Spread betting platforms allows you to speculate on the future price of a financial instrument without you owning the underlying asset. This includes everything from gold, oil, natural gas, stocks, indices, and cryptocurrencies.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

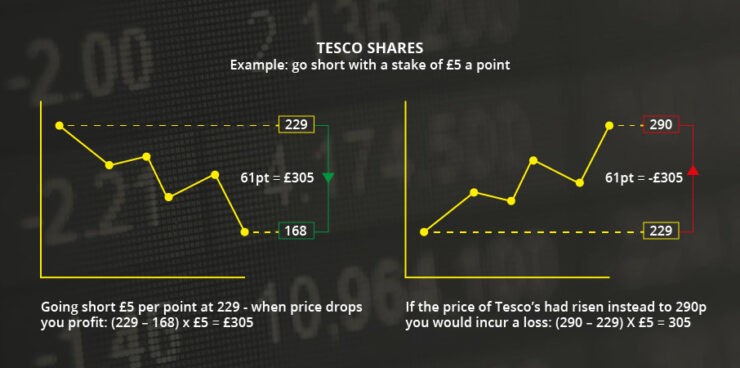

The overarching concept is that you need to determine whether you think the asset will go up or down in relation to its current price. If you’re correct, your profit is calculated by taking your stake-per-point, by the number of points the asset increased by.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Traders often opt for spread betting brokers because in most jurisdictions – gains are tax-free. Moreover, not only can you trade without paying any commissions, but spreads are usually much more competitive than traditional investment avenues.

With that said, spread betting can appear somewhat confusing at first glance if you’ve never dabbled in the space. As such, we would suggest reading our Learn 2 Trade 2023 Guide On Spread Betting – where we explain everything you need to know.

Note: Although spread betting sites allow you to trade with more than you have in your account through a margin system, this also means that you will lose your entire stake if your trade is liquidated.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What is Spread Betting?

Spread betting is a form of trading – similar to that of CFDs. This is because you will have access to thousands of financial instruments, which you can trade without taking ownership of the asset. The main concept is that you need to speculate on whether you think the asset will increase or decrease in value – in relation to its current market price.

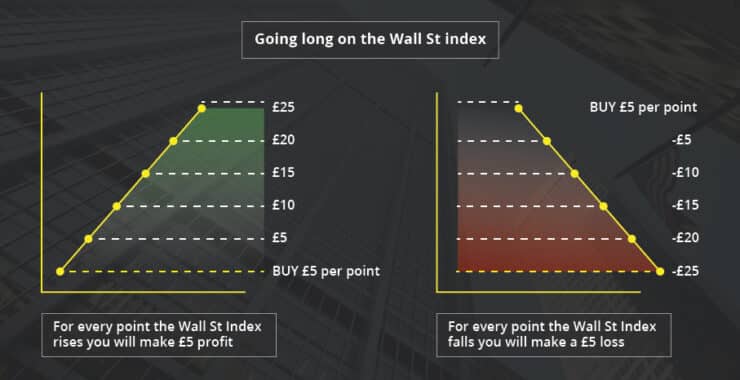

For example, if the FTSE 100 is trading at 2,700 points – a ‘long’ order would indicate that you think the index will increase in value. Alternatively, if you placed a ‘short’ order, you think the opposite. Before you place your respective order, you also need to enter a stake.

This is because the FTSE 100 ended up 100 points higher (2,800 – 2,700), and your stake-per-point was £1. At the other end of the spectrum, if you went short – your total loss would have also stood at £100 – as you were wrong by 100 points.

What are the Pros and Cons of Spread Betting?

How Does Spread Betting Work?

Spread betting operates on a points system, where your profits or losses are based on the number of points you were over or under on the trade. Confused? Well, let’s say that you were trading Nike stocks at $85.50. In spread betting terms, $85.50 would translate to 85.5 points. Then, let’s say that you went ‘long’, which means you think Nike stocks will increase in value.

If you then closed your trade when Nike was priced at 87.0 points (or $87.00), your spread betting trade was successful by 15 points. This is because in this example – each point was based on every $0.10 that the stock went up by. So, if we staked £1 per point, we would have walked away with a profit of £15 (15 points x £1).

Similarly, if you staked £5 per point, your successful Nike stock trade would have netted £75 in profit (15 points x £5). There is, of course, the possibility that your spread betting trades will sometimes go against you. In other words, had the value of Nike stocks gone down, you would have lost money.

For example, let’s say you cashed out your trade when Nike was priced at $82.50. As this translates to a loss of 30 points (85.5 – 82.5), a £1 stake would have lost you £30. In fact, there is no limit to the amount you can lose in spread betting – as trades are based on margin.

Let’s look at a couple of other examples to clear the spread betting mist.

🥇 Example of a Successful Spread Betting Trade

In our first example, we are going to be trading oil. We think that at $28.0 per barrel, the commodity is heavily undervalued. With rumours of a reduction in production output by OPEC and Russia, you decide to go long. This means you think the price of oil will increase against its current price of $28.0 – or 28.0 points.

- You place a long order on oil at £5 per point.

- This means that for every point (or $.10) that oil goes up or down in value, you will win or lose £5.

- A few hours later, oil sky-rockets to $33.50, or 33.50 points.

- This amounts to 55 points more than the 28.0 points you took when you placed your order (remember, points are based on the number after the decimal point).

- As such, you won £275 on this trade.

- This is because 55 points in your favour against a stake of £5 per point amounts to £275.

As we noted earlier, spread betting trades won’t always go in your favour – so we now need to look at an unsuccessful example.

🥇 Example of an Unsuccessful Spread Betting Trade

To keep things simple, we’ll stick with the same example as above, where oil is priced at $28.0 or 28.0 points. Only this time, things don’t go to plan.

- You place a long order on oil at £5 per point.

- This means that for every point (or $.10) that oil goes up or down in value, you will win or lose £5.

- A few hours later, oil crashes to $26.00, or 26.0 points.

- As the original price was 28.0 points, and it’s currently at 26.0 – this translates to a loss of 20 points.

- As such, you lost £100 on this trade.

- This is because 20 points going against you at a stake of £5 per point amounts to a £100 loss.

This is a prime example of how easy it is to lose money when you engage with spread betting. On the flip side, you can easily mitigate your risks by installing a sensible stop-loss order. As we cover in more detail later, this allows you to automatically exit your trade when the markets go against you by a pre-defined percentage.

What Markets can you Trade When Spread Betting?

In a similar nature to CFDs, spread betting brokers give you access to thousands of financial markets. This ensures that you are able to create a diversified portfolio of holdings – 24 hours per day.

Below we have listed some of the most popular asset classes that you can trade at a spread betting site.

Stocks: You can spread bet thousands of blue-chip equities across dozens of marketplaces. Think along the lines of the LSE, NASDAQ, and NYSE.

Indices: If you want to trade the wider stock markets, spread betting platforms also host indices. This includes the S&P 500, Dow Jones, FTSE 100, and NASDAQ 100.

Energies: You can also trade energies. This includes the main oil and natural gas markets.

Hard Metals: The hard metals space includes everything from gold, oil, and copper.

Agriculture: If you want to gain exposure to agriculture products like wheat, crops, sugar, and grain – spread betting platforms typically support these markets.

ETFs: Further highlighting just how extensive spread betting platforms are – you can also trade ETFs.

Currencies: In a similar nature to forex trading sites, spread betting brokers also allow you to speculate on the future direction of popular currency pairs like GBP/USD and EUR/USD.

Cryptocurrencies: Some spread betting sites also allow you to trade the future value of popular cryptocurrencies like Bitcoin and Ethereum.

Spread Betting – Key Terms

So now that you know the basics of spread betting, we now need to look at some of the key terms that you are all-but-certain to come across.

✔️ Long vs Short

First and foremost – make sure that you know your longs from your shorts. As we briefly covered earlier, going long on a market means that you think the asset will increase in price. This is the same as placing a ‘buy’ order when trading CFDs, or a ‘call option’ when investing in an options contract.

If you went short on a spread betting market, this means that you think the asset will go down in value. Once again, this would equate to a ‘sell’ order when trading CFDs, or a ‘put option’ in the options trading space.

✔️ Leverage and Margin

Spread betting platforms allow you to trade with more money than you actually have in your account. For example, let’s say that you wanted to buy £1,000 worth of Disney stocks. Ordinarily, if you bought £1,000 worth of shares with an online stockbroker, you would get £1,000 worth of shares.

However, spread betting sites allow you to apply leverage to your trades – so your £1,000 balance would allow you to trade with significantly more.

For example:

- Let’s say that you are only required to put a 10% margin down to trade Disney stocks.

- Your margin is essentially a non-refundable deposit that the broker gets to keep if your trade goes against you by a certain amount.

- You have £1,000 in your account, which allows you to trade £10,000 worth of Disney stocks.

- This is because £1,000 amounts to 10% of the required margin.

Crucially, trading on margin can go one of the two ways. You either win your spread betting trade and amplify your winnings, or you get liquidated and lose your margin.

For example, if you went long on Disney stocks and the price increased by 20%, you would have made a total profit of £200 (20% of £1,000). However, as you applied leverage of 10:1, your profit was actually £2,000 (£200 x 10).

If the markets went the other way, and Disney stocks went down by 10%, you would have lost your margin. As such, the trade would have been liquidated and the broker would have kept your £1,000 margin.

✔️ Spreads

Much like any other investment channel in the financial markets, you must have a firm grasp of the ‘spread’ when spread betting online. For those unaware, this is the difference between the buy and sell price of an asset. In the case of spread betting, it’s the difference between the ‘long’ and ‘short’ entry price – and it’s always expressed in points.

For example, let’s say that you are trading oil.

- The long price is $27.0.

- The short price is $27.3.

- This amounts to a difference of 30 points, which is just over 1%.

As per the above example, this means that you need to make gains of at least 30 points(1.11%) on your spread betting trade just to break even. This is expensive.

The good news is that the spread betting brokers recommended on this page offer spreads that are significantly more competitive than this.

✔️ Bet Duration

You also need to assess the ‘bet duration’ before placing a spread betting trade. As the name suggests, this merely refers to the duration of your bet. This usually comes in one of two forms – a daily funded bet or a quarterly bet.

- Daily Funded Bet: This particular bet duration is ideal for those of you that wish to engage in day trading. This is because you will be required to pay overnight financing fees for every day that you keep the spread betting trade open. After all, you will always trade on margin when using a spread betting site, which comes at a cost. Spreads are often at their lowest.

- Quarterly Bet: A quarterly bet is more suited to those of you that wish to keep a trade open on a longer-term basis. This is because you won’t be charged excessive fees for each day that you keep the trade open. As such, you can keep your spread betting trade open for up to 3 months before it automatically closes. Spreads are often higher.

Getting Liquidated in Spread Betting

The greatest risk that you face when spread betting is having your trade liquidated. Although we briefly covered how this works earlier, it’s important for us to expand. After all, a liquidated trade will result in you losing your entire margin.

- For example, let’s say that you are trading Apple stocks, which has a margin requirement of 10%.

- You want to trade £5,000 worth of stocks, which means that you will need to put up a margin of £500.

- For as long as the trade remains open, you cannot touch this £500, as it’s taken from your main account balance and placed into your margin account.

On the one hand, it’s great that you are able to trade £5,000 worth of Apple stocks by putting a deposit of just £500 down. However, if the markets go against you, that £500 is at risk of being lost in its entirety. In fact, this would happen if the price of Apple went down by 10%, as this would amount to a real-world reduction of £500.

Before you get to the point of liquidation, the spread betting broker will give you the option of adding more money to your margin account. For example, if you added a further £200, this would require the price of Apple stocks to decline by an additional £200 before your trade is closed.

On the flip side, if you opted against adding more funds to your margin, and your Apple trade hit that 10% liquidation trigger price, the broker would close your trade and retain your £500 margin.

Placing a Stop-Loss Order

The good news is that you can install a stop-loss order to ensure you never get liquidated. Instead, you can opt to exit your spread betting trade when the asset goes against you by a smaller amount. For example, instead of having your trade closed at the liquidation rate of 10%, you could put your stop-loss order in at 2%.

Here’s how a stop-loss order works in practice when spread betting:

- Sticking with Apple stocks, let’s say the current long price is $250.0 – which amounts to 250.0 points.

- You are trading with a 10% margin, which amounts to a £1,000 stake and £10,000 trade size.

- But, you want to limit your losses to 2%.

- To get our stop-loss order price, we need to subtract 2% from the current long price of 250.0 points.

- 2% of 250.0 points is 5.0 points, so our stop-loss order would be placed at 245.0 points.

As per the above, a ‘worst-case-scenario’ would be Apple stocks going down in value by 2%. If it did, you would lose £200 and the trade would be closed (2% of £10,000 trade size). Although you still lost money, if the stop-loss order wasn’t in place, you could have potentially lost your entire margin – which is £1,000.

Is Spread Betting Tax-Free?

Unlike traditional stocks, CFDs, or forex – spread betting profits are usually exempt from tax. This is because the industry is viewed as gambling, as opposed to conventional trading.

As such, if you live in a country where gambling winnings are tax-free, this is hopefully the case with spread betting, too. However, you are strongly advised to check this with a tax specialist in your respective country.

How to Start Spread Betting Today

If you’ve read our guide up to this point, and you think that spread betting is right for long-term investment goals – we are now going to show you what you need to do to get started today.

Step 1: Find a Spread Betting Broker

If you want to spread bet online, you will need to find a suitable broker. Most spread betting platforms also support CFDs, so you’ll likely be using a hybrid site.

Nevertheless, with dozens of spread betting sites active in the online arena, you need to ensure that the platform is right for you. This should include metrics like regulation, payment methods, tradable instruments, fees, and customer support.

To help you along the way, we’ve listed our top five spread betting brokers of 2023 towards the bottom of this page.

Step 2: Open an Account

Once you have found a spread betting platform that meets your needs, you will then need to open an account. Much like any other investment site, the process will require some personal information from you.

This includes your:

- Full Name.

- Nationality.

- Home Address.

- Date of Birth.

- Email Address.

- Mobile Number.

As spread betting is a sophisticated investment arena, the broker will likely ask you some multiple-choice questions to gauge your prior experience. This is to ensure you fully understand the risks associated with spread betting.

Step 3: Verify Identity

Before you can place your first spread betting trade, you will need to verify your identity. In most cases, you can do this by quickly uploading a clear copy of your passport or driver’s license.

Some brokers will also ask for a proof of address. If they do, you can upload a recent bank account statement or utility bill.

Step 4: Deposit Funds

You will now be asked to fund your spread betting account. Most platforms will ask you to meet a minimum deposit amount – which is usually in the £50-£150 range.

In terms of deposit options, this often includes the following:

Apart from the bank account transfer option, deposits are usually credited to your spread betting account instantly.

Step 5: Place a Spread Betting Trade

Once you have deposited funds, you can then place your first spread betting trade. You can browse the many spread betting markets offered by the broker, or simply enter the financial instrument into the search box.

Once you’ve found the asset you wish to trade, you’ll need to set up an order.

- Choose from a long or short order.

- Enter your stake-per-point.

- Assess the margin requirement.

- Choose a stop-loss order trigger price.

- Place your trade.

Once your trade is live, you can close it at any point by placing an opposite order. For example, if you went long, place a short order to close the trade – and visa versa.

In the UK, there are gambling comparison portals such as new betting sites which list all the new betting sites for 2023.

Best Spread Betting Sites of 2023

Want to start spread betting right now, but not sure which platform to use? Below you will find our top five spread betting sites of 2023. All of our top-picks are heavily regulated, give you access to thousands of financial instruments, and allow you to easily deposit funds with a debit/credit card.

1. IG –Best All-Round Spread Betting Broker

Our top pick goes to IG. launched in 1974 - the UK-based broker offers CFDs, forex, and spread betting trading. In fact, you'll have access to over 17,000 individual markets, which is huge.

As such, whether you're looking to spread bet currencies, stocks, indices, and gold - IG likely has a market for you. Minimum deposits start at £250, and you can fund your account with a debit/credit card or bank account. The platform is regulated by licensing bodies in the UK, Singapore, and Australia.

- Established in 1974

- Super-tight spreads

- Spot gold trading at just 0.3 pips

- Minimum deposit quite high at £250

2. Spreadex – Spread Betting on Financial Markets & Sports

Spreadex is a specialist spread betting platform that covers traditional financial markets and sports.

With more than 10,000 individual spread betting instruments, most asset classes are covered. You can place a spread bet from just 10p per point, and minimum deposits start at £1. Multiple payment methods are supported, and the broker holds a license with the UKs FCA.

- 10,000+ financial markets

- Spread betting on sports

- Minimum deposit of just £1

- You will need to pass a credit check if applying leverage

No support for e-wallets

3. City Index – Best Spread Betting Trading Platform

Much like IG, City Index is a multi-purpose broker that covers CFDs, forex, and spread betting. You'll have access to just over 8,000 markets, and spreads are super-competitive.

The UK-based broker is regulated on multiple fronts, and it has a long-standing reputation that dates back to 1983. You can open an account in minutes, deposits start at £100, and supported payment methods include a debit/credit card or bank transfer.

- Top-notch customer support team

- Easy account opening process

- Excellent reputation in the traditional brokerage scene

- KYC process is a bit cumbersome

4. CMC Markets - Spread Betting Broker With Risk Management Tools

CMC Markets offers a highly comprehensive spread betting facility. This includes thousands of market across stocks, indices, ETFs, energies, hard metals, and even cryptocurrencies. Launched in 1989, CMC Markets is heavily regulated.

On top of super-low commissions and fees, CMC Markets offers a number of risk management tools. This will ensure that you keep your spread betting losses to a minimum.

- Thousands of financial markets supported

- Risk-free demo accounts

- Listed on the London Stock Exchange

- Listed on the London Stock Exchange

5. FXCM– Best Low Stakes Spread Betting Broker

FXCM is a low-cost spread betting broker that allows you to place trades at just 7p per stake. This is perfect if you are just started out in the space and wish to begin with smaller stakes.

The broker holds multiple regulatory licenses, and it also supports CFD and forex trading. Several payment options are offers, and account applications are usually approved on the spot.

- Spreads from just 0.6 pips

- Leverage of between 2:1 and 30:1

- Low stakes of just 7p per point

- Selection of markets is quite small

Conclusion

We hope that by reading our guide in full you now have a 360-degree view of how spread betting works. We’ve covered everything from how you can win and lose money when spread betting, the many financial instruments that you can trade, and what risk management tools you can install to mitigate your potential losses.

Ultimately, while spread betting won’t be for everyone, it does offer a number of benefits over traditional investment channels. At the forefront of this is commission-free trades that are often exempt from tax – and spreads that remain unrivaled in other investment arenas.

Crucially, just make sure that you understand the underlying risks of spread betting before taking the plunge. After all, most newbie traders lose money when they first start out, so do tread with caution.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card