As you likely know, wheat is highly important to the global economy. In fact, production started circa 10,000 BC and it’s just as crucial now as it was then, if not more so. Besides rice, wheat is the second most-consumed grain on the planet!

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Where there is the demand for a commodity – you can bet your bottom dollar you can trade it. Interested in trading wheat yourself, but unsure where to begin? If so, you’ve landed on the right page.

[forex_table id=”2796″]In this wheat trading guide, we are going to run through the basics of buying and selling this commodity, as well as some helpful tips and strategy ideas. Finishing off with important metrics to look out for when seeking out a good platform, we conclude by discussing the best wheat trading brokers to consider!

[in-content-heros name=”main-banner”] [in-content-provider-geoip operator=”18731″ cta_text=”Visit eightcap Now”]

Wheat Trading Fundamentals

To put it simply, wheat trading is fundamentally a case of buying and selling the asset via a broker. You are hoping to sell it for more than you initially paid, thus making a profit.

- Decide on an asset to trade – in this case wheat

- Speculate on whether you believe the price of wheat is going to go higher or lower than it is now.

- Place an order with your broker – this tells them your position

- Forecast correctly – you make a profit

- Predict incorrectly – you experience a loss on the trade

With more people than ever having regular access to an internet connection, most trading is done online these days. Furthermore, the lion’s share of wheat traders tend to do so on a short-term basis such as day trading or scalping.

In short:

- Both scalping and day trading are short-term wheat trading strategies

- Wheat trading scalpers tend to close positions within seconds or minutes

- Wheat day traders invariably open and close trades within the same day

If you fancy more of a short-to-medium strategy, you might want to have a go at swing trading wheat instead. For those unaware, we are going to clarify these strategies in more detail later on.

What Drives the Cost of Wheat?

The global demand for wheat is constantly growing, along with the world’s increasing population. This commodity is primarily used in the industrial and food industry and is traded on large scale, on a daily basis.

The biggest force behind the cost of wheat, and any other financial asset, is supply and demand.

So, what drives supply and demand when it comes to wheat trading?

There are actually various factors that can affect the supply and demand of wheat, such as changes in the weather, government agricultural policies, increased energy costs, and shortages or an abundance of the product.

If wheat goes into oversold territory, then a market correction is likely – and so the merry dance begins again. The general rule of thumb is that when wheat supply is too high, the price will fall. This makes way for demand to once again rise due to lower costs.

At some point, the aforementioned high demand will force the supply of the asset to decline. In turn, the price of wheat should increase. The idea being at some point the supply and demand will reach common ground, some sort of equilibrium!

How is the Price of Wheat Calculated?

In terms of currency, wheat tends to be quoted in US dollars by brokers. Incidentally, USD is the most powerful currency in the world, and its own value often drives the cost of wheat.

When it comes to trading, wheat is calculated in bushels – with each individual bushel comprising of a million kernels or 60 pounds of wheat.

As we said, trading platforms will usually show you commodity prices in US dollars. Therefore, it makes sense to use it as a bit of a universal benchmark currency when trading oil, gold, silver, natural gas, and of course – wheat.

If your broker operates in US dollars, but you live in Australia or India for example – your trading platform will usually convert your currency for you, with a small exchange fee. This means that irrelevant to where you live, you can start trading wheat straight away.

When is the International Wheat Market Open?

In terms of when you can trade – day in, day out, wheat is traded at multiple exchanges, all of which overlap – meaning you can trade this commodity pretty much 24/7 via most online brokers.

- London International Financial Futures and Options Exchange (LIFFE)

- The Minneapolis Grain Exchange (MGE)

- The CME Group

- Sydney Futures Exchange (SFE)

- Budapest Commodity Exchange (BCE)

- The Kansas City Board of Trade (KCBT)

- Marché à Terme International de France (MATIF)

- Mercado a Término de Buenos Aires (MAT)

- The Winnipeg Commodity Exchange (WCE)

As you are no doubt aware, all brokers will differ in terms of what they can offer. If there is a specific market you want to access to trade wheat, always ensure your platform of choice offers it before signing up.

How Can I Trade Wheat?

We’ve told you how wheat is valued and calculated, so now let’s have a look at the many ways in which you can trade this useful commodity from the comfort of your home.

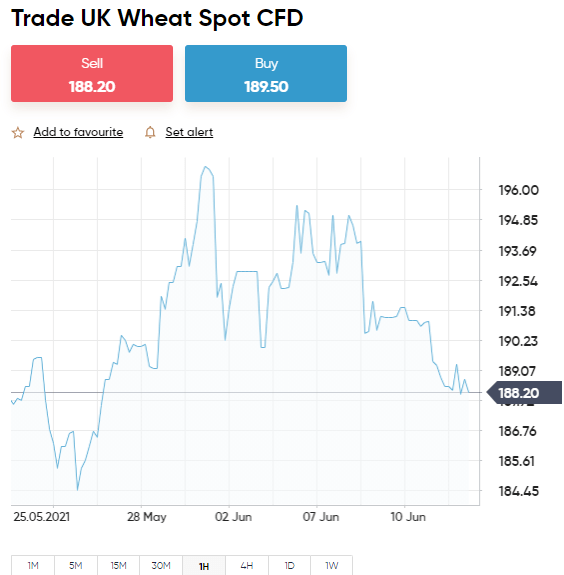

Wheat Trading: CFDs

One of the most popular ways to trade wheat is via CFDs (Contracts for Difference). The CFD will be a contract between yourself and the trading platform you sign up to. All you have to do is try to predict the direction of the asset’s market value in the short-term.

One of the benefits of trading via CFDs is that you are not required to own the underlying asset. As such, you do not need to take delivery of, and store bushels of wheat in your house!

One of the benefits of trading via CFDs is that you are not required to own the underlying asset. As such, you do not need to take delivery of, and store bushels of wheat in your house!

Instead, the CFD simply tracks the real-world price fluctuations of the asset in question. As we said, you need to speculate on the asset’s short-term price movements.

Let’s have a quick look at how a wheat CFD position would play out:

- In this scenario, the Chicago Board of Trade (CBOT) benchmark prices wheat at $6.0220 for each bushel

- 1 wheat CFD contains 100 bushels so that’s $602.20

- The value of wheat rises to $6.0663 – the price has increased by 2.28%

- In turn, your wheat CFD rises to $606.63 – also rising by 2.28%

- The same goes whether the price rises or falls – your CFD will fluctuate, along with the real-life value

Generally speaking, you should find that the vast majority of trading CFD brokers will enable you to trade wheat with 0% commission, or low rates at that. In terms of leverage, if you reside in the UK, Europe, or Australia (from April 2021) – you can apply a ratio of up to 1:10 on wheat CFDs.

For those unaware, this means that to trade with $1,000 you only need to risk $100 from your own trading account. The brokerage firm lays out the rest – comparable to ‘credit’.

For the sake of clarification, let’s have a look at another practical example of a wheat CFD trade:

- Your broker quotes the wheat CFDs at $605.00

- You speculate the price will fall below $605.00

- As such, you place a $2,000 sell order

- The value falls by 3.2% – meaning you speculated correctly

- From your sell order of $2,000 – you made a profit of $64

If, on the other hand, you had applied leverage of 1:10 on this wheat trade – you would have made gains of $640 instead. With this in mind, you should always consider the fact that leverage can magnify both profits and losses – so tread with caution.

If you are a resident of the USA, you will not be able to access CFDs as they are not permitted by the Commodity Futures Trading Commission (CFTC) or the Securities and Exchange Commission (SEC).

If a broker offers you CFDs as an American, it’s best to give them a wide berth, as they are not held accountable by a government-approved regulatory organization.

Wheat Trading: Options

Wheat ‘options’ is another form of trading where you can make gains from both the rise and fall of the price of the asset.

The key difference here is that options contracts invariably come with an expiry date – usually 3 months on each. You must speculate on the rise or fall of the value of wheat – before the expiry date comes around.

Unlike with most other ways of trading wheat, whereby buy and sell orders cement your prediction with your online broker -the orders placed when using options are calls and puts, respectively.

Let us shed some more light on wheat options with a quick example:

- You feel like wheat is going to increase above the current value

- As such, you purchase call options with a 3 month expiry time frame

- The ‘strike price’ on this position is $602.20

- You pay your broker a ‘premium’ for providing market access – this is 2.5% of the strike price

- The ‘premium’ to be paid to the broker is $15.05

- If the value of wheat goes beyond the strike price – you can purchase the asset at that price

If the contract had reached its expiry date valued at say $650.00, you would have made a gross profit of $47.80 for every contract ($650 – $602.20 strike price). You do, of course, also need to subtract the initial premium that you paid from your gross profit to get your realizable net gains.

On the other hand, if the price of wheat did not go beyond the strike price of $602.20, you lose the premium you paid of $15.05 – per contract.

In contrast to the above example, if you had thought the value of wheat would fall before the expiry date came around – you would have bought put options instead. As such, wheat trading options allow you to profit from both rising and falling markets.

Wheat Trading: Futures

There are obvious similarities between wheat futures and wheat options. They both enable traders to make gains from the increase or decrease in value of an asset, ergo – going short and long. Moreover, they both come with an expiration date.

- However, unlike with options – if the expiry date comes around on your futures trade and you still hold the contracts – you are obligated to buy or sell it.

- This doesn’t mean you will have to take delivery of bushels of wheat. Instead, modern online brokers settle these things in cash.

Wheat futures usually offer an expiry duration of 3 months, and as we said – after that time has passed you must buy or sell the asset depending on your prediction. With that being said, unless for some reason you are trading European-style futures, you can offload your contracts at any time before they expire.

This is crucial for risk management purposes and ensures you can either lock in your gains or limit your losses before the expiry date comes around.

Another contrasting feature of the two aforementioned contracts is that futures contracts do not require a premium, meaning you may need to have a hefty bankroll – or use leverage to boost your initial outlay.

Wheat Trading: ETFs

Exchange-traded funds (ETFs) are a great way to diversify your trading portfolio, with small investments. This is also a good way of buying wheat on an indirect basis, skipping past the futures market.

- You are keen to purchase wheat

- As such, you buy a WisdomTree Wheat ETF via your online broker

- This ETF tracks Bloomberg Wheat Subindex (the “Index”) on the London Stock Exchange

- You now have access to the strongest wheat companies on the planet

Furthermore, the wheat ETF is responsible for the logistics, and storage of the wheat – so you don’t have to worry about it.

It’s worth shopping around when it comes to finding a good wheat trading broker. We found that some will allow you to invest in ETFs without paying any commission at all.

Three Popular Wheat Trading Strategies

Got the gist of wheat trading and feel ready to start speculating on the commodity right now? Even so, we would still strongly advise that you first get to grips with popular strategies that are regularly used by wheat traders of all skill sets.

With that in mind, check out three of the most popular wheat trading strategies below.

Wheat Swing Trading

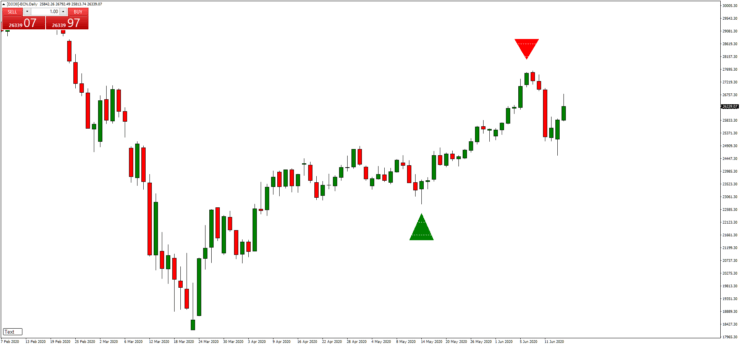

Let’s start with swing trading, which is a short-term trading strategy that heavily relies on technical analysis. When swing trading you are trying to successfully speculate on the short-term price shifts of wheat.

If, after conducting some technical analysis, you believe that the wheat trend is about to change direction – you should instead create a sell order, meaning you are cashing out your position.

Then, to ensure you profit from the impending downward market, you can place an additional sell order. As such, the overarching objective here is to stay with the wider market trend on wheat for as long as possible!

Use Support Levels

You may have heard of support levels or price levels before in the trading space. Support levels were created to give traders a clear illustration of the resistance and support pricing points in specific markets.

If you feel like the wheat trend is on its way down, then you could use a stop-level to stop the value from falling any lower than a specific point.

Alternatively, you can enter the market above the support line – simultaneously actioning a stop-loss order below that line. This is a helpful way to mitigate at least some of the risk of your position.

Wheat Scalping

Another short-term trading strategy, the main objective with wheat scalping is to make modest profits, on a frequent basis. This is achieved by entering and exiting the market multiple times in one day. In fact, seasoned scalpers often place hundreds of trades per day – some lasting for no more than a few seconds!

Scalping lends itself well to a volatile market – enabling traders to cash in on a slim price range (say $600-$620) when the opportunity arises. Wheat scalping is quite a low-risk strategy – largely because you can expect that the asset will rise above $620 or fall below $600 at some point whenever that may be.

As such, you simply need to place a stop-loss order on either side of the price range – meaning you continue to cash in on your position as long as the consolidation period is in place.

Wheat Trading Tips

Now that we’ve talked about how you can trade this commodity for yourself, we are going to offer some tried and tested wheat trading tips.

After all, when you are thinking about a new hobby or career in trading, whatever the asset may be – a strategy is invaluable. By thinking about your own trading goals, you can put together a plan to keep you on the straight and narrow.

Your wheat trading plan might be inclusive of:

- Whether you are looking to enter and exit the market throughout the day, or for days and weeks at a time

- Your premeditated risk/reward ratio on each position (a popular strategy is 1:3)

- The number of hours to spend researching

- Minimum hours per month dedicated to educational resources and learning analysis.

Read Wheat Trading Books

Whether you prefer traditional paper books, digital books or audiobooks – there is a book on just about every tradable asset class for your consideration. Reading can be a great way to inform yourself about any subject, from the comfort of your own home.

By typing ‘best wheat trading books beginners’ into your internet search engine, you will see there are lots to choose from. You can either choose one especially about wheat, grains – or commodities in general.

We recommend the latter – after all, you might want to diversify your portfolio later down the line. This is a good way to avoid overexposure to one asset class.

We’ve put together a shortlist of some of the popular books on commodities trading:

- Hot Commodities: How Anyone Can Invest Profitably in the World’s Best Market – Author, Jim Rogers

- The Little Book of Commodity Investing – Author, John Stephenson

- A Trader’s First Book on Commodities: An Introduction to the World’s Fastest Growing Market – Author, Carly Garner

- Commodities For Dummies – Author, Amine Bouchentouf

Beyond books, there are a plethora of different trading courses available on the internet, some of which are free of charge. It’s not a bad idea to check out some educational content on technical analysis, whilst you are arming yourself with useful information.

Keep Abreast With the Latest Wheat News

As we mentioned earlier, there are many driving forces behind the supply and demand, and therefore the price, of wheat.

To give you a clear indication of what you should be looking out for, we have listed some key factors likely to have an impact on your wheat trades:

- Increase or decrease in value of the US dollar

- Higher energy costs

- Unreliable or high cost transportation

- Rising incomes, particularly in developing nations

- Farmers wheat price expectations

- Changes in the weather

- Pressure from financial index investors

- Government restrictions or stockpiling

- Speculation on shortages or overproduction

If you lack the time or feel a little overwhelmed, we recommend signing up for a news subscription service – specifically aimed at traders. Via email or mobile, these providers send the latest breaking economic and financial news. This is relevant to the asset you are electing to make money on – so in this case, wheat.

Use Wheat Trading Signals

If you could do with a little bit more help in terms of hypothesizing the wheat market – why not try a wheat trading signal service. Not just reserved for newbies, signal providers also serve plenty of traders who simply don’t have enough time to conduct enough analysis.

What exactly is a wheat trading signal? Well, the signal is essentially a notification that is made up of trading suggestions like whether to buy or sell the asset (wheat), as well as ‘take profit’ and ‘stop-loss’ suggestions.

No order will be carried out on your behalf, so these signals are simply tips – all of which you can either choose to ignore, or take notice and create an order with your broker.

We at Learn 2 Trade have been offering trading signals in the online space for several years now – with over 5,000 loyal members in our Telegram group. The vast bulk of our trading signals are based on forex and cryptocurrency movements, albeit, we also cover commodities like wheat from time to time.

Utilize a Copy Trading Feature

We should start by saying that not every online broker will offer a Copy Trader feature. For those unaware, this feature enables you to invest in a trader with a proven track record and copy their portfolio measure for measure (in proportion to your stake).

You can pick a Copy Trader based on metrics such as historical trade success, risk level, and preferred asset class. You will not be the only trader copying the pro, as these Copy Traders unusually have hundreds of others also financially invested in them – as well as using their own capital.

To clarify, if they risk 1.6% of their portfolio in wheat and 0.4% in natural gas – your own trading portfolio will mirror this 2% asset allocation. eToro, for example, offers this service commission-free, with the minimum investment per Copy Trader at just $200.

Trade Wheat With Paper Money

Trading wheat with paper money is nothing to turn your nose up at. Even wheat traders with decades of experience utilize demo accounts. It’s a superb way to learn the markets and try out new trading strategies.

Not only that, but you can practice your price chart reading skills, and depending on the trading platform, switch between a demo account and real account when you feel ready.

The best demo accounts will reflect real-world market conditions, making it easier to hone in on your wheat trading skills without spending a cent.

Key Metrics: Finding the Best Wheat Trading Broker

At this point in our best wheat trading guide, you are probably eager to start trading this hugely popular commodity online.

However, as we said earlier, you can only gain access to the wheat markets through a broker. With so many good, bad and ugly trading platforms in the space, it can be hard to see the forest for the trees.

As well as listing our four favorite wheat trading brokers further down – we have also compiled a list of important factors for you to consider when electing to sign up. This allows you to find a wheat trading broker that 100% mirrors your financial goals.

Regulation

We think that choosing a wheat trading broker that is fully regulated is super important. As we touched on, there are hundreds of brokers out there, some great, but also heaps of sharks too.

Trading commodities, or any asset, can be a precarious game. As such, make sure you start off on the right foot by only entrusting your money with a licensed and respectable brokerage firm.

The most well-known regulatory bodies in the wheat trading scene include the FCA (UK), ASIC (Australia), CFTC (USA), and CySEC (Cyprus). They exist to make the trading of financial instruments safer and fairer for all involved.

Licensed trading platforms must follow a variety of strict rules. This includes customer due diligence, keeping your trading funds in a separate account, and submitting regular audits.

Wheat Trading Fees

At the risk of stating the obvious – wheat trading broker fees can really eat into your profits if you aren’t careful. This is especially the case if you sign up blind, and these fees creep up on you after committing to the platform.

Every wheat trading broker will charge different fees. However, to give you a clear idea of what you should expect, we have listed the most common below.

Commission

The important wheat trading fee that you need to look out for at your chosen broker is that of commission. This is a fee charged every time you place a buy and sell order.

For example, let’s say that you place a $1,000 buy order on wheat – and the broker charges a commission of 0.5%. In turn, your commission would amount to $5. Then, if you cash out your wheat trading position when it is worth $1,300 – you would again pay a commission of 0.5% – or $6.50.

Most of the trading sites that we recommend allow you to buy and sell wheat without paying any commission at all. Instead, everything is built into the spread – which we cover shortly.

Swap Fees

Swap fees, swap interest, or overnight financing fees are the same thing – the fee is charged by some wheat trading brokers for keeping positions open overnight.

This usually applies to leveraged trades, so it’s comparable to interest for keeping your position open out of market hours. The fee is charged daily, usually with a slightly higher rate being applicable at weekends.

Although overnight financing rates are typically low on wheat positions, if you were to keep your trade open for weeks at a time, these fees can soon add up.

Inactivity Fees

Again, not every broker is going to require this fee. But, it’s good to be aware of any potential outgoings in any new venture involving money. Some wheat trading platforms will begin to charge a monthly fee ($10 for example) after a specified amount of time of inactivity.

We find the timeframe is usually 12 months, but always read the terms and conditions as these monthly fees could clear your account if you’re not careful.

Deposit and Withdrawal Fees

The majority of online brokerage firms don’t charge for deposits and withdrawals these days. However, you may find a small charge for using certain payment methods, while some wheat trading sites will also charge for small withdrawal requests.

The best situation is that the only fee you need to pay for funding your account is a currency conversion fee. To give you an example, you might find a currency conversion charge of say 0.5% if you are not using US dollars. On the other hand, some trading platforms accept various currencies.

Platform Navigation

Platform navigation is more important than people give it credit for, especially for newbies. You could be mistaken for thinking the more a broker has on its website the better. But, on the contrary, this can just complicate matters.

Finding the asset you want to trade, and electing to create an order should be made easy for you – by the user-friendly design of the wheat trading broker’s website.

Instead, it’s advisable to choose a wheat trading site that is user-friendly for people of all skill levels. In terms of technical and fundamental analysis, you can always use a third-party platform anyway.

Deposit and Withdrawal Options

If there is a particular payment method you must use, for instance, Visa – check that the trading platform accepts it from the get-go.

You will usually find that wheat trading brokers accept a variety of different payment methods, such as debit/credit cards, wire transfers, and e-wallets like PayPal.

Wire transfers, although a completely trustworthy way to pay online, can take between 2 and 3 business days to hit your wheat trading account. This would obviously delay your first trade – so it’s best to opt for one of the instantly processed payment methods mentioned above.

Spreads

For those unaware, the spread is the difference between the buy and sell price of the asset. The tighter the spread is on wheat buy/sell prices, the better it is for you as a trader.

Much like everything else, the spread on offer will vary between brokers. We found a spread of around 0.30% when trading wheat to be competitive. Don’t forget, wheat trading spreads can vary throughout the day depending on market conditions. That is to say, during times of high volatility, the spread can and will increase.

Best Wheat Trading Brokers

We’ve divulged all of the important metrics you need to know, to get you started on the right track when trading wheat online.

We’ve also saved you a lot of online legwork by sifting through the cream of the crop of online brokers. Sure, there are tonnes of great wheat trading platforms out there, but as we said there are also a lot of wolves in sheep’s clothing in this industry, too.

Bearing that in mind, we have whittled our list of the best wheat trading brokers down to just four.

[in-content-heros-static name=”AVATrade” title=”1. AVATrade – Wheat CFDs With Tight Spreads” description=”AvaTrade has been providing a commendable service to online traders for over a decade. The trading platform is regulated by multiple regulatory bodies – such as those in Ireland (with full FCS backing), Canada, Australia and Japan – to name a few.

If you are interested in trading wheat CFDs, you won’t be short of choice on this platform, and you can apply leverage of up to 1:10, as per ESMA restrictions. In terms of spreads, AvaTrade offers clients $0.002 over market value/fixed spread. This is very competitive indeed.

You can try out strategy ideas using the AvaTrade demo account which is free for clients and comes with $100,000 virtual money. When using a demo account you will be trading in a real market environment.

Moreover, you’ll be able to utilize technical analysis, just as you would in the real-world. When you feel ready simply switch over to a real account, add some funds, and place your order.

If you find yourself out of the trading game for a while, be mindful of the inactivity fee which is payable after 3 months of not actively trading. This is charged at $50 per month thereafter, and will be taken from your trading account automatically. Not only that, but there is an administration fee of $100.

Again, if you are wheat trading on a regular basis, you shouldn’t be affected – but it’s important to be aware of all fees when choosing a broker nonetheless The minimum deposit to start trading wheat with AvaTrade is $100, and there is a selection of accepted payment methods.

This includes the usual suspects such as debit/credit card, wire transfer, PayPal, Neteller, and Skrill. Finally, AvaTrade is compatible with both MT4 and MT5 – and it also offers its own proprietary platform online and via a mobile app.

” ” pros1=”Min deposit from just $100″ pros2=”Leverage of 1:10 offered on wheat CFDs” pros3=”Useful AvaTradeGO app for Android/iPhone” cons”1=”Inactivity fees $50 per month after 3 months” cons2=”Wheat trading paper account only vaild for 21 days” cons3=” disclaimer-text=”75% of retail investors lose money when trading CFDs with this provider”] [in-content-provider-geoip operator=”13395″ cta_text=”Visit avatrade now”] [in-content-heros-static name=”vantage” title=”2. VantageFX – Ultra-Low Spreads” description=”VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs – this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

” pros1=”The Lowest Trading Costs” pros2=”Minimum deposit $50″ pros3=”Leverage up to 500:1″ ” cons2=”” cons3=”” cta-label=”Visit VantageFX” cta-url=”https://learn2.trade/visit/vantagefx” disclaimer-text=”75.26% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.”]

Open an Account With a Wheat Trading Broker Right Now

We’ve covered the fundamentals of wheat trading and offered order examples, strategies, and tips.

In this final section of our wheat trading guide, we are going to run through a basic three-step example of how to sign up with your broker of choice. Whilst the sign-up process may differ from platform to platform – the story is usually near enough the same.

Step One – Sign up With a Wheat Trading Brokerage

So, you’ve decided which trading platform you want to use. Go over to the official webpage and look for the ‘sign up’ button/link – which is usually made to stand out to new customers.

The usual run-down when signing up at a wheat trading broker is as follows:

- Enter full name, address, email address, and mobile number

- When prompted – upload a copy of photo ID such as passport or drivers license

- Later on, you may be asked some questions about your trading history and financial situation

Don’t be alarmed about being asked for such personal information. Each regulated trading platform must adhere to strict KYC (know your customer) rules, which includes confirming your identity, and in some cases what kind of trader you are.

Step Two – Deposit Funds Into Your Wheat Trading Account

That’s it, you’ve just opened your new wheat trading account. This usually takes less than 10 minutes.

You can now sign in to your new account and deposit some money. The lion’s share of online brokers will require a minimum deposit, which can be anywhere from $20 to $1,000.

Presuming you have already checked the trading platform accepts the payment method you want to use – you can now select it from the drop-down list. Next, enter the monetary value and confirm your choice to deposit funds into your account.

Note: If you want to start trading wheat straight away, avoid a bank transfer as this can take several days to process. Instead, choose from a debit/credit card or e-wallet.

Step Three – Place a Wheat Trading Order

Now the fun part. You’ve got a new account loaded with trading funds – so now you must decide whether the price of wheat will rise or fall in value.

Once your decision is made, you can place an order with your trading platform to shed some light on your desired position.

As we’ve mentioned, demo accounts are a great way to learn the wheat markets and also try strategy ideas – all for free. If your broker offers paper money accounts, you can usually switch over to a real account whenever you feel confident enough.

To Summarize

In order to get your wheat trading endeavors off to a great start, you need to have a firm grasp on how the market works. Thankfully, there are a plethora of tools available at your fingertips.

For instance, by utilizing things like technical analysis on a regular basis, you will be able to assess upward and downward trends and market momentum. Armed with all of this knowledge, you stand a better chance at speculating on the rise or fall of wheat’s short-term value.

If you fancy having a go at wheat trading, but in a more passive way – try out signal services, news subscription services, and even fully automated robots. Furthermore, there are heaps of wheat trading books and online courses to take full advantage of, many of which are aimed at beginners.

Demo accounts aren’t to be taken for granted either, so consider practicing wheat trading using paper funds instead of your own capital. On a final note, we recommend sticking with regulated brokers, to protect yourself from the many sharks in the wheat trading space.

[in-content-heros name=”AVATrade”]