It’s easier than ever for your average retail trader to buy and sell currencies on the foreign exchange marketplace. This financial arena has varying levels of liquidity and volatility. This provides both risk, and potential reward. As such, you need a good trading system in place! Looking for the best forex trading system of 2023? Stay right where you are.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

In this guide, we uncover the 10 best forex trading systems suitable for traders of all levels of experience. We also review the best brokers to facilitate your new-found forex trading systems and offer a quick sign-up guide to get started today.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Preview

If you are too busy to read the entirety of this best forex trading systems guide right now – see a quick run-through of the top 10 strategies below

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

- Forex Trading System 1: Educate Yourself on the Market.

- Forex Trading System 2: Understand Various Order Types.

- Forex Trading System 3: Actively Manage Your Risk and Rewards.

- Forex Trading System 4: Study Technical and Fundamental Analysis.

- Forex Trading System 5: Scalping or Swinging – Select Carefully.

- Forex Trading System 6: Don’t be Afraid of Leverage.

- Forex Trading System 7: Take a Hands-Off Approach to Trade Currencies.

- Forex Trading System 8: Create Your Own Forex Trading System.

- Forex Trading System 9: Practice Your Chosen Forex Trading System for Free.

- Forex Trading System 10: Select a Suitable Forex Broker.

In order to try out the best forex trading systems, you will need to register with a brokerage. Even if you already have a forex brokerage account – it’s important to assess whether or not you are getting a good deal.

Suitable Brokers for the Best Forex Trading Systems

To help you weigh up the best trading platforms on the scene right now, below you will find a selection of top-rated providers.

If you already have a brokerage account and are happy with your provider – feel free to skip this part of our guide and move straight on our list of the best forex trading systems for 2023!

1. AvaTrade – Best All-Rounder for Deploying Forex Trading Systems

AvaTrade makes our number 1 spot for various reasons. This broker makes most forex trading systems a breeze. It will offer you leverage of up to 1:500, depending on whether you qualify as a professional or retail trader. Taking advantage of this capital boost is a popular system but will also depend on your jurisdiction, for instance, EU retail clients can access up to 1:30 on major markets on 1:20 on other currencies.

Nevertheless, if you have an appetite for risk, it will please you to learn that AvaTrade enables you to trade minors and majors, as well as heaps of less liquid emerging markets. This includes the Norwegian krone, Turkish lira, Mexican peso, South African rand, Russian ruble, Israeli new shekel, Chilean peso, Swedish krona, and more. All currencies come with super-tight spreads.

Many forex trading systems require access to technical analysis. With this in mind, at AvaTrade, you can connect your broker account with MetaTrader4 (MT4). Here you will find in excess of 2,000 different indicators and other advanced tools. If part of your forex trading system is to practice for free - sign up for the AvaTrade demo trading facility. This mimics the true market conditions and contains $100k in paper money - allowing you to test drive your ideas in a risk-free way.

You can get started with a real trading account by using an e-wallet such as Neteller, Skrill, or WebMoney. You may also use credit and debit cards or bank wire transfers. The minimum deposit to begin using your forex trading system here is just $100. Signing up is easy thanks to the user-friendly design. ASIC and five other regulatory bodies license and watch over this provider and you will not pay any commission fees to trade!

- Trade forex commission-free at a minimum deposit of just $100

- Regulated in 6 jurisdictions, including the EU, Japan, Australia, and South Africa

- Dozens of forex markets and compatible with MT4 and MT5

- Admin fee charged after 12 months of inactivity

2. Capital.com – Best Newbie-Friendly Forex Broker - Deposit $20

Capital.com is one of the most beginner-friendly CFD brokers on this list. As such, if you are looking to try your forex trading strategy for the first time, but find the space intimidating - this could be the right platform for you. When trading currencies, Capital.com offers leverage of up to 1:500. But, again, retail traders are more likely to be restricted to 1:30. There are 70 currency markets to trade here in total - which is huge.

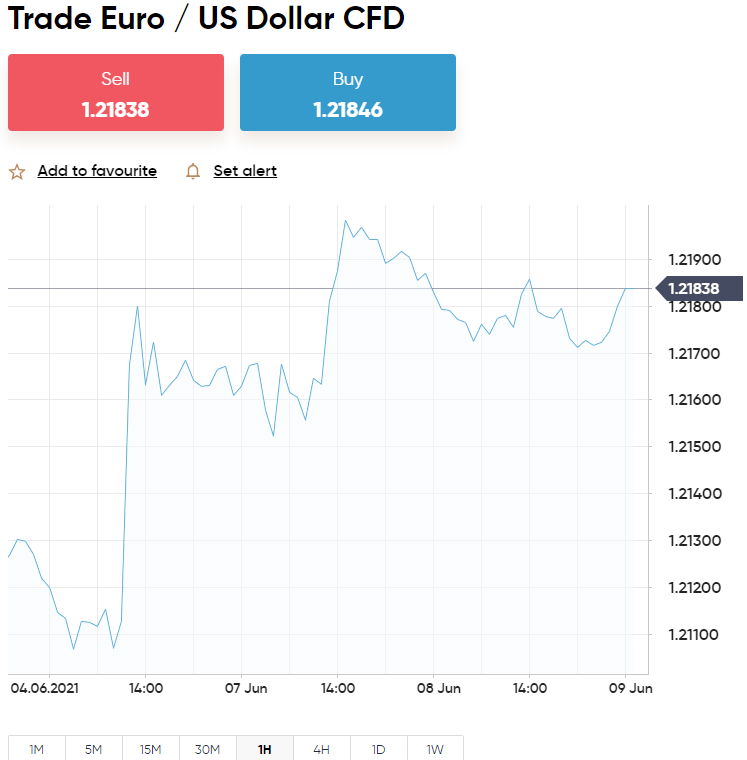

We checked the spread and found this to be tight across most forex markets. On top of majors and minors, emerging currencies at Capital.com include the Swedish krona, South African rand, Russian ruble, Turkish lira, Norwegian krone, Polish złoty, Mexican peso, Romanian leu, and more. To study technical analysis as part of your forex trading system you can link your Capital.com account to MT4. This is also where you can find a free demo account with $10,000 in paper funds.

For those starting with the simple forex trading system of educating yourself on the market - we found a plethora of material under the section 'Learn to Trade'. This includes forex guides, news, strategies, psychology lessons, and more. You can also access the broker's 3,000 plus instruments via MT4 - whereby you can put your plan into action by connecting your Capital.com account.

To get started, you will need to meet a minimum deposit of $20 - which you can do with e-wallets such as Worldpay, Apple Pay, iDeal, and more. You can also use a credit or debit card - or traditional bank transfer. The latter could delay your forex trading endeavors by days - so you're best off opting for an instant payment type. CySEC, FCA, ASIC, and NBRB regulate Capital.com, so your payments and personal information are safe from cybercriminals.

- Compatable with multiple forex trading systems

- Connect to MT4 for technical analysis tools

- Security and privacy standards according to FCA, CySEC, ASIC, and NBRB

- Lacking fundamental analysis for forex trading systems

3. LonghornFX – Best for High Leverage Forex Trading Systems

CFD broker LonghornFX provides access to leverage of up to 1:500 - even for retail clients. The platform makes it easy to use a forex trading system that requires multiple charts and indicators. This is thanks to its partnership with MT4. This guide found that there is a far-reaching selection of currencies to trade here too - not just covering major and minor pairs.

Exotic markets at LonghornFX include the Danish krone, Israeli new shekel, Swedish krona, Czech koruna, Russian ruble, Polish złoty, Turkish lira, Norwegian krone, Mexican peso, and many others. The spread appears to be competitive across all assets here. We mentioned above that you can hook your account up to MT4.

This means that you could quite easily kick-start a forex trading system reliant on forex EAs, opening multiple trades in a day, or even try your plan out for risk-free via the demo account. This is available to download via Android, iOS, PC, and Web trader. There is a small commission fee to trade currencies here, which is about $6 per full lot.

Unlike the other brokers on our list, LonghornFX one accepts Bitcoin deposits. You may also fund your account to begin your forex trading system by using bank transfer or credit/debit cards. There isn't a minimum deposit here, but it's recommended that you add at least $10 to get started.

- High leverage, tight spreads and low commission fees suitable for many forex trading systems

- Perform technical analysis using MT4 with your broker account

- Speedy withdrawals guaranteed

- Platform prefers Bitcoin deposits

4. EightCap – Trade Over 500+ Assets Commission-Free

Eightcap is a popular MT4 and MT5 broker that is authorized and regulated by ASIC and the SCB. You will find over 500+ highly liquid markets on this platform - all of which are offered via CFDs. This means that you will have access to leverage alongside short-selling capabilities.

Supported markets include forex, commodities, indices, shares, and cryptocurrencies. Not only does Eightcap offer low spreads, but 0% commissions on standard accounts. If you open a raw account, then you can trade from 0.0 pips. The minimum deposit here is just $100 and you can choose to fund your account with a debit or credit card, e-wallet, or bank wire.

- ASIC regulated broker

- Trade over 500+ assets commission-free

- Very tight spreads

- Leverage limits depend on your location

10 Best Forex Trading Systems 2023

Below you will find a comprehensive list of 10 forex trading systems worth your consideration. Each system is perfectly suited to those that are yet to create their own profitable forex strategy.

Forex Trading System 1: Educate Yourself on the Market

If you are new to buying and selling currencies, you had better believe you need to educate yourself before trying a new forex trading system.

For any beginners, we cover the basics of forex trading in brief below:

- Pairs: We trade currencies in pairs that fall into 3 categories – minor, major, and exotic. Majors always include USD and another strong market. Minors invariably contain 2 robust economies – but never US dollars. Exotics typically include 1 strong currency and 1 from an emerging nation.

- Spread: If this is your first time using a forex trading system, you should know that this is an indirect fee. In a nutshell, the spread is the difference between the buy and sell price of the pair you are trading. If the sell price is 1.1235 and the buy price is 1.1234 – this is a spread of 1 pip. If you only make 1 pip in gains – you just break even. Gains of 2 pips would result in a net profit of 1 pip, and so on.

One of the most common mistakes newbies makes is to dive into the currency markets headfirst, without understanding how they work. This usually ends in disappointment. As such, the best way to trade forex successfully is by educating yourself first.

Forex Trading System 2: Understand Various Order Types

Another key forex trading system you can adopt yourself is to gain a proper understanding of orders. There are various options to enter and exit the currency markets and knowing what each does will only enhance your experience.

- Buy or Sell Order: A buy order is chosen when you think the exchange rate of the pair will see a price increase. This is referred to as ‘going long’. You will use a sell order when you think its value will drop. This is known as ‘going short’. Crucially, if you open the trade with a sell order – you must close it with a buy – and vice versa.

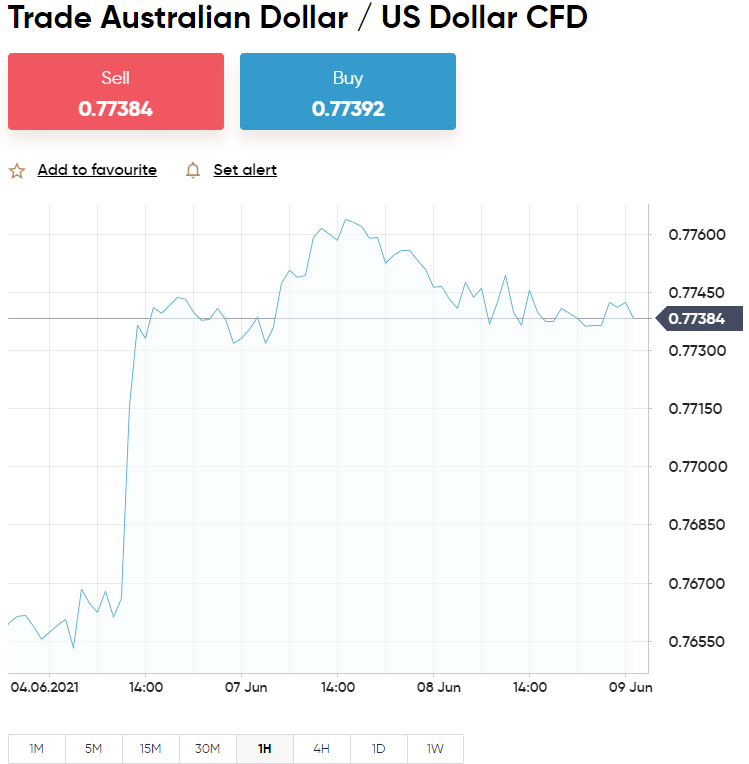

- Limit or Market Order: If you are interested in a specific pair as part of your forex trading system but don’t think it’s currently at a favorable price – you can set a limit order to enter at a value you do like. For instance, let’s say you are keen on trading AUD/USD, priced at AU $0.7762. However, you do not want to enter until it hits AU $0.7917. This is your limit order price. The broker will execute this as soon as AUD/USD reaches your desired value.

- Stop-Loss Order: Many forex trading systems use stop-loss orders. They enable you to close your trade automatically before you incur any further losses. For instance, let’s say that you want to stop your losses at 2%. -Simply place the stop-loss order 2% below your entry price for a long position, and 2% above for a short position.

- Take-Profit Order: The take-profit order is much the same as the aforementioned stop-loss order – albeit with a contrasting outcome. As such, wherever your stop-loss is, the take-profit will be at the opposite side – to lock in your gains if the trade goes your way. For example, if you want to target gains of 9%, set your take-profit order 9% above or below your entry price.

Irrespective of the forex trading system you choose – having a clear comprehension of the basics will set you off on the right foot!

Forex Trading System 3: Actively Manage Your Risk and Bankroll Management

A simple yet highly effective forex trading system is to reduce your chances of account liquidation by actively managing your risk and bankroll management.

Just one way to manage your bankroll is to consider your desired risk/reward ratio. In other words, on each position you take in the currency market, only allow yourself to allocate a certain percentage of your forex trading balance.

For instance:

- Let’s say at the time of placing an order, you have $10,000 in your brokerage account

- Your forex trading system says you can stake no more than 5% per position

- As such, your allocation to this trade must not surpass $500

- If your account contained $1,000 – your position wouldn’t be higher than $50 – and so forth

As well as adopting bankroll management on every trade – one of the first ways we can help mitigate risk is by utilizing the aforementioned stop-loss orders. This stops a bleed from turning into a hemorrhage when your forex system doesn’t go to plan.

Forex Trading System 4: Study Technical and Fundamental Analysis

One of the most commonly adopted forex trading systems on this list is to study technical and fundamental analysis.

For those unaware, there is a multitude of technical analysis tools out there and this mainly includes indicators and price charts. Unless you are planning on using a hands-off currency trading system like forex signals – technical analysis is essential for predicting the markets.

To carry this off, you will need to understand the various indicators that can illustrate trends on overbought or oversold pairs.

Some of the most commonly used indicators used for this forex trading system are as follows:

- Bollinger Bands.

- Stochastic.

- Relative Strength Index.

- Moving Averages.

- Average True Range.

- Ichimoku Kinko Hyo.

- MACD.

- Fibonacci.

Moving onto fundamental analysis, this simply entails keeping abreast with the latest economic and geopolitical developments. You will also keep your ear to the ground for any global events that could impact the value of your chosen forex markets.

This could include:

- Rising or falling interest rates.

- Employment figures.

- Changes in GDP.

- Failing or flourishing economies.

- Social or political unrest.

- Changes to the US dollar.

As you see, there is much to keep an eye on with this forex trading system. There are plenty of news sources you can sign up to if you need some help in the fundamental analysis department.

Signing up for a news subscription service means you will receive all relevant financial and economic updates via your email inbox.

Note: To avoid performing analysis altogether – you can look at a forex trading System 7. This offers a fully automated and hands-off approach to forex trading.

Forex Trading System 5: Consider Scalping or Swinging

Two popular forex trading systems to consider are scalping and swing trading. We talk about both in greater detail in the sections below.

Scalping

If you are the kind of trader that is comfortable making fast-paced decisions – scalping could be a suitable forex trading system for you. This could see you open and close anywhere between a handful and a hundred currency positions in one single day! People who aren’t overly concerned with boast-worthy forex profits tend to favor scalping – as it offers a risk-averse approach to the currency marketplace.

This forex trading system aims for modest gains – which is achieved by catching short-term price fluctuations incurred throughout the trading session. If you play your cards right, all of those small gains can make for a decent end-of-day profit. You will need to keep one eye on the markets at all times when scalping.

Swing Trading

If you like the idea of scalping but simply lack the time to use the forex trading system to maximum potential – consider swing trading. The goal is still to make money from price spikes – only, less frequently than when scalping.

In contrast, the swing forex trading system entails opening a position and holding onto it until you feel you will make decent gains from a price spike. A trade will usually be kept open for between a day and a few weeks at the most.

Forex Trading System 6: Don’t be Afraid of Leverage

Using leverage is one of the first forex trading systems people consider. The problem is, it can be a bit scary for newbies. Before considering leverage, it is important that you clearly comprehend what it is.

For any beginner’s reading, this forex trading system involves getting a short-term loan from your broker. This will take your position to the next level by multiplying it. We find this is usually capped at 1:500 for professional traders and 1:30 for retail clients.

See an example of a forex trading system that involves embracing leverage:

- You have a total of $200 to allocate to a buy order on EUR/GBP – you apply 1:20 leverage on this trade.

- As such, you are now entering the market with a trade valued at $4,000.

- EUR/GBP rises by 3% – you were right to go long.

- To cash out your profit you place a sell order.

- Without adding leverage to this trade, you would have made gains of $6.

- With 1:20 leverage, this forex trading system has created a profit totaling $120.

Crucially, leverage goes both ways. As such, if you were wrong to go long on this pair – your losses would have been multiplied by your chosen leverage limit.

Forex Trading System 7: Take a Hands-Off Approach to Trade Currencies

We have touched on passive forex trading systems throughout this guide. This is because some people either lack the time or the understanding needed to take a fully proactive role in trading currencies.

The best automated forex systems are discussed below.

Forex Trading Signals

First up is the FX trading system that uses a semi-passive approach – forex signals. This will see you receiving trading tips (usually via Telegram) multiple times per week.

Here at Learn 2 Trade, our service includes every aspect of a potentially profitable trading order.

This includes:

- Forex Instrument: GBP/JPY.

- Order: Buy.

- Entry: 159.81.

- Stop-Loss: 159.45.

- Take-Profit: 160.26.

As we mentioned earlier, some people opt to use more than one forex trading system. As such, you could even consider trying our signals service via a free virtual portfolio for a few weeks before going live. This is something offered by all of the brokers we discussed earlier in this guide.

Whether you use real or paper funds – enter the suggested elements into the order box to put it to the test. Ultimately, Learn 2 Trade forex signals allow you to actively buy and sell currencies without needing to perform any research!

Forex Copy Trading

We touched on Copy Trading in our eToro review. This forex trading strategy is to mirror another trader instead of placing your own orders. This entails choosing the most successful forex traders that use eToro themselves.

You will make your decision based on a plethora of information, such as risk rating, portfolio allocation, trading success, and past performance. You can also filter down to specific timeframes, assets, and such.

As we mentioned in our comprehensive eToro review – anything the person you are invested in decides to buy or sell will be reflected in your own trading basket! This is a forex trading system that requires virtually no work at all.

Forex Trading Robots

Would you like for your forex trading system to involve a 100% passive strategy? If so, forex trading robots, or EAs, allow you to do just that. This is automated trading software that can look for trading opportunities 24 hours a day without rest.

The software’s built-in algorithms are designed to read charts and understand indicators and then place forex orders on your behalf. You should only use this type of forex trading system with a regulated brokerage offering access to MT4. This includes the likes of AvaTrade, Capital.com, and LonghornFX, for example. All of which permit EAs at the click of a button.

Forex Trading System 8: Create Your Own Forex Trading System

Have you thought about designing your own forex trading system? In doing so, you’ll have full control over the strategies deployed, types of FX markets targeted, and risk/reward levels.

See step by step instructions below:

- Step 1 – Pick at least one timeframe: The timeframes you choose will depend on what type of forex trader you are. For example, will you be swinging, scalping, or day trading? Swing traders tend to view 15 – 60 minute or 1-week charts. Scalpers are more likely to select 1 – 15 minutes. Day traders might opt for a timeframe of anywhere from 15 minutes to a week.

- Step 2 – Choose trend identifying indicators: One of the most commonly used indicator types for spotting trends is the aforementioned ‘moving averages’. You can use several at a time, meaning you might have one that shows short-term (which will be faster) and one that illustrates long-term (slower). This would be called a moving average crossover and is one of the simplest ways to identify a new trend.

- Step 3 – Find indicators that validate trends: To avoid what’s known as a ‘false trend’, you can also gain insight from confirming indicators such as the (Moving Average Convergence Divergence), and RSI (Relative Strength Index).

- Step 4 – Determine your risk: A good addition to any forex trading system is to think about your thirst for risk and how much you can realistically afford to lose. Once you have decided, you can incorporate your risk-reward ratio into every forex trading position from here on in.

- Step 5 – Clarify your entry and exit plan: Whether you prefer to sit it out until the candle has closed before you enter the market, or are happy to do so the moment your indicators align is up to you. Less aggressive currency traders tend to wait until the candle has closed because you have the bigger picture. Think about your exit from the trade also. Would you rather use a trailing stop or exit once your pre-defined target is reached? Another option is to opt for a fixed-risk approach of using an equal number of pips on each position.

Make a note of your forex trading system design and stick to it. This will aid you in keeping your finances and trading emotions in check! You can also put your plan to the test by using a free demo account – which we talk about next.

Forex Trading System 9: Practice Your Chosen Forex Trading System for Free

Something you may not have considered is to deploy your forex trading system without risking any money. It’s important to ensure that the broker of your choice is also a forex demo trading platform. All 5 of the providers we reviewed earlier will provide you with a paper trading account to strategize with.

Pretty much any forex trading system you think about using will work via a free demo account. For instance, if you are keen to take advantage of everything MT4 has to offer – you can also learn technical analysis and try automated trading via a risk-free virtual portfolio.

At eToro, you will be provided with $100,000 in virtual equity on a portfolio that doesn’t expire! We found switching between the real and demo account to try different forex trading systems to be fast and stress-free.

Forex Trading System 10: Select a Fitting Forex Broker

Last but by no means least – any forex trading system should start with choosing a suitable broker for the task! The provider in question will be looking after your trading capital and executing orders to ensure you enter and exit from the market in a timely manner.

With this in mind, we thought we would divulge the key elements that every broker worth your time should offer:

- Licencing: The licenses provided by regulatory bodies ensure that online brokers stick to strict standards such as customer due diligence, client fund segregation, frequent audits, and much more.

- Tradeable forex markets: There aren’t many forex trading systems that don’t benefit from having a broker with a wide variety of currency pairs available. As such, always check what markets you will have access to before joining.

- High leverage: By high leverage, we mean a broker that can provide you with the maximum that your jurisdiction permits. As we said, all 5 platforms discussed today offer high leverage limits.

- Low fees: Low fees are essential when it comes to successful forex trading. Fees come in all shapes and sizes and usually consist of commissions, overnight financing fees, and spreads. All of the brokers we talked about today offer super low fees and some are 100% commission-free.

- Trading tools: Are the tools and features compatible with your chosen forex trading system? For instance, if you wanted to utilize an EA – you will need an MT4 compatible platform to facilitate this. If you want to copy a trader passively, you could try eToro’s Copy Trader feature.

- User-Friendly Platform: Irrelevant to which forex trading system you choose, it’s crucial you can comfortably find your way around your broker’s dashboard to place orders with ease,

Now that we have covered the best forex trading systems of 2023 – we will now run you through the process of how to sign up with a broker to enter the currency markets.

Try a Forex Trading System Today: Sign up in 5 Simple Steps

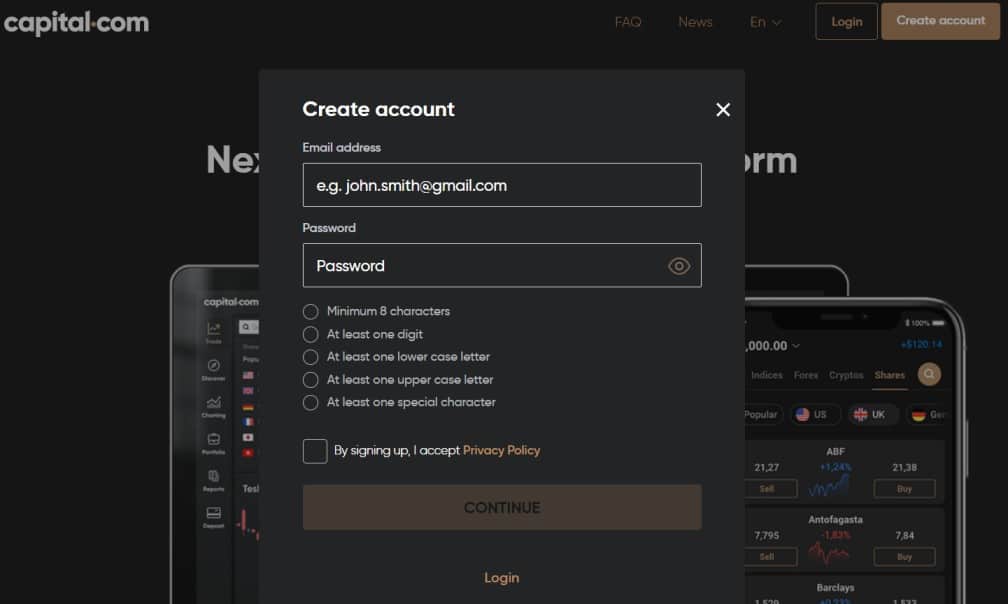

To try a forex trading system today – follow this simple sign-up, using Capital.com for its simple interface, low fees, and regulated status.

Step 1: Join Forex Trading Platform

Go to the Capital.com website and click ‘Create account’ to reveal the below box.

Enter your name, email, and other required information. Next, press ‘Create Account’ to get the ball rolling to use your forex trading system.

Step 2: Send KYC – Proof of ID

Next, you will need to follow the link from within the email and complete your account. To do this, upload a clear copy of your passport or driver’s license.

You can validate your address with a bank statement (you may use a digital copy). You can get started without this documentation but will need to finish this step before making a withdrawal.

Step 3: Make a Deposit

You can now fund your account to make your forex trading system a reality. Capital.com is compatible with credit and debit cards, e-wallets, and bank transfers.

Enter the amount of money you wish to fund your account with, select a payment method – then press ‘Deposit’ to confirm.

Step 4: Find a Suitable Forex Pair to Trade

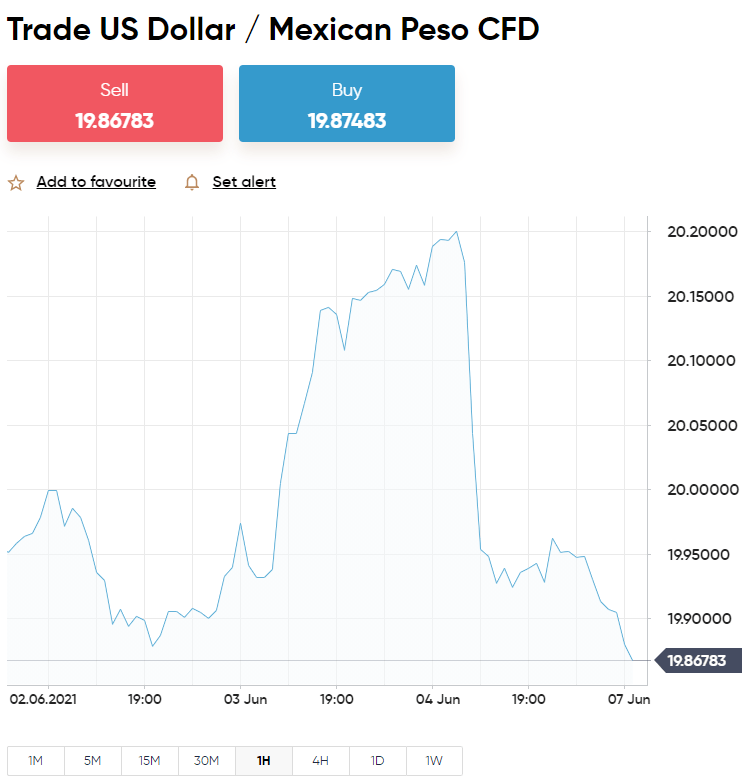

Finding a suitable currency pair to get the ball rolling on your forex trading system is a breeze at Capital.com. Here we are looking to trade US dollars against the Mexican peso.

Press ‘Trade’ and an order box will appear.

Step 5: Place an Order – Kickstart Your Forex Trading System

At this point, you can kick-start your forex trading system by placing your first order. We are going long on USD/MXN.

Conclusion

The best forex trading system for you will depend on your own goals. This could see you watching the markets throughout the day and scalping small frequent profits. Perhaps you are better suited to the hands-off approach of Copy Trading, in which case Capital.com is the best broker for the strategy.

Don’t be afraid to use leverage to boost your stakes, AvaTrade will offer you as much as 1:500 depending on your profile and country of residence. Including a stop-loss and take profit order on every FX position is essential for a forex trading system that involves managing your bankroll and risk – as all should.

Finally, it’s crucial that you include learning the complexities of technical analysis within your forex trading system – to give you the best chance possible at predicting market sentiment and forthcoming trends.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

FAQs

What is the best forex trading system 2023?

What is the most profitable forex trading system?

What is the easiest forex trading system?

Can I design my own forex trading system?

Can I use a forex trading system at night?