There are many traders active in the forex scene that make consistent profits. Such traders typically have years worth of experience in buying and selling currency pairs and have a firm grasp of how to perform advanced technical analysis.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

But, if you’re in the camp of having little or no experience of online forex trading – the likelihood is that you will lose money. This is why so many people are looking to take an automated forex trading strategy that allows them to trade in a completely passive manner.

In this guide, we explore the ins and outs of how automated forex trading works, what you need to look out for to avoid a scam, and how you can get started today in a risk-averse manner.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What is Automated Forex Trading?

In its most basic form, automated forex trading is the process of buying and selling currencies in a completely passive manner. There are generally two ways in which you can achieve this goal. Firstly, some will turn to automated forex robots that can trade autonomously via pre-programmed conditions.

The robot will determine which forex pairs to trade, what orders to place, and when to open and close a position. Secondly, automated forex trading is also possible via a ‘Copy Trading’ tool. This particular option will see you copy an experienced forex trader like-for-like – as opposed to relying on an automated robot.

After all, just because you are trading in a passive manner doesn’t mean that you are guaranteed to make money. On the contrary, much of this industry is dominated by scam artists – especially those selling forex trading robots. This is why it’s important to read guides like ours before taking the financial plunge.

Benefits of Automated Forex Trading

Although automated forex trading won’t be for everyone, the process does come with a number of core benefits.

This includes:

Trade Forex With Zero Knowledge

Perhaps the most notable benefit of automated forex trading is that you can access this multi-trillion dollar industry without needing to have any knowledge of how things work. As we briefly mentioned earlier, in order to make consistent gains in the forex scene, you need to be able to perform in-depth technical analysis.

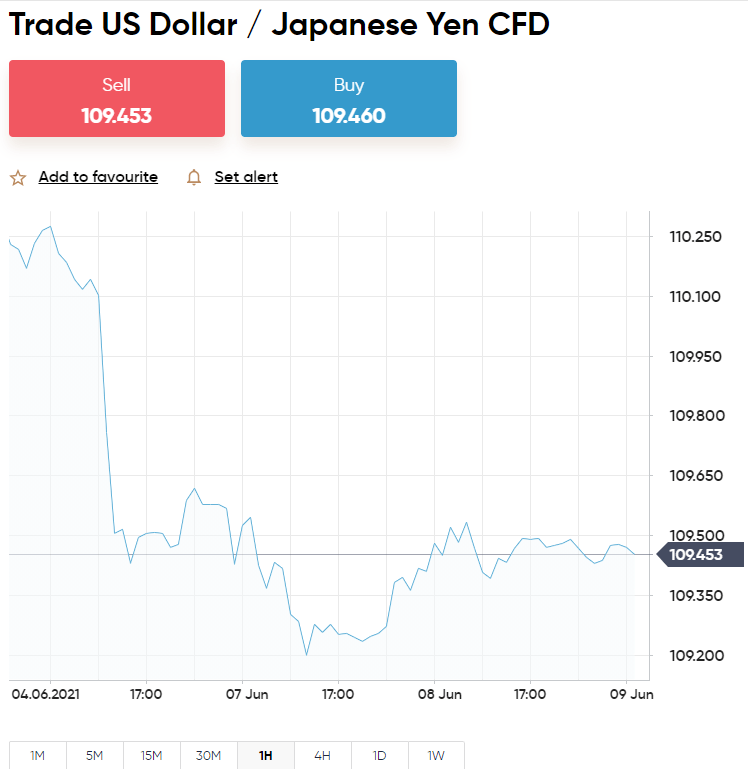

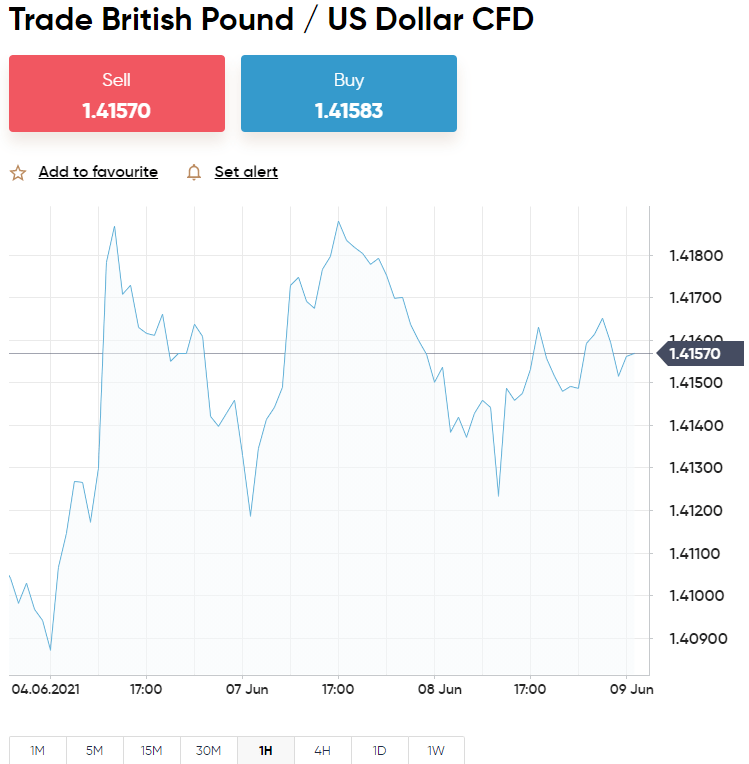

For those unaware, this entails reading forex pricing charts looking for trends. The aim here is to asses whether a forex pair will rise or fall in value based on your findings. Technical analysis requires the use of a variety of indicators – of which there are more than 100.

These forex indicators will look at everything from trading volume and depth to volatility and supports/resistance levels. Ultimately, the key point here is being able to perform advanced technical analysis which can take years to truly master.

But, by using an automated forex trading strategy, there is no need to perform any research at all – as you’ll be buying and selling currencies autonomously.

Emotion-Free Forex Trading

Make no mistake about it – the majority of newbies that try forex trading for the first time will end up losing money. One of the main reasons for this is that inexperienced traders do not know how to handle the emotions of winning and losing money.

Regarding the former, a newbie trader might initially go on a good winning run and think that forex trading is easy. In turn, they will start increasing their stakes thinking with the belief that they cannot fail. Oftentimes, this results in the trader burning through their account balance.

This is why newbies will turn to an automated forex trading system. In doing so, emotions are kept at bay, as the robot or human trader that is being copied will make all trading decisions in a risk-averse manner.

Trade Forex 24/7

When you trade forex in the traditional sense – there are only so many hours that you can dedicate throughout the day. For example, you’ll likely need to put several hours to one side just to perform technical analysis. After all, this will drive the decision-making process in terms of how buy and sell positions you should place.

Then, you also need to dedicate several hours to placing orders and crucially – monitoring the forex markets in real-time. Although you can still make money in this way, opting for an automated forex trading strategy will effectively allow you to trade around the clock.

For example, if you’re using a forex robot then this will be able to trade 24/7. If opting for Copy Trading, you could have several traders under your belt from various timezones, so again, allowing you to trade autonomously all day, every day.

Suitable for all Trading Budgets

There is often a misconception that you need a considerable amount of capital to benefit from automated forex trading. However, this couldn’t be further from the truth. For example, if using an automated forex trading robot that is compatible with MT4, you can choose an online broker that permits small stakes.

A good option here is to open a Mini or Micro Forex Account with a platform that supports MT4. This will allow you to deploy the forex robot and trade with a few dollars here and there.

Alternatively, if opting to copy a human trader, there are many platforms in this space that allow you to do so with a reasonable minimum. For example, eToro allows you to copy an experienced forex trader like-for-like with a minimum investment of just $500.

Perfect for Those Lacking Time

As we briefly discussed earlier, actively trading the forex markets requires a huge time commitment on your part. In fact, those making consistent profits are those that trade on a full-time basis. Many of you reading this guide will likely have work commitments elsewhere and thus – you don’t have the time to research and trade the forex market for several hours per day.

Option 1: Automated Forex Trading via Robots

So now that we have discussed the benefits of automated forex trading – we now need to explore how things actually work. As noted above, there are two different ways you can access this marketplace – forex robots and Copy Trading tools.

In this section, we’ll explain how the form works – automated forex trading robots.

What are Automated Forex Trading Robots?

Otherwise referred to as an EA (Expert Advisor), forex robots allow you to trade in a 100% passive manner. The robot comes via a software file that contains a significant amount of pre-defined conditions. This works on a classic ‘What/If’ algorithm. Put simply the ‘what’ is the action that should be taken when the ‘if’ has been triggered.

As an example, this might be:

- The robot might place a buy order on USD/JPY when the pair breaks through an identified resistant level. The ‘what’ here is the buy order and the ‘if’ is the support level being breached.

- The robot might place a sell order on GBP/USD when the pair’s RSI goes above 80. The ‘what’ here is a sell order and the ‘if’ is the RSI breaching the 80 level.

There are many other examples that we could give you. But, the key point is that the automated forex trading robot will only place orders when a pre-defined condition has been met. In other words, the robot doesn’t have the capacity to make human decisions. Instead, it only does what the underlying algorithmic tells it to do.

This is beneficial, as it: completely removes the risk of human emotion and recklessness. It also means that the robot does not suffer from fatigue – so it can trade 24 hours per day 7 days per week while remaining at the top of its game at all times.

On the flip side, relying entirely on a piece of pre-defined code does make the automated forex trading robot somewhat intransigent. This is because it cant make decisions outside of the rules it has been instructed to follow. As such, the robot cannot take fundamental new developments into account – such as a change of interest rates or GDP downgrade.

How do Automated Forex Trading Robots Work?

So now that you know what automated forex trading robots are, we can dig a little deeper as to how they actually work. In a nutshell, the robot software itself will have been designed by a third-party. By performing a simple Google search of ‘Automated Forex Trading Robots’ – you will be inundated with thousands of such providers.

The vast majority of these providers will promise unpretending financial returns. Never allow yourself to get drawn into such claims – as oftentimes they never come to fruition. Nevertheless, in all but a few cases, automated forex robots need to be installed into MT4 to trade on your behalf.

- MetaTrader4 (MT4) is a third-party trading platform that comes packed with tools – such as technical indicators, screeners, customizable charts, and advanced orders.

- MT4 sits between you and your chosen forex trading broker. There are hundreds of brokers that offer support for MT4.

- Once you have purchased and downloaded the automated forex trading robot, you will then need to install it into MT4.

- In setting up the parameters (such as stake size and maximum risk levels), the robot will then start trading on your behalf 24/7 until you switch it off.

In simpler terms, when the robot places an order, this will be reflected in your brokerage account. As such, the robot has full access to your trading capital. This is why setting up your trading parameters on MT4 is so important, as it will ensure that the robot doesn’t blow through your account balance.

How to Choose an Automated Forex Trading Robot?

As noted just a moment ago, there are tens of thousands of automated forex trading robot providers active in this space. Although it’s great to have so much choice on the table, this does make it difficult to separate the wheat from the chaff.

To ensure you pick a provider that is suitable for your trading goals – consider some of the following metrics:

- Verifiable Results: Is there a way to verify the claims that the robot provider makes? If not, there is no way to know whether or not the robot is actually profitable.

- Reputation: What reputation does the robot provider have in the public domain? Check third-party platforms like TrustPilot and Reddit to gauge what the general consensus is on the provider.

- Tradable Markets: Does the provider specialize in a select number of pairs (preferable), or does it claim to trade every currency under the sun?

- Strategy: It’s also important to explore what strategy the robot takes. For example, will it be scalping, day trading, or swing trading?

- Risk-Management: What risk-management strategies does the automated forex trading robot have in place to ensure you do not blow through your account balance?

- Customer Support: It’s also a good idea to check what support service you will have available to you once you have purchased and downloaded the robot.

As you can see from the above, there’s a lot to consider in choosing the best-automated forex trading robot for your needs. Further down in this guide, we show you how you can test a robot provider out risk-free, via a demo account facility.

Option 2: Automated Forex Trading via Copy Trading

So now that we have discussed everything there is to know about automated forex trading robots, the next option to discuss is that of a Copy Trading tool. As the name suggests, you will be ‘copying’ a human trader like-for-like. Thanks to the growth of the retail investor space, there are now several online brokers that allow you to do this at the click of a button.

However, it must be noted that no platform is quite as intuitive as eToro. This is because the broker is a market leader in the Copy Trading space. It has more than 17 million people using the platform and hundreds of thousands of verified Copy Trading pros to choose from. This allows you to find a seasoned forex trader pro that meets your needs.

How Does Automated Forex Copy Trading Work?

The fundamentals of Copy Trading are actually very straightforward. Once you have found a forex trader that you like the look of and decided how much you wish to invest – there is nothing else to do. This is because anything that the trader does will be reflected in your own brokerage account. This will, of course, be at an amount that is proportionate to what you invested.

For example:

- After performing lots of research on an eToro forex trader, you decide to invest $1,000

- The trader risks 2% of their portfolio on an AUD/USD buy order

- The trader closes the position a few hours later at a profit of 10%

Now let’s see how the above trader was reflected in your own eToro account:

- The trader risked 2% of their portfolio, so you placed $20 on this trade (2% of your $1,000 Copy Trading investment)

- The trader made 10% on the AUD/USD position

- On your stake of $20, this means that you made a profit of $2

As you can see, it doesn’t matter how much the respective trader risks in monetary terms – as everything is proportionate. That is to say, whether the trader risks 1%, 5%, or 10% on a position – the same will be reflected in your account – depending on how much you invested.

How to Choose a Forex Copy Trader?

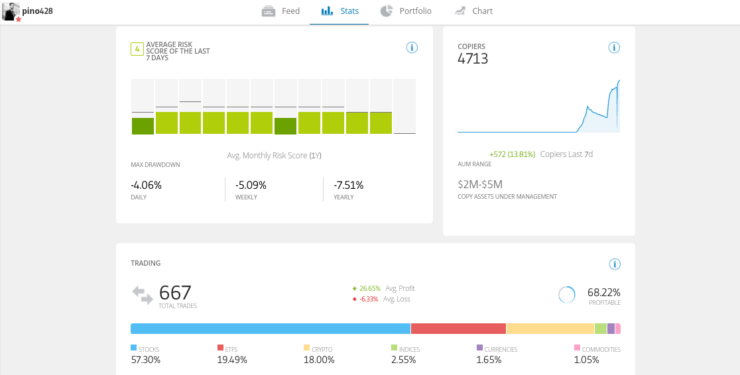

Unlike choosing an automated forex trading robot, everything is 100% transparent when using a regulated broker like eToro. This is because each and every position that the respective trader has ever placed on eToro is publicly verifiable.

This includes:

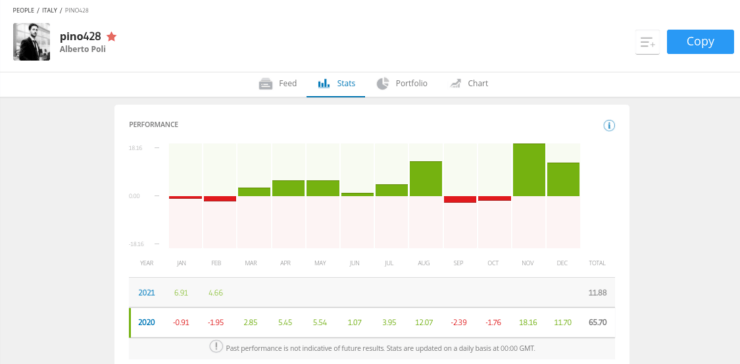

- Performance: Perhaps the most important metric to look at when choosing a trader to copy is their historical performance. This will tell you how much the trader has made or lost since joining the platform, and then broker down on a monthly or annual basis. It goes without saying that you need to focus on traders with a track record of making consistent profits.

- Trade Duration: eToro breaks the average trade duration for you in minutes, hours, or days. This tells you the type of strategy that the trader takes. For example, if this stands at 2 hours and 10 minutes, then you know you are backing a day trader. If the average duration is in days, then they are likely a swing trader.

- Risk: The eToro algorithm will automatically assign traders a risk rating, which is updated regularly. This is based on several factors, such as the amount being traded, how much leverage is used, and what forex pairs are being accessed.

- Maximum Drawdown: This figure will tell you in percentage terms – the most the trader has lost in a week or month – from the peak of their portfolio value. The higher the maximum drawdown percentage, the more risk the trader takes.

- Trades Per Week: This tells you – on a weighted average, how many trades the copied trader places each week. The more trades being placed, the more active the trader is. Once again, this gives you an idea of the type of trader the individual is – such as whether they like to day or swing trade.

The above metrics are just a few of the many statistics you can view when choosing a copy trader on eToro. The most important thing is that you choose a trader wisely, because ultimately – they will decide which pairs to buy and sell on your behalf.

Drawbacks of Automated Forex Trading

Thus far, this guide has focused on the benefits of automated forex trading. However, it’s important to go into any new investment strategy with your eyes wide open. As such, we are now going to discuss some of the drawbacks of taking an automated forex trading strategy.

No Guarantee You Will Make Money

Make no mistake about it – there is absolutely no guarantee that you will make money from automated forex trading. On the contrary, there is every chance that you will make a loss. For example, you might choose a copy trader on eToro that has made consistent gains over the past two years.

But, equally, the individual could go on an extended losing run. If this does happen, your investment will get dragged down at a proportion amount. This is also the case when opting for an automated forex trading robot.

You Will Never Learn how to Trade Forex Yourself

The most successful forex traders are those that know how to perform in-depth analysis by using a collection of technical indicators. They can read, evaluate, and interpret pricing charts and find trends that can influence the future direction of a forex pair.

Seasoned traders are only able to do this because they have dedicated years of their life learning how to make risk-averse decisions based on the information they have in front of them.

Most Robots Are Scams

In less than a day, it’s possible to set up a website offering robot trading services with ‘guarantee’, unprecedented financial returns. Although most people can see through such bold claims – many can’t. As such, the vast bulk of robots active in the automated forex trading space are nothing more than scams.

Crucially, the key problem is being able to verify the results of a robot before you make a financial commitment. This is why we are more inclined to push you in the direction of the Copy Trading tool offered by eToro, as the regulated platform offers a 100% transparent service.

Once again, this is because traders on eToro are unable to amend or manipulate their historical performance. On the contrary, once an order is opened and closed, the respective profit/loss will be reflected in their trading statistics – which is accessible by all.

Robots Can’t Perform Fundamental Research

Another drawback of automated forex trading strategies that are linked specifically to robots, is that the technology cannot perform fundamental research. This is because the robot is instructed to follow the underlying rules and conditions, that have been built into the software file.

While this arguably gives the robot an advantage in terms of performing technical research, it has no knowledge of what is happening in the ‘real world’.

For example:

- When the UK voted to leave the European Union in 2016 – pairs with GBP as its base currency saw double-digit percentage losses in the proceeding weeks and months.

- We know that this is because of the uncertainties surrounding a future UK/EU post-Brexit deal.

- However, the robot would not have known that the major decline in value of GBP was because of this, meaning that it would have likely made irrational decisions that were based solely on the technicals.

As a result of this, Copy Trading is more risk-averse, as the respective human trader will have a firm grasp of both the technicals and the fundamentals.

Choosing an Automated Forex Trading Platform

Not only do you need to pick a robot or human trader to copy – but you also need to think wisely about your choice of platform. After all, in order to buy and sell forex pairs in a passive manner – you need a broker to execute the positions on your behalf.

To help clear the mist, below we discuss some of the key considerations that need to be made in choosing an automated forex trading platform.

Licensing and Safety

First and foremost, you will be required to deposit funds into your chosen platform, so it’s crucial that the provider is safe and secure. The best way to assess this is to look at what regulatory licenses the broker holds.

Some of the main regulatory bodies active in the forex brokerage scene include the:

- FCA (the UK)

- CFTC (the US)

- CySEC (Cyprus)

- ASIC (Australia)

By choosing a platform that is regulated by one or more of the above bodies, you can rest assured that your capital is safe. All of the above regulators have a series of demands that they put on brokers – such as keeping client funds in segregated accounts and ensuring that all traders are verified.

Support for Automated Forex Trading

You do, of course, need to check whether or not your chosen broker actually supports the type of automated forex trading that you wish to engage with.

For example, if you are looking to deploy an automated forex trading robot, then you need to ensure that the broker supports MT4. In rarer cases, the robot might also be compatible with other third-party platforms like MT5 or cTrader. Either way, check that the broker supports the respective platform prior to proceeding.

If, however, you are looking to engage in Copy Trading, then you need to choose a specialist platform that offers this. As we discussed throughout this guide, eToro is by far the biggest player in this space, albeit, several other platforms might be considered.

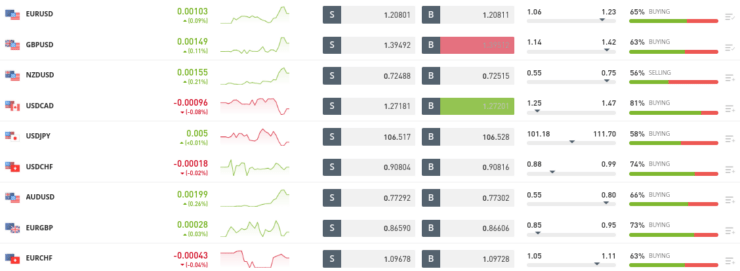

Tradable Forex Pairs

Once you have checked the regulatory status of the platform and that it supports your preferred type of automated forex trading, you then need to explore how extensive its currency library is. In many cases, your chosen broker will support most, if not all, major and minor forex pairs.

After all, these are the most traded forex markets globally. However, some automated forex trading systems also like to trade exotic currencies. As such, check to see what pairs the broker offers before proceeding.

Fees

This metric is of the utmost importance. In a nutshell, you need to have a firm grasp of what fees you will be required to pay when deploying an automated forex trading strategy. If the provider is expensive in this department, then it might make the process unviable – especially of opting for a day trading or scalping strategy.

The main fees that you need to look out for when choosing an automated forex trading platform are as follows:

Broker Commissions and Spreads

All online brokers are in the business of making money, so check to see how much you will be paying in trading commissions and fees. Regarding the former, this is usually charged as a percentage of the amount you stake.

For example:

- Let’s suppose the broker charges 0.2% per slide on all forex markets

- Your automated forex trading system places a $2,000 buy order on EUR/GBP

- This would result in a commission of $4 to enter the trade

- A few days later, the automated system closes the EUR/GBP trade at a total value of $2,500

- This would result in another commission of 0.2% – so you’d pay $5 to exit the position

As we discuss shortly, the best automated forex trading platforms allow you to enter buy and sell positions commission-free. Instead, it’s only the spread that you pay.

The spread is the difference between the buy and sell price of a forex pair – and it is usually expressed in pips. This fee isn’t deducted from your account balance like commissions are. Instead, the gap in pricing results in an indirect fee.

For example:

- You are trading EUR/GBP

- Your broker is quoting a ‘buy’ price of 0.86500

- A ‘sell’ price on EUR/GBP is being quoted at 0.86508

- This means that the broker is charged a spread of 0.8 pips

By paying a spread of 0.8 pips, this means that you are entering the market at a price that is 0.8 pips less favorable than the current wholesale rate. In other words, the automated forex trading system will only be in profit when you make more than 0.8 pips on the trade.

Commission Sharing

This particular fee is only applicable if you are using a Copy Trading tool. Put simply, some automated forex trading platforms will take a commission on any profits that the system makes. We have come across such platforms that take a cut of 20-40% of your financial returns – which is huge.

For example, if you made $1,000 in month 1 and the platform charges 20% in commission, you will be left with $800 while the provider keeps $200. On the one hand, a commission split is somewhat fair if the trader makes you consistent gains. However, there are automated forex trading platforms out there – such as eToro, that allow you to keep 100% of your profits. This is because the Copy Trading tool comes at no additional cost.

Robot Purchase Fee

If you decide to deploy an automated forex trading robot, then you will need to pay the provider a fee. This is almost always a flat fee that you pay once. After that, you are not required to pay the provider any more money.

This is somewhat beneficial as you are not required to sign up for a monthly subscription plan. However, this is also a major drawback – as once the fee has been paid the robot provider has no motivation to tweak or adapt the underlying algorithmic to ensure it remained profitable.

After all, the forex trading markets move at a fast pace and wider trends can change at the drop of a hat. This is why it’s sometimes better to pay a monthly fee as opposed to a one-off charge. In doing so, you can be sure that the robot provider is motivated to stay ahead of curve. If it doesn’t, it will lose customers.

Payments and Account Minimums

In choosing the best automated forex trading platform for your needs, you also need to explore what the payment department is like. More specifically, does the broker support your preferred payment method? The best brokers in this space allow you to deposit funds with a debit or credit card – which is usually processed instantly.

Many brokers these days also support e-wallets like Paypal and Neteller. With that said, you might find that the only payment option on the table is a traditional bank wire. If it is, expect to wait several days for your deposit to be processed.

In addition to supported payment methods, you also need to be aware of what the minimum deposit/investment is. This can actually vary quite widely from platform to platform. For example, eToro allows you to invest from just $500 into your chosen trader. Other providers in this space require a minimum investment that runs into the thousands of dollars – so be sure to check this.

Best Automated Forex Trading Platforms 2021

So now that you know what to look out for when choosing the best automated forex trading platform for your needs, you can now go and do some research. However, if you’re strapped for time and looking for some inspiration, below we discuss the best providers currently active in this space.

1. AvaTrade – Offers Support Automated Forex Robots and Copy Trading

AvaTrade is an established and trusted trading platform that offers heaps of assets. On top of forex, this also includes stock CFDs, indices, hard metals, energies, options, futures, and digital currencies. What we really like about this provider is that it provides support for both automated forex robots and Copy Trading. Regarding the former, you have the option of installing your robot into MT4 and MT5.

As there is also support for third-party platform DupliTrade - this also means that you can engage in a Copy Trading strategy, DupliTrade is home to a considerable number of seasoned forex pros - so you are sure to find a trader that meets your needs. Once you do, you will need to link DupliTrade to your MT4 account. Irrespective of which automated forex trading option you take, AvaTrade allows you to trade in a 100% commission-free manner.

Major forex pairs can often be traded at a spread of less than 1 pip - so AvaTrade is one of the most competitively-priced brokers in this arena. In terms of payments, you can easily deposit funds with a debit/credit card. Bank wires are also supported, as are e-wallets in certain regions. AvaTrade is regulated in six different jurisdictions and authorized to operate in dozens more.

- Reasonable minimum deposit of $100

- Regulated in multiple countries

- Heaps of commission-free assets to trade

- Inactivity fees considered high

2. Capital.com – Best Automated Forex Trading Platform for Small Stakes

In a similar nature to Eightcap - Capital.com is a great option if you are looking to deploy an automated forex trading robot. Once again, this is because the platform is compatible with MT4. Perhaps the biggest attraction with Capital.com is that it is great for small budgets or those with little to no experience of forex trading.

This is because you can get started with a minimum deposit of just $20 - provided you fund your account with a debit/credit card or e-wallet. But that's not all. Capital.com also offers a fully-fledged demo account facility. This means that you can deploy your automated forex trading robot without risking any of your capital. Instead, the robot will trade via MT4 using 'paper funds'.

Then, when you are confident the automated forex trading robot is ready to trade in live market conditions, you can switch back to 'real mode'. Once you do, you will benefit from the 0% trading commission policy offered by Capital.com. This newbie-friendly platform also offers some of the best forex spread in the space. Finally, Capital.com is regulated by the FCA, CySEC, ASIC, and NBRB - so your trading funds are ringfenced at all times.

- Thousands of markets to trade commission-free

- Get started from $20

- FCA, CySEC, ASIC, and NBRB regulated

- Lack of fundamental analysis tools

Automated Forex Trading – The Verdict?

This guide has discussed everything there is to know about automated forex trading in 2021. As we have covered, there are many benefits by approaching the forex trading scene in this way. At the forefront of this is being able to buy and sell currency pairs in a 100% passive nature.

You do, however, need to perform lots of research on your chosen provider – whether that’s in the shape of a robot or a Copy Trading tool. After all, it’s easy to make bold claims about ‘guarantee’ financial returns – but rarely is this the case.

All in all, if you’re looking to benefit from an automated forex trading strategy through a transparent and regulated platform – Capital.com is the best option on the table. This multi-regulated broker allows you to choose from thousands of seasoned forex pros on a commission-free basis.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

FAQs

What is automated forex trading?

Does automated forex trading work?

Is automated trading profitable?

Is automated forex trading regulated?

How much do automated forex trading systems cost?