Forex is the largest and most traded financial marketplace on the planet, with daily trading volumes averaging over 6 trillion dollars. This far surpasses volumes seen in the stock trading arena, which in turn, means lower levels of leverage and higher transaction costs. If you want to know how to start forex trading, you have landed on the right page!

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Today, we dive into how to sign up with a reputable forex broker and review the best platforms for newbies. Additionally, we are going to walk you through how the forex market works, and offer some tried and tested strategies to help you face your trading endeavors with confidence.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Open an Account With a Forex Broker

To learn how to start forex trading – you need a great online broker behind you. For those who already have a broker in mind, we offer a simple 4 step walkthrough of how to sign up below.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

- Step 1: Sign up with a trusted broker that offers access to the forex trading markets. AvaTrade is great for beginners, offers 49 forex pairs, and is 100% commission-free.

- Step 2: Validate who you are with a photo ID and a recent bank statement/utility bill.

- Step 3: Deposit some money into your new account with a debit/credit card, bank wire, or PayPal.

- Step 4: Find the forex pair you want to trade and place an order.

If you still searching for the right platform to start forex trading, we reveal our best user-friendly brokers in the section below.

Best Platforms to Trade Forex for the First Time

Our key considerations when reviewing forex brokers are:

- Licensing: A broker holding a license from a major regulatory body is one you can trust. Some of the most respected organizations keeping the space clean from shady companies are the FCA, ASIC, CySEC, and FSB. However, there are more. These authorities ensure online brokers follow rules and standards set out surrounding KYC, client fund segregation, and more.

- Reasonable Fees: There are platforms that charge a variable or fixed commission fee on each trade, while some also charge extra for specific payment types. Low fees mean more profits in your pocket when you start forex trading and things go your way. Top-rated forex broker eToro charges 0% commission to trade, offers tight spreads, and the only deposit fee to pay is 0.5%.

- FX Pair Variety: It’s important to start forex trading with a platform that is able to offer you access to a range of different currency pairs, and markets in general. The volatility this market offers is part of what makes it so popular. For instance, if you were to always trade majors which include the US dollar, this won’t present as many trading opportunities or as much excitement to you.

- Platform Ease of Use: Being able to place a lightning-fast market order on a whim requires an easy-to-navigate website. As such, before you commit to a broker to start forex trading, ensure you have a good look around. In other words, make sure you are comfortable and the layout is suitable for your skill-set.

As you can see, we look for trading platforms with low or zero commission fees and super-tight spreads – as well as heaps of factors beneficial to you. With this in mind, below you will find a full review of each of the best forex brokers in the space right now.

1. AvaTrade – Overall Best Trading Platform 2023

AvaTrade is another CFD broker on our list that is no stranger to providing a service to traders on a global scale. To start forex trading, you will have more than 60 currency pairs to choose from - which includes major, minor and exotic pairs. Some of the FX pairs available at AvaTrade include CHF/JPY, EUR/USD, GPB/JPY, NZD/USD, GBP/USD, CAD/JPY, GBP/SEC, NZD/CHF, USD/NOK, USD/RUB, EUR/PLN and many more.

The spreads at this forex brokerage are generally competitive. This guide found other assets to include ETFs, commodities, bonds, cryptocurrencies, stocks, and indices. You will not pay any commission to enter or exit the markets at AvaTrade. Furthermore, regulation comes from six jurisdictions so you can trade in safety-conscious conditions with some form of protection in place. If you would like to start forex trading via a free demo facility before going to the live markets - AvaTrade is partnered with MT4.

As we said, you can download the third-party platform to benefit from heaps of tools and automated trading options. We also found the broker's own apps AvaTradeGO and AvaSocial to be useful. The latter allows you to 'follow', 'copy', and 'like' other currency traders. This is a useful way to gain some insight into the forex market - from people with experience.

AvaTradeGO includes charts, management tools, live prices, and the ability to manage your MT4 accounts in both demo and real mode. You can start forex trading by making a minimum deposit of just $100 with one of the many payment options. This includes credit and debit cards, bank transfers, and e-wallets like Neteller, WebMoney, and Skrill.

- Minimum deposit to start forex trading just $100

- Regulated in 6 jurisdictions, including Australia, South Africa, Japan, and the EU

- 0% commission to trade forex

- Admin fee charged after 12 months no account activity

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

3. LonghornFX – Top-Rated ECN Broker With High Leverage

LonghornFX is a user-friendly trading platform that covers dozens of cryptocurrency and forex pairs. You can also trade stock CFDs and multiple indices. You will be able to trade with leverage of up to 1:500 at LonghornFX - irrespective of whether you are a retail or professional client.

In terms of fees, you will benefit from competitive variable spreads throughout the trading day. After all, LonghornFX is an ECN broker - so you will get the tightest buy/sell prices available in the industry. Commissions will vary depending on the asset but typically amount to $7 per $100,000 traded.

We like the fact that LonghornFX processes withdrawal requests on a same-day basis. Plus, the broker offers full support for MT4. The platform can be accessed online, via desktop software, or through a mobile app.

- ECN broker with super tight-spreads

- High leverage of 1:500

- Same-day withdrawals

- Platform prefers BTC deposits

4. EightCap – Trade Over 500+ Assets Commission-Free

Eightcap is a popular MT4 and MT5 broker that is authorized and regulated by ASIC and the SCB. You will find over 500+ highly liquid markets on this platform - all of which are offered via CFDs. This means that you will have access to leverage alongside short-selling capabilities.

Supported markets include forex, commodities, indices, shares, and cryptocurrencies. Not only does Eightcap offer low spreads, but 0% commissions on standard accounts. If you open a raw account, then you can trade from 0.0 pips. The minimum deposit here is just $100 and you can choose to fund your account with a debit or credit card, e-wallet, or bank wire.

- ASIC regulated broker

- Trade over 500+ assets commission-free

- Very tight spreads

- Leverage limits depend on your location

Learn How the Forex Market Works

Before you can start forex trading effectively to the best of your ability – you need to grasp how the market works.

With this in mind, we talk about three fundamental elements of currency trading – pairs, spread, and leverage.

FX Pairs

When you start forex trading for the first time, you will quickly realize that currencies are traded in ‘pairs’. Such pairs fall into three different categories – ‘majors’, ‘minors’, and ‘exotics’ pairs.

Each of these FX pair categories has unique characteristics, which will help you to gauge how they might behave when you look to trade them

See below for clarification:

- Major Pair: A major pair always contains the world reserve currency – the US dollar. This type of pair is easy to buy and sell thanks to such high liquidity/demand. You are unlikely to make big gains from sharp price shifts – but will be able to trade with much tighter spreads and higher leverage. The most popular majors include EUR/USD, GBP/USD, USD/JPY, and AUD/USD.

- Minor Pair: This category of pair always includes 2 strong currencies – but never the US dollar. This might include the euro, Japanese yen, Swiss franc, or British pound. Like with majors, you will find that the more traded the minor pair is – the tighter the spread will be. Some forex brokers refer to minors as a cross-pair. The most popular minors include EUR/GBP, GPB/JPY, NZD/JPY, and EUR/AUD.

- Exotic Pair: Exotic currency pairs always include a major currency and one from an emerging market economy. For the latter, think along the lines of the Thai baht, Turkish lira, and Mexican peso. These forex markets come with wider spreads and lower liquidity. The most popular exotic pairs include USD/THB, GBP/ZAR, EUR/TRY, and AUD/MXN.

Now that you have a clearer picture of what FX pair categories you have to choose from, you will be in a much better position to start forex trading with confidence.

As is clear, due to varying levels of liquidity and such – each type of forex pair offers a different trading experience. Sometimes thrill-seeking traders gravitate toward the volatility of exotic or lesser traded pairs because of the high risk-high reward element.

Spreads

The spread is an important ‘fee’ to factor into your losses and gains on any currency trade. Put simply, when you learn how to start forex trading for the first time, you will indirectly pay the difference between the sell and buy price of the FX pair in question. The broker will usually display this gap in pips (points in percentage).

Let’s see a simple example of the spread in forex trading:

- You are trading minor pair EUR/GBP.

- The sell price of the pair is 0.8685.

- The buy price is 0.8686.

- The spread on this pair is 1 pip.

In this instance, you start your forex trade 1 pip in the red. As such, if you make 2 pips, for example, this counts as 1 pip take-home profit. This just illustrates again that the tighter the spread is when trading forex, the more beneficial it is to you.

Leverage

Leverage is something offered by online brokers to allow you to start trading forex with more money than your account permits. As we touched on in the broker reviews earlier, some jurisdictions, such as the EU, UK, and Australia – allow residents to trade currencies with leverage of up to 1:30 on majors and 1:20 on minors and exotics.

Let’s offer an example of how leverage could affect your next forex trade:

- You are trading EUR/USD and wish to go short with a $100 sell order.

- The trading platform offers you 1:30 leverage.

- Your position is now valued at $3,000.

- The price of EUR/USD falls by 4%.

- Without leverage, you would make a profit of $4 – from the $100 sell order.

- With the EUR/USD trade leveraged to $3,000 – your actual profit is $120 ($3,000 x 4%).

As you can see, leverage can boost your stake when you start forex trading. Also, be aware of the consequences of a losing leveraged position, as your trade can be liquidated by the broker.

Notably, the law does not permit US clients to trade leveraged CFD instruments. However, if you fall into this category, all is not lost, you can still trade cryptocurrencies commission-free at eToro.

Forex Order Types

Before you can start trading forex, you need to inform the brokerage of your position. We do this via the ‘orders’ we place.

See below the most useful orders to be aware of when you start forex trading online.

Buy or Sell

When trading forex, whether you buy or sell will depend on which way you foresee the pair’s price moving.

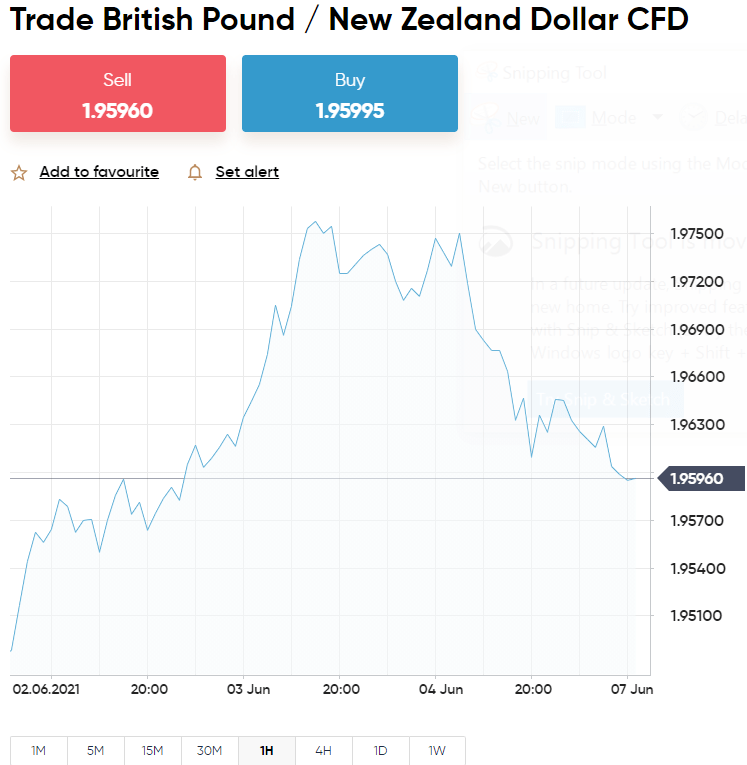

- You are trading GBP/NZD.

- If you think the market value of the pair will increase – place a buy order – we refer to this as ‘going long’.

- Alternatively, if you believe the price is going to decrease – place a sell order – we refer to this as ‘going short’.

This will be your entry into the forex markets via the trading platform of your choice. Next, we talk about more specific order options.

Market or Limit

Once you have decided between a buy and sell position – you can choose a ‘market’ or ‘limit’ order. Again, this covers your entry into the currency markets.

See below an easy explanation of both a market and limit order:

- Market Order: If you like the price of the currency pair you wish to trade – place a market order. Put simply, this tells your broker that you would like to enter the market at the price quoted to you – or the next best available. Due to fluctuations, there will probably be a minuscule difference, such as placing an order on EUR/USD at $1.2001, but getting $1.2002.

- Limit Order: If you would like to enter your chosen forex market at a specific value – place a limit order. This instructs the online broker to execute your entry into the trade at a price point specified by you. For instance, if GBP/JPY is priced at ¥152.31 but you aren’t interested until it hits ¥155.35 – your limit order should be set at ¥155.35. When or if GBP/JPY reaches that point – your order is actioned automatically.

That is your entry covered, which paves the way for you to start forex trading. You also need to consider adding a stop-loss and take-profit order to every trade. See why below.

Stop-Loss and Take-Profit

We talked about how specific limit orders enable us to be price specific when entering the market. Stop-loss and take-profit orders, on the other hand, allow us to close our trade automatically at a particular price.

See an example of a stop loss and take-profit below:

- You are going long on GBP/JPY, now priced at ¥155.35.

- You are not willing to lose any more than 1% from your initial stake and would like to see 2% in gains.

- This is a risk-reward ratio of 1:2.

- As such, you set the stop-loss order to ¥153.79 – 1% lower than ¥155.35.

- Next, you place a take-profit order set at ¥158.45 – 2% higher than ¥155.35.

- If you were to go short on GBP/JPY – you would instead place your stop-loss higher than the entry price, and the take-profit lower

Whichever way GBP/JPY goes – your trade will be closed before you either a) make a loss of 1%, or b) make gains of 2%. You can adjust and recalculate the risk-reward ratio to suit yourself, many forex traders opt for 1:3 or 1:1.5 too.

Discover a Forex Strategy for you

When doing your homework on how to start forex trading, you will have seen the term ‘forex strategy‘ used by many market commentators. Entering this arena with discipline helps us to better deal with the unexpected twists and turns that trading currencies bring to the table.

See below some commonly adopted strategies to use when you start forex trading.

Swing Trading, Scalping, or Day Trading?

The following are popular short-term strategies solutions are adopted by forex traders:

- Swing Trading: This is a fairly slow-paced way of short-term trading. This will see you spotting a price trend and holding your currency pair for days or weeks until technical data suggests it’s time to cash out.

- Scalping: Scalping is fast-paced and involves opening and closing dozens of forex positions throughout a single trading day. The end goal is to make lots of small profits – creating big gains by the end of the day.

- Day Trading: Day trading is slower than the aforementioned scalping strategy but faster-paced than swing trading. This entails opening a forex position, monitoring it throughout the day, and closing before the end of the trading session.

Please note, if you start forex trading with leverage, you will be liable to pay overnight financing fees (sometimes referred to as swap fees) for each night your position is kept open.

At online brokerage eToro, you will see the daily rates appear on each order as you enter information such as leverage and your stake. As such, you are not going in blind to the fees involved and can readjust if you need to.

Try a Free Paper Trading Account

Using a free demo account to start forex trading is often overlooked or seen as a waste of time. The fact is that even traders with decades of experience need to try out new strategy ideas. Many only brokers will enable you to use a real account with actual money, and also a demo account with paper funds.

For instance, eToro gives all clients a free demo account pre-loaded with $100,000. Furthermore, you can easily switch between your real and demo account to try out new ideas – or perhaps have a go at trading a completely different forex market like exotics.

Try Automated Forex Trading

Automated forex trading is nothing new. In fact, large institutional traders have been using this technology since the ’80s. Now that most of us have an internet connection and there are more online brokers than ever – this hands-off approach has really taken off for retail traders.

There are different types of passive trading, the most common are listed below.

Forex Robots

If you want to take part in forex trading but aren’t interested in research, analysis, and placing orders – you might like to try forex robots as they are 100% automated.

The software scans the currency markets 24/7 and will place multiple trading orders on your behalf – via your broker. Forex robots come at a cost, so think about trying it via a demo before committing to the product.

Copy Trading

Another popular automated forex trading option is Copy Trading. As we mentioned in our eToro review – you can invest in and copy a seasoned trader.

If they create a sell order on AUD/GBP and a buy order on GBP/CAD – these will both appear in your portfolio, crucially, in proportion to the amount you invested. You can select a person to copy based on heaps of data and things like a preferred asset class.

Forex Trading Signals

If you would prefer to have more of a say in what orders are placed, and on what currencies – forex signals could be an excellent strategy for you. Here at Learn 2 Trade, we offer free and premium forex signals, comparable to trading suggestions.

Here is an example of how a forex trading signal might look:

- Instrument: EUR/SGD.

- Order: Buy.

- Entry Price: 1.8476.

- Stop-Loss: 1.83.61.

- Take Profit 1: 1.8593.

- Recommended Risk: 1%.

Our team of seasoned currency traders will send each signal via our Telegram group – of which we currently have over 70,000 members! It is then up to you whether you elect to place the order or ignore the signal.

You could also look to try out our signal service via the aforementioned free demo account given at eToro. The broker is regulated, commission-free, and offers 49 tradable forex pairs.

How to Start Forex Trading: Conclusion

When thinking about how to start forex trading it’s vital that you only consider doing so via a respectable online broker. This will offer you some form of protection, whether that be financially with client fund segregation – or just knowing you aren’t joining a disingenuous company.

To start forex trading in the best way possible, think about your trading goals. You can then come up with a suitable strategy. For instance, you may decide to try scalping for frequent but small gains. It’s also wise to use a stop-loss and take-profit order on every currency trade. This enables you to incorporate risk and reward on every position you take – to cover you for every eventuality.

Heavily regulated broker AvaTrade is super-user friendly, making it a great platform if this is your first time trading forex. AvaTrade offers access to heaps of forex markets, is commission-free, and even offers a Copy Trading tool.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

FAQs

How much money do I need to start forex trading?

What is the best online broker to start forex trading with?

Can I get rich if I start forex trading?

How can I teach myself to start forex trading?

How will I know if a forex broker is legit?