Make no mistake about it – if you’re thinking about trading from the comfort of your home – you need to find a top-rated UK broker. Your chosen provider essentially forms the bridge between you and your desired financial markets.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Whether you’re looking for a trading platform that specializes in forex, stocks, cryptocurrencies, or commodities – this guide on the Best Brokers UK 2023 will help clear the mist.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Not only do we discuss the best UK brokers to consider, but we also show you the many metrics that you need to look out for when choosing a platform yourself.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Best Brokers UK 2023 – Our Top 5 Picks

As we explain in more detail further down, there are many factors that you need to consider in your search for the best UK brokers. For example, not only do you need to make sure that the platform is regulated but that it offers your chosen financial markets at competitive fees.

Other important considerations should be made on trading tools, research and educational materials, and customer service. Taking all of the above into account, below you will find a selection of the best UK brokers of 2023.

1. AVATrade – Best UK Broker for MT4/5

AVATrade is a major player in the online trading scene - especially with those based in the UK. The platform is authorized and regulated in heaps of countries, so you can trade safely from the comfort of your home. AVATrade covers most asset classes - including but not limited to forex, commodities, cryptocurrencies, stocks, and even options.

These can all be traded via CFDs and in a 100% commission-free nature. On major asset classes - such as forex and blue-chip stock CFDs, spreads are especially tight. What we really like about AVATrade is that it offers a collection of different trading platforms. At the forefront of this are MT4 and MT5.

These two leading third-party platforms give you access to an abundance of technical indicators, chart drawing tools, order types, and even the ability to install forex robots. Alternatively, you can trade via the main AVATrade website for simplicity/ In terms of getting started, AVATrade requires a minimum deposit of $100. It supports debit/credit cards, so you can fund your trading account instantly.

- Reasonable min deposit of $100

- Regulated in multiple countries

- Huge range of assets to trade

- Inactivity fees considered pretty high

Best Brokers UK – Types of Platforms

So now that we have discussed the best UK brokers active in the space right now, we need to explain the different types of platforms that you will have access to. This largely centers on the type of financial instrument that you wish to gain exposure to and whether you plan to invest or trade.

Below you will find a list of the most common UK broker types in the online arena.

Best Brokers UK for Stocks

If you’re looking for the best UK broker for stocks, you’ll have heaps of options to choose from. These are usually traditional brokerage firms that allow you to invest in shares from several marketplaces. In the UK, for example, this might include shares listed on the London Stock Exchange and the AIM (Alternative Investment Market).

If using eToro, you can buy shares in over 2,400 stocks from 17 different exchanges. Best of all, you won’t pay any share dealing commission and you can invest from just $50 per order.

Best Brokers UK for Forex

The forex trading scene is the largest financial marketplace globally. In most cases, more than $5 trillion will change hands every day. For those unaware, forex trading refers to the process of speculating on the future value of an exchange rate.

For example, if you wanted to speculate on the British pound increasing in value against the US dollar, the pair you would be trading is GBP/USD. To do this, you would simply need to place a ‘buy order’. However, if you thought that the British pound is likely to go down in value against the US dollar, you would need to place a ‘sell order’.

In the UK, you can trade major forex pairs like GBP/USD, EUR/USD, and AUD/USD with leverage of up to 1:30. This means that an account balance of just £100 would allow you to trade with £3,000. In most cases, your chosen UK forex broker will offer dozens of different currency pairs.

Best Brokers UK for Commodities

If you’re based in the UK and you are wanting to trade commodities, you have plenty of options at your disposal. In most cases, you will need to trade commodities via CFDs. This means that you won’t own the asset, but you can still profit from its respective price. In other words, you don’t need to physically buy and store gold to trade it!

In terms of what commodities the best UK brokers offer, this usually covers precious metals like gold and silver, as well as energies such as oil and natural gas. When using a top-rated UK broker like eToro, you can also trade agricultural products. This includes everything from wheat and corn to sugar and cocoa.

Alternatively, you might also consider trading commodities via futures or options contracts. This is a more sophisticated way of accessing the market. If you want to invest in the long-term value of an asset like gold, then an ETF is your best option. You can do this at eToro without paying any commission.

Best Brokers UK for CFDs

When using a UK broker that offers CFDs, you will likely have access to thousands of financial instruments. After all, the CFD is merely tasked with tracking the real-time price of the asset in question. This allows the best UK brokers to offer a vastly wide CFD library to suit most taste buds.

For example, you can trade CFDs in the form of stocks, indices, ETFs, cryptocurrencies, commodities, forex, bonds, and more. Best of all, CFD brokers in the UK typically allow you to trade commission-free and with tight spreads.

It is important to note that the best UK brokers offering stock CFDs also allow you to benefit from dividend payments. This is covered by traders ‘going short’ on the respective market and the funds are usually reflected in your CFD cash account balance.

Best Brokers UK for Cryptocurrencies

Put simply, the cryptocurrency space has exploded in recent months. Not only has Bitcoin since surpassed $40,000, but the wider cryptocurrency market is getting closer and closer to that all-important 1 trillion-dollar region. As such, if you’re looking for the best UK brokers to buy or trade cryptocurrencies, there are many options on the table.

This is something that a lot of UK investors have been looking at in recent months, as the FCA has since banned crypto-CFDs. This means that those seeking leverage or short-selling facilities are turning to unlicensed platforms. Instead, you’re best to stick with a regulated UK broker like eToro.

How to Find the Best Brokers UK of 2023?

Moving into 2023, there are now hundreds of UK brokers to choose from. As you might have guessed, this makes it extremely hard to separate the wheat from the chaff.

The good news is that there are several factors that you can focus on in your search for the best UK broker for your financial goals – which we outline below.

Regulation and Safety

The first point on your checklist of factors should be that of safety. This does make sense when you consider that you will be required to deposit pounds and pence into your chosen UK broker.

So, you should first check what (if any) regulator licenses the broker holds. It goes without saying that if the platform is unregulated, you should avoid it.

Nevertheless, we find that the best UK brokers are authorized and regulated by the Financial Conduct Authority (FCA). However, there are several other reputable financial bodies that are just as competent in keeping you and your money safe.

This includes the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission. In other words, the best UK brokers will hold at least one license from either the FCA, ASIC, or CySEC. In the case of eToro, the broker is regulated by all three.

Supported Assets

Once you have established that your chosen UK broker is regulated by at least one reputable body, it’s then time to explore what asset classes are on offer.

Depending on your financial goals, you might be looking for one or more of the following markets:

- Shares

- Stock CFDs

- ETFs and Mutual Funds

- Indices

- Commodities

- Forex

- Futures and Options

- Cryptocurrencies

At one end of the spectrum, some brokers might only specialize in a single asset – such as stocks. But, the best UK brokers of 2023 will give you access to a wide variety of markets.

Ownership or CFDs

It is also important to determine whether the UK broker in question offers traditional assets that you can buy and own, or CFDs that you will be trading.

For example, if you want to buy stocks or ETFs and retain full ownership, you’ll want a commission-free broker that doesn’t charge any ongoing fees. This means that you can keep hold of your investments for as long as you wish – without needing to have your profits eaten away at.

Alternatively, if you are looking to place more sophisticated trades – such as short-selling or applying leverage, then CFDs will be the way forward. Just remember, you won’t own the underlying asset when trading CFDs in the UK. Plus, you’ll be charged an overnight financing fee for each day that you keep the position open. This is because CFDs are leveraged financial assets.

Trading Platform

It is important to explore what trading platform your chosen broker offers. For example, some UK brokers allow you to invest and trade via their website.

This means that you won’t be required to install or download any software. On the contrary, you simply need to log into your brokerage account through your web browser and you can start trading straight away.

Additionally, you should also check to see what the platform’s mobile offering is like. We find that the best UK brokers offer a native mobile trading app on both iOS and Android devices. This allows you to invest and trade no matter where you are located.

UK Brokerage Fees

UK brokers give you access to financial markets at the click of a button. In turn, your chosen broker will charge you a range of fees. These fees can and will vary quite considerably – so you need to have a full understanding of what you are paying before you open an account.

This is a really important metric to explore when searching for the best UK brokers, so below we have broken down the main fees to expect.

Dealing Fees

Dealing fees are linked specifically to traditional assets like shares, ETFs, and mutual funds. In most cases, this is charged on a fixed-rate basis for each trade that you place.

- For example, let’s suppose that your chosen UK broker charges £8 per trade to invest in shares

- Irrespective of how much you invest, you will pay £8 when you open the trade

- Then, when it comes to selling your shares, you will again pay £8

We should note that the above example would cost you nothing when using eToro. This is because the platform allows you to invest in stocks without paying any share dealing fees.

Trading Commissions

If you are looking to trade assets like forex, gold, or oil – then it’s likely that a variable commission will come into play. This is expressed as a percentage and subsequently multiplied against your stake.

- For example, let’s suppose that your chosen UK broker charges a trading commission of 0.8%

- You decide to stake £500 on gold increasing in value

- This means that you pay a commission of £4

- When you get around to closing your trade, your Gold position is worth £700

- So, your 0.8% commission is multiplied by £700 – amounting to $5.60

Once again, if you were to use a low-cost UK broker like eToro, you won’t pay any trading commissions.

Spreads

All UK brokers charge a spread. This is an indirect fee that few very newbies are aware of. In its most basic form, the spread is simply the difference between the bid (buy) and ask (sell) price. In most cases, this is expressed as a percentage.

With that said, short-term traders in the forex space calculate the spread in pips. Nevertheless, whatever the spread amounts to, you need your position to increase in value by the same amount just to break even.

- For example, if the spread amounts to 0.6%, you need to make gains of 0.6% to get to the break-even point

- If the spread amounts to 2 pips, you need to make gains of 2 pips to get to the break-even point

The best UK brokers will clearly display what the spread amounts to in percentage terms or pips. If they don’t, you can easily calculate it yourself by dividing the bid/buy price into the ask/sell price.

Deposits and Withdrawals

In order to invest or trade with real money at your chosen UK broker, you will need to make a deposit. Some platforms in the space make the process cumbersome, as you need to perform a manual transfer from your bank account. This means that the deposit can take several days to arrive.

When it comes to fees, some brokers charge you to deposit and/or withdraw funds. You should also check how long it takes for the UK broker to process your withdrawal request. In an ideal world, it will process payments within 1-2 working days.

Tools for Beginners

Some UK brokers offer a skin and bones service. In other words, they allow you to invest and trade in your chosen asset – but nothing else. While this is perfectly fine if you are a seasoned pro, it won’t be if you are just starting out in the world of online brokers.

In our view, if you are a complete investing novice, it’s best to pick a UK broker that offers some, or all, of the following tools:

Educational Tools

It goes without saying that the best UK brokers offer a full range of educational tools. This is usually in the form of how-to guides and trading explainers.

For example, there might be an article explaining how the spread works or a video discussing key stock terminology. We are also fans of UK brokers that offer regular webinars.

Automated Trading

There are heaps of people in the UK that want to invest in the financial markets, but they choose not to because of a lack of understanding. The good news is that the best UK brokers offer automated trading services that allow you to invest passively.

A great example of this is FCA broker eToro. Firstly, through its Copy Trading feature, you can copy an experienced investor. In other words, if your chosen investor buys shares in HSBC, you’ll do the same. If the same investor then buys shares in Facebook, again, you’ll do the same.

Although the entire Copy Trading process is automated, you still maintained full control over your portfolio. That is to say, you can add or remove assets from your Copy Trading portfolio at any given time.

Secondly, eToro also offers CopyPortfolios. There are dozens of strategies to choose from – ranging from e-commerce stocks to cryptocurrencies. Either way, these portfolios are managed by eToro, so you will benefit from a 100% passive investment experience.

Tools for Experienced Traders

While the tools discussed in the section above are ideal for newbies, you’ll need to look at other trading features if you consider yourself a seasoned pro. This is especially the case if you are a day trader or swing trader that places a strong focus on technical analysis.

For example, the best UK brokers will offer the following research tools:

- Dozens of technical indicators like the RSI, MACD, and exponential moving averages

- Chart drawing tools that allow you to take your analysis efforts to the next level

- The ability to customize your trading screen – such as multiple charts and a custom watchlist

- Trading indicators such as market sentiment

- Capabilities to install automated trading robots

From our analysis, EightCap ticks all of the above boxes. After all, it is fully compatible with the hugely popular third-party trading platform MT4.

Customer Service

Like any online business, it’s important to go with a provider that offers top-notch customer service. We find that the best UK brokers offer support in the form of live chat. This allows you to reach an agent at the click of a button without needing to pick the telephone up.

With that said, if you prefer to speak with someone over the phone, make sure your chosen UK brokers offer this. The worst UK brokers only offer support via email. This means no assistance in real-time, so it could take several days to receive a reply.

In most cases, the best UK brokers will offer customer support on a 24/5 basis – which follows the traditional financial markets. Any questions or queries outside of this timeframe will likely need to wait until Monday morning.

How to get Started With the Best Brokers UK Today

If you have read our guide on the best UK brokers up to this point, you should now be able to find a platform that meets your financial goals. As we have discussed, we found the Capital.com is the best broker in the UK space in terms of regulation, fees, tradable markets, and user-friendliness.

With this in mind, we are going to conclude our guide by walking you through the setup process at our top-rated UK broker – Capital.com.

Step 1: Open an Account

You will first need to open an account with Capital.com before you can begin trading. This should take you less than a couple of minutes, as you simply need to provide the broker with some personal information and contact details.

Then, you will be asked to provide a copy of your passport or driver’s license and proof of address. This is because Capital.com is heavily regulated and thus – must comply with anti-money laundering laws.

Step 2: Make a Deposit

Once you have opened your Capital.com account, you can then proceed to make a deposit. The platform requires a minimum deposit of $200 – which is about £160.

- Debit Card

- Credit Card

- Paypal

- Skrill

- Neteller

You can deposit with a UK bank count if you wish. However, this might take a couple of days to process.

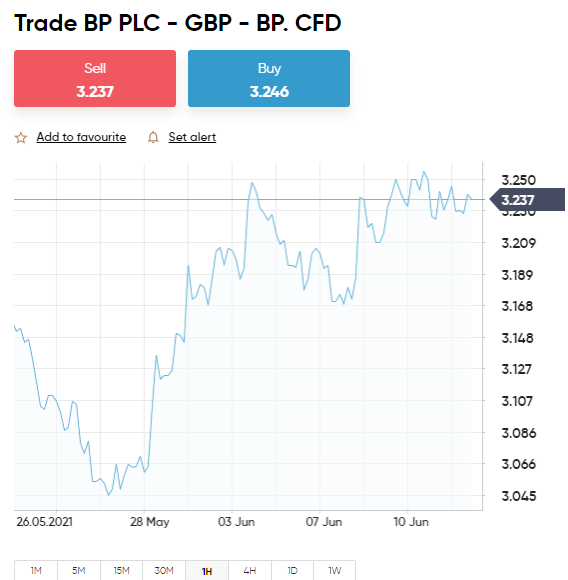

Step 3: Search for Asset

Capital.com makes the asset navigation process easy as it offers a simple search facility. As such, it’s now time to search for the asset that you want to buy or trade.

In our example, we are looking to buy BP shares, so we enter the name of the company into the search box. Then, click on the respective result that loads up.

Step 4: Place Order

Once you have clicked on the asset you want to buy or trade, it’s then just a case of setting up an order.

In our example, we are looking to purchase BP shares, so we are placing a ‘buy order’. And of course, if we felt that BP shares were due to decrease in value, we’d instead be placing a ‘sell order’.

Finally, click on the ‘Open Trade’ button to complete your commission-free investment at Capital.com!

Best Brokers UK – The Verdict

In summary, whether you are looking to invest in stocks and ETFs or trade forex and cryptocurrencies – there is sure to be a suitable broker out there for your requirements. However, with hundreds of providers that active in the online trading space, finding the best UK brokers can be a daunting process.

Fortunately, by reading our guide in full, you should now be armed with all the required tools to find a top-rated UK broker for your needs. We concluded by finding the Capital.com is one of the best UK brokers to consider in 2023 – as the FCA platform offers thousand of markets on a commission-free basis. You can also try out our best forex signals telegram group to help you get started and benefit from regular trading tips.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts