There was a time in the 1980s when the infamous trading floor was considered the playground for the wealthy. These days, it’s accessible to anyone with an internet connection.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

In fact, in the year 2023, there are estimated to be nearly 10 million people actively trading on the internet. This is great news for online broker firms.

Today we’re going to review the hugely popular Libertex trading platform. There are over 200 CFD instruments on this site and the broker has won 30 awards internationally – including ‘Best Trading Platform’!

We’ll start with a little bit of background information on the company, before moving onto what you can trade and what fees you should expect to pay. By the end of reading our Libertex review in full, you should be able to make an informed decision as to whether or not the broker is right for your personal trading needs.

Libertex - CySEC Regulated Forex and CFD Trading Platform

- Trade CFDs and forex on a zero-spread basis

- Super-low trading commissions and no hidden fees

- Regulated by CySEC

- Trade online or via the MT4 platform

What is Libertex?

As we touched on, Libertex has won multiple awards including ‘Best Trading Platform of 2023’. The broker has been providing trading services since 1997, hosting over 2.2 million clients from a variety of countries. The platform is regulated and supervised by CySEC.

Crucially, Libertex is one of only a few brokers in the online space charging tight spreads to its clients.

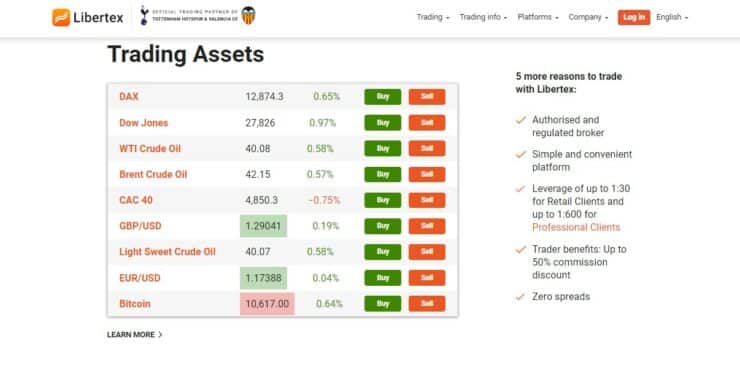

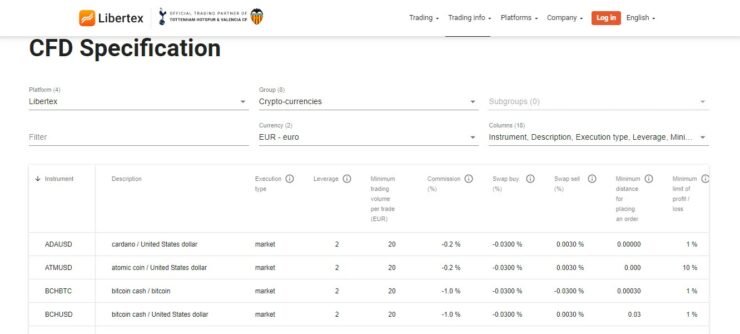

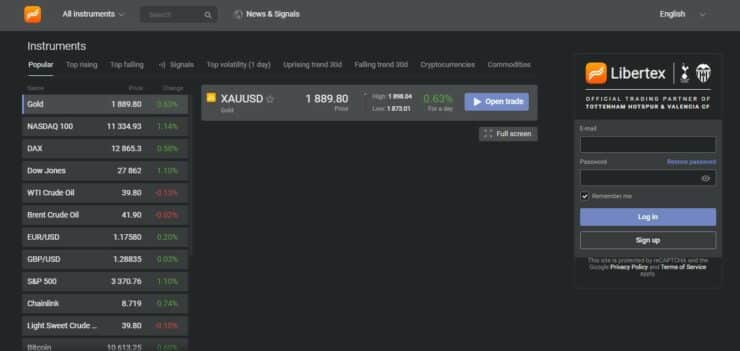

What can I Trade at Libertex?

As we said Libertex focuses on CFDs – meaning there are hundreds of tradable assets on this platform. Some of the most popular include indices CFDs like the Dow Jones and DAX, alongside commodities such as Brent Crude oil.

Below you will find a full break down of what assets you can trade at Libertex.

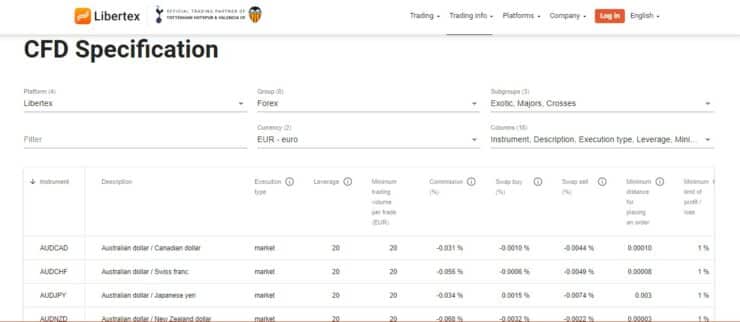

Forex

As we expected, the most traded forex CFDs on the site are GBP/USD and EUR/USD. However, there are heaps more currencies on offer, which we have listed below.

- Exotic pairs include CHF/SGD, EUR/CNH, USD/DKK, EUR/NOK, GBP/SEK, EUR/RUB, you will also find currencies like the South African rand (ZAR) Mexican peso (MXN)

- Major pairs on offer via Libertex are EUR/USD, AUD/USD, GBP/USD, NZD/USD, USD/CAD, USD/CHF, and USD/JPY

- Cross pairs available are AUD/CAD, AUD/JPY, AUD/CHF, CAD/CHF, GBP/AUD, GBP/NZD, GBP/CAD and heaps more

Retail clients on Libertex can trade CFD forex pairs via MT4 or the Libertex app.

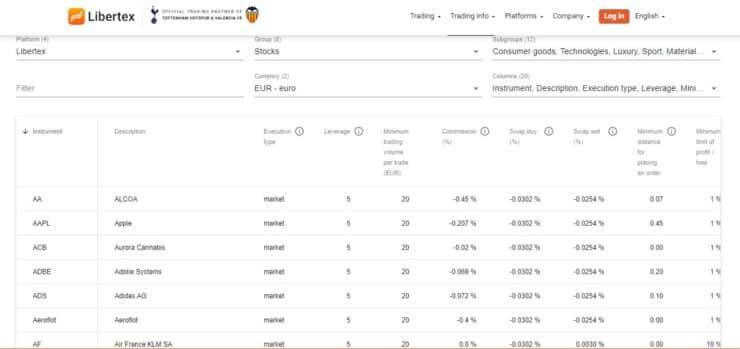

Stocks and Shares on CFDs

Trading stock CFDs via Libertex means that you can buy and sell share positions without owning the asset. Instead, you’re merely guessing whether the shares will rise or fall. On the subject of stocks, there are more than 50 to choose from on this platform.

- Consumer goods: Coca Cola, Nike, Adidas AG and Proctor and Gamble

- Technologies: Netflix, Spotify, Dropbox, China Mobile, Vodaphone

- Luxury: Estée Lauder, Michael Kors Holdings, Ralph Lauren, Tiffany & Co

- Industrials: Boeing, Caterpillar

- Finance: American Express, Goldman Sachs Group, JPMorgan Chase & Co, MasterCard

- Automobile industries: Harley Davidson, Ferrari, Ford Motor

- Energy: Electricite de France (EDF), Enel Chile S.A., PetroChina

- Telecommunications: Apple, Amazon, Hewlett-Packard, Pinterest, Microsoft, Twitter

- Healthcare: Aurora Cannabis, Johnson&Johnson, UnitedHealth Group

- Materials stocks: such as Sociedad Quimica y Minera de Chile (makes fertiliser and chemicals)

For football fans, there’s Juventus Football Club SPA. The minimum volume on Stock CFD trades must be no less than 20 Euro.

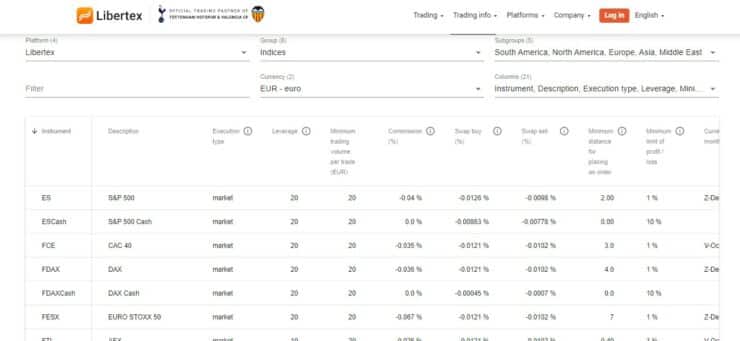

Indices on CFDs

On the subject of indices, there is a variety to get involved with – European and American economies, stretching as far as Asia, and the Israel 35 in the Middle East.

- If you’re interested in North American markets you will find the usual big players such as Dow Jones, S&P 500, NASDAQ 100, Russell 2000, to name a few.

- When it comes to European indices CFDs you can invest in DAX, Spain 35, FTSE 100, Italy 40, Russia50 Index and more.

- The Asia offerings are China A50, Nikkei 225 and Hang Seng Index, and in South America, we have the Chile Index.

Commodity CFDs

With regards to commodities on this platform you can trade the following instruments using CFDs:

- Coffee

- Cocoa

- Sugar

- Soybean

- Wheat

- Brent crude oil

- Heating oil

- Light sweet crude oil

- WTI crude oil.

- Metals such as gold and copper

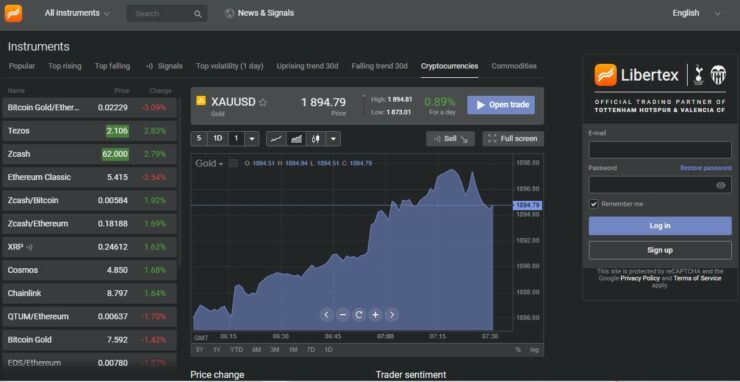

Cryptocurrencies

Crypto CFD trading on Libertex is really easy. The broker offers a wide range of cryptocurrencies from Bitcoin to Chainlink.

- Litecoin/USD

- Bitcoin Cash/USD

- Bitcoin Gold/USD

- Bitcoin Cash/Bitcoin (cross pair)

- Litecoin/Bitcoin (cross pair)

- Bitcoin/EUR (cross pair)

- Ethereum/USD

- XRP/USD

- Ethereum/Bitcoin (cross pair)

- Ethereum Classic/USD

- Monero – Guide, Tips & Insights | Learn 2 Trade/Bitcoin (cross pair)

- EOS/Ethereum (cross pair)

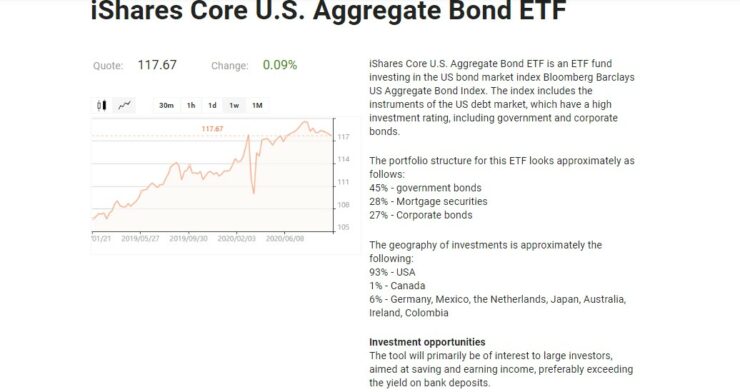

ETF CFDs

For those who don’t know – an ETF (Exchange Traded Fund) usually involves tracking the underlying index of a selection of securities, using a variety of industries or multiple strategies.

Here is an example of ETF CFDs available at the platform – which again, can be traded via the MT4 application or Libertex app:

- iShares Core U.S. Aggregate Bond ETF CFDs is made up of 27% Corporate bonds, 28% Mortgage securities, and 45% government bonds

- That same ETF CFD is also geographically varied like so: 1% Canada, 6% Germany, Mexico, the Netherlands, Japan, Australia, Ireland, Colombia, and 93% USA.

Take note, you will be ‘trading’ the above ETF via CFDs – like all financial markets at Libertex.

Libertex Fees

When it comes to fees, each and every broker will differ. With that in mind, it’s important to always conduct your own research before signing up for a new broker account.

Libertex charges no monthly fee for its service, and tight spreads – but of course, the broker still needs to make money. With that in mind, we are going to delve into a few other fees to look out for on the broker site.

If the client’s account remains inactive for 180 calendar days (i.e. there is no trading taking place, no positions open, no withdrawals or deposits), the company reserves the right to charge an account maintenance fee of 10 EUR per month. (This applies to clients with total account balance less than 5000 euros).

Moving on to overnight fees/swap interest, this fee is charged on any positions left open at the end of the trading day. In terms of CFD instruments, this fee will triple if you happen to roll a position over across the weekend.

Trading Platform Compatibility

Not all brokers are compatible with third-party trading tools and platforms. Fortunately, we are pleased to report that not only is the Libertex compatible with the hugely popular MT4 – but the broker also has it’s very own proprietary platform and app.

Here is a little more information about these useful tools and platforms.

MetaTrader4 (MT4)

The vast majority of seasoned traders have used MT4 at some point. This Libertex-compatible trading platform is packed to the rafters with useful trading tools, charts and analysis. Trading via MT4, traders can use more than one account, and even passively by using trading robots.

- Helpful trend indicators like The Moving Average Convergence Divergence (MACD), Bollinger Bands, Exponential Moving Average (EMA), Ichimoku and heaps more

- Trading tools including but not limited to Orders Indicator, Xandra Summary, Undock Chart, SHI Channel True, Position Size Calculator, SL & TP values, Breakout Zones,, Autofibo, i-Profit Tracker, NewsCal, and plenty more

- Order options: market order, buy stop, sell stop, sell limit, buy limit, buy by market and sell by market.

Take note, MT4 is available via desktop software and even a fully-fledged mobile app. Regarding the latter, this allows you to keep tabs on how your automated trading robot is performing – no matter where you are!

Libertex App

Much like on the Libertex website, the minimum trade volume on the Libertex app is generally 10 units in your currency ($10, £10, etc). With that said, stock CFDs are slightly higher at 20 units.

There are heaps in the way of technical indicators, financial news and trading signals on the Libertex app. Traders are able to download the app via Google Play for Android or the Apple App Store. Alternatively, you can download the app directly from the Libertex website.

The official application is rated highly by users, most of which compliment the app for its user-friendly design and helpful functions. From the palm of your hand, you can execute orders, gain access to live quotations, deposit/withdraw – and more.

Trading and Educational Tools

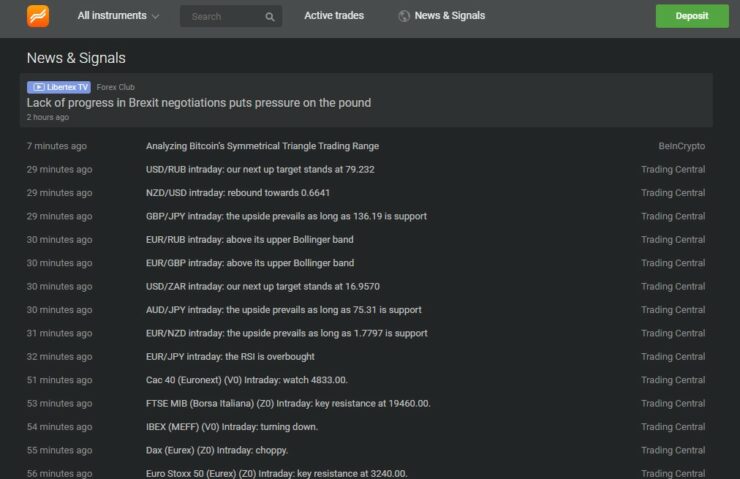

Libertex shines when it comes to educational material. As a client, you will have access to webinars, a plethora of detailed educational videos and financial news and signals.

In addition to the video content, there are nearly 30 different trading lessons surrounding various assets – and don’t forget that free demo account including 50,000 demo dollars.

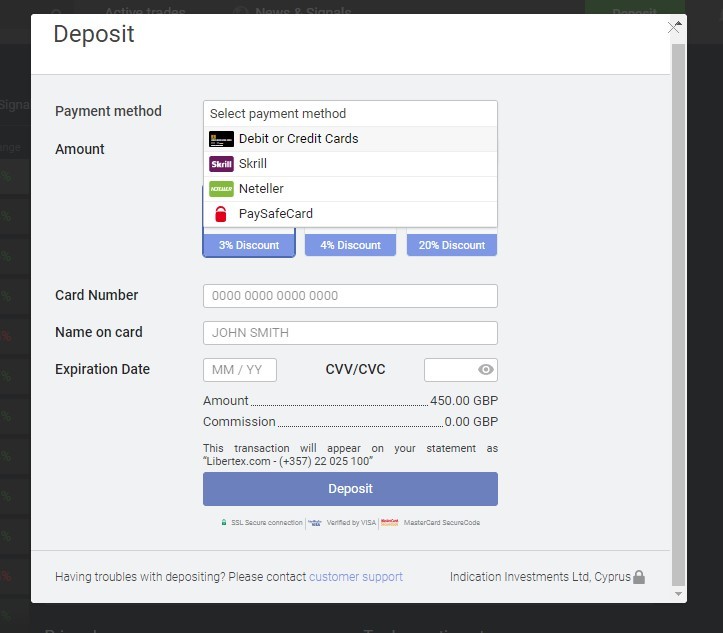

Deposits and Withdrawals

There are heaps of payment methods available on this broker site but you will need to check what’s available depending on your country of residence.

Below we have listed all payment methods available for both deposits and withdrawals in the UK. When you have deposited funds into your account you will be given the appropriate account level.

Take a look at your payment options below.

Deposits

- Credit/Debit card

- Neteller

- Skrill

- Bank Wire

Deposits are free at Libertex and the processing time when funding your account is instant. However, if you deposit via SEPA/international bank wire it could take between 3 and 5 days to reach your account. This processing time will obviously delay your trading plans.

Withdrawals

In terms of withdrawal charges, there are some variations depending on the method used. Please find below a list of acceptable withdrawal methods, alongside the fee (if any) and processing time.

- Credit Card – Fee €1 – Within 1-5 days

- Neteller – Fee 1% – Within 24 hours

- Skrill – Zero fees – Within 24 hours

- SEPA/International bank wire transfer – 0.5% min 2 EUR, max 10 EUR – Within 3-5 days

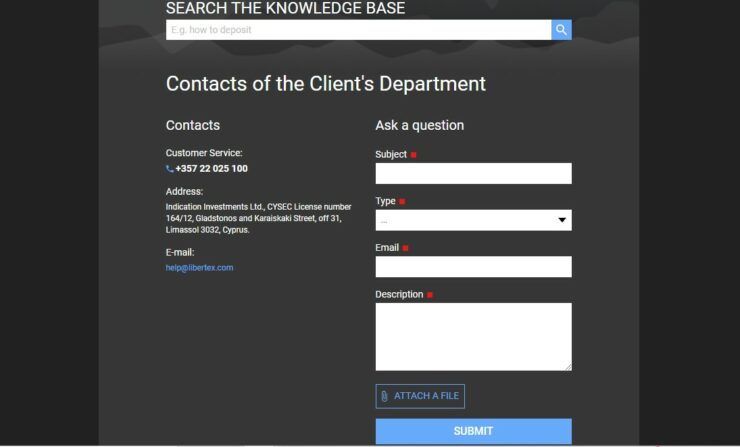

Customer Support Team

The Libertex customer support team are available from Monday to Friday – 8 am until 8 pm.

There is also an FAQ section available which breaks down help sections into areas such as ‘banking’, ‘trading transactions’ and ‘trading conditions’.

Libertex Accounts

Interestingly, Libertex offers various accounts which are based on your status level and minimum account balance. In a nutshell, when you deposit real money into your trading account you can access whichever status lines up with your balance.

We think the Libertex demo account is invaluable for newbie traders who aren’t quite ready to risk real money. Besides newbie investors, demo accounts are superb for experienced investors who just want to try out a new strategy before diving into the live market.

How to Open a Trading Account with Libertex

Signing up for an account with Libertex is super simple. But, to get you started, we’ve put together a 3-step walkthrough.

Step 1: Sign up

The first step to signing up is to head over to the Libertex website. Located on the top of the page at the right-hand side you will see ‘login’ – click this and you will be taken to a new page.

Where you see a sign-up box on the right you will need to select ‘sign up’ and enter your email address and a unique password

Step 2: Deposit Into Your Libertex Account

Presuming you have successfully set up your Libertex account, which takes less than a few minutes – you can go ahead and fund your account using one of the accepted deposit methods listed further up this page.

Step 3: Start Trading

After you have made a minimum of 100 EUR deposit into your account you can start trading! It’s simple to navigate the Libertex website, but we recommend starting with a demo account or a small initial deposit – at least while you find your feet on the platform.

To Conclude

All in all, Libertex offers a good variety of tradable assets on its platform and is one of the very few brokers to offer tight spreads – which is music to any traders’ ears!

In terms of educational content, Libertex is great for beginners. There are webinars, news updates and nearly 30 detailed trading lessons available to clients – accompanied by thorough videos. The company’s in-house trading platform works well, and you can also use MT4 to trade with ease.

Libertex is fully regulated and licenced by the Cyprus Securities and Exchange Commission (CySEC). This means the site is strictly regulated and must adhere to the rules set out by the body in question.

Libertex - CySEC Regulated Forex and CFD Trading Platform

- Trade CFDs and forex on a zero-spread basis

- Super-low trading commissions and no hidden fees

- Regulated by CySEC

- Trade online or via the MT4 platform