FBS is that the broker allows you to open a demo account. In fact, you can trade with paper funds via the FBS account that you are thinking of opening. This will give you a full birds-eye overview of whether or not the specific account is right for you.

Compare FBS Accounts

For a full overview of each FBS account type, check out the table below.

| Account comparison |

CENT | MICRO | STANDARD | ZERO SPREAD | ECN |

CRYPTO

|

| Initial deposit | from $1 | from $5 | from $100 | from $500 | from $1000 | from $1 |

| Spread | Floating spread from 1 pip | Fixed spread from 3 pips | Floating spread from 0,5 pip | Fixed spread 0 pip | Floating spread from -1 pip |

Floating spread from 1 pip

|

| Commission | $0 | $0 | $0 | from $20/lot | $6 |

0.05% for opening and 0.05% for closing positions

|

| Leverage | up to 1:1000 | up to 1:3000 | up to 1:3000 | up to 1:3000 | up to 1:500 | up to 1:5 |

| Maximum open positions and pending orders | 200 | 200 | 200 | 200 | No trading limits | 200 |

| Order volume | from 0,01 to 1 000 cent lots (with 0,01 step) |

from 0,01 to 500 lots (with 0,01 step) |

from 0,01 to 500 lots (with 0,01 step) |

from 0,01 to 500 lots (with 0,01 step) |

from 0,1 to 500 lots (with 0,1 step) |

from 0,01 to 500 lots

(with 0,01 step) |

| Market Execution | from 0,3 sec, STP | from 0,3 sec, STP | from 0,3 sec, STP | from 0,3 sec, STP | ECN |

from 0,3 sec, STP

|

Take note, the spreads listed above relate to the most competitive rate available. If you are on a floating spread account, then the amount you pay will depend on various factors such as the asset and current market conditions.

Deposit Fees

On top of commissions and spreads, you will also need to assess whether or not you will need to pay any deposit fees. This is because certain payment methods are fee-free, while others attract a charge. For instance, you can fund your account with Visa for free, while Stickpay will cost you 2.5% plus $0.30.

FBS Trading Platforms

FBS gives you a number of options when it comes to choosing a trading platform. This includes both MT4 and MT5, which you can access online or via the Windows and macOS desktop software. Additionally, you can access your FBS account via the MT4/5 mobile app. When it comes to order execution speed, this is where FBS really stands out.

FBS Leverage

If you read through our sections on the many account types offered by the broker, you would have noticed that FBS offers some of the highest leverage limits in this marketplace. For example, some accounts come with leverage limits as high as 1:3000 – meaning that you can multiply your stake by a factor of 3,000.

- However, it is important to remember that FBS is regulated by some of the most reputable financial bodies in this industry – including the likes of ASIC and CySEC.

- As a result, the amount of leverage that you will have access to will ultimately depend on your country of residence.

For example, if you are an EU citizen, the most you will get is 1:30 when trading major forex pairs, and less on other assets. With that said, the exception to this rule is that professional clients will be offered much higher limits than standard retail accounts permit. You will, however, need to provide FBS with certain documents to prove that you fall within this category.

FBS Deposits and Withdrawals

When it comes to adding money to your FBS account, you will have a number of convenient payment methods to choose from.

This includes:

- Credit and Debit Cards

- Bank Wires

- Neteller

- Skrill

- Stickpay

- Perfect Money

- Local Exchanges

The easiest way to fund your account is with a debit or credit card, not least because the transaction will be processed instantly and on a fee-free basis.

In terms of making a withdrawal, you will need to cash out at least your original deposit amount back to the same payment method. This is to ensure that FBS complies with anti-money laundering regulations. Although most deposit methods are fee-free, all withdrawals come with a charge. This will depend on the payment method that you are withdrawing the funds to.

For example, debit/credit card withdrawals will cost $1, while Neteller attracts a fee of 2%. On the flip side, FBS is extremely efficient when it comes to processing withdrawals. In fact, in most cases, withdrawal requests are processed within 15-20 minutes – irrespective of the payment method being used.

FBS Minimum Deposit

The minimum deposit at FBS depends on the account type that you open. With that, both the Cent and Crypto accounts require a minimum deposit of just $1. The higher initial deposit requirement comes with the ECN account at $1,000.

FBS Bonus

Another stand-out feature of FBS is that the trading platform offers a range of bonuses. Most notably, the broker offers a 100% matched deposit bonus for all customers that are signing up for the very first time.

You will also come across bonuses that are offered to existing customers. For example, at the time of writing, FBS is offering a cashback promotion of up to $15 per lot when trading forex. It would be wise to read the terms and conditions of any bonuses you are thinking of claiming – especially with regards to wagering requirements.

FBS Education, Research, and Trading Tools

FBS offers a vast range of tools that aim to make you a better and more informed trader.

This includes the following:

Education

If you are just starting out in the world of trading, FBS provides a comprehensive educational department that covers forex. This includes a forex guidebook, tips for new traders, videos lessons, and a glossary. We also like the regular webinars and seminars that the broker offers.

Research

FBS is also strong when it comes to research and analytics. For example, the broker offers a news division that covers some of the hottest topics across forex, commodities, stocks, and economical developments.

Trading Tools

Traders of all skillsets rely on tools to help them make more accurate predictions of the financial markets. At FBS, you will find everything from an economic calendar to forex calculators and currency converters.

Is FBS Broker Safe?

The most important metric to consider before opening an account with an online broker is whether or not your trading capital is safe. At FBS, you should have nothing to worry about – as the broker is heavily regulated.

This includes licenses from the following financial bodies:

- IFSC

- FSCA

- CySEC

- ASIC

In addition to regulation, you should also consider the reputation of FBS before signing up. First and foremost, the broker has been offering trading services since 2009. This means that FBS has a proven and long-standing track record in this brokerage arena.

In addition to this, FBS has since attracted over 17 million client accounts to its platform from over 150 countries.

FBS Supported Countries

FBS is a global broker that operates in most countries around the world. With that said, the broker can not be used by residents of the following jurisdictions:

- Canada

- USA

Most notably, US clients are prohibited from trading CFD instruments, which is why they are unable to use FBS.

FBS Customer Service

The customer service team at FBS is highly rated. The easiest way to speak with a member of the team is via the live chat facility. In most cases, you won’t be required to wait more than a couple of minutes to connect with an agent.

Alternatively, we also like the fact that FBS offers a callback service. By providing your telephone number and preferred time, an FBS representative will endeavor to call you directly.

FBS Review – The Verdict?

In summary, our FBS review found that the online broker has all bases covered. In terms of safety, the platform is licensed by some of the most reputable financial bodies in this space – including ASIC and CySEC. You can get started with a minimum deposit of just $1 and you have multiple account types to choose from.

This includes both commission-free and zero-spread accounts – so traders of all skill sets are covered. You won’t be short of assets to trade either, as FBS supports everything from stocks and forex to crypto and commodities – all in the form of CFDs.

FBS - Top-Rated Broker With 0% Commission and ZERO Spread Accounts

- Trade forex, stocks, indices, crypto, and more

- Various 0% commission and ZERO spread accounts to choose from

- Heavily regulated and solid reputation

- Minimum deposit of just $1

FAQs

Is FBS a legit broker?

What kind of broker is FBS?

What is the minimum deposit in FBS broker?

How long does FBS withdrawal take?

What are the spreads at FBS?