You might have seen the movie The Big Short – where Michael Burry made billions of dollars by shorting the US subprime real estate industry in 2007 before it collapsed. However, did you know that short selling is something available to all traders irrespective of budget or skillset?

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

In this guide, we are going to walk you through the process of how to short stocks in 2023.

To begin, we’ll discuss the ins and outs of what short selling is and how it works. After that, we’ll show you what you need to do to profit from short selling. And to conclude – we’ll show the steps required to short sell stocks from the comfort of your home!

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What is Short Selling? The Meaning of Going Short

Put simply, ‘going short’ or ‘short-selling’ is the process of speculating that an asset will go down. In other words, rather than buying shares in the traditional sense because you think the value will increase, you are actually making a financial move that in the hope that the opposite will happen.

For example, let’s suppose that at $420 per share, you think that Tesla stocks are heavily overvalued. By using an age-old brokerage house, you wouldn’t be able to profit from this hypothesis.

It is important to note that short-selling is reserved just for stocks. On the contrary, if you know where to look then you short just about any asset class going. This includes everything from indices and ETFs to interest rates and gold. Fortunately, all of the principles outlined in this How to Short Stocks Guide remains constant for all financial instruments.

Examples of Short Selling

We at Learn 2 Trade find that practical examples of a financial topic can really help clear the mist. As such, we are now going to present a couple of basic examples of what short selling actually looks like.

Example 1: Going Short on IBM Stocks

In this scenario, you believe that IBM stocks are overpriced.

- At the time of writing, IBM stocks are valued at $110 each.

- You decide to short-sell 10 stocks, taking your total stake to $1,100.

- A few days later, IBM shares are worth $990 – representing a decrease of 10%.

- You are happy with your profits so you decide to cash your position out.

- On a total stake of $1,110 – you made a profit of $110 (10%).

Example 2: Going Short on Facebook Stocks

In this scenario, you believe that Facebook stocks are likely to go on a short-term downward trend.

- At the time of writing, Facebook stocks are valued at $277 each.

- You decide to short-sell 50 stocks, taking your total stake to $13,850.

- A few days later, Facebook shares are worth $263.15 – representing a decrease of 5%.

- You are happy with your profits so you decide to cash your position out.

- On a total stake of $13,850 – you made a profit of $692.50 (5%).

How Does Short Selling Work?

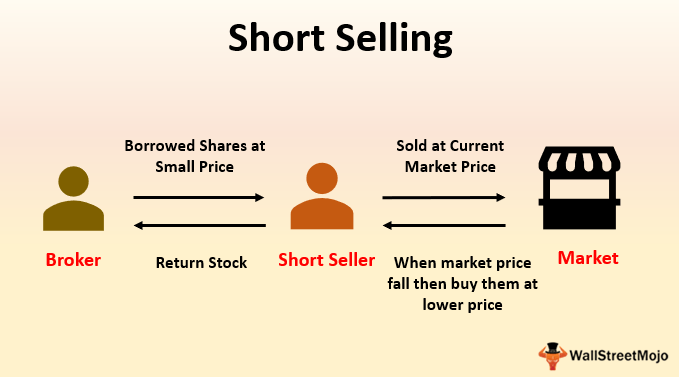

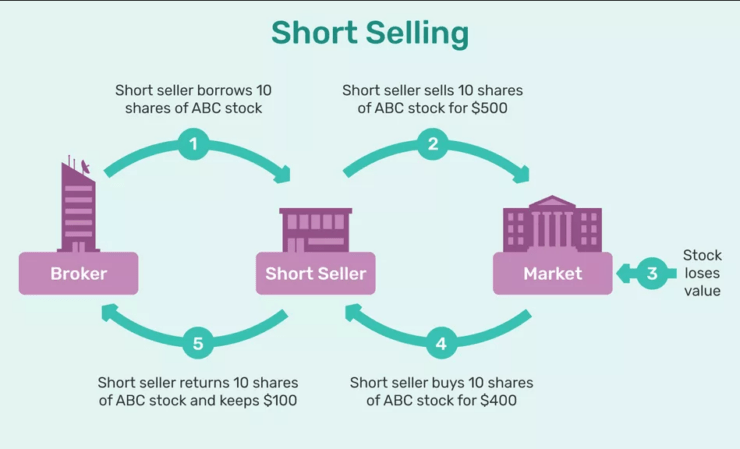

In terms of the specifics, there are actually two ways in which you can short sell stocks. This covers the old, cumbersome, and costly way of ‘borrowing’ the stocks from a brokerage house, selling them straight back to the broker, and then buying the shares back from the broker at a later date.

Before we go any further, it’s probably best that we explain what CFDs are. After all, this is going to be the most effective way of you shorting stocks online.

Short-Selling via CFDs

CFDs (contracts-for-differences) are financial instruments that can be traded online. The instrument itself is backed by an asset. Instead, it is merely tasked with ‘tracking’ the price of the said asset. For example, let’s suppose that Disney shares are priced at $124.06 on the New York Stock Exchange (NYSE).

In turn, your chosen CFD broker offers a market on Disney shares at the exact same price. Then, if Disney shares increased to $124.76 a few minutes later, as would the CFD.

As you can imagine, CFDs are only tracking the real-time price of an asset, meaning that they give you access to thousands of markets. Not only this, but CFDs are a low-cost way of trading your desired market, and you can even apply leverage.

So how does this relate to short selling stocks?

Well, an additional advantage of CFDs is that you always have the option of placing a buy order or a sell order. By placing a buy order, you are speculating on the price of CFD increasing. If you place a sell order, you are doing the opposite. As such, this is how you will short stocks online!

Sell Orders

So now that you know that you need to place a sell order at a CFD broker to short stocks, let’s elaborate on how this works in practice.

To clarify, by placing a sell order, you are telling your broker that you believe the shares will go down in value. If they do, then you make a profit. If they actually go up in value, you will lose money.

For example:

- You want to stake a total of $500 on Ford Motors shares going down in value.

- As such, you place a sell order worth $500.

- A few days later, Ford Motors is trading at $6.70.

- This means that they have fallen by 16.5%.

- On your stake of $500, you made a total profit of $82.50.

However, your short-selling predictions won’t always be correct, so let’s see what would have happened if the value of Ford Motors shares increased.

- Once again, you place a $500 sell order on Ford Motors at an entry price of $8.03.

- Momentum is moving against you and the shares are now worth $9.01 each.

- This translates into an increase of 12.20%.

- You went short on this market, meaning that the increase results in a loss.

- On a total stake of $500, you made a loss of $61.

As we explain in a bit more detail later, you can limit your potential losses when short selling by placing a stop-loss order.

What Stocks can you Short Sell?

Leading on from the above sections on CFDs, the possibilities really are endless. Once again, share CFDs are not backed by the actual stocks they are tracking. As such, this gives you access to an unparalleled number of stock markets.

Some of the most popular markets that seasoned short-sellers like to target are listed below:

- NYSE.

- NASDAQ.

- London Stock Exchange.

- Tokyo Stock Exchange.

With that said, the stock CFD brokers that we recommend also give you access to some of the following markets:

- Shanghai Stock Exchange.

- Hong Kong Exchanges and Clearing.

- Shenzhen Stock Exchange.

- Euronext.

- Saudi Stock Exchange (Tadawul).

- TMX Group.

All in all, short selling via CFD instruments give you heaps of opportunities to make a profit.

Short Selling Fees

This section is potentially one of the most important. This is because short-selling does attract fees that you might not otherwise come across when investing in shares in the traditional sense.

At the forefront of this overnight financing. But, before we get to that, let’s cover commissions and spreads.

Commissions

When you use an online trading platform, you will likely need to pay a commission. This will be charged every time you place a buy or sell order. As such, you need to pay the commission on two occasions – when you open and when you close.

- For example, let’s say that your chosen broker charges a commission of 0.3%.

- You place a $1,000 sell order on Nike stocks.

- The broker charges you $3.

- When Nike stocks go down to $900 you do decide to cash in your profits by placing a buy order.

- This closes the trade, albeit, you will again need to pay a commission of 0.3% – which is $2.70.

- All in, the total commission on your Nike short-selling trade cost you $5.70.

As we mentioned earlier, you can avoid paying a commission when using one of our recommended CFD brokers. Instead, it’s only the spread and overnight financing fee that you need to consider.

Spreads

The spread is simply the gap between the buy and sell price of your chosen stock CFD. It’s best to work this out in percentage terms as this allows you to assess how much you need to make just to break even.

- For example, you want to short HSBC shares.

- Your broker offers a sell price of 20.73p.

- Your broker offers a buy price of 20.77p.

- The spread works out at 0.2%.

- This means that when your short-selling trade is opened, you will immediately be 0.2% in the red.

- As such, only when HSBC shares go down by at least 0.2% will you be in the profit zone.

Most of the share CFD brokers that we recommend offer tight spreads, meaning that you can keep your stock short-selling fees to an absolute minimum.

Overnight Financing Fees

This particular fee is something that you won’t be able to avoid when you short stocks. Put simply, this is a fee that you will need to pay for each day that you keep your short-selling position open. But why? Well, you will need to use CFDs to short sell stocks online – and CFDs are ‘leveraged’ products.

Even if you are not applying leverage (trading on margin), this is still the case. As you might know, leverage products come with interest rates – which will vary depending on the asset. But, the crust of it is that this will eat into your trading profits.

The overnight financing rate is set as an annual percentage, but it is actually charged on a daily basis. In fact, the charge comes into play when the respective market closes for the day.

As such, if you were to short-sell stocks via a day trading strategy, you wouldn’t need to pay any fees. However, the very minute that the market does close – and you still have a CFD position open, the fee will be subtracted from your position.

In terms of how much overnight financing actually costs – this will ultimately depend on your chosen broker. The good news is that it often isn’t as much as you might think. In fact, some CFD brokers offer overnight financing on shares at an annual rate of between 3-5%. Put simply, you could keep your short-selling position open for 12 months as long as you make more than the annual financing rate!

How to Find Stocks to Short Sell?

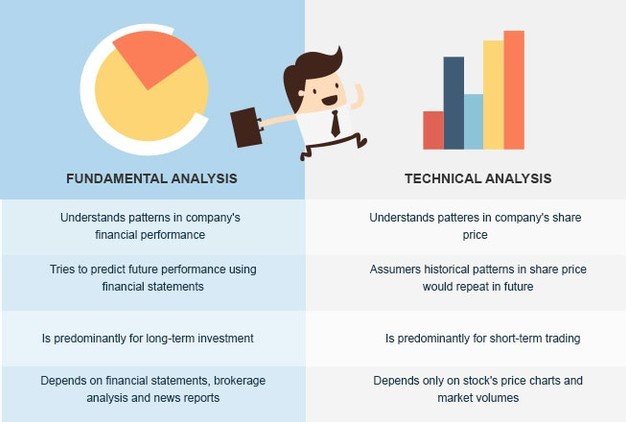

There really is no short-and-fast answer to this question. After all, the process of identifying which stocks to short requires an understanding of both technical and fundamental analysis. As you might well know, this can take many months to master.

Nevertheless, to help clear the mist, below we have listed some of the things that you can do to short-selling opportunities.

Fundamental Research

This is by far the easiest way to profit from short-selling. In most cases, all it takes is a bit of common sense and urgency. Put simply, fundamental research is the process of assessing how a relevant news story might impact the value of a stock. After all, stock prices move up and down as per demand and supply. This demand and supply is fueled by how the stock in question is performing – or is likely to perform in the future.

At the other end of the spectrum, let’s say that Inovio Pharmaceuticals announces that its latest COV-19 vaccine trial has been put on hold by the FDA. It goes without saying that this will panic stockholders and thus – likely result in a sell off. As a result, this would be a great opportunity to enter a sell order on the shares! However, you would need to be quick to maximize your potential profit.

Look For Overvalued Stocks

Ordinarily, shrewd investors will look to find undervalued stocks as a way to invest at a discount. However, as a short seller, you need to do the opposite. That is to say, you need to find a stock that is potentially overvalued. If you can, then this would allow you to enter a short-selling position with the view of profiting from the stock’s over-inflated price.

But how do you do this? Well, one of the best ways for newbies to assess whether a stock is over or undervalued is to utilize an accounting ratio. At the forefront of this is the P/E ratio.

P/E Ratio

The price-to-earnings (P/E) ratio looks at the company’s current stock price against that of its earnings per share. To get the latter, you need to divide the total number of shares in circulation into the firm’s most recent annual profit.

Once you have the earnings per share, you then need to divide it into the current stock price. This will give you a ratio. Now, you then need to compare this ratio against the industry average.

For example, let’s suppose you are looking at GlaxoSmithKline stocks. If it has a P/E ratio of 17, but the industry average for pharmaceutical stocks is 12, then it might be overvalued and thus – present a good short-selling opportunity!

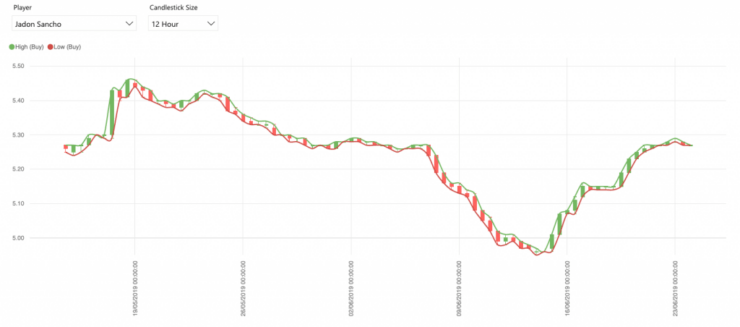

Relative Strength Index

The relative strength index (RSI) is a hugely popular technical indicator that is used by almost all short-sellers. This is because the indicator has the potential to tell us when a stock is overbought or oversold. If it’s the former, then the RSI would indicate that a short-term correction is potentially in the making.

If it is, then this would allow you to enter a sell order on the stock. The general rule of thumb with the RSI is that if the indicator breaches 70/100 – then it’s likely in overbought territory. If the indicator is below 30/100 – then it means the stocks are potentially oversold.

What is a Short Squeeze?

You might have come across the term ‘short squeeze’, but have no idea as to what it actually means. In simple terms, this refers to the price action of a stock. More specifically, it is when the value of stock move in an upward trajectory very quickly.

In doing so, it forces short-sellers to exit their position and place a buy order. They do this with the view of cutting their losses by chasing the upward trend. In turn, this forces the price of the stock to increase at an even faster rate, in a domino-style effect so to speak.

This is something that you can avoid as a short seller by ensuring that you always have a stop-loss order in place. If you don’t quite know how this works in practice, let’s us provide you with a simple example.

Stop-Loss Orders When You Short Stocks

Stop-loss orders are something that we recommend on all trades – and not just stocks. In a nutshell, they allow you to mitigate your losses at a specific price point. For example, let’s suppose that you want to short Alphabet stocks, but you don’t want to lose more than 10% of your stake. As such, all you need to do is set up a stop-loss order at a price 10% higher than your entry price.

For example:

- Let’s say that Alphabet stocks are priced at $1,500 each.

- You think they are overvalued, so you place a sell order.

- You don’t want to lose more than 10% of your stake.

- As such, you set your stop-loss order at $1,650.

- If your short-selling trade goes wrong – meaning that Alphabet stocks increase, your trade will be automatically closed if the price hits $1,650.

In other words, even if Alphabet stocks increased by 20% (resulting in a 20% loss for your sell order), you wouldn’t lose more than 10% as you had a stop-loss order in place. Take note, stop-loss orders are never 100% guaranteed to be matched by the markets.

Although this is rare, it can happen during volatile market conditions. The only way to ensure that this doesn’t happen is by placing a ‘guaranteed’ stop-loss order with your broker. This will usually cost you a little bit more in commission, but it is most definitely worth it.

Best Brokers to Short Stocks

So now that you know the ins and outs of how to short stocks, we are now going to discuss the best online brokers to do this with. As we have uncovered throughout our guide, all of the recommended brokers listed below specialize in CFD instruments. This ensures that you can short-sell each and every stock that the platform has on offer.

1. AVATrade – Trusted Online CFD Broker With Low Fees

AVATrade is yet another online trading platform we are big fans of. The broker is in possession of several tier-one licenses and utilizes institutional-grade security practices. As such, your funds are safe at all times. However, where AVATrade really stands out is that it offers a huge asset library that consists of stocks, indices, ETFs, options, commodities, and more.

Once again, all stock CFDs offered by its top-rated trading site can be short-sold. You will find that AVATrade offers some of the best spreads in the stock CFD space. The platform does not charge any commissions, and all deposits/withdrawals are fee-free. You only need to add $100 to your account to start short-selling with this broker.

.

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Conclusion

In a time not so long ago, shorting stocks was something available to those from an institutional background. This is because the ‘old’ way of doing things was overly complex – subsequently requiring investors to borrow the stocks from a third-party and then buy them back at a later date.

But, fast forward to 2023 and beyond and anyone can short stocks by using a regulated CFD platform. In fact, you can even short stocks with leverage these days – allowing you to amplify your profits at the click of a button!

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card

FAQs

What does it mean to short a stock?

How do you short stocks online?

What are the best stocks to short right now

What fees will I pay when I short stocks?