The greenback’s recovery was sponsored by the recently proposed $1.9 trillion stimulus measure by President-elect Joe Biden and an impressive rally in the US Treasury yields.

It’s worth mentioning that gold has been under immense pressure all through January amid the growing demand for the USD as a safe-haven currency, despite recent dovish statements by US Federal Reserve Chair Jerome Powell, stating that that interest rates will continue to remain at floor level for as long as necessary.

Also, the US Treasury bond yields are expected to keep rallying in the meantime, which is exerting additional prospects of the non-yielding commodity.

Meanwhile, it appears that gold traders are split across those looking for long-term buying opportunities on the safe-haven asset amid rising inflation and massive quantitative easing measures, or those looking for arbitrary selling opportunities on the backdrop of a recovering USD and rising cases of coronavirus infections in Western Europe and the US.

Moving on, gold’s price dynamics today will be largely determined by the price action of the USD, amid the absence of market-moving data from the US.

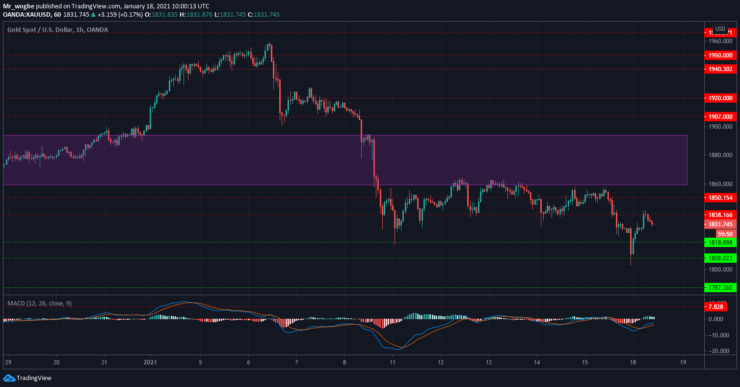

Gold (XAU) Value Forecast — January 18

XAU/USD Major Bias: Bearish

Supply Levels: $1838, $1850, and $1860

Demand Levels: $1818, $1808, and $1800

Gold continues to trade on a backfoot, as speculators begin to anticipate an $1800 price tag for the commodity soon. The precious metal fell below the $1808 support line in the early Asian session today but has since recovered amid a lack of follow-through strength.

The commodity needs a sustained break above the $1860 pivot zone, at least, to shake off the lingering selling pressure. Failure to take the $1860 resistance over the coming days could accelerate gold’s descent to the $1800 level.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.