Best ECN Brokers? As you probably know, the forex market is one of the most liquid trading scenes in the world. But, have you heard of the electronic system taking the trading world by storm?

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

ECN, which is an acronym for Electronic Communication Network, enables you as a trader to be able to compete with a much bigger pool of financial institutions in the market.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Due to these technological advances within the financial arena, a large number of forex brokers are beginning to use this much more accessible system – ECN. Put into simple terms, this system allows ECN brokers to enable trades on a network that is used by several other forex traders.

For those traders who cannot be as involved as they would like to be during market hours, or those who just want a bit more diversity – ECN brokers are ideal. After all., who doesn’t want tighter spreads and lower commission rates?

We at Learn 2 Trade have put together a guide on ECN brokers, which will cover the basics of ECN, a number of handy tips on what to look out for, and of course – the best ECN brokers out there for your consideration.

What is an ECN Broker?

In a nutshell, when it comes to the trading of foreign currencies, the focus is to make as much profit as you can, and as often as possible. In the forex market there are two main varieties of brokers. Firstly, we have STP brokers; which stands for ‘straight-through processing’. This is the ‘middleman’ going back and forth between liquidity providers and you (the trader).

Secondly, you then have ECN brokers, which create a direct channel of contact between you (the trader), and the providers of trading assets (liquidity providers). What mainly sets an ECN broker apart from a traditional broker is the use of an ECN ‘system’.

In light of the fact it unites several market associates’ price quotations, an ECN broker can usually provide you with much tighter ask-bid spreads and better commission rates. More on that later.

What are the Benefits of ECN Brokers?

In order to access the forex trading market, you will first need to find a suitable broker. This is because forex isn’t done in the same way as shares and other assets, nor is forex trading on the same regulated exchanges.

Depending on which broker you use, you can potentially gain access to many different trading positions and exchange rates. Selecting the right platform for the kind of trader you are is essential if you want to become a profitable forex trader, and this is where the best ECN brokers can help you.

Always start by making sure the ECN broker you have chosen, or are looking into, is fully licenced and regulated. You will find that a lot of brokers actually register with more than one regulator, sometimes several. As such, this does come with an extra layer of security on your funds.

As well as making sure your ECN broker is fully regulated, you should always double-check that it provides the right type of trading accounts and platforms for you. At the end of the day, this is a personal preference and is going to depend on your style of trading.

A few other things to consider are the accessibility of technical indicators, trading conditions, minimum deposit required, permitted payment methods, your preferred currency pairs, and of course – spreads.

ECN Broker vs Market Maker

Before we look at the difference between the two, we first need to understand what a ‘market maker’ is? Put simply, a market maker is essentially a broker which sets the ask and bid prices by using their own system. In some circles, this is called ‘making the markets’.

Investors are then able to open and close trading positions in the market after having a look at the prices on the market maker’s platform. Generally speaking, market makers do not place client positions with any other liquidity providers. At the other end of the spectrum, the best ECN brokers do. The market broker will lose out if the client lands a winning position because winning positions are paid to the client out of the market maker’s own account.

Unlike market maker brokers, ECN trading platforms makes a profit by charging a fixed commission on each position. This is often because of the large volume of clients, and that ECN commissions and fees can be low in comparison.

Why Should I Trade With an ECN Broker?

If you’re not already sold by this point, trading forex pairs via an ECN broker ensures that you are accustomed to a variety of features and benefits like no other broker-type can offer.

When the technical infrastructure is working correctly, you can usually begin trading immediately, and without having to wait around for anyone else.

Why the Best ECN Brokers Stand out From the Crowd

As we’ve covered the difference between the two main types of platforms used by forex traders, we are now going to delve into what makes ECN brokers stand out against the competition.

No Trading Against its own Clients

As well as bringing you together with a variety of market participants, an ECN broker is merely a negotiator between your selling and buying orders. In Layman’s terms, this means that the broker will never trade against your position. On the other hand, STP brokers have been known to trade against their own clients by opening conflicting positions.

An example of this would be if you as a trader open a buy (long) position on GBP/USD, and then your STP broker supplies that position to the liquidity provider. But, what you might not know is that the STP broker might then open a sell (short) position on GBP/USD. In other words, this is the complete opposite of your position and thus – a major conflict of interest.

Although this might seem a little underhand, the reason that STP brokers will do this is that if you lose from your GBP/USD long trade, the broker wins a payout. But, if on the other hand, you were to win, the broker would lose its funds. As such, the act of trading against you is just a back up for the broker.

As we’ve already covered in detail, the best ECN brokers are not designed to submit your positions to any liquidity providers. Instead, you can do that yourself.

Trading With ECN Increases Transparency

The network is accessible by many forex traders, so it is often said that ECN forex brokers facilitate much more attractive trading conditions. Using an ECN broker definitely limits price manipulation and creates a bit more trust than other traditional brokers. This is largely due to the fact it doesn’t set it’s own ask and bids prices.

ECN brokers open the doors for trades throughout the ECN system or interested forex investors. By charging you a variable commission rate (rather than fixed) for a full transaction, you will likely find that the spreads on offer are a lot lower than most standard brokers. As well as more accurate prices, the best ECN brokers also offer clients accurate price history figures, as well as live and current financial news.

For those unaware, re-quotes come about when a trading order is rejected due to a shift in the price of an asset you wish to invest in. At this point, the broker re-quotes the asset in question. The re-quote hardly ever works out in your favour so it can have a detrimental effect on your trading performance in the long run.

ECN – Cutting out the Middleman

The main middlemen we are referring to are STP brokers. When you begin to trade you need several companies all providing assets for trading. without these so-called liquidity providers, trading wouldn’t be possible. Generally speaking, liquidity providers and traders tend to not communicate directly. For this, there are ‘middlemen’. In simple terms, their role is to match both trading parties into one workspace.

Anonymity

When you trade with an ECN broker, nobody knows who you are. A specific benefit of being anonymous is that trades are based on true market conditions and neutral prices.

Direct Market Operations

The best ECN brokers facilitate positions via direct market executions. This means that they do not record a trader’s position and try to connect them to liquidity providers. That is to say, the best ECN brokers do not create their own quotes. Instead, they simply use different liquidity providers to get their prices and can negotiate their own trades.

This type of broker could be particularly appealing for investors who are looking to make bigger transactions, because these brokers do give investors anonymity if they need it.

For example:

- Let’s imagine you open a position for the currency pair GBP/USD (for 1 lot).

- Instead of your broker having to negotiate the position with a liquidity provider, an ECN platform allows you to negotiate with the most appropriate GBP/USD provider active at the platform yourself.

It is, for this reason, that assets are considered to be so liquid, as the middleman has been taken out of the mix and there is no one getting in the way of trading partners. Crucially, you as a trader are able to buy or sell currency pairs almost immediately with an affiliating liquidity provider.

Tighter Bid-Ask Spreads in the ECN Markets

As we touched on earlier, the best ECN brokers are essentially a hub for a variety of different forex market dealers. These can be anything from investment funds (otherwise known as hedge funds) to commercial banks. Because there are so many market participants in one place, there will always be variety when it comes to the prices quoted – both higher and lower bid-ask prices.

Multiple Assets Available

There are several different asset classes available through the best ECN brokers, and these are usually as follows:

Considerations When Choosing Searching for the Best ECN Brokers

The amount of ECN brokers in existence seems to be increasing year after year. Most likely, this is because the market isn’t centralised, and so traders have access to a much greater variety of trading conditions and exchange rates. This is very attractive to brokers and traders alike.

As noted earlier, ECN brokers can be considered particularly appealing for investors who are looking to make bigger transactions too, because these brokers do give investors anonymity.

With that being said, before you make a decision on which ECN broker is right for you, there are a few things you need to make sure of first – which we list below.

Are They Fully Regulated?

It is vital that the ECN broker you choose meets at least minimum industry standards. It’s also a good idea to make sure that the broker has some presence in the country that you reside in, as it means you will be ruled by the same legal system. This can make things a lot less complicated if things don’t go to plan.

Each and every UK broker is legally obliged to hold an FCA licence (Financial Conduct Authority). When using a fully licenced broker you can be sure that you are protected by a variety of safety measures set out by UK/EU legislation.

Segregated Client Funds

We highlighted earlier the importance of selecting a broker who is fully licenced and regulated. You might be interested to know that another benefit of this licence is that you will also be covered by IPS, which stands for the Investor Protection Scheme.

The IPS ensures that all of your funds are segregated from the broker’s funds. Some brokers make an individual account in their company name, but hold your funds separately. In other cases, brokers might create an account in your name and keep your funds in there.

Depending on the fund protection level this is going to give you peace of mind in the unfortunate event of a broker going bankrupt. This is because your funds won’t be washed away with the broker’s personal debt.

Commission and Spreads

Traders often wonder what makes an ECN broker’s spreads so low. As we’ve already covered in this guide, the simple fact is they combine lots of liquidity providers together along with their price quotes.

Your choice of bid-ask options will be huge, and of course, there will be some liquidity providers who offer higher bidding and lower asking prices. But, there will also be providers offering lower bid prices and higher ask prices.

Either way, you at least have a better diversity of options to choose from, not least because the quotes are always collected by one ECN forex broker.

Deposit and Withdrawal Options

There are many ways in which you can fund your ECN trading account, however, each broker platform will differ slightly.

The very best ECN brokers offer a variety of different payment options to choose. The most common payment options are:

- Credit and debit cards; such as Mastercard and Visa.

- E-wallets; such as PayPal, Skrill, and Neteller.

- Bank-transfer.

Commonly Used Trading Tools and Indicators

You’ll want to ensure that your chosen ECN broker offers a fully-fledged suite of technical indicators. This should include the likes of:

- Moving Average Convergence Divergence (MACD).

- Relative Strength Index (RSI).

- Stochastic.

- Ichimoku Kinko Hyo (AKA Ichimoku Cloud).

- Bollinger Bands.

- Parabolic Stop and Reverse (SAR).

- Average Directional Index (ADX).

Customer Service

Much like with any organisation or company you deal with, you need to know that you can expect a good level of customer service.

Whilst most reputable ECN brokers do have a great customer support team for its clients, one of the ways you can gain some insight is to check out the reviews left by other customers. Word of mouth is what usually keeps customers coming back.

ECN Disadvantages

Realistically, like light and dark most good things come with negatives as well. With this in mind, we have to inform you of some of the disadvantages that can go hand in hand with opening an account with an ECN broker.

Fixed Commission

ECN brokers don’t take spreads as service payment, so they will have fixed fees and commission for each and every transaction. It really depends on how big those commissions are and what your trading budget is. In other words, ECN brokers are likely not suitable for small trading stakes, as your potential profits will get eaten away by a flat commission fees.

High Deposit Requirements

In order to open an account with an ECN broker, you will often find that platforms expect a higher deposit fee. This is down to the high service costs, and the fact that they allow you to communicate directly with liquidity providers.

No Micro-Lots

As liquidity providers can also have such high requirements and service costs, market participants can sometimes hold a position size of 10,000 currency units (or a 0.1 lot) This means as a trader if you want to open a position for less than this figure, you will not be permitted to.

Should I use an ECN Broker?

Some traders find ECN platforms quite complicated and difficult to use, so if you’re just starting out it might not be suitable. As such, if you really want to trade with an ECN broker, it will be worth doing your own research and learning how it works for yourself.

Signing up With an ECN Broker – How-to Guide

Now you are armed with all of the information you need on ECN brokers, you probably want to get started.

First, of course, you need to decide on which ECN broker best suits your needs. As there are lots of brokers out there to choose from, it’s always advisable to conduct some research of your own before fully committing.

Step One – Find an ECN Broker

Still not sure which ECN broker suits your needs? Not to worry, our expert team at Learn 2 Trade has put together a list of the best ECN brokers to help you to separate the wheat from the chaff. This can be found at the end of this guide!

Step Two – Open an Account

Open a trading account by filling in the registration form with your basic information. This is standard practice with any broker.

- Full name.

- Residential address.

- Date of birth.

- Contact details, such as email and telephone number.

- Enter any required financial information or trading history (this will vary between different platforms).

Step Three – Identification

Now you will need to submit your proof of identity. Again, this will vary, but generally speaking, you just need to send a copy of your passport or national identity card.

Some ECN brokers may require additional proof of who you are; such as a utility bill, phone bill or any other official letter with your name and residential address on it.

Step Four – Confirmation

Your identity and personal details will be checked in accordance with regulations. Usually, you will receive confirmation of this almost immediately.

If you feel like it’s taking too long, there is nothing to stop you from contacting the ECN broker’s customer support team, and they will be more than happy to chase up the delay for you.

Step Five – Deposit Funds Start Trading

Now you should be able to log in to your account, set up your preferred payment option, and deposit some funds. As soon as your account has been funded, you can begin trading straight away.

As a side tip, it’s worth checking whether there is an ECN demo account available to help you find your feet.

5 Best ECN Brokers of 2023

Don’t have the time to find an ECN broker yourself? Don’t worry – as we at Learn 2 Trade have done all of the hard work for you!

Below you will find the 5 best ECN brokers of 2023 and beyond.

1. Forex.com– Best All-Round ECN Broker

Forex.com is a specialist currency broker that also offers other asset classes. This includes CFDs in the form of stocks, commodities, and indices. In what it calls GTX Direct, Forex.com offers a fully-fledged ECN trading arena.

This means that you will be accustomed to reasonably competitive fees, spreads, and commissions. With more than 90 forex pairs on offer, you will have access to a full selection of majors, minors, and exotics. Interestingly, the platform allows you to get started with a minimum deposit of just $50.

- High-grade ECN trading platform.

- $50 minimum deposit

- More than 90 forex pairs supported

- Other ECN platforms in market are more competitive with fees

2. FXTM– Best ECN Broker for Zero Commissions

FXTM is an online broker that is regulated by the FCA and CySEC. You will be able to trade everything from forex, commodities, spot metals, and stocks - all in the form of CFDs. Its ECN accounts require a minimum deposit of $500, and you will benefit from zero commissions and tight spreads. You will also have the option of using popular third-party platforms MT4 and MT5.

- Zero commissions.

- Tight spreads

- Heaps of financial instruments supported

- $500 minimum deposit

3. Pepperstone Markets – Best ECN Broker Advanced Trading Platform

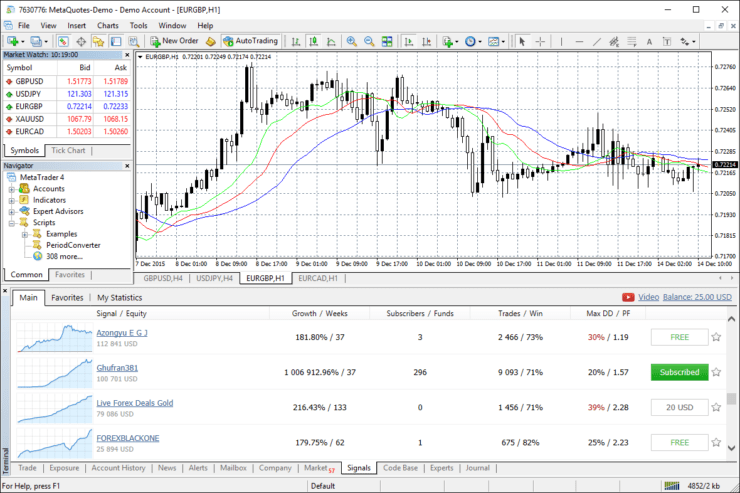

Pepperstone Markets is a hugely popular online trading platform that offers both STP and ECN accounts. You will have access to a full suite of trading platforms - including MT4, MT5, cTrader, and ZuluTrader.

This is ideal for those of you that require advanced chart reading and drawing tools, as well as the ability to deploy automated robots. It accepts several payment methods, such as a debit/credit card, PayPal, and bank transfer. Negative balance protection if offered, and you can engage in both scalping and hedging without concern.

- Low fees and spreads.

- Multiple payment methods supported

- Choose from four different trading platforms

- Real-time news is a bit basic

4. Think Markets– Best ECN Broker For High Leverage

Think Markets is an online broker that holds several regulatory licenses. This includes - including the FCA. Among several other account types, Think Markets also offers ECN accounts. This particular broker is popular with traders that want access to high leverage limits. This stands at a whopping 1:500 if you are a professional client.

- Zero commissions.

- Tight spreads

- Heaps of financial instruments supported

- $500 minimum deposit

5. Robo Forex - ECN Accounts With 0 Spreads

Robo Forex is an online trading platform that offers ECN accounts. You can get started in minutes, and minimum deposits start at just $10. Best of all, you will not be accustomed to any spreads when trading via your ECN account. The platform is home to high levels of liquidity and fast execution speeds.

- 0 spreads.

- Minimum deposits just $10

- Fast execution speeds

- Relatively unknown in the brokerage scene

To Conclude

Thanks to superior trading execution and trading conditions, we think that an ECN broker enables seasoned traders to enter positions more fluently, but more importantly – more profitably.

By cutting out the middleman there is a lot more clarity. And with the removal of conflict of interests, the best ECN brokers are widely considered to be a dependable and safe way of trading. This is because your ECN broker is going to make a commission regardless of whether you lose money or make a profit.

Always remember, regulated brokers must adhere to strict obligations and rules when it comes to the security of your trading funds. With this in mind, if your ECN broker is regulated by one or more licensing, body – you know you are in safe hands. As such, we at Learn 2 Trade will never recommend an unregulated broker on our website.

Before you make a final decision on what type of broker you would like to use, it is important to do some research. No two brokers are the same, and their products and services on offer will tend to be slightly different.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

- Broker

- Min Deposit

- Score

- Visit Broker

- Trade CFDs and forex on a zero-spread basis

- Super-low trading commissions and no hidden fees

- Super-low trading commissions and no hidden fees

- Deposit as little as $10 to start trading

- Super-low commissions and tight spreads

- Trade forex, crypto, commodities, and indices

- A highly liquid market so you can make the most of volatility

- Manage your trades on our secure and encrypted infrastructure

- Enter in the market with as little as $100

- Over 4,500 markets including FX, shares, cryptos, indices and commodities

- Earn rebates on monthly trade volume when you qualify for Active Trader

- Lowest trading costs for popular crypto markets*