StormGain review, Are you looking for an online cryptocurrency trading platform that offers high levels of leverage? If so, you might want to consider using StormGain – not least because you can trade cryptocurrencies with leverage of up to 200x.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Whilst there are hundreds of crypto exchange platforms out there, StormGain is highly recommended by seasoned traders. You do not have to be a crypto nerd to understand this platform though, as it is suitable for traders of all skill sets.

Any successful trader knows that your best chance of success is having the right tools, and StormGain really does not disappoint in this respect.

But, before opening an account with the platform, we would suggest reading our in-depth StormGain review. We have everything you need to know – including fees, leverage, safety, payments, and commissions.

What is StormGain?

StormGain was created in 2019 and considers itself to be a cryptocurrency trading platform for traders of all shapes and sizes. Leverage is gaining popularity amongst crypto exchanges, but the tools and flexibility make StormGain stand out from the crowd.

Some platforms can be quite confusing for new crypto traders, but StormGain has worked hard on making their exchange a simple interface. In fact, we at Learn 2 Trade find it a lot less complicated in comparison to other crypto trading platforms out there.

This sets users up for a much less daunting experience, especially if you are new to the scene. Best of all, StormGain offers a plethora of useful features and freebies which we are going to cover more later on.

StormGain Products on Offer

Whether you are using the web browser platform or the mobile app – you will see that StormGain has four key products available to its clients.

When you have signed up with StormGain, the following products are accessible to you:

- Instant Exchange: Swap your crypto immediately at market price.

- Regular Exchange: Trade your crypto with advanced order types as well as more sophisticated tools.

- Margin Exchange: (or trading using a multiplier) with margin exchange you trade crypto with up to 200x leverage.

- Crypto Wallet: You can send, receive or store your cryptocurrencies here – more about this further down this page.

The above core products ensure that you have all of the required tools and features to trade cryptocurrencies in an effective manner.

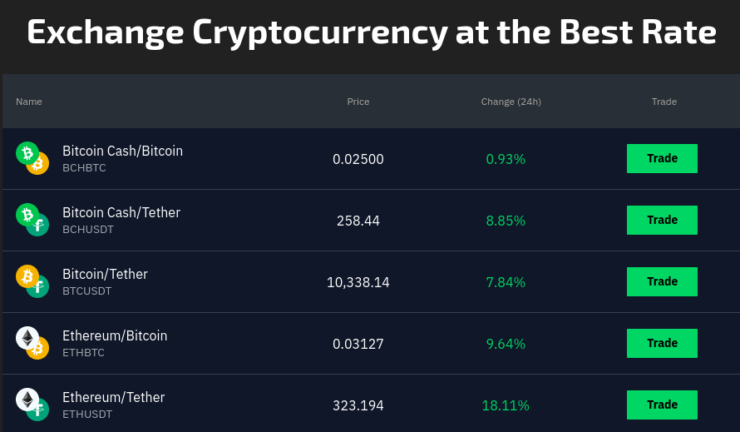

What Currency Pairs can be Traded?

As well as the more well-known BitcoinCash/Bitcoin and Litecoin/Bitcoin, there are a vast amount of pairs on offer on StormGain.

- DASH/BTC (Dash/bitcoin)

- BTG/USDT (Bitcoin Gold/Tether)

- ETC/USDT (Ethereum Classic/Tether)

- ZEC/USDT (Zcash/Tether)

- ADA/USDT (Cardano/Tether)

New digital pairs are being added by StormGain on a regular basis, so keep checking back.

Fees and Limits at StormGain

StormGain makes it really easy to sign up for an account. They also have competitively low fees. This is dependent on what financial assets you are wishing to trade with.

Just like other popular crypto exchanges, StormGain’s fees leave plenty of space for you to make a profit. With this in mind, we are going to provide you with some examples. This way, you can see for yourself what kind of fees you should expect.

All fees are correct as of February, 2026.

Commissions

At the lower end, StormGain charges a headline commission rate of 0.095%. BCH/BTC is slightly more expensive at 0.25%. However, in the grand scheme of things, this is actually very competitive.

As an example. Let’s say you want to trade 10,000 BCH/USDT, this will cost you 10 units in commission. With a commission of 0.095% and a minimum exchange size of 0.0001 BCH.

If you wanted to trade 10,000 BCH/BTC, however – this will cost you 25 for the trade as the commission fee is 0.25%

The average swap commission for BCH/USDT, LTC/USDT, ETH/USDT, BTC/USDT is 0.04% to buy and 0.004% to sell.

Spreads

StormGain is a 0% spread broker. Instead, you just have to pay a commission fee of up to 0.25% per order. As noted above, this depends entirely on which currency pair you are trading and is still considered very low.

Deposits and Withdrawals

It is free to deposit on StornGain when funding your account with digital currency. The minimum deposit required will depend on your chosen coin.

When it comes to bank card deposits, you will be charged a commission of 5%. There are minimum fiat deposits too, with the amount dependent on your choice of currency. For example, there is a minimum deposit of 50 USD, EUR and CHF, 70 AUD, 1000 CZK.

Again that is just a few examples of each. You can find all fees on the website. Moving on to SEPA transfers, the withdrawal commission is 0.1% on BTC and ETH. The minimum withdrawal is 150 EUR with SEPA, with a maximum of 10,000 EUR.

Leveraged Crypto Trading on StormGain

If you want to trade cryptocurrencies using leverage, then StormGain offers high-quality trading tools. This stands at a staggering 200x leverage on Litecoin, Bitcoin, Ripple, Bitcoin Cash and Ethereum to name a few. To put this into perspective, this means that a $100 deposit at StormGain would permit a maximum trade size of $20,000.

Although it is worth noting that the terms and conditions on offer will differ a lot. The fact that currency markets are so volatile makes an ideal environment for leveraged trading.

StormGain created a very capable platform which enables you to quickly and simply trade, without spending your life savings doing so. One of the most important things to consider when you are interested in using leverage is to learn how to manage risk.

Before you commit make sure you look into all of the StormGain features to ensure the exchange is suitable for you personally.

Leveraged Crypto: A Specialist Market

As we have noted, a lot of CFD brokers now offer leveraged crypto products. However, it has to be said that StormGain does offer very competitive terms. The majority of fiat CFD brokers are unable to offer such high leverage limits, not least because of bodies like ESMA.

For those unaware, the UK and European traders are capped to maximum leverage limits of 1:30. However, this is not the case with StormGain. As we have mentioned, StormGain allows just about anyone to open an account, so long as that person has crypto holdings.

Limit Orders and Leverage Combined

You probably have a clear idea by now that trading with leverage comes with a lot more risk than just using a cash position. Due to the fact that StormGain allows you to execute limit orders, using high leverage is considerably safer. The two commonly used orders in this field are take-profit orders and stop-loss orders.

Let’s go into a little more detail on each.

Stop-Loss

Essentially, leverage multiplies your trading capital so that you are able to maintain your position. To give you an example, using the leverage of 10x means that you are able to use 10 times the amount of money you initially had.

This means that if the trade goes well, your gains will be 10 times higher. The risk comes in when you consider that if it does not go so well, your losses are also magnified by 10.

This is one of the main reasons that any seasoned trader will tell you that when you use leverage you should also place a stop-loss order. The last thing you want to do is use that leverage and go over the limit available in your trading account.

By having a stop-loss order in place you do not have to worry about the losses going further than you can afford.

Take-Profit

If things go well when trading using leverage, your gains can be outstanding and can soon build momentum. Always have in the back of your mind that even if things are going well for you, the market can be extremely volatile. Those gains can be eaten up in the blink of an eye.

There are a few crypto exchange platforms who do not offer limit orders. If you plan on using leverage, we advise avoiding those platforms as your losses can spiral out of control.

How do I Know if Leveraged Crypto is Suitable for me?

Like we have said, it is not easy using leverage as it heightens your risk. What is good for one trader might not be good for you. Pay attention to a few considerations before you dive in and begin trading with leverage. This should be the case regardless of how reputable the platform is.

Risk Management at StormGain

It does not matter what you are trading, risk management is one of the most important things you need to have a good comprehension of.

- Let’s imagine that you are using the leverage of 40x. You are using your entire account balance to secure your position in the market.

- Hypothetically speaking, your account is worth 200 USDT. Your position in this scenario would be worth 4,000 USDT.

- However, your 200 USDT is now put up as a margin. As this amount to 2.5% of your total order size (4,000 USDT), a 2.5% loss would liquidate your position.

- In simple terms, this means that the trade will be closed and you will lose your entire margin.

As a result of the above, having a risk management strategy in place is going to be a very important part of your StormGain trading experience. This is especially the case if you wish to trade using leverage.

For example, irrespective of how much leverage you apply, setting up a stop-loss order at 1% will ensure that you do not lose more than 1% of your total stake. If and when your trade goes in the red by 1%, your position will be closed automatically by StormGain.

A stop-loss order is a great way to manage your risk when using leverage. Always try to select levels which are going to help you to preserve your margin account. This will help you to keep up your trading momentum.

Legging In at StormGain

‘Legging in’ is a strategy used to create a leveraged position. So, rather than using all of the capital in your margin account, you would instead open one small position. This gives you a chance to see which direction the market is going.

If you happen to be mistaken in predicting which way the market will go, your losses will be much smaller in comparison. This is crucial when using a high leverage broker like StormGain, not least because you will have access to multiples of 200x.

Of course, knowing whether or not the markets will rise or fall is virtually impossible. When you look at your stop-loss orders, it could become obvious that you were wrong about the market direction.

You can look at the starting position you take when legging as a test of your crypto trading theory. So, even if you get the direction of the market wrong, by entering a small position at first you have a chance to test your hypothesis.

If you open your position and it goes as well as expected, then you can always add to it. Ultimately, we recommend that you have your own trading plan in place. It is a good idea to know how much or little you would like to add to the position.

Do not forget to utilise take-profit orders too, so that when a leveraged position goes in your favour your gains are locked in.

StormGain: The Platform

A lot of crypto exchanges design their own trading platform. StormGain is no different. As we have covered tools and products earlier on, you already know that this comes with some great features for traders.

StormGain’s platform is well laid out and easy to use. On the left-hand side, you will see all of the latest prices. In the middle, you have your chosen trading instrument. On the right-hand side, you will see your wallet balances.

In order for you to make a trade, you just have to click ‘open a new trade’. A window will then open up where you can install stop-losses and leverage etc.

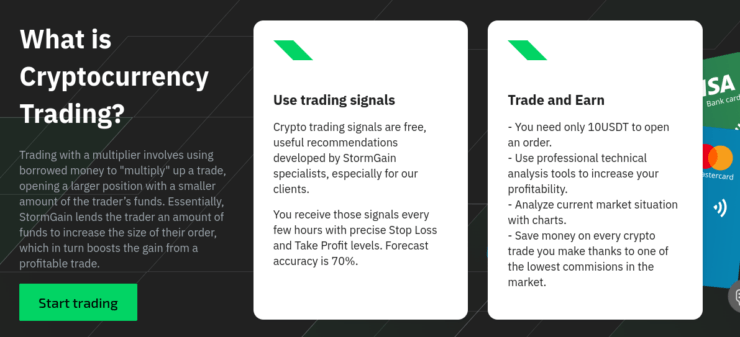

StormGain has a unique feature on its platform – built-in ‘trade signals’. You will be made aware of any new trading opportunities by automatic trade alerts. This is thanks to the highly sophisticated AI algo technology.

Although you can access algo services via third party websites, on StormGain it is completely free to use. On top of that, you will receive interactive charts to study. Market alerts are supported too, so you will be kept up to date with any financial news which might affect your trades.

Innovative Tools for pro Traders

Are you the kind of trader who likes to utilize leverage, as well as high spec tools? If so, StormGain has a useful toolset within its trading platform.

StromGain offers cryptocurrency derivatives which are secured by USDT (Tether). You simply deposit 50 units of any currency into your StormGain account, and you can then apply leverage by anywhere up to 200x.

There is no denying that using leverage heightens your risk of loss. But any potential gains from a trade will be amplified too. A deposit of $200 could potentially be leveraged to financial assets amounting to $40,000.

It is not recommended to use leverage liberally, as this can easily be the downfall of inexperienced traders. When you have a good knowledge of the market and have made a few trades; then, by all means, dabble with leverage. However, it is very important to have a robust risk-management strategy in place first to aid you in staying solvent.

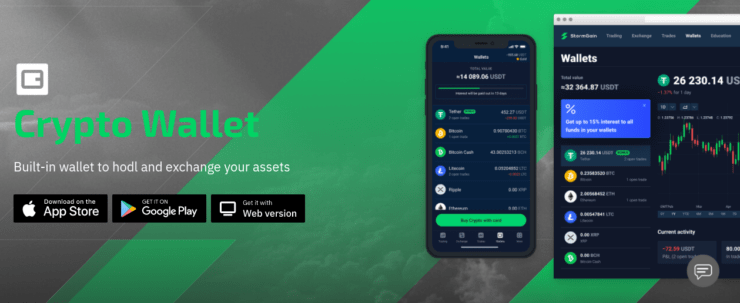

StormGain Cryptocurrency Wallet: Built-in

Technology is moving fast. This is a multi-currency wallet that is exclusive to the StormGain platform. The wallet enables you to exchange or transfer funds and manage your account securely on the go.

The cold wallet is considered to be one of the safest ways to store your cryptocurrencies. With cold storage, your money is stored and accessed offline, particularly the private keys. The private key controls the passage to your crypto wallet, which must always be offline.

Each and every wallet will have both a private and a public key:

- The private key: This allows you access to your coins for when you want to spend them, or withdraw them from your wallet.

- The public key: This is essentially your ‘address’. When people send coins to you they will use this information.

As you can see, it makes sense to keep your currencies in cold storage (offline). If it is not on the internet you know that it is not in a vulnerable position when it comes to hackers or malware.

Cold Storage Types

Essentially cold storage can be done in many ways, but the crux is that anything kept offline can be classed as cold storage. Here are some other ways of doing this.

- Keeping your private key on a USB.

- Print off your private key in number form or as a QR code.

- Write your private key down on paper.

- Store your private key on an offline wallet.

- Store it on a hardware wallet.

StormGain also has security protocols and two-tier authentication in place. Hot and cold wallets offer traders the best of both worlds. When you wish to shift the digital assets then no problem, you have a full scope of service.

6 Cryptocurrency Wallets

There are six cryptocurrency cold wallets on the StormGain platform and they are for the coins listed below:

- Litecoin (LTC)

- Bitcoin (BTC)

- Ethereum (ETH)

- Bitcoin Cash (BTH)

- Tether (USDT)

- Ripple (XRP)

Cold Wallet Versus Hot Wallet

We have made it clear that a cold wallet is the most secure way to store your crypto coins. As cold is the opposite to hot then you probably guessed that a hot wallet is one which is connected to the internet. But the question is if a cold wallet is so secure, why would you even consider using a hot wallet to store your bitcoin?

To give you a clearer picture of the two opposite wallets at StormGain – here is a simple comparison:

Hot Wallet

- Connectivity: Online

- Account Type: Checking Account

- Most useful for: Spending

Cold Wallet

- Connectivity: Offline

- Account Type: Savings Account

- Most useful for Holding

The hot wallet is useful for making the most of all of the conveniences in online banking we have all become accustomed to. Such as transfers, exchanges, depositing, and any type of money management really. You can secure your hot wallet at StormGain by including 2-factor authentication, PINs and passwords, etc.

Of course, there is a slim chance that the security measure could be infiltrated by extremely determined hackers and crooks. It is for this reason that StormGain utilizes both cold wallets and hot wallets.

Using the app enables you to trade, buy and exchange currencies 24 hours a day and 7 days a week from your phone. As we have said earlier, the majority of your coins are guaranteed to be held in cold storage (offline) to protect you from hackers and wrongdoers.

Deposits and Withdrawals at StormGain

You are able to withdraw and deposit here using the following cryptocurrencies:

- BCH (Bitcoin Cash).

- BTC (Bitcoin).

- LTC (Litecoin).

- ETH (Ethereum).

- USDT (Tether).

- XRP (Ripple).

To deposit or withdraw with StormGain, choose the asset you want and hit ‘send’ fund to your wallet address. If you want to withdraw just hit ‘receive’.

As an alternative, you can fund your account using a credit and debit card. However, it is worth bearing in mind that depositing this way will cost you. This is because there are processing fees to consider.

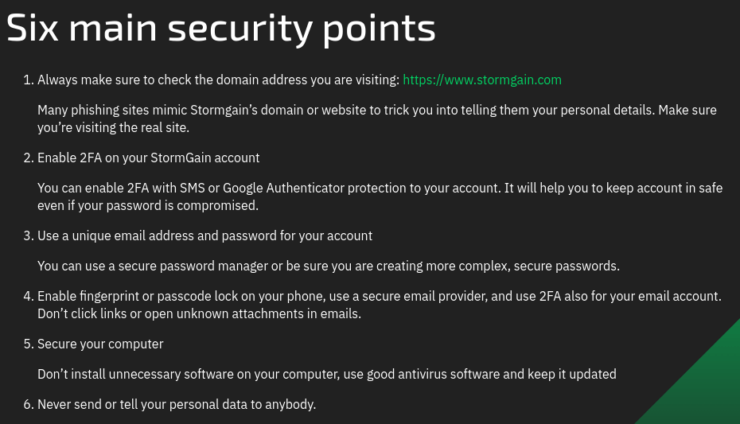

Is StormGain Safe and Secure?

Yes, it is. This crypto broker has an assortment of in-exchange security extras, encrypted recovery backups, and moderate transparency. As such, StormGain is considered to be a safe platform to use when exchanging cryptocurrencies.

As we have said, StormGain offers a variety of security features for your crypto exchange account, which we discuss in more detail below.

2FA: Two-Factor Authentication

Essentially, this is an extra layer of security alongside your password. So, when this is enabled, you will have to enter the 2FA code that is sent to your mobile phone when performing key account functions.

TOTP: Time-Based One-Time Password

StormGain uses TOTP for two-factor authentication. Put simply, a 6 digit unique and temporary code will be generated. This will be usable for 30 seconds only. In order to execute anything to do with your assets, you must provide this code as well as your usual password.

Actions which kick start 2FA are crypto withdrawals, wallet whitelisting and sending crypto to other users of the application. 2FA is available for both Google Authenticator as well as SMS.

Another area in which StormGain tackles digital asset security is cold fund storage for crypto-wallets. We are going to cover crypto wallets in more detail further down in our guide.

StormGain: Simple Registration

Whilst KYC (Know Your Customer) is a good thing for crypto trading, it has to be said that a fair few platforms have had to turn customers away as they were unable to meet the stated regulatory terms.

With that said, it is really simple to open an account with StromGain. All you have to do to get started is to go to its website and then put in your email address and a unique password to create your account.

Now you need to deposit using a cryptocurrency. Then, you should be able to trade with leverage of up to 200x on your chosen digital asset.

Enter and Hold on

Bitcoin prices did not fall far below $5k between the months of April and May last year (2019). They did not rise by a lot either (no more than $5.5k). Let’s say you bought into Bitcoin at $5,350 and added to that position as the market was on the rise. Put simply, the profits would be superb.

Of course, there is no way of knowing 100% when the markets will rise. But one of the best things about using the legging technique at StormGain is that because your losses are smaller, you are able to see clearly when the market is on the rise.

When a position goes up in value, the amount of leverage that you are allowed to use also goes up too. StormGain enables you to multiply up to 200x of your account capital. So that means that for every 1 USDT the position rises, an extra 200 USDT can be added to the position.

StormGain vs eToro

We have established that StormGain is a brokerage worth your time – however, have you considered other options? Ultimately, although this platform is part of the Blockchain Association, it is not actually regulated.

From the hundreds of alternative brokers on the scene, we found eToro to stand out from the crowd. Furthermore, the platform looks after more than 20 million traders globally!

See below a list of reasons eToro is so well-liked and respected:

- Regulation: Unlike StormGain, eToro is regulated. This includes licenses with the FCA (UK), ASIC (Australia), and CySEC (Cyprus). FINRA and SEC in the US have also approved the platform. This means that the brokerage commits itself to comply with the rules and regulations laid out. All of which keep this space clean from crime.

- Payment Methods: eToro accepts multiple fast and convenient payment types. You can make a deposit using credit and debit cards like Visa, Visa Electron, and MasterCard. Compatible e-wallets include PayPal, Skrill, Trustly, and Neteller. You may also use a bank transfer.

- Social Trading Platform: Whether you are just starting out, or are well versed in the art of trading digital currencies – social trading can be invaluable. Essentially, like with social media, you can ‘follow’, ‘like’, ‘comment’, and socialize with other crypto traders. This can be helpful for gaining insight into your chosen market, picking up some tips, or swapping strategy ideas.

- Asset Diversity: There is a wide range of cryptocurrencies to trade at eToro. First, you have access to all the most popular choices such as Bitcoin, Ethereum, Litecoin, Ripple, and Bitcoin Cash. There are also alternatives like Dogecoin, Uniswap, Chainlink, Tezos, ZCash, TRON, IOTA, Cardano, and more. You will also find thousands of stocks, forex pairs, ETFs, commodities, and indices.

- Copy Trader Feature: There is a stand-out feature here called Copy Trader. Carefully select a pro to invest in. Whatever position they open or close will be mirrored in proportion to your investment. For instance, if the Copy Trader places a sell order on EOS using 1% of their equity – 1% of your investment will also be short on EOS tokens. If the Copy Trader closes with a 10% profit – you also make 10% gains.

- Free Virtual Portfolio: StormGain offers a free demo loaded with 50,000 USDT of paper trading funds. eToro goes one step further, providing you with a demo portfolio packed with US $100,000 in virtual equity. This does not expire and you can swap and switch between the real and virtual account whenever you like. This makes it well suited for strategizing.

To summarize, eToro is fully licensed and regulated. The broker offers access to heaps of cryptocurrencies, as well as alternative markets – all of which are 100% commission-free to trade. The spread is competitive across most markets and you can start with small stakes – this is from just $25 on digital currencies!

To Conclude

There are only a small number of crypto brokers offering such a high amount of leverage to crypto traders. Crucially – it does not matter where you live in the world, StormGain makes the signup process easy and seamless.

However, it is important to remember that by using Stormgain to trade, you are entrusting your hard-earned money with an unregulated broker.

This is why we much prefer Capital.com. Not only is the platform – which is home to 20 million clients, regulated – but it allows you to trade thousands of assets commission-free. Plus, you can easily deposit and withdraw funds with a debit/credit card or Paypal!