Market maker brokers are known for pushing market liquidity, as well as enabling quick and easy trading transactions between buyers and sellers. Looking to trade from the comfort of home but need a good market broker?

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

In this Best Market Maker Brokers Guide, we run through our top providers of 2023. We also explain the nuts and bolts of what market makers are alongside key factors to consider in finding one for your needs.

Additionally, we discuss market maker fees and commissions, trading tools, and leverage.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Best Market Maker Brokers 2023 – Our Top 5 Picks

When exploring the best market maker brokers for your consideration – we take extra care in the selection process. As such, things like regulation, a variety of financial instruments, customer service, and low fees are non-negotiable.

You should always conduct your own thorough research when looking for a trading platform. However, we have saved you some online legwork by whittling our findings down to 5 of the very best market maker brokers of 2023.

1. AvaTrade – Best Market Maker Broker With Variety of Trading Tools

This multi-award-winning market maker broker is highly regarded by traders and authorities alike. In fact, this platform is regulated by multiple financial organizations based in places such as Australia, the UK, South Africa, Europe, Japan, and more.

Mainly dealing in CFDs, this market maker provides access to ETFs, cryptocurrencies, individual shares, forex, and indices. Clients from some countries can access leverage as high as 1:400 on indices and forex, and up to 1:200 on commodities. If cryptocurrencies or individual shares are your thing - you can access leverage up to 1:20.

If you want to easily access technical analysis tools, AvaTrade is compatible with trading platforms MT4 and 5. As we said, these third-party platforms are packed to the rafters with useful indicators, educational content, and charts. AvaTrade's very own trading platform also offers heaps in terms of tools. This includes portfolio simulations, risk management lessons, multiple charts, economic indicators, and calendars from various regions.

Speaking of third-party platforms, the sociable traders out there will be happy to learn this broker works in conjunction with 'Zulutrade' and 'DupliTrade'.

If you aren't aware of what social trading is, it's a little bit like social media. Although, instead of witty life updates, traders and investors post regular strategies, news updates, and potentially profitable trading opportunities. You can also 'like' and 'follow' traders for strategy ideas and trading tips.

In terms of fees - this market maker is 100% commission-free. Furthermore, if like most of us you are never too far away from your phone - think about trying the 'AvaTradeGo' app. The application works on Android and iOS phones and is free to download. When it comes to funding your account, the minimum deposit at AvaTrade is a very reasonable $100. Accepted payment types include debit/credit cards and also bank wire transfers.

- Reasonable minimum deposit of $100

- Regulated in multiple countries

- Heaps of commisison free assets to trade

- Inactivity fees considered high

2. VantageFX –Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Market Makers Explained – What to Consider When Choosing a Market Maker Broker

It’s no secret that the best market maker brokers create their own internal markets. There are some really great trading platforms out there, in which you can trade from the comfort of your home safely. On the other hand, there are also many shady market makers offering financial services.

As such, it’s important to consider every aspect of the brokerage, before signing up. The best market maker brokers are fully regulated. This is because, without regulation, you have no way of knowing if a provider is legitimate, until it’s too late.

What is a Market Maker Broker?

In a nutshell, a market maker is a broker who is certified to facilitate buy and sell orders on various assets. Thus forming a bridge between buyers and sellers of the market in question. This bridge is invaluable to traders of all skill sets.

After all, no matter what asset you are interested in trading, there must be both a buyer and a seller. In other words, if you are looking to buy $200 worth of Bitcoin – you need to find someone who is willing to sell $200 worth of Bitcoin. This is precisely why you need to sign up with one of the best market maker brokers!

Market makers are able to remove a lot of the directional risk usually associated with traditional trading. As most people have an internet connection these days, the average Joe Trader is able to buy and sell whichever asset they desire – with the click of a button.

Placing an order via a market maker usually takes a matter of minutes, and depending on what kind of order you are looking to place – it will usually be executed within seconds.

Market Maker Brokers vs ECN and STP

For those unaware, we should briefly explain the difference between market makers, ECN, and STP. As you already know what a market maker is, we will offer clarification on ECN and STP below.

Starting with ECN (Electronic Communication Network), this is actually a computer-based network used by this type of broker. This enables them to access quotes from several market candidates.

This type of platform makes a direct bridge of contact between you and the liquidity providers. As such, they facilitate trading in and out of market hours. The problem with ECN brokers is that they invariably charge a fixed commission fee on every trade. On the other hand, you will usually find a much tighter spread on these platforms.

When it comes to STP (Straight Through Processing), similarly to ECN brokers – the platform will hand over all (or some) of client trades straight over to the liquidity providers (such as banks). STP providers can sometimes lack the efficiency and speed required for most traders. This can be down to re-quotes and slow order processing times.

In stark contrast, the best market maker brokers are often much more user-friendly than their counterparts. Thus making your entry and exit in and out of the markets a much simpler process.

How do Market Maker Brokers Turn a Profit?

Put simply, market makers need to be compensated for any losses they incur from creating markets and maintaining liquidity. As such, any asset covered by the broker will come with a spread based on the buy and sell price – which is comparable to an indirect fee.

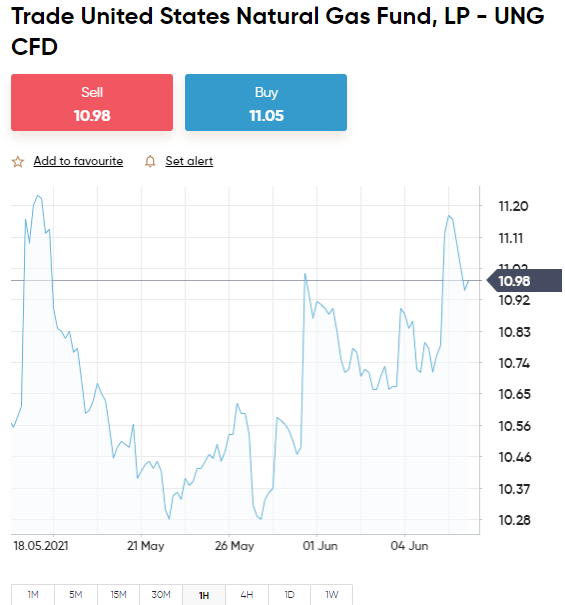

For those unaware:

- The ‘buy’ price represents the price the market is prepared to pay for the asset in question

- The ‘sell’ price is the price the market is prepared to sell the asset in question for

To clear the mist, see a practical example below of how the spread works at a market maker broker:

- Let’s say you are trading the Euro against the US dollar

- The buy price on EUR/USD is $1.2150

- Whereas the sell price on the pair is $$1.2152

- This illustrates a spread of 2 pips

- You are starting your trade 2 pips in the red

- If the EUR/USD position increases by 2 pips – you break even

- Anything above 2 pips is profit

Importantly, some market maker brokers charge a fixed spread, and some charge a variable spread. As such, it’s crucial that you do your homework before signing up.

What are the Benefits of Market Maker Brokers?

There are many benefits to trading via one of the best market maker brokers on our list.

The most notable benefits include:

- Market makers ensure liquidity on the financial product in question

- No need to wait for a suitable buyer or seller to be located – thus orders can be executed at any given time

- Some enable variable lot sizes and only require a small amount of capital

- Transparent price structure

- Some market makers offer free news fees and charting software

- Fast and convenient market entry and exit

- Fractional futures and CFDs

- Fixed spreads, zero negative balances, and stop-losses are often guaranteed

- User-friendly brokerage platforms

- No need to deal with multiple parties

What are the Drawbacks of Market Maker Brokers?

Where there are benefits of market maker brokers, there are usually a few drawbacks too.

In the name of thoroughness, we are going to list such negatives below:

- Potential slippage following global breaking news events

- Might not be ideal for scalpers as price movements can sometimes be less volatile

- Some traders worry about conflict of interest upon order execution

How to Find the Best Market Maker Brokers in 2023?

Having made it to this point, you will now have a clear understanding of not only what market marker brokers are, but also how beneficial they are to your ability to buy and sell with ease.

We mentioned that the best market maker brokers will be registered with at least one regulatory body. It’s also important that other factors such as fees, ease of use, available assets, and accepted deposit methods are taken into account.

See below for some key metrics to look out for when looking for the best market maker brokers of 2023.

Regulation and Safety

As you have likely discovered, there are some bogus online brokers operating on the internet. As such, choosing a market maker that is regulated is absolutely imperative.

If the market maker broker holds a license from bodies such as the FCA, CySEC, ASIC, or CFTC – you can be sure that the platform is following strict rules on various levels.

Benefits of opting for a regulated market maker include:

- Clients funds are segregated from the company account for protection against debt or bankruptcy

- Regulated market makers must follow KYC (Know Your Customer) procedures – meaning validating clients ID to prevent financial crime

- Regular audits are submitted and the platform must display risk warnings to ensure transparency

- Leverage limits in place depending on assets and location – to put a stop to traders borrowing an uncontrolled amount of money and facing account liquidation

As you can see, fundamentally, regulatory authorities serve to keep the market maker space clean and safe for everyone.

Minimum Stake

Whilst examining the best market maker brokers, you should pay attention to the minimum stake stipulated. To put it bluntly, if a platform is demanding $500 for each stake – this going to eat away at your trading account funds faster than a speeding bullet.

The good news is, at eToro, you can start your trading endeavors with a stake of as little as $25. Furthermore, the broker is 100% commission-free, no matter what asset you choose to trade or invest in.

Supported Assets

At the risk of pointing out the obvious, you should ensure the market maker broker is able to provide access to a wide range of markets and assets. Whilst you might have your heart set on trading hard metals right now, later on, you might want to diversify your portfolio to avoid overexposure to one market.

The best market maker brokers will be able to offer the following popular assets:

- ETFs and Mutual Funds

- Futures and Options

- Stock CFDs

- Commodities

- Forex

- Shares

- Indices

- Cryptocurrencies

On the one hand, some market makers specialize in just forex or stocks. In contrast, brokers such as eToro, Capital.com, EightCap, AvaTrade, and EuropeFX are able to offer a plethora of different asset classes.

Ownership or CFDs

We explained earlier what CFDs are and how they work. However, to reiterate – when trading you will often do so via CFDs. This means that you are able to hypothesize on an asset’s rise or fall in value – crucially, without taking ownership of the underlying product.

See a recap below:

- In scenario A, you think that copper is going to see a sharp decrease in value

- As such, you place a sell order via your CFD market maker – if the price falls, you make a profit

- In scenario B, you think copper is going to increase in value.

- As such, you place a buy order via your CFD market maker – if the price rises, you make a profit

As we touched on earlier, residents of the US are strictly banned from accessing CFDs – irrelevant to the asset. UK residents on the other hand can access a plethora of CFDs – excluding cryptocurrencies.

In terms of ownership, you can purchase financial assets in the traditional sense at many market maker brokers. If this is the route you want to take, you should avoid CFDs. The reason is that CFDs invite overnight financing fees, otherwise called swap fees. For anyone oblivious to these fees – they are chargeable for each and every day that you leave your position open.

Maximum Leverage

The vast majority of traders who trade via CFDs choose to apply leverage to enable them to open a large position on a small margin. We mentioned leverage and the limits imposed on various countries earlier on.

However, to ensure you have a thorough understanding of leverage, we shed some light below:

- Leverage is often displayed as a ratio like 1:2, 1:5, 1:10, 1:20, and so forth

- Sometimes the same leverage is displayed as a multiple such as x2, x5, x10, x20

- Let’s say you are looking to trade Ethereum, and the market maker offers you leverage of 1:2 (or x2). This means that with an account balance of $500, you can open a trade worth $1,000.

- Instead, imagine you are trading oil, and the market maker offers you x10 (1:10) leverage. This means that if you have $100 in your trading account, you can boost your stake to $1,000

Just remember that the leverage you can gain access to very much depends on where you live – and the specific limits imposed by regulators.

Importantly, CFDs are banned on all assets for US clients. If you live in parts of Europe, Australia and the UK – specific leverage caps will generally be:

- x30 on major forex pairs

- x20 on non-major forex pairs

- x10 on all commodities (not including non-major indices or gold)

- x5 on ETFs and stocks

- x2 on cryptocurrencies (note crypto CFDs are prohibited for UK clients)

On the one hand, leverage can give your position a good boost – and in turn your profits. Crucially, there is one major point you need to bear in mind – that very same leverage can also boost your losses, should the trade not go in your favor.

Trading Platform

Our guide found that the best market maker brokers will enable you to trade on its proprietary platform – cutting out the need to download software. This is quite important for beginners who want to keep things simple.

For traders and investors who want heaps of technical analysis tools and a wide variety of customizable indicators – look for a market maker that is compatible with MT4/5 or cTrader.

If this sounds like something you are interested in – you should check out our best market maker brokers EightCap, AvaTrade, and EuropeFX for size!

Best Market Maker Brokers – Other Online Brokerage Fees

When searching for the best market maker brokers for your future trading endeavors, it’s vital that you check out the all-important fees.

To give you an idea of what to expect, see a list below of the most commonly charged market maker fees.

Dealing Fees

If you are a complete novice when it comes to the trading scene and you are planning to stake small amounts, you are best advised to sign up with a platform charging a variable fee.

If you see yourself as more of a large-scale investor, fixed fees are likely to be more suitable.

We have put together a simple example of a fixed fee below:

- You want to invest in Tesla shares and your market maker charges a fixed commission fee of $12 on every trade

- Irrelevant to your stake – albeit $50 or $10,000 – you must pay $12 in commission

- When the time comes to sell your Tesla shares – you must pay $12 again

Had you invested in Tesla via market maker eToro, you would have saved $24. This is thanks to the broker’s commission-free model, meaning you won’t pay a cent when trading or investing.

Trading Commissions

As we said, if you are a small-time investor looking to trade regularly with more modest stakes – you will be better choosing a market maker charging a variable fee.

Let’s take a look at an example of a variable fee for clarity:

- You are trading silver and the market maker broker charges a variable fee of 0.4% on each trade

- After performing some technical analysis, you have a strong feeling that the asset is going to see a price increase

- As such, you create a $100 buy order on silver

- You need to pay the broker 0.4% – this equates to 40 cents

- Days later, your position is worth $170 – as such, you decide to exit your silver trade

- Again you must pay 0.4% – which is 68 cents

It should be now crystal clear to you why modest traders are better suited to variable commission market makers. With that said, if you trade via one of our best market maker brokers charging no commission – both examples would result in a huge saving. After all, the less you pay in fees, the better it is for your trading profits.

Deposits and Withdrawals

Before you can get started with the best market maker brokers – you need to be able to deposit funds into your account. Each platform differs when it comes to payment type compatibility. Therefore, it’s important you check this information before signing up.

- This is especially the case if you have a particular payment type in mind.

- The best market makers will allow you to fund your account with a range of payment methods, such as credit/debit cards, e-wallets and bank transfer.

- The latter is the slowest way to start your trading journey, as payments can take in excess of 3 days to process.

Top market maker eToro is compatible with an impressive amount of payment types including all of the above. Furthermore, it tends to take a matter of minutes to start trading here, thanks to the brokers’ automated ID validation methods.

Tools for Beginners

Trading tools offer endless benefits to both seasoned traders and newbies alike. As such, we have listed the most useful tools offered by the best market makers.

Educational Material

By conducting a simple internet search you will see that there is a seemingly limitless amount of educational content available. With that said, it’s much easier to have all of your trading tools in one basket. Whether that is on the market makers’ website, or via third-party platforms like the aforementioned MT4/5.

Ar eToro, for example, there is a good variety of educational material aimed at beginners.

This includes :

- Podcasts

- Daily market analysis

- Webinars

- Video tutorials

- And heaps of educational guides

You may also want to try out the free demo account offering at eToro. This comes with $100,000 of practice money, so you can learn the ropes without risking your own capital in the process. It’s also a good way to try out any trading strategies you are unsure about.

Automated Trading

In terms of automated trading, our best market maker broker of 2023 – eToro, excels. The platform offers a feature called ‘Copy Trader’. In a nutshell, you can select someone to copy from heaps of vetted and successful traders.

Simply invest a minimum of $200 in your selected seasoned trader, and anything that person buys or sells will be reflected in your portfolio.

If the Copied Trader invests 2% of their portfolio in gold, 2% of your allocated funds will also be dedicated to gold – and so forth. You can invest in up to 100 pros at any one time. For instance, if you had $1,000 in your account, you may decide to copy 5 at once as a means to passively diversify your portfolio.

The market maker also offers a popular trading feature called ‘Copied Portfolios’, which is another entirely passive way of trading. The portfolio will be taken care of by a team of pros at eToro.

Customer Service

Customer service can be a lifeline, especially for newbies. We find that the best market maker brokers offer multiple contact methods. The top of the list has to be ‘Live Chat’, as it is undoubtedly the quickest and most convenient way to get assistance.

Other forms of customer service include email, telephone, and an in-platform contact form. You will usually find that customer service is available 24 hours a day, 5 days a week in line with the markets.

How to Get Started With The Best Market Maker Brokers Today

Now that you are fully aware of the best market maker brokers and what they do – you can open an account and get started. We have used Capital.com for our walkthrough, as the market maker offers thousands of assets on a commission-free basis.

Step 1: Open an Account

First things first – head over to the Capital.com platform and hit ‘Join Now’, which will see this on the main page. As per the aforementioned KYC, you now need to fill in the relevant particulars to let the platform know who you are.

You will also be required to upload a copy of government-issued photo identification, such as your driving license or passport. Another KYC requirement is proof of address. A bank account statement or utility bill are both acceptable at Capital.com.

It’s important to note that you can skip this part of the registration process. However, this will need to be uploaded before you are able to either withdraw funds or deposit $2,250+.

Step 2: Make a Deposit

Now you can choose your preferred payment method.

Capital.com is compatible with the following payment types:

- Debit card

- Credit card

- PayPal

- Klarna

- Neteller

- Skrill

- Bank Transfer

- and more – location dependant

Step 3: Search for an Asset

Now that you have registered as a Capital.com client, you can decide which asset you want to trade. If you already have a clear idea of what this might be – simply type it into the search box.

If you have yet to decide, look to the left-hand side of the main page and you will see ‘Trade Markets’. Upon clicking this you will see a range of asset classes to choose from – all of which can be filtered down even further.

For instance, if you are interested in commodities, but aren’t sure on specifics. Click ‘Commodities’ and a full list will appear of what’s available.

Step 4: Place Order

At this stage, you should be ready to place an order to enter your chosen market.

- If you suspect the asset is going to see a price increase – select buy at the top of the order box

- If you suspect the asset is going to see a decrease in price – select sell at the top of the order box

You will also need to enter a stake, market or limit order, and the stop-loss and take-profit values.

That’s it! Capital.com will action your order as instructed – as soon as you hit ‘Open Trade’. As we said, you will not be charged a cent in commission on this order.

Best Market Maker Brokers – The Verdict

Throughout this guide, we have talked about how the best market maker brokers are fully regulated by a respectable authority. The truth is, there are heaps of crooks operating in this space. As such, the only way to know for sure that a platform is genuine is to rely on its regulatory standing.

Of course, there are other important factors to consider, such as asset variety, low fees, and how easy the platform is to navigate for your skill level. You also need to think about payment type options. Not to mention how long it might take for the broker to verify your ID – so you can start trading right away.

Another thing to be mindful of is whether the market maker broker offers trading tools and educational content. With that said, you might be happy to access charts and indicators via a third-party trading platform such as MT4/5. Furthermore, there is a wide variety of online trading courses, asset-specific books, and interactive portfolio simulators available at your fingertips.

Capital.com came out as the reigning champion in our best market maker brokers rundown for multiple reasons. This platform is regulated by the FCA, ASIC, CySEC, and NBRB – whilst offering heaps of different assets to trade and invest in. You will pay no commission at all when using this provider.

Furthermore, the platform is super user friendly, which makes finding assets and placing orders effortless. Signing up usually takes minutes and there are a variety of payment methods to choose from.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts