Corn has been domesticated and traded as a commodity since the dawn of agriculture. It started in Southern Mexico, found its way to Europe in the 1400s, and is now a multi-billion dollar trading scene.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

As such, with its many facets and applications, corn continues to be high in demand in all parts of the world. With that said, for a beginner entering the commodity market, trading corn comes with numerous challenges.

[forex_table id=”2796″]Much like any other asset, corn is no stranger to volatility. You also have to be aware of its seasonal characteristics that will drive the price up and down. On the flip side, corn can also give you the upper hand by protecting you against inflation.

With these attributes in mind, we have prepared a guide to give you a comprehensive idea of trading corn. We will cover the fundamentals of effective strategies and introduce you to the best corn trading brokers active in the online arena.

[in-content-heros name=”main-banner”] [in-content-provider-geoip operator=”18731″ cta_text=”Visit eightcap Now”]

Corn Trading Fundamentals

The concept of corn trading simply means to buy or sell in order to make a profit. The action you choose is determined by a variety of market factors that steer the asset’s price. Often, the key is to foresee the supply and demand of the item in the market.

- You speculate on the price of corn, whether it will rise above its current value or fall.

- You tell your chosen corn trading broker what type of order you want to place.

- A buy order is utilized if the price is expected to increase, or a sell-order if you foresee it to fall.

- If your prediction is right, you stand to generate returns on your position.

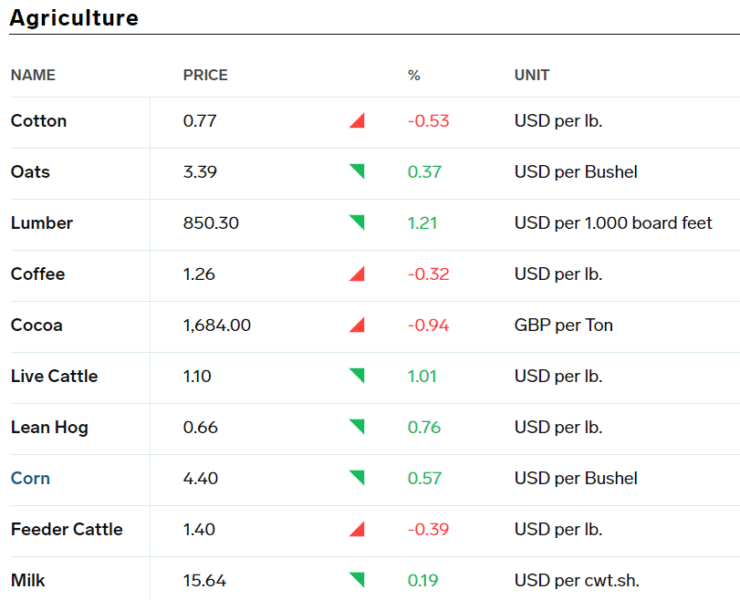

Corn trading falls under the broad category of commodity trading, alongside natural gas, crude oil, or coffee. In terms of the fundamentals, commodities such as corn are considered a way to diversify portfolios beyond conventional financial instruments.

The price of commodities often tends to be inversely proportional to stocks, making it an appealing asset during times of market volatility. While corn holds all these advantages, like other agricultural commodities, there is also a prime concern.

That is to say, grains such as corn can prove to be very volatile during the summer months or due to the weather’s unpredictability. Professional traders analyse the corn trading market by evaluating the supply against the population growth to profit from the rising commodity prices.

In the past, for the very same reasons, commodities trading required a thorough knowledge of the sector, expertise, money, and time. Now with the space moving online, you can indulge in corn trading directly from your phone or computer.

As such, not only can you access commodity brokers online, but you also have a treasure trove of resources right at your fingertips. Additionally, online corn trading also offers the advantage of applying leverage.

How much leverage you can get will depend on your country of residence and of course – the broker itself. For instance, non-gold commodity trading is capped at 1:10 in the UK and the EU. This implies that if you have only $100 at your disposal, you can get a stake ten times its worth. In this example, you can trade with $1,000, even though your account balance shows a future of $100.

Now, whether you decide to buy or sell, traders will devise a number of strategies that work for corn. These range from day trading, swing trading, trading with CFDs, and more. We will get into more detail about this in the later sections.

For now, we are going to give you some more background information on the factors that influence the wider market sentiment of corn.

What Determines the Price of Corn?

In a nutshell, the market price of corn increases when there is more demand than the supply available. At the other end of the spectrum, if supply outweighs current demand, the price will decrease respectively.

Though an agricultural commodity, corn has become more than a food product, not least because it is also a highly valued fuel source. In fact, approximately 40% of corn production is used to produce ethanol, an essential ingredient in gasoline production.

It is also deemed an alternative source of energy. Consequently, corn’s price is correlated with that of ethanol, gasoline, imports, exports, and weather changes.

Ethanol Market

Ethanol has become a major reason for the demand of corn. As each year passes by, this demand is expected to rise further. Crucially, this means that corn prices move in a close relationship with that of ethanol.

With the rapid expansion of ethanol production, the demand for corn has also grown tremendously. With this in mind, many governments, including the US, provide subsidies for corn growers. Ultimately, in the event that the demand for ethanol is to expand, so will the prices of corn.

Crude Oil

As corn has grown as a major ethanol energy source, its price is also correlated to crude oil. After all, this is the primary feedstock for gasoline production. Crude oil is also an input used by farmers in terms of diesel and gasoline to power farm machinery.

In other words, most energy consumed on a farm is heavily reliant on crude oil. As the price of crude oil increases, it will also result in a more expensive production process and thus – a resultant increase in the price of corn.

Another way to look at it is that ethanol is marketed as an alternative biofuel to gasoline. Thus, the price of ethanol will also have to be competitive. This will drive the price of corn, with direct correlation to that of ethanol, which in turn might vary alongside crude oil.

This correlation, however, has disparities. This is primarily because the biofuel industry is still evolving. This association might become more steady and significant as the biofuel industry evolves. Nevertheless, the current landscape is indeed prone to short-term changes. And traders who want to keep tabs on corn prices should also look into the oil market.

Weather

Weather and climate can have a significant impact on all crop growth, including corn. Even moderate changes in weather can result in the number of extremely hot days in the growing season.

The US Dollar

Being the reserve currency of the world, the US dollar plays an influential role in most commodity pricing mechanisms, including corn. It is also the most stable foreign exchange instrument, making it the preferred currency used for the international exchange of corn.

When the dollar drops against other currencies, it will require more dollars to buy corn. Those who sell corn stand to make more dollars when the currency is weak.

In simple terms, the US dollar shares an inverse relationship with the price of corn. Since the United States is also the leading global corn producer, it is unlikely that corn will be traded in any other currency for the foreseeable future.

Geopolitical Issues

Corn production is not uniformly distributed across the world. The US dominates the sector, followed by China, Brazil, Argentina, Ukraine, and India. The top producers are also often viable to geopolitical crises determining the price of corn.

For instance, the 2014 crisis in Ukraine sent the price of both corn and wheat soaring. Being the largest exporters of the crop, the socio-economic conditions in any of these countries could have a short-term impact on the price of corn.

Historically, the global economy will also have an effect on corn. Booming economies mean higher prices, whereas weak economies lead to falling levels.

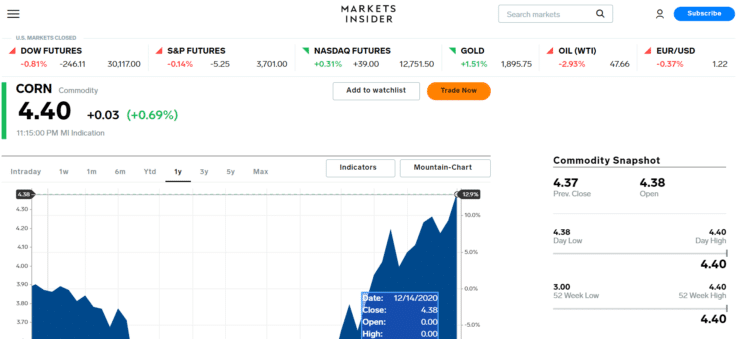

How is the Price of Corn Calculated?

As we mentioned just a moment ago, corn is quoted in US dollars primarily. If you are trading locally, you might also find a market traded against the respective economy.

While measuring in units, corn is weighed in metric tons or bushels. 1 Metric ton equals 39.3679 bushels of corn in standard conversion.

Though you will be dealing with US dollars, it will not hinder you from trading corn from any part of the world. If you are a resident of a country with another currency, your trading platform will help you exchange it for US dollars. It can be done entirely online, meaning you can begin your corn trading journey with ease.

When Does the Global Corn Trading Market Open?

You can engage in corn trading electronically almost 24 hours a day. The catch is, you will need to trade across the globe through an online broker who has access to multiple trading markets.

Let’s say you are trading corn through the Chicago Board of Trade (CME Group), Bombay Stock Exchange, or the London Commodity Exchange. This means that when one market closes, the other will open.

How Can I Trade Corn?

As you guessed, it is not always possible to trade corn in its physical form. Instead, you will be using different financial instruments that represent the value of corn.

This includes the following:

Corn Trading: CFDs

CFDs stand for Contracts for Differences; a derivative instrument that allows traders to speculate on corn prices. When trading through CFDs, you will not own the asset as such. Instead, the CFD value will be calculated as the price difference between the time you enter the trade and its current cost.

The main advantage of trading through CFDs is that there is no need to purchase futures or options. CFDs will reflect the real-world price fluctuations, whether it goes higher or lower.

- Say you enter the corn trade using CFDs at the current price of $4.25

- The price of corn soon rises to $4.50

- There is a 5.8% price increase that applies to your CFD

- If there is a price drop, let’s say to $4.00, that will be a price decrease of 6.2% on your CFD position.

Since CFDs are commonly traded, most brokers will also allow you to apply leverage on them. As noted earlier, you can often get at least 10x leverage on your corn trades.

Let us see how CFD example above will work with leverage of 10x.

- The trading platform has corn priced at $4.25

- You speculate that the price is going up

- You decide to trade $100 via buy order

- As such, the value of your trade is now worth $1,000

- The price of corn goes up by 5.8%. Ordinarily, this would give you a profit of $58

- However, since you applied leverage, you would make 10 times this figure – taking your actual profit to $580

But, you will have to remember that the above leverage concept also applies if you make losses too. In other words, these losses will be magnified by the leverage ratio you decide to apply.

While CFDs are available in most countries, including Europe, the UK, Australia, and New Zealand, there are also nations that prohibit them. Most notably, if you are a resident of the United States, you will not be able to find a regulated exchange that offers CFDs.

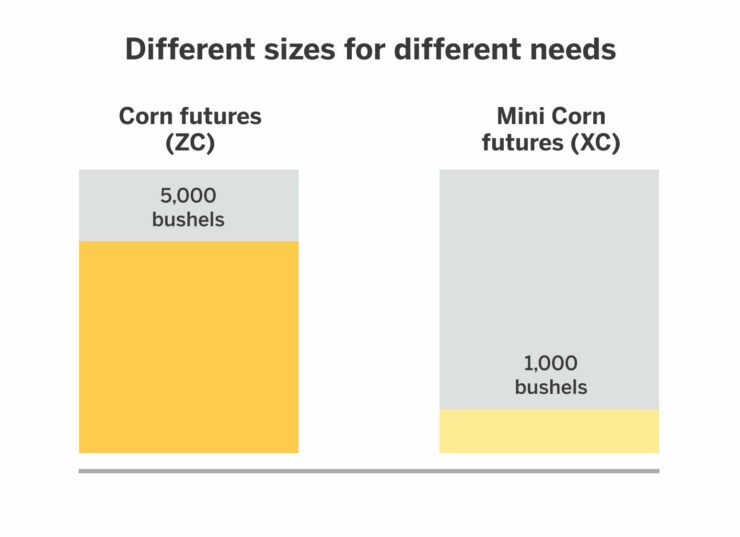

Corn Trading Futures

Futures contracts are one of the most commonly used means of commodity trading – and corn is no different. For those unaware, futures are a contract agreement between two parties to engage in a trade at an agreed-upon price and an expiry date.

Usually, corn futures contracts are valid for three months. That is to say that by the end of three months, you are bound to buy or sell the asset, regardless of whether the market is in your favour or not.

Futures are easily comparable to CFDs, albeit, the main difference being the attached expiration. This is because you can apply leverage and choose to go long or short with both corn futures and CFDs. But, the advantages are not the only parallels. Futures are also precarious and are recommended only for experienced traders, as there is always the chance of losing more than what one originally invested.

Corn Trading Options

Options are similar to futures, except that there is no obligation to execute your trade at the point of expiry. In other words, when the contracts expire, you have the right but not the obligation to proceed with the purchaser or sale.

There are two ways of dealing with corn options. You buy a Call option if you want to go long and a Put option if you’re planning to go short. Much like futures, the expiry date on options is usually three months. However, you can also find markets with both a shorter and longer duration.

Now, at what point will you need to execute the trade will be based on a set of predetermined price levels. These are known as Strike Prices. Let us provide you with an example.

- Imagine you choose an option with a strike price of $20 per bushel.

- If it is a call option, this means you have the right to buy corn at $20, no matter what the current market price is.

- On the other hand, a put option will give you the right to sell corn at $20.

Another trading strategy using corn options is the Option Spread. This is created concurrently selling and purchasing corn options but with distinct strike prices. It can also be carried out with corn options that have separate expiration dates.

We have an example here that will give you a clearer idea of how corn options work in practice.

- You buy a call option that is set to expire in 2 months

- The strike price listed is $2.5 per bushel

- This means that you expect the corn price to go up on or before the two-month cut-off period.

- Your online broker charges you 5% as the premium to access the market.

- This amounts to 5% of the $2.5 strike price, which is $0.125 per contract

- If the minimum order is 100 contracts, you will need to pay a total premium of $125 on the corn call options.

Now, the price of the corn could exceed the strike price, leaving you with the option of buying them. Let’s say corn is then valued at $3.00, which means you made a $0.5 gain on each contract.

If, however, the price fell as opposed to your predictions, you can simply choose not to purchase the contract on expiry. In turn, you will lose the premium amount you put upfront – buy nothing more.

The same applies to put options as well, only that you are hoping for the price of corn to go down. All in all, compared to corn futures, options come at an advantage of the ability to limit potential losses.

Corn Trading: ETFs

Exchange-Traded Funds (ETFs) are common in the commodity trading scene, as they are suitable for long-term investments. These are financial instruments that track the movements of corn in real-time.

ETFs are considered the way to invest in corn indirectly, meaning you are speculating on the commodity increasing in value over several months or years. The most prominent corn ETF is that of the Teucrium Corn Fund.

Three Popular Corn Trading Strategies

In order to make profits when corn trading online, you not only have to be informed of the market, but you also need the right strategies. As you gain experience, the strategies you employ will evolve. For now, we will introduce you to the three most common tactics that will stay relevant regardless of your trading proficiency.

Corn Swing Trading

Swing trading is a short-term strategy where the trader attempts to predict market variations of an asset caused by “swings” or oscillations around the predominant trend line. You will be buying or selling assets as it nears the tip of the up or downswing.

This type of trading typically remains open for more than a day, but for a maximum of a few months. You will be following the broader trend, but for a shorter period.

The key of swing trading lies in technical analysis, in forecasting if the price of corn is about to take a swing in the other direction. For instance, let’s say the price of corn has been rising steadily. As such, you place a buy order to ‘catch’ the trend for as long as it remains in place.

A few weeks later, you believe that the price of corn is about to hit a ceiling, so you exit the position by placing a sell order. If and when your prediction comes to fruition, you would then place another sell order to that you can catch the downward swing.

Study Support and Resistance Levels

Support levels indicate the point at which the price of corn is likely to remain above. In other words, it is a historical price point that generally speaking, will prevent the value of corn from dropping any lower.

By understanding what support lines are associated with corn, you can enter a buy position just above.

Crucially, by following the support and resistance levels, traders can keep an eye out for potential profits when trading corn online. Alternatively, if you want to wait beyond the respective level, you can place a stop-loss order. This will limit your risk in case the price of corn continues to rise or drop further.

Corn Scalping

Scalping is a trading strategy that targets small changes in the price of corn. This means that a trader will be placing multiple trades in a day to merit from the minimal differences in prices.

Scalping is particularly useful for trading commodities, as the market is typically home to volatile conditions throughout the day. Plus, liquidity is generally high, too.

However, scalpers also have to have strict exit strategies, since you have more to lose from one large loss than what you gain from multiple smaller profits. Since the gains are also moderate, you want to work with trading platforms and brokers that offer the tightest spreads and zero commissions.

Corn Trading Tips

Corn trading is not so different from stocks or forex trading. Many of the strategies are relevant, and so are the learning techniques. We recommend that you educate yourself more on the corn sector so that you are armed with all the necessary information you need to make informed trading choices.

Here are some ways you can improve your corn trading strategies and keep abreast with the current market trends.

Read Corn Trading Books

What better way than to learn from the experts with tons of experience in the industry? Trading professionals have managed to create guides that offer insight into their strategies and insights.

A quick internet search will reveal to you some of the best books on corn trading that can help you pick up tips and tricks of those that have succeeded in the space.

To get you started, we have a list of the most notable books in this genre.

- Mastering the Grain Markets: How Profits Are Really Made by Elaine Kub

- A Trader’s First Book on Commodities by Carley Garner

- Commodities For Dummies by Amine Bouchentouf

- The Little Book That Still Beats the Market by Joel Greenblatt

You do not always have to narrow down the niche to corn trading per-say. More generalized books on commodity trading can also offer you an invaluable understanding of how to evaluate the market and make a profit off of corn.

If you are not a fan of reading, then you can also look into an online course that focuses on corn trading. You will also find plenty of resources on dedicated trading sites such as ours!

Bear in mind that along with the market, the strategies and techniques of corn trading will also evolve alongside it. So it is paramount that you continue your trading education irrespective of whether you gain experience or not.

Stay On top of the Corn Market

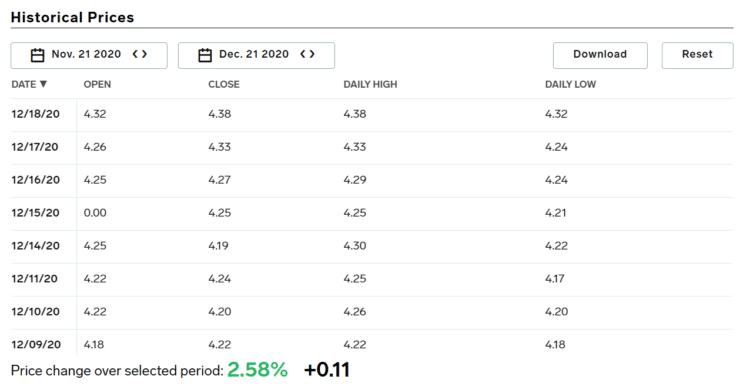

Any trading strategy can be based on the two main analytical components: fundamental analysis and technical analysis. Put simply, doing thorough market research falls under the first category.

This entails keeping track of the socio-economic issues, political landscape, and financial outlook on a global level. In addition, you will also have to follow the weather or any other attribute that will influence the production of corn and its place in the market.

You might be thinking that this fundamental analysis encompasses almost every type of news and will demand all your time. That is why there are platforms devoted to delivering the relevant info to you in real-time. Aside from news resources, these subscription services will scour the information from multiple sources and provide you with your preferences.

You can stay informed through alerts by email or the respective app. That doesn’t mean you do not have to do the research yourself. It will be helpful if you follow Yahoo News, CNBC, or the likes of The Economist to stay updated on current affairs.

Technical Analysis

Earlier, we mentioned that strategies such as swing trading use technical analysis as a critical source. In comparison to fundamental analysis, this approach is more complex and challenging for new traders. In fact, it might even take years for some traders to completely understand technical analysis and use it to their benefit.

Technical analysis combines several charts and indicators specific to your commodity, in this case, corn. Investing your time and effort in technical analysis will give you a better chance at speculating the volatility of an asset – especially in terms of short-term trading.

To give you an example, a trader can review the historical price charts and draw conclusions on the support and resistance levels of corn. They can also help you predict the trend swings corn might take based on this historical data.

Use Corn Trading Signals

At this point, both the fundamental as well as technical analysis might seem overwhelming to you. But don’t worry. We have a solution for that as well. The alternative is to try a corn trading signal service.

With a signal service, you will get trading suggestions based on the current market analysis. In effect, you will receive insights on trade indicators and how to place orders to benefit from them, all without having to do the research yourself. Some trading signal services also send you the trading analysis alongside so you can verify their signals.

Learn 2 Trade is one such provider that offers signals. Most of our insights follow forex and cryptocurrencies, but we do cover commodities like gold, oil, and corn when an opportunity arises, too. The Learn 2 Trade signal service is an excellent option if you do not have sufficient time to perform market analysis on your own.

Take Advantage of Copy Trading

Copy Trading features work exactly as it sounds. This tool will allow you to copy other trader’s corn strategies into your own portfolio. But these measures will be mirrored on yours only in proportion to your stake. You will be investing in this corn trader in return for their personal trading strategies.

As simple and effective as this might sound, only a few online brokers offer this service. When they do, you can choose a corn trader based on the performance metrics. You can check up on their track record of success, the risk ratio, and their dominant financial instrument. But note that there will be other traders like you copying the same investor for their experience.

One of the most reputable online brokers with this functionality is eToro, where the trades are commission-free, and a minimum investment of only $200 per trader you want to copy.

Use a Demo Account

Beginner traders will also be pleased to know that several online brokers come with the advantage of demo accounts. These allow you to practice corn trading, but with paper money and no risk. Actually, even experienced traders use demo accounts to try and test their new strategies.

But for amateurs, in particular, these demo accounts are excellent to practice analysis skills, apply insights, and evaluate the risks. They reflect the real-world market conditions and will prepare you for the challenges of the real corn trading arena.

You can start with a real account when you feel ready. However, depending on the broker, there will be a limit on the amount of paper money at your disposal.

Key Metrics: Finding the Best Corn Trading Broker

From all the points we discussed above, it is obvious that you need the right online broker who can give you access to the right resources and trading platforms. As eager you are, this is one of the most significant decisions of your trading career.

With the wrong broker, you will be putting your capital at risk. However, with all online brokers and their smart advertising, it is becoming increasingly confusing to make the right choice.

Regulation

There is no compromise with the number one item on your checklist – regulation. The internet is flooded with brokers who claim to have attractive packages but at the cost of unregulated trades. This will put you in a position of risk at all times.

Your first job is to ensure that the broker of your choice holds itself accountable to one or more regulatory bodies. The most common are the FCA in the UK, ASIC in Australia, CySEC in Cyprus, and the CFTC in the US. These bodies authorize brokers in order to facilitate safe and fair trading for all involved parties.

This means that your licensed corn broker should adhere to a number of strict rules that range from your trading funds’ security, submitting to regular audits, and due diligence to all their customers. As there is enough risk involved in corn trading, you do not want to further it by choosing an unregulated trading broker.

Corn Trading Fees

As evident, online brokers make money through numerous types of fees, they execute trades on your behalf. If not careful, these fees could quickly mount up and eat away at your profits.

There is no way to avoid such costs, so you should have a firm understanding of each fee category and how exactly you are getting charged by the broker.

This includes:

Commission

There is no standardized rate of a commission set for brokers. While some charge you a flat fee for each trade, most platforms stick to a commission fee in the form of a percentage.

For instance, say you sign up with an online broker with a 1% commission on corn trading.

- You risk $100 on a particular corn trade.

- At 1%, you will be paying $1 to the broker as commission.

- If your trade closed at $120, you will be charged $1.20.

Not every broker charges commissions. Many allow you to take part in CFD trading on a commission-free basis. In such cases, you also have to make sure that their spread is not too hefty.

Spread

The spread is a term you commonly come across in all trading departments. In practice, it is the variation between the buy and sell price of corn. This translates that the tighter the spread, the less you pay. The spread on corn trading will also vary highly from one broker to another.

Spreads are built around the current market prices of corn. Sometimes the spread will also be volatile along with the market conditions of the commodity. Like the commission, the spread is also best calculated as a percentage. In all cases, you are looking to get spreads as low as possible without compromising any other online brokers’ features.

Swap Fees

Swap fees are also commonly known as overnight financing fees or swap interest. This fee is applicable if you keep your corn trading position open overnight. Swap fees are charged daily, and sometimes, at a higher rate for the weekends.

Though commodities like corn often come along with relatively low swap fees, this can add up quickly. As such, if you are planning to keep a position open for a week or longer, you have to watch out for swap fees.

Inactivity Fees

Some brokers will also charge you an inactivity fee if your trading account stays inactive over a specified time. The duration is usually one year, beyond which you will be charged a small amount every month.

Again, this is another possible means of the unnecessary fee you will have to pay. This exerts the significance of reading the terms and conditions thoroughly when you sign up.

In this case, you can avoid the fee merely by closing your account if you do not wish to continue trading with the particular corn broker.

Deposit and Withdrawal Fees

While the majority of corn trading brokers will not charge you a fee for deposits, you might be required to pay for withdrawals. In addition, certain payment methods will also attract an extra fee.

If, for example, you are trading in a different currency than in your deposit account, this will involve a currency conversion fee. This, again, will depend on the platform and its policies regarding accepting various currencies.

Platform Navigation

Having a good user experience is something that many people still tend to overlook before signing up to a corn trading broker. But once you do, complicated navigation might make it difficult for you to merit from the platform’s full features.

This is particularly significant if you are new to using online resources for your corn trading endeavours. As most corn brokers come with demo accounts, now you can easily access them to understand how it will feel to handle the platform.

Deposit and Withdrawal Options

Most online corn trading brokers give you the option for multiple payment methods. This includes credit cards, debit cards, wire transfers, and third-party e-wallets such as PayPal.

If you have a preference, you should make sure that your broker offers the payment method in question. It is also vital that you verify how long it will require the online brokerage to process your payments.

Best Corn Trading Brokers

Now, coming to the most awaited part of this guide. We have laid out all the important parameters to introduce you to corn trading and what you need to be wary of. While these offer plenty of wisdom, finding the best corn trading broker is still hard work.

To save you some time, we have done the heavy lifting and narrowed down the five best corn trading sites to consider in 2023.

[in-content-heros-static name=”AVATrade” title=”1. AVATrade – Trade Corn CFDs With Tight Spreads” description=”AVATrade has a longstanding reputation in the online trading arena. With a global outreach, the online broker is also regulated to offer the services under FSA, IIROC, BVI, FSCA, ASIC, and many more.

For corn trading, traders can get leverage as high as 1:200 on this platform. However, for those who are based in the UK, the leverage will be capped at 1:10.

AVATrade is also prominently known for being technically advanced. It integrates seamlessly with third-party software, so you will have no trouble working with MetaTrader 4, DupliTrade, or can go for the exclusive AVAOptions.

In addition, the spreads on commodities are also quite competitive. If you need access to the platform on the go, AvaTradeGo, the mobile app, will make it easier for you. You also get access to a demo account for a limited number of days.

” ” pros1=”Min deposit $100″ pros2=”Leverage of 1:10 on commodity trades” pros3=”AvaTradeGO mobile app” cons”1=”Inactivity fees are costly” cons2=”Free commodity trading demo only valid for 21-days” cons3=” disclaimer-text=”75% of retail investors lose money when trading CFDs with this provider”]

[in-content-provider-geoip operator=”13395″ cta_text=”Visit avatrade now”] [in-content-heros-static name=”capital-com” title=”2. Capital.com – Commission-Free and Competitive Spreads on Corn” description=”

Licensed under FCA, CySEC, ASIC, and NBRB Capital.com is another perfectly feasible online broker for trading commodities. The highlight of this platform is the zero commission on all assets. You can also trade commodities on leverage, but it will be capped at 1:10 as per the ESMA limits.

All you need is a minimum deposit of 20 dollars, euros, or GBP based on your payment method. Capital.com also offers a competitive spread for traders. Sometimes, the spread could go as low as 0.04% but could always vary along with the market.

” ” pros1=”Trade commodities commission-free” pros2=”Competative spreads” pros3=”Regulated by the FCA, CySEC, ASIC, and NBRB” cons1=”

” cons2=”” cons3=”” cta-label=”Visit Capital.com” cta-url=”https://learn2.trade/visit/capital-com” disclaimer-text=”78.77% of retail investors lose money when trading CFDs with this provider”]

Open an Account With a Corn Trading Broker Right Now

We have covered almost every fundamental aspect of corn trading. Now, all you need is to take your pick and sign up on a trading platform. It involves only three simple steps.

Step One: Register With an Online Corn Trading Broker

Once you have finalised your choice of broker, you can start using their services by signing up on the site. The process is quite similar to creating an account on any other website.

The only difference is, this being a financial broker, you will also need to provide some personal information. This is in accordance with KYC (Know Your Customer) regulations and to prevent any cases of money laundering and fraud.

You will be required to provide your full name, residential address, a government-issued photo ID, and in some cases, a national tax number.

Step Two: Add Funds to your Account

You now need to transfer money to your corn trading account. You simply have to select your preferred payment method and choose your deposit amount.

Usually, you will have options for bank cards, wire transfer, or e-wallets. The minimum deposit amount will also vary depending on your online broker.

Step Three: Place a Corn Trade

With your account and funds ready, you can proceed to engage in corn trading. Before that, you will need to do your homework and decide whether corn’s market price is expected to rise or fall. Based on your research, you can place the respective order with your broker.

If the corn broker has a demo account at your disposition, do not hesitate to use it first. Trading with paper money will prepare you better with the ins and outs of real-world corn price fluctuations.

To Summarize

To summarize out guide on corn trading, the basics of all financial markets remain the same. Before you take the plunge with your capital, you need to have an understanding of the corn trading industry and a strategy to guide you.

In the case of corn, the only difference may be the seasonal market variations that apply across all agricultural commodities.

Your most powerful tool is fundamental and technical analysis, so make sure you learn the ins and outs of how this works in practice. A trading signal service will also prove to be highly valuable regardless of your trading experience.

We hope this guide has cleared the mist on how corn trading works and how you can pursue it!

[in-content-heros name=”AVATrade”]