Thankfully for traders, forex demo accounts allow you to try out various aspects of the forex trading markets without actually having to deposit your own hard-earned cash. Just some of the features you can take for a test drive are technical analysis, leverage, buy and sell orders, and even an auto forex robot that trades on your behalf.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

It is like a very hands-on demonstration of what a real-life forex market looks and feels like. You will be trading currency pairs, and exploring all of the many technical analysis and charts tools which would be available to you via a normal forex trading account.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

The best part about it is that you do not have to take any risks when deciding to buy or sell. As such, whether you are a seasoned trader or a bit of a novice, you are able to replicate real-world market conditions without the risk usually attached.

In this Best Forex Demo Account 2023 – Full Beginners Guide, we are going to detail all that there is to know about forex demo accounts – including how to get started, pros and cons, and demo account trading strategies.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

What is a Forex Demo Account?

Essentially, the best forex demo accounts allow traders to buy and sell financial instruments, all without depositing a single penny. In most cases, when you open an account with an online brokerage firm, you will be able to trade with forex demo account funds (meaning, of course, you are not using any of your real money).

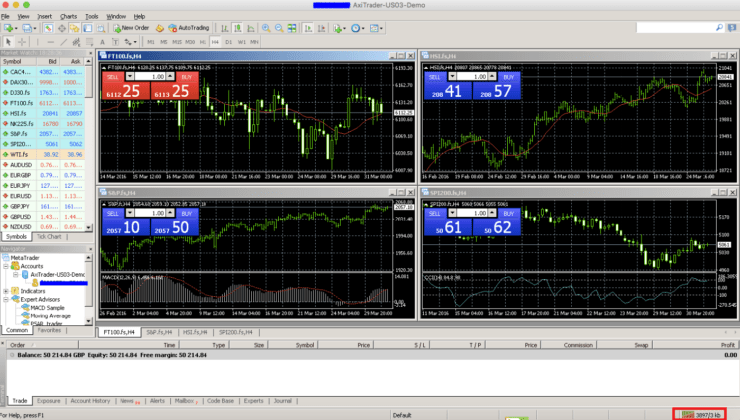

In some cases, the demo account will be made available to you via a desktop trading platform such as MT5 or MT4. In other cases, it will also be accessible to you through your browser. Your forex demo account will usually reflect what is going on in the real financial markets – meaning you will be trading via live conditions. If the demo account does not offer this you should look for another platform as you will not get the full benefits.

Pros and Cons of Forex Demo Accounts

The Pros

The Cons

What can the Best Forex Demo Accounts be Used for?

Although at first glance it can seem like demo accounts are just for beginners, this is actually not the case. Of course, newbies can indeed use a demo account for learning the ropes of forex. But they are also a great way for even the most experienced traders to test out different trading processes and various strategies – all without risking a penny of your real money pot.

Our team of experts has put together a list of reasons that we think the best forex demo accounts are worth your time and consideration.

New Traders

Although demo accounts are for everyone, it has to be said there are obvious benefits for a newbie. Essentially, it can be a great way of learning the inner workings and mechanics of trading currencies. Even if you have never placed a sell or buy order before and do not know where to start, you can try it out without risking any of your own capital.

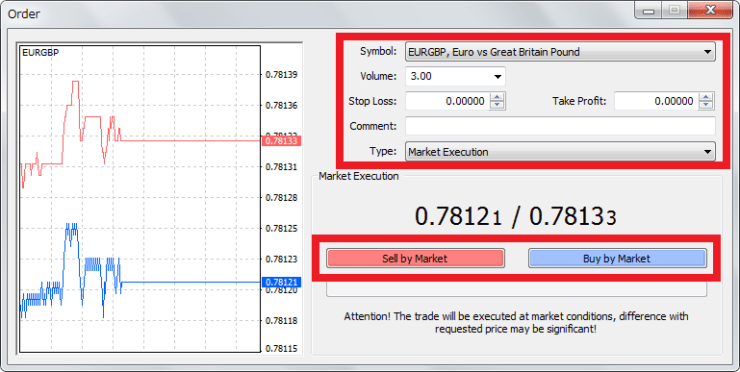

Understanding Market Orders

One of the first things to mention here is that using a demo account will give you a much better comprehension of how market orders work.

Some of the common orders utilized in the forex trading markets are:

- Buy orders

- Sell orders

- Limit orders

- Stop-loss orders

- Take profit orders

All of these are orders which enable your forex broker to understand what you want to do and what your next move is. Of course, when using the best forex demo accounts, you are able to gain a good understanding of how these market orders work. Most importantly, you will be doing this without the risk of making a costly financial mistake.

Analysing Price Movements

When you reach the stage where you have a good grasp of market orders and how they work in forex trading, then you can move on to studying the market trends. By analysing these price movement trends, you are able to gain a good amount of knowledge of how financial instruments typically move within the market.

Risk Management Strategies

Protecting your orders from a negative abrupt movement in the market is absolutely crucial. One of the reasons that using a forex demo account is so useful is that it enables you to refine your own risk management strategies. This can save you an awful lot of stress in the future.

If you neglect to educate yourself with adequate risk management strategies, you are highly likely to experience more losses in the long run.

Understanding Spreads

We think that understanding the spread is very important as it can greatly affect your ability to make a profit from forex trading. As such, if you are still a bit of a novice when it comes to spreads, then you will definitely benefit from using a forex demo account.

One of the best ways to learn more about how spreads work is to take full advantage of your demo account as this is going to demonstrate pricing fluctuations throughout the trading day, and in real-time, too.

Leverage Tools

The vast majority of experienced traders utilise leverage tools to the fullest, as it is an effective way to boost trading capital. Of course, most things in life have an opposite and with leverage, this can also mean that instead of boosting your position it could go the other way and increase your losses.

It is because of this that we would suggest learning the ins and outs of leverage via a demo account before doing this with real-world funds. This way, you are able to see the good, the bad, and the ugly when it comes to trading on margin.

Trying out a Broker

Demo accounts really shine when it comes to experimenting with new forex brokers. This is because by eliminating the need to deposit any funds, you can see how the trading platform operates within a live trading marketplace.

Once you are happy with the forex demo results, you can proceed to open a standard account with the broker of your choice. Of course, we would not recommend doing that right away, as you first need to ensure you have a firm grasp of how the forex markets operate.

Mastering Technical Analysis

Learning the forex market ropes involves a lot of technical analysis, charts, and essentially – ‘learning by doing’. Educating yourself on a variety of technical analysis techniques will give you a much better chance of being successful in your online trading ventures.

In a nutshell, technical analysis is the technique of reading forex charts. The main concept centers on studying historic and current price trends in order to predict where a price trend might go in the future.

Technical Indicators usually fall into one of the following categories:

- Oscillators: Used when there is not a strong trend in ranging markets. It is a countertrend indicator, so to speak.

- Bill Williams Indicators: An iconic market analyst and trader who invented a number of revolutionary technical indicators and strategies. These indicators tend to be oscillators as well.

- Trend Indicators: Trends monitored by algorithms using a variety of moving average (100-day, 50-day, etc.).

- Volume Indicators: Accounting for volume, the number of price changes during a pre-defined time frame.

- Channel Indicators – Usually consisting of the upper price channel and lower price channel, also monitoring trends.

Just a handful of the commonly used technical indicators used are:

- Bollinger Bands – negative and positive trendlines.

- RSI – relative strength index is a popular oscillator

- Stochastics – another hugely popular oscillator

- Awesome Oscillator – still an oscillator, but a Bill Williams indicator.

- Fibonacci Retracement – this one indicates where resistance and support are predicted to happen.

- MACD – an acronym for Moving Average Convergence Divergence, showing two moving averages.

- CCI – aka Commodity Channel Index, is a very popular indicator used to spot overbought and oversold environments (much like Stochastics and RSI)

It is recommended to use more than one technical indicator to hone in on your chart reading skills. Crucially, there is no better way to gain a good understanding of this than to use a forex demo account to practice for free – meaning you do not need to risk a single penny.

New Trading Strategies

Even the most experienced and competent traders utilise demo accounts. The financial markets are an ever-changing environment, so it makes sense to use a demo account to practice some new trading strategies. In other words, what worked last month might not work as well today, so it makes sense to stay one step ahead of your trading competitors!

There might also come a time when you just want to try something new in a risk-averse manner. Once again, this makes forex demo accounts invaluable.

As a trader, there might come a time when a particular strategy is not working quite as well as you thought it might. But, by testing this out through a demo account, you are able to make alterations and improvements along the way. And when you feel like your strategy is really paying off and going to plan, then you can put this into action on a real forex trading account and enjoy the profits.

Testing Trading Signals

Signals are becoming more and more widespread in the online forex trading arena. Usually, this is a recommendation to enter a trade at a particular time or price, on a specific currency pair. This signal will be created either by a forex robot or a real human analyst.

Although there might be a small payment required to get the signal service going, the demo account will certainly allow you to test this out. Your signals can then be used on a demo account in conjunction with other forex strategies and systems before taking the risk of a long-term obligation.

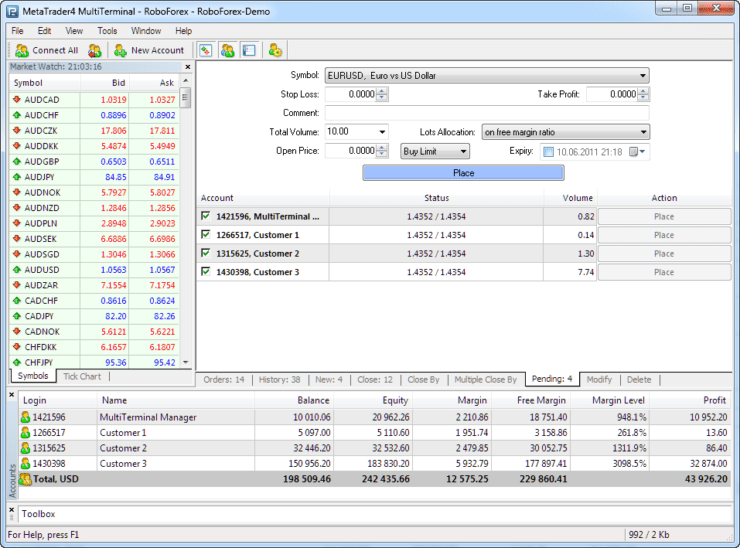

Auto Trading Systems

Some forex demo accounts will enable you to try out trading systems such as expert advisors (aka EAs) or forex robots.

The best thing to do is find an online forex broker which enables you to access MT4 or MT4. In doing so, you will be able to open a forex demo account on the broker site and download the software straight to your device. At this point, you are going to need to link up your trading software to the automated forex robot, as this allows for the automated software to be able to trade on your behalf.

Of course, the most important factor to remember here is that you are actually using a live demo account to trade. As such, it really does not make any difference to you if the automated robot makes you a ton of money or not. If you are pleased with the work that the automated forex robots have done on your behalf, you can always take the plunge and move over to a real-life forex brokerage account.

The Downside to Forex Demo Accounts

It has to be said that there are a number of pitfalls when it comes to forex demo accounts. At the forefront of this is that it might be easy for you to get carried away by taking extra risks (knowing it will not actually cost you). It can, therefore, give you a false sense of hope when it comes to trading with real money.

For example, you might have a return percentage of 50% after using a free demo account for a number of days or weeks and assume that trading is easy. The worst thing you could probably do as an inexperienced trader is run over to your forex broker, deposit funds into your trading account, and begin real trading, with real money.

Ultimately, forex demo accounts can lead you to take much bigger risks than you would do with your own money. That feeling of no risk can lull you into a false sense of security, and perhaps make it seem deceptively easy.

Emotional Decisions

This comes down to what is known as ‘forex trading psychology’. this refers to the three most common emotions displayed by traders when making important decisions on the market.

These 3 emotions are as follows:

- Fear/nerves: The bigger the risk, the more chance you have of acting out of fear. This may lead to you taking even bigger risks to counteract your mistake.

- Greed/arrogance: If you feel like you are only getting excited over big trades, or only feel like big risks are worth your time, there is a high chance you might be getting a bit greedy. Instead, you need to view forex trading as a long-term journey.

- Excitement/conviction: Traders feel this emotion every time they enter a trade. That is normal and you can feed on this excitement by way of conviction at the final step of trading.

The confidence that comes with greed can be a good thing in trading, but it can also make trader a bit conceited. This can lead to poor decision-making skills when trading forex. Most traders will experience losses at some point – whether it is weeks in the red or just a bad position every now and again.

Experienced traders usually know when to cut their losses and learn from past mistakes before moving on. The problem is that traders who lack this experience often make high-risk decisions and end up burning themselves out.

Sloppy traders who lose track of their risk management strategies and do not use the right technical analysis tools can soon end that profitable streak with one bad decision. As such, the main thing to remember is that using a demo account means that you are not gaining the true emotional side of the trading experience.

There will be both gains and losses on your demo account, but you certainly will not have the same feelings as you would in the real world, with real money. Ultimately, many would argue that you can only understand trading phycology once you are trading with your own money.

How to Choose a Forex Demo Account

You should now be fully in the loop when it comes to the pros and cons of using a forex demo account. As such, you should be ready to think about selecting a platform.

Taking into consideration that each broker will differ slightly, we have put together a list of things to consider when searching for the best forex demo accounts.

Choose a Broker you Actually Expect to use

It might be considered a little bit counterproductive to spend weeks testing and observing a specific forex broker (using your demo account), only to change brokers when it comes to trading with real money. The reason you might find this counterproductive is that the new forex broker might turn out to operate their business in a completely different way to the last, and so you could perhaps find it unfavourable to the way you like to trade.

For this reason, we do advise opening a demo account through an online broker you can see yourself using in the future. After all, when you trade on your forex demo account, the real market conditions will be matched.

You might also find that currency pair spreads differ between different brokers. For example, your demo account broker might offer a spread of 0.7 pips on USD/GBP, whereas a different forex broker might charge a higher amount at 1.2 pips. As such, it is best not to complicate matters too much and stick to a forex broker if you have enjoyed the demo account on their particular platform.

Real-World Market Conditions

As we have touched on above, the best forex demo accounts will offer you a real-world market environment. Otherwise, there is not much point in the demo.

These real-world market conditions are a big part of learning about forex trading and building on your skills as a successful trader.

Trial Time-Frame Allowance

When you find a broker, always check with them how long you will have access to your demo account for. This is because some brokers might only allow a matter of days, others weeks.

In order to gain a good understanding of forex trading, we do think that you will need at least a month to build up your trading knowledge, as well as your confidence in understanding the markets.

Demo Account Starting Balance

Believe it or not, even demo accounts come with limits. Each demo account will differ in this respect, so it is always good to check this information before you sign up. Some of the best forex demo accounts come with a starting balance of over $100,000.

Chart Reading Tools

As soon as you have covered the basics, you can begin looking into which tools you will have access to via the demo account you have chosen. After all, such tools are an integral part of testing out the previously discussed trading strategies before going live.

Payments

Even though you are signing up for a demo account, you should be aware that some online forex brokers out there are going to ask you for your payment details. The reason for this is to stop people from abusing the free demo by opening several accounts.

Our honest advice on this? We would advise choosing a demo account which does not require those card details. The whole idea of starting out with a demo is feeling safe that you are risk-free and have not spent any of your hard-earned money.

It is not that we think the broker is going to take your money without asking, but we know that in order to try a forex demo account it is not an absolute necessity for you to give out your payment information, especially at this early stage.

Getting Started With a Forex Demo Account

If you are a trader, whether you are experienced or not, you might still be wondering how you can get started with a demo account? Well, in this section of our best forex demo account guide, we have put together a 5 step process of how to get started today!

Step 1 – Selecting a Forex Broker

You need to start by identifying an online broker which offers traders a demo account option. As we touched on earlier, we think it is better to sign up to a broker which you can later see yourself wanting to use with real money later down the line.

Here are some of the questions you should be asking yourself before making your final decision:

- What payment methods are available to me?

- Does this broker have regulatory licences?

- Which assets will I be able to trade?

- When it comes to commissions, spreads, and fees – is this broker competitive?

- Is the brokers’ customer support as good as it could be? (we always recommend checking our reviews for this kind of thing).

- Are MT4 and MT5 supported by the broker? (This is particularly important for auto trading).

Step 2 – Open a Forex Demo Account

Now you have made it this far, you need to go ahead and opening an account. As previously noted, this is to stop people from taking advantage and open more than one demo account with the same online broker.

You will need to enter some personal information at this point and that is usually as follows:

- Full name

- Residential address

- Date of birth

- Contact details

- Nationality

Step 3 – Trading Platform Selection

Now you have an account with your broker of choice. You can make a decision on what platform works best for you and your trading style.

Generally speaking, this usually involves downloading a platform such as MT4 or MT5. If you prefer to trade via your web browser, you will likely be able to use the broker’s proprietary interface.

If you do decide to download the MetaTrader platforms (MT4/5) then you will now be able to try out a forex automated robot!

Step 4 – Start Using Demo Account

Just like when trading in the real world you are now free to sell, buy and access the markets. When you do this, your paper trading funds will be deducted from your demo account balance – making it look all too real (without the risk).

It is always a really sensible idea to keep an eye on your historical statistics in terms of orders. This is going to give you a really clear idea of how you are fairing in terms of losses and gains.

More specifically, this is going to tell you whether your strategies are working or not. After all, this is one of the main objectives of having a demo account!

Step 5 – Convert to a Real Forex Broker Account

Hopefully, by this point, you have made the most of your demo account, and have your trading strategies down to a ‘t’. If this sounds about right and you are feeling confident enough to fly the demo nest and open an account with a full forex broker, this should be fairly simple to do.

Presuming that you are sticking with the broker you went to when opening a demo account, the chances are that you have already provided most of the information you need to set up a standard account. Now you will just need to provide some photo ID and proof of address (this is usually a utility bill or bank statement).

There is no way around this part of the signing up process. As it is a legal requirement in the fight against money laundering. And all brokers must adhere to these rules.

Now, all you need to do is enter your payment method of choice onto the broker website, and deposit some trading funds into your account. The most commonly seen payment methods will be e-wallets (such as PayPal to name one), bank accounts, and debit/credit cards.

Voila! You can now start to trade in the real world forex markets. Just remember, you might want to air on the side of caution by starting off with small stakes.

Best Forex Demo Accounts in 2023

The vast majority of online forex brokers now offer a demo account of some sort. As such, this can make it challenging to know which platform to sign up with.

To help clear the mist, below we list some of the best forex demo accounts in 2023.

1. AVATrade – 2 x $200 Forex Welcome Bonuses (bonus permission is approved by regulation)

AVATrade is a good option if you want to use your demo account via MT4. This is also the case if you plan to install automated forex robots, as this is fully compatible with AVATrade. The platform offers lots of advanced chart reading tools. And you can also access other CFD instruments like stocks, indices, and commodities.

- 20% welcome bonus of up to $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

2. Capital.com – Zero Commissions and Ultra-Low Spreads

Capital.com is an FCA, CySEC, ASIC, and NBRB-regulated online broker that offers heaps of financial instruments. All in the form of CFDs - this covers stocks, indices, and commodities. You will not pay a single penny in commission, and spreads are super-tight. Leverage facilities are also on offer - fully in-line with ESMA limits.

Once again, this stands at 1:30 on majors and 1:20 on minors and exotics. If you are based outside of Europe or you are deemed to be a professional client, you will get even higher limits. Getting money into Capital.com is also a breeze - as the platform supports debit/credit cards, e-wallets, and bank account transfers. Best of all, you can get started with just 20 £/$.

- Zero commissions on all assets

- Super-tight spreads

- FCA, CySEC, ASIC, and NBRB regulated

- Does not offer traditional share dealing

To Conclude

The best forex demo accounts allow you to experience the real-world currency markets without risking your own capital. This is ideal if you are a beginner. As it allows you to learn the ropes of buying and selling forex pairs in a risk-free manner. At the other end of the spectrum, the best forex demo accounts allow experienced traders to test and perfect new strategies without putting real-world funds on the line.

Ultimately, forex demo accounts allow you to familiarise yourself with ever-changing market prices, charts, and risk management tools – all of which are required skills to become a great trader.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card

FAQs

What is a forex demo account?

Who offers forex demo accounts?

Can you make money from a forex demo account

Do I need to download software to use a forex demo account?

How much does a forex demo account come funded with?

Do forex demo accounts trade in live market conditions?

How long can I use a forex demo account for?

Read more related Articles:

Forex Trading for Beginners: How to Trade Forex and Find the Best Platform 2024